him.eth

@himgajria

Followers

4,345

Following

1,738

Media

218

Statuses

3,813

Investor + founder @eqtnxyz and

Dubai, UAE

Joined October 2018

Don't wanna be here?

Send us removal request.

Explore trending content on Musk Viewer

Cohen

• 217942 Tweets

$GME

• 131023 Tweets

Aziz Yıldırım

• 73027 Tweets

GameStop

• 61293 Tweets

Ali Koç

• 41489 Tweets

Roaring Kitty

• 37665 Tweets

Vance

• 36028 Tweets

gracie

• 34139 Tweets

सुशील मोदी

• 32790 Tweets

Mourinho

• 30644 Tweets

Hot Sale

• 27513 Tweets

Atiku

• 26504 Tweets

Square Enix

• 25974 Tweets

$AMC

• 24534 Tweets

GPT-4o

• 23257 Tweets

DIAMOND HANDS

• 20821 Tweets

Tuberville

• 19393 Tweets

Deco

• 19082 Tweets

Carlos Vives

• 17149 Tweets

सुशील कुमार मोदी

• 16896 Tweets

TREASURE IS COMING

• 15835 Tweets

McDavid

• 15713 Tweets

Vitor Roque

• 14378 Tweets

Bronny

• 11653 Tweets

John Fury

• 10209 Tweets

Assassin's Creed Shadows

• 10084 Tweets

Last Seen Profiles

@bascule

The algorithm is based on targeting parts of the image with the greatest brightness and colour density.

If you’re insinuating it’s designed to be racist, you’re wrong.

209

133

3K

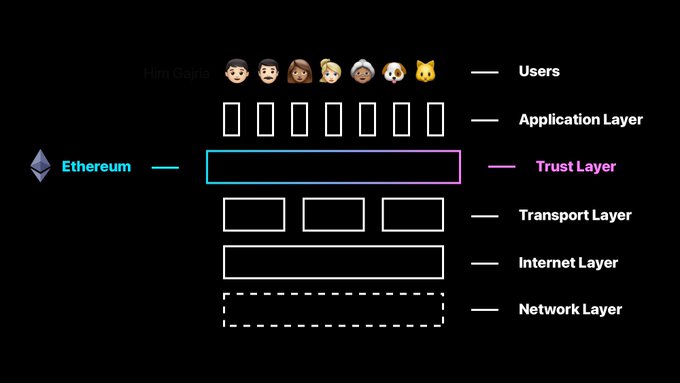

What’s even more ironic: we invented smart contracts just to end up using

@cobie

as the escrow for this bet;

A bet on the future price of a smart contract platform. Can’t make this up.

14

43

1K

Recent criticism on Bittensor - protocol doesn’t work.

Reality on Bittensor - actual products currently live on the protocol.

Subnet 3 -

@myshell_ai

Subnet 4 -

@manifoldlabs

()

Subnet 6 -

@NousResearch

Subnet 8 -

@taoshiio

Subnet 18 + 19 -

@Corcel_X

17

74

264

@ThinkingAlts

@JohnTodaro1

It’s crazy to think Ethereum charges you fees to send money to your friends.

Here on Solana you have no friends.

7

3

178

@austin_rief

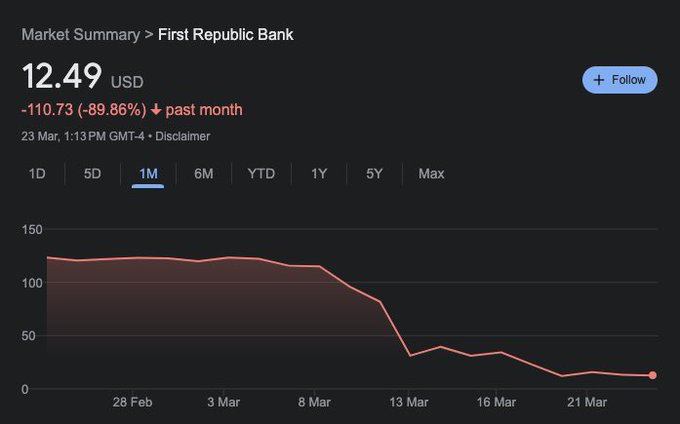

Worst part about traditional finance:

The old men that were running CDOs and toxic debt in 2008 are still doing it.

1

5

147

@ahcastor

This is what a 1 minute chart spanning 30 minutes looks like for absolutely every publicly traded asset.

0

0

122

@0xHamz

The difference is he signed up for the making money part.

He didn’t sign up for the part where they use his capital without his consent.

If there’s anyone I wouldn’t do business with, it’s the one that breaks their agreement.

2

1

109

@paulg

@VitalikButerin

Intellectual dishonesty?

You literally let someone else use your identity to push something you’re not sure of yourself.

That’s clearly intellectual dishonesty.

2

2

87

@zebulgar

@tomfgoodwin

Ironically, those two words automatically nullify your opinions on morality.

