kirk

@OneTrueKirk

Followers

4,411

Following

1,711

Media

702

Statuses

6,699

father, garden appreciator, building @creditguild . occasional curmudgeon. Writing at

onetruekirk.eth

Joined December 2013

Don't wanna be here?

Send us removal request.

Explore trending content on Musk Viewer

billie

• 344540 Tweets

CHASING THE SUN

• 336659 Tweets

Alito

• 250036 Tweets

Scottie

• 160939 Tweets

Gabigol

• 130622 Tweets

Crockett

• 112355 Tweets

Valhalla

• 54565 Tweets

RPWP TRACKLIST

• 50218 Tweets

NCAA

• 44268 Tweets

Louisville

• 43960 Tweets

Juventus

• 43206 Tweets

#ساعه_استجابه

• 37559 Tweets

College Football 25

• 36296 Tweets

NAYEON NA ALBUM TRAILER

• 35704 Tweets

Barron

• 34873 Tweets

कन्हैया कुमार

• 28305 Tweets

ジュラシックワールド

• 28299 Tweets

Homofobia

• 25918 Tweets

أبو عبيدة

• 22692 Tweets

ابو عبيده

• 22543 Tweets

Amit Buskila

• 20443 Tweets

LOST IS COMING

• 20077 Tweets

Madden

• 19498 Tweets

Shani Louk

• 18739 Tweets

D-2 TO CHEESE

• 16737 Tweets

Tabilo

• 16737 Tweets

LMPD

• 13691 Tweets

$BASED

• 11449 Tweets

Last Seen Profiles

Pinned Tweet

Trying something new -- have you been following our work at the

@CreditGuild

but unsure about taking the plunge?

Book a one on one call to me to ask questions and discuss the protocol. Morning and evening PST slots available

0

3

11

Thiel fellowship but it's

@Tetranode

posting bounties to get Rari devs to drop out of high school

5

10

253

The

@Uniswap

v4 singleton and its new accounting model would make it easy to do protocol level MEV capture as proposed here

5

19

147

I'd like to encourage

@MakerDAO

$MKR delegates to vote YES on onboarding $FEI as collateral. It is backed by more than $1 in reserves (mostly ETH and decent. stables like $DAI itself) for every $1 circulating $FEI and represents a great revenue stream for the risk level

13

13

102

Exciting times in the lending space, lots to learn from:

@MorphoLabs

Blue/Metamorpho becoming the go-to for risk managers to operate their own pools

@LiquityProtocol

v2 interest rate prioritizing redemptions

@aave

v4 implementing a variety of modern features like per-collateral

10

17

115

@Tetranode

When an optimistic rollup is down, transactions can still be executed via L1, but then you pay L1 gas, so it is infeasible to liquidate the small accounts enabled by the rollup. Imo, need higher collateralization on rollup plus emergency shutdown mechanism if downtime is too long

