Ram Ahluwalia CFA, Lumida

@ramahluwalia

Followers

36,018

Following

9,208

Media

2,502

Statuses

18,615

CEO of @lumidawealth . prev: Founded PeerIQ (exited). ex-Wall St. Non-Consensus Investing, Alts, Digital Assets. Disproving the EMH one day at a time.

New York

Joined October 2008

Don't wanna be here?

Send us removal request.

Explore trending content on Musk Viewer

Mother's Day

• 2156128 Tweets

Arsenal

• 538453 Tweets

Ángel

• 209581 Tweets

Travis

• 168200 Tweets

Cataluña

• 86422 Tweets

Spurs

• 86392 Tweets

Sarah

• 84942 Tweets

Racing

• 55788 Tweets

Illa

• 53989 Tweets

#Amici23

• 53671 Tweets

Pacers

• 42119 Tweets

The Knicks

• 35075 Tweets

Hawks

• 34768 Tweets

Vitória

• 34619 Tweets

Trae

• 34362 Tweets

Abel

• 27024 Tweets

#ConexiónHonduras10

• 23492 Tweets

Rony

• 23454 Tweets

الزمالك

• 22967 Tweets

Pistons

• 22434 Tweets

Costas

• 17938 Tweets

雨の月曜日

• 17758 Tweets

Veiga

• 17112 Tweets

Rory

• 12743 Tweets

Belgrano

• 12439 Tweets

土砂降り

• 11729 Tweets

Rossi

• 11127 Tweets

Jara

• 10760 Tweets

Last Seen Profiles

1/ How do we explain FTX's $10 Bn in losses? Where did the $2 Bn in venture funds go?

My working hypothesis is that FTX was a fraud even prior to recent events and as far back as 2021.

#SBF

will go down in history as a fraud larger than Bernie Madoff. 🧵

237

786

4K

Bridgewater CIO:

‘We find that GPT-4 scores at an 80th percentile investment associate.

With AI, technologically you now have millions of them at once.

And if you can [ control errors ] you can do a tremendous amount at a rapid rate.’

Yes, yes, yes.

#OddLots

29

118

1K

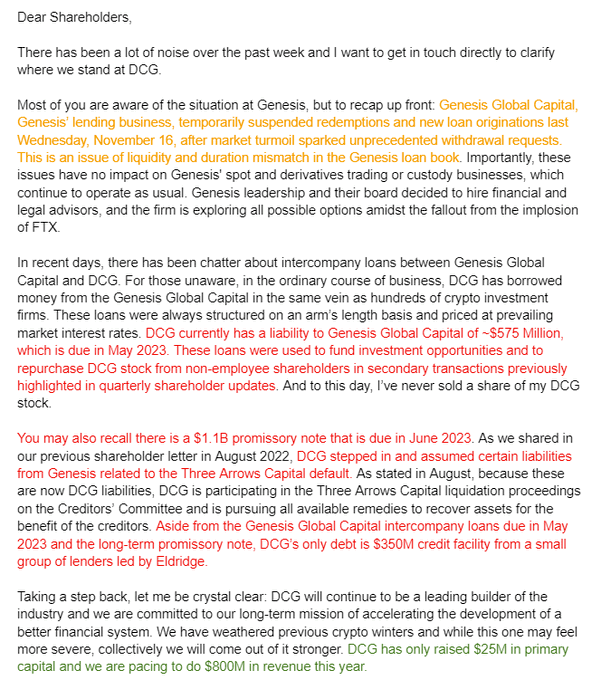

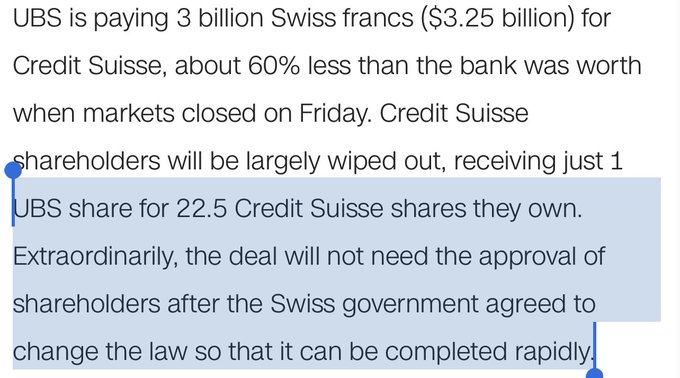

1/ NY Attorney General vs. DCG

@BarrySilbert

:

FTX was worse than Madoff.

