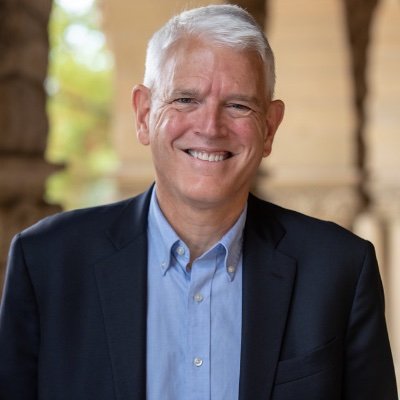

Mark Sobel

@sobel_mark

Followers

9K

Following

13K

Media

120

Statuses

2K

Former US Treasury/US rep IMF; US Chairman OMFIF; Non-Res Senior Advisor CSIS

Joined June 2018

If you believe our trade deficits have much to do with US dissaving & especially our fiscal deficits, then -- if you believe trade deficits are an emergency, which I don't -- it seems as if there may be a DOMESTIC emergency, not an international economic emergency.

0

0

1

Vlad Rashkovan, Ukraine’s IMF rep & former deputy NBU governor, joins OMFIF/me. We discuss Ukraine's current economic situation, military financing, energy & budget needs; IMF relations & program discussions; and ‘reparation’ loan. https://t.co/d6eGMVd0uh

omfif.org

Vladyslav Rashkovan, Ukraine’s representative to the International Monetary Fund and former deputy governor of the National Bank of Ukraine, joins Mark Sobel, US chair at OMFIF, to discuss the...

0

0

1

Trump/Xi Summit. A temporary pause amid decoupling & fragmentation. More tension on its way. Fundamental economic problems are not being addressed. They need a better way amid discord to speak to one another & keep a lid on pressures. https://t.co/o2ounM8SA0

omfif.org

President Donald Trump declared his summit with Xi Jinping a ‘12’ on a scale of one to 10, while fawning over Xi as a great leader. Xi seemed far more reticent and stoic.The summit presented a hefty...

0

0

2

Thanks for having consistently and rightly made this point for years. I'm sure the future will provide you with ample further opportunity to do so.

3/3 In that case, it can simply increase investment by whatever rate is needed to achieve the GDP growth target, whether or not that investment creates net value for the economy. To the extent that this requires an acceleration in the debt burden, debt becomes the constraint.

1

0

5

Argentina's central bank on Friday published data for September showing huge capital flight. Outflows eclipsed Aug. '19. Historically, these outflows never return and are lost to Argentina. This could have been prevented if the Peso were allowed to float. https://t.co/ezEGqLV3Dw

106

322

917

Outstanding commentary.

Initial big picture thoughts on the Trump-Xi meeting this past week, based on details released 1. My starting premise is that the best case scenario for U.S.-China relations is managed détente: (a) the US (a) avoids outright conflict; (b) strategically decouples from China on

0

0

2

You are just in love with Day of the Dead!

De retour du #Mexique, pays de mes ancêtres : 130 millions d’habitants qui se fraient habilement un passage entre nord et sud. Avec des équipes @cmacgm et @cevalogistics au top, nous participons activement à cette aventure ! 🇫🇷 🇲🇽

1

0

1

Powell's statement is interesting since 1) core services ex housing inflation (where tariffs have very little impact) is still running hot; 2) core goods prices (where tariffs primarily pinch) are also accelerating; 3) PCE housing is cooling but that's been widely expected.

"non-tariff inflation is not so far from 2% now." This seems more important than FOMC is giving credit for and in tension with the assessment that inflation risks are to the upside.

11

23

109

After one day, so much for position of strength. If Milei is such a free market libertarian, let the market determine the peso FX rate. Time for much greater flexibility. Keep tight macro & let peso float. US should not support an unsustainable FX rate. https://t.co/H0NToQEEvv

ft.com

Doubts return over future of Javier Milei’s controlled exchange rate policy

Milei’s victory is a great win for Argentina continuing on the path of stabilization & reform. It’s a welcome opportunity to move towards far greater exchange rate flexibility & resilience as well as rebuild reserves from a position of strength. Argentina should seize it ASAP.