6

3

88

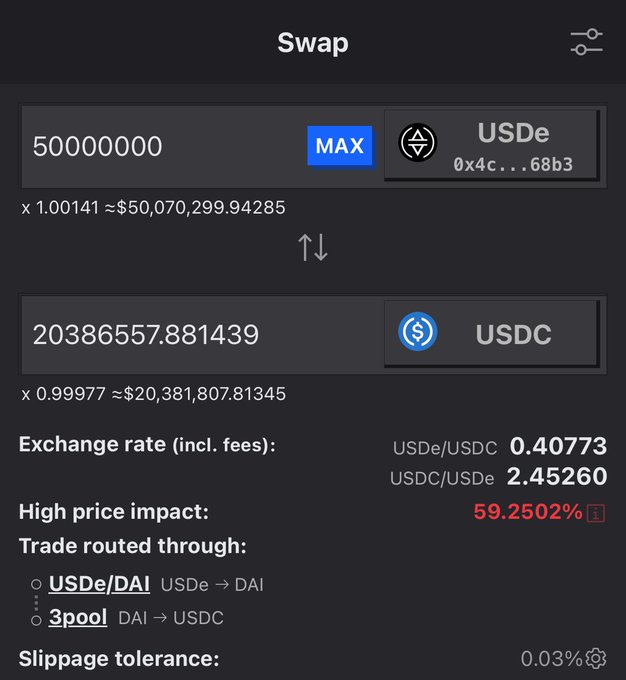

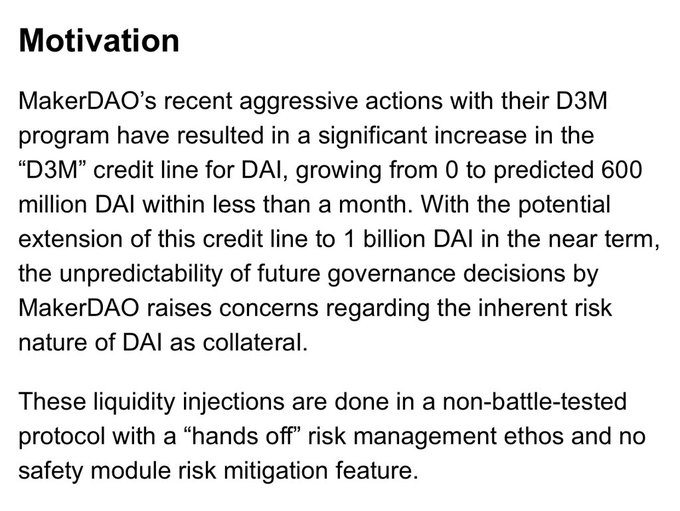

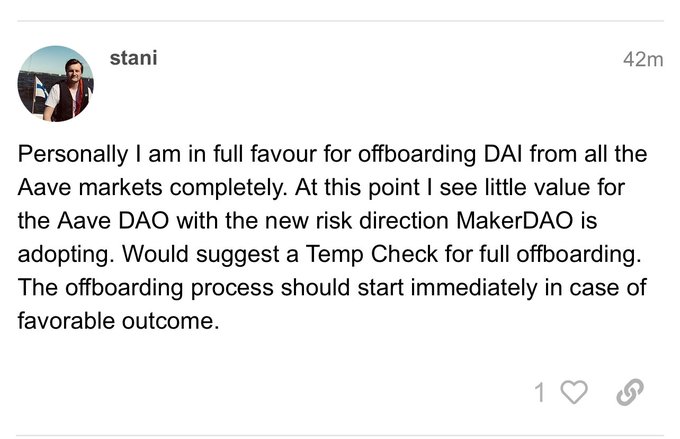

𝗪𝗵𝘆 𝗱𝗶𝗱 𝗠𝗮𝗸𝗲𝗿 𝗵𝗮𝗿𝗱𝗰𝗼𝗱𝗲 𝘁𝗵𝗲 𝘀𝗨𝗦𝗗𝗲 𝗽𝗿𝗶𝗰𝗲?

The

@sparkdotfi

-

@MorphoLabs

integration uses a hardcoded $1 price for Ethena collateral. This arrangement has been the subject of much criticism on Twitter. There are two important downsides to a fixed

10

8

83

Early August 2022:

@Elliot0x

identifies oracle attack risk in Compound, after discussion we confirm it applies to Aave as well and tell both teams

Late August 2022: Neither team wishes to take mitigation action before we publish, the report is released

