Collins Belton

@collins_belton

Followers

12K

Following

45K

Media

898

Statuses

15K

Father, Husband, Attorney, Gamer, Wanderer, More Existential and Pithy Words Implying A Perfectly Calibrated Blend of Complexity and Simplicity.

Joined May 2019

@GaryGensler @andrewrsorkin @SquawkCNBC Ideally you’ll spend some time to explain how, once again, the commission’s enforcement priorities focused on entities trying to deploy technology to prevent these market failures & asymmetries while you were meeting with the perpetrators or overlooking their malfeasance?

12

124

663

Cannot stress how angry I am that the SEC and @GaryGensler + predecessors spent years harassing DeFi builders trying to move us away from opacity and literally missed all of these obvious risks that die hards have been screeching about for years.

13

79

657

@katienotopoulos Given this paragraph below, what public interest did it serve to dox these folks? . It doesn't seem like you think there's any public harm and the identity of these people without something more doesn't seem to be in the public interest to the point of violating their privacy.

30

13

513

While I can't say I'm surprised, I'm happy @coinbase is shedding light on how @SECGov's approach is actively disincentivizing proactive engagement and compliance. The hypocrisy of asking for engagement and subsequently stonewalling willing participants should be made public.

After months of trying to engage with the @SECGov on our planned Coinbase Lend product, we recently received notice that it intends to pursue legal action against us. We believe dialogue is at the heart of good regulation, even if the SEC may not.

9

65

506

Putting aside my thoughts on the SEC's behavior and hypocrisy, I think the below sentence buried in @coinbase's posts deserves special attention separate from the securities law chicanery. This should leave you uncomfortable.

13

122

496

Wow, ok so this story has gone from strange to downright “what the actual hell is happening” with swiftness. The commission fees to the sketch BD with China ties is a big red flag and highly atypical to anyone familiar with venture in the US, especially in finreg. Great sleuthing.

This Prometheum storyline has got to be the strangest thing I have seen in awhile in this industry. Has anyone actually looked into this? Beyond bizarre….

22

49

444

BSC seemingly broken, @elonmusk rugging Bitcoin, @VitalikButerin rugging dogcoins, Facebook capitulating on Libra, and the Asia session hasn't even started. Haven't seen a day like this in a while.

18

49

421

Did you catch what happened there? . This is not the SEC asking for the info of people who have engaged in some illegal activity. This is @SECGov just asking for the info of people *merely interested* in a product that *may* be offered in the future.

10

41

335

With the Bitcoin ETF news now official, I think it’s important to recognize how critical it was for Grayscale to be willing to go to the mat and engage our judicial process for us to get here. @GaryGensler essentially concedes as much in his statement:.

18

42

327

Hot FUD: A landmark regulatory decision for #DeFi is likely coming that will serve as its DAO Report. A few players are more vulnerable to regulatory action IMO: (1) Decentralization Flirts, (2) Permissioned Stablecoins and (3) wrapper/offchain custodians. Thread (1/lot):.

13

70

300

I believe this CFTC Order may end up being one of the most relevant and telling regulatory actions for DeFi founders and investors yet. More than any other prior order, the CFTC directly emphasizes and assesses some of the key elements of "true" DeFi platforms in this order.

JUST IN: The @CFTC has fined @PolymarketHQ $1.4 million and ordered it to wind down certain markets by Jan. 14. @nikhileshde reports.

5

77

290

LOL @MattWalshInBos it gets better! I checked the broker dealer site only to see this and had to laugh out loud remembering that this is the same iced tea company that “pivoted” to blockchain in the 2017 bull run:.

29

38

248

While I’m not surprised, this is arguably the most significant legal action that has occurred in crypto and could have absolutely gargantuan ripple effects for everything from dev liability to first amendment implications of code publication.

9

41

228

Man, @valkenburgh is arguably one of the closest people I can think of that rivals the founders and other seminal philosophers across time in some of the ways he thinks about and frames the purpose of government and the structure of financial systems.

A must-watch U.S House of Representatives testimony on the ethos and strength of #Bitcoin by @Valkenburgh today.

3

32

213

@GaryGensler Thanks for the additional clarity Chair. To ensure the market can continue moving towards a model of compliance, could you confirm for us when ALGO’s coin model transmuted from an “interesting” mechanism to a noncompliant offering? Much appreciated.

