Colin Robertson

@mortgagetruth

Followers

3,134

Following

67

Media

1,182

Statuses

13,382

Wholesale AE in early 2000s. Commentary on mortgage/real estate/housing market since 2006 @

Los Angeles, CA

Joined December 2006

Don't wanna be here?

Send us removal request.

Explore trending content on Musk Viewer

BECKY X MAYBELLINE LIVE

• 230469 Tweets

Northern Lights

• 211450 Tweets

オーロラ

• 170154 Tweets

#Auroraborealis

• 92475 Tweets

DeNA

• 61864 Tweets

#baystars

• 61443 Tweets

THE SIGN in MANILA

• 43046 Tweets

京王杯SC

• 22051 Tweets

Fulham

• 21610 Tweets

太陽フレアのせい

• 18177 Tweets

ベイスターズ

• 18129 Tweets

ハマスタ

• 17413 Tweets

バチコン

• 16802 Tweets

ウインマーベル

• 10671 Tweets

Last Seen Profiles

@thechosenberg

If you were 9 years old in 2008, you had ample time to buy up until 2021, at age 22.

10

2

123

I've found that real estate agents are very hesitant to negotiate their fee. So much so that it's often a non-starter unless you are very persistent and aggressive.

Recently asked two agent friends and they said the same.

In other words, the fee often ISN'T negotiable.

89

5

107

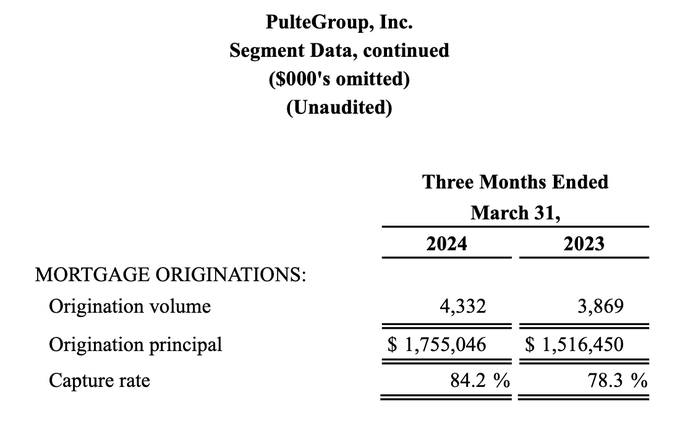

Rocket Mortgage originated $78.7 billion in mortgage loans during 2023, compared to $133B in 2022.

Volume in Q4 was $17B, down from $19B a year earlier.

Crosstown rival United Wholesale Mortgage (

@UWMlending

), which calls itself the

#1

overall mortgage lender, will report on…

18

23

99

This is crazy.

And explains why there are bills in both the U.S. House of Representatives (H.R. 4198) and the U.S. Senate (S. 3502) to amend the Fair Credit Reporting Act (FCRA).

Trigger leads have gotten out of control and credit bureaus need to do more to protect consumers.

15

11

79

@texasrunnerDFW

Isn't Chicago cheaper than Phoenix and Dallas?

Per Redfin:

Chicago median home price: $360k

Phoenix median home price: $440k

Dallas median home price: $454k

So I assume the "tipping point" was freezing temps, which arguably aren't much worse than humidity or 110F daily.

24

1

76

I'm beginning to get worried with all the doomers now backing off their housing crash predictions for 2024.

Think we're screwed now.

