Aaron Chow (Elephant Analytics)

@aaronmchow

Followers

464

Following

192

Media

154

Statuses

2,898

Dad. Husband. Financial Analyst (primarily energy focused). Traveler. Founder of Distressed Value Investing. Co-founded Absolute Games (PENN). FbFund alumni.

Vancouver, BC

Joined April 2022

Don't wanna be here?

Send us removal request.

Explore trending content on Musk Viewer

México

• 638825 Tweets

Uruguay

• 61388 Tweets

Yuta

• 53890 Tweets

#jjk262

• 45526 Tweets

Copa América

• 39210 Tweets

JULIANA AL 9009

• 30971 Tweets

A'ja Wilson

• 29631 Tweets

Asian Value

• 27418 Tweets

Gege

• 26693 Tweets

悪魔の日

• 22795 Tweets

Cubs

• 21753 Tweets

Hannity

• 21699 Tweets

VIRGINIA AL 9009

• 21214 Tweets

Rika

• 19176 Tweets

#MHA425

• 16881 Tweets

Selección Mexicana

• 15657 Tweets

Jiaoqiu

• 14556 Tweets

chivas

• 14303 Tweets

Bielsa

• 14112 Tweets

インリン

• 13506 Tweets

Tala

• 13179 Tweets

ショウキュウ

• 12594 Tweets

悪魔の数字

• 11416 Tweets

Ben Carson

• 10021 Tweets

Last Seen Profiles

@DesertFox1942

@ruelallemand

@LegendaryEnergy

No, that's been altered. Your picture is from the April 1941 issue.

@rueallemand

posted the correct picture from the Man of 1938 edition.

1

2

59

@palikaras

@bleedblue18

There's been a long history of promising (and then not delivering) on communications.

MMAT never delivered the promised dividend presentation. NBH has not provided an investor presentation.

Nearly 3 years and nobody can do a presentation?

3

5

54

@palikaras

Now that you are past your quiet period, are you going to comment on your/ $MMAT's decision to not stop the $MMTLP spinout to address FINRA's U3 halt? Or is your position that you have wiped your hands clean of it and MMTLP's shareholders are on their own to deal with things?

6

3

40

@palikaras

Thanks for your response. I agree that questions should be asked of current management. However, you were $MMAT's CEO for 10 mths post $MMTLP halt. It is a shame you weren't interested in such transparency and dialogue when you were still in a position to legally provide answers.

3

5

32

@palikaras

Shareholders have spoken, and I agree that companies should better align with shareholder interests.

However, are you going to ignore that you ghosted shareholders on your promised dividend presentation? The divi was the top question from shareholders.

4

5

28

@NotDaDroid

@JohnDavid_BLP

@Keubiko

@FINRA

@johnbrda

@BasileEsq

@FNez_Blogger

@anna_trades

@TradingSecrets7

@tonys_twits

@bleedblue18

@MMATDUK

@Cyntaxed007

@palikaras

@krucialmix

@RareDealsHere

I think turning to various "leaders" for direction and being unwilling to read filings and stuff on their own is what got most people into the mess in the first place.

4

0

25

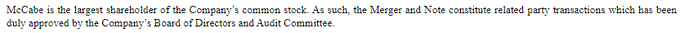

@TradingSecrets7

@tonys_twits

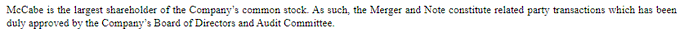

Ah, the fake "whale" Will Stuart? NBH said that McCabe was their largest shareholder post-halt in late December 2022, when McCabe had 12.8 million shares.

$MMTLP

4

1

25

@tonys_twits

According to NBH, the only shareholder with more than 8.3 million shares is McCabe. Thus Will is most likely faking his ownership like the other "whale" David was. $MMTLP

9

0

23

@palikaras

I'd certainly be interested in hearing about a public accounting of what steps were taken to sell the NBH/ $MMTLP assets (as was originally planned) and what sort of interest (if any) there was in those assets.

3

4

22

@GandalfWizz

Let's have a public hearing for $MMTLP. Get everyone under oath and sort it out in public.

