wassielawyer (哇西律师)

@wassielawyer

Followers

30,533

Following

917

Media

347

Statuses

6,589

Biglaw restructuring lolyer turned hentai penguin in suit.

Singapore

Joined March 2018

Don't wanna be here?

Send us removal request.

Explore trending content on Musk Viewer

スタンプ

• 154772 Tweets

GPT-4o

• 146875 Tweets

#บุ้งทะลุวัง

• 146410 Tweets

#GmmTreatFourthBetter

• 79816 Tweets

Luka

• 76109 Tweets

Change Fourth Manager

• 73093 Tweets

Mavs

• 34987 Tweets

#Varanasi

• 32332 Tweets

書類送検

• 24108 Tweets

Jリーグカレー

• 21009 Tweets

スナック

• 18305 Tweets

スクエニ

• 17032 Tweets

インプレゾンビ

• 16999 Tweets

SAROCHA REBECCA IN KAZZ

• 15182 Tweets

로즈데이

• 13946 Tweets

サマソニ

• 11757 Tweets

MAIN VOCAL SUNG HANBIN

• 11326 Tweets

Last Seen Profiles

Pinned Tweet

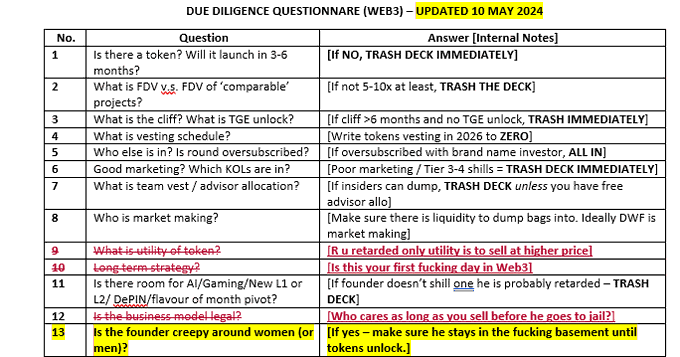

Don't really blame

@hosseeb

for this to be honest.

Its pretty clear the rest of the crypto VCs are following some variation of my due diligence framework. Most don't have

@dragonfly_xyz

's resources.

I have now updated it for future reference.

16

31

182

1/ Ok just some clarifications because people instantly become insolvency practitioners / lawyers whenever a platform is experiencing difficulties to maximize engagement farming.

Now

@CelsiusNetwork

is clearly insolvent. The question is what sort of insolvency are they in?

67

334

2K

I see this girl a lot and I'm confused about her story.

So she got rugged by Celsius and became some sort of crypto paparazzi/e-girl that hangs out with the latest villains / wannabe main characters using the fact that she is the kind of Asian that white guys find attractive?

192

31

2K

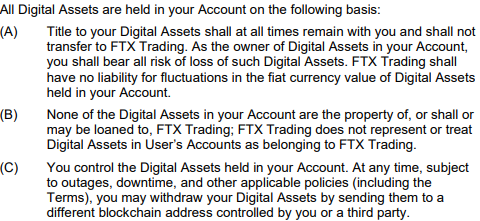

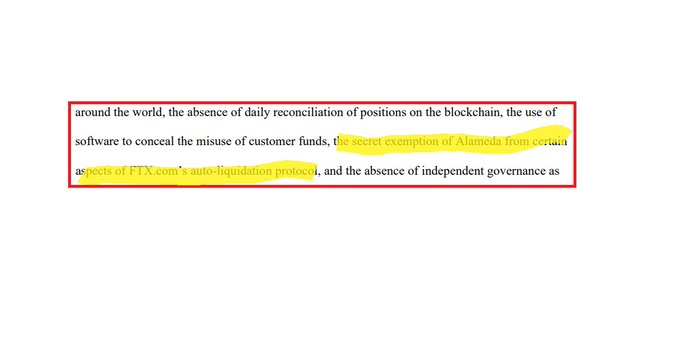

Extract of FTX terms of service.

If title to the Digital Assets belong to the customer and FTX used it - that is the definition of theft...

48

177

997

Anyone else think it’s pretty insane that Celsius is considering Chapter 11, 3AC is in liquidation and various players are dealing with very real fallouts while

@terra_money

, the first domino to fall is just happily working on their V2.0 after voting to delete their own debts?

