David Puell

@dpuellARK

Followers

68,954

Following

2,176

Media

564

Statuses

2,584

On-chain research @ARKInvest | I like #Bitcoin , Books, and Bebop | Disclosure:

Joined May 2017

Don't wanna be here?

Send us removal request.

Explore trending content on Musk Viewer

FA Cup

• 564230 Tweets

Manchester United

• 487087 Tweets

Nicki

• 316652 Tweets

Kroos

• 316245 Tweets

الاهلي

• 245439 Tweets

George Floyd

• 219361 Tweets

#WWEKINGANDQUEEN

• 194741 Tweets

River

• 175896 Tweets

Bernabéu

• 163570 Tweets

Córdoba

• 138523 Tweets

Lyon

• 102247 Tweets

Amsterdam

• 87895 Tweets

Fentanyl

• 86452 Tweets

ابو عبيده

• 70946 Tweets

Long Live

• 67931 Tweets

マリノス

• 40194 Tweets

National Service

• 39460 Tweets

Gunther

• 37469 Tweets

Josh Taylor

• 34165 Tweets

Chauvin

• 28619 Tweets

Mets

• 26734 Tweets

Demichelis

• 26089 Tweets

Militão

• 25984 Tweets

كروس

• 25887 Tweets

Karoline

• 22649 Tweets

كاس العالم

• 18822 Tweets

Libertarians

• 18326 Tweets

Apertura

• 17431 Tweets

Grayson Murray

• 15454 Tweets

GAGA CHROMATICA BALL

• 14595 Tweets

Cristal

• 13090 Tweets

#TaylorCatterall2

• 12452 Tweets

Farruko Pop

• 11222 Tweets

Last Seen Profiles

I’m glad to announce that I will be doing crypto and on-chain research for

@ARKInvest

. Taking

#Bitcoin

on-chain analytics to the next level with the ARK Team is a dream come true. Excited for things to come!

219

136

4K

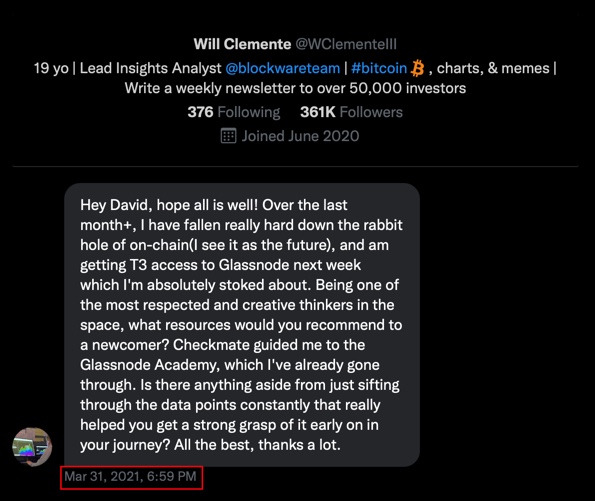

Heard this kid has come a long way. This DM was sent when his account was at less than 10k followers.

Perfect example of how self-education and hard work (and good meme game) are highly-valued characteristics in the crypto meritocracy.

@WClementeIII

28

50

2K

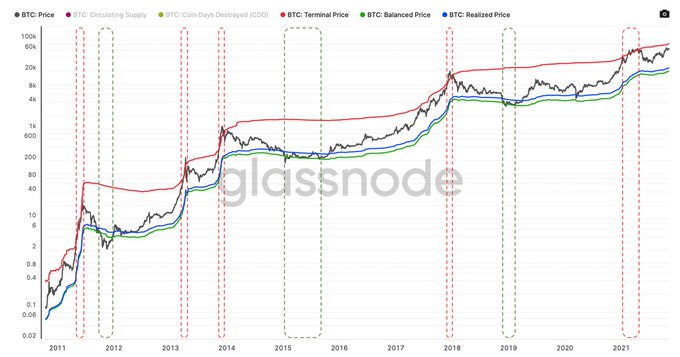

$BTC: I have the pleasure of introducing the most interesting top-detecting model I've seen for Bitcoin. This metric is a full

@_Checkmatey_

original. The lad was awesome enough to let me present it to you for the first time.

1/ Meet "terminal price" (red below)...

69

290

1K

Mexico's third richest man, owner of a media conglomerate, a bank, with the ear of the Mexican President, just disclosed his 10% BTC position, shilling

@saifedean

's "The Bitcoin Standard" in the process.

"Bitcoin protects the common citizen against government expropriation."

Hoy les recomiendo EL PATRÓN BITCOIN, este libro es el mejor y más importante para entender

#Bitcoin

.

El Bitcoin protege al ciudadano de la expropiación gubernamental.

Muchas personas me preguntan si tengo bitcoins, SÍ. Tengo el 10% de mi portafolio líquido invertido en el 😌💵

421

672

4K

45

324

1K

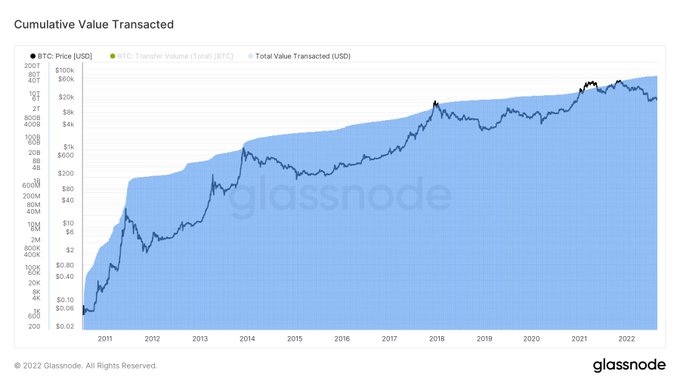

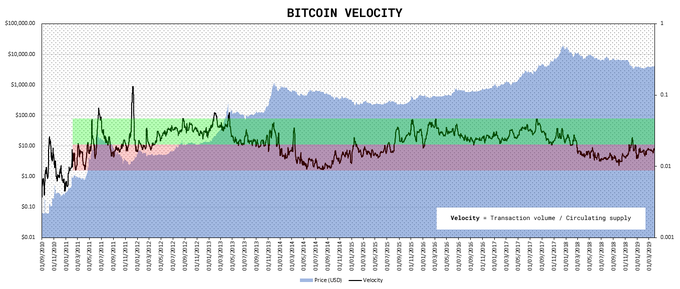

The total value transacted in USD on the

#Bitcoin

network just passed the 100 trillion mark.

