Emil

@EmilKalinowski

Followers

24,161

Following

3

Media

1,884

Statuses

6,870

Helping you understand how the 2007 malfunction of the monetary system - and its continuing disorder - affects finance, economy, politics and society.

Cayman Islands

Joined April 2011

Don't wanna be here?

Send us removal request.

Explore trending content on Musk Viewer

어린이날

• 536406 Tweets

こどもの日

• 501971 Tweets

#EğitimHaykırıyorTekinistifa

• 158199 Tweets

子供の日

• 136599 Tweets

#光る君へ

• 106150 Tweets

Mülakatsız68binAtamaistiyoruz

• 85104 Tweets

#ขวัญฤทัยEP12

• 79520 Tweets

GW最終日

• 72762 Tweets

予選突破

• 47466 Tweets

Al Jazeera

• 35248 Tweets

#CHEWHU

• 31796 Tweets

Happy Easter

• 29874 Tweets

Cole Palmer

• 28978 Tweets

Noni

• 28043 Tweets

Gallagher

• 20816 Tweets

柱稽古編

• 19825 Tweets

BINGLING THROUGH IT

• 19188 Tweets

سعد اللذيذ

• 16561 Tweets

Santner

• 15731 Tweets

四塩化一黄酸

• 15681 Tweets

GW終わり

• 15044 Tweets

Kerem Shalom

• 12131 Tweets

#فيصل_ابورميه_المطيري_58

• 11760 Tweets

Madueke

• 11515 Tweets

Happy Cinco de Mayo

• 10711 Tweets

蜜璃ちゃん

• 10065 Tweets

Last Seen Profiles

There is a new world order developing and the number one asset class to own in that new world order is now gold.

—

#RussellNapier

, October 2022

83

120

844

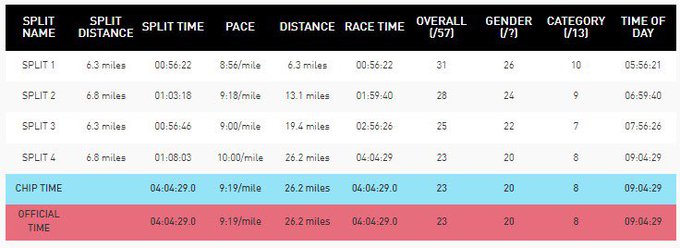

Some personal news, I tried to off myself this morning… by running a half-marathon (1:57:22) followed by a 3km ocean race (47:18).

Instead of having me committed they gave me a plaque!

Lastly, I ran into

@RaoulGMI

along the beach (no speedo).

#TheCaymanExperience

#PiratesWeek

61

7

415

This man accosted me at the

@Hedgeye

Live concert—if you know who he is please tell me so I can notify security.

39

11

387

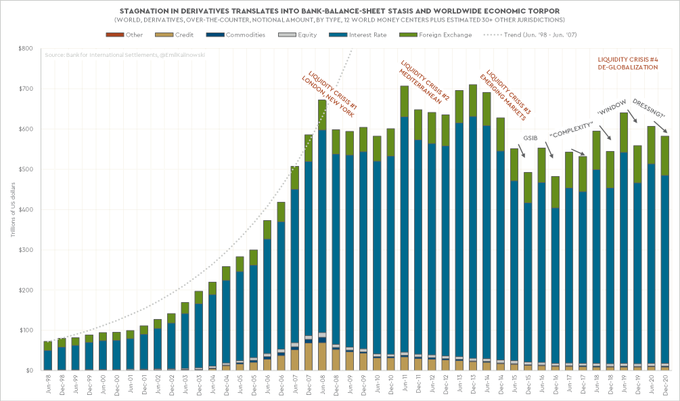

The

#FederalReserve

's Reverse Repo Program has exploded to $0.5 trillion. Why?

The mainstream, orthodox narrative is that 'this is fine'; a response to 'too many bank reserves'.

What does it really mean? Collateral scarcity. Systemic fragility. A warning.

#RRP

23

68

320

“Podcasts are becoming influential sources of misinformation.”

Agreed! What’s needed is a government funded, apolitical organization of technocrats that’ll evaluate news and determine what’s safe for the public to learn. We’ll call it the National Ministry of Public Truth.

40

30

302

Russia exported 819K barrels/day to India in May, up from 277,000 in April, making 🇷🇺 the second-largest energy supplier for 🇮🇳. The increase is associated with record discounts on 🇷🇺 energy to increase demand and help offset the losses from Western markets.

—

@GPFutures

9

61

245

Happy to see

@coloradotravis

and

@MetreSteven

intend to produce documentaries, educational films and self-help videos about monetary policy.

