Andy West

@HedgeQuartersHQ

Followers

5,234

Following

373

Media

554

Statuses

2,366

Investor. Founder HEDGEQUARTERS & Longlead Capital Partners. Former Deputy Head at Regal Funds. PhD Economics (Finance). Personal views. Not financial advice.

Everywhere theres a market

Joined July 2009

Don't wanna be here?

Send us removal request.

Explore trending content on Musk Viewer

billie

• 262368 Tweets

Xavi

• 109160 Tweets

علي النبي

• 85839 Tweets

Laporta

• 42623 Tweets

デザフェス

• 35940 Tweets

#يوم_Iلجمعه

• 35120 Tweets

下半身露出

• 26757 Tweets

Scottie

• 22990 Tweets

OUROAD IN CHIANGMAI

• 20911 Tweets

#Aぇいきなりスペース

• 17864 Tweets

紫耀くん

• 16023 Tweets

イッシュ

• 14932 Tweets

تشافي

• 14923 Tweets

Flick

• 13173 Tweets

Isco

• 10874 Tweets

Louisville

• 10683 Tweets

Last Seen Profiles

The pivotal moment in

#Fed

press conference:

When (incorrectly) told the market had reacted positively, Jerome Powell seems frustrated and lists ONLY reasons why this is the wrong interpretation.

Very telling for

#stocks

.

$QQQ $SPY

#macro

#inflation

744

1K

6K

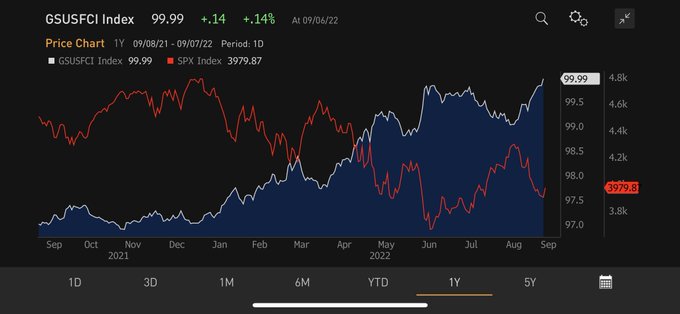

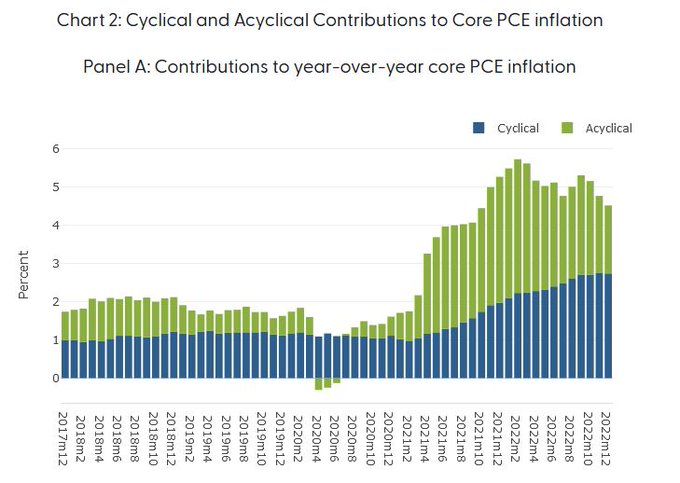

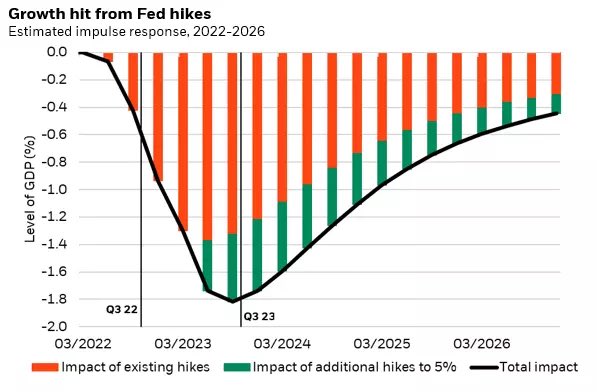

Have

#Fed

rate hikes led to the slowdown in

#inflation

we've seen so far?

That's the conventional wisdom anyway. BUT, the San Francisco Fed's own index actually says "NO"!

Why & implications. A thread...

#macro

#Stocks

#SPX

$QQQ

1/8

11

66

229

My best advice to new

#investors

is to first understand that

#stocks

are not businesses. They are an artificial expression of Hype, Hope & central bank Manipulation that occasionally catch a fundamental flu. Flu season is coming back soon.