4

1

22

@MMATNEWS

"Audited share count" seems to be the latest buzzword, but I'm genuinely curious if anyone knows of an example of a share count audit happening before, and/or what exactly that would entail. Haven't heard of that before $MMTLP and was not able to find any prior examples yet.

5

8

21

@palikaras

@MmatMom37

Well good luck. I hope that Congress/regulators will contact/interview you so that you can explain everything that happened around $MMTLP without being restricted by any corporate confidentiality issues. Unfortunately what's happened has had a significant effect on many people.

1

4

20

Oil is near all-time highs in Canadian dollars.

It hit $147 USD on July 11, 2008. The exchange rate was $1.009 CAD to $1 USD that day (noon rate), so that is $148 CAD.

Exchange rate is $1.257 CAD to $1 USD now, so $118 USD oil = $148 CAD.

#COM

2

3

20

@TradingSecrets7

You seem pretty averse to including stuff like current production, projected free cash flow and EBITDA in your comparison...

Unlike you, Chevron and Exxon like discussing those metrics.

5

1

19

@CGasparino

@ABA

I think you mean a division of

@ABABankers

, although I suppose tagging the American Birding Association is also apt given the role birds have played in this story.

3

1

19

@Outlier_999

@RaemenSoups

@SouthernOracle6

@Broncho24

Gray spread the info in 2022 about a $19+ billion deal for the Orogrande; info which he got from a bankrupt felon who was pretending to be a multi-millionaire. Yet we're the ones who are misinforming people around $MMTLP and getting people to fall for it? Talk about projection.

3

0

18

@Judee0075

@drdawg1996

Chris Pronger (NHL hockey) was one of the few cases of commotio cordis on video. After he got hit by the puck, he got up, took a couple strides and then collapsed (5 to 10 secs after getting hit). He survived fortunately.

0

0

14

@MMATNEWS

If there is anything going on, McCabe should put out a NBH press release with more details. Have official communications from the Chairman like a real company, instead of secondhand info passed through Twitter Spaces.

5

1

17

@dizalifornia

Everybody wanted attention for $MMTLP and to not be ignored. Hence all the campaigns to raise awareness.

Now that there's lots of attention, people are complaining that the attention is suspicious. Can't have it both ways. Raising awareness comes w/ risk of negative attention.

3

0

15

@BurrbQ

@nbhydrocarbons

@RaemenSoups

Well, that works out to a nice 1/50th of a cent per share. I'm sure everyone will be very excited to see that NBH is making announcements about big value creating deals like this instead of making progress with Congress.

5

2

15

@mauri1664

@EricTopol

Yes, the Omicron peak in the US resulted in around 4x as many cases as the Delta peak. So CFR for Omicron is significantly lower than Delta, but overall impact was greater due to the very high rate of infection.

2

1

15

@chigrl

This bill would actually impose a higher legal threshold for the examination of devices than the current situation under the Customs Act (which is no threshold).

However, civil liberties groups point out that the proposed threshold is still too low.

0

1

15

@Curtis5633

Calling things FUD is a way to avoid having a decent discussion. Gray posted this several days after he made his claims that $MMTLP's assets would be sold for $19+ billion. Didn't want to be questioned about the accuracy of his claims, so calling questions FUD is an easy way out.

0

4

16

@Caviar_Kat

@Bullthe_Butcher

@mikespikevd

@johnbrda

Between the options and the shares he owned before, that adds up to 4.568 million shares. If he has a bit over 1.9 million now, that means he sold ~2.65 million shares or around 58% of his total shares. That's the math.

(2/2)

Options info:

5

0

14

@PhantomBlack699

@BradSandler

Your screenshot only shows selected liabilities. It doesn't include landlord claims around rejected leases, which are treated as general unsecured claims. See doc. 1437 - "Treatment of Executory Contracts and Unexpired Leases"

$BBBYQ op. lease liabilities were $1.5+ bil in Feb.