3

9

80

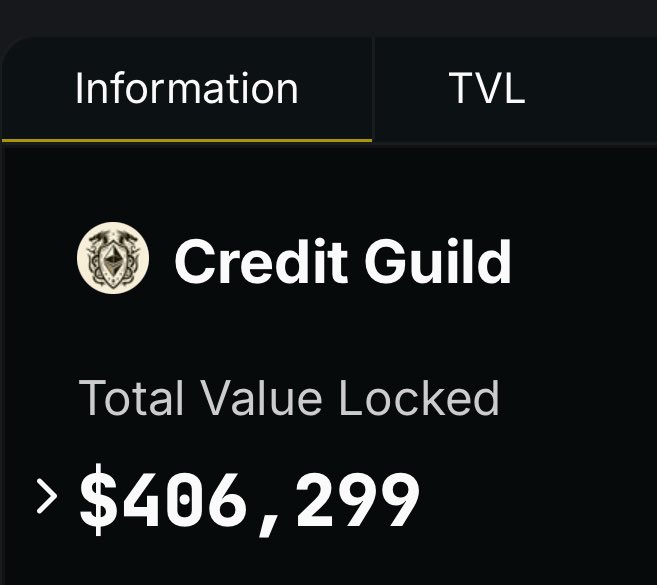

The

@CreditGuild

v1 is now LIVE on

@arbitrum

Lend USDC and WETH to earn GUILD rewards

Borrow against

@pendle_fi

@ether_fi

@KelpDAO

principal tokens,

@Rocket_Pool

rETH, ARB, wBTC, and more

Many more collateral and debt assets coming over the next weeks

The initial GUILD

13

21

76

Honored to build alongside

@hiFramework

. I was motivated to work with framework after

@0x_Osprey

, a longtime

@RariCapital

community member, joined their team, grateful for all the support so far 🙏

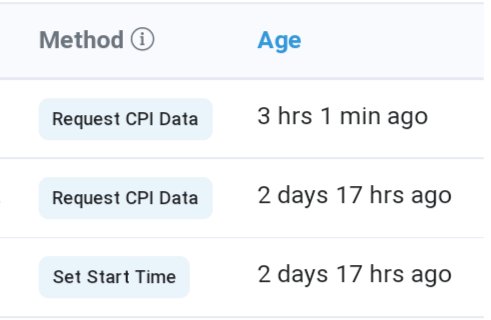

1/ We just co-led the $2 million seed round for

@VoltProtocol

, an inflation-resistant stablecoin protocol that uses CPI data pulled on-chain via

@Chainlink

.

Basically, we think Volt could give users the ability to maintain their purchasing power in inflationary times.

A 🧵👇

2

14

138

5

3

63

With the passing of FIP-96, I am honored to serve as a member of the

@feiprotocol

@VoltProtocol

@RariCapital

Tribal Council. Volt will be open to the public in a matter of days, so it feels like a good time for reflection on the journey so far and some personal introduction. 👇

2

8

63

Days like today reveal the dangers of on chain lending markets and the key importance of reserves for stablecoin issuers and other lenders. The

@feiprotocol

@RariCapital

TRIBE is deeply overcollateralized, allowing it to endure losses in lending venues.

2

5

49

Our snapshot vote has passed! Grateful to see one of the largest $TRIBE turnouts ever yet voting YES.

@voltprotocol

@feiprotocol

2

9

54

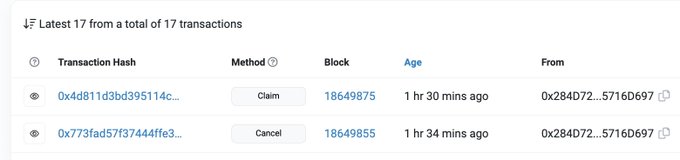

🥹🥲

Not a fast/hyped launch, but feeling a sense of gratitude and awe as users try out the

@CreditGuild

It’s both a heavy responsibility and an uplifting thrill to be in production. Thanks to all who have shared feedback and kind words

And thanks again to the llamas

5

3

50

𝗢𝗻 𝗶𝗻𝘁𝗲𝗿𝗲𝘀𝘁 𝗿𝗮𝘁𝗲𝘀 𝗶𝗻 𝗗𝗲𝗙𝗶

The most popular way to manage interest rates is based on utilization. The current interest rate is defined based on how much of the total lending supply is borrowed. This is how things work on

@aave

,

@compoundfinance

, and

4

6

49

It was

@joey__santoro

's idea to make VOLT a truly stable asset with built in protection from inflation. He made me realize that to fulfil the dream of a better money, you need not only a robust backing and governance mechanism, but to break free of any peg to fiat money

2

4

48

Heard from

@Chase

this week that they will be debanking our company. While merely an inconvenience for us, the nakedly political persecution of cryptocurrency-related businesses grinds my gears. Sharing in case others may benefit

1

3

46

During the Scottish free banking era, it was common for banks to take out newspaper ads to denounce their rivals, and even things like accumulating notes of a rival bank, then paying a bunch of people to conduct a bank run, were not unheard of

5

3

46

.

@MakerDAO

should have launched products like Gnosis Pay years ago tbh

Imagine if you could spend DAI using a credit card from mainnet and any major rollup

So much value left on the table by not investing heavily in this + top quality mobile app. I want to use sDAI via Apple

9

2

44

Debt DAO is an interesting new angle on debt financing for decentralized orgs. Working with the Olympus community has been a great experience for

@VoltProtocol

🤝 glad to see debt dao doing the same.