30

2

76

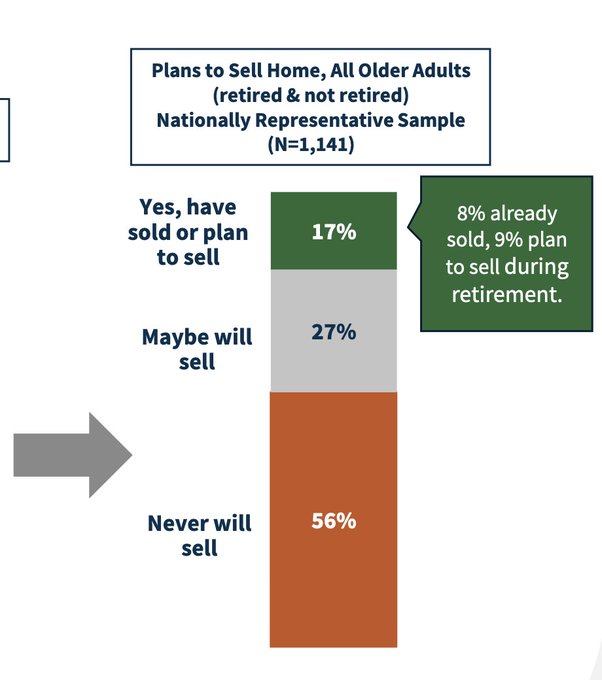

Even if they do, most will carry on b/c they can easily afford the payment w/ their 2-4% 30-yr fixed and comparable rent is often much more expensive.

And even with 40% downside many would still be above water.

A lot different than 2008 when it was often much cheaper to just…

27

1

67

@GRomePow

Non-QM lending. And with massive down payments. You could arguably worry more about the 580 score 3.5% down FHA stuff, which is much more widely available.

4

1

67

@theRealKiyosaki

If everyone is champing at the bit ready to buy when values tank, we aren’t there yet. Not even close.

4

1

60

@NipseyHoussle

I think this speaks more to American life today. Very few people get to know their neighbor, go outside, put down their phone. Nothing to do with real estate.

5

2

58

Madison, WI-based Fairway Independent Mortgage Corporation has shuttered its wholesale lending division.

Will focus entirely on retail loan origination moving forward. No longer working w/ mortgage brokers.

Fairways refers to itself as the

#2

retail mortgage lender overall.

8

6

56

@GRomePow

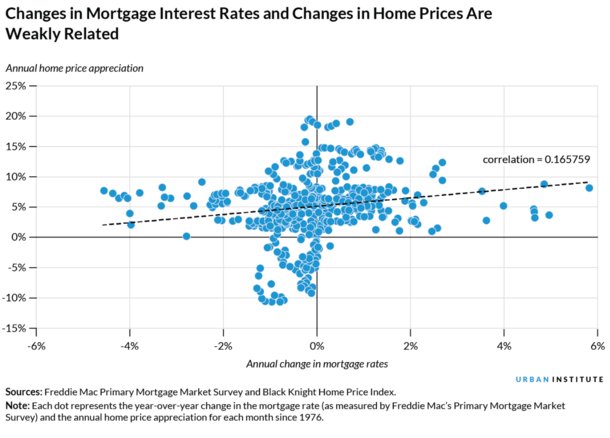

There isn't a defined negative correlation between mortgage rates and home prices.

Both have risen together.

The recent massive increase in rates obviously put pressure on home prices, but pretty soft decline considering the doubling in rates.

8

2

46

The housing bubble argument du jour is that short-term rentals (STRs) will sink the market when operators are forced to sell en masse.

When they sell, or get foreclosed on, the average Joe will also see their property value fall in price.

It's logical. More supply, especially…

@MrAwsumb

@mortgagereels

@mortgagetruth

@m3_melody

@MacroEdgeRes

This is my concern. This time they have done a similar thing with STRs, highly leveraged in many cases and based on nightly rates that are not sustainable. New STR restrictions are forcing people to sell and others will have to due to top income projections not actualized.

1

0

5

33

1

49

@ChristineDolik

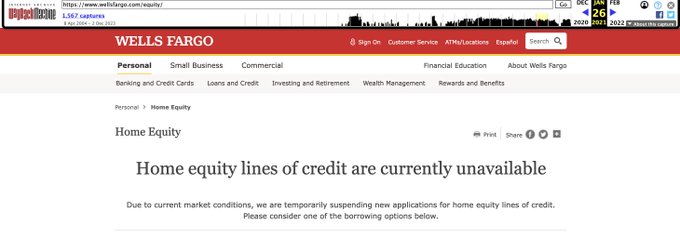

We outlawed this stuff after housing crisis in early 2000s. Canada did not get the memo.

5

2

44

Why does it matter what your neighbor paid for their home?

That’s their business. If you’re harboring resentment you need to get out and live your life more.

I’d focus more on how they are as a human rather than what their mortgage payment is.

