Ryan Berckmans

@ryanberckmans

Followers

30K

Following

63K

Media

340

Statuses

13K

Ethereum community member and ETH investor

Joined April 2012

@mrjasonchoi For any person in the world, the goods & services accessible by them are determined by the extent of their trade network. A larger trade network increases capacity for specialization, resulting in new goods & services and making existing goods & services better and cheaper. The.

31

102

359

People are missing the important points in this Solana emergency fork situation. 1) Eth has client diversity and a protocol spec steered by a meaningful research community. The most popular eth client, geth, has at most 41% market share. Sol has one prod client (just one; don't.

am i hearing this right?. there was a zero day on solana mainnet and >70% of the validators privately colluded to upgrade and patch the critical bug before it was even made public.

49

95

757

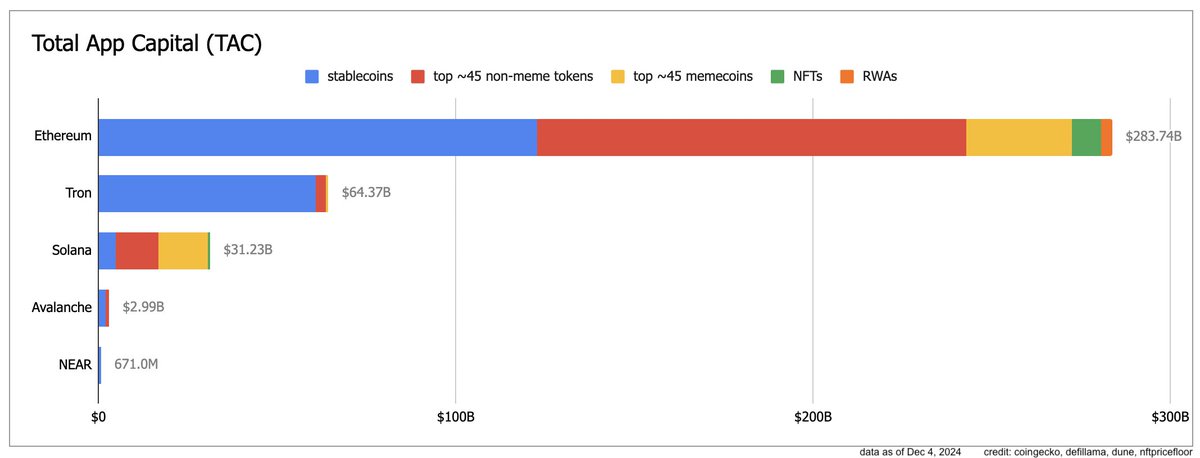

It's time for more Ethereum community leaders to directly bullpost ETH the asset, like Sandeep did here. Any project winning on Ethereum is, de facto, run by an eth community leader. For example, Tether and Circle mint more USDT and USDC on the eth L1 than on any other chain.

60

81

677

🚨PSA: Ethereum needs Coinbase to urgently prioritize deposits/withdrawals for zkSync and StarkNet🚨@brian_armstrong. It's because zk-rollups with off-chain data are how Ethereum reaches millions of users in 2022. But, rn the L2s are ahead of the onramps. Help us, Coinbase!❤️

17

98

644

I can't imagine Vitalik talking to somebody like this.

@JackNiewold @pinpals1 @scipio_nl @gametheorizing @0xHamz Curious why you focus on the shit you got rather than the shit you put out. Time to make an alt, you idiot.

106

22

624

@Ledger @P3b7_ By including a backdoor in canonical firmware upgrades for existing ledgers, you guys have betrayed your customers and mandate and displayed extreme negligence. You should have created a whole new device with different firmware or smart contract wallet.

🚨Ledger firmware v2.2.1 installs Ledger Recover, a negligent service that extracts your hardware wallet private keys and sends them over the internet. @Ledger @Ledger_Support @BTChip your only job is to avoid private key leak and you've turned this leak into a product. Insane.

6

23

542

Many people know that Solana is actually quite centralized, both operationally and in terms of L1 design. And almost everybody knows that Solana rapidly copies Ethereum's successful products and inventions, as is everyone's right. But almost nobody realizes that Solana's.

impressed by the amount of things being tried by teams on Solana that aren’t being tried anywhere else.

98

50

537

Great to see that Max has left Eth's extended core dev community. Ethereum is for everybody, and Eth has many earnest critics, but Max wasn't one of them. Max has joined Solana. He writes:.> In my first 100 days, I plan on writing a spec for as much of the Solana protocol as I.

Last week was my last week at Consensys. Today is my first day at @anza_xyz. I’m taking my talents to Solana. In my first 100 days, I plan on writing a spec for as much of the Solana protocol as I can get to, prioritizing fee markets and consensus implementations where I.