And, DCG was worse than Enron.

This thread will show how.

And why the NYAG's request will force a sale of Grayscale.

76

287

1K

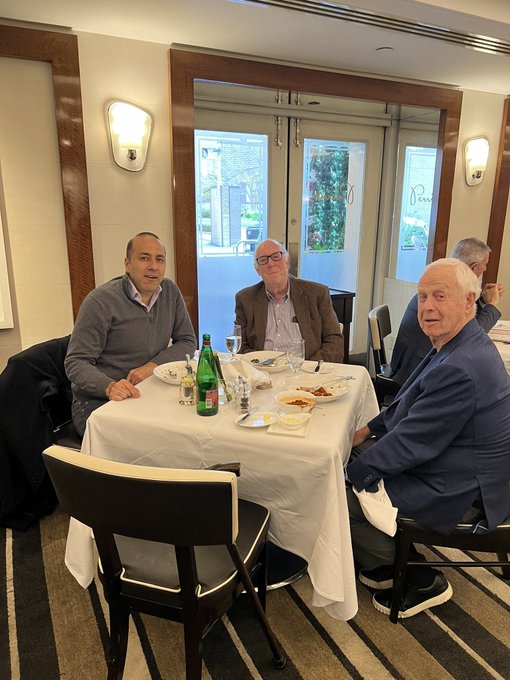

Quote from SEC Chair Arthur Levitt today: ‘Crypto will be part of the American financial scene sooner than later.’

🤞

SEC Chair Arthur Levitt (

@ArthurLevitt

) understood how to balance investor protection and capital formation.

He is a legend: longest serving SEC Chair, Entrepreneur and builder.

I am grateful to count on Arthur as a dear friend and mentor.

We took this picture after

8

12

177

40

184

915

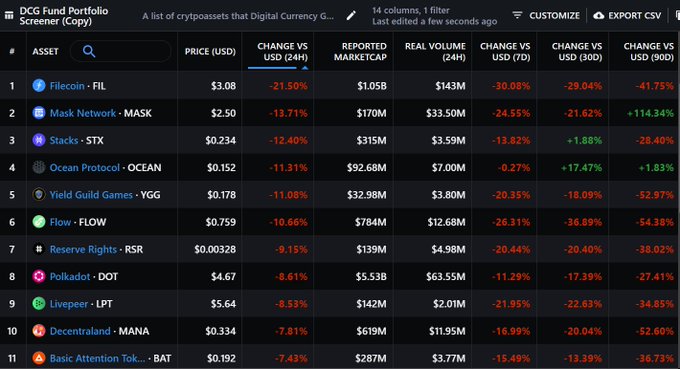

1/ DCG tokens are selling down hard. GBTC broke below $8 on Fri.

It's been 30-days since Gemini Earn interest was paid. If there is a cure period we're crossing that threshold.

That raises the prospects of a Notice of Default from Gemini.

@MessariCrypto

sorted by 24 hr %

29

172

737

1/ Curtains are closing on the once iconic DCG, at least as we know it today.

There’s subtlety in

@cameron

’s letter and new risks.

- FTX clawback

- Misrepresentations

- State AG investigations

- Jan 8th deadline

Let’s dig in. 🧵

44

181

745

1/ The Celsius bankruptcy examiner report is out.

My opinion is that

@Mashinsky

and other executives will go to jail for a long time.

Celsius propped $CEL token while Mashinsky dumped on retail.

Evidence show willful deception to keep the 'flywheel' going

Highlights🧵

29

156

749

Silvergate, the first crypto bank, faced a bank run that led to its downfall.

Despite facing allegations around AML, it was not these issues that ultimately caused the demise of $SI.

