baufinanciaphaster 👹

@bauhiniacapital

Followers

17,711

Following

5,429

Media

7,235

Statuses

79,728

残り物には福がある. Trafiquant de l’ésotérique. Unverified(Ogre). Usually couth, sometimes kempt, often gruntled. Strong opinions, held weekly, sometimes more often.

Altered States

Joined March 2015

Don't wanna be here?

Send us removal request.

Explore trending content on Musk Viewer

Galatasaray

• 110407 Tweets

Al Jazeera

• 102114 Tweets

Bernard Hill

• 86079 Tweets

Vlad

• 82440 Tweets

#GSvSVS

• 71298 Tweets

Spurs

• 66354 Tweets

Tottenham

• 62816 Tweets

West Ham

• 60174 Tweets

سعد اللذيذ

• 48917 Tweets

Theoden

• 44784 Tweets

Happy Cinco de Mayo

• 31198 Tweets

Ziyech

• 28038 Tweets

Mertens

• 26534 Tweets

Cavs

• 26258 Tweets

Anfield

• 19676 Tweets

Sivas

• 19069 Tweets

#محمد_عبده

• 18557 Tweets

Garland

• 18277 Tweets

Tim Scott

• 17319 Tweets

Paolo

• 17232 Tweets

LOSE MY BREATH MV TEASER 2

• 15482 Tweets

Emerson

• 14941 Tweets

Gakpo

• 13715 Tweets

Bülent Uygun

• 11254 Tweets

توتنهام

• 10122 Tweets

Last Seen Profiles

The secret to becoming a trillionaire, even if you have no capital to start.

Save on $4 coffee/day by drinking water, invest $28 every week, earn 1% a week like

@reallwillmeade

says by buying ETFs and hedging with puts (like HFs do). After 40yrs, you will have $2.98 trillion.

62

76

1K

Dear

@BillAckman

, I'm gonna QT this b/c you don't really reply to people (2x in past 12mos AFAICT) but you QT a lot, and you have responded to one QT in 18mos. You don't seem to interact much but use twitter as a bullhorn. Your loss.

My, I hope thoughtful, replies follow:

1/n

26

75

563

@nycsouthpaw

Is that 'Goochland' on his t-shirt the same Goochland which is.... [checks notes...] just north of Richmond and... [checks notes again....] as of when he was probably growing up, on the Forbes Top Ten List of "Where the Rich are Moving"?

3

7

393

You'd think

@RAF_Luton

would know better than to allow them to cross the streams.

It would be bad.

11

9

269

This is a take. The thread is worth reading for the take.

I expect it overstates things.

Couple of problems.

1) while vanna can drive moves, I expect it is more gamma curvature and density than vol (in real trader terms, vanna of one-week options is meaningless).

11

31

259

How to NOT Understand What is Going On In Financial Markets

Read this thread. All the way through. It is full of claptrap and fear-mongering.

If you want, you can follow along in my thread.