10

34

205

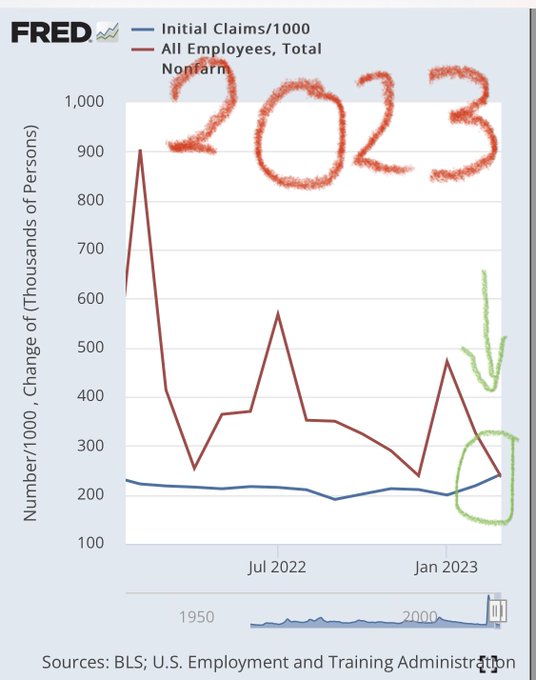

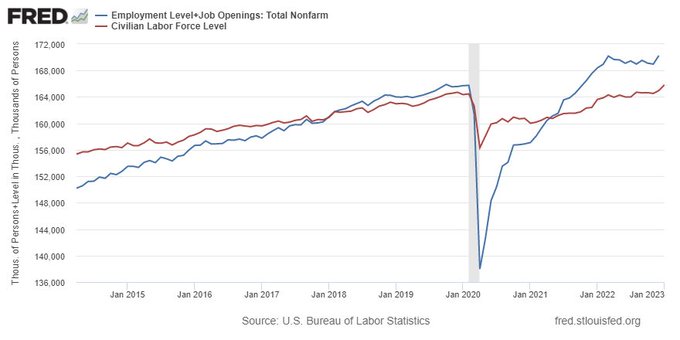

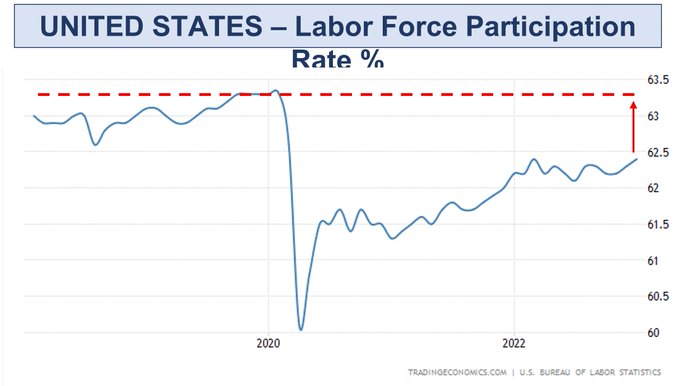

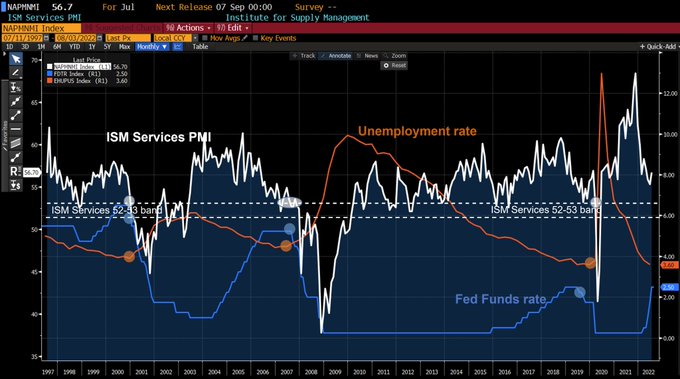

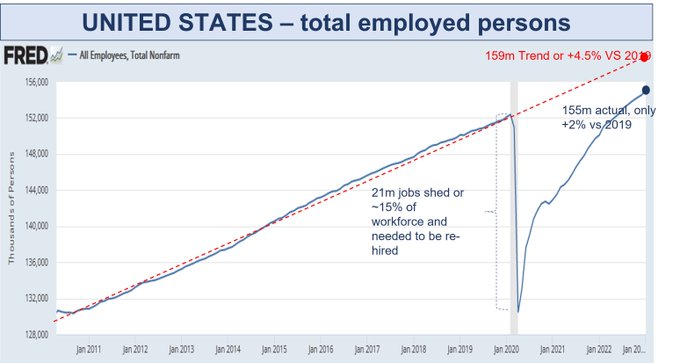

WHATS HAPPENING WITH US EMPLOYMENT / PAYROLLS and implications

a thread:

1/x

After a +517k Jan 23 payrolls & resilient employment mth after mth despite a year of rate hikes, whats really happening & does it mean soft landing?

read on

#macro

#unemployment

#stocks

$SPY $QQQ

11

48

229

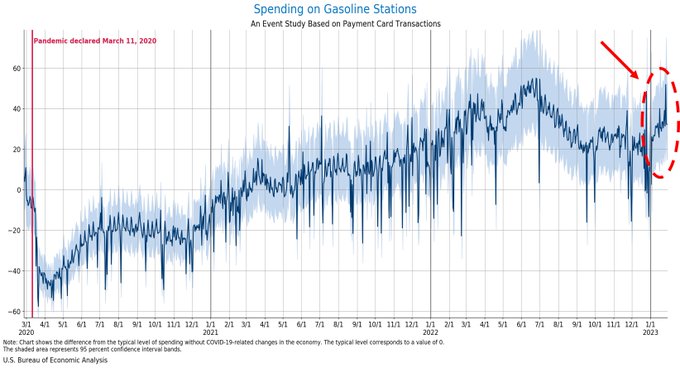

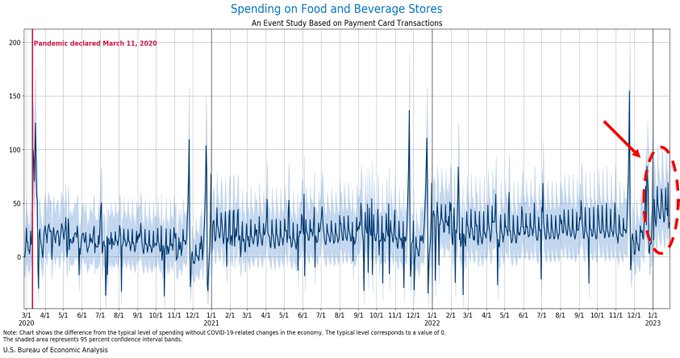

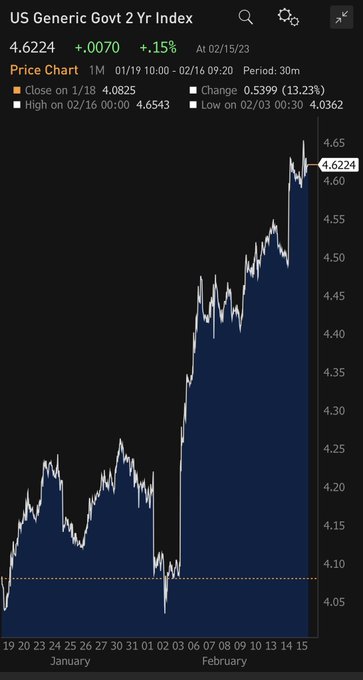

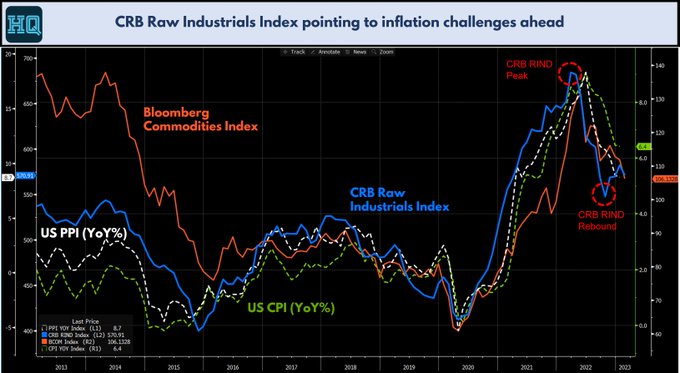

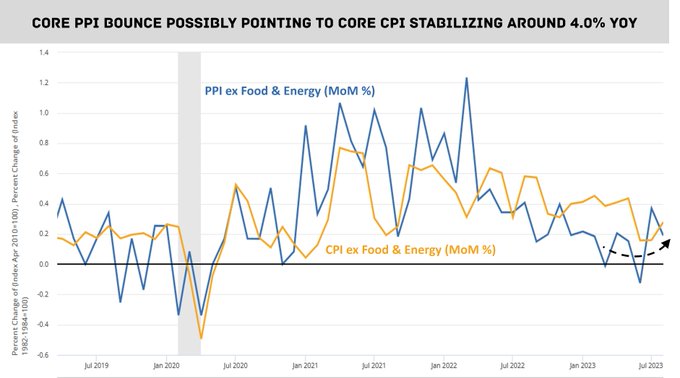

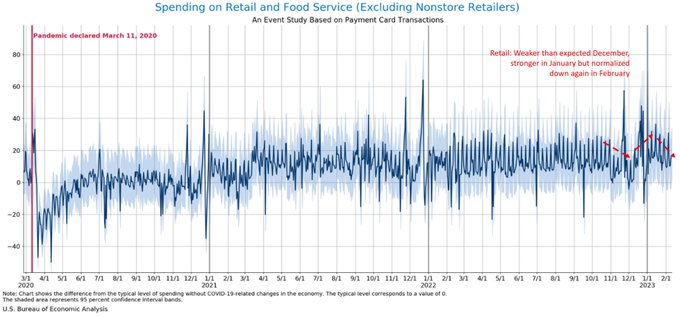

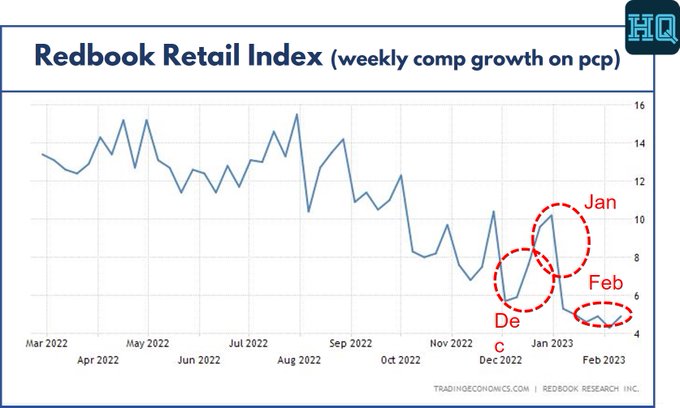

#Inflation

watch:

The stock market is pricing the disappearance of inflation & rates risk. But theres pretty good evidence that a bout of inflation is back:

CPI nowcast Jan +0.63% / Feb +0.49% mom. Charts are why - Food and Fuel.

