Eric Nelson, CFA

@ServoWealth

Followers

4,727

Following

693

Media

3,254

Statuses

22,532

*CEO of Servo *Simply Smarter Investing *Tweets =/= financial advice *Need a 2nd opinion on your investments?

OKC

Joined September 2013

Don't wanna be here?

Send us removal request.

Explore trending content on Musk Viewer

Portugal

• 339721 Tweets

Chomsky

• 170633 Tweets

FREENBECKY AT WORKPOINT

• 165903 Tweets

#TheLoyalPinOnAir4Aug24

• 157112 Tweets

Willie Mays

• 118806 Tweets

The Catch

• 101312 Tweets

Justin Timberlake

• 94442 Tweets

TSOU OST BY LINGLING

• 80347 Tweets

FURIA ES GRAN HERMANO

• 72703 Tweets

Juneteenth

• 70721 Tweets

Alperovich

• 70189 Tweets

Nubank

• 57585 Tweets

#WWENXT

• 47761 Tweets

ELIJO CREER

• 40198 Tweets

Leah

• 29386 Tweets

Pizarro

• 25078 Tweets

#loveislandusa

• 24962 Tweets

Joe Hendry

• 22464 Tweets

400K Krittanun for X

• 21005 Tweets

Dutton

• 19437 Tweets

Paloma

• 16977 Tweets

Espinoza

• 14362 Tweets

Bruno Mars

• 12194 Tweets

Tinelli

• 11235 Tweets

Say Hey Kid

• 10996 Tweets

#LetsGoOilers

• 10571 Tweets

Last Seen Profiles

Pinned Tweet

Want to learn how you can have a better investing experience at

@Betterment

by working w/an independent advisor thru

@Better4Advisors

to get a better asset allocation implemented w/Dimensional asset class funds & ETFs?

Let’s talk…

0

0

4

@morganhousel

1. Low fees are all that matter

2. I'm smart enough, I should be able to manage my own $

3. Investing is easy, I'll stay the course

4. Investing is a commodity

5. ETFs are always more tax efficient than mutual funds

6. The last 3-5 years of returns is a good predictor of future

7

4

131

Bonds have had no real returns since 2009…and some hourly “advisors” have been recommending 70%+ in bonds for retirees the whole time because they’re “safe”

Cheap advice =\= Good Advice

11

6

72

@realifeanyiezeh

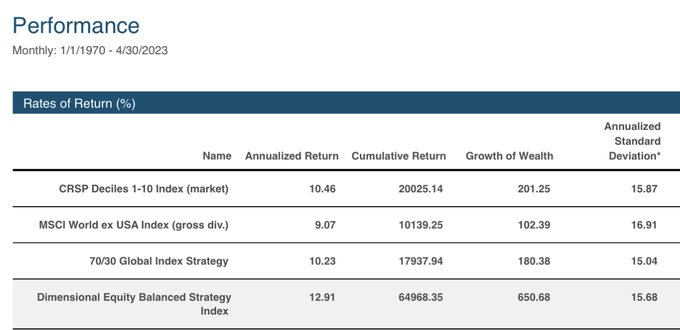

It’s a model portfolio of mutual funds DFA has been publishing w/o making a single change for 25 years. No backtest/hindsight bias.

6

4

71

@morganhousel

@Schuldensuehner

Adjusted for Tom Brady Super Bowl wins, the S&P 500 is negative since 2000 😂

0

0

61

Excluding unprofitable stocks from the small cap universe (ie Dimensional) has been very profitable…

4

7

56

Think I’m exaggerating?

Here are model portfolios that Vanguard gives TO ADVISORS to manage at Betterment for Advisors.

🤢🤢🤢

10

1

37

@DiminSweaterGuy

If you can live off dividend distribution (say 2.5% or less withdrawal rate) then yes.

If not, put 2-3 years of annual spending in a short-term bond fund & the rest in the Equity Strategy

3

2

35

How to minimize sequence risk in retirement?

1. Planning: spend < you earn

2. Allocation: put ~5yrs of income in short-term bond fund

3. Spending: stocks in bull mkts, bonds in bear mkts

4. Diversify: globally across small/value stocks to help in “lost decades”

#Servoinsights

3

7

34

@ValueStockGeek

It’s not the vol that led to S&P 500 failure, it’s the concentration: 100% US large growth stocks.

A similar vol portfolio (all-stock) that’s globally diversified & has small cap & value tilts, the DFA Equity Balanced Strategy, saw $1M grow to > $2M net of $50k/yr withdrawals

5

1

31