The responsibility for bank supervision lies with the Executive Branch, but this process was…

42

103

661

Michael Lewis is a great storyteller.

But he delivers narratives rather than true understanding.

FTX was a money losing business.

That led to fraud.

FTX was getting arbed by their own clients.

An exchange can withstand *any* run on the bank because deposits are never…

39

86

636

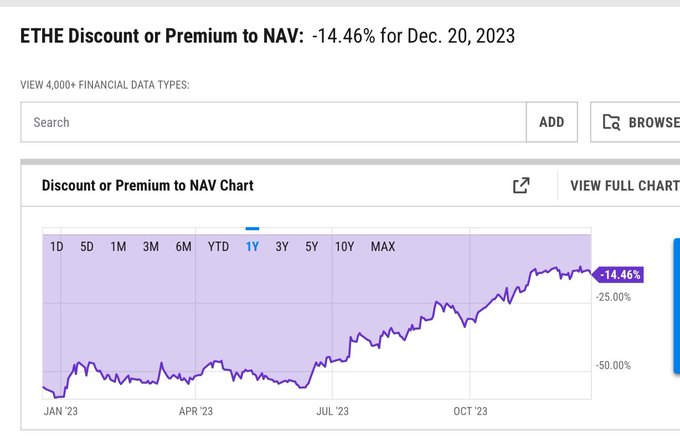

1/ Genesis Ch 11 Finding:

How GBTC went to a 50% discount.

Summary:

- Genesis pledges GBTC to

#GeminiEarn

- Genesis suspends withdrawals.

- Gemini forecloses on GBTC collateral

- Gemini sells GBTC to a private buyer causing spread to widen

Timeline thread...

31

145

595

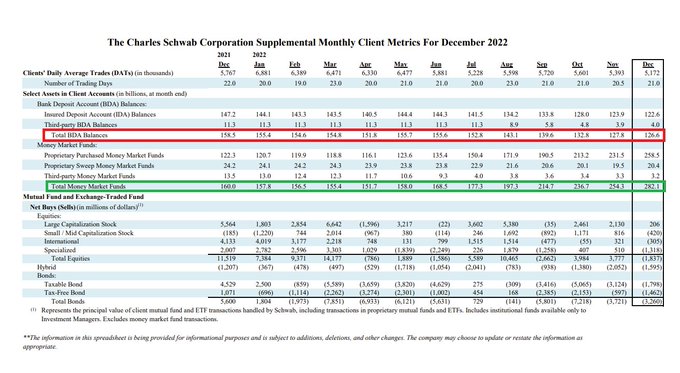

I’d like to thank JP Morgan for denying service to Digital Asset clientele.

It’s been great for business.

If you a JP Morgan Private Wealth client, we at

@LumidaWealth

are happy to help you find a new home.

Here’s our stack:

TradFi Custody: Charles Schwab. We never custody.…

19

58

574

1/ There are a lot of smart VCs concluding the demise of Luna set in motion contagion.

No.

The collapse of the GBTC premium was the main culprit.

It created, for a time, the perception of a perpetual motion machine disguised as a ‘carry trade’…

🧵

#bitcoin

pump + Genesis

49

106

562

Non-Consensus View:

The visit of China’s premier js a symbolic bending of the knee.

China is capitulating.

@balajis

is not reading this correctly

Why? China is hurting.

- China’s currency is under pressure as capital leaves at the fastest rate in 7 years

- FDI is down…

73

67

496

The Courts have ruled 3-0 against the SEC Chair.

We’re going to do a 4-0 and possibly have a Supreme Court that is already skeptical of executive branch overreach weigh in on ambiguous law.

All this case law is piling up and thwarting Chair Gensler’s objectives.

16

67

459

1/ Larry Fink just spoke with

@CGasparino

on Fox Business.