2

0

10

@oxford_guthier

@singersofe

Monkeypox is not smallpox. It is a member of the same family of viruses as smallpox, but the West African variant that has been spreading produces considerably milder symptoms than variola major. The 2003 monkeypox outbreak in the US ended up with 71 cases and 0 deaths.

1

1

14

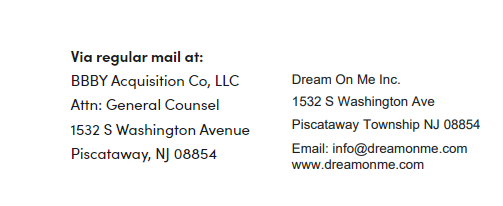

@PhantomBlack699

BBBY Acquisition Co LLC has the same headquarters address as Dream On Me. It is owned by Dream On Me's owners. $BBBYQ

2

3

14

@Caviar_Kat

@Bullthe_Butcher

@mikespikevd

@johnbrda

Facts? Brda had 2.318 million $MMTLP shares prior to the merger, not the 2 million that some people claim. He also had 2.25 million options that vested when the merger closed.

(1/n)

1

1

13

@EnergyCredit1

@Roy1981Sal

@Bullthe_Butcher

It is interesting with $MMTLP. If we estimated NBH's value at 50 cents per share, we'd be called shills and all sorts of names.

NBH does deals at ~50 cents per share, and some of those same people will say great job, trust in McCabe!

2

2

13

@b_kochkodin

Yep, an older WSJ article mentioned that 80% of Wells Notices from 2011 to 2013 resulted in SEC charges. Certainly not 100%, but no company or individual in their right mind would actually want to get a Wells Notice.

2

3

14

@Wendall_Roy

@palikaras

@bleedblue18

He had plenty of time when he was CEO to deliver on the promised dividend presentation.

Should current management be more transparent/communicative? Yes.

Does that excuse George's failures in those areas while he was CEO? No.

1

1

10

@EnergyCredit1

@palikaras

Yep, he wrote a long post to dance around the topic.

2 questions for

@palikaras

:

1. Does fair value mean market value - the estimated price that would be received for an asset if it was sold?

2. Did $MMAT value the Orogrande collateral at a fair value of 0 at end of 2023?

3

2

13

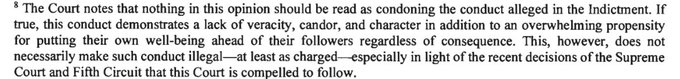

@ericakatherined

@Carpintero909

@PJ_Matlock

@Short_USDT

The judge did not rule if the allegations were true or false. He did rule that *if* the allegations were true, it wouldn't constitute illegal conduct, but morally it is a different story.

0

0

13

@Davec8789

@palikaras

Planned moves typically involve an orderly transition (such as announcing a future resignation date and staying on as a consultant) along with a statement from the outgoing CEO offering support to the next CEO.

Removed immediately is what happens when someone gets axed.

2

0

13

@MMATNEWS

It appears that it was the DoJ's criminal case against members of Atlas Trading that was dismissed. The SEC's civil case is ongoing. That case was paused until the criminal case was resolved, so the civil case should resume now.

0

0

13

@TradingSecrets7

Can't say this is "huge" since he was already essentially the power behind the throne.

Huge would be if they actually get around to selling the assets for anything meaningful or can raise the hundreds of millions needed to make a proper attempt at proving things out.

0

1

13

@TradingSecrets7

Hess has been generating $5+ billion EBITDA per year.

NBH has been generating negative EBITDA, so the true value is perhaps zero (or less) based on your comparison.

1

0

12

@Trevor28980161

@GrayTendo

Gray also previously informed the $MMTLP community that the Orogrande would sell for $19.3 billion. That made everyone excited before and probably convinced some to try to hold for much more than $10 per share...

4

1

12

@b_kochkodin

There's a note in the S-1/A about the Bronco Prospect having a fair market value of $0.5 million (about what I expected) and the Back-In Orogrande interest currently having nominal value.

So I guess the value of the subscription rights = 0.2 cents per share according to NBH.

4

3

12

@MoneySoot

Are you going to keep your promise to do a video with an elephant costume soon too?