79

106

976

1/ Disingenuous to reference LUNA imo - FTX-Alameda are so fundamentally structurally different from Terra that an FTX failure scenario would look very different.

CZ knows this of course but he also knows that the average FTX user does not.

42

91

643

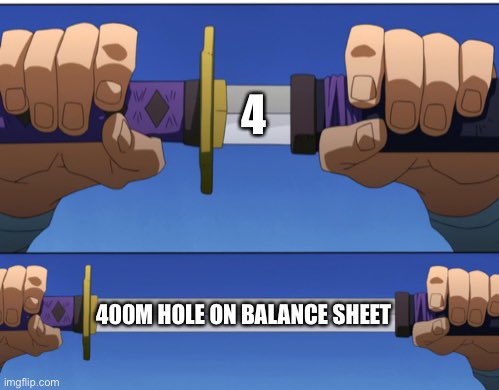

You have 1 SOL.

Sam steals your SOL. Sam goes to jail. John takes over.

John says: “Here’s $16 for your SOL”.

You: “I don’t want $16 I want my SOL. It’s $190 now.”

John: “Sorry G’s selling the locked SOL at $60.”

You: “Can I get the locked SOL?”

John: “No.”

You: “Can I…

43

89

596

Want to clarify this.

I admire

@stablekwon

for continuing to try and lead the rebuild efforts.

I don’t think he should be the face of it given the bad optics but if nobody from the builders step up to lead it,

@stablekwon

leading is absolutely better than zero leadership.

110

46

557

Unpopular opinion.

If

@stablekwon

and

@LFG_org

actually mobilise reserves to support people hurt by the debacle - they absolutely deserve credit.

They deserve criticism for poor crisis management (esp Do Kwon for his hubris) but we need to give credit where it’s due.

62

63

547

Guys if we had just bailed

@stablekwon

out last year, all the ponzis would still be running,

@SBF_FTX

would be controlling both the House and Senate and we would be telling all our normie friends to “have fun staying poor” while

@zhusu

leads us into the promised super cycle.

18

51

521

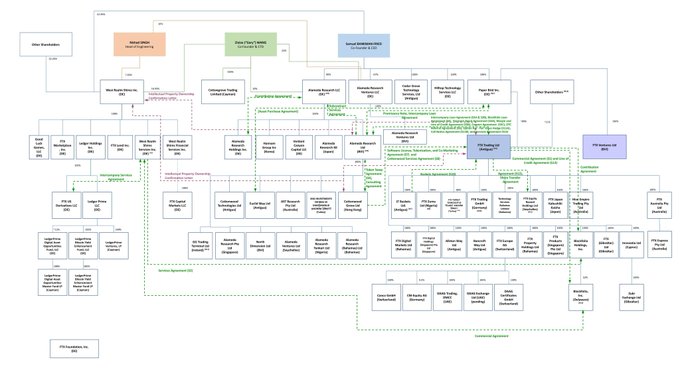

1/ So here is an explanation of the structural clusterfuck in understandable English.

FTX Trading Ltd (aka FTX Intl), Alameda Research and FTX Ventures were separate structures. They should not have a commingled balance sheet, and a failure of one should not affect the others.

17

118

498

1/ I want to begin this thread by stating unequivocally that

@SBF_FTX

using customer assets to provide a line of credit to Alameda was illegal and indefensible.

That said - I find some points in SBF's account in the lead-up to the Ch 11 filing somewhat believable and disturbing.

36

52

482

1/ A decision relating to

@DeFianceCapital

's lawsuit against 3AC in Singapore has just been made public and contains some interesting points around the treatment of cryptoassets and trust relationships.

For context, I have been working with

@Arthur_0x

on this for the past year.

45

103

485

Singapore prison is widely regarded as one of the shittiest prisons you can find in a first world country.

And the man made it sound like a 5-star mindfulness retreat everyone needs to go on in order to revitalize mind, body and soul.

Man is blessed with a superpower...

44

40

470

1/ So what is

@SBF

's latest proposal to 'save Voyager's customers' all about? Why is Voyager so pissed with his offer?

Join your friendly neighborhood hentai anime penguin in a suit as we delve into the latest move from the

@FTX

-

@AlamedaResearch

Distressed Opportunities Fund.

30

85

380

1/ Some thoughts on how a community buyout of FTX could work. Completely theoretical of course and actually executing requires an immense level of cooperation and coordination between participants which I am not sure is possible.

But here is how it could work. Theoretically.

