Coin by Zerodha

@CoinByZerodha

Followers

54,797

Following

11

Media

159

Statuses

5,076

India's largest direct mutual funds platform by @zerodhaonline .

Bangalore

Joined June 2018

Don't wanna be here?

Send us removal request.

Explore trending content on Musk Viewer

Diddy

• 537412 Tweets

الهلال

• 532436 Tweets

Alito

• 385282 Tweets

Flamengo

• 166722 Tweets

Peter

• 164474 Tweets

Corinthians

• 152047 Tweets

Cássio

• 112408 Tweets

Barron

• 91766 Tweets

رونالدو

• 59186 Tweets

デザフェス

• 51923 Tweets

#Kyrgyzstan

• 36751 Tweets

Gabi

• 34822 Tweets

#Smackdown

• 29867 Tweets

Bianca

• 22594 Tweets

كاس الملك

• 17707 Tweets

Cobasi

• 15556 Tweets

ムビナナ

• 14770 Tweets

the boy is mine

• 13618 Tweets

Dabney Coleman

• 13100 Tweets

Last Seen Profiles

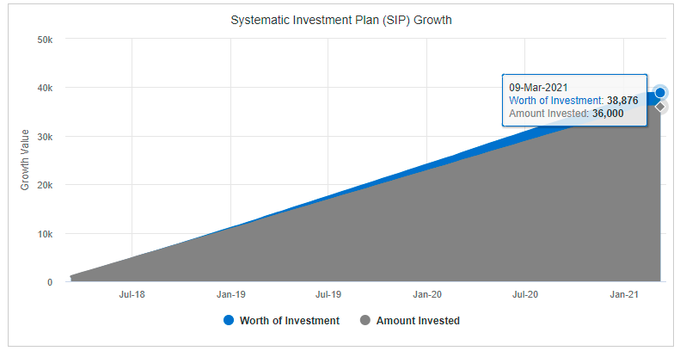

Look, we are not saying you should do this

#NoSmokingDay2021

🚬Butt if you had started a SIP of Rs 1000 a month instead of smoking 2 cigarettes a day, you could've saved nearly 39,000 in the last 3 years in a liquid fund😶

To be clear, we are not saying you should do this🤐

22

53

401

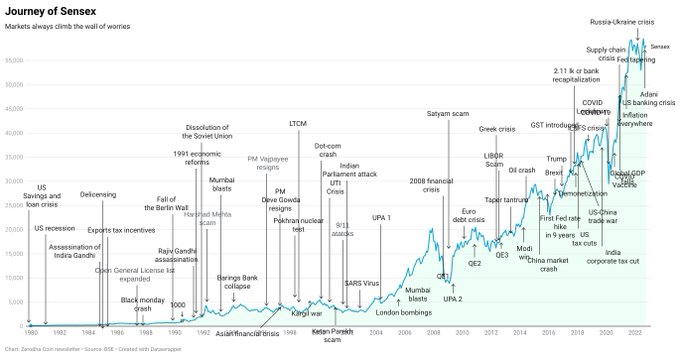

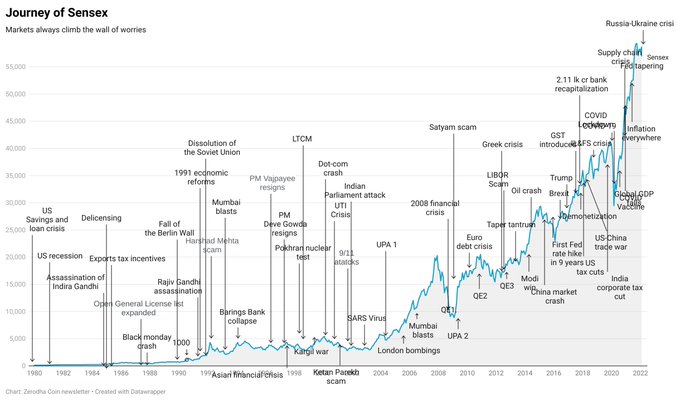

Will the

#RussiaUkraineCrisis

trigger WW3?

Will the markets fall more?