#macro

#CPI

#stocks

$SPY $QQQ

15

37

205

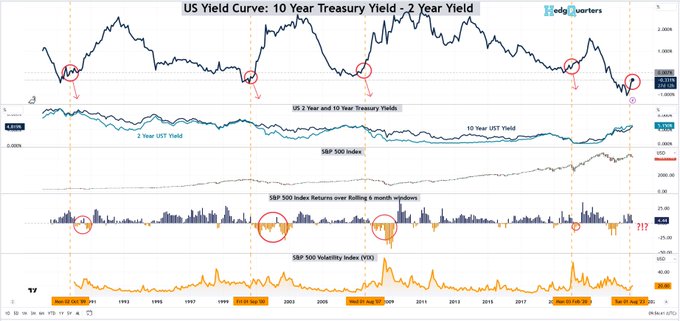

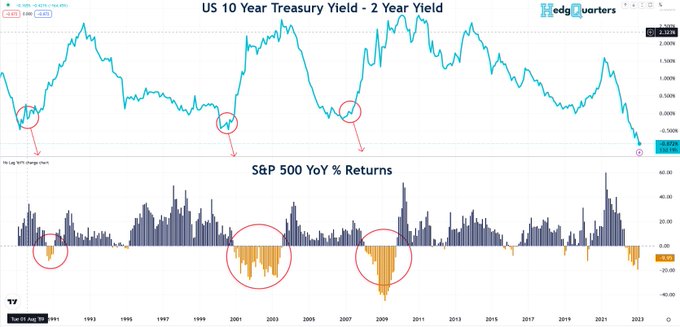

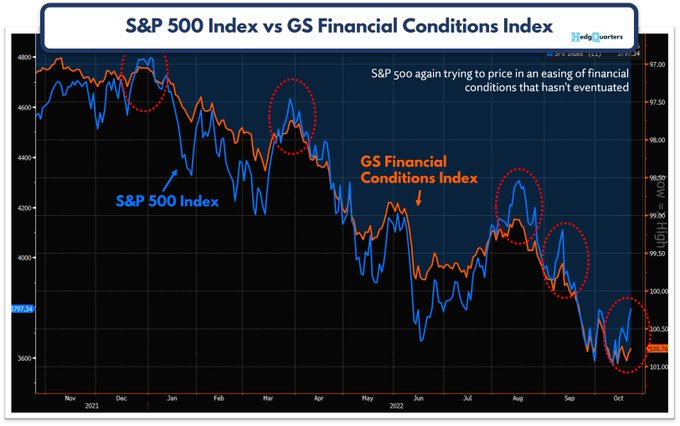

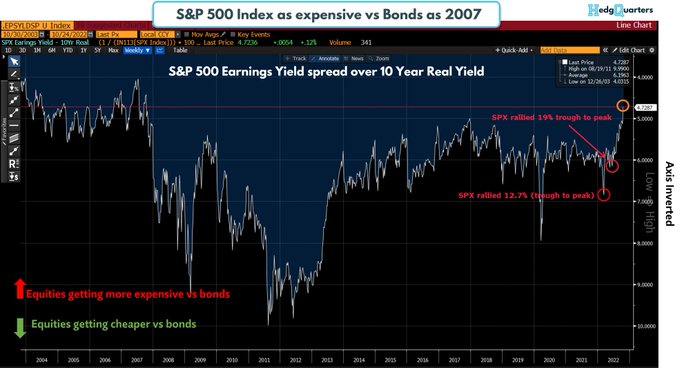

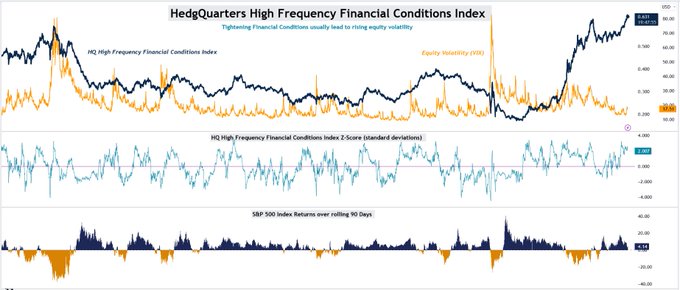

Lets be very clear about the potential risk to

#stocks

on a steepening yield curve such as we are experiencing now. This chart is worth studying closely...

The chart highlights 4 episodes where the yield curve underwent steepening over the last 35 years and what happened to

10

58

198

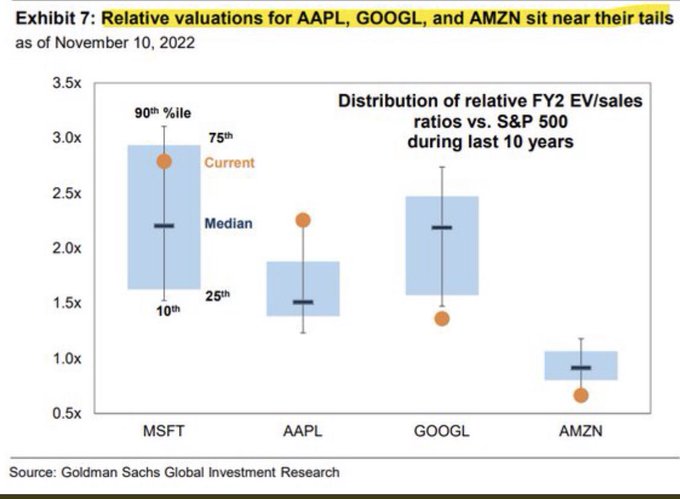

The last time the US 10 yr yield was at 3.5% was 2010. The Fwd P/E ratio of the

#SPX

was ~13x.

We’re still at ~17x. And the “E” will fall as well…

$SPY

7

18

92

To all the people who keep saying “everyone is bearish and short, so the market can’t go down” - just remember that when everyone is bullish and long the market kept going up.

$SPY $QQQ

#SPX

13

4

86

A little history lesson that is very apt for understanding markets today. Short 🧵

Blackstone said this week at a conference that their deal to buy Crown Resorts a yr ago could not happen today as the finance is not available. This is a red flag…

$SPY $QQQ

#stocks

2

14

87

Could Friday's

#Payrolls

report be a negatively biased news event?

One possible payout profile I'm considering (purely personal views, consensus is 170k):

- Payrolls > 170k:

#GOTHilocks

. Yields rise, more steepening. Bonds down, stocks down.

