Hanif Bayat

@HanifBayat

Followers

7,415

Following

141

Media

186

Statuses

2,038

CEO & founder of , 🇨🇦 personal finance encyclopedia. Former banker. PhD in Physics. Discussing economy, finance, real estate, entrepreneurship, etc.

Toronto, Ontario

Joined January 2018

Don't wanna be here?

Send us removal request.

Explore trending content on Musk Viewer

Leverkusen

• 485626 Tweets

Lookman

• 377811 Tweets

Atalanta

• 374193 Tweets

Europa League

• 259714 Tweets

Luna Park

• 154739 Tweets

Nikki Haley

• 90824 Tweets

Gasperini

• 82948 Tweets

Emiliano

• 59566 Tweets

Haddad

• 59325 Tweets

キスの日

• 49016 Tweets

アミューズ

• 45825 Tweets

Vitória

• 44057 Tweets

Kyrie

• 42879 Tweets

Atlético

• 37876 Tweets

法的措置

• 37837 Tweets

滝沢ガレソ

• 34510 Tweets

All-NBA

• 33969 Tweets

Soto

• 24811 Tweets

Patricia Benavides

• 22667 Tweets

#AEWDynamite

• 20167 Tweets

Cacá

• 19128 Tweets

Amazonas

• 18911 Tweets

アタランタ

• 15348 Tweets

Draymond

• 15127 Tweets

Kawhi

• 14552 Tweets

Yuri Alberto

• 11098 Tweets

#Survivor46

• 10485 Tweets

Last Seen Profiles

Pinned Tweet

Debating the 34% capital tax hike for entrepreneurs:

Who invests this money better?

1.

@tobi

, who built

@Shopify

, created 11,000 jobs & improved millions of lives.

or

2. The 🇨🇦gov, which spent $50M+ on an inconvenient app (Arrive Canada).

Thoughts?🤔

Oh wait, there is a

56

196

1K

Politicians claim new capital gains taxes will align us with California & New York🤔

Not true!🚫

1. Capital gain tax exemptions for entrepreneurs:

🇺🇸 Up to USD$10M

🇨🇦 Up to CAD$1.25M

2. Total income taxes on CAD$500K:

🍁 Ontario: $231K (45%)

🇺🇸 California: $195K (39%)

🇺🇸 New

Chrystia Freeland is asked these excellent questions by Irene Galea of the Globe

@IreneHGalea

"analysis confirms the adverse effects of higher capital gains taxes..."

Canadians deserve answers to these questions that she avoided. She is driving innovation and entrepreneurs away!

114

189

611

27

108

422

Tax system must reward the makers, not the takers.

1. Not all rich people are competent or useful.

2. Yet, to build a rich economy, society must reward hard work & innovation with wealth.

Ignoring the 2nd point, is a fundamental issue with socialism🚨

As Thatcher said "The

54

45

326

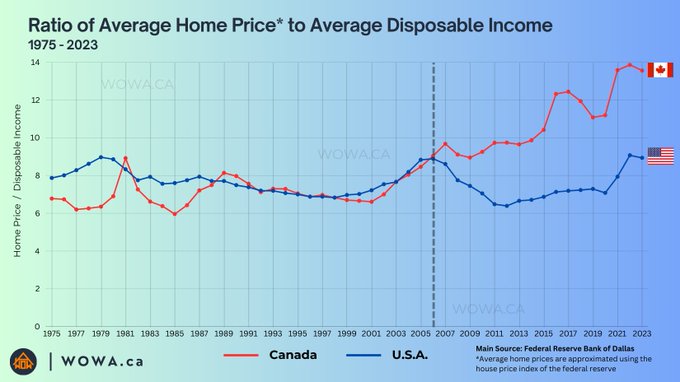

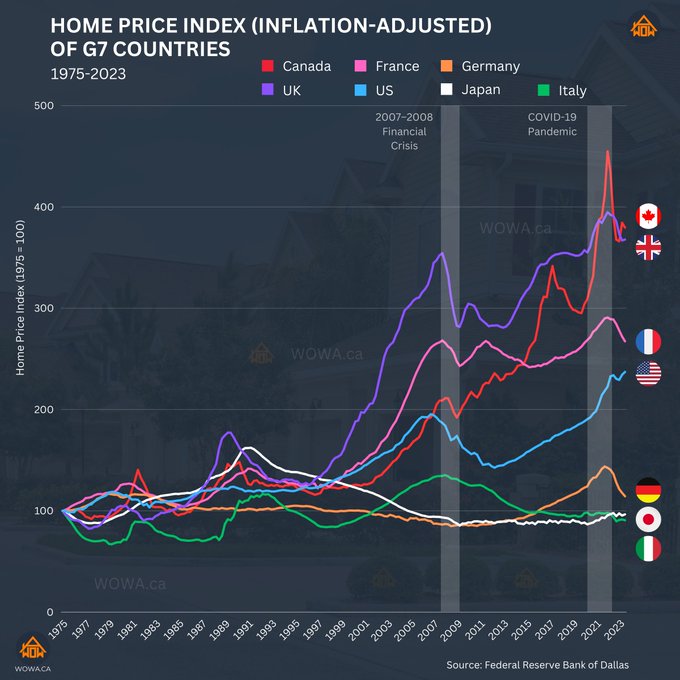

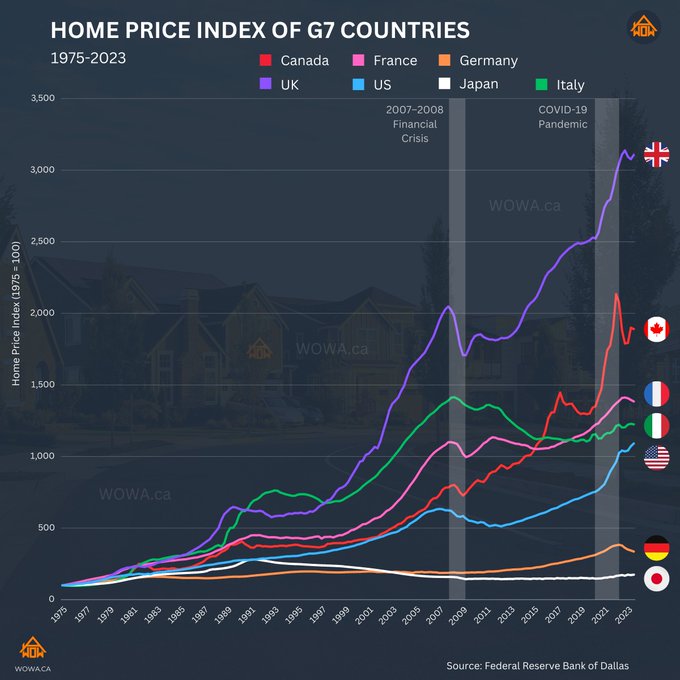

The ratios of avg. home price to avg. disposable income in 🇺🇸 & 🇨🇦

1975-2005: The ratio ranged from 6 to 9 in 🇺🇸 & 🇨🇦

Post-2006: 🇨🇦 ratio soared above 9, reaching 14 times of income! Why?

Maybe🤔:

#BoC

's too many rate cuts in 2008, while 🇨🇦 home prices didn't crash unlike U.S.

49

76

304

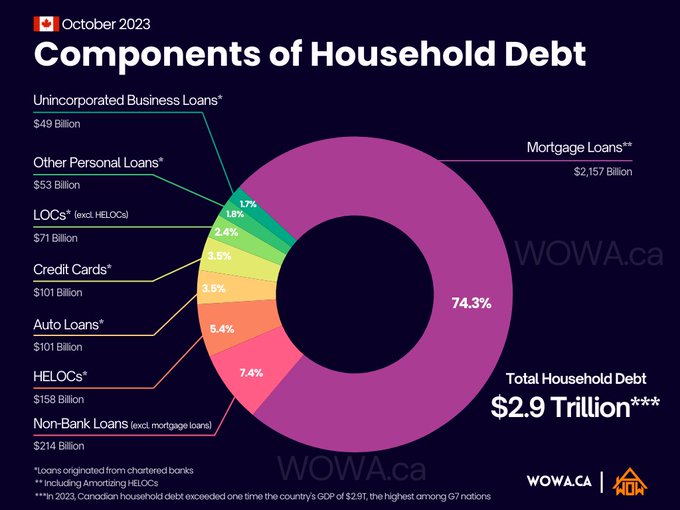

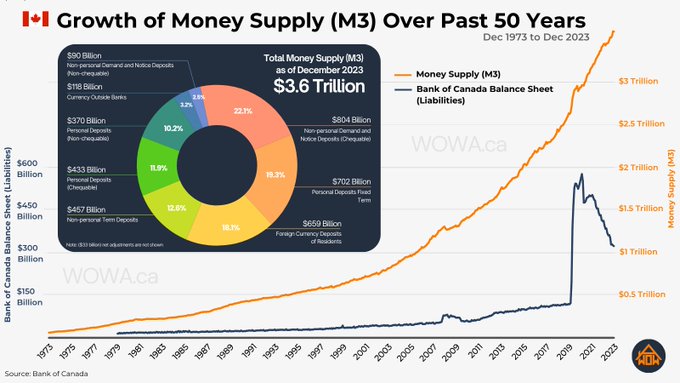

The 🇨🇦money supply (M3) has quadrupled since Jan 2005, hitting $3.6T in Dec 2023!😲

Infographic:

1. Money supply (M3*) exponential growth (Yellow)

2. M3 components (Pie chart)

3.

