flip

@trevor_flipper

Followers

4K

Following

22K

Media

1K

Statuses

6K

analyzing @Delphi_Digital | ex @goasymmetric all views are my own

Joined November 2021

Imagine sitting at a poker table where your opponent gets a free last look at your cards before deciding to call or fold. That is how many on-chain exchanges operate today. @tradeparadex reimagines onchain markets from First Principles to make perps trading fair. In the

67

31

226

Can Solana finally match centralized exchanges in speed without losing its decentralization? Two new projects, @bulletxyz_ and @bulktrade, might be the ones to pull it off. --------------------------- The Problem with Solana Right Now Solana is easily one of the most active

40

7

74

After analyzing @bulletxyz_, I’m convinced its architecture is superior for delivering a high-frequency trading (HFT) execution environment compared to Solana’s current offerings. Bullet aims to be the Nasdaq onchain. How Bullet Works Bullet runs a streaming execution model:

17

14

113

@Delphi_Digital @bulktrade Ok fine I will buy delphi pro! Thank you guys for the write up 🙏

6

1

29

Can Perp DEXs match centralized exchanges in speed? @bulktrade believes it is possible. Current Solana perp DEXs are bottlenecked by L1 constraints. Prices lag 400ms behind due to block times, orderbooks display liquidity that disappears when makers decline fills, and during

30

27

182

The council says: "Tune in"

gBullet☀️ Join us this Wednesday for a live discussion with BULLET Co-Founder @Tristan0x and special guests @trevor_flipper & @fiddybps1. 🎙️ With perp DEXs are entering a new era, are CEXs finally losing the throne? We’ll discuss that and a whole lot more; October 22 at 10am

146

45

359

Imagine if @tradeparadex bought paradigm 😂 Would be a crazy call option on owning the winner in crypto options

Paradigm + Paradex putting up some serious numbers 🔥 30D Group Volume --> ~$100b (annualized $1.2T) 30D Group Revenue --> $5m (annualized $60m)

18

3

60

Gold being up 60% YTD reminds me of one of Jim Simons' early gold trades in his career:

71

473

3K

Why is no one talking about @krakenfx's position assignment system? Seems like a good system to implement before ADL Pecking order would be 1) liquidation (normal on OB) 2) insurance fund 3) position assignment system 4) ADL

6

0

15

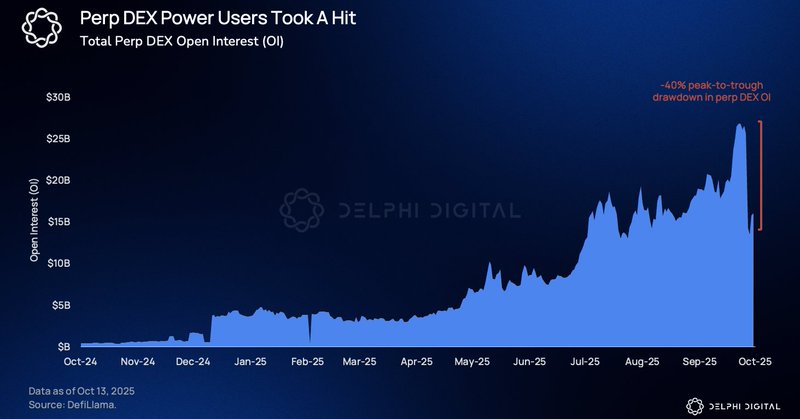

Open interest (OI) on perp DEXs has been absolutely decimated since late last week, dropping as much as 40% from peak-to-trough. Why am I pointing this out? Because OI tends to drop when interest wanes or we hit a liquidity flush, and we just saw the biggest liquidity flush ever

10

2

39

Oct 10 Crypto Massacre: Binance Edition The most important microstructure fact from the October 10th crypto massacre isn’t just “volatility was high and we had chain congestion,” it’s that the reference/pricing/quotes many desks and DEXs lean on became unreliable, exactly when

29

48

316

two things that I believe are not true about the crypto crash 1) "low-risk trading strategies shouldn't have gotten liquidated" - Running an arb trade, or a long/short trade, is NOT "low risk". It may have lower directional price risk, but it does not have low risk.

69

63

650

@RaoulGMI @Ledger Crypto assets trade like high yield bonds (70 vol, massive downside wicks with no liquidity and counterparties disappearing), yet this industry introduces leverage and exchanges as if they are stocks / commodities. Crypto is the HY bond market — prices aren’t real in most cases

3

2

54

if u still here, ur gmi, just survive, things will get better quicker than u think gn ct

35

23

598

tagging @variational_lvs as I’m sure he had some valuable opinions as well

0

0

1

While some want to write post-mortems, I don’t think that is fair at the moment because we don’t have the full picture yet. The people best positioned to explain what happened are the exchanges and the market-makers with full logs and risk books; I’ll wait for their write-ups

1

1

16