25

15

257

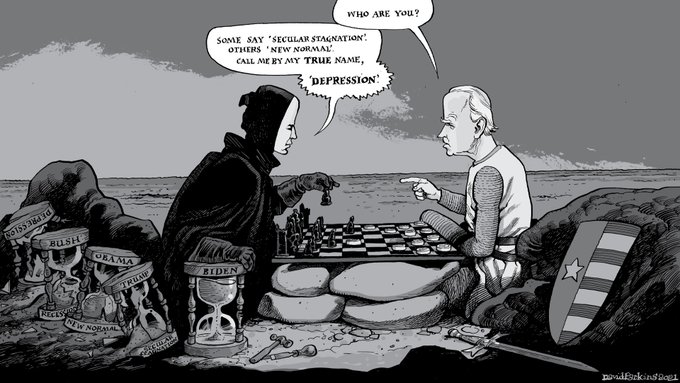

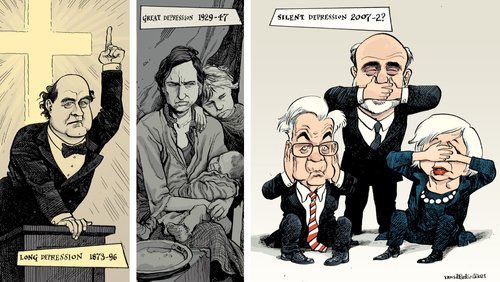

I guess instead of writing about it and talking about it on YouTube I should have gone on TikTok—

That’s ok, I’m just pleased to know this depression will be remembered as I named it (maybe I can get a coupon for a free cup at the soup kitchen).

17

15

213

I wonder if I should clear my 2024 calendar to be available for interviews?

Very happy this is getting publicity finally because identifying the true depth of our, at one-time economic, but now metastasized social and geopolitical problem improves our chances of solving it.

32

14

206

Please help push my interview (12.2k views) with

@JackFarley96

on

@Blockworks_

past

@biancoresearch

's day-earlier appearance (21.7k) as I'll be talking to Mother soon and she'll ask, 'Done anything meaningful with your life yet?'

📺

22

28

192

Thank you Mr.

@JamesGRickards

for including me alongside Jeff in your latest bestseller. Amazing!

(For all those interested, I will be autographing page 188 all this week down at the beach by the second red buoy.)

It seems you're doing your way

@JeffSnider_AIP

@EmilKalinowski

in the last

@JamesGRickards

book 'Sold out' p188

2

1

26

16

13

177

@leadlagreport

@SantiagoAuFund

@YouTube

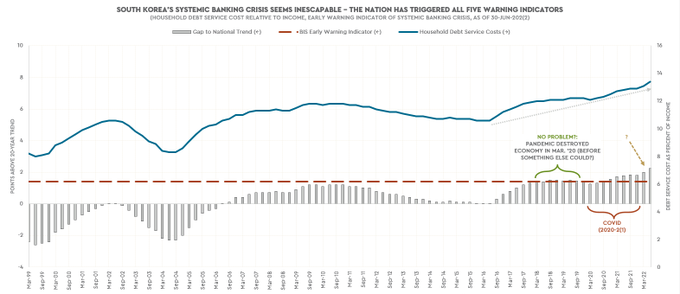

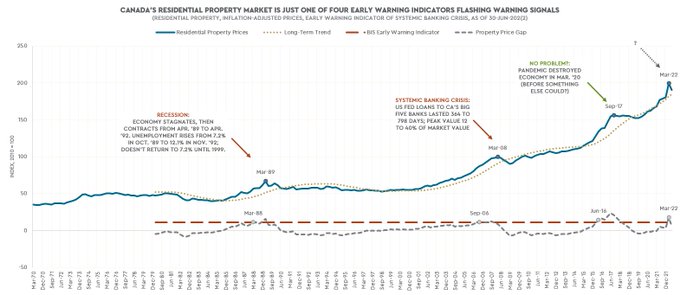

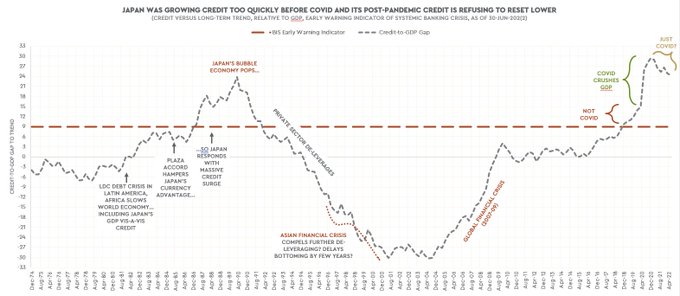

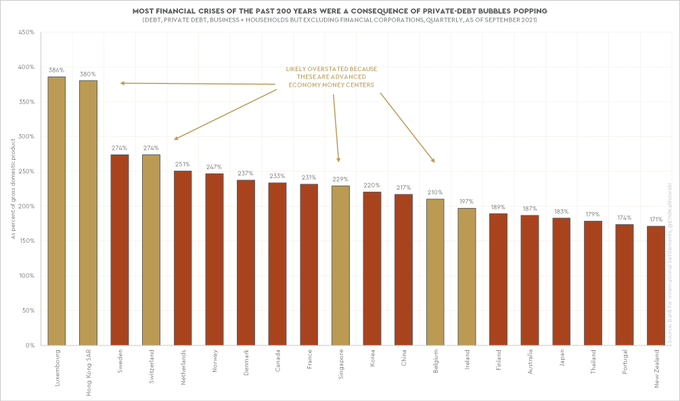

My tier ranking of sovereigns most likely to suffer a debt/financial/currency/economic crisis in next three years:

Tier 1

🇰🇷

Tier 2

🇨🇦

Tier 3

🇸🇪🇨🇿🇳🇴

Tier 4

🇭🇰🇫🇷🇨🇭🇨🇳🇨🇱🇱🇺🇦🇷🇸🇰🇩🇪🇳🇿🇧🇷

27

54

166

"The first casualty of war is said to be the truth, and it probably perishes even before the first shot is fired. The second casualty of war is sound money."

—

#RussellNapier

(Feb, 2022)

11

25

157

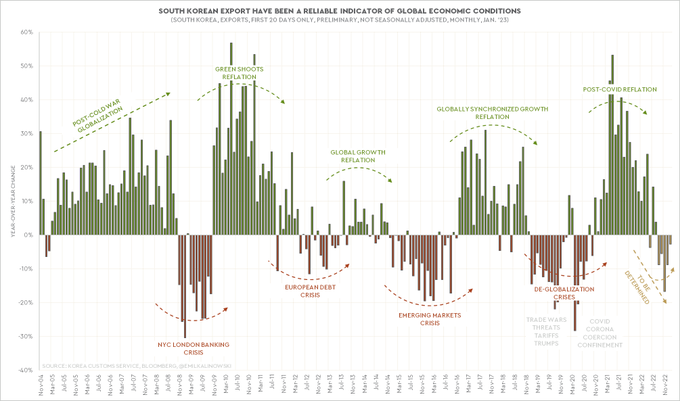

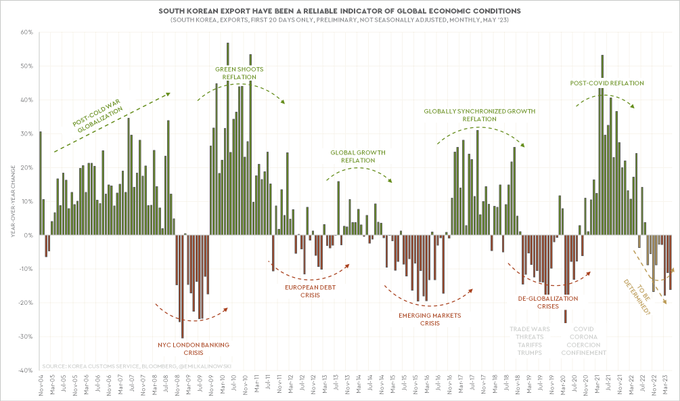

#SouthKorean

exports (prelim., 20 days) were negative for the 9th consecutive month in May. This happened in 2015-16, 2019-20 and almost 2008-09.

Korea's

#1

export destination is China.

Base metal prices have had a 70% correlation to this economic account since Aug. '07.

17

36

157

Today's anniversary show of Making Sense, a podcast with

@JeffSnider_AIP

, is a special countdown of the Top 10 Show Intros of Season One. The critics agree:

Havenstein: "I wouldn't have done this"

Van Metre: "I am speechless"

Pal: "Haunting"

GooglePod:

16

5

153

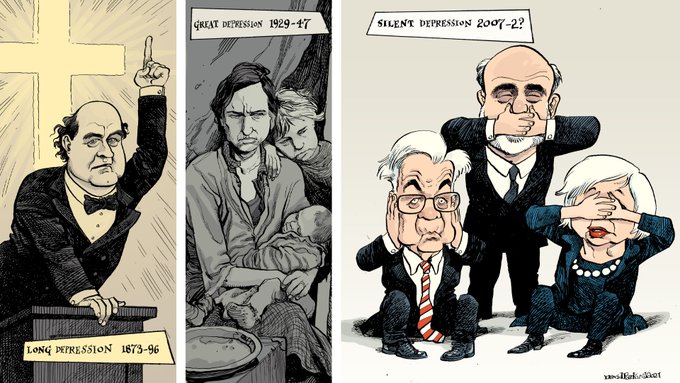

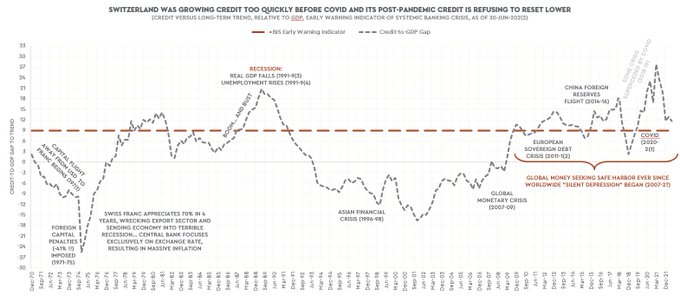

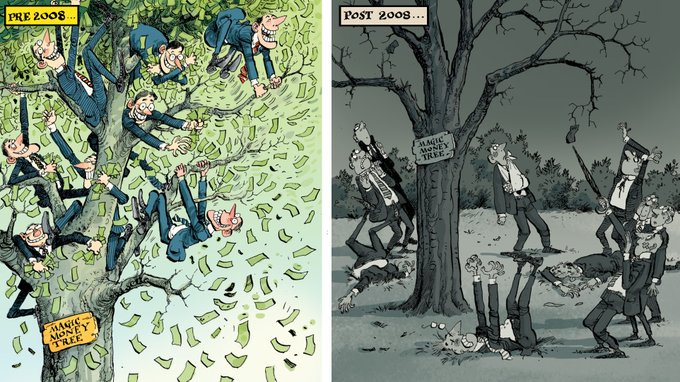

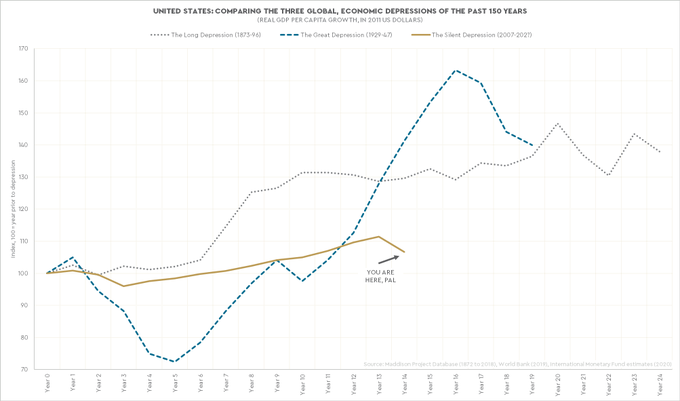

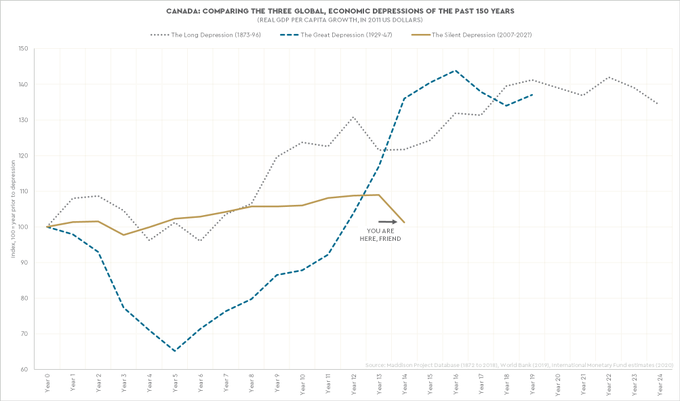

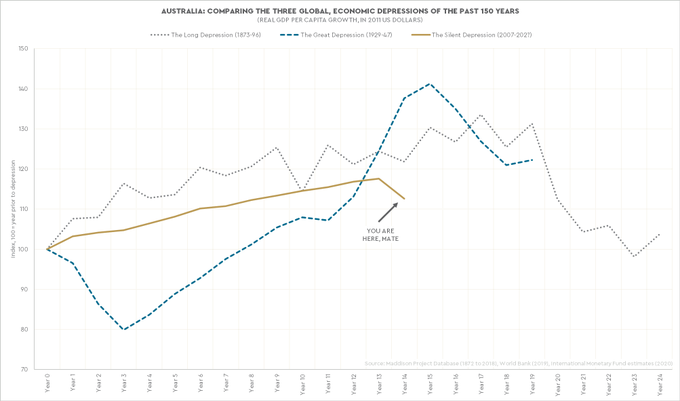

This is why I call it the Silent Depression. Policymakers / economists / technocrats / central bankers took steps to ensure it would never happen again (are they gods?). Therefore, it cannot (be said to) happen again lest they look bad; and we cannot have that!

@TonyNashNerd

"Depression" was way overused in 2008/2009 too. In the 1930s, policymakers took steps to ensure we could not have another depression. Included in these steps was adoption of automatic stabilizer programs (subsequently expanded in 1960s).

4

0

8

9

28

151

Why not both?

17

13

142

@MacroAlf

I'd add that central banks can print a kind of money (bank reserves), but it's rather narrow in terms of who can use it and where (e.g. laundromat tokens).

So, QE creates trillions of laundromat tokens. And that's not very useful to the real economy...

14

9

141

"Now of course, the Fed doesn't print money. The Fed's liabilities are not medium of exchange, they're not a store of value, they're not money. They do not circulate."

-

#LacyHunt

(interviewed by

@DiMartinoBooth

on 29-Mar-2021 at

@RealVision

)

14

26

130

I’m really getting sick of all the petty restrictions being place on the good people of the international elite.

We’re trying to run a business here!