#BoC

balance sheet liabilities (Navy blue)

Any surprise in Money Supply's exponential growth?

Not

20

61

291

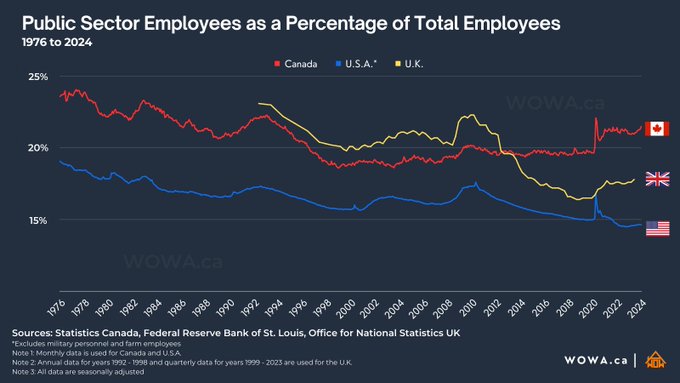

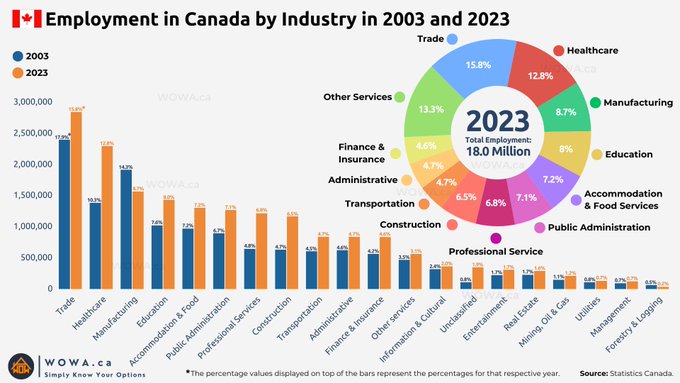

"The devil is in the details"

40,700 new jobs 🇨🇦 in Feb 2024

Breakdown:

Employees +2,400

+18,800 in public

-16,400 in private

Self employed: +38,300

Nearly half of the job growth (47%) was in the public sector!

Unsustainable▶️below tweet

Jan to Feb 2024:

•

18

68

246

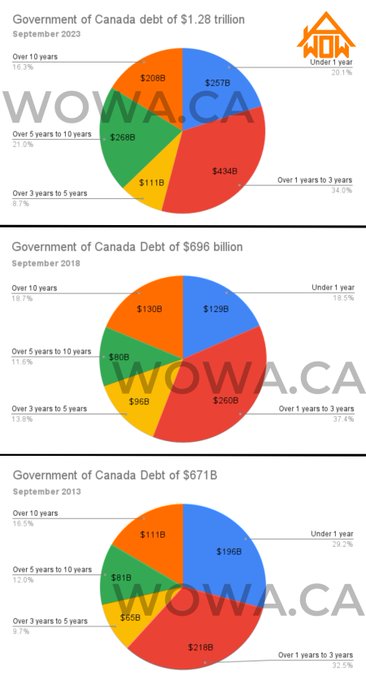

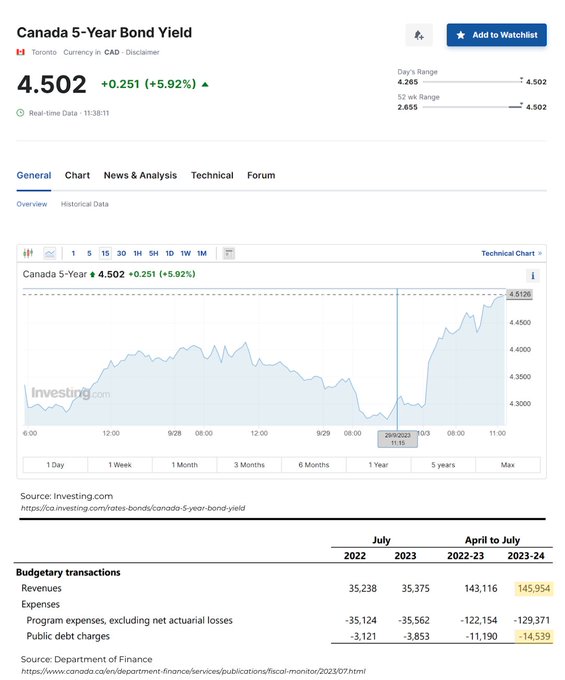

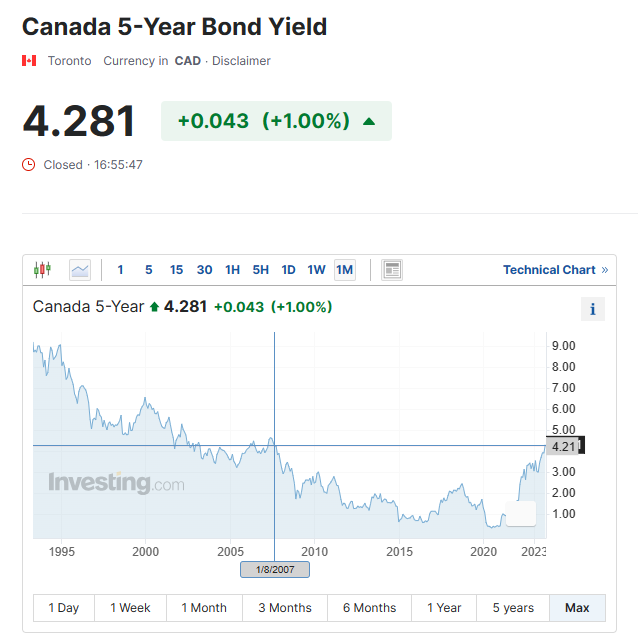

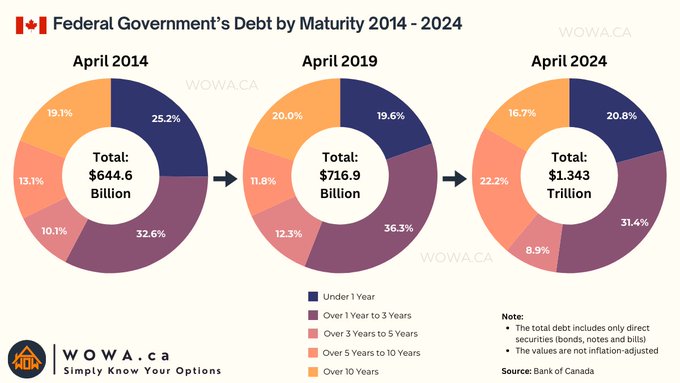

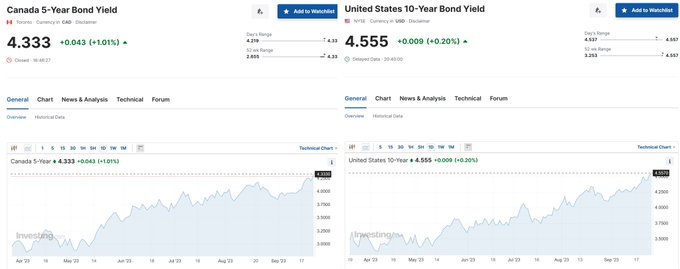

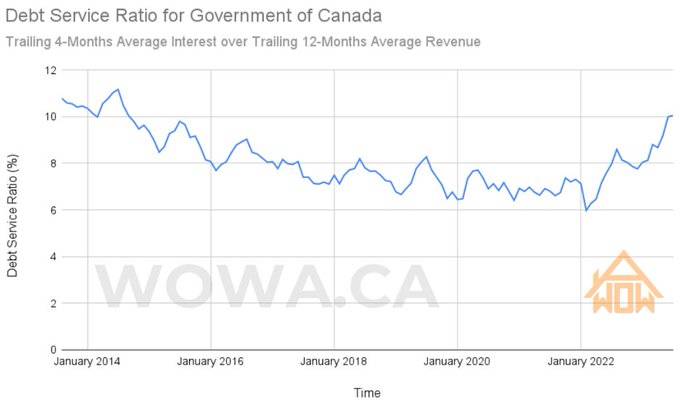

5-year bond yield just hit 4.5%😱

Highest since early 2007!