76

100

383

Breaking my Terra embargo to propose a way to save LUNC.

@stablechen

auctions Do Kwon pics as NFTs for LUNC.

NFTs staked in web interface - users burn LUNC to buy virtual eggs/tomatoes/trash to pelt at NFTs. 90% burn, 10% to NFT owner.

Final result auctioned as art for UST.

30

48

337

I am getting way too interested in this $LUNA $Terra

@terra_money

thing despite my bags being incredibly negligible.

35

63

329

The reason why agreement is so difficult is because people keep dealing in absolutes.

Not all LUNA holders are selfish.

Not all UST holders are unreasonable creditors.

Not all VCs are here to rob you.

Not all builders are sensible.

@stablekwon

is not the devil incarnate.

50

28

339

1/ Spent 2 hours trawling through Celsius filings to write this thread explaining in non-lawyer friendly terms what the winning Celsius bid entails.

TLDR: If your Celsius bag is more than $5000, you get smol distribution and become shareholder in mining / PE company.

41

61

346

1/ We operate in an industry where the economic incentive to be a bad actor far outweighs the good.

@zachxbt

has spent time, effort and significant mental resource shining a light on the bad actors of this space, not for personal gain but to make the industry better as a whole.

11

45

331

Got cited on Bloomberg as a 'pseudonymous lawyer' instead of 'a hentai anime penguin in a suit'.

@matt_levine

please fix!

This is a frigging good article by the way from one of the best finance authors out there and I encourage everyone to read it.

29

43

319

13/ But we are in the crypto world so who knows what will happen?

I'd encourage

@CelsiusNetwork

to publicly disclose what sort of insolvency they are facing at the moment and the next steps they are intending to take.

Let's hope its not 100x leveraged LUNAC.

6

21

314

So apparently Huobi is listing these 'FTX debt' tokens.

For the love of Christ this isn't even a debt token, its a securitization.

This is such a terrible idea on so many levels. Also - not all debt claims are equal and fungible.

32

29

294

1/ Abu Dhabi's crypto play just took me down a rabbithole.

TLDR: Tokenised equity?

I recently looked at Abu Dhabi's new DLT Foundation legislation, looks like its aimed at bringing in DAO business.

Separately been hearing about

@M2Exchange

, a new Abu Dhabi regulated exchange.

26

62

295

This is probably the most frustrating thing about BLAST.

Have spent hours explaining to clients why they can’t run on-chain hedge funds with anon LPs or dangle token incentives… while a Paradigm backed MLM straight up markets securities to the public.

Including in the US.

17

28

297

1/ The FTX jurisdictional battle between the US and the Bahamas and what it means for us all explained by a hentai anime penguin in a suit in between making coffee at the

@wassieEmporium

.

Let’s start with a recap.

13

61

285

1/ Longer thread on the 'private placement' mode of fundraising, why it is a net negative for the space and why in an ideal world we should make ICOs great again.

The problem isn't the identity of the participants in these private placements.

Its the model itself thats broken.

28

65

271

20/ It would have been near impossible for

@cz_binance

to buy FTX outside of a Chapter 11, given FTX's potential regulatory liabilities and shady transactions.

It is now incredibly doable for him to buy out customer liabilities and clean FTX assets and leave the shit behind.

4

12

251

Terra explained in a tweet

@stablekwon

stablecoin broke. Trillion Luna printed.

People down bad. People mad. Kwon missing.

@FatManTerra

maybe sue Kwon for holders.

#LUNAtics

want burn.

Kwon back say maybe restart. CZ say plan bad. Kwon insist restart.

Everybody even more mad.

36

34

243

No matter what your views are - gotta respect how

@cz_binance

handled this.

SBF was Washingtons darling and managed to blow up at the expense of customers.

CZ was under far more pressure and got out with a retirement, handover to chosen successor and customers funds SAFU.

9

24

251

7/ So if a player were to actually consider 'bailing out' FTX customers, it makes far more sense doing it out of a Chapter 11 process because you get to leave behind whatever you don't want in the burning dumpster fire which

@SBF_FTX

created.

6

10

242

1/ Since

@laurashin

's interview with

@KyleLDavies

, I've been asked multiple times about my opinion on it and the ensuing drama.

Going to try for a somewhat balanced take here which will probably enrage most people.

Kyle (and Su) doesn't owe most people an apology.

38

23

242