2

27

208

@lukesotheraccn1 @eTrue250 @smf_chi @wvrcomarco @TrayD12 LMAO you're wrong for this family, if he did that Will would have been forced to become a felon that evening.

2

5

185

In what world would collecting their PII (and presumably things like their wallet information) make sense if not to just generally track their behavior. What does @SECGov plan to do with this? This seems like something worthy of a FOIA request.

1

11

176

@hasufl It's hilarious to me how many people want the benefits of equity / equity like instruments and then try to ferret out of any of the obligations or negative implications of being an equity owner. You are literally the owner of the business; if it has failed, *you* are responsible.

3

6

181

Listening to @SBF_FTX talk about trying to comply with multiple country's crypto regulatory and licensure regimes is incredible and also highlights why I chuckle when people talk only about US regulators. These issues are not going to be limited to the US, buckle up.

9

6

177

Imagine going back to 2011 and showing the OWS crew @SenWarren eagerly supporting Jamie Dimon’s perspective that a payment network uncontrolled by Wall Street with unprecedented (and frankly unsafe) levels of transparency is the true threat to America. Fascinating.

JUST IN - JPMorgan Chase CEO Jamie Dimon: "I've always been deeply opposed to crypto, #Bitcoin, etc.". "If I were the government I'd close it down.".

11

30

171

Pretty disgusted to see the attitude of many Americans on this because they clearly think this bank was exclusively serving “rich tech bros” because of the name.

My friend runs a community housing development organization and their accounts and grants are tied up in this mess. I hope the non tech angle gets covered as well.

6

17

155

Well, I chose the wrong morning to start late. Hard to TL;DR this one. To try - CFTC Alleging:. - Unregistered deriv platform/broker .- Knowingly offered products to ineligible US.- Knowingly allowed crime/terrorism proceeds .- Cartel real.- IMO, more likely 2 come from DOJ.

13

36

157

NO CHANCE LMAO. Yoinking this from @propelforward . This BD was involved in ANOTHER blockchain grift the SEC actually pursued for fraud in 2019!.

8

12

149

Can’t believe it even needs to be noted that the Constitution and Equal Protection Clause do in fact still exist in 2022, and that the government can’t…*checks notes*…ban an entire race or ethnicity from participating in life and commerce. We kind of had a war about this….

*COINBASE SAYS AT THIS TIME, WE WILL NOT INSTITUTE A BLANKET BAN ON ALL COINBASE TRANSACTIONS INVOLVING RUSSIAN ADDRESSES - RTRS. $COIN.

12

19

156

Wow, if this is true, Tether is apparently holding more US T Bills than all of the UAE and many other countries. At this point, regardless of what you believe on their history, I think it’s hard to see the USG railroading these guys easily anymore.

Today Tether shares its attestation for Q2/2023 (2023-06-30). Another quarter, another massive result. I'm immensely proud of our team. Hightlights. 1. Q2/2023 Tether's operational profits > $1B. How?.The main component of the profits are the interests on the T-Bills that Tether.

13

17

134

@SenWarren @RonWyden @PCAOB_News A crypto bank folded and is so far able to cover all deposits and make their creditors whole. A regular bank is in the process of melting down with undisclosed liabilities and an unclear path to repayment for creditors, and your focus is on increased auditing stds for crypto?.

1

9

137

The "Mnuchin Rule" is finally out, and so far, the only thing I can describe it as is an aggressive invasion of individual privacy supported by some of the worst legal and policy contortion rationale I've seen in a while.

FinCEN has proposed a new rule extending AML regulation to "unhosted wallets.". If adopted, the rule would require regulated companies to verify the name & address of non-custodial wallet users for any transaction > $3k. Public comments are due January 4.

3

17

135

What a dissent. One thing that really frustrates me about the state of things at the SEC is the fact that there’s almost a disregard for legal precedent and SEC practice. In some ways this is understandable since @GaryGensler is not a lawyer and not legally trained.

In addition to ironing this t-shirt (which republishes code from a comment letter), will I need to register as an exchange before wearing it? "It depends," per the SEC's latest release:

5

14

133

Astounding that this CEO scorned employees for rightly calling out what can only be described as biblical level mismanagement impacting thousands of people’s lives after the opportunities afforded by an historic money generating era for the business was completely squandered.

Coinbase CEO @brian_armstrong announced today the difficult decision to reduce the size of the Coinbase team by 18%. More details and rationale in Brian’s email to employees, which has been made public for all to see ➡️

4

8

124

I’m not going to have a chance to read until later but myself and colleague/mentor @lex_node are apparently cited by @HesterPeirce here. I try to play the chill and collected card often, but I can’t lie; this is one of the coolest moments of my career.