What does this mean for our taxes?📊

Last 4 months (April-July 2023):

Gov. revenue: $146B

Interest Payment: $14.5B

∼10% debt-service-ratio

Soon, over 11% of our taxes will be used for Gov. debt interest!

#cndpoli

27

60

219

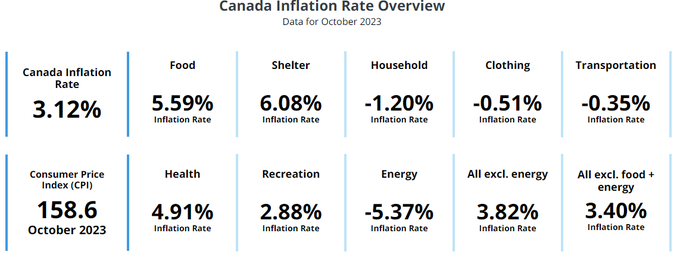

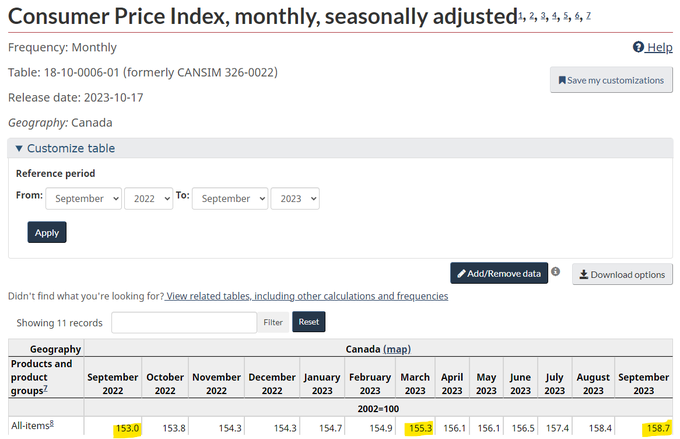

🇨🇦 Inflation dropped to 3.1% in Oct, mainly driven by falling oil prices. Excluding energy, the inflation actually went up!😲

Inflation excluding energy:

Oct 2023: 3.82%

Sep 2023: 3.69%

Energy prices are driven by global factors, not

#BoC

decisions!

More

20

43

216

#BoC

unlikely to consider a rate cut before July 2024

more:

Dividing (annualized) inflation data into two 6-month periods reveals a big inflation rise:

📈Sep. 2022 to Mar. 2023: 3%

📈Mar. to Sep. 2023: 4.4%

This suggests inflation won't decline fast!

We

20

28

199

I was asked why the rising number of employees in the public sector is worrisome!?

These are the reasons:

1. Taxation and Economic Growth:

Taxes from the private sector are expected to fund not only public employee salaries but also other government expenses like old age

31

46

193

There are 19,235 homes listed for sales in the GTA, up ~60% from 11,910 on Nov. 30, 2022, while sales lag behind last year's numbers! 🏡

#ToRe

home inventory has been over 19k for the past 6 weeks!

It looks like 19k+ sellers in the GTA are setting what they believe are the

22

37

195

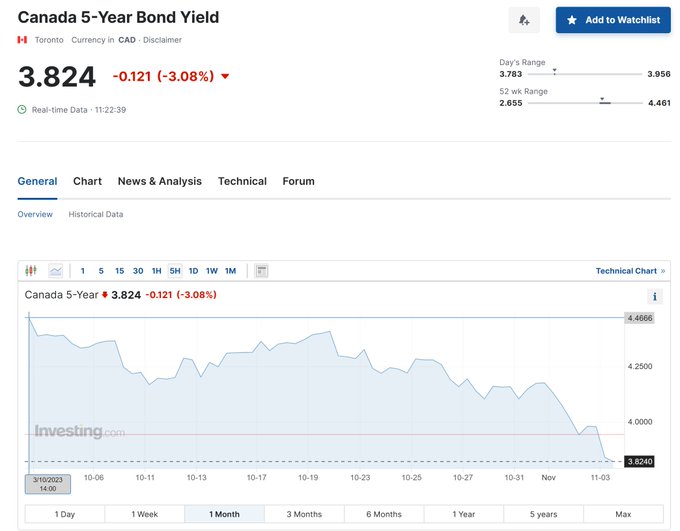

Canada's 5-year bond yield fell by 65 basis points (15%) in 1 month. Why?

After the Fed Nov. 1 &

#BoC

Oct. 25 meetings, the market thinks both Fed & BoC have completed their rate hikes for this rate-hiking cycle.

As a result, we may see slightly lower fixed mortgage rates soon.

23

19

155

@arthurmemedaeva

@tobi

@Shopify

Completing your sentence: "There are many economists with PhDs in the government who rely on government funding, which might prevent them from being completely truthful!" 😉

1

6

124

🇺🇸CPI remains high, impacting 🇨🇦 by potentially limiting 2024 rate cuts:

• Higher 🇺🇸 inflation➡️Fewer rate cuts in 🇺🇸

• Fewer rate cuts in 🇺🇸➡️Fewer rate cuts in 🇨🇦 to avoid a sharp rise in USD/CAD, why?

Stronger USD➡️Higher prices for imported goods ➡️ Rising inflation

🇨🇦

15

19

122

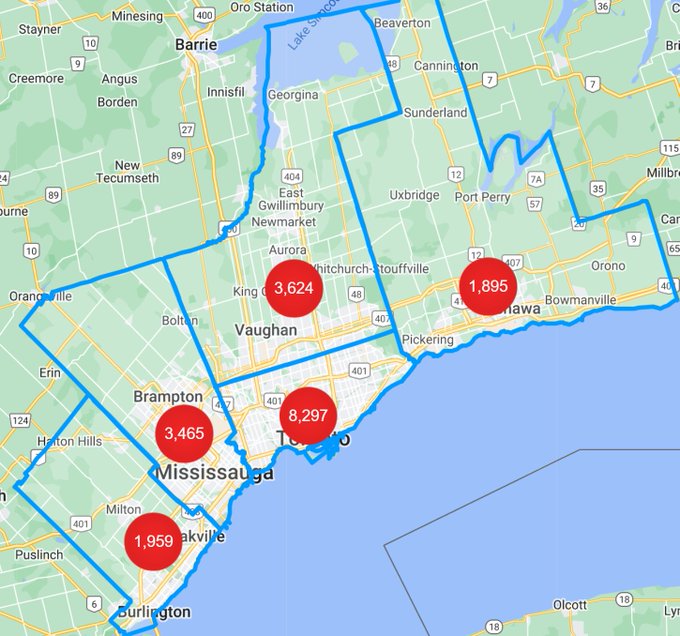

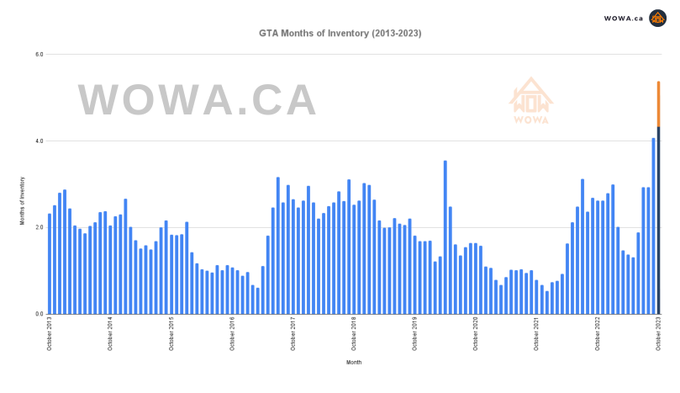

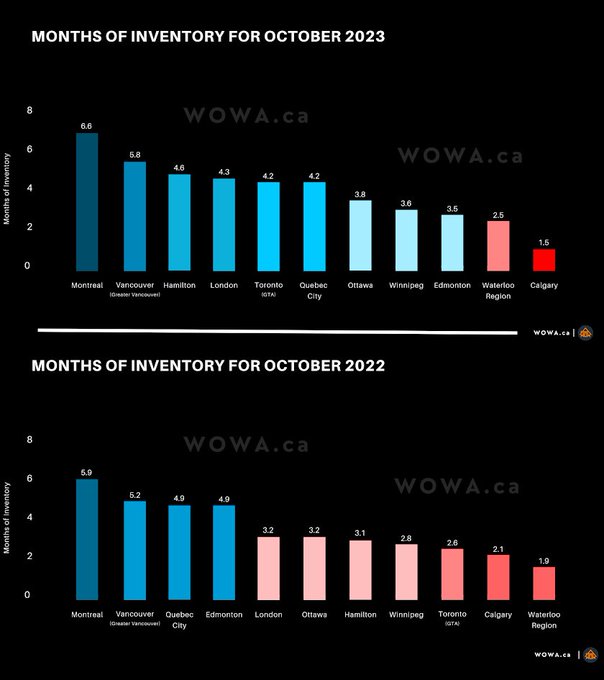

#ToRe

market is experiencing a slight freeze!❄️

Greater Toronto Area (GTA) months of inventory (MOI) hit 4.1 in Sept., the highest in a decade.