11

42

230

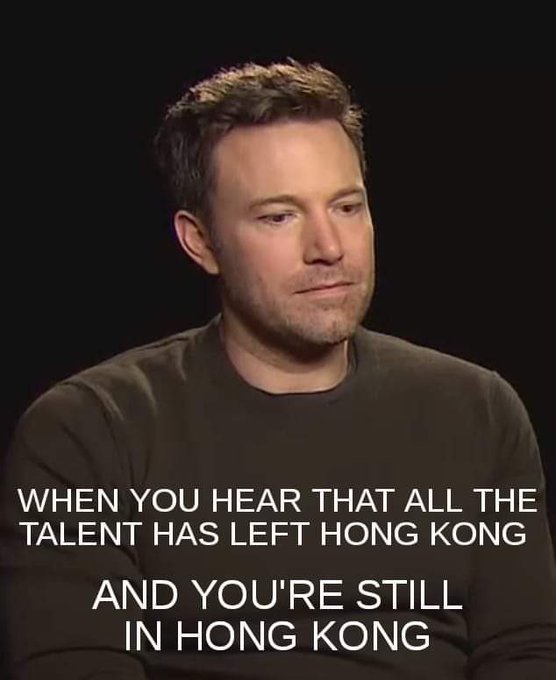

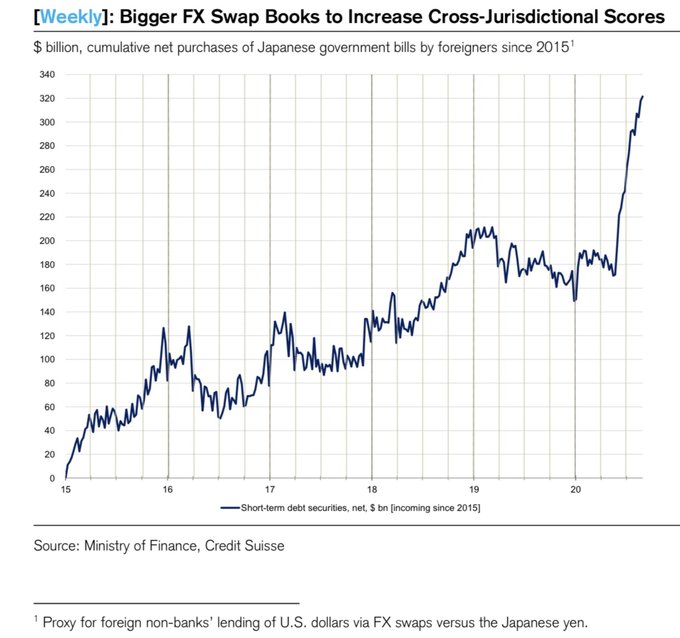

People need to take a chill pill and

@Jkylebass

needs to understand how money works in HK.

1) There is a US$10bn IPO which launched yesterday and prices/closes in one week.

Big IPOs take money out of the system. Big and popular IPOs take a LOT of money out of the system.

15

38

188

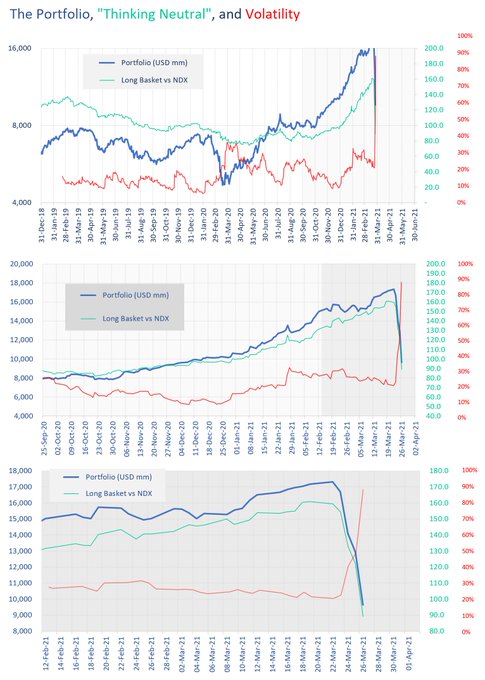

Within a portfolio (and a portfolio construction method), thinking about optionality and opportunity is important: a counter-thread.

3

40

195

Spoken like someone who has never visited Japan. Or someone who took a cab from Narita straight to the Grand Hyatt and ate in The Oak Door, French Kitchen, and Keyakizaka before going upstairs to an office. Then back to the airport.

Granted, it’ll be OK food but it’s not Japan.