6

7

124

OK, a quickie. TL;DR. SEC alleges:. - Binance/CZ fraudulently repped independence of Binance US and intl .- BCZ operating unregistered exchange/BD/clearing agency.- $SOL, $ADA, $MATIC, $ATOM, $BNB, $BUSD (!) + more + staking programs are securities .- Requests asset freeze (!).

11

28

117

I remain genuinely impressed at the number of teams in this industry that seem to prioritize innovating new ways to obliterate goodwill and snatch defeat from the jaws of victory. One of the more novel talents of this little hamlet of ours.

Arbitrum foundation made a proposal (AIP-1) to allocate 750M ARB tokens for admin and op costs, but $ARB holders voted against it. Now they said the vote was just a formality, and they have already spent 50.5M (6.7%) of the proposed 750M $ARB. Your vote is not vote

4

10

119

So, as many predicted, looks like #Libra is all but DOA unless @davidmarcus and FB pull off a minor miracle. I’m going to say something that will probably get me shunned by some - I think this should upset a lot of people. Not because the result isn’t great for crypto (it is). .

5

21

114

@mikedemarais @lex_node It’s absolutely amazing that they have millions of people offering to extend our dollar hegemony and they are adamantly refusing to take the W. I don’t even bother arguing this angle b/c it’s so baffling there’s nothing I can think to argue to make the point clearer.

5

15

114

I’m not one of the people who hates all modern media outlets but they seem to intentionally be making it a Sisyphean feat to defend the integrity of the profession with the quality of FTX reporting.

Alameda Research CEO Caroline Ellison is a math whiz who loves Harry Potter and taking big risks. She is also one of the supporting players in Sam Bankman-Fried's FTX catastrophe — and a new darling of the alt-right. Read more:

6

9

112

I raise this often as a common counter to people trying to paint everyone in crypto as some type of criminal. The irony of people using some of the largest, centralized parties asking for regulation and not getting it as a cudgel to bludgeon us all with is absurd.

Why is @collins_belton frustrated with the SEC? Because he feels the SEC is being “disingenuous” in their portrayal of cryptocurrency companies. He specifically cites a “catch-22,” where the SEC asks companies to register but won’t offer approval. Link:

10

19

112

@coinbase is just the first to share this request, but I can assure you the SEC has asked and will likely continue to ask others this type of stuff despite the fact that they have no reason to believe these people have engaged in anything untoward.

0

3

103

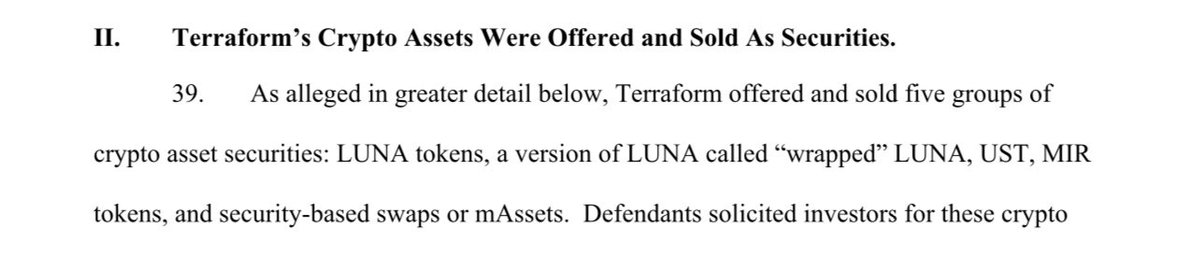

OK, after an initial skim, there is ALOT going on and this may arguably be the most important SEC case brought to date for them to test MULTIPLE theories, but one of the biggest takeaways: they’re alleging everything in Luna eco - UST, Luna, wLuna & MIR assets were securities.

The SEC is suing Terraform Labs, the company behind the failed TerraUSD stablecoin, and its co-founder Do Kwon for securities fraud. By @NelWang.

7

17

98

Wow, this might be this cycle’s EOS moment. Almost an undisputed win for CZ short of a miracle and also really undermines the credibility of recent DOJ/FinCEN actions after emphasizing their view that it was a den of wickedness and terrorism.