For Oct., GTA MOI is expected to inch closer to 5, given the current 20.5k active listings in GTA & an estimated ∼4400 sales.📈

13

28

115

1. I agree with John that

@PierrePoilievre

video contains several simplistic statements & exaggerations.

2. However, I believe Pierre's solution is much better than Truedue's, mainly due to his superior financial vision.

3. IMO, the main cause of the housing bubble is the

54

12

113

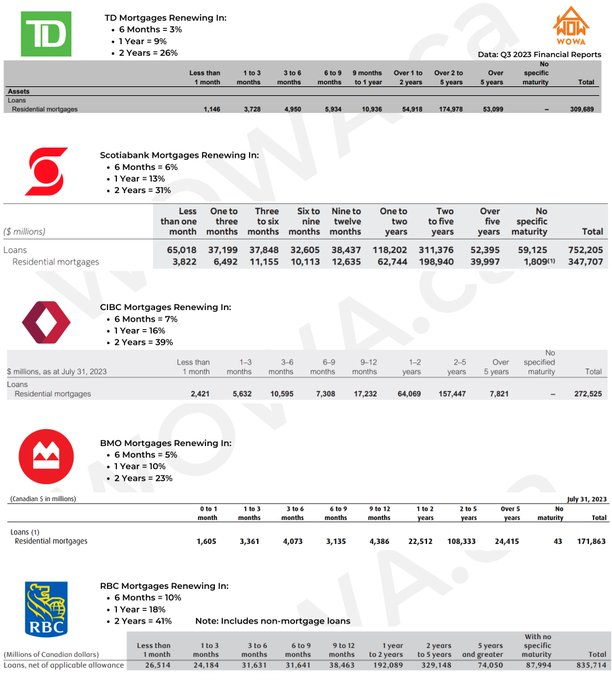

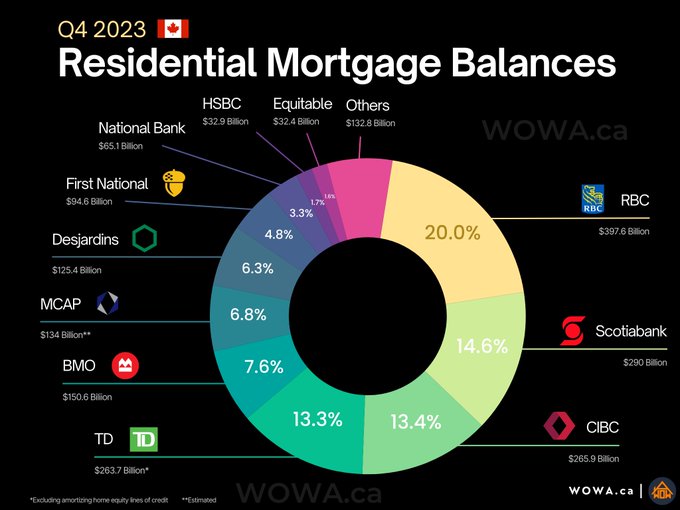

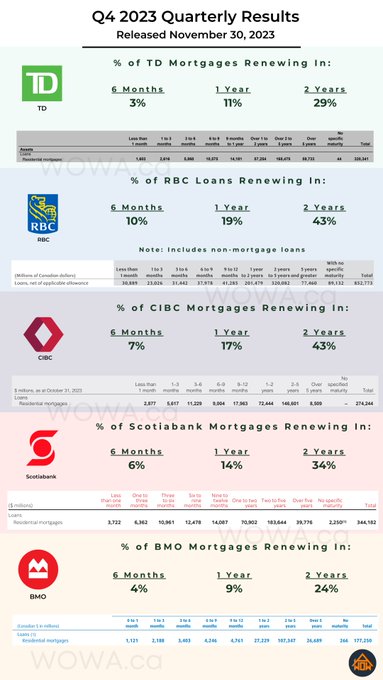

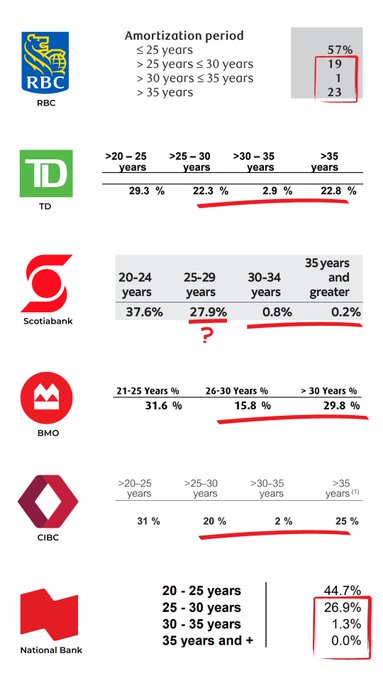

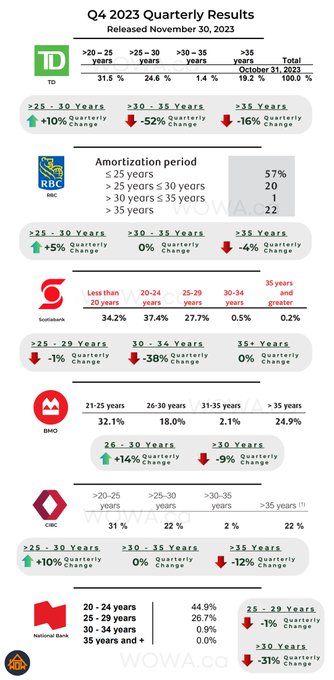

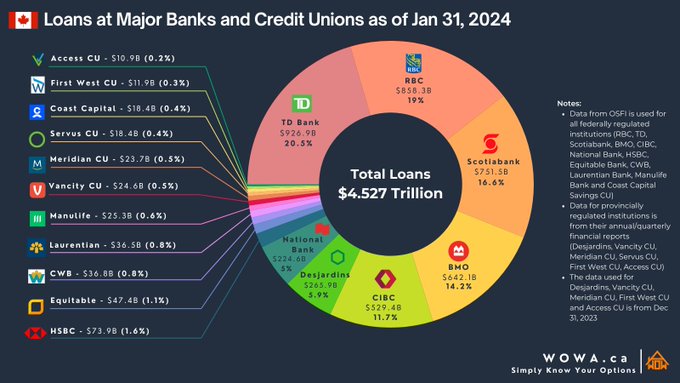

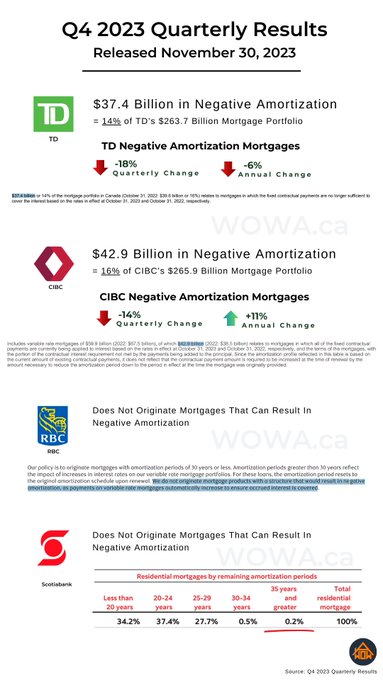

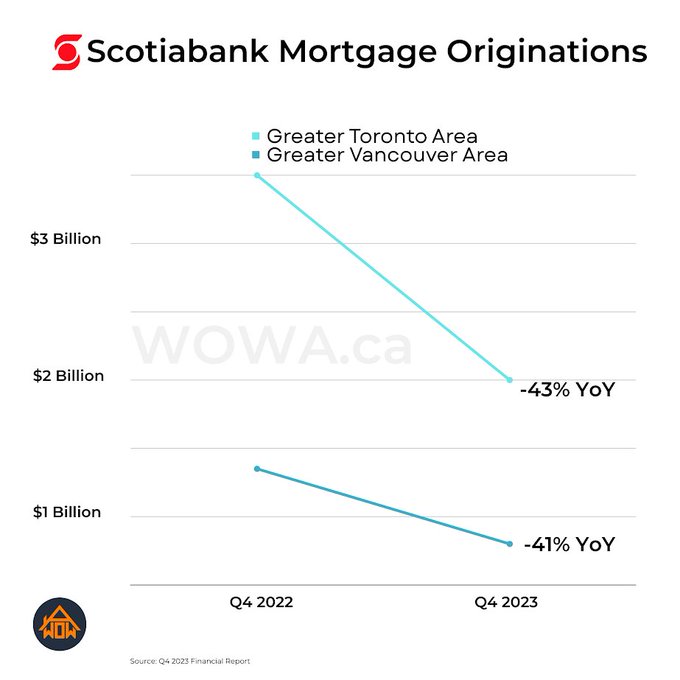

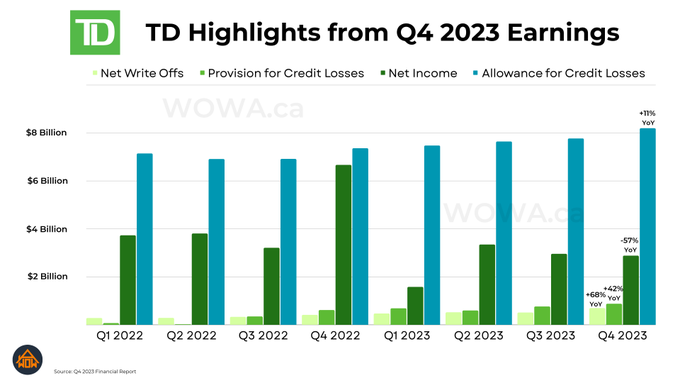

Big 6 Banks Q4 Reports

Residential Mortgages Stat (Oct. 31, 2023): A slight decrease in remaining amortization > 25 years since July 31, 2023.

Remaining Amortization>25 Years

(% of all mortgages)

RBC: 43%

TD: 45%

BMO: 45%

CIBC: 46%

National Bank: 28%

Scotia: NA

>30 Years

RBC:

7

21

105

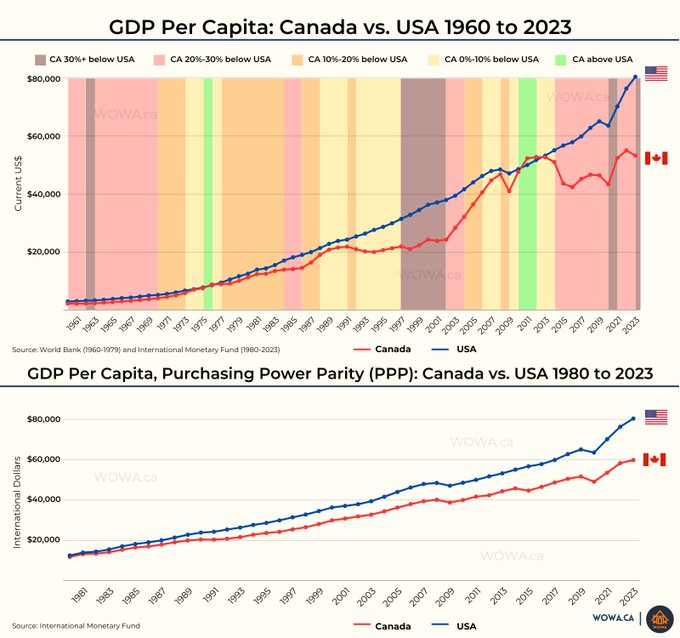

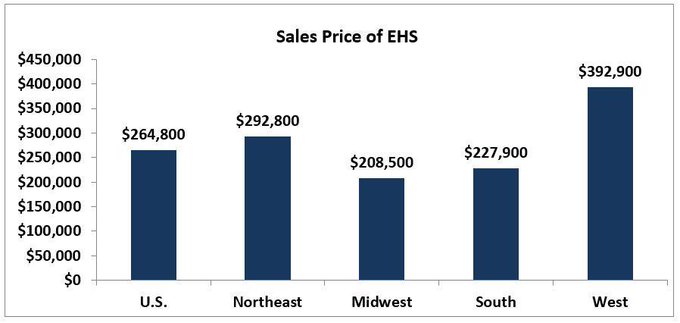

Median

#homeprice

in Canada is 46% higher than US while its median household income is slightly less than US!

Median home price:

Canada ≈ CAD$500k (excluding

#ToRe

&

#VanRE

≈$400K)

USA: CAD$343K (USD 265k)

Median household income:

Canada: CAD$73K

USA: CAD$80k (USD 61K)

The national median existing-home price for all housing types was $264,800 in August, up 4.6 percent from a year ago.

#NAREHS

1

28

27

18

55

91

@wesSE22020

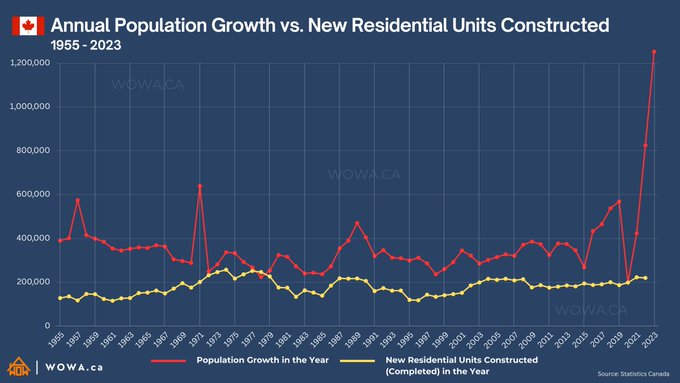

I believe the government has an 'overspending' problem, not a revenue problem. The housing crisis could have been addressed earlier by easing zoning restrictions and moderating the influx of immigrants. The government cannot continuously 'borrow more,' 'tax more,' and 'spend

5

3

93

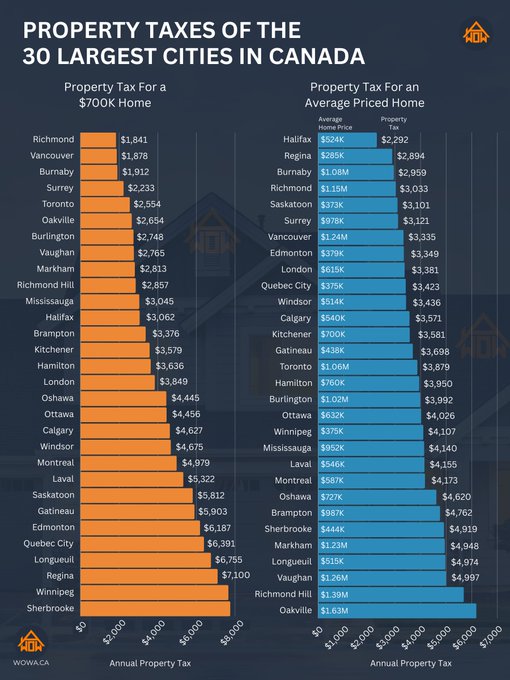

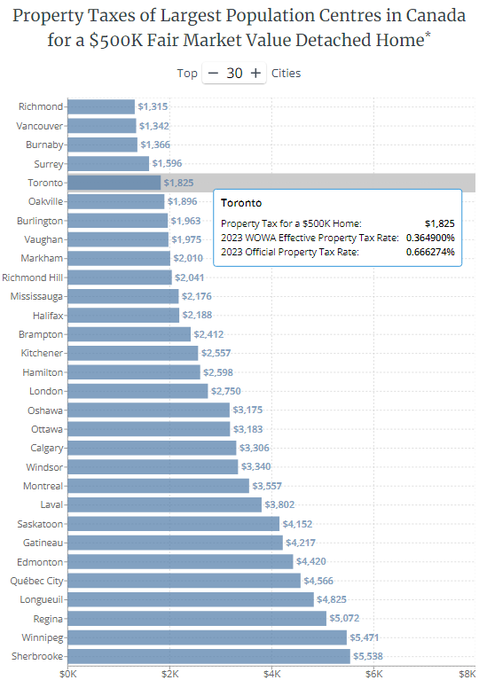

Since many asked after the last post:

Here we presented the property taxes for the 30 largest cities in Canada, considering TWO scenarios:

A. $700k property value

B. An averaged priced home in each city

(Effective property tax rates are calculated based on the analysis of over

12

28

88

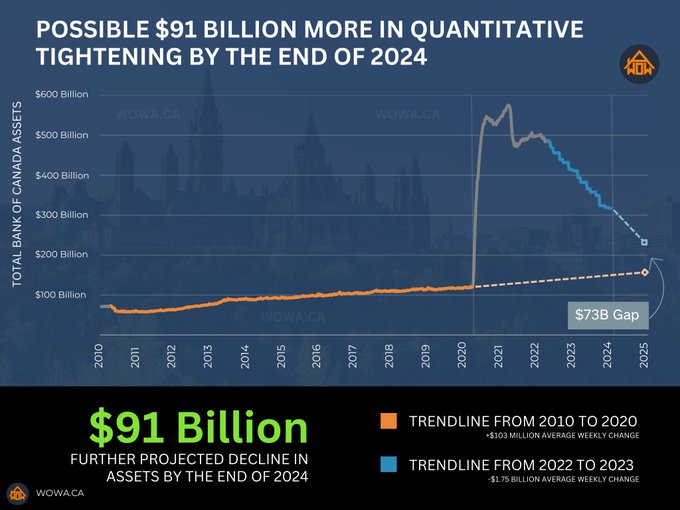

Two notable monetary changes since Apr 2022:

• Rate hikes

• Quantitative Tightening (QT)

While

#BoC

stopped rate hikes and market expects up to 150 bp rate cuts in 2024, BoC might not stop QT before 2025:

This could reduce the monetary base by ∼$91B!