Topics:

- Bitcoin ETF

- Crypto & Disintermediation

- Inflation and Rate outlook

- Banks & CRE

All of our favorite topics :)

Here's a breakdown & rapid reactions🧵

15

90

446

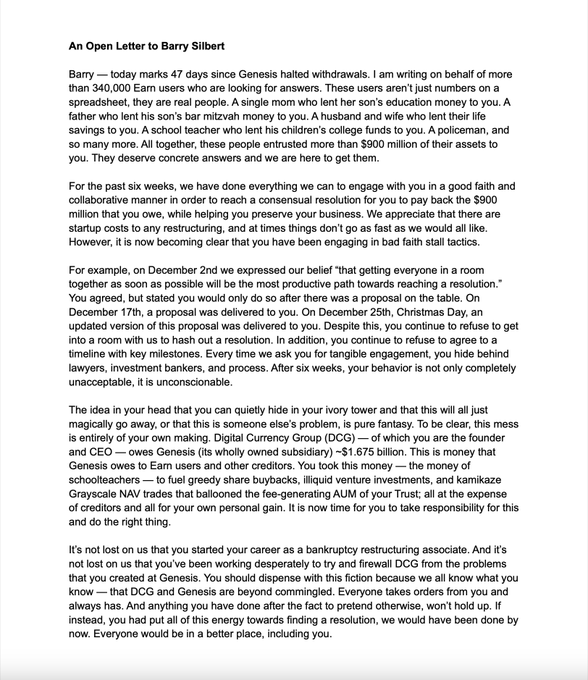

1/ Letter from

@cameron

to

@BarrySilbert

.

"After six weeks, your behavior is not only completely unacceptable, it is unconscionable".

It's a a game of chicken now.

Any 3 Earn creditors can coordinate on an Involuntary Petition for Ch 11.

Rapid analysis thread...🧵

29

94

426

Let Your Kids Fail

SBF is fully accountable for his actions.

SBF is also a product of a generation of parents that have raised kids by removing any obstacle to success from their path.

SBF never experienced adversity in life.

Take video games today.

They don’t have…

@AutismCapital

SBF has the ‘entitlement’ and ‘all bad feelings are bad’ defense 🤔

Jurors know better

2

4

92

54

75

429

@chamath

Price cuts are bearish.

Less revenue, earnings and margin and lower Return on Invested Capital.

Apple is raising prices on the next iPhone. That’s sign of a moat, dominant position, and consumer staple / must habe

Buffett quality businesses raise prices…

108

9

424

1/ What a contrast:

SEC Chair Jay Clayton: "I am remarkably impressed by true stablecoins. Wouldn't a stablecoin be a better way to [ move money]? "

SEC Chair Gensler: "We already have digital currency - it's called the US dollar."

#BloombergInvest

13

36

356

10/ Should get an investigative journalist on this. How to test?

Post the term sheet for BlockFi and Voyager acquisition.

Also, how much was Alameda borrowing from BlockFi.

@lawmaster

@fintechfrank

13

24

364

The precision in President Xi Jinping’s transcript is extraordinary.

If I didn’t know any better, it would read like a deep fake.

Excerpts:

(1) ‘China will never pursue hegemony or expansion and never impose its will on others.’

> Taiwan is safe.

(2) ‘China does not seek…

43

47

345

@NAChristakis

Admissions DEI took priority over academic scholarship, meritocracy, and learning for learning’s sake

Kids show up Freshman year and think they know world history from TikTok

8

15

321

@balajis

I have visited several of these cities. And the infra and airports are great.

And I thoroughly enjoyed spending time in Hong Kong, Shanghai and other cities.

However, the images depict the ‘exemplars of the most exemplary’ cities.

It’s a cherrypicked crop of the top 1% of…

34

2

327

Non-Consensus:

Why is it so fashionable to predict the decline of the US?

Hard disagree with

@Noahpinion

and

@balajis

Let’s break it down by category.

1) Technology leadership: US dominates

2) Military: US dominates

3) Banking: US has 4 of the Top 10 banks.

China has 4…

47

43

319

13/ This article from

@JeffKauflin

reports the FTX & Alameda lost $3.7 Bn *before* 2022. [!!]

Before Luna. before 3AC. Before credit contagion.

That's nearly 2x capital as compared to dollars raised.

They may have been insolvent already.

9

46

297

A former SEC Chairman once said ‘No honest man need fear the SEC.’

