DeFiance Capital

@DeFianceCapital

Followers

53,682

Following

90

Media

24

Statuses

191

Thesis driven crypto investment firm. Fundamental driven liquid venture investing.

Singapore

Joined February 2020

Don't wanna be here?

Send us removal request.

Explore trending content on Musk Viewer

Bridgerton

• 371148 Tweets

Cohen

• 271421 Tweets

Butker

• 212063 Tweets

Colin

• 107492 Tweets

billie

• 75351 Tweets

Catholic

• 74705 Tweets

Penelope

• 63912 Tweets

Kanté

• 42210 Tweets

ISABELLE EMBAIXADORA

• 37641 Tweets

Usyk

• 36222 Tweets

Francesca

• 33997 Tweets

Daniel Perry

• 30930 Tweets

NCAA

• 28450 Tweets

Fermin

• 27270 Tweets

Leeds

• 23802 Tweets

Fall 2025

• 22432 Tweets

Deschamps

• 22373 Tweets

GTA 6

• 22270 Tweets

Megalopolis

• 22184 Tweets

Greg Abbott

• 21740 Tweets

Katy Tur

• 20514 Tweets

Olise

• 19117 Tweets

Eloise

• 16038 Tweets

Pedrinho

• 14212 Tweets

ひーくん

• 13900 Tweets

Jarry

• 12660 Tweets

Betis

• 12625 Tweets

Norwich

• 12580 Tweets

Laporta

• 11669 Tweets

Lacazette

• 11085 Tweets

Aleyna

• 10482 Tweets

Last Seen Profiles

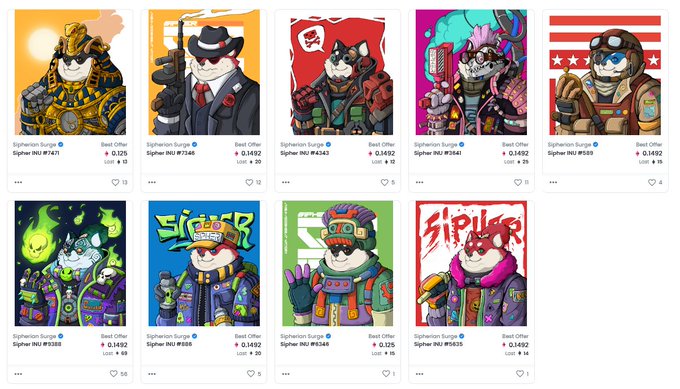

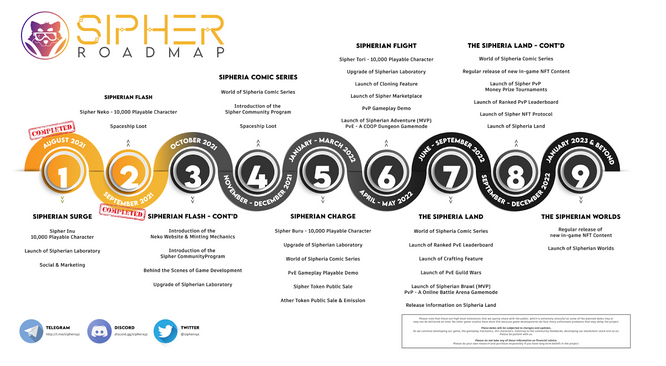

DeFiance Capital is proud to announce that we invested and have acquired 8 of the rarest Genesis Sipher INUs released by

@SIPHERxyz

Why we bought the INUs 🐶

42

109

292

Thanks for the feature!