8

12

79

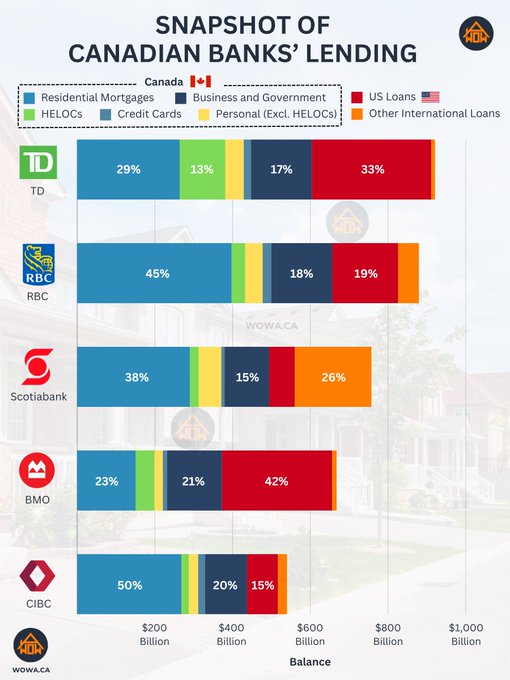

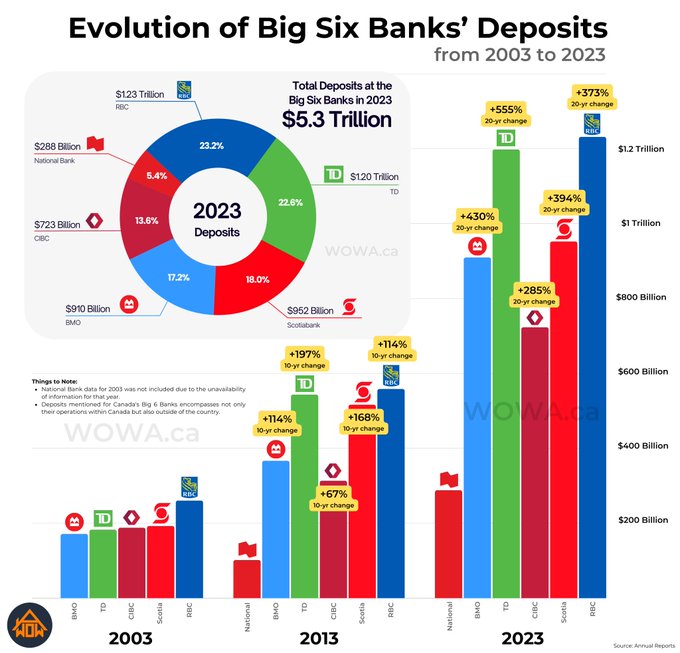

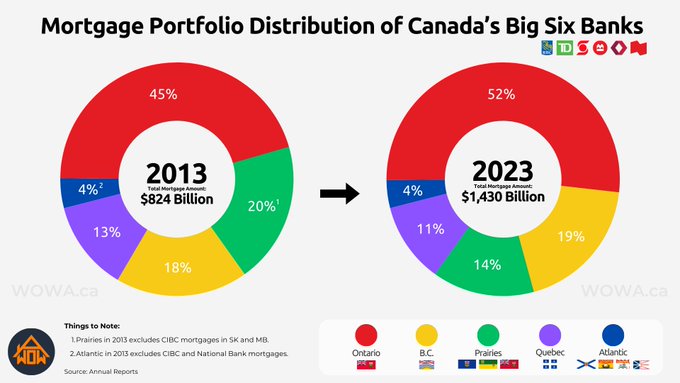

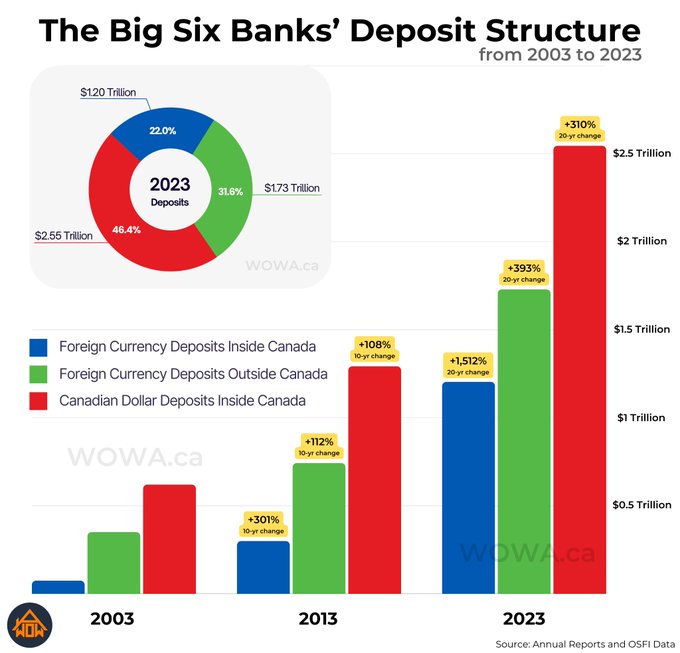

How did banks' deposits soar 400% in 20 yr?

1. Expansion in 🇺🇸: 51% of 🇨🇦 banks deposit are in foreign currencies! (More details in our next post)

2. Money supply = Money Multiplier x Monetary Base

Monetary Base (

#BoC

🇨🇦 balance sheet) rose from

$42.9B in 2003

to

$319.3B in

8

22

77

Many support home price corrections due to concerns:

1.💰High real estate returns hindering entrepreneurship

2.🏠Unfair burden on younger generations, allocating most income to housing

3.📈Unproductive property appreciations exceeding some salaries

4. 🏙️

#VanRe

&

#ToRe

make

4

8

74

@WildCat_io

@tobi

@Shopify

@theJagmeetSingh

I wish he had even a month's experience managing a simple convenience store to understand how challenging it is to run, sustain, and grow a business.

2

1

70

🏡Takeaways from my

@globalnews

interview:

🇨🇦 Real estate will stay sluggish & home prices won't rise next year due to

1. Delayed & slow rate cuts

2. Recession will come to 🇨🇦 before 🇺🇸

3. Expected 🇨🇦 high unemployment will pave the way for rate cuts

5

7

68

"Industry expert" drops FOMO advice, but let's hear the other side:

1. Most First-time buyers priced out in ON & BC🏠

2. Rate drops? Not so fast⏰

3. Maybe recession on the horizon📉

4. Some Investors battling to keep rentals afloat even after rate

8

8

70

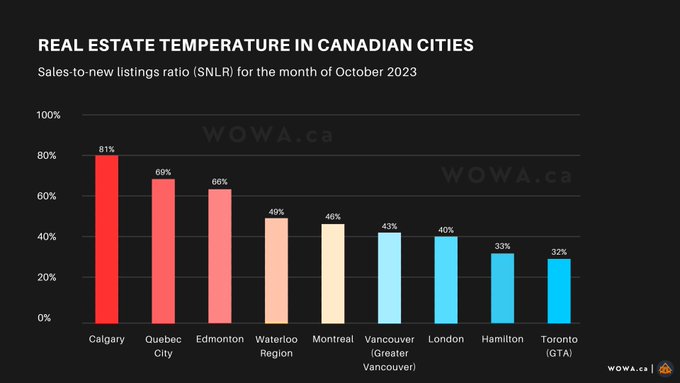

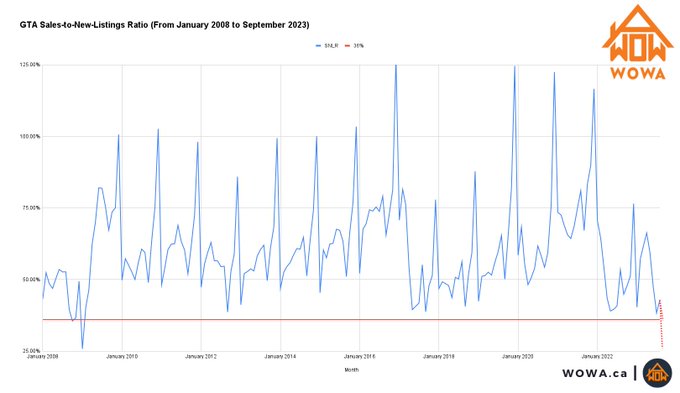

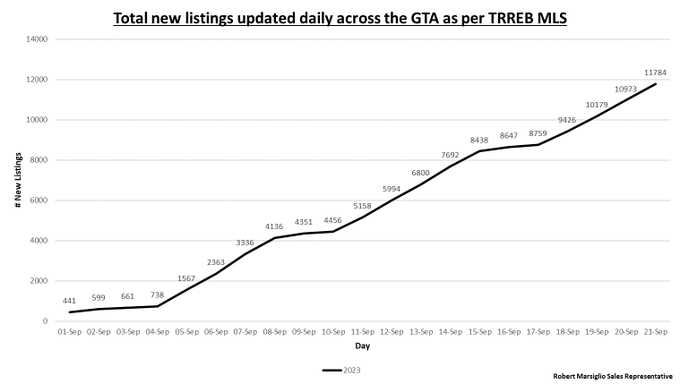

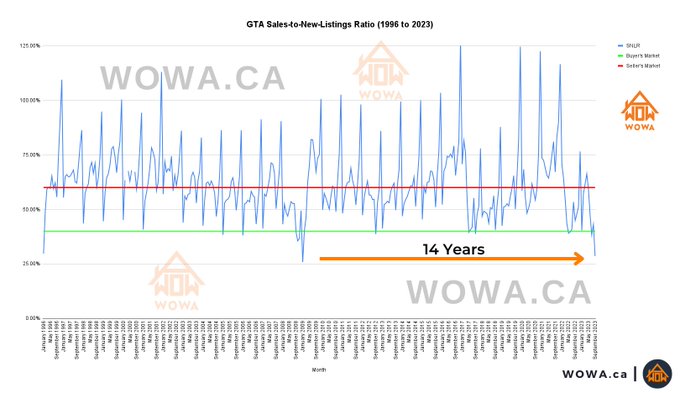

GTA Sep 2023 Sales to New Listings Ratio (SNLR) will be ≤ 36% (Buyers' Market)

From

@rob_siglio

graph, GTA new listings will pass 16k. Assuming this month's # sales ∼Sep 2022 (5038± 15%)⇒sales # 4282 to 5794

⇒ 27% ≤ GTA SNLR ≤36%

The Lowest GTA SNLR since Jan 2009!

#ToRe

@ManyBeenRinsed

Here is the GTA for you, Woes.

Seeing about 560 per day (incl weekend and long weekend). Weekdays hovering 800-850.

9

8

52

1

12

54

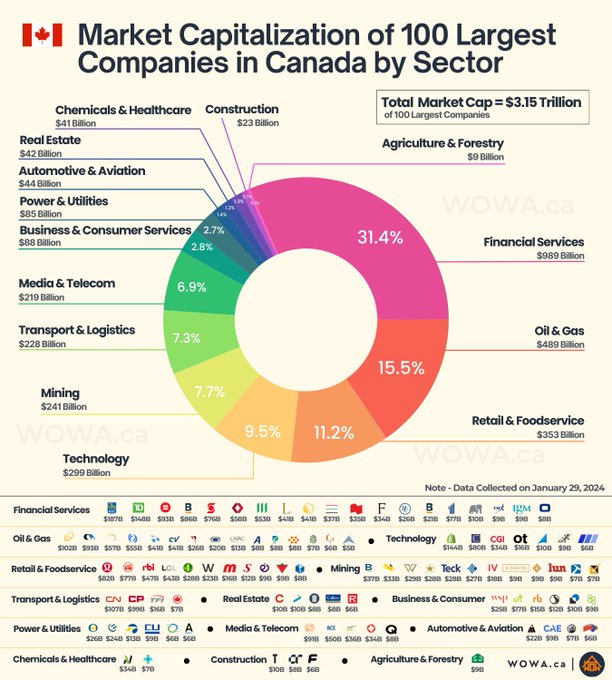

When

#RealEstate

fees contribute more to

#CDNEcon

than agriculture (1.9% vs. 1.6%)

When more than 20% of economy is related to Real Estate & manufacturing is only 10%

No surprise that

#GDP

shrank when

#housingmarket

goes down!

#TORE

#VanRE

@StephenPunwasi

2

17

51

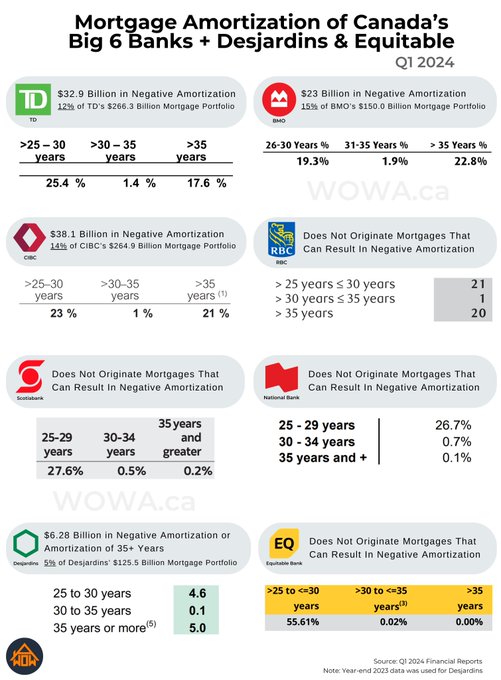

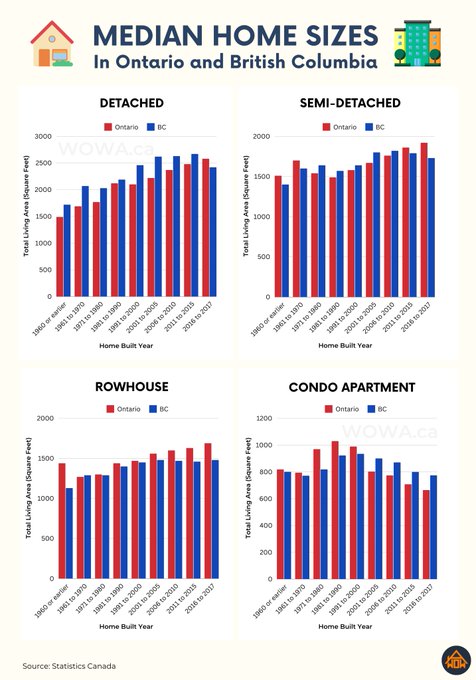

Is 35 the new 25? Let's hope not!🤞

Why worry about 35+ year mortgages?

• Easy money creates bubbles🎈

• Bubbles lead to more debt 💳

• Causing unsustainable cycle🤯

Resulting in:

1. Lifelong debt traps, reducing freedom⛓️

2. Bubbles inflate further!📈

3. Politicians might

1

8

51

@Kymeleon1

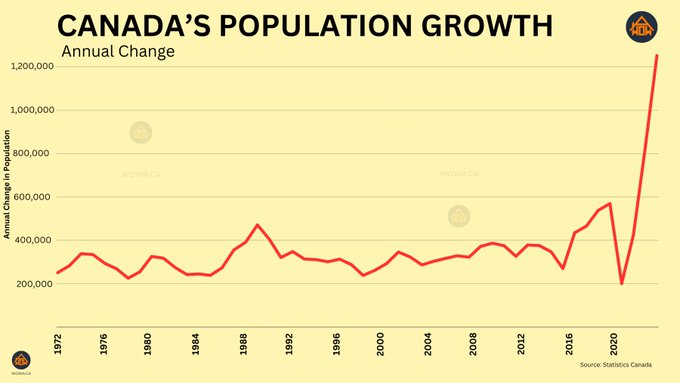

Yes, leadership plays a crucial role, and since 2015, several wrong decisions have been made, including expanding the government and the recent rapid population increase of one million per year. However, it's overly optimistic to expect that the ministers under the next Prime

5

2

43

@Mill_Moron

Yes! The banks' negative amortization portfolios are as follows:

CIBC: $38.1B

TD: $32.9B

BMO: $23B

Desjardins: Between zero and $6.2B (not reported)

3

2

43

As forecasted below, GTA's SNLR hit 28.6% (deep buyer's market), the lowest since Jan. 2009. Prior to 2009, the last time reached this level was in 1996.