Should you sell everything or buy something?

All your questions answered here 👇

5

48

242

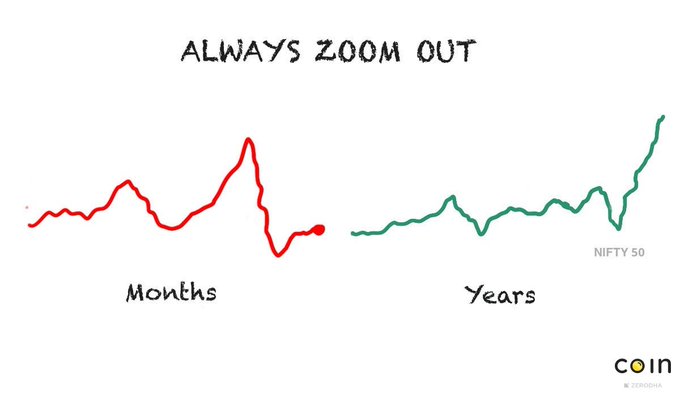

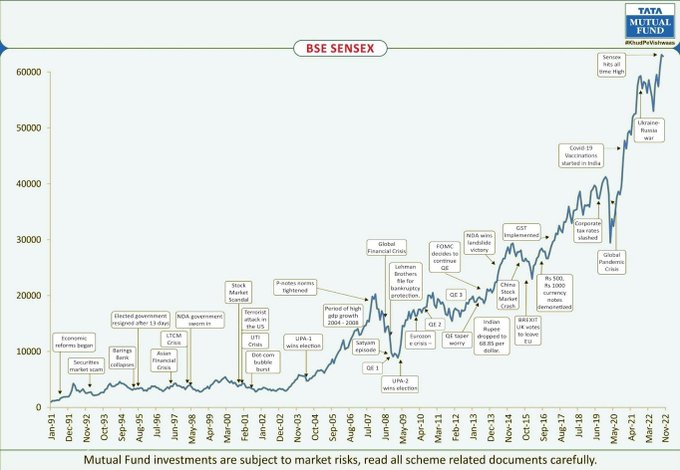

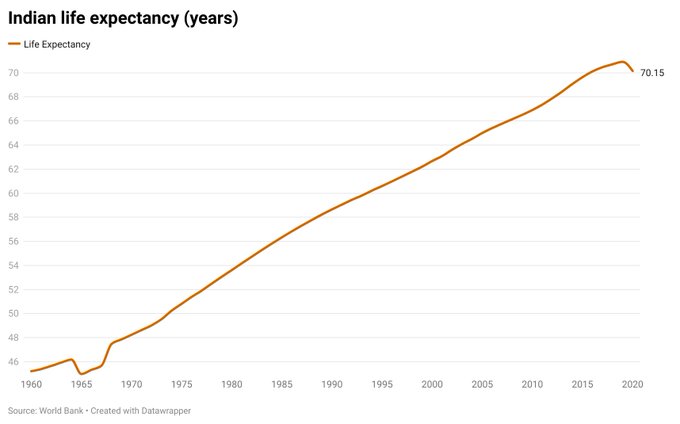

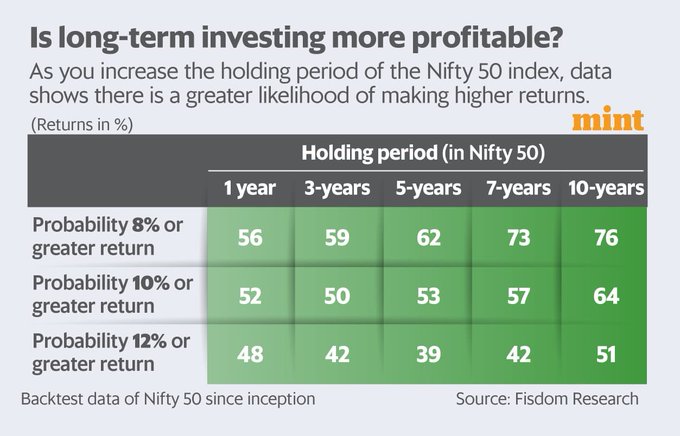

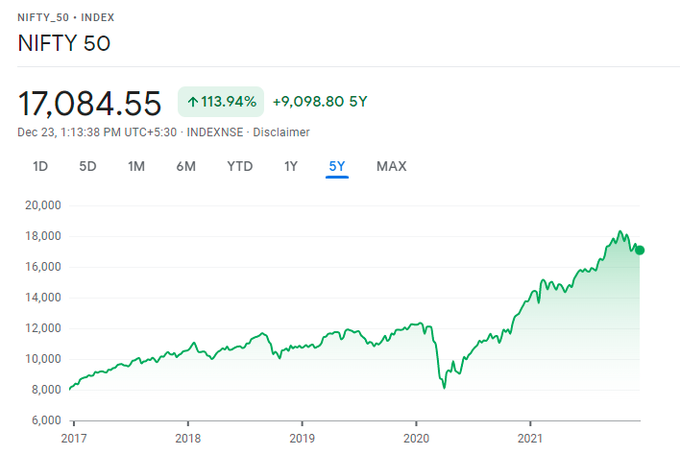

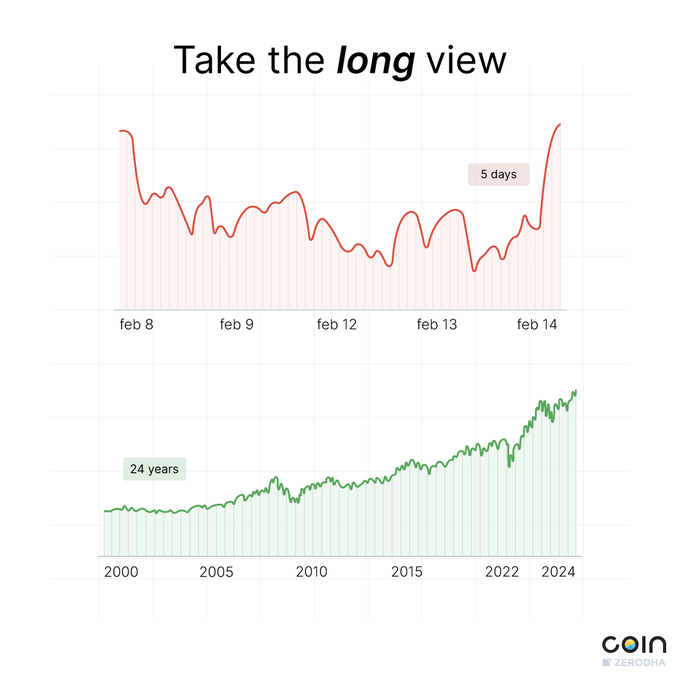

The longer your investment horizon, the higher the odds of better returns.

Image:

@ActusDei

6

15

159

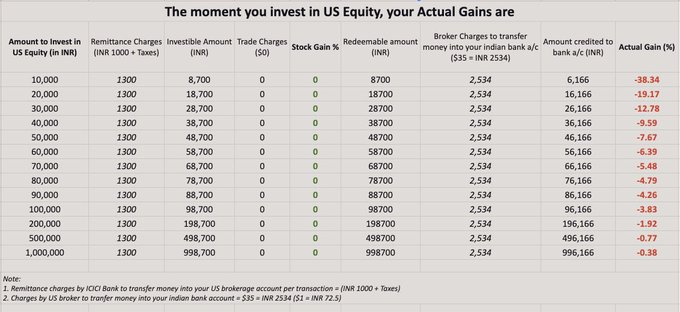

One of the easiest, low-cost, & tax-efficient ways to invest in the US or globally is through international mutual funds. This is the best option for the vast majority of investors.

