George Robertson

@BickerinBrattle

Followers

11,194

Following

2,073

Media

10,231

Statuses

72,831

Expert in fixed income, equity, and derivatives of both. Started at "Liars Poker" Salomon, last job as head of long duration (US Treasurys) for Morgan Stanley.

NYC

Joined February 2018

Don't wanna be here?

Send us removal request.

Explore trending content on Musk Viewer

#TheKingdomsConcert

• 213610 Tweets

Lakers

• 205204 Tweets

#WWERaw

• 141343 Tweets

Mariners

• 126604 Tweets

Lebron

• 113822 Tweets

Nuggets

• 101487 Tweets

Jamal Murray

• 66490 Tweets

Darvin Ham

• 39058 Tweets

Jokic

• 30986 Tweets

All To Myself D-2

• 30740 Tweets

#TheGrandConcertEnglotinUSA

• 30535 Tweets

Tatum

• 29225 Tweets

Porter

• 28186 Tweets

Derrick White

• 25641 Tweets

Cancun

• 16589 Tweets

Reaves

• 16495 Tweets

KDLEX CONCERT TIX RELEASED

• 13645 Tweets

風呂キャンセル界隈

• 13328 Tweets

桂由美さん

• 12837 Tweets

Freya

• 12619 Tweets

Vando

• 12599 Tweets

無料10連

• 12267 Tweets

Hayes

• 12074 Tweets

渡航費用12.6億円

• 10786 Tweets

政務三役31人

• 10335 Tweets

Last Seen Profiles

@palazzo214

@eyokley

@LeaderMcConnell

this seems to be lost on most. I think McConnel upped the ante from "mere" impeachment" to now Title 18 ss2384 Seditious Conspiracy - think RICO can be used then. I am fairly certain this is a valid charge and Trump faces 5 to 10 years in a fed pen if so

12

41

262

@trekkiebill

@ntinatzouvala

Always found it interesting how one can confuse, at first, the pictures of John Brown with the early beardless pictures of Abraham Lincoln. Then I think that John Brown was the real Lincoln. Or Lincoln had to become John Brown.

4

1

185

would anybody be interested in my group putting on a series of X Spaces to go over the 4 or 5 items I just went over with

@jackfarley

?

If enough interest we will do this.