23

3

47

@rohindhar

I never understood the cleaning fee and asking the guest to clean it before they leave.

Personally think those fees should all be built into the ABNB rate.

Imagine a hotel charging the nightly rate, resort fee, and cleaning fee. And asking you to clean before you check out.

7

0

44

Per Redfin, 38% of homeowners don’t believe they could afford to buy their own home if purchasing it today.

Even if you could afford it, WOULD you buy your home at its current value at today's mortgage rate?

29

4

43

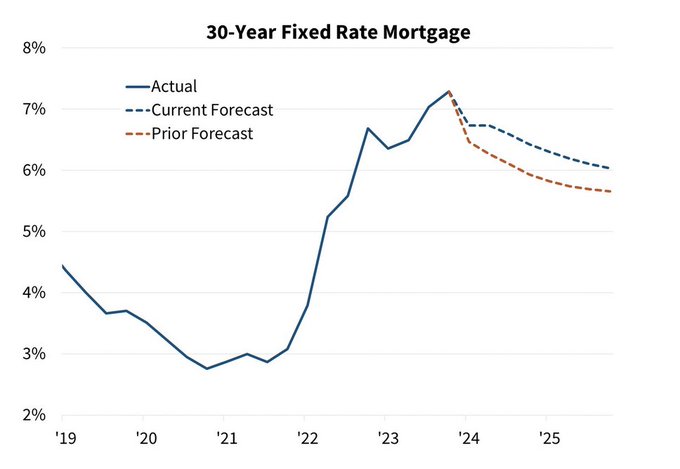

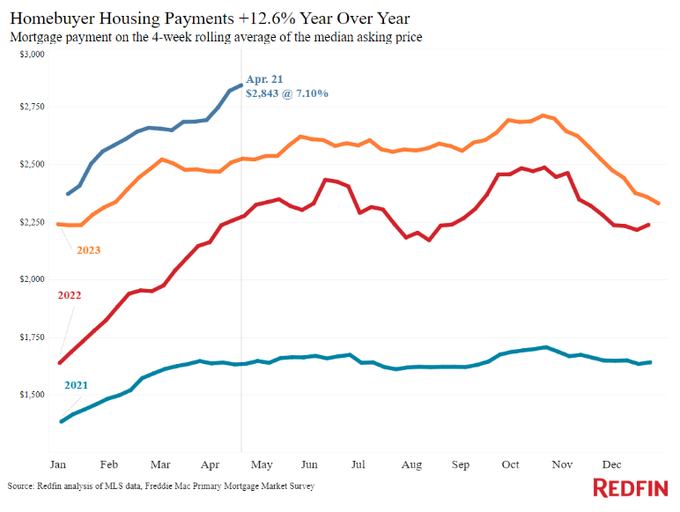

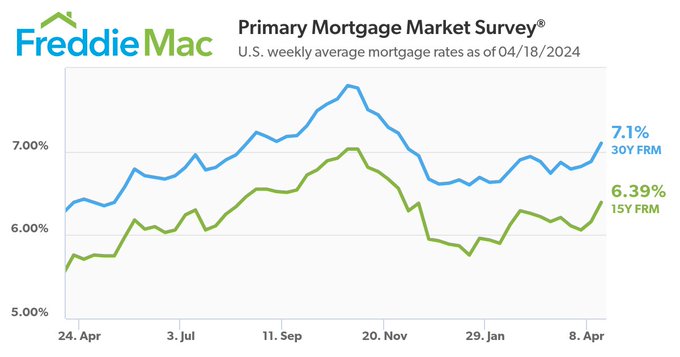

Now that mortgage rates have surged again, I'm throwing this back out there.

Are we as HIGH as we can go? Or are we going to beat that 8.64% average seen in the year 2000?

The 30-year fixed hit 8.64% during the week of May 19th, 2000, its current 21st century high, per Freddie Mac.

Will that be tested or does this mean there's light at the end of the tunnel?