You don't have to worry about filling forms, visiting banks & currency charges

Here's why 👇

8

20

143

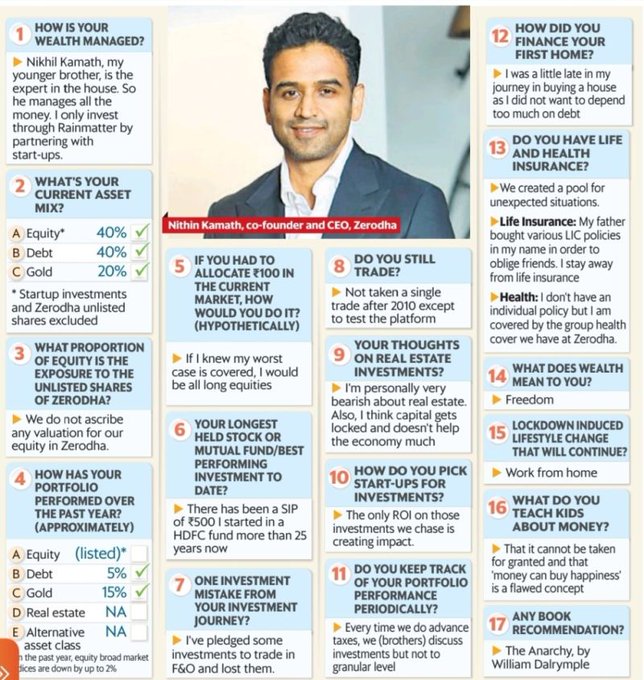

Two things that stand out from this Mint series about how people manage their personal finances.

1. There's no “best” way of investing. The way you save and invest will be a reflection of your risk tolerance, risk capacity, values, and unique life circumstances.

I get asked often, why stop trading?

Trading isn't just trading stocks, It's trading your time and efforts to do things, where the risk to reward is most in your favour. While I have stopped trading stocks actively,

@zerodhaonline

is by far the biggest trade of my life. 1/7

47

295

3K

4

13

108

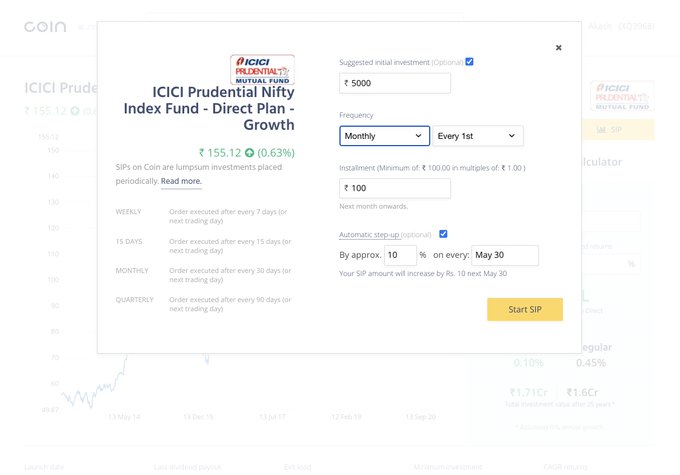

💯 Stepping up your SIPs is one of the easiest hacks to build a larger corpus. Here's why👇

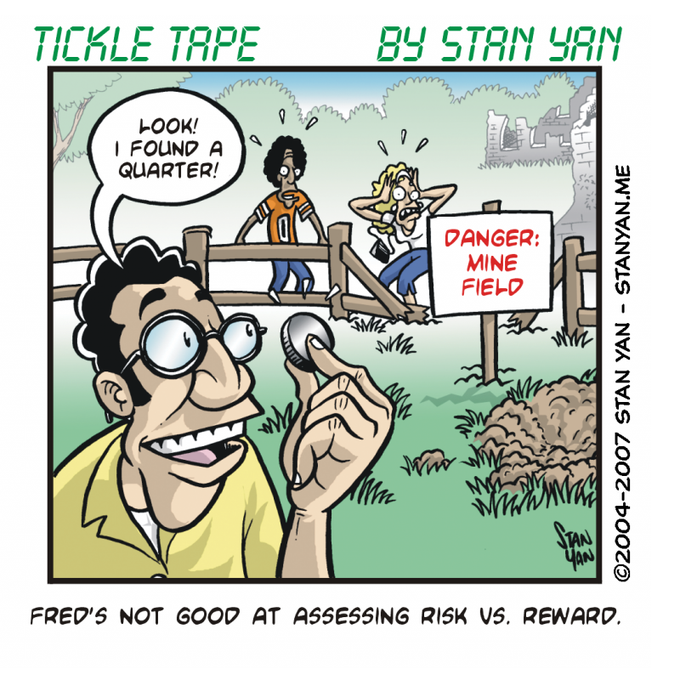

Intertia or status quo bias is the No.1 enemy of investors. It's human nature to prefer inaction over action.

