Krishna Memani

@KrishnaMemani

Followers

34,892

Following

452

Media

201

Statuses

6,514

Investor The views expressed here are entirely personal.

Livingston, NJ

Joined July 2014

Don't wanna be here?

Send us removal request.

Explore trending content on Musk Viewer

スタンプ

• 150173 Tweets

GPT-4o

• 120887 Tweets

#WWERaw

• 92549 Tweets

Luka

• 75027 Tweets

Dallas

• 47910 Tweets

Mavs

• 33284 Tweets

Shai

• 27879 Tweets

#บุ้งทะลุวัง

• 25375 Tweets

Gunther

• 19494 Tweets

#GmmTreatFourthBetter

• 18953 Tweets

Ilja

• 18283 Tweets

Change Fourth Manager

• 16931 Tweets

書類送検

• 16373 Tweets

スナック

• 15619 Tweets

スクエニ

• 15345 Tweets

Jey Uso

• 13999 Tweets

Jリーグカレー

• 13026 Tweets

Mavericks

• 11900 Tweets

Chet

• 11759 Tweets

ITAM

• 11412 Tweets

로즈데이

• 10079 Tweets

Giddey

• 10058 Tweets

違法ケシ発見

• 10053 Tweets

Last Seen Profiles

@DavidSacks

Was RoKU a small business... leaving 400 plus million in an on balancesheet deposit...this small business and farms and family owned business is a narrative politicians use....

10

9

430

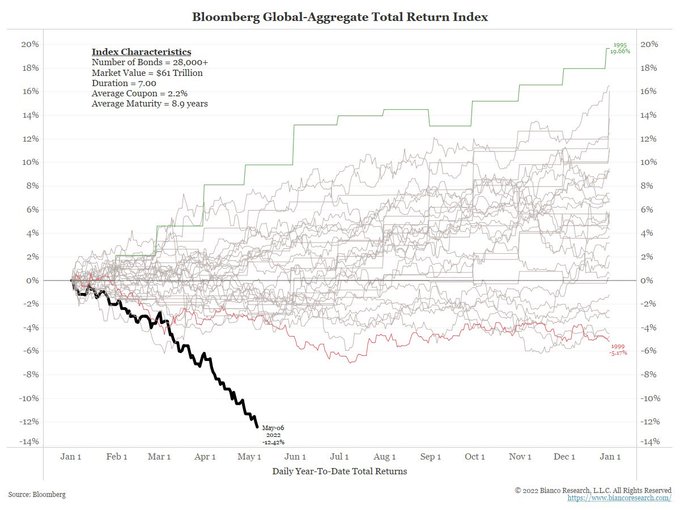

Actually Bianco's point is very good...2008-9 was called a housing crisis when it was a banking leverage crisis...so this isn't a tech crypto speculation as much as bond speculation...that is unwinding hard

@KrishnaMemani

I agree …

but substitute the bond market for Crypto. The bond market was the most speculative asset (thanks to years of central bank printing) and now it is unwinding hard.

18

17

106

15

51

324

I’ll be co-hosting

@SquawkCNBC

tomorrow from 7-8am ET. Looking forward to joining

@MelissaLeeCNBC

,

@WilfredFrost

, and

@andrewrsorkin

for some great discussions about the markets, the economy and trade.

0

8

182

Tale of the taper: Why the European Central Bank is unlikely to scale back its bond purchases any time soon:

#ECB

5

57

171

Today, I’ve chosen to no longer be dismissive about my thoughts on

#Greece

& the

#ECB

. Here's why:

http://t.co/xTAXo0Sfab

7

19

110

One central bank has driven monetary policy innovation for two decades. No, it’s not the

#Fed

.