160

246

1K

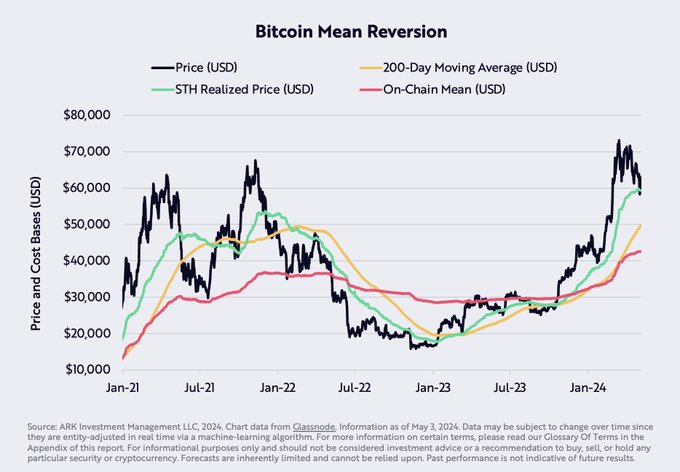

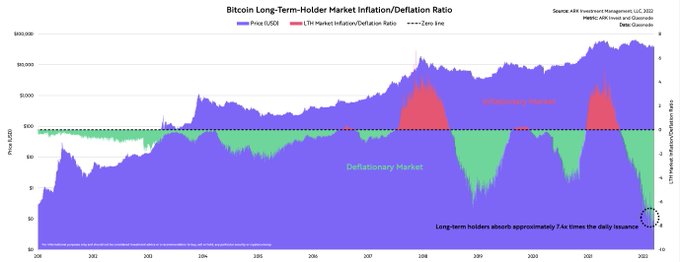

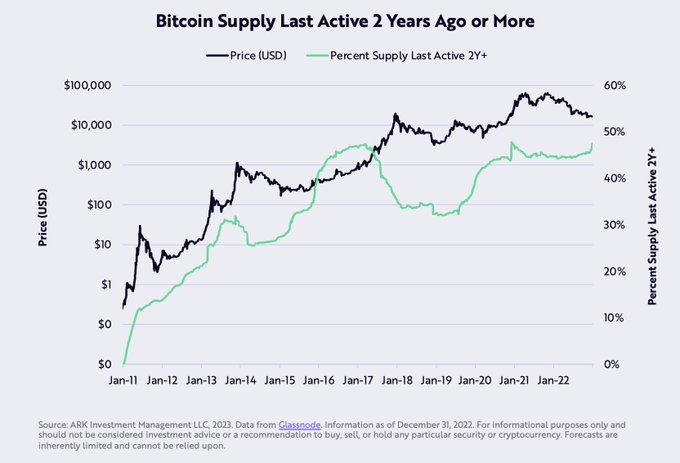

Our analysis suggests that

#Bitcoin

, proportional to supply held by long-term holders (LTH), is at its most deflationary in history.

1/ Introducing LTH Market Inflation/Deflation Ratio, created in collaboration with

@_Checkmatey_

(Glassnode).

72

213

903

$BTC: I adjusted

@WClementeIII

's supply shock ratio for total circulating supply. Gives an oscillating behavior. Looks healthy today.

30

90

887

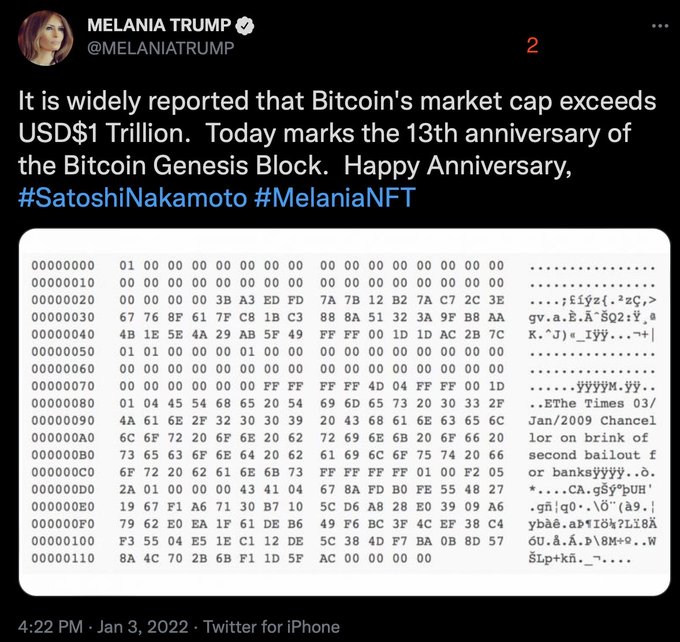

Culturally, if I had to pick an exact date when

#Bitcoin

went mainstream, it would be today.

One of the most disruptive figures in 21st-Centory history declared his skin in the game in one of its most disruptive technologies.

16

99

811

There's few candles in the history of

#Bitcoin

that are worthy of a name of their own. You know, like chess openings...

We shall name this, "Elon's Candle."