If you don't want to do that, I'd be happy to do a debate w/you about the value of the O&G assets sometime instead. Can get people like CPLANT and Pecos Bill on too.

$MMTLP

4

0

12

@SmokeyStock

@TradingSecrets7

@tonys_twits

No offense, but it is suspicious when people provide "proof" to social media personalities, but aren't willing to do so through official sources like SEC filings & NBH. I'm sure there are many excuses being made for why he can't/won't provide proof through official channels.

0

0

12

@tpow84

Seems quite self-absorbed... I'm sure he'll be back on Twitter due to a need for attention.

0

0

12

@denniskneale

@RepRalphNorman

@Ricochet

@FINRA

@SEC

I hope there are public hearings on everything related to $MMTLP. That would be good news.

1

1

12

@TradingSecrets7

Didn't take long for another mention of Permian acquisition activity that has no relevance to $MMTLP/NBH. O&G companies know the true value of the Orogrande, which is why nobody bothers to pay a few bucks per acre for the land that is adjacent to it.

@NextWaveEFT

@JeffSamson51

@VetranoJennifer

It is pretty funny that people like bringing up "nearby" Permian transactions from 100+ miles away as comparisons for MMTLP/NBH, while determinedly ignoring the fact that the truly adjacent acreage is really worthless.

3

0

9

3

3

12

@CGasparino

@FINRA

I'm curious if anyone who thinks they don't have the NBH shares they are entitled to has written confirmation from their broker that their shares are missing?

7

0

10

@defaultusert

The guy completely messed up the MMTLP timeline too. The 1st corp action said that MMTLP shares will be canceled. The 2nd corp action said that the symbol MMTLP will be deleted. So he got things backwards, which (among other things) completely destroys his BBBYQ thesis.

2

0

11

@FreeCommercials

@SECGov

@Metamaterialtec

The SEC doesn't move very fast with investigations. The Wells Notices come 22 months after the SEC started its investigation in September 2021.

1

0

9

@GiraffeTwiza

I don't think anyone who actually invested a decent amount into MMAT considers a 99+% drop in share price from the highs to be a "gift"...

1

0

10

@MattPrider

@terminallytang1

@TrishHodkinson

I think it was also pretty easy to understand that Fulani didn't want the conversation to continue in that direction. No need for a host to stubbornly (or obliviously) continue with that line of questioning.

0

0

11

Looks like McCabe sold ~6.8 million $MMTLP shares prior to the spinout. Had 19.6 million shares in Nov 18th filing. As of Jan 23rd, now has 12.8 million shares. That explains why there was no Form 3 filed upon spinout, as he was no longer a 10% owner by that time.

#NBH

3

1

11

@whatyournamed

@palikaras

@palikaras

says that "open dialogue is key". Now is the time for him to prove it and offer to answer any and all questions that the $MMTLP shareholders may have of him. Use his knowledge of the situation to fight for them too. I agree that he likely won't do anything though.

1

2

11

@PhantomBlack699

@BradSandler

Your screenshot shows $0.41 mil in pre-petition payables for $BBBYQ in addition to $1.03 bil in unsecured debt. Most of the pre-petition payables are general unsecured claims, except for bills related to goods received by BBBYQ within 20 days of the bankruptcy filing. 1/n

2

0

8

@EnergyCredit1

@palikaras

@Palikaras

said "Fair value is the price that would be received to sell an asset"..."in an orderly transaction between market participants".

He also signed the 10-K where $MMAT said the fair value of 22.6% of the Orogrande was 0, so I guess he agrees that it would sell for 0.

0

0

8

@PatrickDehkordi

@tonys_twits

S-1 filing from Jan 2023 shows McCabe as the only 5+% shareholder w/ 12.8 million shares. 5% at the time was ~8.3 million shares.

The 8-K from Dec 21, 2022 says that McCabe is the largest shareholder (he had 12.8 million shares then).