Toronto home prices didn't drop in Sep. as it takes time... but "Winter is Coming". 🏠❄️

#Tore

More:

GTA Sep 2023 Sales to New Listings Ratio (SNLR) will be ≤ 36% (Buyers' Market)

From

@rob_siglio

graph, GTA new listings will pass 16k. Assuming this month's # sales ∼Sep 2022 (5038± 15%)⇒sales # 4282 to 5794

⇒ 27% ≤ GTA SNLR ≤36%

The Lowest GTA SNLR since Jan 2009!

#ToRe

1

12

54

4

10

39

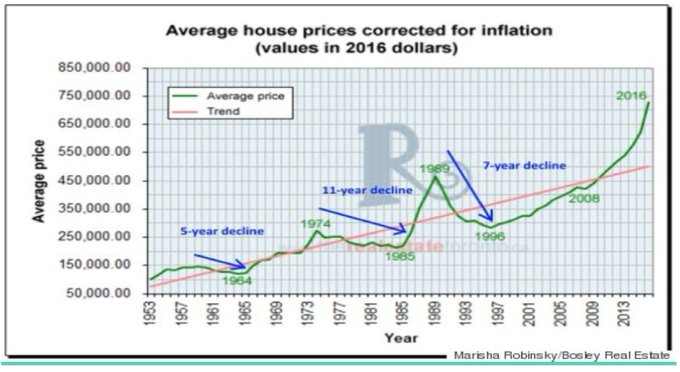

#BankofCanada

rate policy is the main reason for the rapid

#homeprice

growth of last 10 yrs

#ToRe

#VanRe

Hist.

#BOC

rates:

Jan.1935: 2.25

1945: 1.25

1955: 1.75

1965: 4

1975: 8

1980: 13.75

1985: 9.4

1990: 12

1995: 8.13

2000: 4.75

2005: 2.50

2010: 0.25

2015: 0.75

2018: 1.25-1.75

6

11

35

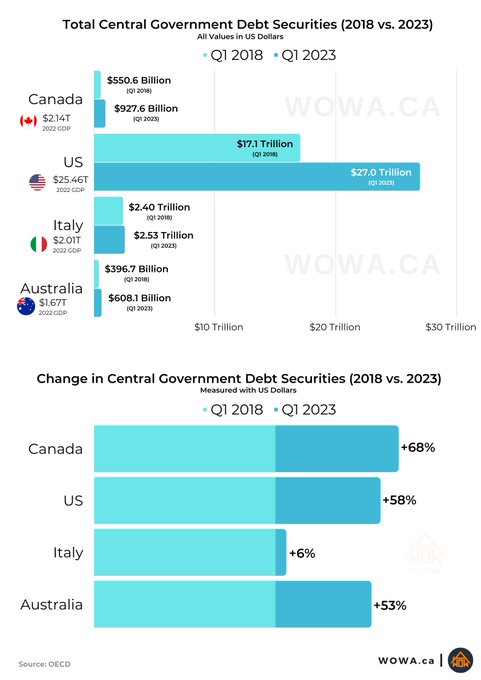

Comparing government debts (debt securities): Canada had the highest % increase, while Italy & the USA have higher Debt-to-GDP ratios.

Notes:

1. 🇨🇦 🇦🇺 🇮🇹 have similar GDPs

2. We only considered securities like bonds, excluding other liabilities (e.g. pensions)

#cdnecon

#cdnpoli

7

15

35

@SteveSaretsky

As you noted, the impact goes beyond 0.13%, as many self-employed use their corporations for pension plans.

The actual number of people affected by the consequences of this decision (e.g. fleeing entrepreneurs), reaches into the millions!

This 0.13% is yet another fabricated

3

4

34

@chef_tian97

36% of big 5 banks mortgages (and most probably all mortgages) are set for renewal within the next 2 years.

2

2

34

@StephenPunwasi

@Vic_Turbendian

@hmacbe

@SteveSaretsky

@vanbourse

@realTheProphet

@Charlies_Hammer

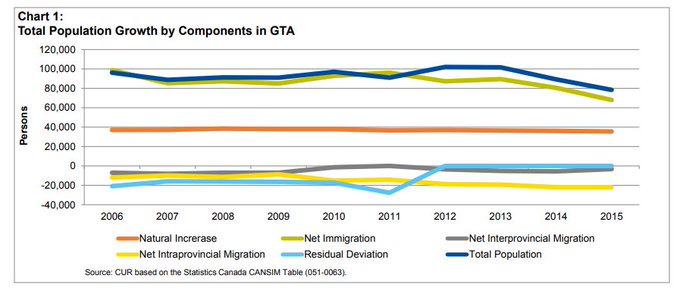

Role of immigrants in increasing GTA

#homeprices

has been exaggerated! No. of immigrants came to GTA has decreased significantly between 2011 & 2016 but in the same period

#homeprices

went up a lot!

The main factor has been Easy & Cheap borrowing!

#ToRe

…

5

9

31

@DMFSBLF

We're facing a shortage of 'affordable housing.'

Many individuals desire and need to buy homes, but are unable to do so, leading them to opt for other options such as renting a room/property or staying at their parents' basements.

2

2

29

@JohnPasalis

Signs that show an economy is too much dependent on real estate:

Real estate fees contribute more to

#cdnecon

than agriculture (1.9% vs. 1.6%)

More than 20% of GDP is related to real estate while manufacturing is 10%

Median home price in Canada is 40% more than US

#ToRe

#VanRe

0

6

30

There is sth fishy about CND mortgage market when the avg. mortgage eligibility has increased much faster than avg. income

From 2009 to 2017 avg. new mortgage amount in Toronto has doubled, but how about avg. income in this period!?

@StephenPunwasi

@mrdruthers

@dima_nomad

#ToRe

4

11

26

@MarketManiaCa

Low interest rates and easy money can create bubbles. After 2008, despite Canada's relatively stable economy not requiring aggressive cuts like the US, the

#BoC

reduced rates significantly, following the Fed cuts. Now, we're seeing bubbles across Canada. 🇨🇦💸

#cdnecon

1

5

29

@GRDecter

Thanks for sharing our chart. I would greatly appreciate it if you could replace it with the complete version of the chart that features our

@WOWA_Canada

logo.

3

2

26

I believe governments should cut their costs during deficits, not just hike taxes.

But as noted below, property taxes in

#ToRe

&

#Vanre

are among the lowest in🇨🇦. As a homeowner in Toronto, I'm more concerned about high income taxes (impacting working class) than property taxes.

4

2

26

@somwchi300

Again, people target the speaker rather than the message. The statement is accurate: you need people to generate wealth and socialism doesn't get it!

3

1

25

Canada March 2018:

C$252B personal loans secured by homes (12% GDP)

C$32B business loans secured by homes

@BetterDwelling

USA Nov. 2017:

$448B

#HELOC

2.3% GDP

Canada vs USA: 12% GDP vs 2.3% GDP!

$252B personal loans HELOC (non-productive) makes

#cdnecon

vulnerable

#TORE

#VanRe

2

15

24

The cost of owning a home in Canada is at the highest level in 28 yrs & likely to go up as rates rise. Does it have an impact on

#homeprices

? Eventually yes! Take a look at what happened 28 yrs ago

#Tore

@StephenPunwasi

@SteveSaretsky

@dbcurren

@dima_nomad

4

7

21

@y3khan

Because these statistics applicable to negative amortization rather than underwater mortgages. Negative amortization is concerning for borrowers facing financial challenges, but banks primarily prioritize risk management over the issue of underwater mortgages.

3

2

21

In May 2008, Toronto & Calgary had the same home prices index at $380k

Now (Nov. 2023)

#ToRe

Avg. $1,082k (0% YoY)

Index: $1,081k (0% YoY)

More:

Calgary:

Avg. home price: $540k up 10% YoY (Half of GTA's!)

Index: $572k up 10% YoY

0

3

22

@oolsen50

Not true. The calculation considered a FICA taxes for a single person in 2022. Actually the effective tax rates are even lower for 2023.

2

0

22

@voteLabonte

The U.S. has a significantly higher number of contractors ($694B for 19k contractors) compared to Canada ($22B for 1,800 contractors) in 2022, a fact I consider positive for supporting the private sector.

In Canada, there are 200k unionized healthcare worker. Removing them could

2

2

20