How absurd is it that Coinbase has to *sue* its regulator for clarity?

And the SEC chooses to fight in court

Rather than update Interpretive Guidance that makes no mention of DeFi, staking, or stablecoins?

11

39

296

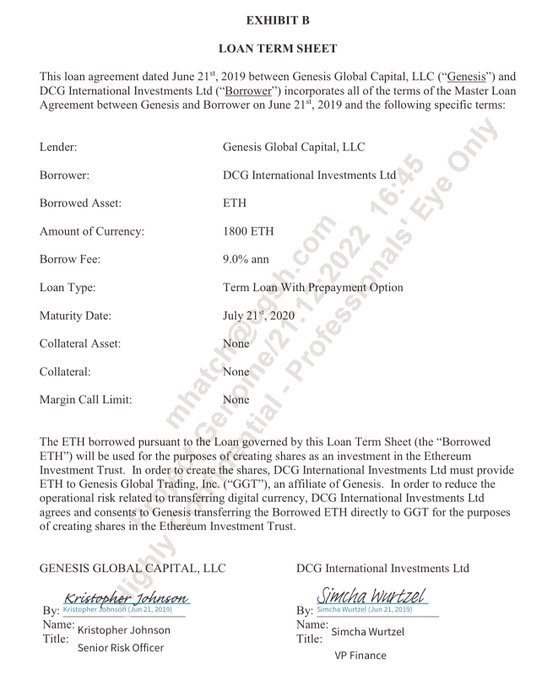

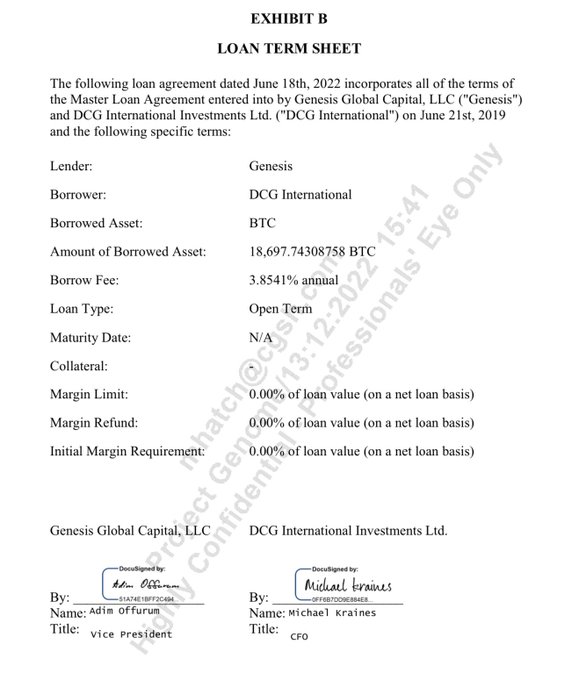

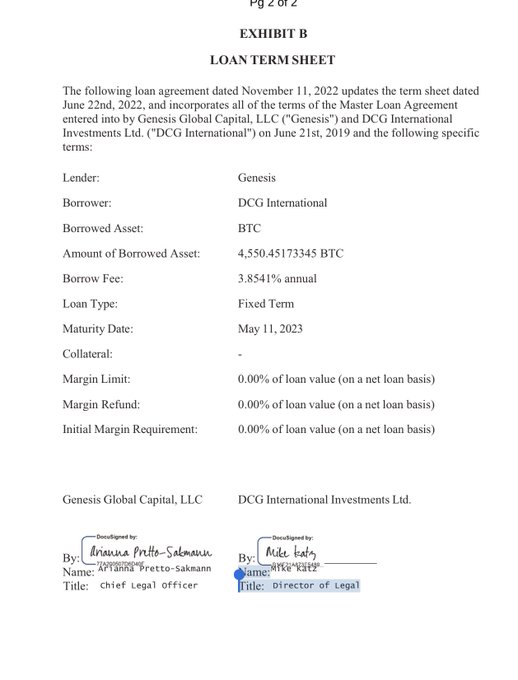

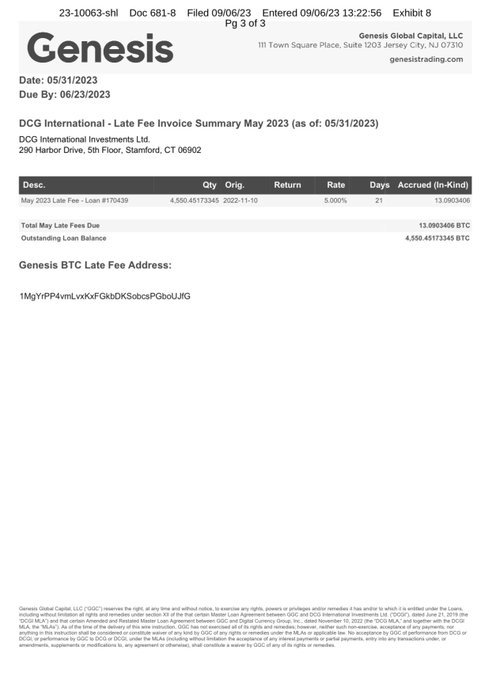

What we learned from the Genesis complaint against DCG:

- DCG was borrowing Bitcoin from its subsidiary at a 3.8% interest rate.

- The Late fee penalty rate of interest is 5%

- Meanwhile, JPM, the safest and most over-capitalized bank in the world, borrows at a 6% rate for…

33

49

237

The US has a choice to make:

Enable regulated on-ramps and custody from high integrity leaders like

@CaitlinLong_

, or push activity to unlicensed overseas players with zero oversight…

and get another FTX.

1/ IT'S TIME FOR ME TO REVEAL A FEW THINGS. I've just published a post "Shame On Washington, DC For Shooting A Messenger Who Warned Of

#Crypto

Debacle." Link to post is here:

371

1K

4K

20

40

261

The Fed is in a checkmate position.

Choice 1) Raise rates and stop inflation…but widen the yield pickup of money market funds over deposits. More ‘carry trades’ come undone.

The US. banking system *is* a carry trade - the largest. All banks ‘borrow short, and lend long’ and…

15

58

257

@molly0xFFF

I am waiting for the simulation to end at any moment now

Can’t make this up