Thus "Will" is making things up. $MMTLP

2

1

10

@dallas_ak

@enthused08

@DeadKat_Bounce

@errantpotato242

@Doku_HL_SD

@johnnaarintl

@busybrands

@FNez_Blogger

@JunkSavvy

@MetaGuyMarduk

@HollywoodHenry

@Cyntaxed007

@arjcinfo

@djanthonyacid

Anyone is welcome to post a NBH (not TRCH) PR or filing where they claim 3+ billion barrels of oil. Maybe something like that will be created now that McCabe was in charge, but it certainly doesn't look like DuBose wanted to be associated with a 3+ bil barrel oil claim.

$MMTLP

5

2

10

@RaemenSoups

@Outlier_999

@GobMcCobb

@SnackBioTech

@onehundredmph

@b_kochkodin

@DOJCrimDiv

Funny that he'd mention CRGP (Calissio). That company issued a special divi that resulted in a U3 halt. CRGP was later accused of fraud by the clearing firm (COR Clearing). CRGP had a default judgment entered against it after it didn't defend itself and its former CEO absconded.

1

0

10

@XxXBaylieeXxX

Will was trying to get people to register their $MMTLP shares with AST way before the halt. He didn't send his own shares to AST before the halt.

@Tiggersdad2

@Lightbulb_Sun_

@FreeCommercials

@metaheadj

Looks like Will Stuart has been trying to convince others to register their shares with AST for a while. Telling people to register in August 2022 while apparently not bothering to register whatever number of shares he does have.

2

0

6

4

2

10

@SmokeyStock

Even if you love the tech, a shaky financial situation can undermine everything and lead to things like massive dilution, management turnover, a potential R/S and other things like we are seeing here.

A deep look at the financials should be a key part of any DD.

Best of luck.

0

1

9

@UCopy417

@buyingpressure

When nothing happens within the next 90 days, I'm sure you'll just claim that something else is going on with BBBYQ...

12 hours ago you claimed that " $BBBYQ will be still trading fine this week". Now that it isn't trading, on to the next claim...

2

0

10

@oncefromearth

@SmokeyStock

@ODgreenTrader

@ya_u_know_me

@TRCHEnergy

@EnergyCredit1

In this case "He's lying" means "I don't like what he's saying, so I'll just call him a liar since I can't rebut specific points".

1

0

10

@Giftsonglass

NBH is worthless until they can demonstrate profitable oil extraction. If they spend $7 million on wells and get 10,000 barrels of oil, yes they've found oil, but that's useless since they've spent $700+ to produce a barrel of oil that they can sell for $75/$80. $MMTLP

6

0

10

@TradingSecrets7

Since you say you have lots of accounting experience, you should be able to understand that $MMAT risked not being able to pay their employees much longer (beyond a few weeks) without raising more money...

2

0

9

@johnbrda

The downside of NBH is that people are stuck in a company with minimal revenues, high cash burn, no interest/ability to sell the assets, no ability to return cash to shareholders, that is diluting existing shareholders and also can't seem to make an investor presentation. $MMTLP

3

1

10

@MMATNEWS

I suppose there's nothing wrong in asking members of Congress to sign the letter. However, expectations for pretty much anything around $MMTLP or $MMAT end up being built up much bigger than reality. There's always something "huge" coming "soon".

6

0

10

@FrankieBstock

It is a sublease (looks like for up to the full 68,000 sq. ft).

$MMAT appears to be downsizing (don't know to what extent), but the HQ lease runs to 2031. They seem to have decided that they don't need the clean rooms and that much office space.

2

0

9

@MMATNEWS

Probably due to the risk that a 1 for 35 split wouldn't allow them to regain compliance. Stock was around double current levels when the 1 for 35 was first proposed.

2

1

9

@Broncho24

@johnson3_chris

@Keubiko

I don't get why the "illegally listed" thing is a talking point. The only harm caused (compared to it not trading) was to those who bought MMTLP and now are stuck w/shares in a worthless company. To make that argument, they'd have to admit the company is worth little though.

2

0

9

@Keubiko

The $MMTLP universe is topsy-turvy land. Valuation estimates done by the experts hired by TRCH/MMAT are considered "FUD" and the work of shills, while numbers provided by random YouTubers with little valuation experience before TRCH/MMTLP are treated as unchallengeable gospel.