8

11

132

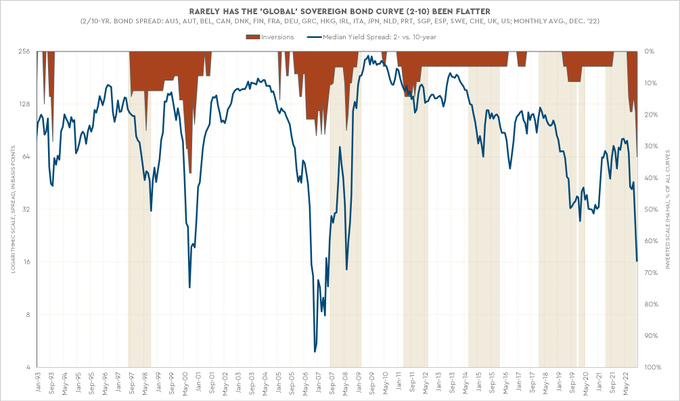

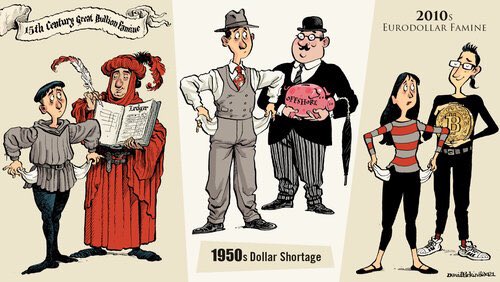

Time to buy bonds? Also, did the ECB warn of a 2011-12 Euro Crisis re-run?

Eurodollar University, Ep. 253 with

@MacroAlf

&

@JeffSnider_AIP

:

📖

📺

🔊

🥜

☁️

16

21

131

I highly recommend listening to this podcast to hear Mr. Achuthan explain why the outlook remains recessionary, has been recessionary and there's not much out there suggesting otherwise.

Prescient, accurate inflection identification for many years now.

.

@ErikSTownsend

welcomes Lakshman Achuthan

@businesscycle

to the show. They examine the growth, business and inflation cycles along with ECRI’s leading indicators which are plumbing lows never seen before except during the depths of the 2008 crash.

7

21

93

11

10

130

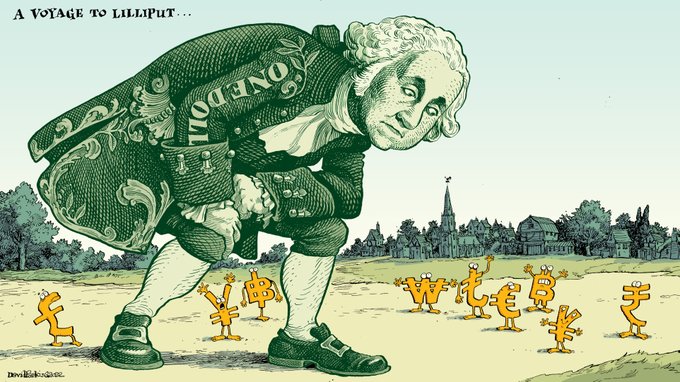

The

#PetroYuan

is helping China relieve its

#dollar

sourcing difficulties. Interestingly, those difficulties ARE NOT registering on the PBOC's balance sheet. Indeed, foreign exchange reserves are 'unchanged'. For months! In the middle of a monetary maelstrom?! That's no accident.

7

33

128

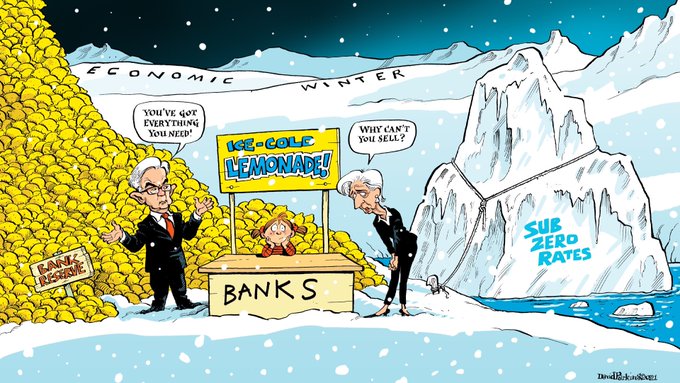

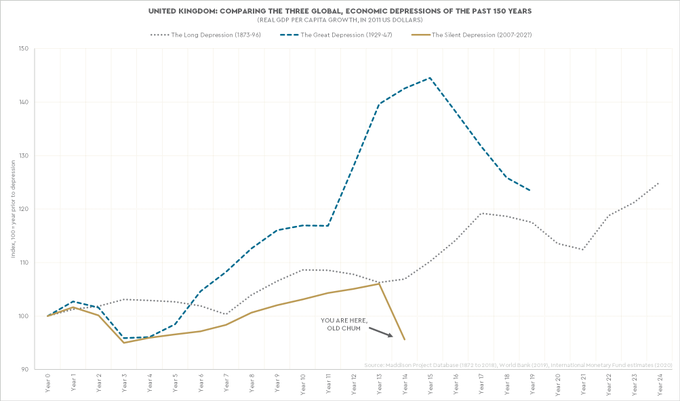

@AnnPettifor

@DanielaGabor

Britain's GDP/capita expansion since 2006 is on par with the Long and Great Depressions. Why? Because we are in another, global depression. This one is silent because the economists cannot admit that they let it happen again. They do use euphemisms though.