4

0

79

@_simmac_

@bascule

While I agree, using brightness to target parts of an image can result in the unintended outcome of targeting fairer skin, the creator probably didn’t intend for this to happen.

Bias would be when the creator consciously or subconsciously designs an algorithm to be biased.

52

2

70

Instead of remaining on Ethereum, a decentralised network, dYdX is moving to its own chain.

Wouldn’t call the new chain democratic when the insiders hold >50% of the voting power.

Allocations | main | Governance Documentation

Allocations for the ethDYDX token.

docs.dydx.community

5

5

69

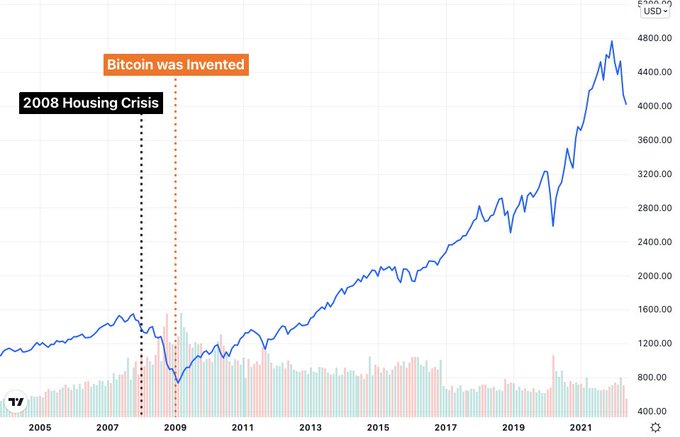

@santiagoroel

Not bottom signals:

- S&P only down 20% from highs.

- Macro market cycle hasn’t closed since 2008. Long overdue.

- Fed about to unwind balance sheet.

- Fed is at the beginning of rate hike cycle.

- NFTs still selling near ATHs

- Market still has confidence to catch bottom.

2

8

67

@stablekwon

Graceful.

2

1

63

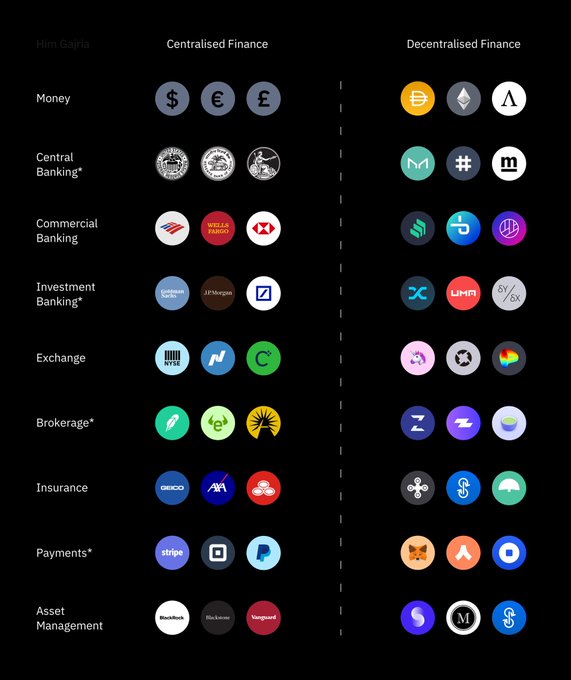

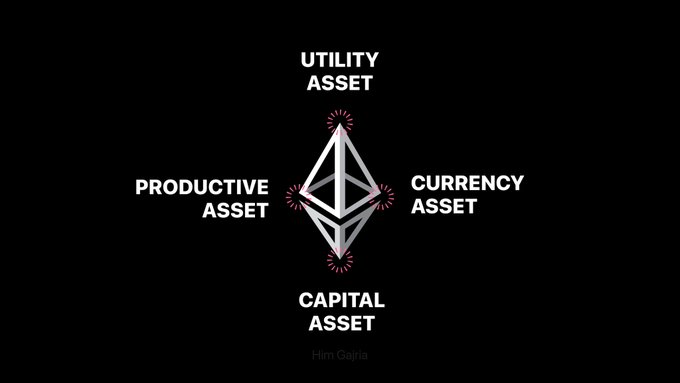

@iamDCinvestor

While making this chart, I realised every single project listed here is on Ethereum and it wasn’t even my goal to do that, it’s just that literally everything of value in crypto is on Ethereum.

4

17

55

@gaborgurbacs

@Greenbackd

Berkshire Hathaway reserves are greater than Bitcoin’s market capitalisation.

3

1

40

Never thought someone would translate it into a book, let alone Chris Dixon.

1

2

38

@awilkinson

The patent for the original Vision Pro was filed in 2007, while Apple was under Steve.

4

2

40

@CoinDesk

@CelsiusNetwork

@Nate_DiCamillo

DeFi is literally on-chain. Meaning, it’s fully public, open and auditable by anyone.

2

0

37

@fintwit_news

@BillAckman

I’d put my money on him, than a lot of actual military strategists.

2

0

38

@adamscochran

Going forward: “We’re not accessible to residents and citizens of the US, and do not permit the use of our xyz within the jurisdiction”

1

0

38