Diego Milano

@diegobmilano

Followers

1,562

Following

358

Media

46

Statuses

1,121

Quercus Fund Investment Manager

Ourique, Portugal

Joined July 2014

Don't wanna be here?

Send us removal request.

Explore trending content on Musk Viewer

Mother's Day

• 1277376 Tweets

Mauro

• 145377 Tweets

#DebateChilango

• 91528 Tweets

Emma

• 70398 Tweets

Nuggets

• 67045 Tweets

Wolves

• 46920 Tweets

Taboada

• 45129 Tweets

Iztapalapa

• 37952 Tweets

Clara Brugada

• 37366 Tweets

つばさの党

• 36815 Tweets

Juliana

• 34860 Tweets

Denver

• 34217 Tweets

Jokic

• 32531 Tweets

Sebastián

• 31118 Tweets

BIRTH Campaign

• 26428 Tweets

Minnesota

• 25997 Tweets

Jamal Murray

• 25814 Tweets

Cruz Azul

• 25202 Tweets

Pumas

• 23815 Tweets

Bruins

• 22801 Tweets

Benito Juárez

• 22474 Tweets

Fabra

• 20622 Tweets

家宅捜索

• 19235 Tweets

Rayados

• 17450 Tweets

Gobert

• 15995 Tweets

Tigres

• 15862 Tweets

LOSE MY BREATH REMIXES OUT NOW

• 13195 Tweets

Jordi

• 12588 Tweets

#Canucks

• 11441 Tweets

#ほっともっと16周年

• 10508 Tweets

Gambino

• 10316 Tweets

Last Seen Profiles

@JTLonsdale

The book “Concrete Planet: the strange and fascinating story of the world’s most common man-made material”, by Robert Courland, shows some interesting perspectives over Roman concrete characteristics.

1

8

98

“You build your network, tools, screens, relationships like a spider builds a web. You keep building it out. Then one day something hits the web. You feel the tremor and you go look at what you caught. This is how the great ideas find you.”

2

7

30

@SchopenhauerCap

Have a look at (Peugeot Invest).

With shares today at 105.6, you get 114 EUR/share in their stake in STLA, plus another 110/share in other net assets.

2

0

29

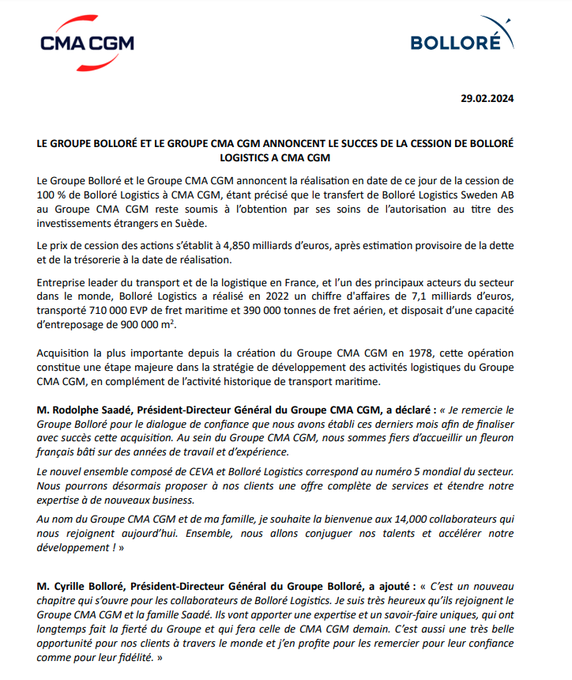

EUR 5.7bn bid for Bolloré Africa. Official.

@LuchesiPhilippe

@ohcapideas

@EricKoop3

@off_the_run

@french_special

@FoxCastlehold

@chriswmayer

@GWInvestors

@DapperDanMan0

3

1

23

@sinstockpapi

$882.HK, Tianjin Dev, is worth >5x its market cap right now, by its stake in Otis China +net cash.

If it doubles in 5-10y, it’s a 10-bagger (1H21 is not out yet, but Otis results implies China profit is +25% YoY).

And there are still a few other valuable subs, some listed.