115

20

114

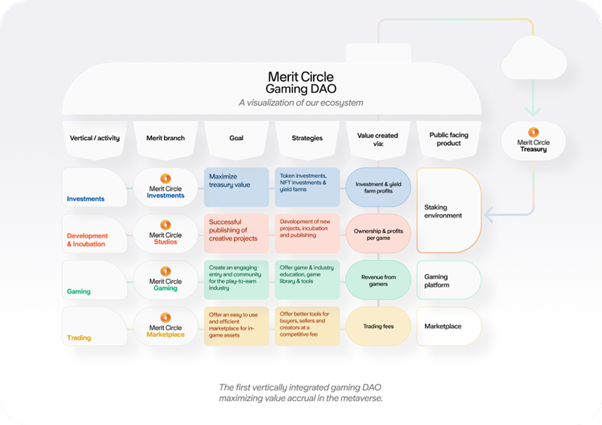

DeFiance Weekly Portfolio Highlights (Merit Circle $MC)

Today, we want to shine the spotlight on

@MeritCircle

, a vertically-integrated Gaming DAO defining the standard for being a valuable partner to games and crypto gaming enthusiasts.

A🧵

10

24

109

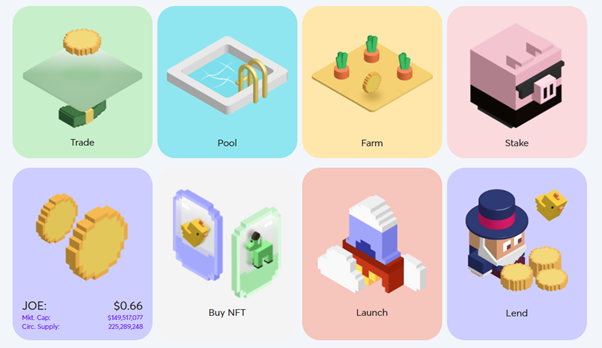

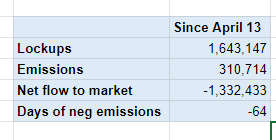

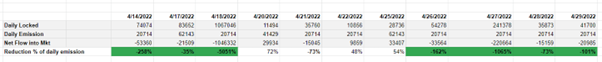

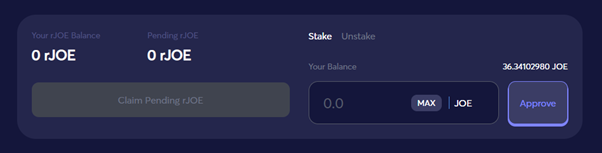

DeFiance Weekly Portfolio Highlights (Trader Joe $JOE)

Today, we would be sharing more about

@traderjoe_xyz

, the one-stop decentralized trading platform on the

#Avalanche

🔺 blockchain.

A thread🧵

16

17

79

Ethereum is our community and we are proud to back the

@gitcoin

Grants Round 7 to support public goods in Ethereum. We've been following Gitcoin CLR grants closely since the beginning and think it is playing a critical role in the Ethereum ecosystem.

3

6

42

Excited to back

@paraswap

as one of the leading liquidity aggregators in the space.

We think the more liquidity in crypto will flow to DeFi in the future and Paraswap is likely to capture a major piece of that market.

0

9

40

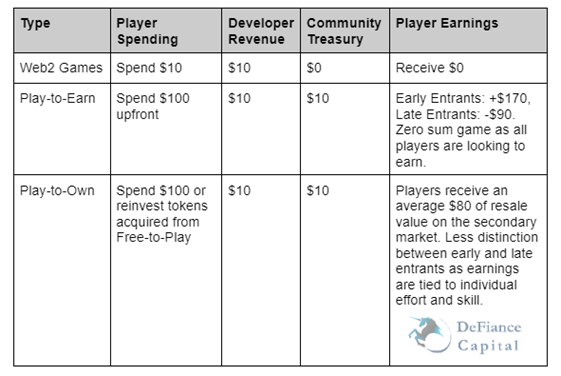

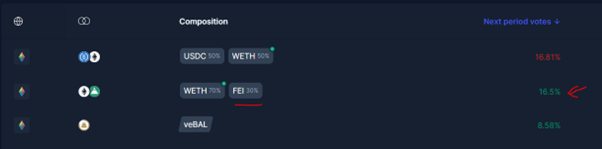

1/ Balancer ($BAL)

Balancer is an AMM that allows multiple assets in different weights in a single pool.

