Bank Policy Institute

@bankpolicy

Followers

10,966

Following

1,431

Media

430

Statuses

3,366

The Bank Policy Institute (BPI) is a nonpartisan research and advocacy group representing the nation’s leading banks.

Washington, DC

Joined December 2009

Don't wanna be here?

Send us removal request.

Explore trending content on Musk Viewer

Rafah

• 1219849 Tweets

GW最終日

• 517721 Tweets

NUNEW 3RDMV IS OUT

• 447304 Tweets

井上尚弥

• 272395 Tweets

Inoue

• 160309 Tweets

シェリン

• 118934 Tweets

陸奥一蓮

• 96028 Tweets

ボクシング

• 69355 Tweets

大千秋楽

• 57117 Tweets

#キュウゴー

• 50598 Tweets

サプライズ

• 48447 Tweets

BINGLING SACRIFICES FOR LOVE

• 39812 Tweets

モンスター

• 38180 Tweets

Bruno Mars

• 34617 Tweets

ジェシー

• 27818 Tweets

GW終了

• 26655 Tweets

井上選手

• 25746 Tweets

逆転3ラン

• 24439 Tweets

筒香のホームラン

• 21369 Tweets

#GWを写真4枚で振り返る

• 17338 Tweets

20 YEARS OF MINJI

• 15570 Tweets

Białoruś

• 15207 Tweets

MIOTO NO VENUS PODCAST

• 15002 Tweets

筒香選手

• 13218 Tweets

Bernard Pivot

• 12899 Tweets

AESPA SUPERBEING TEASER 1

• 12732 Tweets

Last Seen Profiles

Pinned Tweet

The Consumer Financial Protection Bureau finalized a regulation today that will increase costs for responsible consumers who pay their credit card bill on time.

There are five major problems with the rule. 📺⬇️

#FactsOnFees

1

3

7

A "bank" funded by uninsured deposits, reliant on assets that can be subject to rapid and substantial capital losses in times of stress. What could go wrong?

@krakenfx

24

72

348

In 2009, President Obama signed the bipartisan CARD Act into law. Many in Washington celebrated this major accomplishment.

Accusations that banks charge "illegal" fees, or are not committed to providing robust disclosures, are irresponsible and just wrong. Get the

#FactsonFees

.

87

42

289

Day one of FinTech Ideas Festival is wrapping up with Dan Schulman, Brad Garlinghouse, and Deirdre Bosa talking payments.

#FIF2019

12

37

110

We analyzed the reported cases of allegedly fraudulent

#PPP

transactions based on DoJ news releases & criminal complaint affidavits cross-referenced w/ SBA loan-level data.

In a majority of cases, the allegedly fraudulent loan was obtained from a FinTech.

7

54

96

What is a SAR?

How many of these SARs are really illegal activity versus false positives?

Why would a bank identify a suspicious transaction for law enforcement and continue to bank that client?

We answer your questions:

#FinCENFiles

14

35

69

The federal government's new capital rules would make loans more expensive and less accessible, hurting everyday Americans when our economy is still recovering from a pandemic and grappling with rising interest rates.

Take action to

#StopBaselEndgame

:

6

15

56

Happening Now: Fed Vice Chair Lael Brainard joins

#tchbpi2022

to discuss inflation.

Read the Vice Chair’s prepared remarks here:

8

13

40

Notice anything missing from this month’s accountant report from Circle? A breakdown of the types of assets backing

@circlepay

’s “stable” coin (USDC) is conveniently excluded.

So much for greater transparency…

4

7

40

The

@CFPB

has repeatedly denounced legitimate bank fees, like credit card late fees, as “illegal” and as “junk fees.”

This rhetoric mischaracterizes late fees as inherently bad, ignores existing consumer protections and confuses rhetoric with reality. Get the

#FactsonFees

. ⬇️

38

7

33

1/5 Today, the

@bankofengland

is again serving as “market maker of last resort,” supplanting private sector intermediation and trading bonds with taxpayer money. The BofE is acting in crisis but the Fed has taken the same action in normal times (2019) as well as crisis (2020).

2

8

34

The

@CFPB

has proposed to cap the safe harbor for credit card late fees at $8, which will have unintended harmful consequences for banks’ ability to serve customers across the credit risk spectrum.

Read our latest here:

37

6

25

Allowing tech companies to enjoy the privileges of being a bank, without requiring them to meet the duties and obligations of being a bank, threatens the safety and strength of America’s banking system.

Learn more at .

#KeepBankingSafe

2

6

26

Chairman McHenry is right. Major policy decisions should be driven by economic analysis. Not politics.

@PatrickMcHenry

@FinancialCmte

3

3

23

.

@ICIJorg

and

@BuzzFeedNews

recently released

#FinCENFiles

based on thousands of illegally leaked SARs. The report lacks a full understanding of the AML framework and has led to considerable confusion about the AML regime in the US.

