Bucket Shop Capital

@bucketshopcap

Followers

11,198

Following

914

Media

117

Statuses

3,451

Private investor. Former allocator and buyside TMT analyst.

Joined January 2021

Don't wanna be here?

Send us removal request.

Explore trending content on Musk Viewer

Kroos

• 472009 Tweets

Reich

• 141285 Tweets

England

• 139267 Tweets

Boeing

• 69929 Tweets

#2024해피수호데이

• 65930 Tweets

Rashford

• 51731 Tweets

Shadow of the Erdtree

• 51637 Tweets

招待コード

• 50919 Tweets

Singapore Airlines

• 48285 Tweets

Modric

• 41869 Tweets

Southgate

• 36086 Tweets

Starc

• 35092 Tweets

#KKRvsSRH

• 33753 Tweets

ROCKSTAR PRINCE SUHO DAY

• 32129 Tweets

كروس

• 29257 Tweets

#日野下花帆生誕祭2024

• 29047 Tweets

Klaus Schwab

• 28452 Tweets

GENTO AYAW PATALO

• 26690 Tweets

Iniesta

• 23292 Tweets

クロース

• 20033 Tweets

Shaw

• 19898 Tweets

花帆ちゃん

• 19700 Tweets

Hellblade 2

• 19083 Tweets

Vivian

• 18411 Tweets

Sancho

• 17842 Tweets

Prat

• 12984 Tweets

Luna Park

• 12272 Tweets

Tripathi

• 12116 Tweets

チェンソーマン

• 10818 Tweets

Quansah

• 10096 Tweets

Last Seen Profiles

Pinned Tweet

People see "allocator" in my bio & DM on what it takes to start an equities HF. My views below. These will sound painfully obvious to most of

#Fintwit

but are difficult in practice. In my experience most managers, even those w/ pedigree, are upended by violating 1+ of these.

11

17

247

For PE to public mkts transition, my recommendation nowadays is simply don't do it, unless you are good enough to work for a $3B+ SM (duration) or major MM. Otherwise you get paid less, work 3x as hard & have to be an emotional tampon for ppl you will pretend to be dumber than.

29

11

369

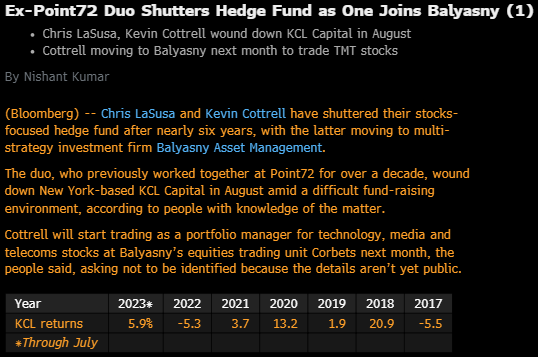

Frankly, I 100% used to take the interviewer's side here but funds always looking for free ideas/work & ghosting candidates afterwards makes me understand the "Gen Z" viewpoint more. Not trying to paint with a broad brush but I don't blame good candidates for this behavior.

29

12

350

@CAGR_Party

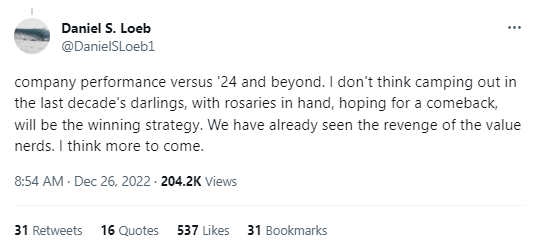

20+ year public investor. Today’s Day 1 advice IMO would be focus on the tactical/ST debate first, then fill in the historical depth of work later. 80%+ of whether you’ll make $ in stock is positioning/ST catalyst related vs “deep reality of business”.

4

5

138

@GavinSBaker

The two watershed moments for me were $NVDA q1 eps and guide and $MSFT co-pilot announcements. Both wake-up calls to rapid deployment of AI. Latter demonstrating immediacy of crucial enterprise deployment. Ignore at your peril.