14

8

88

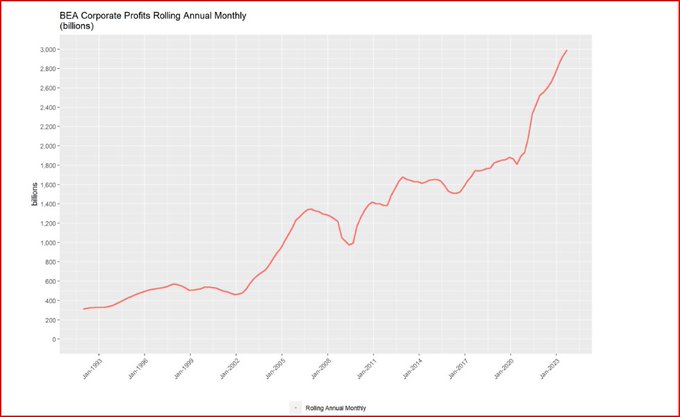

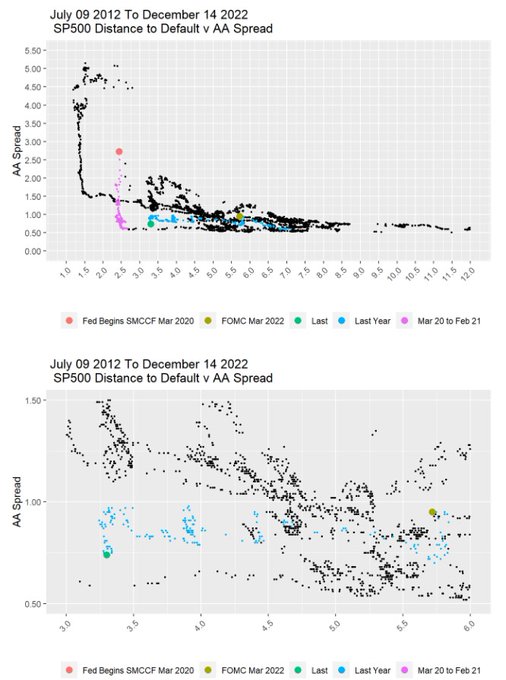

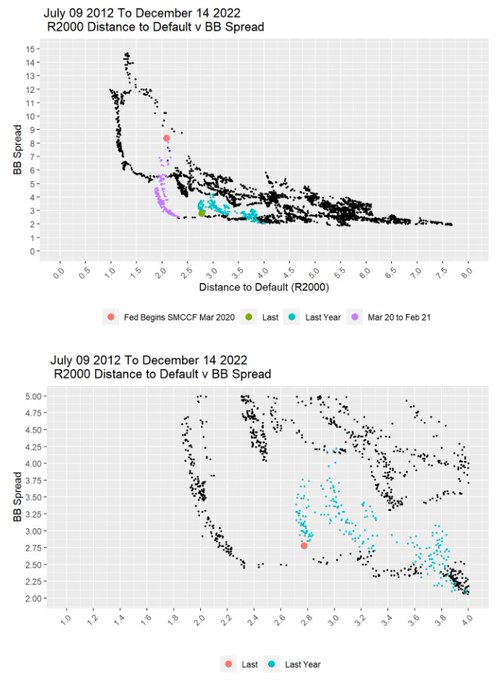

Fed has jammed credit to where BB is about 20% rich in value. While obvious strong arming has closed spread while Fed buys credit ETFs, the default risk has, if anything, gotten worse.

@lisaabramowicz1

5

20

73

@whstancil

you mean 350,000 white men who laid down their lives to eliminate slavery. would have been 0 lives if the 290,000 who died to promote and maintain slavery didnt fight, betraying their nation and for most officers of those men, their sacred oath.

9

0

63

"Something Happened" My read of the last two extraordinary trading days . Long chain.

@TheStalwart

@boes_

@dampedspring

@PMehrling

@M_C_Klein

@michaelxpettis

@pdacosta

5

6

39

@profplum99

the problem isnt MMT - MMT is as close to truth as economics comes - it is Pacioli/Riacardo reality - it is what folks want to do with MMT which becomes the problem. the funding required for every US war, and now for covid, is proof of the axiomatic nature of MMT

@wbmosler

3

0

35

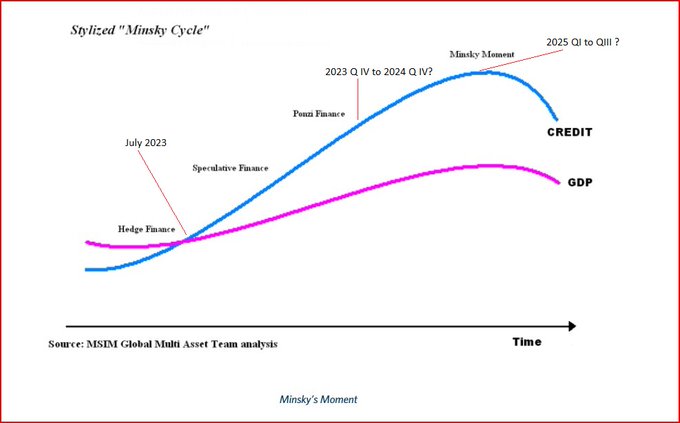

Terrific and necessary guidance help from

@dampedspring

. It is very important if I am to make sense to understand the three stages of Minsky, his concluding Ponzi stage and then what a Minsky Moment is all about.

3

4

34

@dampedspring

see you soon

by the way noted the slight uncalled. we disagree at times but your sincerity always obvious and you are making available 40 years of experience. thank you

3

0

33

Hugh remember the 5000 call and how you laughed and laughed. does that mean you dont know what is going on and I might know what is going on? hows the ghost in the machine, the Masonic plot to rule the world via Eurodollars going? oh, there arent euodollars now sigh

This is a great discussion

➡️

@hendry_hugh

on China: "It all comes back to the dragon's ass" 😂

3

1

14

6

4

33

Rather impressive.

BREAKING NEWS: Argentina achieved a balanced budget in January for the first time in over a decade.

President

@JMilei

achieved it without congressional action by freezing spending at 2023 levels, cutting many agency budgets by over 50% in real terms.

632

5K

35K

5

3

31

this will be her achilles heel as indicates she doesnt understand Chartalism which is the main pillar to her ideas on fiscal dominance - which I agree. but her thesis all falls apart when she extends it to internationalism and anti-state core value of crypto

The brilliant Lyn Alden, renowned for her razor-sharp financial analyses will be a key speaker at

#BitcoinAtlantis

. Her expertise will light the way for

#bitcoin

enthusiasts! 💡

Welcome,

@LynAldenContact

! 🧡

🎟

26

36

262

6

2

30