MacroDispatch

@Macrodispatch

Followers

865

Following

2K

Media

1K

Statuses

3K

Data & Charts = Bread & Butter Building The Macro Puzzle Data Point by Data Point Just following my curiosity! Formely Macrohive,The Macro Compass,StoneX

Joined February 2023

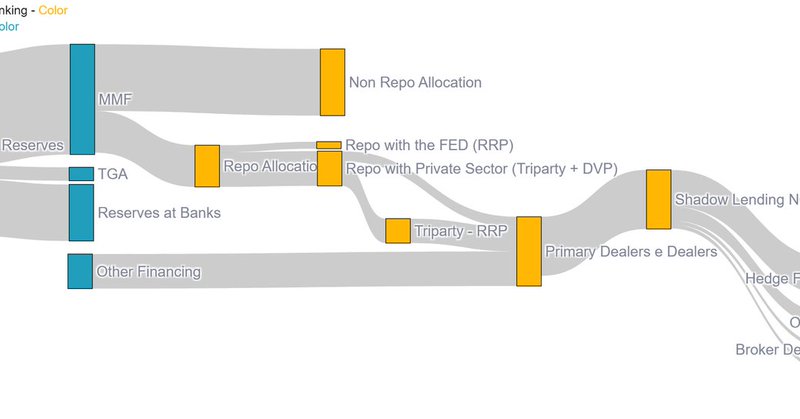

[REPO - STIR Interactive] Ever Wondered If Everything is Okey in the repo Market? Me and @Analystlearner have done a deep dive in the and came up with a @streamlit application to monitor repo on an ongoing basis Latter will published a thread and link

5

12

65

The only place where Fiscal Dominance exists is on macro podcasts I hope this helps 🙃

8

2

27

Global repricing in rates! Belly smashed everywhere! Other central banks were already at or below neutral, so it makes more sense! For the US, it seems like the neutral is being repriced higher, despite what the administration wants!!

1

28

167

SOFR volume hit an all-time record of $3.36 trillion last Friday⚡️ Meanwhile: SOFR 4.12% → +22 bps over IORB TGCR 4.08% The markets are running on fumes… and we’re only at the early stages of the process #DXY #collateral #repo

2

12

60

Great content, take a moment to listen!

As with every conversation with Jack, this one has got me thinking about many things. I will be writing some follow-up notes reflecting. Additionally— I encourage you all to bring your comments & disagreements. Gives me food for thought and investigation.

1

0

1

Looking like the new normal, the repo market vol is back.

Los 24 mil millones en el SRF son una cifra insignificante dentro de un mercado repo que mueve más de 3 trillones diarios. Además, el uso del SRF consume espacio en los balances de los dealers, los cuales están sujetos a límites regulatorios. Por este motivo y por el estigma

0

0

2

it's overseeing an operational algorithm for institutional knowledge graphs that change decision surfaces via autonomous cross-domain reasoning over hererogeneous data structures, get it straight, do you know nothing about B2B SaaS

4

1

50

Las aguas vuelven a su cauce en el mercado repo

1

1

15

The graph tells us the obvious: when Repo rates are high, more collateral goes into the Standing Repo Facility . It's good to finally know that there's a "price" for the participants to submit collateral and not institutional barriers that prevent the facility from functioning

1

6

25

The market sent $50.35 billion of securities to the SRF and $51.802 billion of cash to to the RRP Friday. Ironically, the number of securities given to the Fed about equals the amount of cash received. This was the first time the SRF functioned as designed

1

2

14

@AahanPrometheus @dampedspring @DerivativesDon @conksresearch If anything, the bid on FHLB Reserves in FED-FUNDS, finally has some movement from -7bps to -4bps Non-month-end pressure shows a slight mismatch in balance sheets due to IORB spreads; no big jump like December 2019 or the infamous 2019 + If we get to it, the Fed will intervene

0

1

3

Interesting. They've announced that QT ends next month. Beginning December, they will reinvest maturing Agencies into Bills (75% in the 1-4 months bracket). This does nothing for reserves! SR-ZQ boxes should be pressured lower! This is good for repo volatility! :)

One of those rare meetings where the Implementation Note is more interesting than the policy statement! I think reserves are indeed "somewhat above ample". The Fed 'should' pause QT, adjust the rate on SRF, and announce term repos! IOR adjustment would be boring lol.

1

9

61

The placement of REPO GC within the target range with 25 at the top and 0 at the bottom. The "new normal" could be the top of the range, or maybe a certain amount of bps above the top where participants access the SRF. Or where cash from other markets comes into the Repo market

0

2

9

If you like the visuals and want to keep an eye on them for free, just RT and access the link below. https://t.co/pUdb92XJ69

macrodispatch.com

Building Macro One Data Point at a Time!

0

0

1

But also keep in mind that, differently from 2019, we know ex-ante what the Fed's reaction function is, and it will intervene to stabilize markets. It plays its cards not to intervene, but in the end, it always does.

1

0

0

Repo is the base rate, and this does affect derivatives funding, leverage strategies,

1

0

0

What will it be conditional on: The trajectory of private rates... If we start getting 100 bps spreads over IORB, like in December 2018.

1

0

0