2

9

95

Success is more than just having a lot of money. It's also about having good relationships, physical & mental health, being mindful, and living a life of purpose. This was the key message of Balance by

@aphallam

.

👌 It's a beautiful book that forces you to think holistically.

15

16

97

Investors often ignore the basics of investing in bull markets, especially new investors. But good times don't last.

So, this week, we caught up with Rishad Manekia of

@KairosCapitalIN

to discuss the basics of personal finance for new investors & how they can get started.

1

20

94

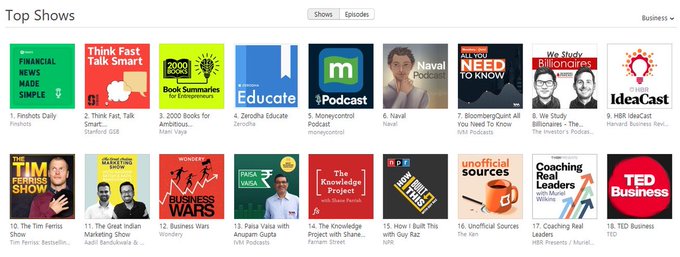

On this week's

#CoinWeeklyChat

, Anurag Mittal, Fund Manager

@IDFCMF

talks about all things debt funds, the new IDFC G-Sec index funds, interest rate cycles, inflation, economy and more.

#ZerodhaEducate

17

30

95

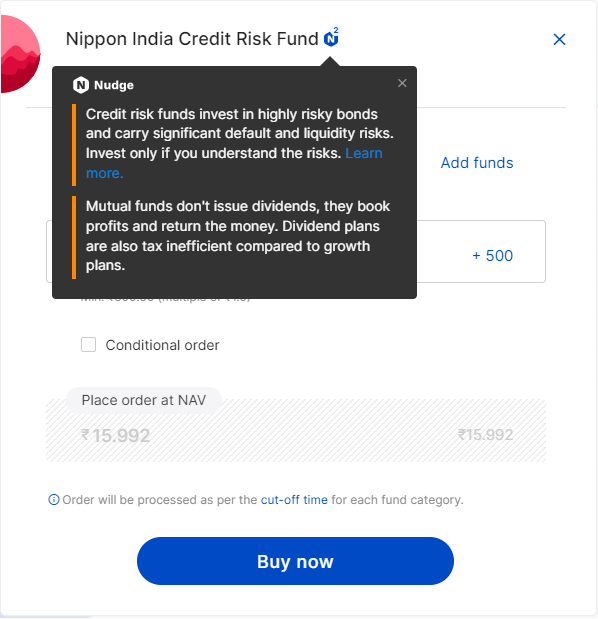

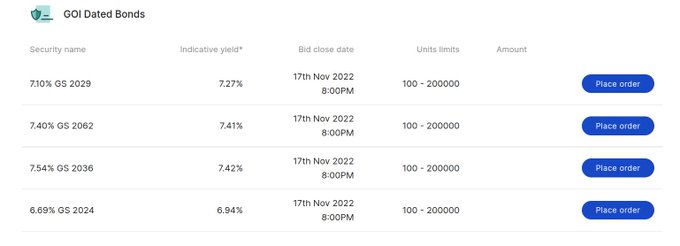

Investors spend a lot of time worrying about the equity part of the portfolio and don't nearly pay enough attention to the debt portion. But you should be just as careful when building your debt portfolio.

🧵A few things to keep in mind.

2

13

92

On today's

#CoinWeeklyChat

live, Nitin Kabadi, head of ETFs and Chintan Haria, head of product development

@ICICIPruMF

will be talking about all things index funds, ETFs, smart beta, and passive investing. Do post your questions below in the tweets and we'

14

29

89

🎧This week, we caught up with Prashanth Jain, the veteran CIO of

@hdfcmf

.