- Payrolls 130k - 170k:

15

9

85

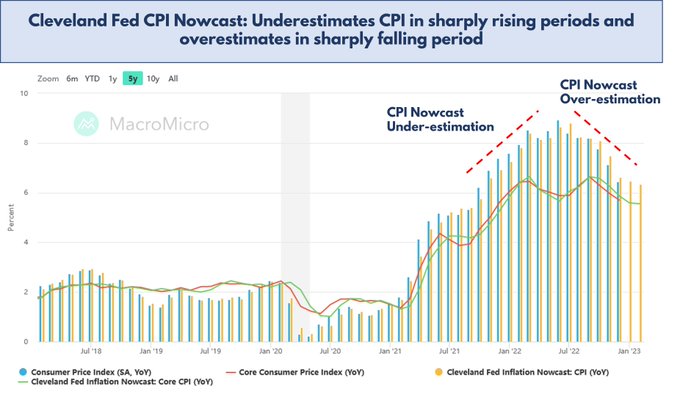

INTERPRETING THE CPI NOWCAST & how it works - a 🧵:

I, like many, have seen the rise in the CPI Nowcast over the last month & used it as a basis for expectations for Tuesday's

#CPI

release.

But how accurate is it at times like these. See chart:

#macro

#inflation

$SPY $QQQ

#SPX

6

23

82

US Housing signals: The 6-mo drop in the NAHB Housing Market index is a 4 standard deviation event. This should happen once every 83 years. Let that sink in as a signal for housing &

#stocks

We've had 2 such events in 3 yrs but unlike 20, this ones not going to be saved by ZIRP.

9

23

81

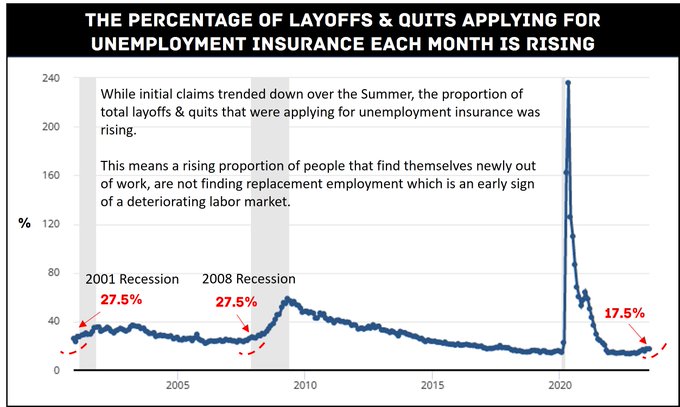

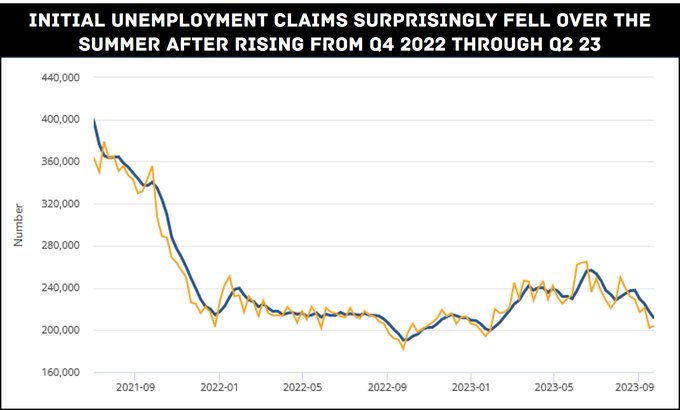

Is the labor market really as strong as we think?

Perhaps not on this evidence...

The surprise of Summer was a multi month fall in initial and continuing unemployment claims after they had been rising since Q4 2022. This was a key plank of the

#softlanding

narrative as in past

5

20

79

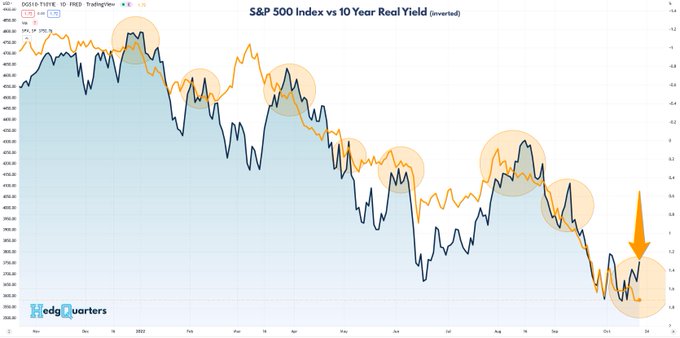

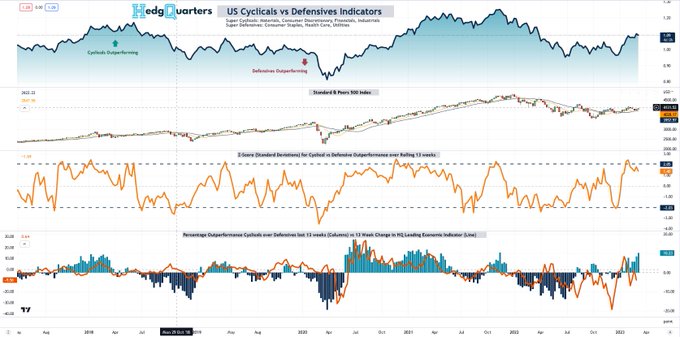

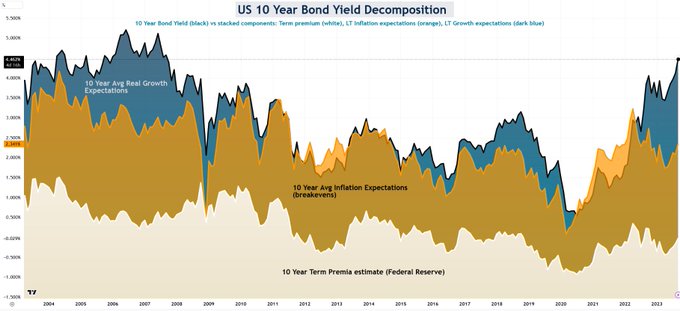

Another way to see this is to compare the

#SPX

Earnings Yield vs the 10 Yr Real Yield.

The conclusions are the same but the signals are often clearer. When real yields fall, the SPX can rally (lower earnings yield), when real yields rise, SPX rallies fail (red circles)

$SPY $QQQ

0

7

63

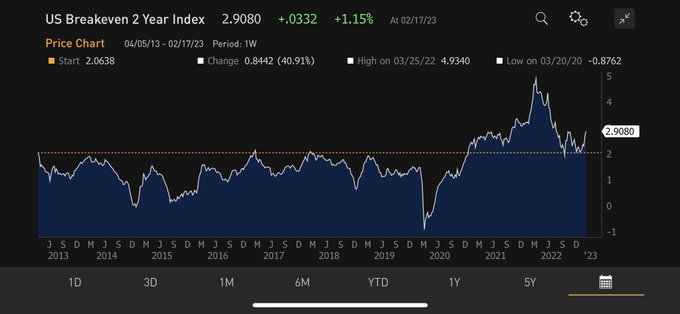

2% used to be the CEILING for

#inflation

expectations

Now it’s the FLOOR

We are in a very different environment to most of the last decade so why do brokers continue to use

#stocks

5-10yr avg P/E as a basis for price targets?