#mortgagerates

4

2

15

35

4

42

@texasrunnerDFW

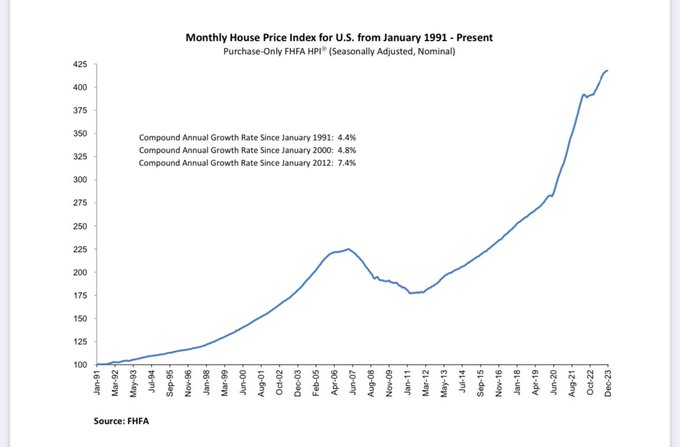

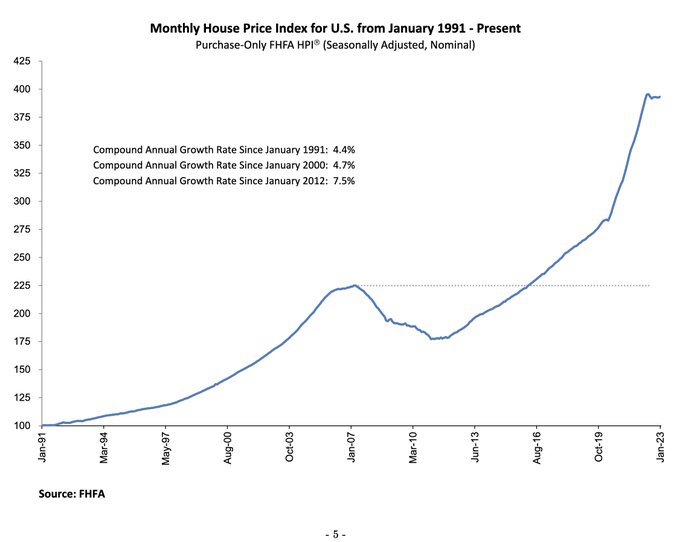

Here's the chart from the Federal Housing Finance Agency (FHFA) seasonally adjusted monthly House Price Index (HPI®) released March 28th, 2023.

4

3

41

@KobeissiLetter

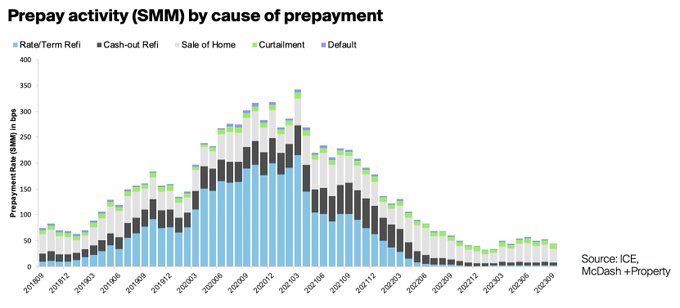

Mortgage rate lock-in is just one piece.

Underbuilding for a decade is the main factor, combined with the millions of Americans who hit peak first-time home buyer age.

Many sellers are buyers so inventory isn’t necessarily much different.

Just fewer transactions.

4

1

37

@ThinkAppraiser

The issue in early 2000s was homes were overvalued but kept selling b/c of stated income and no doc UW. Today that’s not the case so you just have much lower sales volume. It’s not to say affordability is any better, but at least you have to qualify for a mortgage these days.

9

1

39

@roblabonne

I feel like there are too many breweries now. Too much choice. Overwhelming. Lot of old stuff sitting on shelves.

And on top of that beer is kind of out right now.

1

0

33

@SacAppraiser

I don't understand why some housing pundits don't believe mortgage rate lock-in is real. It's evident in the data and in countless anecdotes.

4

0

36

@NipseyHoussle

The more you see this, the higher the odds it will eventually stop. And it won't be pretty.

0

0

33

I feel like we’re going to see another wave of mortgage layoffs/closures now that ‘higher for longer’ is setting in.

12

6

32

@KobeissiLetter

You mean buying a home today has become a luxury.

