Natasha Sarin

@NatashaRSarin

Followers

7,040

Following

426

Media

81

Statuses

858

Professor @YaleLawSch & @YaleSOM . Former Counselor (tax policy and implementation) at @USTreasury ; Professor @PennLaw & @Wharton .

Joined February 2019

Don't wanna be here?

Send us removal request.

Explore trending content on Musk Viewer

Kendrick

• 2369448 Tweets

Madonna

• 1207758 Tweets

Sant Rampal Ji Maharaj

• 358633 Tweets

어린이날

• 295542 Tweets

こどもの日

• 266792 Tweets

Not Like Us

• 255461 Tweets

Canelo

• 229239 Tweets

Copacabana

• 207092 Tweets

Anitta

• 147921 Tweets

Pabllo

• 120245 Tweets

#UFC301

• 79563 Tweets

子供の日

• 74281 Tweets

Anthony Edwards

• 70745 Tweets

Leafs

• 67831 Tweets

鯉のぼり

• 66312 Tweets

Michael Jackson

• 53982 Tweets

DONBELLE ASAPriceless ENDING

• 51077 Tweets

Itaú

• 48313 Tweets

Bruins

• 43553 Tweets

Aldo

• 39252 Tweets

GW最終日

• 38994 Tweets

端午の節句

• 36367 Tweets

#マリカにじさんじ杯

• 36005 Tweets

Pasta

• 34937 Tweets

Pantoja

• 32518 Tweets

#Mile1stSoloConcert

• 30543 Tweets

Erceg

• 30429 Tweets

NHKマイルカップ

• 25617 Tweets

マリカ杯

• 15801 Tweets

新潟大賞典

• 14603 Tweets

アスコリピチェーノ

• 13358 Tweets

ジャンタルマンタル

• 12150 Tweets

Marner

• 10598 Tweets

Last Seen Profiles

Pinned Tweet

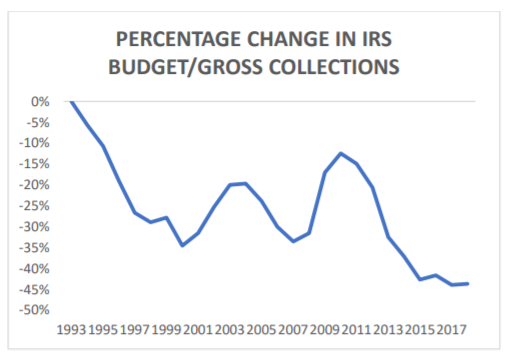

The IRS is outgunned, outmanned, outnumbered, outplanned.

Single most imp tax reform is providing resources needed to police the $$$.

My latest in

@nytopinion

⬇️

77

95

397

To illustrate how absurd $750 is:

Poorest 20% of Americans

(People who make less than $25K/year)

Paid more in federal taxes in 2016 and 2017 than President Trump

33

747

2K

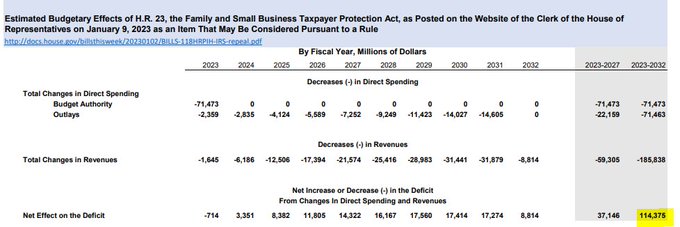

The first bill a new Congress considers is an important statement of the majority’s priorities.

House Republicans’ first order of business?

Protecting wealthy tax cheats, adding to the deficit, and making it impossible for IRS to serve the American people the way they deserve:

31

366

815

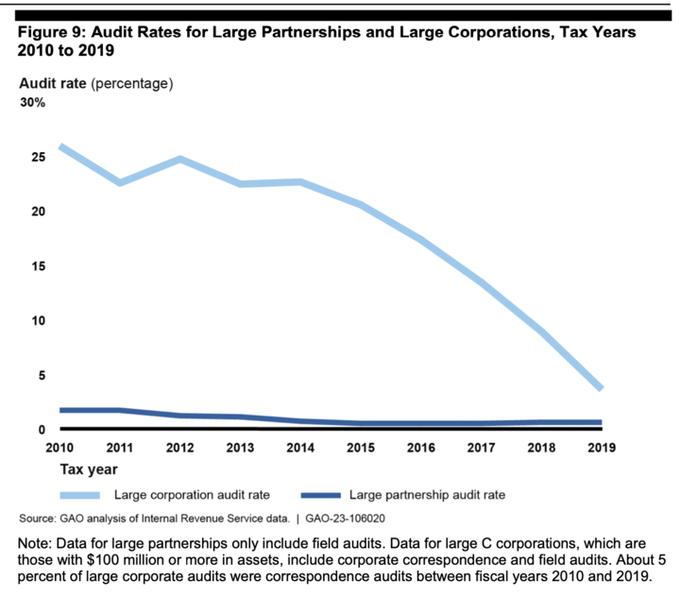

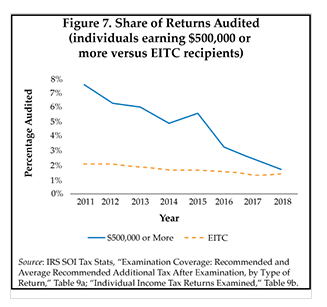

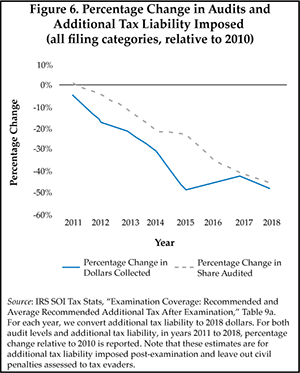

Over the last decade, audit rates have fallen most for the very richest Americans.

The result?

Less tax revenue and a more unequal tax system.

My latest in

@bopinion

A thread:

13

134

508

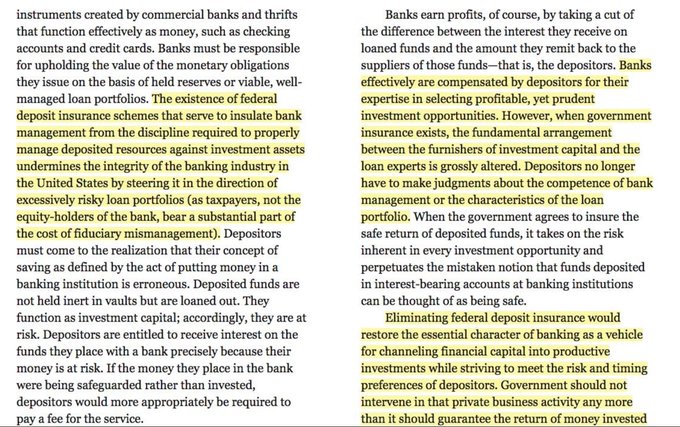

Returning to the gold standard and eliminating deposit insurance not just fringe views