In this brilliant & wide-ranging conversation, Prashanth spoke about the Indian markets, current valuations, his research process, portfolio construction, active vs passive & a whole lot more.

Enjoy👇

2

4

83

Many investors spend a lot of time trying to find the "best" date and frequency for SIPs. But the returns are the same regardless of when you invest. Here's an analysis from

@WhiteOakCap

on the "best" SIP date and frequency. Also, a few tips on what you should do instead 😀

15

14

79

Update: SEBI issues a press release clarifying the reasoning behind the circular mandating multi cap mutual fund schemes to invest a minimum of 25% of the AUM in small cap and mid cap stocks. Read more 👇

0

17

78

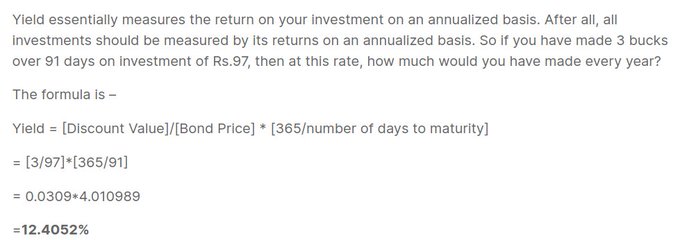

Is there anything I can read to understand more?

You can check out this

@ZerodhaVarsity

chapter:

2

7

67

A comfortable retirement🏖 is the ultimate goal we work and invest for. But given that it's a distant goal, most people don't think about it.

We recently caught up with

@AMajitmenon

of

@PGIM_IndiaMF

to talk about how to plan for your retirement and retirement readiness in India.

2

10

65

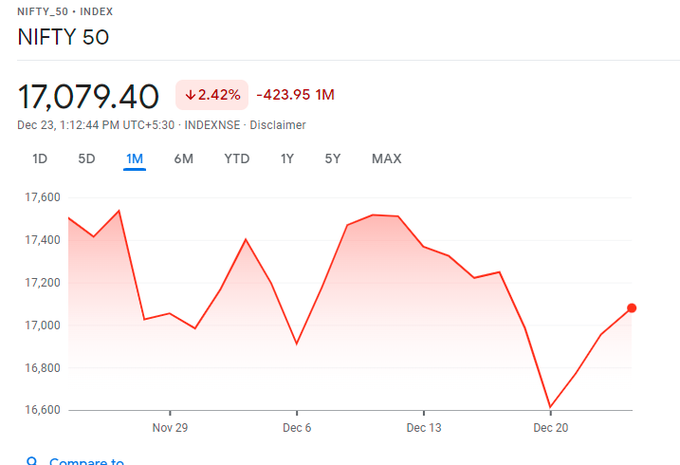

Why are the markets going up?😕

Is this a bubble?💭

Should I reduce my investments?😟

How do I start today?🤩

How do I invest❔

These are some questions investors have today. So, we caught up with

@KalpenParekh

&

@SahilKapoor

of

@dspmf

to help you make sense of these questions.

4

14

68

International funds are in flavour right now because of the good returns. But investing based on past returns is a terrible idea. In this episode,

@pratikoswal88

of

@motilaloswalamc

explains the need for global diversification and the right way to think about it.

#ZerodhaEducate

2

7

67

Have you stepped your SIPs, yet?

@zerodhaonline

Automatically Step-up for SIPs with

@CoinByZerodha

is a wonderful option !

@_groww

@FundsIndia

"Step-Up" please!

@IndiaEtfs

4

0

10

14

5

67

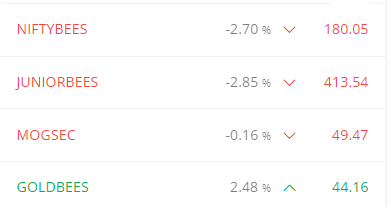

If you wanted to invest in gold and missed the last issue of Sovereign Gold Bonds (SGB), a new tranche opens for investment today:

9

6

61