34

116

757

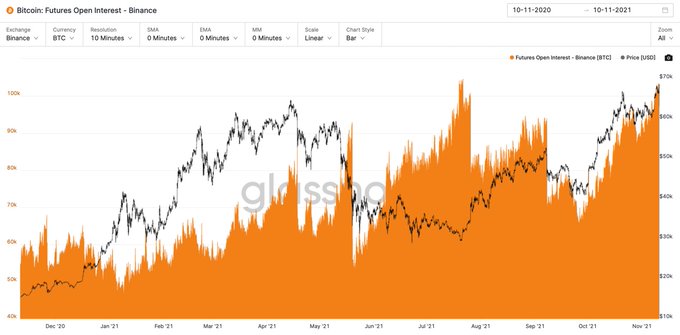

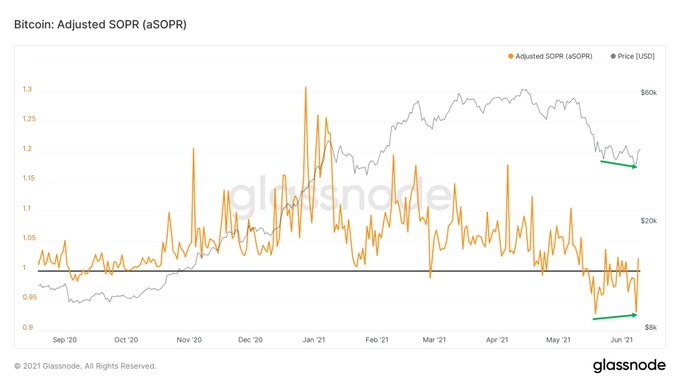

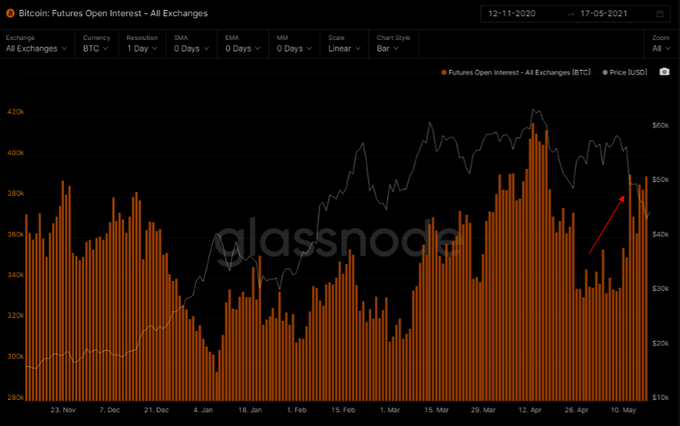

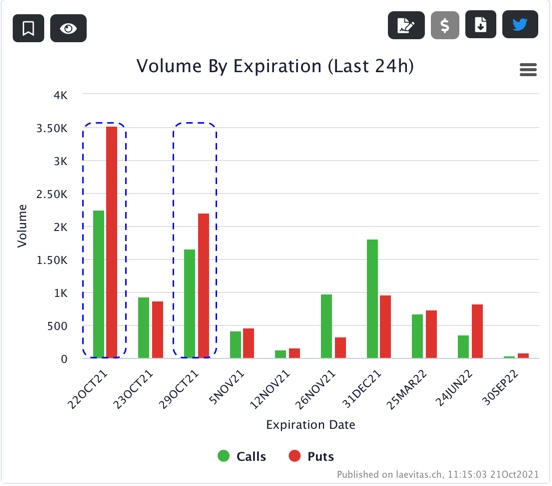

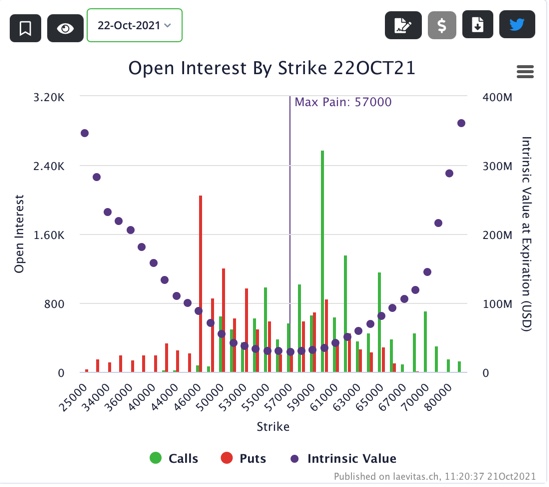

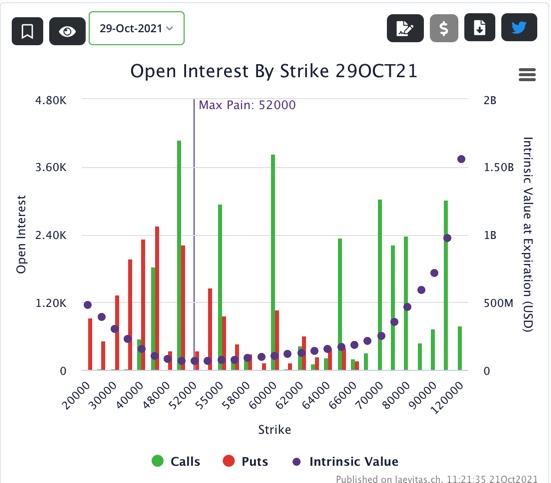

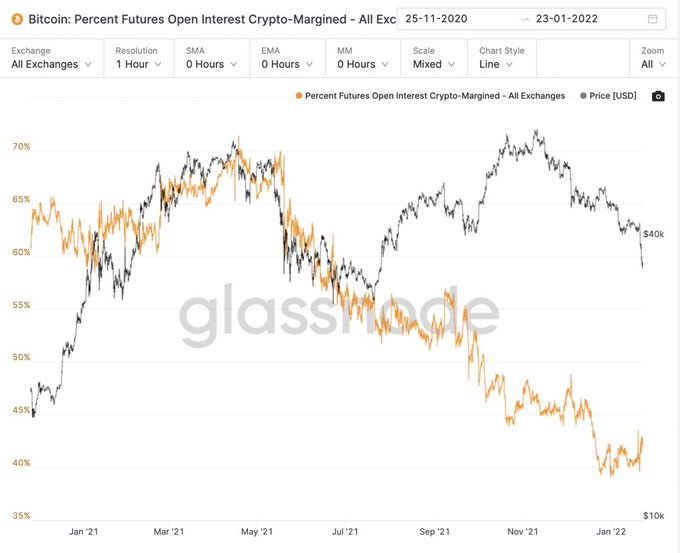

#BTC

: That's a massive spike in open interest today, combined with still positive derivatives premium. Neither premium nor OI seem yet wiped.

This spike is not CME, as it seems to be Binance.

33

94

717

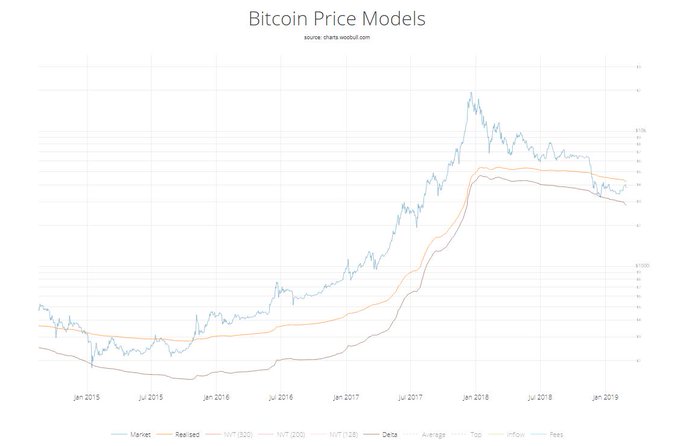

$BTC: Introducing Delta Capitalization and MVDV Ratio: an experimental valuation model for catching Bitcoin tops, bottoms, and cycle lengths.

Shoutout to

@woonomic

for the pretty charts and the awesome collab.