They are literally held by no serious person in the field

It is unsurprising that a terrible President made such a dangerous Fed pick

But it is insane that R Senators are supporting her

16

160

482

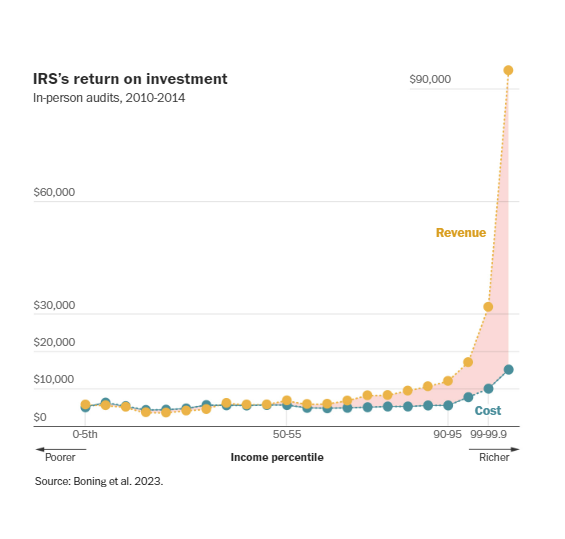

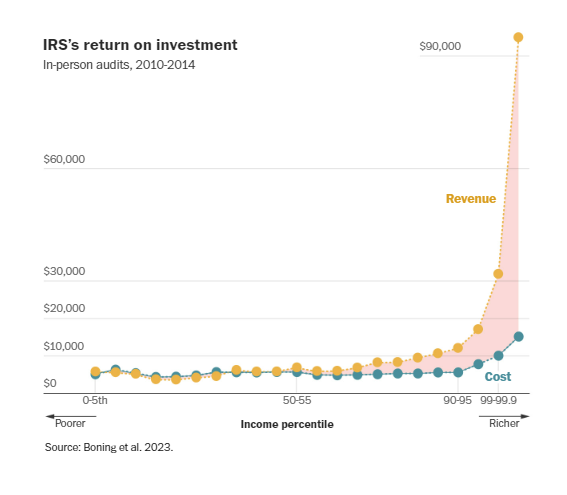

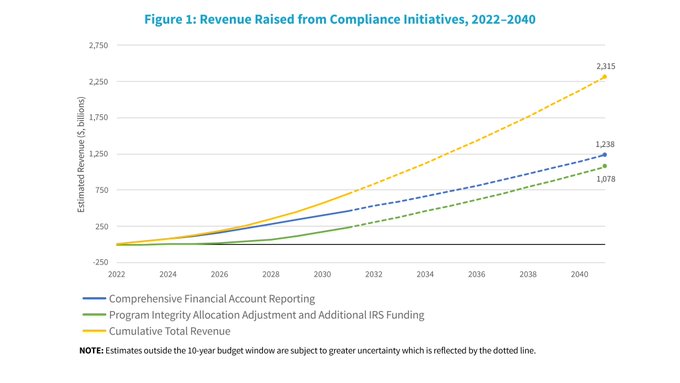

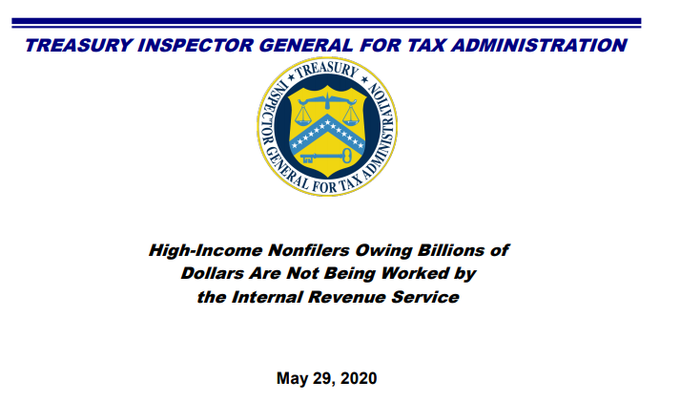

Look at the ROI on high-end tax enforcement activity!

Why in the world would House Rs--or anyone, really--be in favor of doing *less* of this work?

23

143

462

The IRS has fewer auditors than at any time since WWII.

No surprise that tax gap costs the U.S. 3% of GDP/yr, disproportionately from the $$ who don't pay their fair share

@POTUS

proposals to improve compliance will raise $700B+, create a more efficient, equitable tax systm

10

96

454

“When you under-fund the IRS, it’s just a tax cut for tax cheats.”

—John Koskinen, former IRS Commissioner

From today’s

@arappeport

piece on the substantial importance—and revenue raising potential—of

@POTUS

’s plan to overhaul the IRS:

14

121

385

Here is the case for the Biden Admin's focus on resourcing IRS to pursue wealthy tax cheats in one graph:

Auditing the rich is expensive--but it has *ginormous* returns!

Thread on seminal new paper, also featured in great piece by

@crampell

today:

What are the returns to IRS tax audits? How do they vary across the income distribution?

In a new paper🚨, we find that $1 spent auditing high-income taxpayers yields more than $12 in revenue.

For an overview, check out

@crampell

’s coverage 1/:

12

169

451

10

155

391

Some news: I’ve concluded my time at

@USTreasury

. I feel so grateful to

@SecYellen

,

@TreasuryDepSec

, and my amazing colleagues for their tireless push to create a fairer tax system. So proud of all that’s been accomplished and so excited to cheer on all the good on the horizon.

16

17

345

Investing in tax compliance is central to addressing economic inequality.