14

10

174

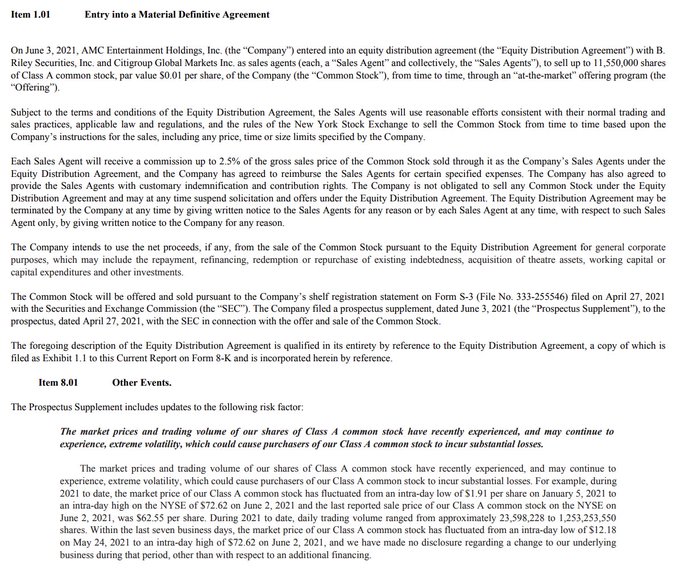

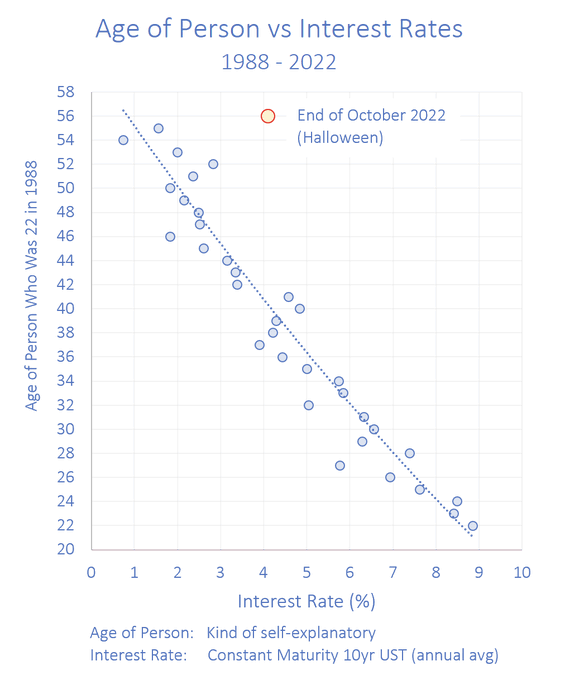

Carson Block of

@muddywatersre

writing in the FT lays the blame of stonk gyrations like GameStop (sub $20 on 12 Jan, up 18-fold in 10 trading days) squarely on low rates and passive investing.

This is Hogwash, Blatherskite, Buncombe, and Taradiddle.

12

18

156

I don't think people get it.

Selling Bloomberg LP is the *whole point* of getting elected for him.

NEW: Bloomberg adviser

@TimOBrien

tells me the billionaire businessman will release his tax returns, and he’ll sell Bloomberg LP if elected.

163

558

1K

10

15

143

I've been trying to get my head around this shocker because it opens a couple of weird cans of worms.

First, US$78bn of inflated revenues was something like 53% of reported revenues in 2019-2020. If those were false, then 2018 has to be in question (2019 gain was only +2.4%yoy

11

22

121

Very interesting thread on China's "crackdown" and within a Chinese perspective on control, makes utter sense.

3

35

122

The idea that bitcoin "ultimately shifts power from banks & corporations back to the people globally" is an idea which could only be held by someone who doesn't understand money.

"…useless complicated math problems…"

@SenWarren

if you believe

#bitcoin

doesn't ultimately shift power from banks & corporations (the ones you fight!) back to the people globally…you're right…useless. If instead you want to help us decentralize that power…math is critical.

1K

3K

17K

2

10

120

@ChrisCJackson

If someone knows Bill Ford, it will be up to ppl like him to set the record straight the next 4yrs.

4

6

112

@guardpilot

@nycsouthpaw

Indeed, that is what the story created behind him says. On a 90-acre plot (which ain't cheap).

Farmville IS south of Richmond by 16-17 miles.