16

167

521

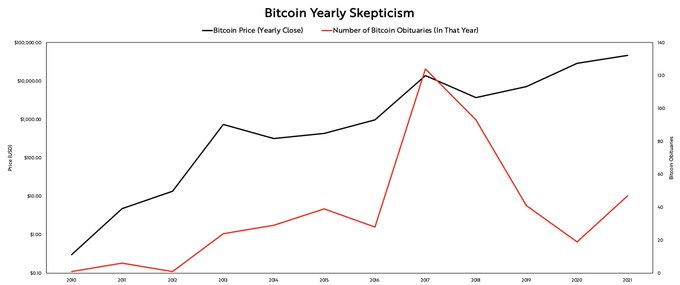

#Bitcoin

's public skepticism by reputable sources peaked in 2017.

Despite higher prices, 2021 stood at a 62% reduction in skepticism compared to that 2017 all-time high.

Either skeptics are less in number, or less willing to stake their reputation in being wrong about Bitcoin.

188

61

451

$BTC: Introducing

@coinmetrics

' brand new transaction volume estimates. (Shoutout to

@nic__carter

,

@khannib

, and

@panekkkk

for the data.)

A thread on why it is so beautiful, at least from an analyst's perspective...

1/ Velocity—a.k.a. inverse NVT ratio (7-day median smooth):

17

145

441

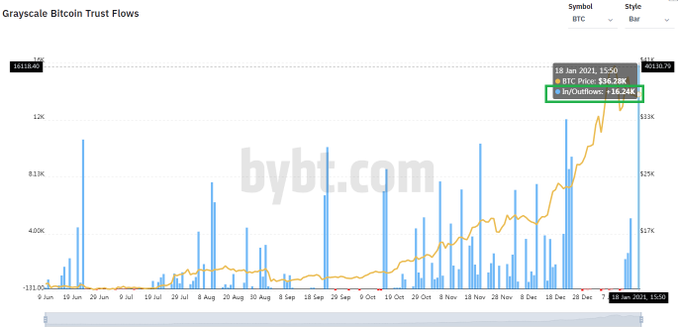

$BTC: Grayscale added 30k BTC to its trust just this week. That equals about one month of new issuance.

So, for the week, $GBTC's demand side is 4x the potential supply side of all natural sellers in the

#Bitcoin

market.

H/T:

@Travis_Kling

.

23

64

436

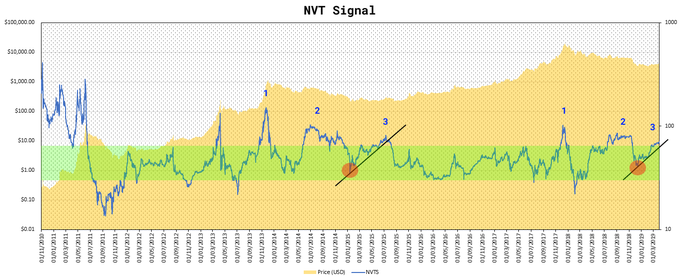

$BTC: NVT Signal with brand new

@coinmetrics

transaction volume data.

Tells a much clearer picture of the current state of affairs. Loving it.

@woonomic

,

@MustStopMurad

, and I have more on this later.

24

93

384

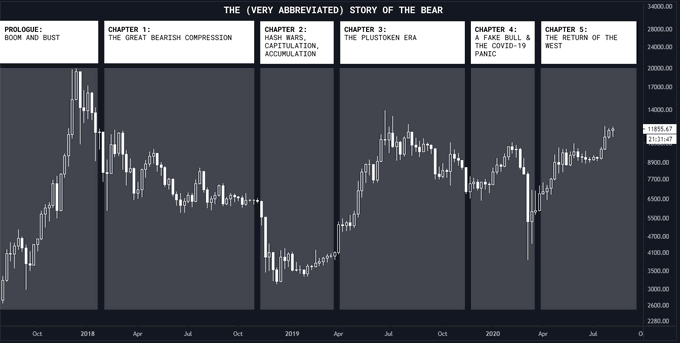

If you are new

#Bitcoin

investor, make sure to prepare your psyche to the hash wars, the PlusTokens, the COVIDs, the Elon tweets, the BlockFi botched giveaways of this world.

Only way to survive, not sell bottoms, and live healthier over the long term.

Always assume a swan.

9

46

370

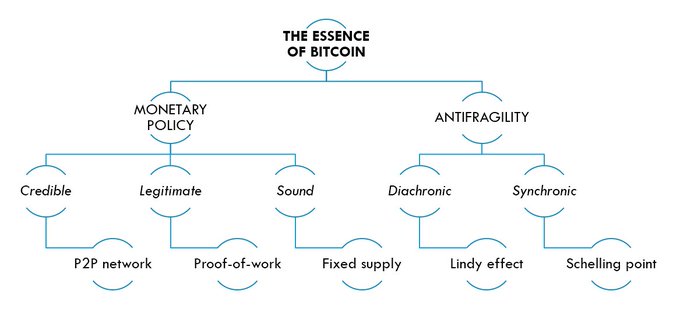

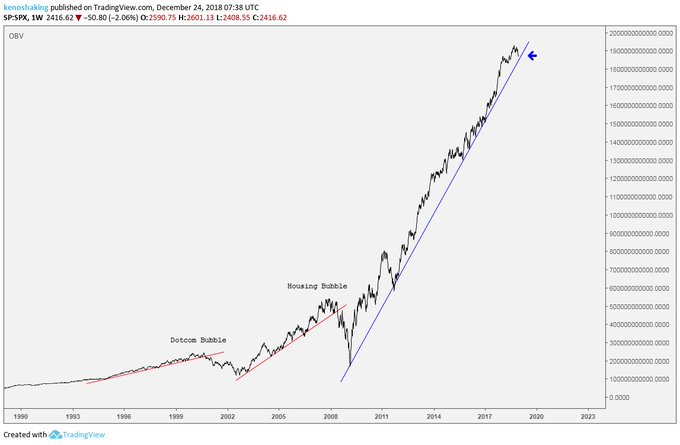

For the newbs or the shitcoiners, the essence of Bitcoin in a simple graph.

(Based on

@pierre_rochard

.)