Hint: it’s irrelevant

$SPY $QQQ

4

13

61

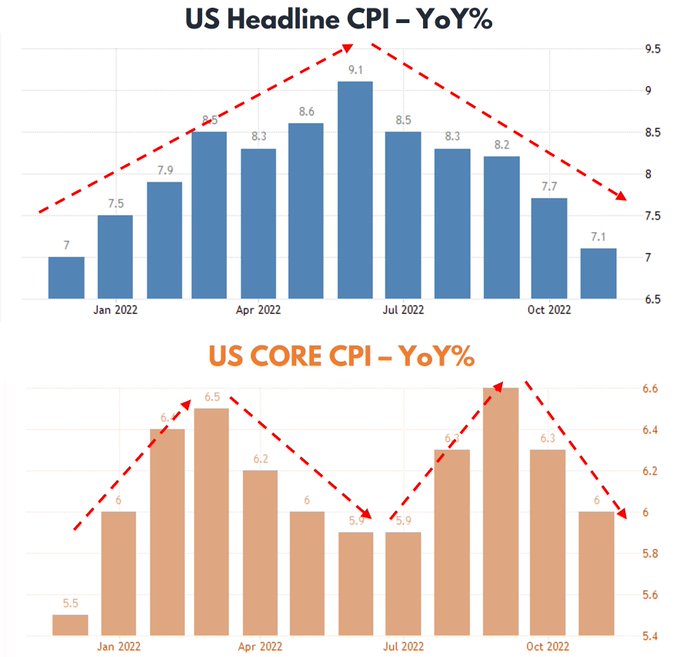

The

#inflation

eclipse, with headline falling below Core has turned some people dovish. The trouble is that looking at YoY CPI measures is seeing the most lagged version of a lagged indicator.

These charts show where the trouble lies for the

#Fed

:

1/

#macro

#stocks

$SPY $QQQ

12

22

63

@scienceisstrat1

@paulg

@ElbridgeColby

@Noahpinion

@erikbryn

The trouble with this is that you can’t replicate the localized 2ndry supply chains elsewhere without a long runway & sig cost inflation. $AAPL assembly plants in China are surrounded by suuportive infra of related components. So APPLs most valuable prods are manufactured there

6

5

58

Home Builder

#Stocks

:

Material divergence between $XHB (and its constituent stocks) and an index of STARTS - COMPLETIONS which is running negative and will get more so.

The rebound YTD was built on anecdotes from Builders in recent reporting that traffic & sales had improved

7

12

58

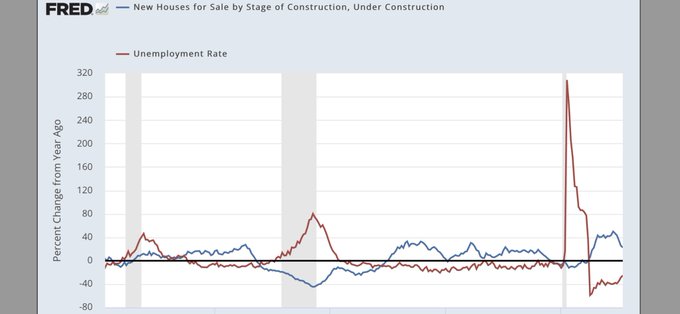

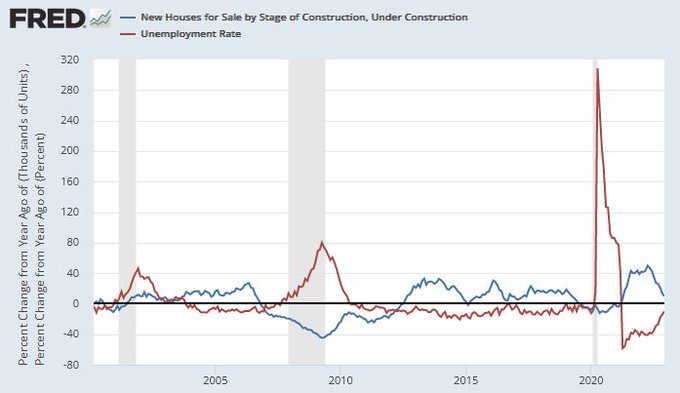

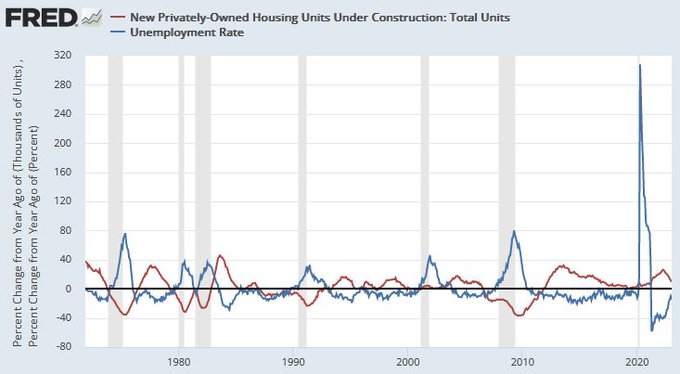

@MacroAlf

This is the best timing indicator for unemployment/ NFP contraction I have found: Watch the “homes under construction “ data. When backlogs are worked through, unemployment starts to rise. We are not far off…

0

9

56

"Jackson's HOLE" - ranking as one of the most costly 8 minutes due to one man in history- a 🧵

Chair Powell started by saying "Today, my remarks will be shorter, my focus narrower, and my message more direct."

- in other words, "you better listen carefully"

$QQQ $SPY

#stocks

3

13

55

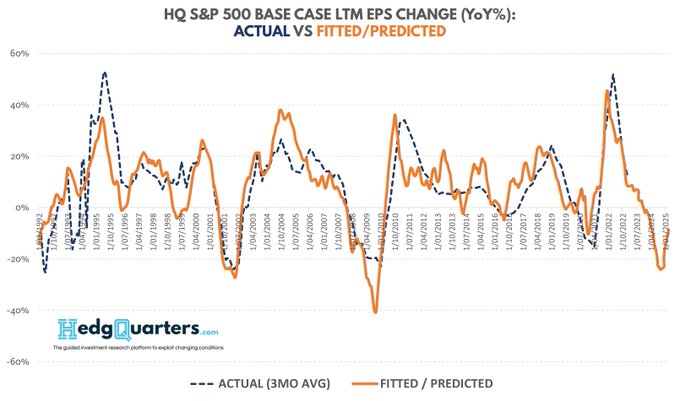

HEDGE FUND ACADEMY Playbook

#1

A framework to forecast stock prices everyone can use - a 🧵

“HF PMs, whose clients expect consistent monthly profits with low drawdowns, use variations of this framework to identify, asses & actively manage ideas”

#investing

#stocks

$AMZN

#SPX

3

15

52

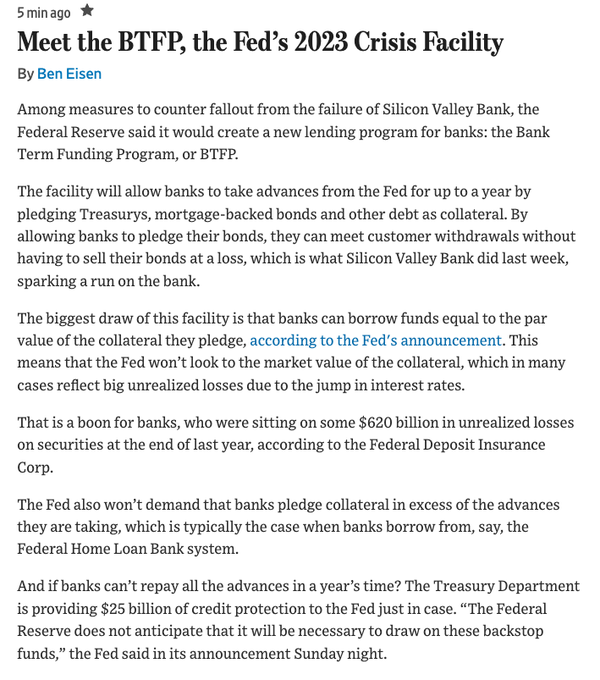

Is it just me or does this seem remarkably like

#QE

!?! You give us your treasuries at an inflated, non market price, and we'll give you the cash equivalent as if Fed Funds were back at 0.1%!