3

0

45

It was a stressful morning, but all

@VoltProtocol

funds are now safe. More details to be shared soon.

1

1

41

@ryanberckmans

I would advise against alarm based on draft legislation. First of all, the bill has no relevance to decentralized stablecoins which do not have issuers

2

1

36

It's high time for DeFi lending community to coordinate around migrating all gov token collateral off

@AaveAave

/

@compoundfinance

v2 and onto v3 markets or

@eulerfinance

where more appropriate security measures exist to address long tail assets

3

3

39

.

@VoltProtocol

will be live on mainnet this Friday April 22 and noon pacific time. I’ve already minted my first $VOLT, soon you can too! Below are some details on how to access the system and answers to FAQ

3

7

40

@DeFi_Cheetah

@CurveFinance

It’s the opposite innit — governance is the ONLY way they are able to make changes to the loan parameters. The current parameters of the system are not contractual terms. They have just as much permission to change them as he had to borrow

3

0

39

𝗢𝗻 𝗣𝗿𝗼𝘁𝗼𝗰𝗼𝗹 𝗢𝘄𝗻𝗲𝗱 𝗟𝗶𝗾𝘂𝗶𝗱𝗶𝘁𝘆

While I argued against buybacks, including Maker’s buyback-and-LP strategy, protocol owned liquidity is a useful common good

It allows for more stable liquidity than “renting” from yield farmers, and can be made capital

𝗔𝗴𝗮𝗶𝗻𝘀𝘁 𝗯𝘂𝘆 𝗮𝗻𝗱 𝗯𝘂𝗿𝗻

What’s the best way for protocols to distribute revenue?

The dominant models today are buy and burn vs staking for yield. We favor the latter at the

@CreditGuild

for two reasons:

1. Buy and burn favors those who wish to exit, at the

5

2

13

6

5

38

Quite the house of cards is being built with various “delta neutral” or otherwise “hedged” strategies on top of

@GMX_IO

$GLP despite the fact that like Uniswap, passive LP is structurally unprofitable

9

3

35

.

@VoltProtocol

has begun the process of deprecating support for

@arbitrum

. While we remain excited about L2 scaling, integrating support for multi-layer mint, redemption, and PCV handling was too large a burden to take on prior to completing the market governance MVP.

3

3

36

𝗖𝗿𝗲𝗱𝗶𝘁 𝗚𝘂𝗶𝗹𝗱 𝗚𝗼𝗲𝘀 𝗟𝗶𝘃𝗲 𝗔𝗽𝗿𝗶𝗹 𝟭𝟵

It’s happening… the

@CreditGuild

will go live on

@arbitrum

next Friday, April 19. Join us as we launch the first oracle free lending pool and work toward removing third-party risk from DeFi

Lenders, borrowers, stakers,

1

5

37

July 2023: myself and others speak out in an attempt to encourage the community to follow recommendations by

@chaos_labs

,

@gauntlet_xyz

et al to reduce risk

1

2

34

Deleted original tweet about

@eigenlayer

airdrop since it incorrectly stated Pendle and KelpDAO users would not get fair share of tokens, still think it is Very Bad ™️ to allow deposits from US and other jurisdictions users in the frontend, but exclude them from airdrop

1

3

34

Callable loans are the core primitive of the Ethereum Credit Guild, which will be the successor to

@VoltProtocol

. 🧵 on the how and why of oracle free lending

3

7

29

I am planning to host the first Credit Salon in NYC coinciding with

@messarimainnet

//

@ETHGlobal

New York this September. The goal is to get back to fundamentals of removing trusted third parties and bringing crypto settlement/payments into the real world. Format below 👇

7

2

32

.

@samkazemian

made a great point on spaces the other day that even “overcollateralized” stablecoin issuers actually have very thin reserves

1

0

31

@0xngmi

Same issue as UST/LUNA — you cannot achieve stability at scale with endogenous backing

Other than that the mechanism is okay and could work using something like ETH collateral, though will face the same scalability issues as other ETH backed stables

7

0

32

Correct. It is beyond obvious that

@GaryGensler

’s SEC is targeting Ethereum not for any principled reason, but simply because he “lost” on the Bitcoin ETF and needs to deliver a win to his patrons if he has any hope of continuing to advance his career in government.