12

28

127

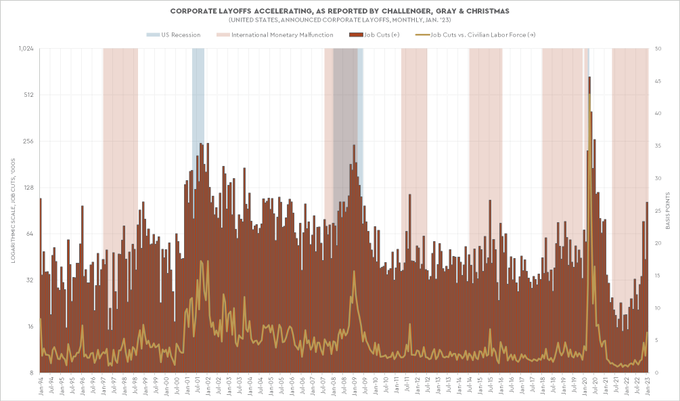

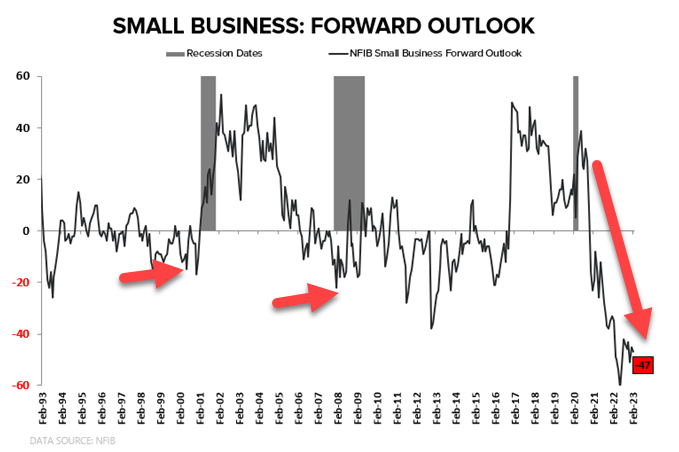

Nobody—nobody!—could have seen this economic malfunction coming for the last 24 months.

Small Businesses = over 99% of total U.S. Employer firms and >60% of net private sector hiring on a monthly basis

This is way worse than 2001 or 2008

#Quad4

Recession

16

99

236

16

15

126

3.1%—post-WW2 real growth 🇺🇸

1.6%—post-GFC real growth 🇺🇸

The “most significant economic story of our lifetimes…”

As per

@DavidBahnsen

in “Our Japanese Economy” (National Review, 11-Sep-2023)

#TheSilentDepression

10

20

127

RICHARD FISHER: QE is easy money that powered the stock market.

@JeffSnider_AIP

:

#QuantitativeEasing

is NOT cheap money, it is

#BankReserves

that DO NOT flow into stocks, BUT BUT BUT... the Fed's easy-money-narrative DOES flow into equities! Psy-op and sloganeering, not money.

13

20

123

Just booked an appointment at the local parlor to get my other bicep branded with another "I ❤️ Lyn Alden" tattoo.

@Jen66718580

@PeterMcCormack

To his credit,

@EmilKalinowski

has been one of the leading voices in the idea that the 2010s were a silent depression.

I agree with that analysis, coming from a Dalio-esque long term debt cycle angle.

4

3

53

16

2

123

IF banks produce the overwhelming proportion of money for the economy; and

IF banks continue to increase their lending to only the most-creditworthy customer(s);

THEN it’s no surprise to me the economy stinks, has stunk and will stink.

12

14

116

Shrimp tarte with creamy Yukon

#gold

(go long!) potatoes. Also, hollandaise egg and salmon. Also (again), I’m irresponsibly long Brunello—I’m blasted.

8

1

121

Typical, post-conference cocktail party courtesy of

@Hedgeye

. Was looking for Neil Howe but…

10

3

117

Neat. I believed when I first coined the name that historians will label 2007-2x as a ‘silent’ depression to vilify establishment economists for prioritizing the profession’s reputation over ‘obvious’ realities.

I’m secretly rather proud of myself.

The term

#SilentDepression

is gaining traction for good reason.

The official response, such as it is, by

@federalreserve

has been to bail out the big banks, preserve private equity profits, and assure the financial sector has everything it needs at all times.