Think Uni V2 with:

- 2 or more assets

- weight options like 80/20 (vs 50/50)

- tighter prices, Curve-style stable swaps.

- More risk flexibility

3

6

40

Official response from

@AlphaFinanceLab

team regarding the misinformation recently.

We would also like to add that Alpha Finance is one of the most professional and diligent team we have the pleasure to work with.

We'd like to share our response to the misrepresented information from

@defiyield_info

, as Defiyield does not fully understand the rationale which they would have had they reach out to discuss 👇

7

16

74

0

10

38

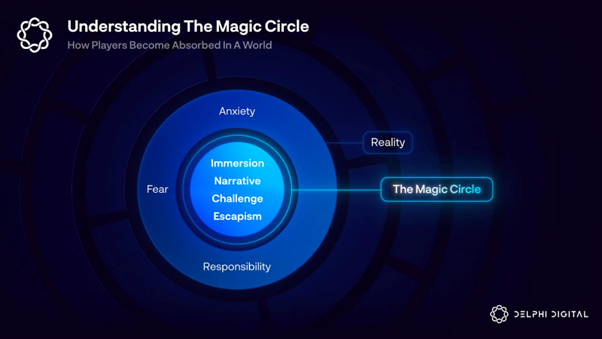

As gamers ourselves, DeFiance appreciates the potential of in-game NFT assets and will be looking to further support our portfolio in the burgeoning GameFi ecosystem.

Proud to join our friends at

@Delphi_Digital

, do give their original piece a read!

15

6

30

13/13

TLDR

Trader Joe has been a stalwart of

#Avalanche

🔺 DeFi by building a feature-rich one-stop trading platform.

They are not stopping here, with the recent launch of their

@joepegsnft

#NFT

marketplace and the imminent revamp of their AMM design.

11

1

22

We are proud to say that we will be renting out these valuable NFTs to our portfolio guilds like

@MeritCircle_IO

which have the ability to put the asset to better use. At the same time, Guilds that own such top-tier assets can better attract gaming talent.

9

0

20

Excited to support Switcheo in their efforts to build a cross-chain liquidity and derivatives trading protocol. Through relentless execution across market cycles, the Switcheo team has proven themselves as a force to be reckoned with.

🚩 Official Announcement 🚩

We are incredibly honoured to welcome

@DeFianceCapital

as our newest strategic partner, along with joining partners Three Arrows Capital,

@DigiAssetFund

,

@DeFi_Capital

&

@MXC_Exchange

Read more about the event on our blog!

9

34

134

2

5

21

12/13

We will continue to back the strong team of builders at Trader Joe and we look forward to using the new features of Joepegs and trading on the revamped version of their AMM.

Bull or bear - the roadmap remains the same:

• Feature rich NFT marketplace on

@joepegsnft

• Cultivating a vibrant NFT ecosystem for creators

• A novel AMM model

8

15

156

7

0

15

Fin/

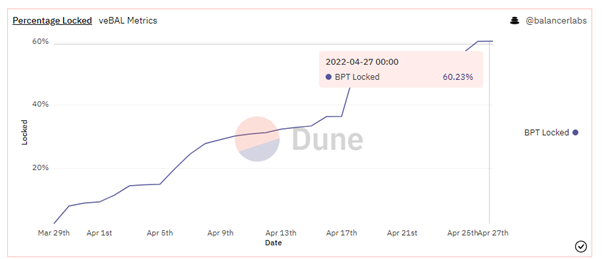

@BalancerLabs

veBAL is the catalyst for BAL battles - and will kickstart the $BAL flywheel.

various DAOs and projects are starting to show signs of interest.

We expect this to boil over with the start of

@CurveFinance

4 pools - as the dynamics vs diff stables change.

2

2

13

Great write-up and interview on this round from

@TheBlock__

and

@Yogita_Khatri5

JUST IN: Decentralized derivatives exchange dYdX raises $10 million in Series B (via

@Yogita_Khatri5

)

4

24

97

0

3

14

Excited to back Furucombo to make DeFi more accessible!