6

113

350

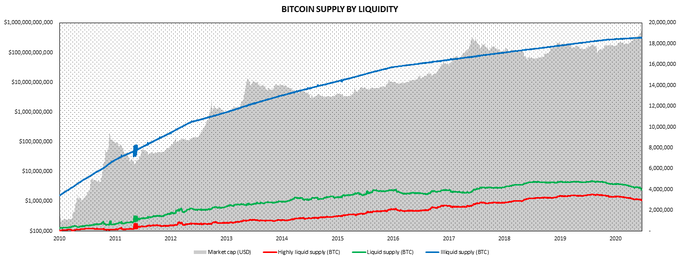

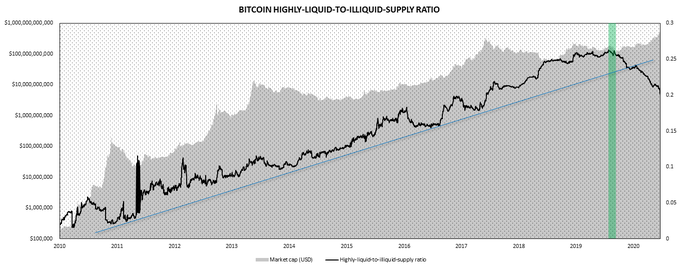

$BTC: Few experiments with

@glassnode

's liquidity-supply metrics that were recently published, shown below (as of Jan. 3).

1/ A brief thread...

16

92

326

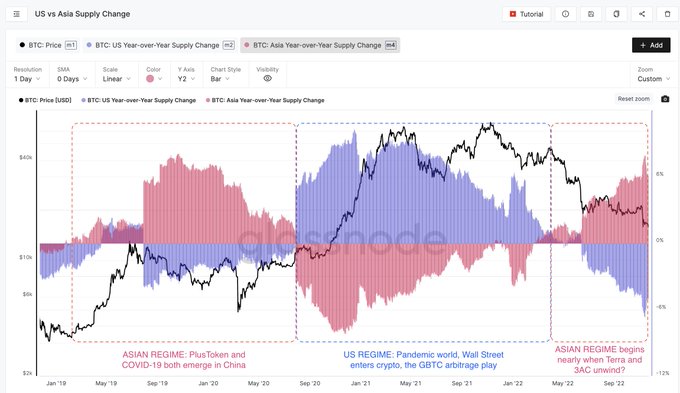

Hypothesis: By tracking

#Bitcoin

YoY supply change, Asia vs. the US, might one determine the world region that rules price action?

When all this FTX fiasco calms down, I'm going to keep an eye on Asia.

31

56

319

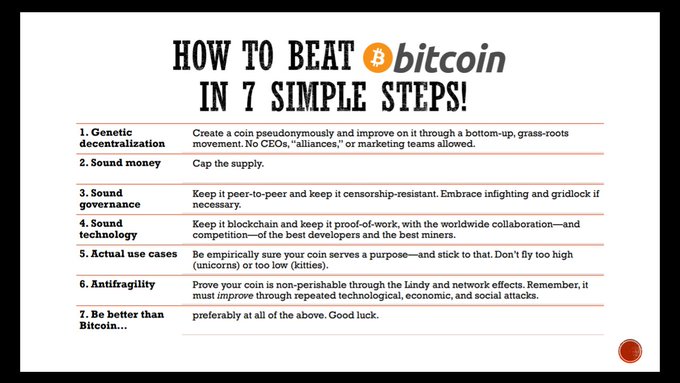

It's so easy to outcompete

#Bitcoin

! Here's how in 7 simple steps...

Note: This list was based in part on the insights of

@_Kevin_Pham

,

@pierre_rochard

,

@jimmysong

,

@saifedean

, and others.

9

82

256

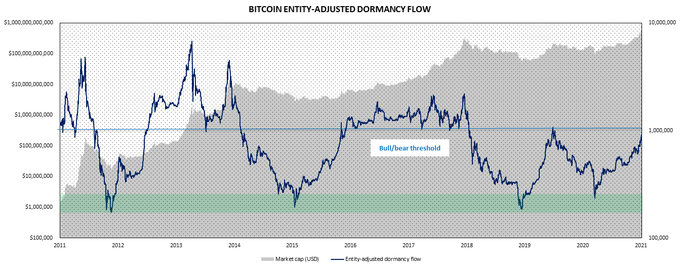

$BTC: I had the honor of writing this new piece on Bitcoin Average Dormancy with Reggie Smith (

@SupremeVinegar

), inventor of the concept.

Three brand new on-chain indicators here. Enjoy!

14

81

263

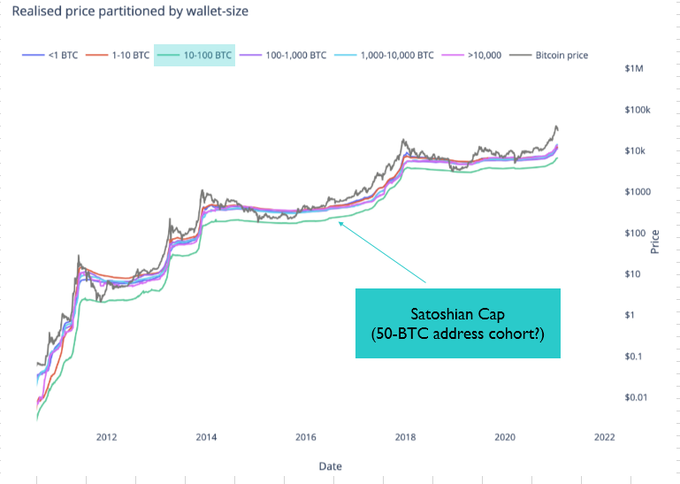

Can't believe I missed this.

Well, let's give it a proper intro. This is the

#Bitcoin

Satoshian Cap, which gives all its generational bottoms so far.

Actual on-chain research:

@whale_map

.

Rationale:

@girevik_

.

Dude who just put a name on it: me.

@kenoshaking

This cohort is much lower than others simply because it contains all the 50 BTC mining rewards from 2009, valued at $0. I.e. what is typically assumed to be Satoshi’s coins.

3

2

16

5

53

259

$BTC: Couple of my metrics just went live on

@glassnode

, both for confirming cycle bottoms.

1/ Delta cap = realized cap - average cap

11

38

258

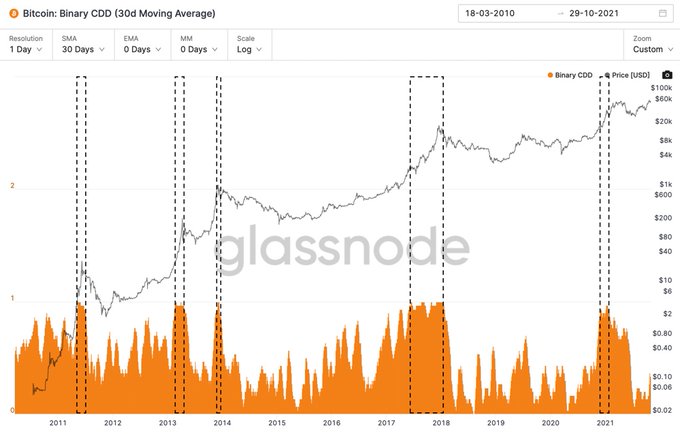

$BTC: Below, binary coindays destroyed by

@hansthered

, but with a twist: a monthly moving average is applied.