Terrific editorial from

@nytopinion

:

7

80

241

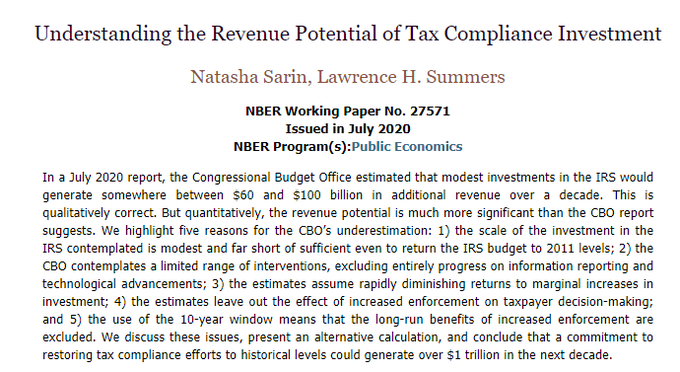

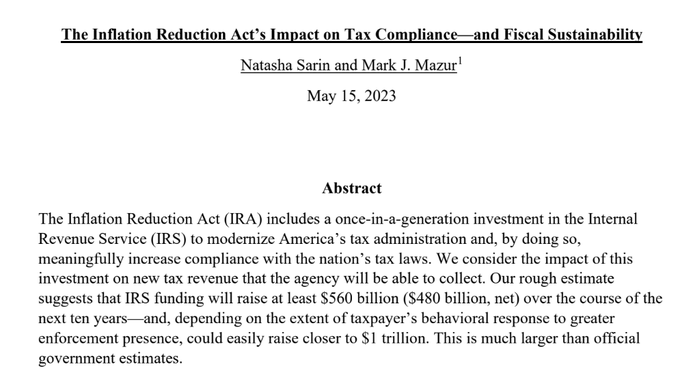

In a new NBER WP out today,

@LHSummers

and I estimate that investment in tax compliance can generate over $1T in the next decade.

NBER:

A version is also out in Tax Notes today:

7

60

219

BEYOND THRILLED to see the IRS release its Strategic Operating Plan, a blueprint for how the $80B investment from the Inflation Reduction Act will transform tax administration.

It is *146 pages* of amazing detail

A thread of some highlights:

5

60

215

At the IRS, every paper return received is transcribed *by hand* and “large amount of time has been used looking for carts to put files on and staples for stapling files together”

Harrowing read on consequences of gutting IRS and the importance of Biden Admin funding efforts ⬇️

4

72

202

This is terrifying because we do not teach law students (who become SCOTUS clerks) anything about statistics, and this gobbledy-gook can be read as fancy science suggests coup is viable.

16

32

173

This is wild!

Thanks to budget cuts, millionaire audits down 80% in the last decade; the partnership audit rate is ~0

Left unaddressed, top 1% will evade $2T in owed taxes over the next decade

Rs should explain why they are pro wealthy tax cheats (& pro *increasing* deficit)

5

64

164

#Econtwitter

--

@Dannyyagan

and I are hiring research assistants!

Pre-docs and current PhD students looking for an exciting RA opportunity, please apply!

Everyone else, help us spread the word!

5

61

156

My latest: Trump puts a famous face on a well-known problem:

The wealthy aren't paying what they owe bc our tax system allows it.

"President Trump is one insidious example of the wealthy not paying their fair share," writes

@NatashaRSarin

. "We have to invest in tax compliance so they are forced to."

4

20

60

4

36

145

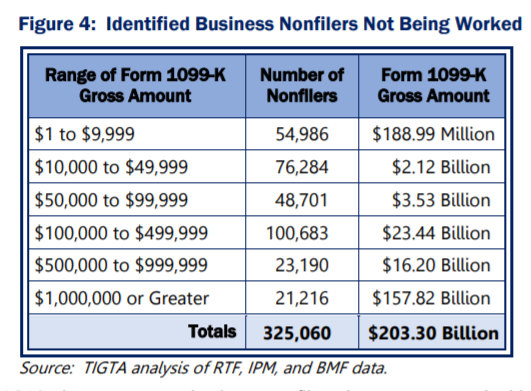

In case you missed it: IRS Comm Rettig sent a 26 (!) page letter to

@SenWarren

,

@SenWhitehouse

,

@SenSanders

on the value of

@POTUS

tax compliance initiatives.

There is a lot of really important (and new) data here.

A thread:

3

54

140

Some wild facts:

85% of overdraft fees are borne by just 10% of consumers.

A large bank CEO literally named his yacht “The Overdraft.”

2

30

137

A year ago, President Biden signed into law the Inflation Reduction Act, which included a historic investment in the IRS.

American taxpayers are already seeing huge returns.