6

0

22

@morganhousel

Coincidentally, I started reading it yesterday. First chapter already blew my mind with stats like “75% of all births during the next 50 years will happen in Africa”.

0

0

12

@IrrationalMrkts

$882.HK Tianjin Dev, $220mm mkt cap

- Trades at less than 3x P/E

- Net cash more than 2x its mkt cap

- Stake in Otis China worth at least 2.5x its mkt cap

- Stake in 2 listed cos 1.4x its mkt cap, at market prices

And a bunch of other assets

2

0

12

@FocusedCompound

$882.HK, TianjinDev. Net cash is twice the size of mkt cap. A conglomerate structure hides a very high quality business (Otis China), easily worth 3x mkt cap. Also, stakes in listed companies worth >100% of mkt cap.

2

1

12

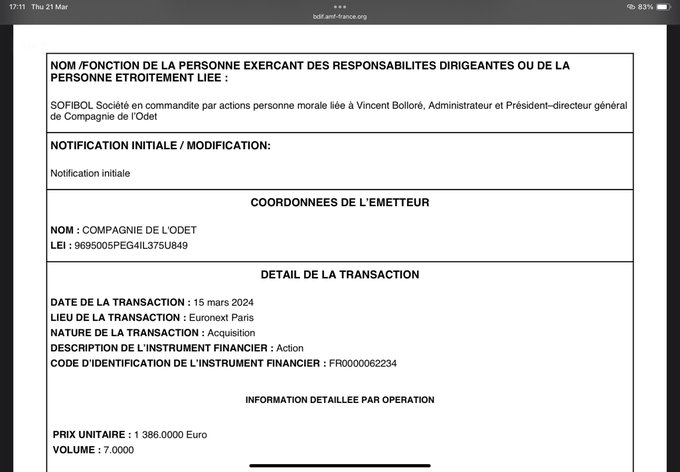

Can someone tell me why $ODET is up 10% this morning, on a huge volume and no new news? Not that I am complaining, quite the contrary…

@ohcapideas

@EricKoop3

@french_special

@FoxCastlehold

@LuchesiPhilippe

@GWInvestors

@chriswmayer

2

0

11

@jay_21_

$0882.HK, TianjinDev, by miles

2.5x mkt cap in cash + 1.5x mkt cap in two listed companies + 3x mkt cap for its stake in Otis China.

And other assets too.

Less than 3x recurring P/E.

What can close (part of) the gap? Do something with the cash (M&A, dvds…)

3

2

11

@FocusedCompound

Ok, here I go.

$882.HK. 2x the mkt cap in net cash.

A stake in Otis China (elevator is a great biz), that at a mere 15x would be worth more than 3x mkt cap.

Stakes in listed TianjinPort and Lisheng worth another 1.5x mkt cap.

And 2x mkt cap in other assets. Keep that as a change

1

0

11

@DapperDanMan0

@ohcapideas

@FoxCastlehold

@FrenchCMunger

@chriswmayer

@GWInvestors

@foso_defensivo

@valueDACH

@vitaliyk

@LuchesiPhilippe

@evantindell

@EricKoop3

@smallandvalue

@off_the_run

Excluding draconian moves (possible), imo the best way for VB to increase the value for himself is to buy more $ODET and $BOL shares at his 100% owned holding (Bollore Participation SE), before any simplification. Now, in order to do that, the divs must indeed flow again to $BOL.

1

0

11

@alluvialcapital

TianjinDev, $882.HK.

2.5x its mkt cap in net cash +

1.5x mkt cap in two listed companies +

3x its mkt cap for its stake in Otis China

Oh, they also have other assets but we can stop counting xd

At less than 3x P/E, on recurring earnings.

Seems like a mirage…

1

1

11

@ClarkSquareCap

@Larryjamieson_

Hmm I’ll try to be brief:

$882.HK <2x net cash AND <3x P/E AND >70% discount

$142.HK <3x P/E AND >70% discount

$HSBK < 3x P/E (is bank cyclical?🧐)

$743.HK <2x net cash (Cement🤢in China🤮)

4

1

10

“Hey $BOL.PA, it’s $ODET.PA here. Why don’t you take 538mm of your own shares in exchange for the 2.34mm shares of Odet you own?