Whenever the metrics caps at 0.9 to 1, irrational exuberance can be inferred.

Main outlier is 2017, where CDD saw a major spike do to the Bitcoin Cash fork.

12

40

235

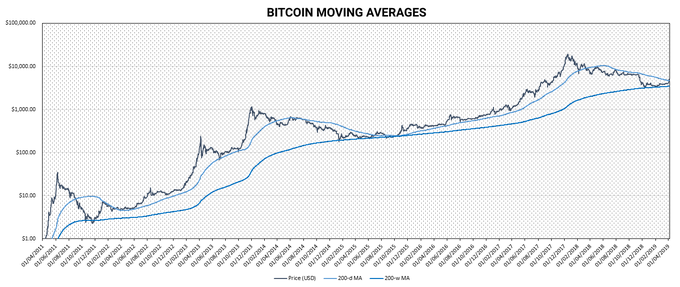

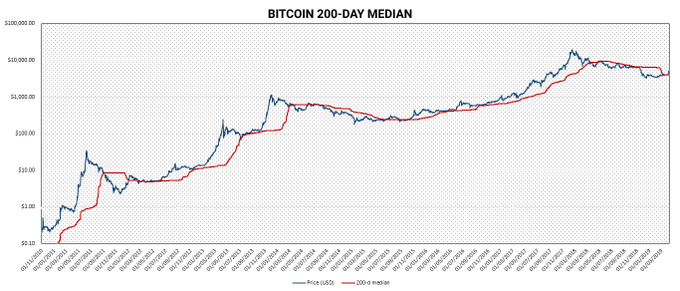

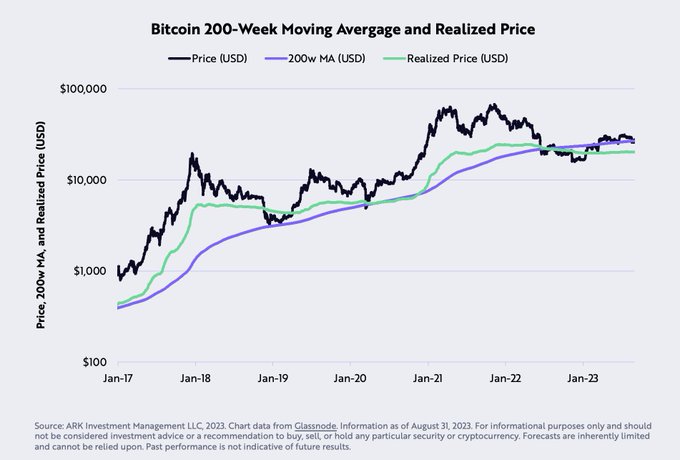

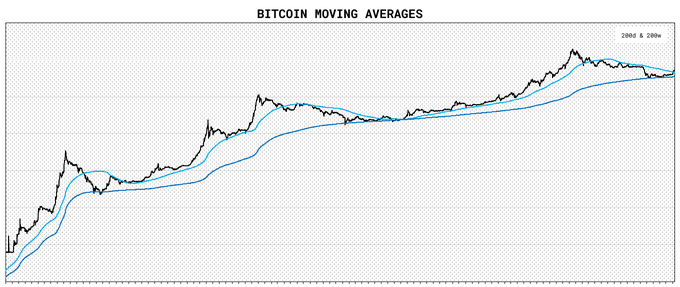

The

#Bitcoin

Monthly for August, done in collaboration with

@WClementeIII

is live!

Thread:

1/ Bitcoin has lost its 200w MA at $27,580, with realized price as stronger downside risk support at $20,300.

21

70

231

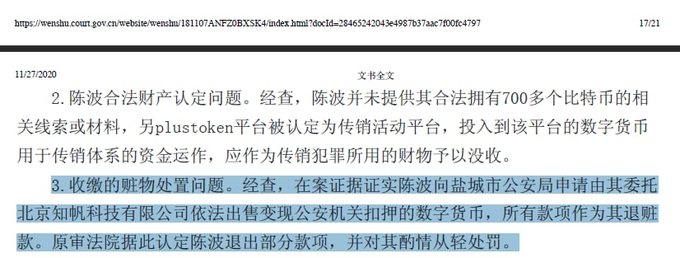

$BTC:

1/ So here's the deal with all the PlusToken news we've been seeing recently in the crypto media. Thing is, tho it's just being reported now after the Chinese government put out official balances,

@ErgoBTC

blew this story open for the on-chain community over a year ago...

9

62

240

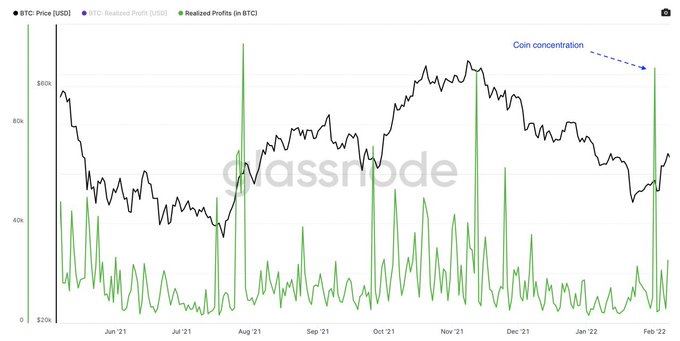

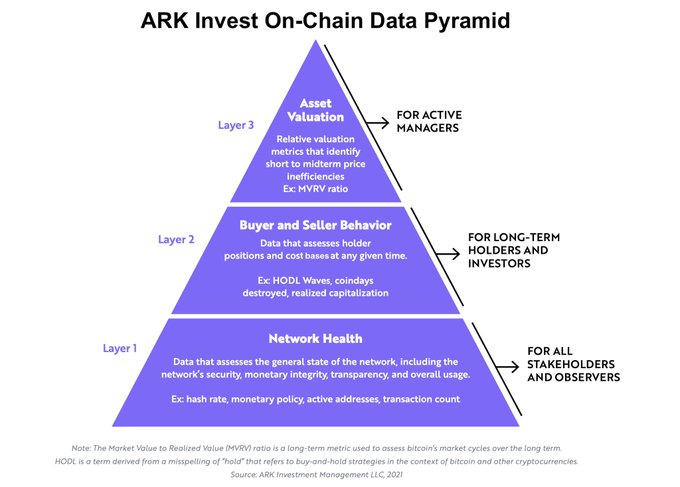

In other words:

1. The former (short- to midterm) holds attention to derivatives premia, open interest, among others.

2. The latter (mid- to long-term) holds attention to on-chain activity.

3. Both are fundamental, not technical, analyses.

15

35

225

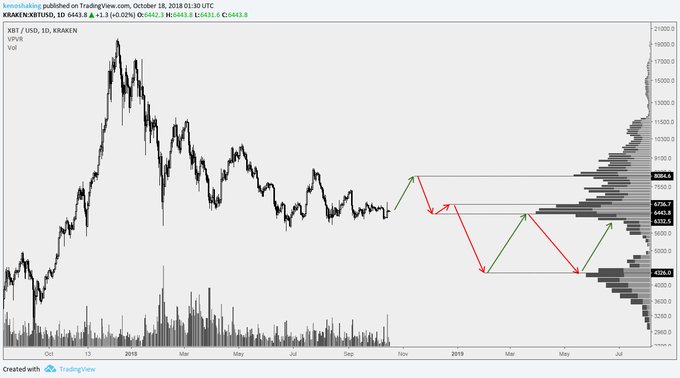

1) It has been a long road since the Bitcoin top of 2017. Herein, a nowhere-near complete summary of what has transpired.

Next below, a brief thread on few interesting tidbits. Shoutout to

@whale_map

for the innovative on-chain metrics.

1

62

223

I had the honor of co-authoring this new white paper on

#Bitcoin

on-chain analysis with

@_Checkmatey_

from

@glassnode

.

18 months in the making, two publications, 120+ pages of material, 30+ new or improved on-chain metrics.

Goes live tomorrow.

Coming Tomorrow - A collaborative white paper with

@Glassnode

18 months in the making. Don't miss it, subscribe now to receive your copy.

29

89

282

18

23

224

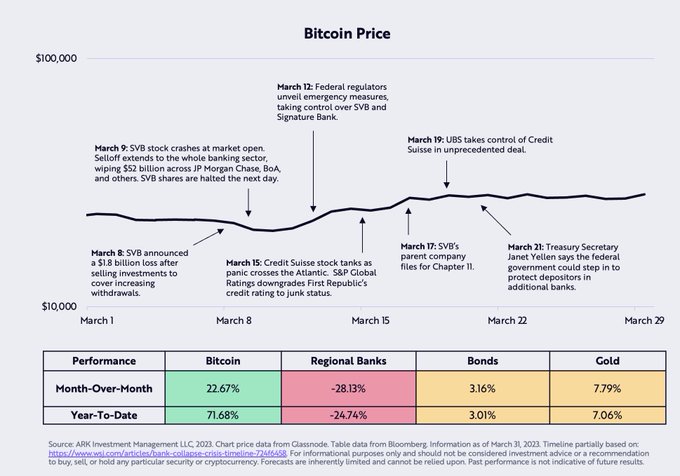

The Bitcoin Monthly for March is out!

Amidst the largest banking crisis since 2008-2009,

#Bitcoin

has flourished, being the best performer amongst top defensive assets.

10

66

217

Part 3 of my collaboration with

@yassineARK

and

@ARKInvest

, with data by

@glassnode

, is out.

This time we feature five brand new original metrics.

Check it out and enjoy.

Analyzing BTC's price action without using on-chain data is like valuing a company without using its financials

On-chain data is BTC's ultimate valuation tool

Just published “A Framework for Valuing BTC” w/

@kenoshaking

feat 5 new ARK on-chain indicators

71

658

2K

15

21

201

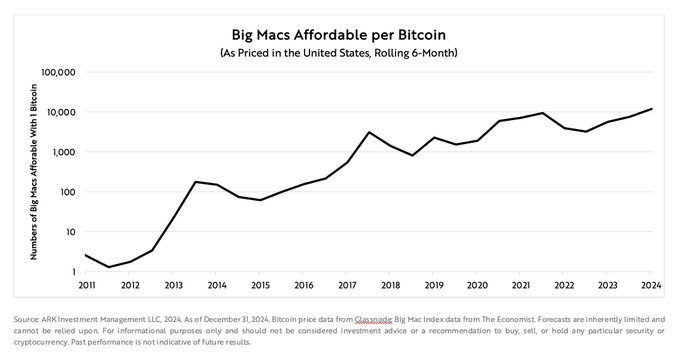

Fun fact: as of end of 2023, the number of Big Macs you can buy with 1 bitcoin surpassed 10 thousand for the first time.

Powerful burgernomics.

H/T:

@QuantMario

20

32

207

Join us next Wednesday, 6 pm ET!

@natemaddrey

,

@_Checkmatey_

,

@hansthered

, and I will discuss:

1. On-chain archeology and forensics.

2. What are on-chain heuristics?

3. The open-source nature of on-chain analysis.

4. On-chain skepticism?

28

39

192

#BTC

: On-chain context for this transaction...

1. Yes, movement of coins in the 7y-10y age band is a predictor for tops.

2. Since 2017, it is not uncommon behavior from a long term perspective.

💤💤💤💤💤💤💤💤💤💤 A dormant address containing 2,207

#BTC

(150,512,129 USD) has just been activated after 8.1 years (worth 294,287 USD in 2013)!

1K

2K

13K

11

35

188

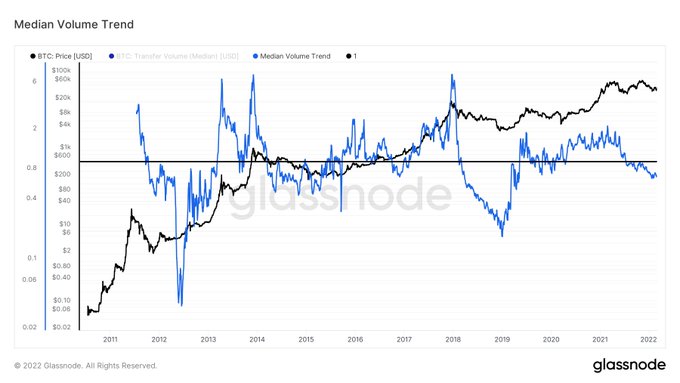

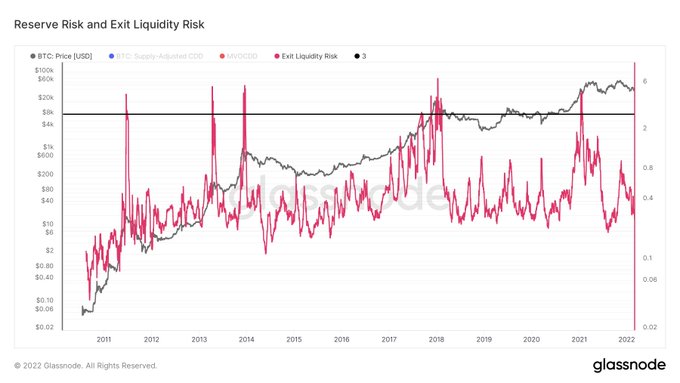

1/ Two new

#Bitcoin

on-chain metrics that look interesting to me:

Blue:

@CryptoVizArt

's median volume trend, which seems to suggest retail participation above 1 (or a lack of it below 1).