14

8

119

11

5

133

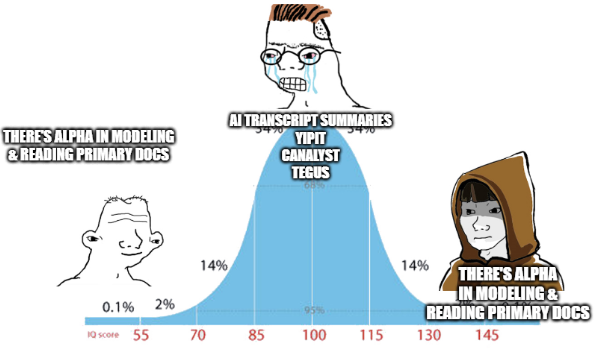

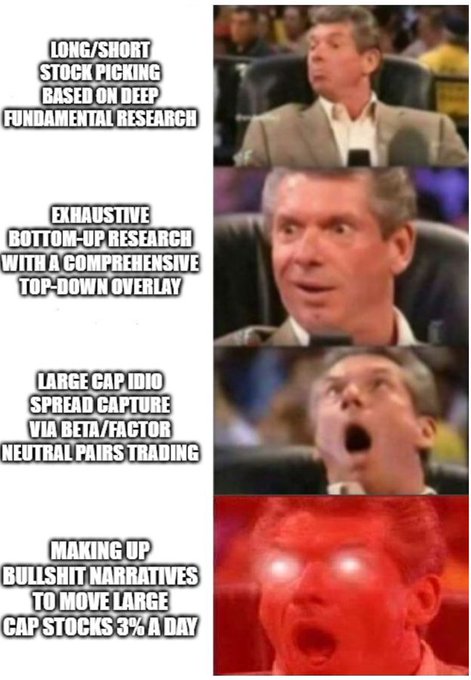

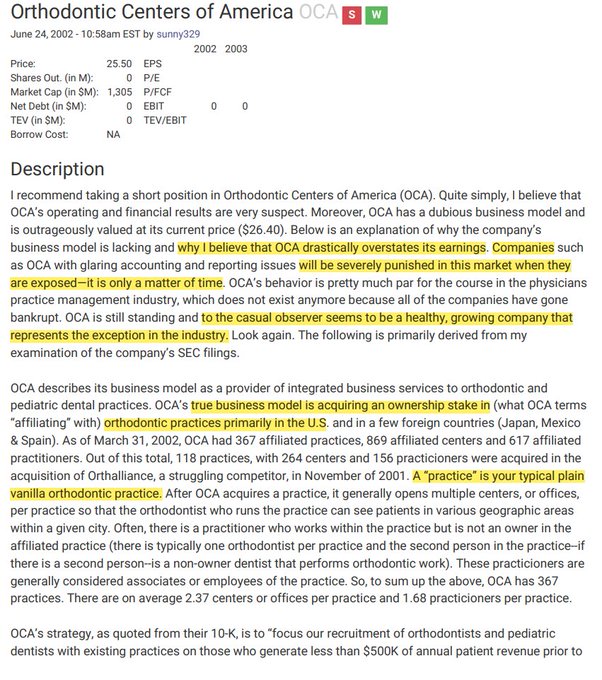

Sorry to inform you, but nowadays there's no need for any of this work. Get Yipit to tell you what's happening, find out where the bogey is & load the trade.

8

7

127

Funny thing is how few PMs will raise their hand & take the L, even when it’s actually their fault. Analysts would be blamed & careers threatened. If you want to be more like Buffett, my guidance would be start with the basics like this.

Buffett at

#BRK

2024: We sold the entire stake in Paramount and we lost quite a bit of money. It was entirely my decision to go into it, not Todd or Ted.

53

34

687

1

2

108

TBF this is both buy & sell-sides now. Everyone riding the same momo train. Pod brain at ATHs for both groups. "Cadence of the exit rate" type thinking & extrapolating, then seeing the stock go up & extrapolating more. It is what it is but let's not pretend it's not everyone.

7

5

104

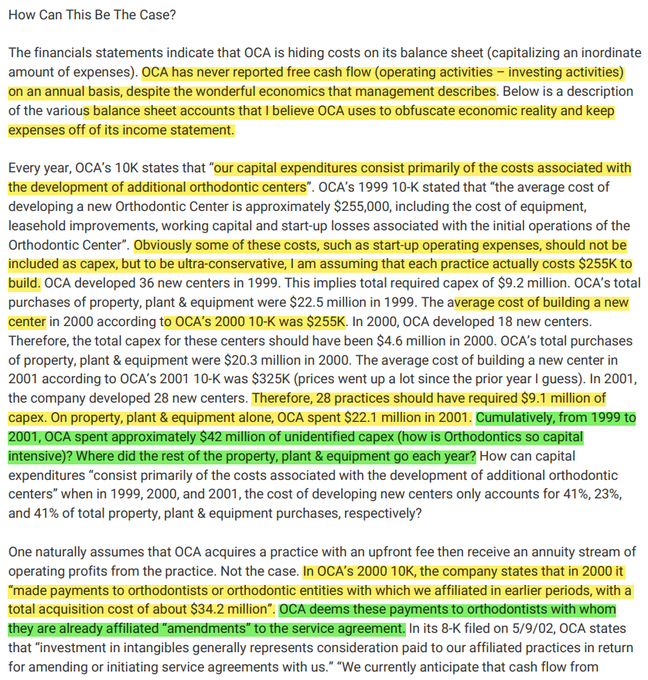

~3 months later and am hearing of some complete morons getting hired at these Tier 2/3 shops, it's actually insane to me. Absolutely will not end well.

@liensofnewyork

Hearing lower tier places like Everpoint at P72, Hudson Bay, Verition, Walleye, Crestline etc. keep looking for ppl. Quick glance at who they're hiring suggests they're already reaching for "talent". The model is limited by human capital far more than consensus thinks.

6

4

45

10

4

96