At current prices there would be no cash involved”

@FoxCastlehold

@LuchesiPhilippe

@abroninvestor

would that be possible / allowed?

@YannickBollore

5

0

10

Mozambique, Ethiopia, DRC, Rwanda, Uganda, and now Zimbabwe.

At this pace, in a couple of years $2233.HK West China Cement may become the largest cement producer in sub-Saharan Africa ex-Nigeria (Dangote is currently

#1

, and by far the largest in Nigeria)

2

0

8

@OtterMarket

Sonagi in Portugal. 80mm in RE, 70mm in cash after selling a non-core investment. 40mm mkt cap.

1

0

8

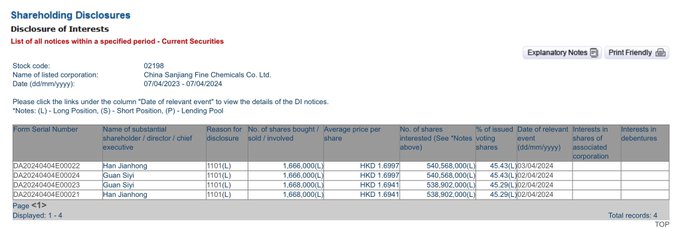

@SebKrog

2026?

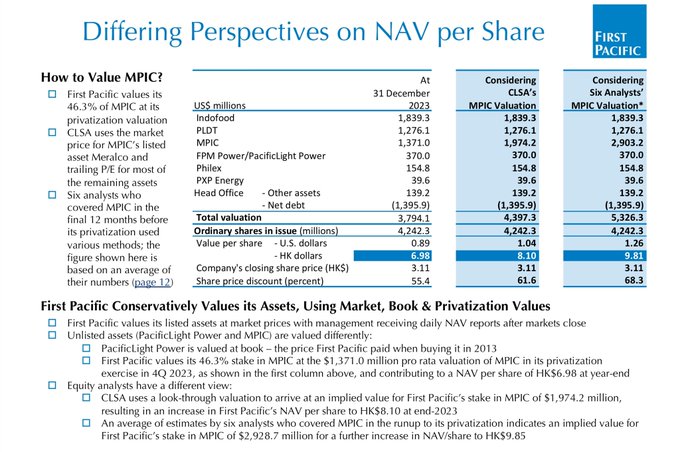

First Pacific $142.HK

Halyk Bank $HSBK

Sanjiang Chemicals $2198.HK

West China Cement $2233.HK

Tianjin Dev $882.HK

1

0

8

@ToffCap

And trades at another 60% discount to NAV, of which 50% is STLA

In other words, you get a bunch of other stuff in addition to STLA for free

3

1

8

@EricKoop3

@OlmesJo

@GWInvestors

@off_the_run

@ohcapideas

@DapperDanMan0

@french_special

@smallandvalue

@FoxCastlehold

@FrenchCMunger

@chriswmayer

@foso_defensivo

@valuedach

@vitaliyk

@LuchesiPhilippe

@evantindell

200k more on the 10th... okay, it has become everyday routine

1

0

8

@french_special

@off_the_run

@ohcapideas

@smallandvalue

@EricKoop3

@FoxCastlehold

@DapperDanMan0

@chriswmayer

@GWInvestors

@foso_defensivo

@valuedach

@vitaliyk

@LuchesiPhilippe

@evantindell

Seems most likely, yes. But I’d not rule out $BOL.PA distributing the $VIV.PA stake, repeating the “tax deductible only over 5%” playbook, opening space for more buybacks on the cheap before any takeover premium, since its effective stake would go down from 30% to 19% (30% * 64%)

1

0

8

@CCM_Ryan

Anything? I’ll try again:

$882.HK, TianjinDev

SOE in China

HKD 1.7bn mkt cap

- 2.2bn in two listed cos

- 3.0bn+ in net cash

- 16.5% stake in Otis China, where they get 300mm+ in profits, 40%+ROE. Otis would jump at the opp. to buy it at, say, 5.0bn

- xxx in other assets

5

0

8

@ohcapideas

@foso_defensivo

Using your numbers, $ODET discount gets close to 85%! $BOL.PA is extremely undervalued, but I think Odet is a better alternative for anyone managing less than $50mm in AuM.