About the same distance latitude-wise as going from the LA Zoo down to Compton in LA and just a tad more than the length of Manhattan.

2

1

117

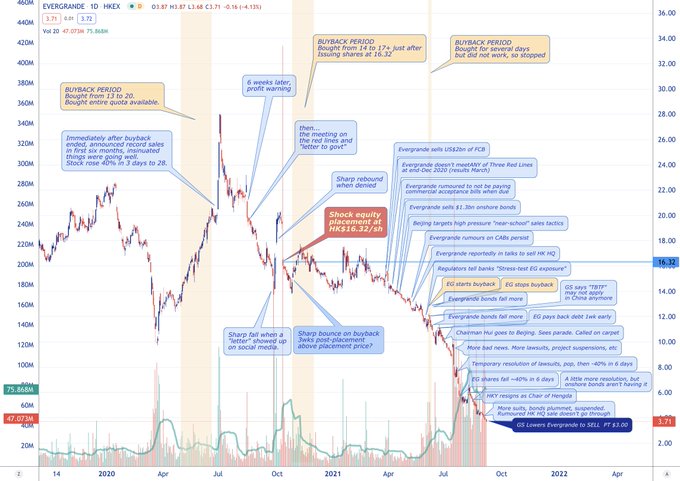

@Noahpinion

@FabiusMercurius

Also important to not say things which aren't true.

1) Evergrande did not just default.

2) Evergrande's debt did not cross $600B USD.

As to "owned by many int'l banks", 8 out of the 10 listed are index funds where it is a truly tiny weight, and the other two might as well be.

3

3

116

Oops. Blocked again by

@INArteCarloDoss

who seems to find issue with people pointing out issues with his all-encompassing expertise.

This time? I pointed out that what % of ratings bucket doesn't meet certain criteria doesn't tell you how much of the industry does.

🤷♂️

20

2

117

For a non quant…

delta is instantaneous beta (of option price to stock price)

Gamma is change in instantaneous beta when price moves.

11

5

113

I am deeply disappointed in all the journos I know who did not jump on Carlo's

#bigflip

hashtag on 23 Jan.

A well-followed twitter account who creates a hashtag for an opinion because he changed his mind obviously deserves widespread financial media coverage for that opinion.

12

3

107

@zatapatique

And alt-right twitter is like

See???!!! I told you! And it's even got French words! ⬇︎⬇︎⬇︎

3

30

97

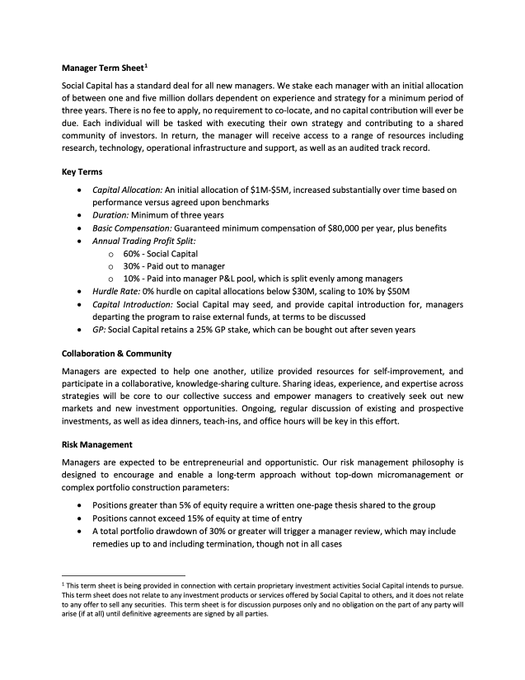

I was asked to comment on this. So comments follow.

There is more to this thread above.

Please forgive typos. Happy to have feedback/discuss.

5

14

104

Your regular reminder there are plenty of blue checkmark professionals 'specialising' in finance who should probably just find another milieu.

9

5

101

A brief word about the petrodollar, triggered by this exchange below.

"Price oil in gold and blow up the petrodollar" is not the way it works, and it never will be.