My latest in

@PostOpinions

:

5

44

106

This is incredibly stupid

ZERO rationale other than burn it all down

Given tragedy of fiscal stalemate, handicapping monetary policy is insane

12% of Americans reported not having enough to eat last week -- Trump Admin determined to make things worse on way out, not better

Wow. Major news coming out of the Treasury, as reported by

@SalehaMohsin

:

All emergency programs from the CARES Act will expire on Dec. 31. So that's:

Municipal Liquidity Facility

Main Street Lending Program

Primary and Secondary Market Corporate Credit Facilities

3

48

98

4

32

91

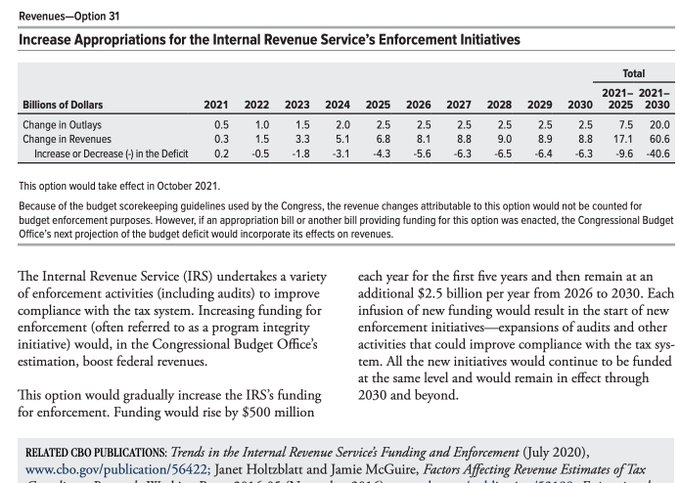

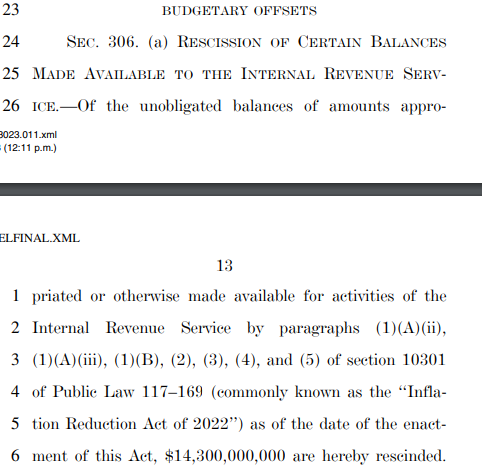

All kinds of bad on this list, worth noting rescinding IRS funding would *increase* the deficit, per CBO:

So, Rs aren't even directionally right here. And worth asking why they are so pro wealthy tax cheats.

4

28

94

Rs claim the global min tax threatens sovereignty, is unconstitutional, decreases the competitiveness of our companies, hurts workers, and won't raise revenue

That sounds bad. Fortunately, none of it is true.

My latest in

@PostOpinions

with

@KClausing

5

22

92

This week, I joined the faculty of

@YaleLawSch

with a secondary appointment at

@YaleSOM

. Thrilled to be returning to New Haven and really excited about the opportunity to apply all that I’ve learned these last two years to my research and teaching.

10

2

92

🚨SO excited to see the IRS is answering ~90% of calls it receives, up from ~13% this time last year🚨

A truly remarkable stat—$80B investmt already transformative!

Reminder: when Rs propose defunding IRS, they’re saying let’s erase these gains, make agency worse at serving ppl

1

20

90

Bipartisan tax experts on need to invest in the IRS, per

@BudgetHawks

:

“higher funding will more than pay for itself by allowing the IRS to better collect taxes owed under the law while drastically improving Americans” satisfaction with our tax system”

1

22

84

Was only a matter of time; SO thrilled to see

@PikaGoldin

win the Nobel.

CG’s research is ofc pathbreaking, she changed the way we understand women and work.

She’s also an icon for women in econ: Her guidance and generosity has shaped the careers of so many in the field.

2023 economic sciences laureate, Claudia Goldin, provided the first comprehensive account of women’s earnings and labour market participation through the centuries. Her research reveals the causes of change and the main sources of the remaining gender gap.

#NobelPrize

22

1K

4K

2

8

83

Beyond the sig revenue potential ($1B+ tax dodge for one firm!), investing in tax compliance is essential to ensuring a tax system that is equitable.

American workers pay all the taxes they owe; large corporations (and the executives who run them) should also.