We correct the record—

10

12

18

“We want to provide innovation that is legendary to our customers.” - TD Bank Group President and CEO Bharat Masrani at our 2019 FinTech Ideas Festival joined by Ryan McInerney from Visa, Noah Breslow from OnDeck and Deirdre Bosa from CNBC.

@TDBank_US

@FinTechIdeas

#FIF2019

1

13

19

Why is that?

It’s because trading one token for another token or for a nonbank stablecoin is unconnected to the real economy. So, concerns about financial stability risks of crypto appear to have been overstated. 3/7

2

5

17

Did you know: the operational risk charge in the Basel proposal drives 90% of the increase in capital requirements.

The proposal dramatically overstates banks’ op. risk & layers a broad, unnecessary tax on every bank activity.

#StopBaselEndgame

2

3

18

.

@federalreserve

Vice Chair for Supervision Michael Barr said the Basel capital proposal would have a minimal impact on the cost of lending: only 3 basis points, or 0.03 percent. However, the banking agencies’ analysis inexplicably leaves out $1 trillion...🧵

3

4

16

Given that 35,000 comments were received, and assuming an 8-hour federal workday, this means that the OCC reviewed ~398 comments per hour before finalizing its rule. For an analysis of similar probabilities, see:

@bankpolicy

@baerheel

@IntraFi

The question is whether the OCC rushed the rule. Given that the rule was finalized 10 days after the comment deadline closed, it will be easy to argue it did so.

Opens the OCC up to lawsuit on violation of the Administrative Procedure Act.

2

1

2

1

7

16

.

@federalreserve

Vice Chair for Supervision Michael Barr downplayed concerns in a speech this week about the Basel capital proposal’s effects on lending.

But, the cost analysis relied on has a trillion-dollar omission:

2

1

16

Diamonds, yachts and private jets. Kleptocrats have learned that "the best way to hide and move stolen wealth is to set up a raft of anonymous shell companies..." It's time for that practice to end.

#EndAnonymousShellCompanies

0

10

14

We'll be on the Hill this afternoon with the

@FACTCoalition

hosting a panel discussion on why legislation is needed to end anonymous shell companies. The panel features experts from

@AEI

@fdd

@GLFOP

@Global_Witness

@StreetGrace

and

@TI_Defence

. Register—

0

4

15

Capitol Account recently hosted an event sponsored by BPI to examine the Basel Endgame proposal. In his remarks, Eugene Scalia highlighted the deficiencies of the proposal and the need for a more rigorous analysis.

Watch the full event: .

#StopBaselEndgame

0

3

13

The “move fast and break things” mentality of Silicon Valley should not be given a free pass when it comes to the safety of the U.S. banking system and the financial health of Americans.

Learn more at .

#KeepBankingSafe

4

1

12

Today, legal legend Carl Howard of

@Citi

attended his final BPI (and Clearing House) Bank Regulatory meeting. He retires with the universal respect and admiration of his peers, who will dearly miss his wit and wisdom.

1

2

13

RELEASE: Banks, Credit Unions and Consumer Groups Call for Passage of Bipartisan Solution to Close ILC Loophole

Read:

@FSCDems

@FinancialCmte

@RepMaxineWaters

@PatrickMcHenry

@uspirg

@NCLC4consumers

0

3

12

The HFSC Financial Institutions and Monetary Policy Subcommittee hosted a hearing on Jan. 31 on the Basel III Endgame proposal, which highlighted the proposal's many deficiencies.

Here are the 7 key takeaways. 📺👇

#StopBaselEndgame

2

1

12

RELEASE—Largest banks have served smallest businesses through

#PaycheckProtectionProgram

:

▶️ $115k avg loan size

▶️ 64% of loans < $50k

▶️ 51% of all loans went to businesses with < 5 employees

▶️ 75% to < 10 employees

▶️ 98% to < 100 employees

5

5

9

With 97% of public comments opposing or seriously concerned about the Basel Endgame proposal, it’s time for a new playbook.

Say “no” to Basel Endgame’s costly new capital regulations. Learn more at .

#StopBaselEndgame

3

3

12

RELEASE:

@CFPB

Finalizes Rule to Increase Costs for Responsible Consumers that Pay Bills on Time

5

2

12

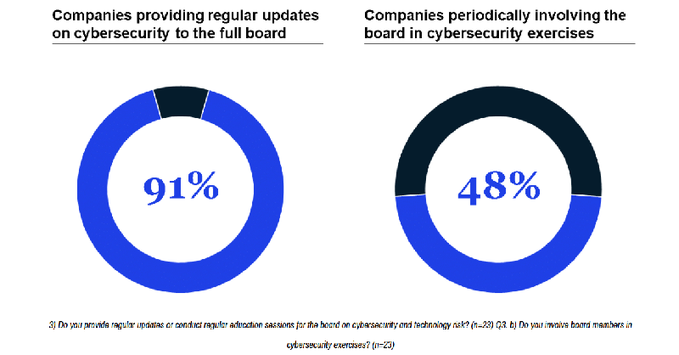

Did you know:

- 95% of board committees discuss cybersecurity and technology risks 4x or more per year

- 91% of companies provide regular cybersecurity updates to the full board

A new survey finds that

#cybersecurity

is a growing priority in financial services boardrooms.