Not complaining, but market prices really are just for the plebs aren't they!!!

Gives a

6

10

54

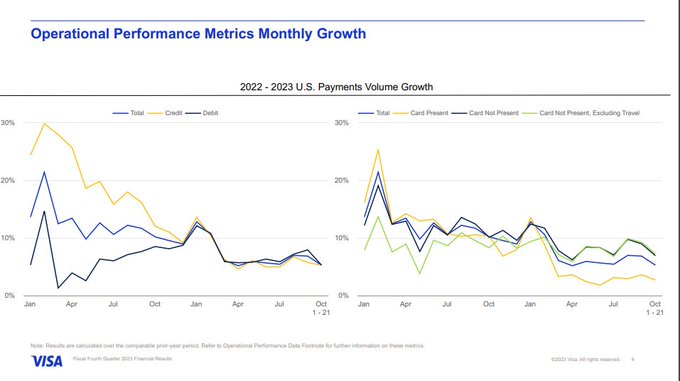

Chart on left has important message - Debit card (savings) mix shift due to high CC rates, has meant credit card stats were less reliable for tracking retail sales recently.

But the convergence in Oct between Debit and CC payments volume growth means we can likely start to place

1

4

53

HEDGE FUND UNIVERSITY coming:

1/ I've wanted to do this for a while for

#investors

. After 20 years of

#investing

in

#stocks

and derivatives, incl running my own hedge fund for ~ a decade, over the next month I'll be sharing a series of threads profiling:

$SPY $QQQ

#SPX

#macro

3

10

50

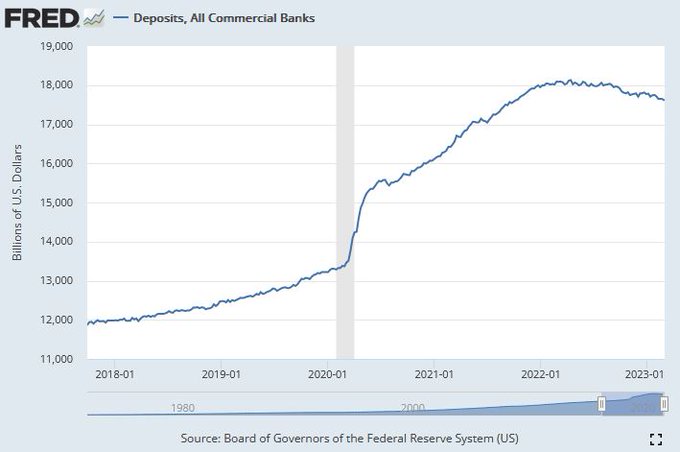

I'm setting a reminder for THIS data release! Its not till Mar 24 that we get the bank deposits number updated to Mar 15th

That should show a picture of what happened to bank deposits as the $SIVB closure news hit. The 50bps 6mth yield drop hints at it.

#macro

2

6

46

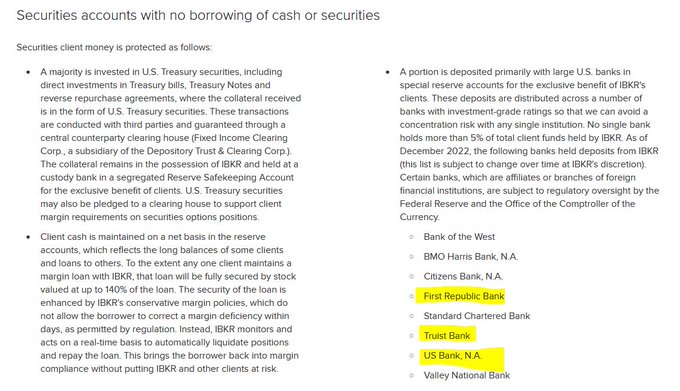

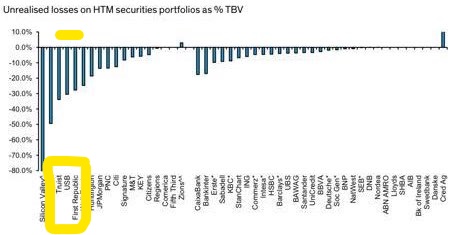

What’s the total equity capital of all US banks?

$2.2 tr

With Banks sitting on unrealized losses of $620bn, that’s ~30% of the entire industry’s equity that doesn’t actually exist today if the funds are required before interest rates get cut again

= Cap raises

#macro

$SVB

2

9

49

#INFLATION

WATCH 🧵

1/ Inflation drivers differ btw cycles & this pandemic driven cycle is unique in our lifetimes. So what gives us the best leading read on

#CPI

?

Many watch oil as thats historically a big driver, but this time evidence suggests an alternative

#macro

#stocks

1

14

49

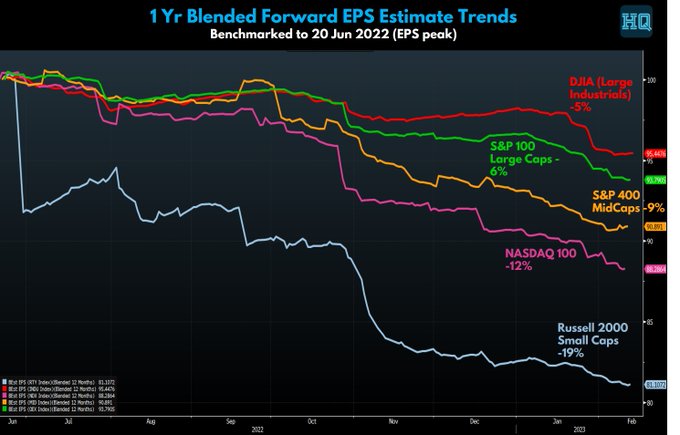

@MichaelKantro

So true. Housing has already rolled (prices, activity, NAHB), Orders rolled (S&P PMIs), Profits are rolling now based on EPS forecasts and employment is the last domino to fall with less educated cohort unemployment already rising in the stats.

1

2

44

@TaviCosta

Interesting comparison but what if this simply reflects unsustainably low capex in energy that is insufficient to replace let alone grow production? Ie the Energy FCF is temporary

5

2

46

#YouveBeenWarrened

Senator Warren went full

#JudgeJudy

on Chairman Powell in today's testimony.

Even been in one of those arguments where its pretty clear the person doesn't care what you say - they just want to bash away?!?

#macro

#Fed

#inflation

#stocks

15

3

44

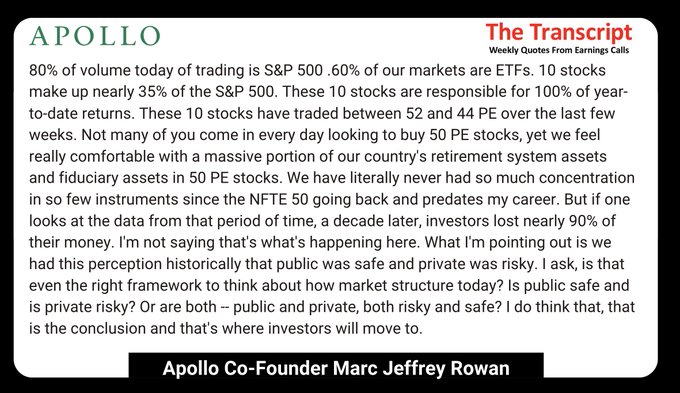

Man, that’s so well stated. Thats transcript of the year for me! Hats off Marc Jeffrey Rowan

2

5

38

@sentimentrader

Cue the CMTs with their “in the last X times this happened stocks were up Y% over the next yr” tweets

How bout the drawdowns in between? How bout looking whether the conditions in the last X times are in any way analogous to now?