49

54

527

BTC being #1 is a massive drain on all of crypto. Today, it costs $9B/yr in new BTC buys to run Bitcoin's proof of work. And yet, Bitcoin produces ~zero usefulness vs Eth's app layer. So much money wasted. BTC dominance is unsustainable. The flippening will free the industry.

404

51

502

Dear @Ledger @Ledger_Support @BTChip . Ledger Recover was a huge project. For many people, it might be a good solution. However, the community invested in ledgers based on the firmware having no backdoor of any kind. I have a starter proposal for us to put away the pitchforks🧵.

33

82

489

@0xdavidhan @KyleSamani I respect you a great deal, so when I read your praise of Kyle's talk, I immediately watched the video. I tried to keep my feedback short but Kyle is an absolute fountain of misinformation and marketing spin, and I just kept writing, so here we go:. Kyle's sensationalist.

50

88

483

imo, the Ethereum community should be alarmed about Solana being quite competitive for payments. Everyone knows that Solana has payments far "under one second and one cent.". But fewer know about "Solana Pay", an open, decentralized high-level payments framework plus integrated.

Coinbase plans to integrate with @solana 👀. The company wants transactions on its platform “under one second and one cent.”. To do that, @coinbase will integrate Lightning on Bitcoin and “other layer-1s that are very fast, like Solana,” CEO @brian_armstrong told Decrypt.

64

60

467

Holy shit. I didn't know that Google could revoke access to Google authenticator. Who is building a self-sovereign Google authenticator competitor? I'm in.

He lost access to Google Authenticator and couldn't sign into any of his other online accounts to tell them that he had a new, non-Gmail email address. 6/.

60

47

452

The best CNBC-style TV spokesperson in Ethereum is @pythianism. Vance runs 9-figure ETH bags, has loved Ethereum for years, and crushed his recent Bloomberg interview. Let's get Vance on TV more instead of pomp.

17

35

440

Somebody forgot to tell Solana about the ~$1.6B in investment income revenue earned in Q1 2025 by the $142B in stablecoins on Ethereum. None of that was extractive MEV btw. ETH is slept on.

🚨BREAKING: @Solana generated more revenue in Q1 2025 than all other L1 & L2 chains combined. - Revenue: $819 million

38

27

373

In 2032, it'll cost 0.0017% of BTC's market cap to 51% attack it for a full day. ~~. Last week, @woonomic asked if it had been proven that Bitcoin's security budget is unsustainable. I ran some numbers. Looks like Bitcoin will end up having to abandon the 21M supply cap🧵.

69

59

345

WisdomTree, an American public company with $110 billion under management, announces a real-world asset tokenization platform on Ethereum 🚀.

Today we announced the launch of WisdomTree Connect™, a new platform unlocking tokenized real world assets (RWA) access for firms seeking integration between traditional and decentralized finance. Learn more:

9

60

356

USDT on Eth flips USDT on Tron 🎉. It was inevitable. Centralized chains like Tron are too risky to attract the kinds of apps, partners, and integrations that drive big demand for onchain capital. Eth is eating the economic world.

BREAKING: USDT on Ethereum overtook USDT on TRON. The USDT supply on @ethereum grew by ~$20 billion in the last month.

9

46

355

Alt L1s are cooked on speed/cost. So what's left for them?. Some alt L1s, like hl or Story, claim they have to be alt L1s for their tech customizations. This used to be true, but is becoming false. Ethereum L2 SDKs are gradually winning this. All that's left for alt L1s are.

Introducing the MegaETH public testnet. 20,000 tps / 1.7 gigagas/s of pure, single-threaded performance alongside 10 ms blocktimes. You will remember what real-time feels like.

32

43

363

Solana's Actions launch seems really powerful. Ethereum's strength is our intellectual honesty and network effects, so imo we should not shy away from learning from others' great consumer crypto launches. What is Solana Actions? A combination of things:.- Actions is similar to.

Today, we connect Solana to the entire internet. Vote, Donate, Mint, Swap, Pay — use Solana, everywhere.

28

57

331

1/ Here's a list of things I think may be often misunderstood or discounted about the idea that SOL may pass ETH. It won't. - ETH/USD is currently weighed down by ethereum's cost of PoW, which has the effect of overstating relative confidence in SOL (and other tokens).👇.

Great quote from a deep crypto big brain tonight "If SOL eats ETH then every single token is worth remarkably less." It really is "turtles all the way down," and there is no reason that each primitive can't be 100% altruistic, with zero rake.

12

82

324

lol, Balaji filtered out Ethereum to make Bitcoin seem #1 for daily fees. He also knows that BTC fees are an expense for holders (negative cash flow) because fees go to miners who must dump them to pay for mining. But the old honest Balaji is long gone. ETH's era will come.

Vanguard is wrong. Bitcoin does have something analogous to cash flows, namely fees. And people are currently paying $2.7M/day in fees to use Bitcoin, which is ~$1B annualized.

19

26

318