Many millions of existing homeowners in very cheap.

1

1

33

This morning, United Wholesale Mortgage (UWM), the nation's largest mortgage lender, celebrated the mortgage broker share hitting its highest point in 15 years.

UWM operates solely via the wholesale channel, yet still managed to become the

#1

mortgage lender in America with…

7

8

33

@JohnWake

Question is were they making out like bandits during the pandemic and now just doing OK. Or do they need that pumped-up revenue to survive?

7

1

32

@NipseyHoussle

In 2008 it was this same story but they had an adjustable-rate mortgage that was about to reset and negative equity of $100k.

2

0

29

@ThinkAppraiser

675? That's decidedly below average, if not bordering on bad. Might need to launch a competitor called Prime.

3

0

30

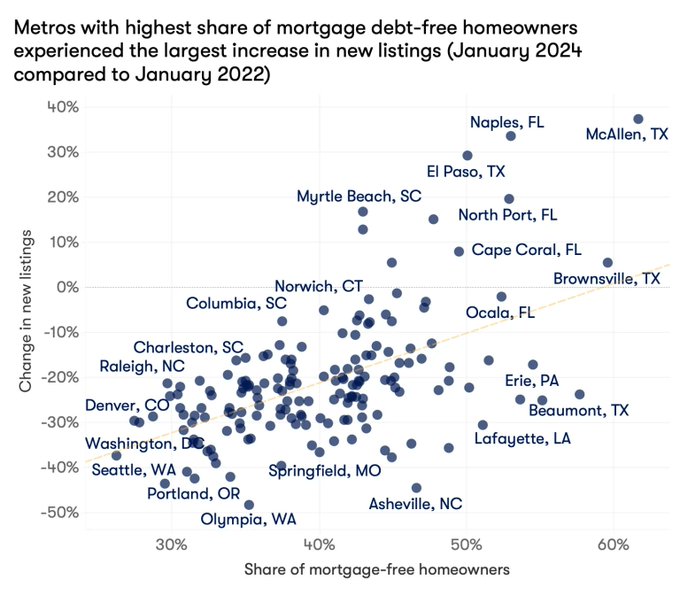

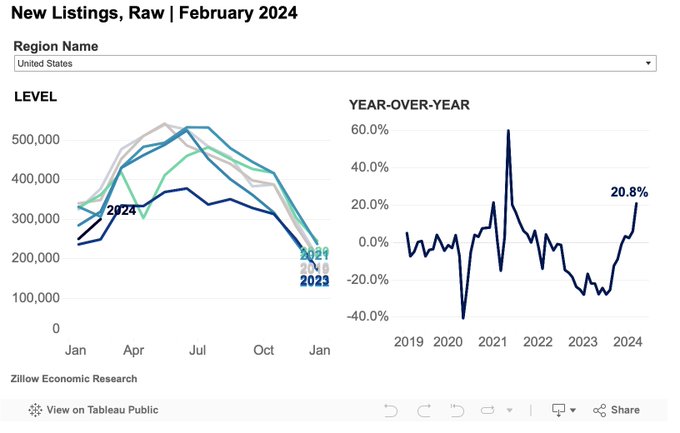

@texasrunnerDFW

This is a good thing. Inventory has been too low for too long.

With more homes on the market and lower interest rates, prices should soften and boost affordability.

3

0

29

As expected, UWM finished 2023 as the nation's top mortgage lender, and by a wide margin.

Company originated $108.3 billion in home loans during 2023, down slightly from $127.3 billion in 2022.

A whopping $93.9 billion of it was home purchase loans.

Rocket Mortgage originated $78.7 billion in mortgage loans during 2023, compared to $133B in 2022.

Volume in Q4 was $17B, down from $19B a year earlier.

Crosstown rival United Wholesale Mortgage (

@UWMlending

), which calls itself the

#1

overall mortgage lender, will report on…

18

23

99

1

5

30

A reminder that it's NEVER EASY when it comes to mortgage rates.

It looks like we're going back to a 7%+ 30-year fixed today, at least by

@mortgagenewsmnd

measure.

This time you can blame Fed chair Powell for his remarks on 60 minutes, hinting that cuts might be harder to come…

11

2

30