37

124

361

9

15

116

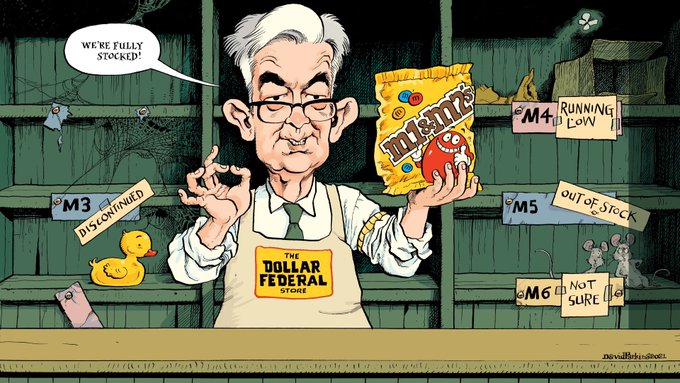

Have you seen a chart of M2 lately? Money supply has achieved escape velocity into the inflation-osphere! 🤯

And yet the nominal economy stinks. 😔

@JeffSnider_AIP

says something is missing. (Spoiler Alert: what's missing is 'money', like M3 or M5 and especially M∞). 🤔

9

15

111

But I was told by the authorities just last week that every thing was terribly terrific…

11

7

111

POWELL: MEASURES OF MONEY SIGNALING A SYSTEMIC CRISIS IN PROGRESS SINCE MAY ‘22 IS FAKE NEWS.

POWELL: DON’T LISTEN TO EURODOLLAR UNIVERSITY WITH

@JeffSnider_AIP

.

7

7

110

@JackFarley96

That's me.

Intelligent, supportive, funny... me, me, me...

Me also...

I have a great body, and sometimes I go months without looking.

This is a man we're talking about, right?

Does he have to use the word poopy?

I am really close on this one... really, really close.

10

1

107

Merry Christmas to shifu

@JeffSnider_EDU

—monetary sensei, economics yogi, macro Santa who comes with the gifts that keeps on giving: insight and education.

7

5

109

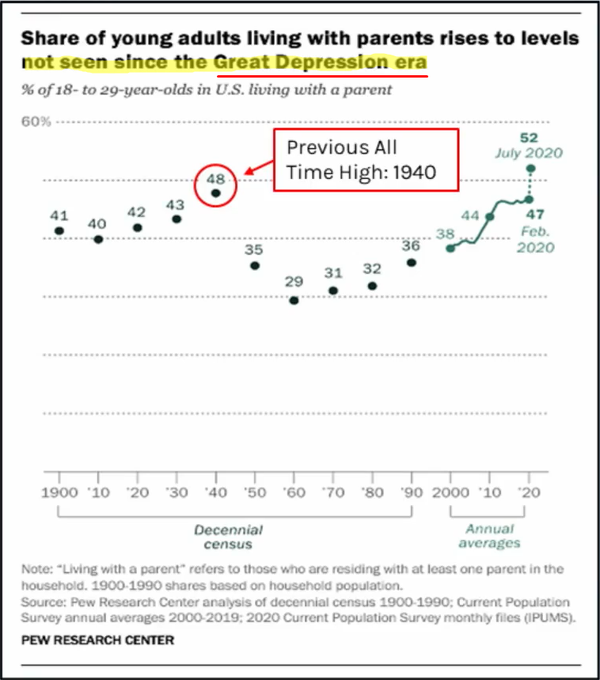

Watching

@Hedgeye

#MacroShow

with

@HoweGeneration

who reminded us that in the US we are observing multigeneration households at levels last seen during... the previous depression.

#SilentDepression

(2007-202?)

7

28

106

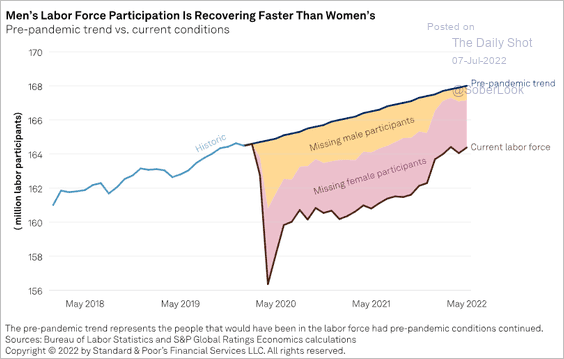

But the unemployment rate is so low! But the job openings are so high! This might be the best jobs market in decades! *sarcasm*

It seems that markets believe the Fed will use the 'strong' labor market and high CPI readings excuse to keep hiking right into the teeth of recession.

Interesting graphic that debunks the

#employment

is strong story.

1) We are not creating NEW jobs, just replacing jobs lost during the pandemic.

2) Millions remain missing from the labor force which makes the

#employment

rate appear stronger than it is.

25

151

468

11

23

103

Tomorrow

@JeffSnider_AIP

and

@NicholasBlack60

will be talking digital assets and cryptocurrencies. Any topical questions you'd like me to ask these two experts?

You can follow the show live tomorrow here:

28

10

104

This was a spectacular performance by

#JeffSnider

.

Everyone knows him as an expert on the offshore dollar system but in this show he really showcased his knowledge of

#China

.

Also, the ultra-rare—previously thought extinct—

@JeffSnider_AIP

prediction (sorta).

Free to watch!