0

3

10

Loans are 3.3% higher than 1 year ago despite reduced loan demand in a recession.

Cash is up 83% b/c banks must hold the Fed’s vastly expanded reserve balances.

Treasuries have grown 41%.

W/ Fed buying $80b/month of Treasuries, good thing banks are there to help as well. 1/3

The biggest U.S. banks reduced the portion of their collective balance sheets they’re dedicating to loans to a new low, extending a trend that’s seen the largest lenders put less and less of their firepower behind everyday borrowers (via

@nasiripour

)

7

28

44

2

5

11

ICYMI:

@GoldmanSachs

surveyed participants of its “10,000 Small Businesses” program, finding that 84% of respondents are concerned that the Basel Endgame Proposal will negatively affect their ability to access capital.

Learn more:

@GS10KSmallBiz

0

3

10

A year ago today, BPI announced the merger between the Clearing House Association and the Financial Services Roundtable. It's been an exceptional year for our organization, and we're proud to share some of our many accomplishments over the last year:

2

1

11

RELEASE w/

@ABABankers

@ConsumerBankers

@fsforum

and

@TCHtweets

:

Congress should exempt stimulus payments from court-ordered garnishments -

0

6

10

The Basel Endgame proposal would impose excessive capital requirements on consumer loans, making credit more expensive and less available for the most vulnerable American customers.

See our latest on what Basel means for retail lending:

#StopBaselEndgame

2

2

10

BPI and a coalition of associations representing banks & credit unions submitted a letter to the Senate Committee on Armed Services Chairman

@JimInhofe

and Ranking Member

@SenJackReed

calling for swift passage of legislation to

#EndAnonymousShellCompanies

.

0

7

10

Regulators should

#StopBaselEndgame

and re-propose. The proposal is

⚠️ Bad for consumers.

⚠️ Bad for small businesses.

⚠️ Bad for the economy.

Learn more at .

@federalreserve

@FDICgov

@USOCC

@FSCDems

@FinancialCmte

4

1

9

Ajay Banga from MasterCard and Tim Sloan from Wells Fargo are live on stage with CNBC’s Andrew Ross Sorkin at the FinTech Ideas Festival

#FIF2019

0

3

9

We recently hosted the 2019 FinTech Ideas Festival in San Francisco in partnership with

@CNBC

, the event's exclusive broadcast partner. Check out some of the highlights from the conference, including photos and video of the main stage:

0

3

8

BPI CEO Greg Baer issued the following statement in response to a vote by the House of Representatives and Senate to override the President’s veto of the NDAA for FY 2021, which includes language to reform the AML framework and

#EndAnonymousShellCompanies

.

0

9

9

BPI joined

@ABABankers

,

@ConsumerBankers

,

@fsforum

,

@SIFMA

,

@IIBnews

,

@BAFT_Global

,

@IIF

, Mid-Size Bank Coalition of America to submit a letter to the House Financial Services Committee in support of efforts to modernize the AML / CFT regulatory system:

0

0

9

.

@BrookingsInst

hosts "Fixing America’s payment system: The role of banks and fintech" ft.

@BrianBrooksOCC

keynote and panel moderated by

@Aarondklein

incl.

- BPI CEO Greg Baer

-

@ChrisBrummerDr

- Michael Calhoun,

@CRLONLINE

-Margaret Liu,

@CSBSNews

0

5

9

Bill Nelson, our chief economist, will be on

@SquawkCNBC

tomorrow at 7:30 am to talk about the Fed’s path in 2019 with

@steveliesman

1

3

9

We're excited to be in San Francisco this week to host the 2019 FinTech Ideas Festival with our exclusive broadcast partner,

@CNBC

! Join the conversation using

#FIF2019

and watch coverage from the event by

@dee_bosa

,

@levynews

,

@CNBCJosh

and

@andrewrsorkin

Less than 24 hours to go and production is well underway to turn this incredible space into a place for innovation.

#FIF2019

0

0

4

0

6

8

Big Tech wants to know: how much money is in your bank account?

Learn more at .

#KeepBankingSafe

1

3

6

BPI Chief Economist Bill Nelson joined

@GeorgeSelgin

and

@DavidBeckworth

this evening at

@AEI

to discuss Selgin's new book "Floored!: How a Misguided Fed Experiment Deepened and Prolonged the Great Recession." Click here to read Bill's remarks

0

2

8

BPI and a coalition of trades including

@ABABankers

,

@ConsumerBankers

@CUNA

,

@ICBA

,

@NAFCU

and

@TCHtweets

urge the OCC to undertake an open and transparent process before considering a new narrow-purpose payments charter:

0

2

8