1

0

9

@JunkSavvy

Shows how little MMAT thinks the Orogrande is worth. The $24 million in notes receivables were secured by 25% of the Orogrande, but MMAT would rather take $6 mil in cash plus dilution with $6 mil in stock sales than foreclose on a quarter of the Orogrande for resale. $MMTLP

8

0

9

@MoneySoot

NBH already had a 100% working interest in the Orogrande in May. This proposal doesn't add more WI. McCabe was entitled to a 10% back-in WI once/if the Orogrande produced enough to pay back expenses to date. That would have left NBH w/90% WI. NewCo is getting that up to 10% now.

2

2

9

@_TraderZero_

@dani162337

@Bullthe_Butcher

@RaemenSoups

@denniskneale

@johnbrda

@Ricochet

@busybrands

@jt

@djanthonyacid

@KarmaCollects

@bryantjames

@Kneale_Podcast

@palikaras

That's 3+ billion total barrels of oil that some are claiming (not daily production). However, it would cost over $10 trillion dollars to get that much (3 billion barrels) oil out of the Orogrande based on the well results so far.

0

2

8

@Tiggersdad2

Prisoner's dilemma. It was in each individual's best interest to proclaim that "retail is not selling" and hope that others hold while they unload their $AMC shares before the conversion.

1

0

9

@pkent24

@TradingSecrets7

Well, hopefully nobody is listening to

@TradingSecrets7

for advice. For someone with a lot of "accounting" experience, he seems to be incapable of effectively analyzing balance sheets and cash flow statements.

1

0

9

@b_kochkodin

That's another sign of NBH's limited current value. If NBH was actually worth even $1 billion ($4 per share), then he would have apparently just walked away from employee options worth $4.6 million. $MMTLP

4

1

9

@Outlier_999

@dizalifornia

@Broncho24

People are trying to preserve their ability to dump their shares on others if NBH ends up trading again. Need to keep up the pretense that the O&G assets are worth something in that case.

If NBH had any ability to sell the assets for a decent amount, this wouldn't be needed.

0

0

8

@NextWaveEFT

@JeffSamson51

@VetranoJennifer

It is pretty funny that people like bringing up "nearby" Permian transactions from 100+ miles away as comparisons for MMTLP/NBH, while determinedly ignoring the fact that the truly adjacent acreage is really worthless.

3

0

9

@palikaras

You had a divi presentation ready soon after your Mar 2022 tweet, but MMAT's board (which at the time was still a majority from pre-2021 MTI) wouldn't let you present/mention it?

And despite this you didn't withhold your vote from other directors at the Dec 2022 annual meeting?

1

0

7

@b_kochkodin

I hadn't paid attention to TRCH's early #'s much before. It increased potential reserve #'s from 250 mil barrels (2014) to 3+ bil barrels (2019) despite awful well results between 2014 & 2019. Wells don't come close to expectations, so you increase the estimates. Makes sense...

2

0

9

@HAMShortkiller

Maybe you should wait until $MMTLP investors get the $100+ per share that you said they're being offered before you hit them up for donations. I'm sure they'd have lots of money to support this if what you said comes true.

5

1

8

@Caviar_Kat

@john_brda

@Bullthe_Butcher

@mikespikevd

@johnbrda

Yep, it looks like I was correct about the misinterpretation. Various Vanguard funds (such as Total Stock Market ETF) may have sold 17 million $MMTLP before the halt, and someone seems to have translated that into FINRA's retirement fund specifically sold 17 mil.

3

1

9

@pulte

@PlatnumSparkles

The unsecured debt holders are most likely quite screwed, and they knew that.

The last trades on $BBBYQ's unsecured notes were at 0.25 cents on the dollar. Unsecured debt holders were selling $100,000 face value in debt for $250. You don't do that if you expect to be paid back.

4

0

9

@RaemenSoups

@SEC_Enforcement

If McCabe thought that Congress was so important, he'd hire lobbyists with the right connections and/or spearhead the efforts himself (more than an occasional email or call).