1

34

85

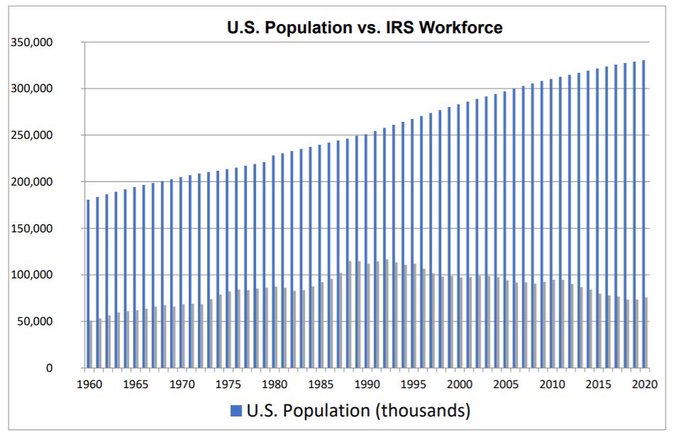

Quite striking to see what’s happened to the workforce over the last 60 years relative to the US population.

Providing the IRS with the resources it needs is *only* way to ensure the agency can provide the services taxpayers deserve and collect owed taxes from high-end evaders.

10

35

79

Thrilled to announce the launch of the TAX REFORM PROJECT with

@LHSummers

, Fred Goldberg, and Leslie Samuels:

2

17

80

I was!!! So grateful to speak at

@codeforamerica

Direct file pilot is *such* an exciting moment for tax admin

IRA investment in IRS finally gives agency resources to serve taxpayers, and you're already seeing results!

Read IRS's (106 pg!) report here:

@NatashaRSarin

overjoyed at the joy in the room when people heard about then IRS plan for a free tax filing system next year.

#CfASUMMIT

0

5

11

3

7

80

🚨NEW PAPER🚨

@KClausing

and I have a Hamilton paper out today, “The Coming Fiscal Cliff: A Blueprint for Tax Reform in 2025”

Thesis: Policymakers should approach 2025 tax debates w/ eye toward raising $$$ to address deficits & pay for imp priorities, eg a fully refundable CTC

2

21

74

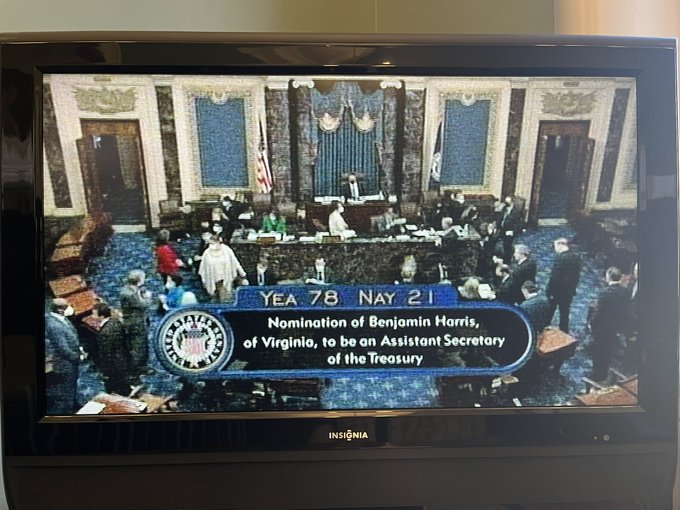

Quite a week for

@USTreasury

! Ben Harris is the heart and soul of the building, and we would be lost without him.

Feel so privileged to get to work with

@econ_harris

every day—now as my official boss, the Assistant Secretary for Economic Policy 🎉🎉🎉

3

8

74

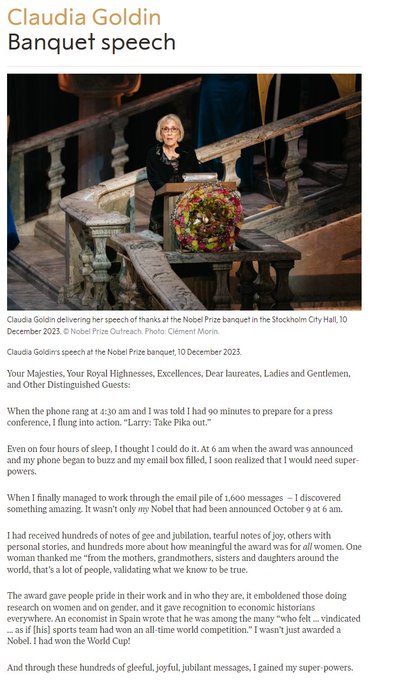

Belatedly found my way to these lovely remarks by

@PikaGoldin

at the Nobel banquet earlier this month. Sharing here because I promise they will bring you joy.