3

13

100

As someone who had a “controversial” view that Virgil’s actions were stupid and criminal, let me be very clear that this sentencing is bullshit in a country where billionaires pillaged our coffers through fraudulent mortgage schemes and facilitated billions of money laundering.

Judge Castel: Virgil Griffith has no ideology. He'll play off both sides, as long as he is at the center. I sentence him to 63 months in prison and a fine of $100,000.

7

11

97

This happening probably heralds the arrival of the crypto class as a political group. Would be an insane change of events given all the background chatter the past few weeks.

This would be absolutely monumental beyond just thinking about the ETF flows. Politically. SEC position re: ETH security question. Insane if this happens.

3

10

97

@pleasesendmebtc @CryptoKaleo @CredibleCrypto Literally just companies being economically rational being framed as wokeness lol, incredible.

2

0

85

UPDATED TAKE: If you're a @BinanceUS customer, withdraw right now. I'm not saying this because I think there's an imminent loss of funds, but only because I just noticed that the TRO proposes that customer funds only be transferable if CZ/existing Binance mgmt isn't involved.

As previewed yesterday, SEC requesting an asset freeze for Binance US. However, looks limited to Binance US, so I don't think this is going to be a material issue for Binance Intl atm. Could be bad for Binance US users though; probably not worth keeping things there.

5

24

89

@AdorablPenguin @wheatpond You don’t need to live where you work though. And, setting up a business with a lot of capital typically allots you more options for visa sponsorship.

0

0

90

Few minutes in and I’m already bewildered at why this man would come here and expose himself like this? . Gonna hit some chamomile for this; getting too old to have my blood pressure spiking over internet debates. But as expected @RSSH273 is holding it down for the actual…law.

❤️🔥 What is Prometheum? A compliant path for crypto or a catch-22?. The debate about the SEC-friendly trading platform rages on. 🤼 Co-CEO Aaron Kaplan spars with Paradigm lawyer @RSSH273 over the state of U.S. crypto regulation. 🔊 Full episode:

6

6

96

This reinforces what people like myself, @jchervinsky, @boironattorney, @lex_node and other DeFi attorneys have been trying to stress lately: . If your FE is the only means of accessing your platform, regulators have strong incentive to bring you under their regulatory ambit.

4

11

93

Happy to follow up here and announce that I'm starting a pilot to open the pro bono clinic offer I extended below to first time and underrepresented founders. Thread w/ some info below, starting w/ a TL;DR since it’s a bit long, but please read if you intend to sign up.

More to come here in the next few weeks, but current thinking is that I’ll offer at least 2 days a month where people can sign up for pro bono engagements and discuss high level corporate/crypto/venture capital issues.

7

16

95

Wow, seven pages in, and this may now be my go to in order to contextualize the absurdity of the current legal landscape in the U.S. Judges rarely opine on the egregiousness of government behavior the way J. Wiles is going in within even these first 7 pages.

Everyone committed to the rule of law should read J. Wiles' Voyager decision. These are remarkable statements from a federal court with no skin in the game other than calling things as they are.🧵⬇️ /www.nysb.uscourts.gov/sites/default/files/opinions/312840_1170_opinion.pdf.

3

11

92

Not sure if these are the entirety of the Hinman documents coming today but if so, I don’t think these are fatal for it’s $XRP case. If anything, it seems they didn’t want these out bc it will make it functionally VERY difficult to argue ETH specifically is a security.

Next extract. But the OGC has concerns. It may impact on what the SEC says about Ethereum in the future. No problem with those concerns. Hinman spoke to Buterin and understands how Ether works. The Ether discussion stays in the speech. We no why. /8

21

18

80

You see, it’s only an unregistered broker dealer when YOU use it. The rules are clear, children.

"BlackRock will be using Coinbase (COIN) Custody for the ETF and the crypto exchange’s spot market data for pricing, the source said.". It's almost as if the screenwriters realized they had forgot to write the next narrative and just refurbished the usual from the past.

1

8

88

It’s just amazing to me that regulators globally fumbled this so badly in part because of arrogant skepticism that something like DeFi could actually work and become an untamable hydra. Now each day it becomes increasingly hard to get people to color in the lines.

it almost seems like blockchain projects that tried to go "the compliant" route are the *ONLY* ones that have failed . developing a regulatory regime for crypto and DeFi that doesn't punish comply0000rs should be the #1 goal of all regulators (but isn't).

4

12

90

So uh. @RepRoKhanna and @SenAlexPadilla, you all just OK with an MA Senator from your party and the feds nuking a critical California institution in an errant attack on digital assets or. ?.