Instead other people are left to do the work and use their time.

1

1

8

@johnbrda

Well, I hope that all parties (FINRA, the SEC, MMAT, NBH, you, etc...) that have been involved in the $MMTLP situation end up testifying under oath (Congressional hearing, court case?) so that differing statements can be sorted out in a more effective arena than social media.

0

1

9

@MikeQfishing

@RaemenSoups

@EnergyCredit1

I remember that people were pre

saying that McCabe hates shorts because of TRCH, so he wouldn't sell $MMTLP.

Then he sold 6+ mil shares before the halt. The price he is willing to sell at seems lower than most retail investors (who didn't sell any shares at $10).

0

1

9

@teacher_alpaca

@defaultusert

@MMATNEWS

Looks like they've also photoshopped a 21 year old picture of Branson in there too.

Britannica uses that pic for Branson's biography page and notes that it was from 2003.

2

1

8

@errantpotato242

@Doku_HL_SD

@johnnaarintl

@busybrands

@FNez_Blogger

@JunkSavvy

@MetaGuyMarduk

@HollywoodHenry

@Cyntaxed007

@DeadKat_Bounce

@arjcinfo

@djanthonyacid

I think the real reason is that shareholder expectations became too high. If the Orogrande sold for something like $25 mil in late 2020, no big deal. In '21, shareholders started to expect billions though, so if it sold for a fraction of that, everyone gets angry at management.

3

0

8

@JohnnyTabacco

@_TraderZero_

@SocialWatchNew

@FINRA

@SECGov

@FBI

Do you have a link to the source for that 10 million to 15 million borrowed number for $MMTLP? I've asked several times about the source, but I think you've been dodging that question. Claiming the SEC references the data too doesn't speak to the source either.

3

1

7

@tonys_twits

You're mixing up net revenue interest with working interest. Before, NBH had a 66.5% WI and a 49.875% NRI in the Orogrande. They now have 100% WI (66.5% + 22.6249% +10.8751%) and 75% NRI. NBH is also now 100% responsible for development/exploration costs. $MMTLP

1

0

7

@Broncho24

GrayTendo? I guess if you have a soothing accent, people may still like you even after you've influenced them to hold for the $19.3 billion asset sale instead of selling their shares when MMTLP hit $10 or $12.

3

0

8

@Bullthe_Butcher

@MikeQfishing

@surferobx888

Proving any sort of damages will be difficult. Even if some NBH shareholders don't have access to their shares (as the filing claims), NBH isn't trading and isn't paying any dividends, so it seems to make zero financial difference.

4

0

8

@Bow47064648John

@Outlier_999

@MoneySoot

@HoofErik10986

Capital is very important and NBH/TRCH has not been able to raise enough development capital for 10 yrs. Thus why NBH is willing to give up 75% of the Orogrande for $67 million in cash plus $59 million in capital commitments.

3

1

7

@b_kochkodin

NewCo looks pretty worthless to me, but I'm sure there will be the same "math" being spread over social media saying is worth hundreds of millions to billions.

3

0

8

@Josh_Young_1

@calvinfroedge

There is an average of 1 to 2 main-track derailments per week in Canada. Also at least 3 potash train derailments in 2021 in Canada.

These sort of incidents happen more than we think they do, but we're probably paying more attention to them now.

1

0

7

@onehundredmph

@b_kochkodin

@DOJCrimDiv

That isn't from Forbes. Also, the "FUD" has been right pretty often.

It was called FUD to question whether there would be a $19+ bil. Orogrande sale as promoted on Twitter Spaces in late 2022.

People seem content to be given bad info as long as that bad info is bullish.

1

0

7

@tonys_twits

Yep, NBH had until the end of March 2023 to fully satisfy its lease obligations (drilling five wells) for the 2022 fiscal year. It did most of that work in Q1 2023, leading to the costs you reference.

1

0

8

@Broncho24

Heh, that space was titled "Hard questions and debates welcomed about a ticker". More like we welcome questions (only those approved by us) and no debates please.

1

1

7