0

14

74

Often think how lucky I am that my parents brought me to a US that welcomed them & helped us thrive

This country meant so much that they invited Pres Bush to my 1st bday—he declined, but sent a card

Trump Admin crusade against immigrants will have lasting consequences ⬇️

1

9

70

85% of overdraft fees are borne by 10% of "repeat overdrafters" -- lowest income, most vulnerable consumers.

It is insane that we don't have stricter regulation of bank fees, and even more nuts that when banks shirk the (limited) rules we do have, they get off scot-free.

NEW: How a big Trump Admin bank regulator went soft on JPMorgan and other banks that kept charging customers overdraft fees.

@PatrickMRucker

:

2

63

83

1

9

69

Today's compliance proposal is about much more than $700B+ it will raise.

It is about tilting the scales of tax justice in favor of ordinary Americans--who already pay all they owe.

And away from the wealthy--who for too long have been able to outgun a gutted IRS.

No longer.

1

17

64

1/5 large companies paid nothing in federal taxes last year

In today's

@PostOpinions

with

@LHSummers

, we argue that taxpayers (and policymakers!) need to know why this is.

A thread:

3

20

63

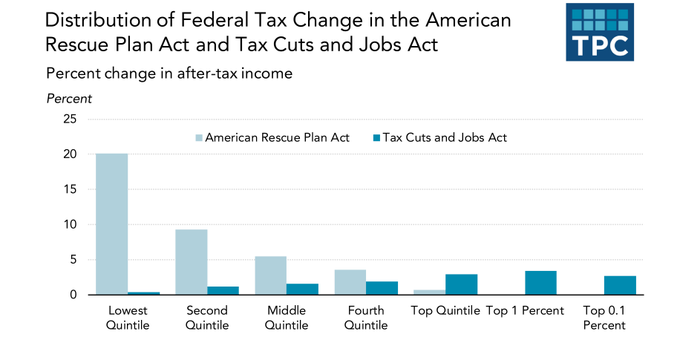

A tale of two Presidents:

Distribution of tax changes in the American Rescue Plan Act vs. the Tax Cuts and Jobs Act, via

@howard_gleckman

5

81

148

1

12

61

Since SVB failed, many--incl the Biden Admin--have called for reversing Trump-era banking deregulation.

That's a step in the right direction, but wouldn't have prevented the crisis that unfolded at SVB.

Much more is needed. My latest in

@PostOpinions

:

4

20

61

Oh good, it's starting already.

Reminder: you voted for ~$2T in tax cuts.

Other reminder: In the middle of a pandemic w/ desperate need for stimulus $$ (and interest rates so low!) means absolutely not the time for this nonsense.

2

10

60

There’s been a lot of chatter about how the IRS will deploy new resources

So this by

@crampell

could not be more timely—look for yourself at a tax system that today is “held together by scotch tape” and understand why $80B for the agency is so important

1

20

58

Terrific by

@mattyglesias

on the need for a robust investment in the IRS.

This would mean more tax collection from the wealthy, who today underpay knowing a gutted IRS lacks the resources to pursue them.

As Matt emphasizes, would also mean improving taxpayer services for all.

2

10

53

@SecYellen

on the importance of info reporting

When IRS has third-party info, compliance 95%+

W/ no reporting, compliance under 50%

Bit of info to the IRS will help end two-tiered tax system, where ordinary workers pay what they owe; $$ who accrue income in opaque ways do not

"There's an enormous tax gap in the U.S. estimated at $7T over the next 10 years in terms of a short fall of tax collections to what we believe are owed," says

@SecYellen

. "It comes from places where the information on income is opaque and can be hidden."

29

17

54

2

17

46

For House Republicans, tax policy appears to be less about raising revenue and more about satisfying wealthy donors.

My latest in

@PostOpinions

:

A thread ⬇️

3

22

45

Today, IRS doesn't have the resources it needs to go after high-earners and the corps they own

Result is 3% of GDP lost every year in owed, but uncollected taxes

As a matter of revenue-raising, efficiency, and most imp justice: investing in tax compliance is first order

2

19

46

The fact that the this processing is manual meant more than 1 million hours of IRS employees’ time was spent adjusting one return at a time.