3

2

27

Trump/Japanese PM meeting. BOJ to meet. US Treasury's ex-Japan Financial Attache, Japanese econ expert and my former colleague, Matt Poggi, writes about Sanaenomics -- bridging Abenomics and New Capitalism. Huge thanks to Matt.👇 https://t.co/BfwctwDCom

omfif.org

Sanae Takaichi begins her tenure as prime minister of Japan with a rare combination of political momentum and market confidence.

0

0

1

Japanese FX policy is schizoid. MOF doesn't want a weak(er) yen circa current levels as it boosts prices. But BOJ runs accommodative policies & MOF doesn't want it to lift rates b/c of higher interest bill. Thus, verbal intervention in face of fundamentals. 🫵🚫🎂➕🍴2️⃣

The yen advanced on Tuesday, outperforming its Group-of-10 peers, as markets welcomed supportive remarks from Japanese officials and cheered the outcome of a high-profile meeting between US and Japanese leaders in Tokyo

1

1

5

They will still have to find a way to liberalize the currency that minimizes damage to inflation expectations. Holders of pesos might not like it, but this is their only path to a sustainable balance of payments, and their best hope for robust long-term growth. Magical dreams and

3

7

39

Milei’s victory is a great win for Argentina continuing on the path of stabilization & reform. It’s a welcome opportunity to move towards far greater exchange rate flexibility & resilience as well as rebuild reserves from a position of strength. Argentina should seize it ASAP.

Expect a lot of the real exchange rate RER doomsday analyst to retrench and spin their message after the Milei win. Respect for those like @Brad_Setser @MaryAnastasiaOG who are sticking to their guns. My view has been that RER is only a part in a bigger picture and not the main

1

5

17

US Treasury not a hedge fund. Made $1.2 bn on GFC money market guarantee; made gtee to protect against run on $ & world fin system. Profited on Mexico 95; supported b/c high interdependence with US & avoid harm to our econ. Profits not rationale/justification for such action.

By the close of trading Monday, the US Treasury was likely ahead by about 1% to 2% on its recent purchases of the Argentine peso, according to the timing of its buying and the market’s subsequent moves

3

3

26

Europeans always tell me more Europe is urgently needed & national differences must be overcome, esp now given the Trump Administration & that American can no longer be counted on. Russia is on Ukraine’s & Europe’s doorstep. This doesn’t seem like “more Europe”!

Leaders of 26 EU countries asked the European Commission to 'present, as soon as possible, options for financial support based on an assessment of Ukraine’s financing needs' but did not formally back a loan based on Russia’s immobilised assets. https://t.co/f3VDDurU2C

0

1

10

Guess UST is just trying to get to 10/26, but it's hugely costly b/c Argies wants out cheap, courtesy of UST. I know why UST holds euros/yen. Bad enough UST taking pesos on its books, but is it also taking the FX risk? That would be height of folly/waste of taxpayer money.

The Treasury's Exchange Stabilization Fund is rapidly becoming the Peso Stabilization Fund. Big US purchases of Argentine pesos today "Traders estimate the US Treasury sold between $400 million and $500 million [dollars], which they say is its biggest intervention so far" 1/2

3

3

14

Huge thanks to Robin. His brilliant interview and writing skills almost succeed in making me sound semi-lucid and scantly interesting. Not sure why I'm worthy of gracing his FTAV pages, but I'm flattered and honored. With appreciation!

Mark used to be known as the Treasury’s international bad cop. These days I suspect quite a few of his old counterparties pine for the @sobel_mark of yore.

3

4

29

A relevant blurb below from ESF Annual Report. Query for Treasury: Is what was agreed just a $20 bn framework (a la Mexico $9 bn NAFA agreement), or has there been an actual drawing under the framework and if so what are the associated terms and conditions?

0

2

9

Absolutely spot on. The US should staunchly support taking hold of Russian assets and backing Europe as it finally at long last is moving forward on this front! https://t.co/y61i7Ns51g

project-syndicate.org

Vladyslav Rashkovan & Greg Wilson argue that the time has come to put Russian funds frozen in Western countries to good use.

2

2

9