Dive deep into financial market plumbing, Fed policy, the Chinese economy, and inflation in this macro masterclass between

@JeffSnider_AIP

and

@KeithMcCullough

Watch their entire conversation for FREE here:

3

6

47

9

15

103

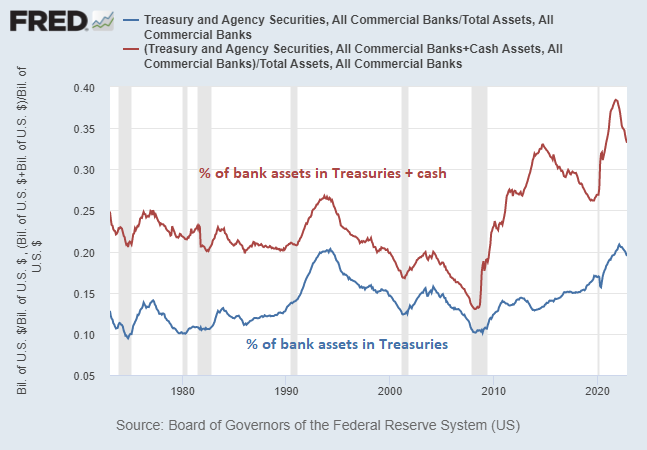

Banks have abandoned loans, hiding within a safe-asset fortress.

Eurodollar University, feat.

@JeffSnider_AIP

:

10

11

101

JC is unimpressed by my 3.9-kilometer, 19-race effort in Jamaica last week, saying—and I paraphrase—'you moved through the pool like a pregnant yak'.

Running on the other hand, he avers, doesn't allow pork on the course. Wrong! Here I am grazing, in a marathon, three weeks ago.

@EmilKalinowski

Sry but u still look fat

I was always under the impression that u can be fat as fck and still swim ok

Quite diff than running for instance

2

0

1

29

0

103

I interviewed

@Jared_Bibler

about his fabulous book

#IcelandsSecret

.

Iceland's GFC experience is infamous—actual bankers went to jail!—but what happened really?

📺

🔊

📡

🎙️

20

17

100

None of the "Mass Formation Psychosis" interviews with

@joerogan

,

@CHMartenson

,

#RobertMalone

or

#MattiasDesmet

explained WHY and WHEN.

In this episode with

@JeffSnider_AIP

we do: a 15-year (so far) worldwide economic Silent Depression.

14

22

98

In last three weeks I sought an audience with oracles

@JeffSnider_aip

and

@hendry_hugh

; now you can too (courtesy of this podcast).

9

14

101

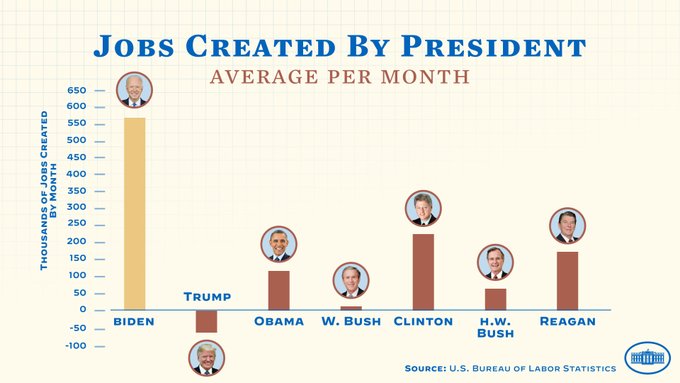

At least by this one measure, and many other economic accounts, Biden is America’s best President!

Coincidentally (?) such measures identify Johnson, Trudeau, Morrison, Arden and many (all?) leaders as their nations’ greatest leaders too.

This may be humanity’s greatest age!

18

7

94

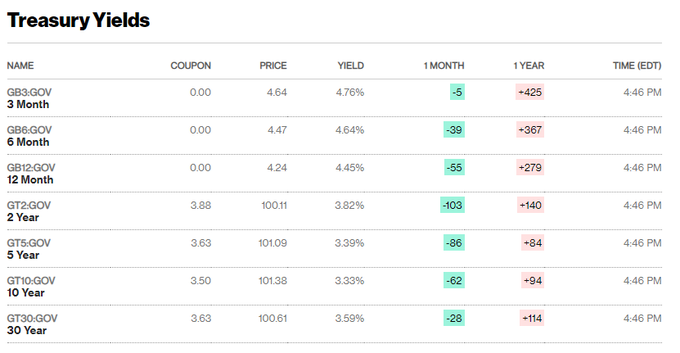

A March 31 regulatory deadline may cause a volatile rebalancing of the US Treasuries. How did it get to this?

We start in 1974, with a modest German bank (Herstatt) that grinds the interbank system to a halt. It's

@JeffSnider_AIP

story hour!

#SLR

#TreasuryBills

#CapitalRatios

7

14

97

Recently I told

@JeffSnider_AIP

that mail to the island is slow to arrive. For example, I get

@TheEconomist

by bottle. Some scoffed.

Today a

@WSJ

opinion column about inflation washed up on shore (in the offshore). Jeff reacts to it live, in this episode:

9

3

93