0

0

15

End/ We will continue to offer strong support and stewardship in the DAO to further our shared vision to accelerate the Play-to-Own movement and Web3 games.

Read more about the next steps and follow

@Marco_Merit

@tommyqeth

@Pentosh1

to learn more

8

1

14

We also bought the unique [Full Sets], which have collectible value based on their matching traits.

Sipher INU

#3641

“Traitsmaster” in particular has 11 Traits making it one of six INUs that possess the max number of traits.

1

0

12

Thrilled to continuously support InsurAce to make DeFi safer.

🔊

#InsurAce

is thrilled to announce the $3M strategic investment co-led by

@AlamedaResearch

@CapitalHashkey

, with continuous support from our Seed investors

@DeFianceCapital

@paraficapital

@hashed_official

@Signum_Capital

;

1

12

53

0

1

10

9/ Push

#1

is that traditional games have restricted economies that prevent players from easily receiving real-world value from their efforts within games.

1

0

11

13/ Pull

#2

: Web3 games align incentives between players, investors and developers via Tokens and NFTs, creating strong player empowerment and community stewardship as everyone is invested in the success of the game.

1

0

10

Excited to lead

@insur_ace

seed round and support them in building a decentralized insurance protocol to complement the exponential growth of DeFi space now.

Expect the DeFi insurance space to continue to grow and make DeFi safer!

0

2

9

Excited to work together with

@BoringDAO_Defi

to bring more non-Ethereum assets to DeFi through its cross-chain solution.

📢1/2 Official Announcement

We have completed our private round and received a total of $1.45 million in financing from several institutions including

@DeFianceCapital

,

@HashKeyGroup

,

@snzholding

,

@YoubiCapital

,

@altonomy

, Puzzle Ventures,

@SnapFingersCom

, etc.

3

102

213

2

1

8

We are incredibly excited to back Union Protocol to bring uncollateralized borrowing to Ethereum!

Under-collateralized borrowing is one of the biggest financial primitives that yet to be tackled successfully in DeFi and happy to support

@unionprotocol

in tackling this.

I am excited to announce

@unionprotocol

has raised $3M!

Backed by some of the most insightful firms in the space:

@placeholdervc

@1kxnetwork

@coinfund_io

@DistributedG

@TheSpartanGroup

@variantfund

@KR1plc

@scalarcapital

@DeFianceCapital

InfiniteCapital

13

19

151

1

2

10

Another channel to tokenize BTC through

@BoringDAO_Defi

has launched!

0

1

7

11/ Push

#3

: UGC creators also face risks when rules are changed at a whim to benefit developers unilaterally.

1

0

7

10/ Push

#2

is that a dichotomy exists due to incentive misalignment between players and developers. profits are increasingly prioritized by developers while players continually seek the cheapest and best products.

1

0

8

6/13

Joepegs

Trader Joe then launched an

#NFT

marketplace that will feature a feature-rich launchpad and different collection tiers. Users can also look forward to the launch of TraderJoe’s very first NFT project 👀

1

1

7

3/13

TraderJoe currently has the deepest liquidity and highest volume amongst DEXes built on the C-Chain (outside of stableswaps like Curve and Platypus), making it the best location to trade on

#Avalanche

🔺

1

1

8

10/13

Check out this tweet to learn more about how you can use your $JOE tokens.

3

0

6

12/ Besides critical Push factors, the Pull factor is the value proposition of Web3 Games.

Pull

#1

: Deeper liquidity of secondary market leading to greater trading volumes + revenues

1

0

7

10/ Curve war background: Started when CVX competed with YFI (and other stables) for Curve DAO power to give their pools higher rewards. This tension led to a higher CRV price.

We are starting to see such interest in BAL:

1

0

7

6/ Studio

Merit Circle will create value by being directly involved in the building of games. The expertise of working together with the games under their portfolio will increase the success of incubated games.

@Edenhorde

NFT for example has a successful start

1

0

6

13/ “Convex” forks are just starting: Aura Finance forum proposal by maki

•

1

0

6