Think about the savings that could accrue (and benefits to taxpayers IRS could provide!)—if agency had the resources it needs to automate

4

11

45

Terrific from

@RepRoKhanna

on imp of giving gutted IRS resources it needs

Left unaddressed, tax gap=$7.5T over a decade (3% GDP!)

Wealthy disprop fail to pay fair share

@LHSummers

, Rossotti, and I estimate investmt in compliance raises $1T+

Key to fair, efficient tax system

"Everyone should agree on this simple principle, that you ought to pay the taxes that you owe, it seems to be the essence of the American sense of fairness,"

@RepRoKhanna

says. He has introduced legislation that would beef up the IRS with $70B.

13

12

61

3

10

43

There is a whole lot of misinfo about the bank reporting proposals under consider, that

@SecYellen

clears up here:

One imp one: Those protecting $$ evaders push myth this proposal means IRS will see every transaction above $600 in all bank accounts

That is completely false.

“There’s a lot of tax fraud and cheating that’s going on.” Treasury

@SecYellen

tells

@NorahODonnell

the proposed $600 IRS reporting requirement for banks is “absolutely not” a way for the government to peek into American’s pocketbooks but to hold billionaires accountable.

6K

885

2K

2

9

43

In rare cases when the IRS goes after wealthy & corps they owe, they are stuck in disputes that last for years

Outmatched by those who can spend basically infinite resources to push back

As this great story by

@paulkiel

details

1

5

42

@gabriel_zucman

@akbarpour_

If you thought the efficiency story was true, you'd expect that as resources declined revenue wouldn't have fallen as much -- not what we see, there's a 1:1 decrease

It's actually not that surprising when you remember that IRS tech is from the 1960s and in need of sig overhaul

0

3

38

Estimates suggest $1 to IRS for enforcement—> at least $12 in additional taxes collected.

Giving IRS resources it needs is no-brainer!

Raises revenue, improves efficiency and equity of tax system.

0

8

38

Just beyond bonkers to have as a pillar of your "debt plan" making it easier for the $$ to cheat on their taxes which ***ADDS TO THE DEFICIT***

Here's the CBO score the last time Rs proposed IRS cuts, which was House Rs *first bill!* in Jan -

So much for fiscal responsibility.

3

15

36

As

@LHSummers

and I have argued in past, regulators have to figure out how to incorporate market info into prescription of bank health

Stress tests are perfect vehicle to do this! Should supplement annual stress-testing with a market-based approach

3

1

34

My take on the stakes of Moore in

@postopinions

:

Tl/dr: SCOTUS must rule against the Moores. Failing to do so, even in a narrow way, risks more Moores—cases that draw into question long-settled (and clearly constitutional!) areas of the tax code.

2

16

33

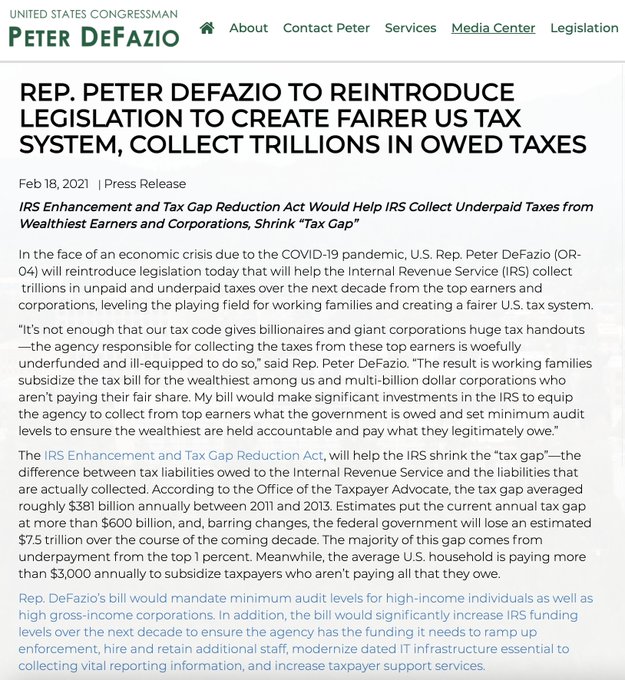

Really excited to see from

@RoKhanna

and

@RepPeterDeFazio

IRS fails to collect $600B of owed taxes/yr, disprop from $$$

Yet, top 1% as likely to be audited as EITC recipients

As matter of fairness, efficiency, revenue-raising--this must change, and these proposals will help

0

8

32