3

0

36

If sequential MoM

#inflation

was allowed to continue at that 0.5% pace, from July the CPI would rise through the entire back half of the year

In other words the

#Fed

will be tempted to keep hiking at 25bps per month until MoM inflation is consistently below 0.25%

1

6

36

@DavidInglesTV

Question is - will we actually see this increase demand for credit? China consumer and business confidence is horrendous. There’s been no activity response yet. Very similar to 2008 US.

2

1

35

@DiMartinoBooth

Great chart. It shows how the yield curve inversion leads large scale equity downside as eventual recession hits. This is what I’ve explored below. It’s the Fed cuts you have to beware which makes this rally based on expectations of a near term pivot puzzling.

3

8

35

@BobEUnlimited

I agree -

1

2

38

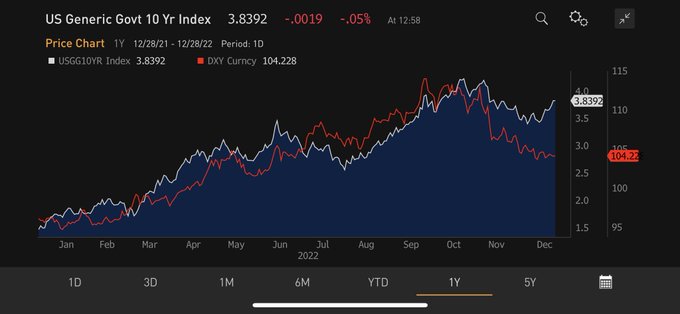

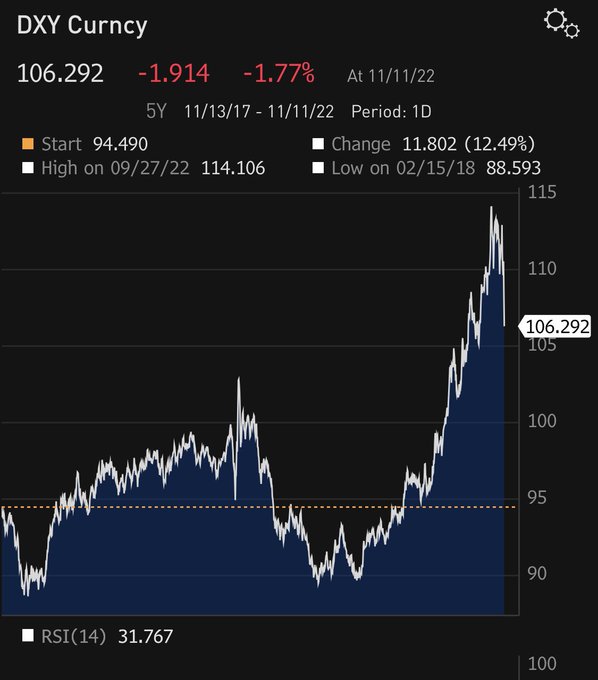

Hypothetical What-if to ruin the start of your 2023…

$DXY rips to 110?

Worth asking what happens to your portfolio if it does! The 10 year certainly thinks so.

$SPY $QQQ

#macro

3

3

33

Prediction: When

#Bonds

truly bottom, $AAPL will crater.

Why?

Big money needs somewhere to go before it sells its largest positions.

1

9

34

@EPBResearch

Great Thread. This chart tends to show the inverse relationship btw Units under construction and broad unemployment.

When the red line goes negative, we are within a few months typically of a rise in unemployment.

Not there yet but closer...

0

5

33

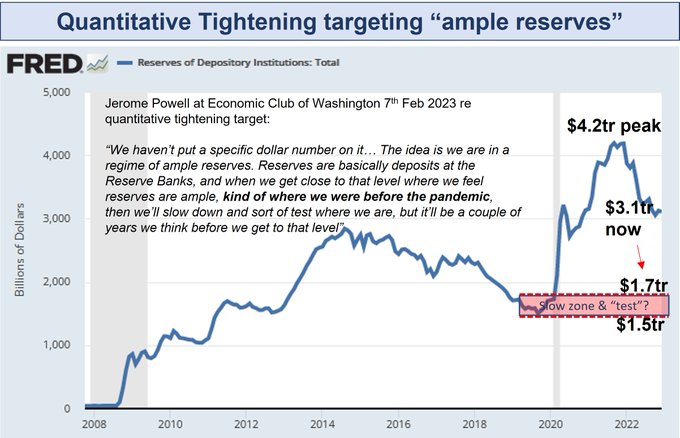

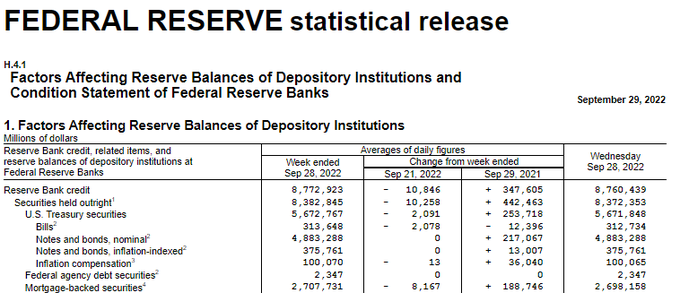

So here comes the real illiquidity crisis. Will gradually build as cumulative QT ramps then we'll get a break in some market that will require

#Fed

intervention just like the BoE did to save the pensions.

Sept 25th was settlement date for MBS. Fed balance sheet weekly update was released an hour ago. MBS down $8.16B on the week, Treasuries down $2.09B. Fed was telling the truth all along. 😜 Y'all ready for more? 'Cause it's coming, you just have to know where to look.

@Quillintel

12

60

256

2

6

32

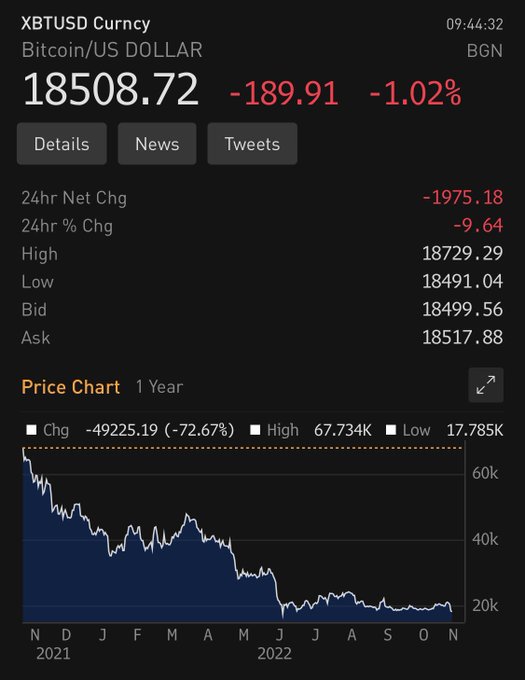

#Bitcoin

- has anyone considered that the artificially low volatility in $BTC since June (vol lower than stocks!) arose from crypto exchanges defending the price to avoid a further run on the whole crypto system?