The denomination of the price of something is just what it is. (cc

@jroche071973

)

12

15

91

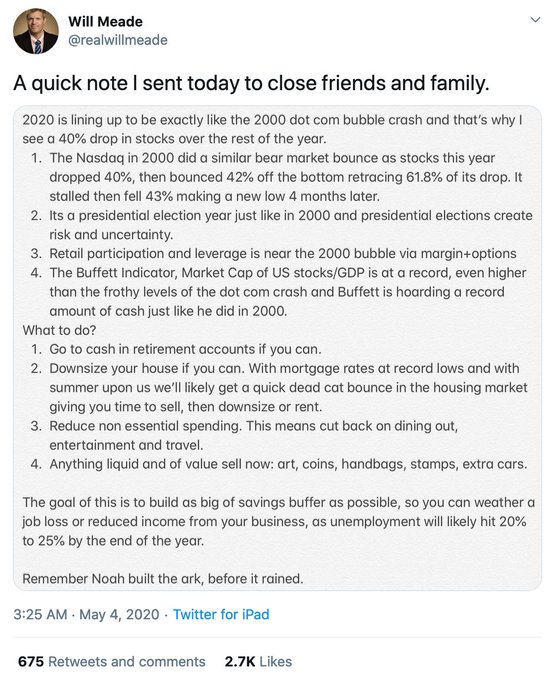

Would you believe that in the year since his famous "sell everything tweet (since deleted) marking one of the all-time great market-timing calls,

@realwillmeade

has more than doubled follower count to 171+k?

(adding 20+ new followers per tweet, which is quite a feat I admit)

5

6

89

An excellent treatment by

@michaelxpettis

. Frankly much more expert and adult than most of what has been written (long form helps).

Definitely worth a read. I would go one step further and say...

2

12

81

@JoyAnnReid

@jeffjarvis

@KellyannePolls

Didn't you talk smack about Donald Trump on National TV, repeatedly, only 9mos ago?

4

21

79

Single BEST aerial view of the expanse of Tokyo I have ever seen. Stunning.

Thanks Eric and his h/t to

@justinmccurry

2

7

78

@neelkashkari

If twitter had been around when you were a banker, would you have been real name account talking finance? Seriously?

Famous ‘coward’ writers include Ben Franklin, Bronte sisters, Jonathan Swift, Agatha Christie, Asimov, Toni Morrison, dozens of Constitutional pundits in 1787.

3

5

73

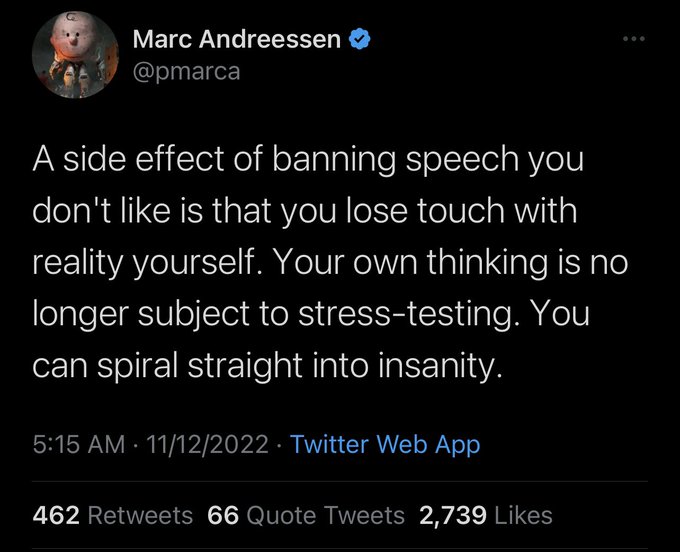

Hi

@pmarca

. Interesting you should say that. I agree being open to criticism and other ideas is important to keeping oneself grounded.

Anyhoo…keeping it real over here. Hope everything’s OK over there on the other side.

5

4

74