2

33

106

You have no idea how true this is until the medical practice you go to has been acquired by Optum....mindlessness, dash for efficiency that leads to gross inefficiency, treating old patients as a number on the ledger....I blame them and I blame the doctors who sold their…

10

12

106

So let me ask a question.....If Peter Thiel wasn't rich and successful, would you care too bits about his views on European politics....and if you wouldn't, why would you care simply because he was rich and successful as a tech entrepreneur....

16

16

105

This is astounding amount...with circle at 3.3 and Roku at 0.5 b...that leaves a lot of unaccounted for large deposits...a public company would have to disclose it...so has to be private companies, but more likely the VCs themselves and personal accounts...

5

11

98

The good news: a mini economic boom is underway in

#China

. The bad news: long-term challenges may remain.

5

27

85

@TaviCosta

If the intent was to reduce domestic gas prices (as opposed to global oil prices), wouldn't this be the preferred option....to feed your own refineries....whether the overall policy was good is a separate question

7

3

96

Financial markets are calling

#Fed

’s bluff on any 2016 rate hike. Here’s why they’re probably right:

1

22

82

@dampedspring

@biancoresearch

Bianco knows better...but it doesn't matter....you can use a cash account with a MMF sweep....not that hard...that is why the term cash equivalents was invented. I can understand Circle maintaining a large on balancesheet deposit, but ROKU, really?

3

0

89

My latest

#Greece

perspective: Let’s Hope the Greek Deal Isn’t a Versailles Mistake:

http://t.co/fAhpenJOsc

#Grexit

http://t.co/aETU95Own0

7

49

79

VIDEO:

@TomKeene

and I talk about what to expect in 2015, from the

#ECB

to the

#FED

to

#emergingmarkets

:

http://t.co/oW9kxjb6ol

4

25

81

#Grexit

? Eurozone crisis? The real story now seems to be

#China

:

http://t.co/YUauL6rtVD

http://t.co/C7clR7pvYF

3

27

75

I give up....I guess I don't understand what they are thinking, at least for 24

18

7

77

From a macro standpoint, the best odd lots ever. Next time put him and Zoltan in an intellectual cage match, backed by data as opposed to narrative, and the hollowness of Brettonwoods 3.0 will become self evident.

EXTRA ODD LOTS:

The BIS is out with a new report on the global impacts of a booming $USD.

So its head of research

@HyunSongShin

came on to talk with me and

@tracyalloway

about what they found, and the "tripwires" strewn throughout the financial system

6

59

277

1

0

72

Here’s the kickoff to my mid-year outlook. Take a look & read my big calls for 2015.

http://t.co/RiXyJSbBxX

http://t.co/X5USO9JwHR

1

13

62

@GRDecter

Most companies are run like that...their outstanding debt goes up every year...so does their networth and profitability...

9

0

71

Hello! I’m excited to join Twitter. I’m the

@OppFunds

CIO and the “Low for Long” Guy:

http://t.co/pA3JHFaobL

19

9

52

There are a few posters I like...

@donnelly_brent

because he talks from experience.

@sidprabhu

for the best disses imaginable to the extent that he gets blocked......

@dampedspring

because he puts it out there even if he is misguided and i diasagree with him 90 pct ,

@RenMacLLC

,…

8

10

55

Ultimately, the current cycle will be longest cycle on record

#2015Outlook

http://t.co/eYAkCuPIp7

4

27

51

In the GFC, there were a few really annoying characters, who were 100 pct right about the problem, if not the solution. That prize for this cycle goes to...wait for it ..

@sidprabhu

4

8

52

#Greferendum

vote may cause flight to quality w/ USD & Treas prime beneficiaries. My POV:

http://t.co/SSE7ab2rb3

#oxi

http://t.co/CJUUoT7qZQ

6

27

50

#China

#yuan

devaluation supports my view that global

#interestrates

will remain low for long:

http://t.co/6g4aHyaxEa

http://t.co/xIZ5ZsITZq

0

7

47

It’s tough being the

#Fed

chair, especially these days. Let’s talk Wednesday's FOMC meeting & investor implications:

2

17

45