The reality script writers are on strike

6

2

264

Mike Novogratz (

@novogratz

) on a Bitcoin ETF:

> We are going to get good news in Oct

> Bitcoin is an international asset

> This will be a gamechanger (due to the sales forces of the ETF issuers)

@twobitidiot

#mainnet2023

@MessariCrypto

24

50

256

1/ After Genesis there was Exodus.

We are entering the next phase of the drama - chapter 11.

@cameron

is waging a maximum pressure campaign threatening lawsuits against

@BarrySilbert

to get a ‘fair deal’ submitted to the court

🧵

13

53

245

Barry's resignation was

@Sonnenshein

's X-Mas gift.

What to make of

@bsilbert

resigning from Grayscale?

Grayscale has had 9 meetings with the SEC per the table below (h/t

@JSeyff

)

Today, there are only allegations against DCG which have not been resolved in a court of law.…

21

45

249

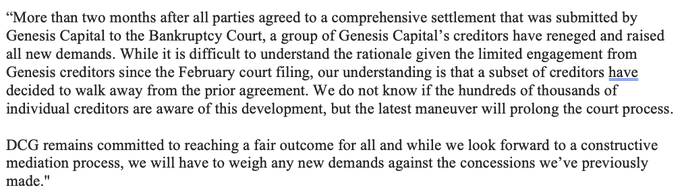

A Beautiful Ending to the DCG - Genesis Saga (First Season)

We did it :)

Creditors will be made effectively whole (97% recovery) with additional remedies on the way.

The upside? Gemini Earn & Creditors will receive in-kind distributions — they were forced long, by hook or…

50

48

246

The White House report shows crypto has a storytelling problem.

Crypto is viewed as a speculative, unregulated casino that does not deliver on benefits to the public.

The promise of crypto is significant.

The crypto sector needs to link crypto to direct public and private…

37

41

247