Red:

@PrfDude

's exit liquidity risk, which seems to detect spending outliers above 3.

11

47

181

#Bitcoin

supply elasticity continues to decrease.

1. Long-term-holder supply just made all-time highs.

2. Highly hodled or lost coins are at levels not seen since October, 2020.

32

32

170

2022 will be the Year of Tests for

#Bitcoin

:

1. Harshest macro environment in Bitcoin's history.

2. Systemic contagion of hydra-like form and proportion (Terra, Celsius, 3AC...).

3. Unlocking of Mt. Gox coins at nearly 35x profit.

15

29

175

My collaboration with

@yassineARK

over the last year, a three-part series covering all basic aspects and several complex aspects of on-chain analysis, is out as a single, updated whitepaper.

This should serve as the ultimate guide for anyone delving into this emergent field.

Just published the ultimate manifesto on the power of on-chain data w/

@kenoshaking

This is the culmination of all the work we’ve done this year developing a framework to assess Bitcoin’s fundamentals.

On-chain data = alpha

Enjoy.

68

385

1K

10

37

170

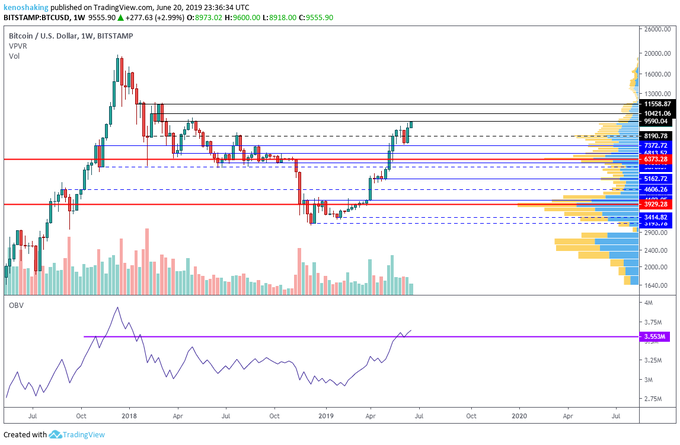

$BTC valuations support cluster with volume profile and OHLC confluences...

Delta price: 2.9k.

NVT price (320): 2.5k.

NVT price (200): 2.3k.

NVT price (128): 2,1k.

Average price: 1.3k

Why I disagree with

@Sawcruhteez

and stand

#BullishWithMurad

,

@MustStopMurad

.

9

40

169

@WClementeIII

Clemente waking time allocation:

33% charts.

33% drawing frogs by hand, scanning them, and Photoshopping them into his photography catalogue.

33% Blockware Solutions, LLC.

1% food and beverages.

8

4

165

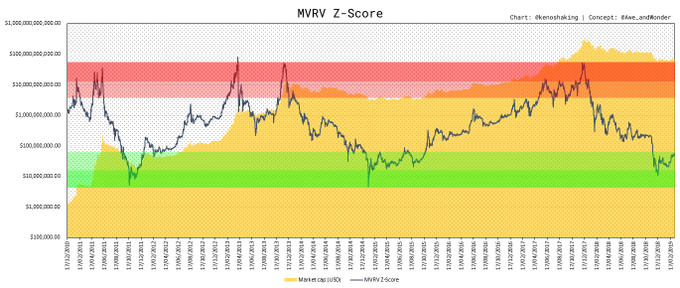

Introducting the Bitcoin MVRV ratio in co-authorship with

@MustStopMurad

.

Many thanks to

@nic__carter

,

@khannib

,

@woonomic

,

@Kalichkin

.

10

54

165

If I had only five landmark moments in the history of

#Bitcoin

on-chain analysis to pick as the most crucial for the field, these would be my selection:

10

40

167

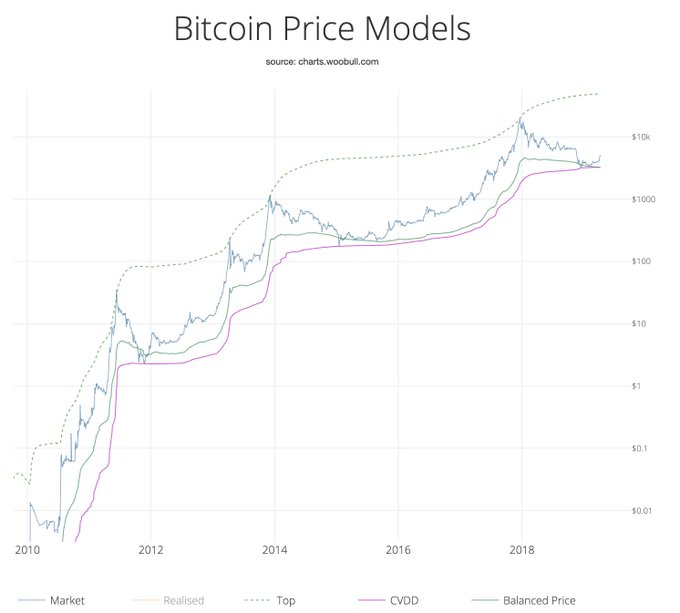

$BTC: Introducing Cumulative Value-Days Destroyed (CVDD) and Balanced Price with

@woonomic

!

Full article:

Thread:

Introducing Cumulative Value Days Destroyed (CVDD) and Balanced Price. New experimental models using the early metric of Bitcoin Days Destroy. Check

@kenoshaking

's handle very shortly for Balanced Price, I'll dig into CVDD here.

21

144

417

3

39

159

Scenario that looks interesting to me:

Cost basis of short-term holders (STH) is below cost basis of long-term holders (LTH), shown in green here.

In other words: STH-MVRV > LTH-MVRV.

LTH realized price: $31.7k.

STH realized price: $22.2k.

H/T:

@_Checkmatey_

20

29

157

This extract from an essay I never finished popped up today.

It will be my pinned tweet for now and shall be finished before

#Bitcoin

hits $100k (in, you know, apparently, couple of weeks or something).

7

22

149