1

0

7

@RodAlzmann

Are net-nets asymmetric enough?

Hidden gems within companies that hold more net cash than their mkt cap:

- Otis China for free with $882.HK TianjinDev (<3x P/E)

- Universal Music Group for free with $ODET.PA

1

0

7

@Steven_Kiel

How can you have more asymmetry than with a company with net cash 2x its market cap, listed stakes worth >100% and a stake in Otis China worth 4x its mkt cap?

The downside is what, to trade at 1/4 of cash?

EV/earnings = 1 (!) => 150% upside

$882.HK Tianjin Development Holdings

1

0

7

@sinstockpapi

I think worst case is the city forces it to buy shitty assets at outrageous prices, so all cash is lost (though SASAC usually arbiters it well enough).

But I don’t see how the value of Otis China can vanish, apart from an unthinkable nationalization. They are parters since ‘84.

2

0

7

@daniel_toloko

I thought the only stock that could consistently trade at hugely negative EV (ie net cash >> mkt cap) was Surgutneftegaz.

Then I found another one, $882.HK TianjinDev. After a few months calling attention to it to all my 87 followers (😜)… nothing changed :p

1

0

5

@Alex__Pitti

Sonagi, in Portugal (SNG). EUR 41mm mkt cap, has a 10.8% indirect stake in Semapa (listed), which at market prices equates to EUR 100mm (at sub 6x P/E). Plus a bunch of real estate assets worth more than its mkt cap.

Good luck trying to buy any shares though.

0

0

5

@FoxCastlehold

Imperial Mediterranean is within the controlling loops,controlled by Bolloré SE, right? Even better 🤗

1

0

5

@david_katunaric

When your small caps’ next earnings releases are months away because they only update the investors 2x a year 😝

0

0

5

Thank you for the opportunity,

@capitalemployed

Hope you all enjoy the reading!

FRESH OFF THE PRESS 🔥

Read our interview with

@diegobmilano

from Quercus Fund.

Diego is a deep value investor and shares his thesis for investing in two Hong Kong listed stocks that are selling wildly below their NAV. 👇

0

2

4

0

2

5

@evfcfaddict

@NICKRADICAL4

@DavidDiranko

@JoashReid1

@Jave_t23

@acidinvestments

@mind_the_bear

@JonathanPaxx

@Tintincapital

@RhinoInsight

Truly happy and honored to be on this list! 🤗🚀

1

0

4

@off_the_run

@ohcapideas

@EricKoop3

@DapperDanMan0

@french_special

@smallandvalue

@FoxCastlehold

@FrenchCMunger

@chriswmayer

@GWInvestors

@foso_defensivo

@valuedach

@vitaliyk

@LuchesiPhilippe

@evantindell

230k+ shares again on the 8th. I suppose we will see such buying activity for a lot more days...

Besides, seems that ODET is leveraging in order to do that (I would guess giving BOL shares as collateral).

2

0

5

@TheLongHappy

@Bonhoeffer_KDS

@dodgingalpha

@roojoo3

@ReturnsJourney

For FPC? I’d guess a total distribution of at least usd 150mm going forward (9% yield).

Probably growing HSD every year.

That considers 35% payout for Indofood, 60% for PLDT, 0 for MPIC and close to 100% for PLP.

Indofood payout should grow when it delevers

2

0

5

@Larryjamieson_

Only net-nets with at least 200% of the mkt cap in net cash, less than 3x P/E non-cyclical, and conglomerates at 70% discount to NAV.

Low liquidity is a plus, hair is a must.

2

0

5

@FriendlyCapMgmt

@SchopenhauerCap

I think the same way as

@walter_schloss

does: you get STLA at a discount plus a lot of assets for free.

So yes, I think it is far more attractive.

0

0

5