With todays collapse that inventory may need to be liquidated!?!

5

3

33

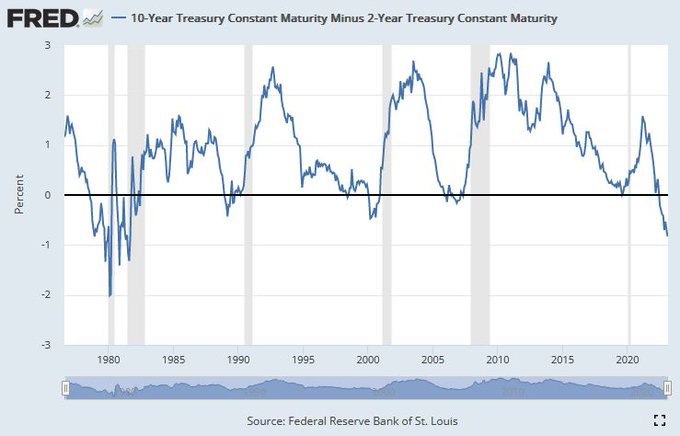

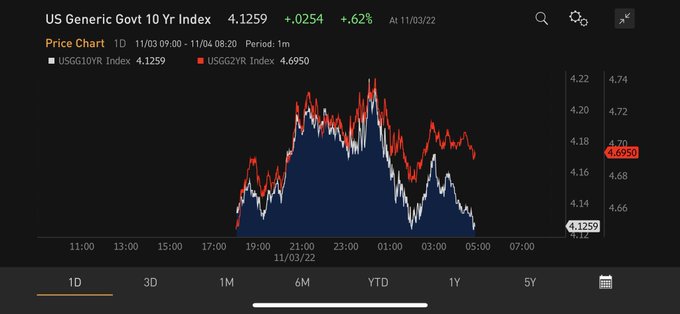

The US Treasury 10Yr -2Yr yield spread just hit -58bps in the wake of the Hawkish

#Fed

press conference yesterday.

Bond market saying recession will be deeper.

Meanwhile equity volatility is having another day at the beach. 🏖🌊☀️

5

3

32

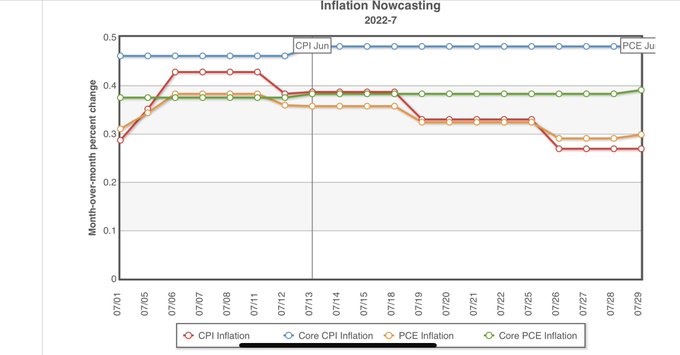

@carlquintanilla

@ClevelandFed

@fundstrat

That’s selective reporting. This is their chart for inflation NOWcasts across measures. All core inflation measures moving higher which as we know is what is focused on by Fed. The headline figure simple reflects a fall oil in July. Aug will

@move

higher again.

1

1

28

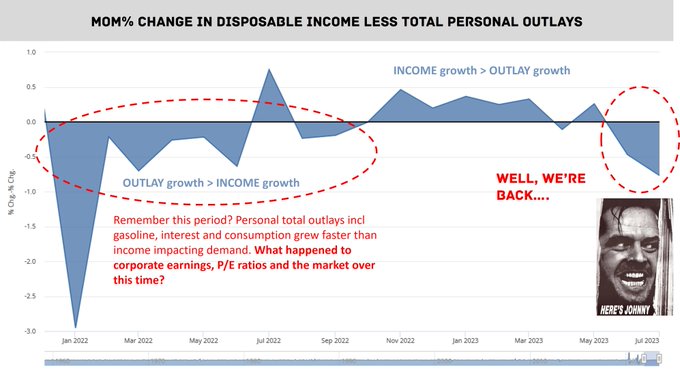

I'm very concerned as the

#softlanding

narrative builds that a key dynamic is being overlooked. We know the resilient US consumer has been at the core of why there has been no

#recession

so far. But the resiliency of the consumer is facing a harder test each successive week due

2

4

31

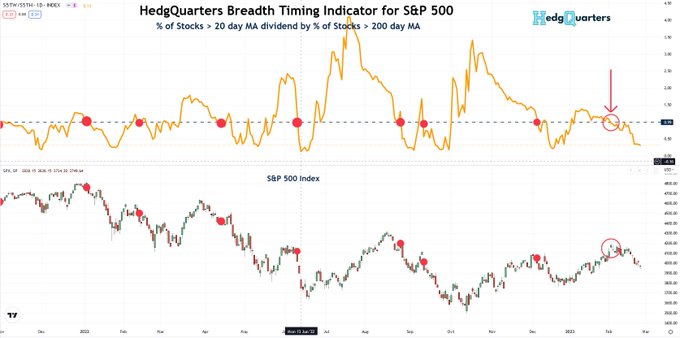

Breadth Update:

The breadth unwind continued with further falls in

#SPX

& $SPY over the last 2 days.

There is potentially more to this move based solely on past episodes in the chart, but also note that a ratio of 0.20 (0.34 now) has often signalled a near term trough

$QQQ

1

5

31

@PauloMacro

Your point is a good one. But what it ensures is bad. This will push the Fed to keep raising rates, possibly to 6% to get an overheated economy under control and rebalance Supply and Demand.

Because what you are implying is lower oil will boost Core PCE.

4

3

30

$DXY and US 10 yr yield in free fall. That’s good right?

Actually it just gives the

#Fed

more room to hike rates without breaking something…yet.

Financial conditions MUST remain tight to fully normalize

#inflation

.

Don’t trust

#stocks

to beat the Fed.

0

5

30

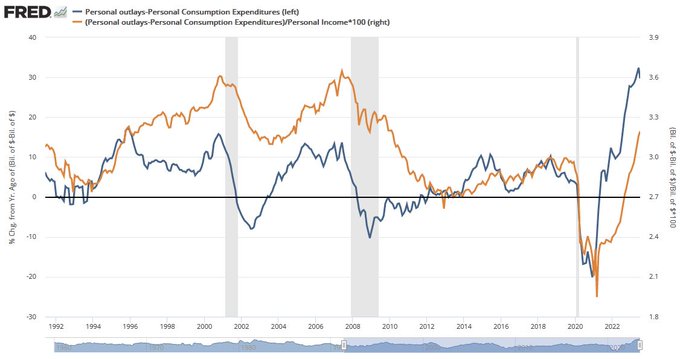

If you listen very carefully, that gurgling sound you hear is household savings once again being sucked down the drain due to the combination of residual

#inflation

,

#gasoline

prices climbing and

#interestRate

burdens still going up.

When we saw this in Jan-Oct 2022, consumption

2

6

29

Breadth Update:

Data was HOT, HOT HOT! And so with rates fears at the forefront we saw breadth ratio break lower again. Current 0.31 (

#stocks

> 20DMA / 200DMA). Low but not extreme after such a January rally

Many prior lows around 0.20 or below.

$SPY $QQQ

1

10

30

@CathieDWood

What’s any of that got to do with the Phillips curve??? All you’ve said is lower prices stimulate demand. Pretty sure Charlie Munger knows that well.

3

0

25