Don’t

4

6

30

I chose to build alongside Joey and the Tribe after seeing them uphold a high standard of values and ship like fiends in the face of adversity. Easy to pick winners when world is up only, hard to know who to trust when SHTF. Couldn't choose better than

@joey__santoro

🤝

1

0

30

The ongoing strategic response from

@feiprotocol

@RariCapital

to recent events will serve to make the $TRIBE much more resilient to future market volatility and smart contract risk

2

7

29

Calling on

@feiprotocol

@RariCapital

$TRIBE holders to take a look at this proposal regarding and provide comment

1

7

24

My baby just mooed in response to the

@CoWSwap

moo

It’s never too early to teach them to take profit

3

1

31

Have seen some takes unfairly blaming Gauntlet for losses incurred by borrowers on Morpho Blue

Borrowers were the main losers in the depeg, and are NOT borrowing through a Gauntlet vault, but rather directly through Morpho Blue pairs that anyone can lend to or borrow from

The

2

1

29

Remembering the debates I used to have with ghostsinthecode about whether on chain yields would compress to at or below off chain yields. You were right, I was wrong! 10yr treasury yield is now twice that available to $USDC depositors on

@AaveAave

4

1

30

Two years and change ago, I quit my job to focus on solving a particular problem – governance of lending protocols was both not scalable, and not incentive aligned. The result is a model I call market governance.

1

4

28

POV: protocol is launching in <24 hours

ONE day until ̶C̶h̶r̶i̶s̶t̶m̶a̶s̶

@CreditGuild

launch on

@arbitrum

The full set of launch lending terms is linked in the next tweet. A few highlights here. Borrow ETH against

@pendle_fi

@ether_fi

@KelpDAO

August maturity principal tokens (as well as “raw” eETH)

@Rocket_Pool

2

4

13

2

0

29

@soupdefi

It IS cringe, but it’s just a one day old account posting in a public forum, not a reflection on Arbitrum team or core community

2

1

29

The critical difference between the major lending markets is not in the underlying code, but in who is able to make decisions about risk in the protocol, and the specific nature of those decisions

With

@MakerDAO

adopting Aave style lending markets (see

@sparkpool_eth

) and

@AaveAave

launching a stable coin it seems the projects are converging towards the same thing just coming from different directions.

Will there be any differences left?

32

8

134

1

3

29

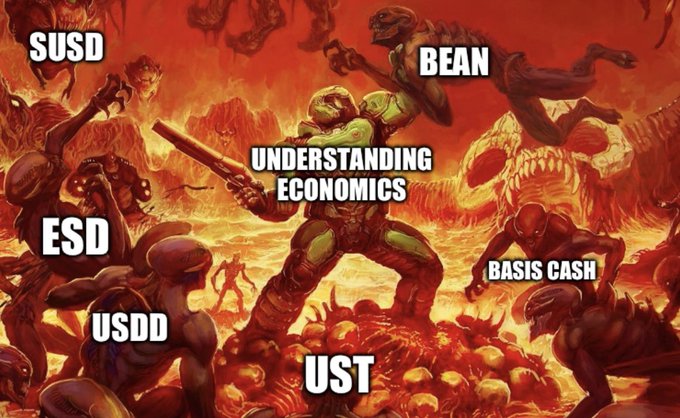

Correct

1/ Today, we are assigning an 'F' grade to the following stablecoins.

1️⃣

@synthetix_io

tokens like $sUSD and $sEUR

2️⃣ $BEAN by

@beanstalkmoney

These tokens are part of Bluechip's Red Flag List, a list of stablecoins that have triggered a red flag outlined in our framework.

6

16

81

4

4

29

🤝

@InfoTokenDAO

thank you for your support, excited to keep building together

Excited to announce

@InfoTokenDAO

's seed investment in

@VoltProtocol

Volt is forking USD to remove inflation

IT likes to invest in builders, and

@OneTrueKirk

is shipping

2

8

50

0

4

29

Soon will be possible to launch token through factory contract with known vesting and initial distribution through […], seed liquidity with

@BalancerLabs

LBP, create options market for it with

@PrimitiveFi

and spin up a

@RariCapital

Fuse pool with $VOLT or $FEI ready to go

4

2

29