3

9

85

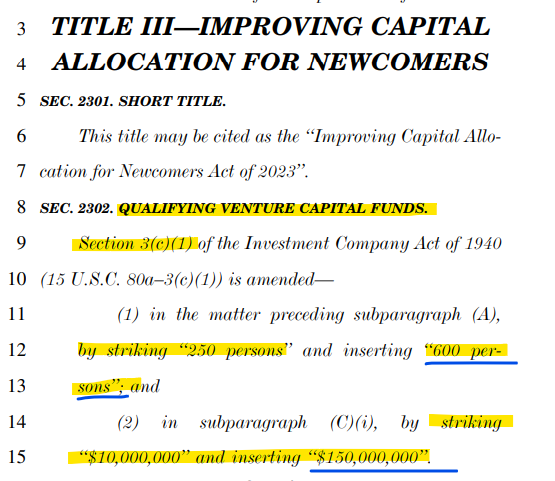

Wow, this would be a huge deal if passed. The change in accredited investor definitions to include investors limiting their investments to 10% of NW could change the investing landscape in America and give so many more people access to better opportunities.

⬛ The U.S. House of Reps just passed a transformative bill for VCs & emerging fund managers:. ✅️Expanding "Qualifying Venture Capital Funds": Increases investor limits for VC funds from 250 to 600 limited partners (LPs) and assets under management (AUM) from $10 million to

5

18

87

This is ultimately why, despite sharing nat sec concerns and recognizing data privacy issues with Tik Tok, I cannot support an outright ban on the “app.” There is no way to tailor a bill so narrowly and instead it will form the basis for new layers of surveillance and censorship.

If the RESTRICT ACT (“Tiktok ban”) passes, it will be used to attempt a ban on #bitcoin. Have any of y’all actually read the text of the bill? . This isn’t about Tiktok. This gives the executive branch total control to police the internet. Wake up.

8

19

82

Please read this from @lex_node if you are in DeFi. I’m not even going to say anything independent b/c I don’t want to dilute from such a strong call to action. Make no mistake, if implemented as is, this would be an absurd expansion of the SECs regulatory ambit.

I have reviewed the SEC's proposed amendment to Regulation ATS. As strongly hinted at by @HesterPeirce, it is a major threat to free speech, investor choice and technological innovation. More thoughts here: .

3

16

82

Incredible. This is now the third major meltdown that, had the commission been paying attention, they could have engaged with *prior to* the failure, & somehow @GaryGensler is about to do media rounds as Captain Hindsight? Is there anyone serious in this industry on either side?.

I’ll be joining @andrewrsorkin on @SquawkCNBC at 8:00am ET to discuss recent developments in the crypto markets.

4

7

78

For everything this man has done, we need to collectively step up and ensure that we don’t let wealthy ALLEGED scofflaws use their ALLEGEDLY ill gotten gains to silence critical work of arguably the most important person uncovering malfeasance for the betterment of the space.

1/ It’s unfortunate I have to make this thread but I am being sued by MachiBigBrother for an article I published in June 2022. Today Machi filed the defamation lawsuit. The lawsuit is baseless and an attempt to chill free speech. I intend to fight back & defend free speech.

2

3

82

Maybe controversial, but this seems insanely “bullish” for the rest of the year if you’re concerned about surprise US legislation. Disappointing as an American, as it seems that the admin has no real direction reading between the lines.

2

7

76

@laurashin Not 100%, but few theories:. 1. Wants to avoid need to recuse in future actions;.2. Wants to avoid creating arguments that could be used against the SEC (e.g. see Ripple);.3. Wants to continue using ambiguity as a cudgel;.4. Doesn't want to galvanize action / provide standing.

7

3

79

@CryptoKaleo Lol very weird for Christians to be cheering for the billionaire to fail at humiliating and not pay a dude with muscular dystrophy who spends his spare time doing charity work in his city.

0

0

74

@StevenTDennis Seems like they’re about to let Manchin become Biden’s Lieberman. If they repeat the same mistakes they’ve got no one to blame but themselves.

3

8

61

@CryptoKaleo @pleasesendmebtc @CredibleCrypto If anything it’s efficient and arguably the opposite of flawed. Insurance is designed for this and, if risk premiums increase too much from repeated problems, they’re forced to get better security or shut locations down. Vigilantism isn’t a scalable legal/commercial strategy.

2

1

68