ValueStockGeek

@ValueStockGeek

Followers

83K

Following

40K

Media

10

Statuses

111

% of population over 65 in 1990: 12.6% % today: 16.8% Life expectancy for 65 year old men went from 15.3 years to 18.2. Women, 19.6 to 20.7. There are more older people as a share of the overall population. They also live longer - with more time to compound.

1

2

30

If you've beaten the S&P over 10+ years, your strengths are usually in the areas you are different from most other investors, not the same. The first 5-10 years of a stock picking journey should be spent figuring out how your natural temperament and abilities can amplify

13

27

256

It was pretty bad when the media hyped minor Ted & Todd positions as ‘Buffett buys xyz.’ Now that Buffett has announced his retirement, it’s completely ridiculous.

2

2

39

This phone (the Motorola DynaTAC 8000X) cost $3,995 in 1987 when Gekko used it. It had enough battery for only 30 minutes of talk time & weighed 2 pounds. Coverage was confined mostly to major cities. Networks could only handle a small number of simultaneous users in each area.

3

6

86

I actually think a great macro call is one of the worst things that can happen to an investor. You convince yourself it’s predictable and you have a knack for it. It’s not and you don’t.

0

4

66

Michael Burry probably would have been better off if he stuck to his original cooking. Long only. Dirt cheap deep value stocks that have technical support. Would have lost a little in ‘08 - but no one would have cared. No fame. No drama. No home runs. Strong and steady.

4

2

65

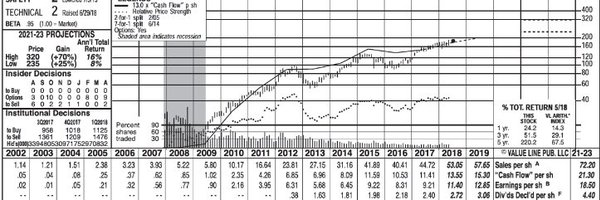

That decline was an 80% drawdown and it was underwater for 13 years.

69

377

16K

The problem with following markets from the late 90s through 2010 is that you assume bubbles are easy to spot & trade around. They are not.

3

1

48

The Beneish M-Score is one of the best indicators that the company has a high probability of being a zero. If a company is manipulating earnings, the party will eventually end & it's going out with a bang not a whimper. Enron, Worldcom, and Healthsouth are good examples.

0

1

7

I spoke to @Greenbackd about his excellent new book "Soldier of Fortune: Warren Buffett, Sun Tzu and the Ancient Art of Risk-Taking" https://t.co/a5a2ipw1Jq

securityanalysis.org

This episode is with a returning guest to the podcast - Tobias Carlisle.

1

4

29

The issue is that we have no idea how those jobs get replaced. But we have massive evidence that they do. With that said, we could do more to protect these workers and transition them. But the solution isn’t to stifle innovation.

0

0

12

Capitalism isn’t a religion because you don’t need any faith. It objectively works. Creative destruction works. We have a couple centuries of hard proof that it does. Imagine if we decided to protect buggy whips (no autos), typing pools (no PC’s), rail (no planes), etc.

“There’s no Nicene Creed of Capitalism.” Tucker instinctively, and correctly, favors allegiance to the American people over a religious adherence to an economic system. Shapiro, “Would you, Tucker Carlson, be in favor of restrictions on the ability of trucking companies to use

2

0

23

It’s weird to me that adults who lived through 2008-11 think that the economy is bad right now. It’s like they have no memory of how hard it was to get a job or a pay increase. I’m worried how people will react to the next recession like that if they can’t handle it now.

12

3

128