Michael Pento

@michaelpento

Followers

8,511

Following

139

Media

182

Statuses

356

Please note: We do not provide investment advice on Social Media Sites. If you would like to inquire about our investment services please call 732-772-9500.

Joined April 2009

Don't wanna be here?

Send us removal request.

Explore trending content on Musk Viewer

#ช้อปถูกที่Lazada66xZNN

• 150553 Tweets

Normandy

• 112170 Tweets

Uruguay

• 68700 Tweets

Yuta

• 61453 Tweets

#DDay

• 47217 Tweets

Asian Value

• 43693 Tweets

政治資金規正法

• 43369 Tweets

Jiaoqiu

• 34274 Tweets

VIRGINIA AL 9009

• 32915 Tweets

悪魔の日

• 29505 Tweets

Normandie

• 26682 Tweets

Yinlin

• 25478 Tweets

インリン

• 20025 Tweets

#HappyBINIDay

• 18829 Tweets

Bielsa

• 16957 Tweets

浜田議員

• 14842 Tweets

ラブソング

• 14706 Tweets

Last Seen Profiles

A Market Implosion In 2022 Is Inevitable | Michael Pento (PT1) via

@YouTube

Thank you

@menlobear

for another great interview!

6

12

66

We have abused our reserve currency just long enough and we are living in the environment when it's ending.

I just did an interview with

@RafiFarber

and Phil Low discussing exactly what drastic things need to happen to bring the economy back into balance and how our investment…

5

8

62

This weeks podcast is dedicated to distilling the most essential points from my interview with

@menlobear

on

@thoughtfulmoney

and expanding on how to prepare for the inevitable popping of this bubble.

There may be huge opportunities in the near future for investors if you know…

6

3

63

Thank you,

@wealthion

, for another great interview. Michael Pento: A 'Hard Landing' Recession Is Coming & It Won't Take Long... via

@YouTube

8

7

55

Market manipulation and a decade of sub 1% interest rates have created a massive asset bubble that we will need to face.

With the support from BTFP ending, weakness in the banking system could trigger another liquidity crisis.

@PalisadesRadio

2

8

44

Thank you

@DollarCollapse

for making my interview with

@maxkeiser

and

@stacyherbert

one of your Top Ten

1

10

31

The disheartening truth is that inflation and Fed policy failures have bankrupted the middle class.

@AnthonyFatseas

and I discuss the plight of the middle class, the deteriorating economic outlook and how the Fed will likely react to what might come next.…

1

5

36

The 60/40 portfolio has failed investors since 2021 with the duration bonds getting absolutely crushed.

@DunagunKaiser

and I discuss the tough position the Fed is in and the pathway of inflation on Liberty And Finance:

0

3

31

Keiser Report | War is Over, If You Want It | E1749 via

@YouTube

Thank you

@maxkeiser

for another great interview. My interview with Max is at 13:00.

5

2

29

Keiser Report | No Cure for a Gold Craze | E1627 via

@YouTube

Thank you

@maxkeiser

and

@stacyherbert

for a great debate on

#bitcoins

#BitcoinCash

#bitcoinprice

#GOLD

#goldprice

8

3

31

At the inaugural Thoughtful Money Conference, hosted by

@menlobear

, two major catalysts were discussed that could potentially propel the U.S. back into a deflationary period and bring asset prices down from historically overvalued levels.

Conference:

7

0

30

Poor Fed policy is the driver behind the growing gap between the 'Have-Nots' and 'Have Yachts'.

@GaryBohm5

and I discuss how Fed policy has seriously hurt the middle class and touch on how far away fair valuations in the markets are as a result:

4

1

27

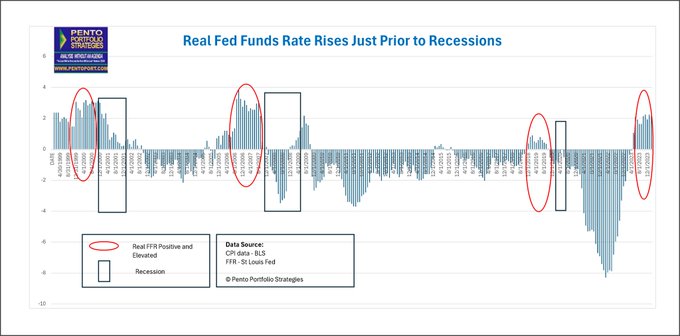

Chart of the year (E1593) — RT Keiser Report

Thank you

@maxkeiser

and

@stacyherbert

for another great interview!!

1

6

24

Thank you again -

@maxkeiser

and

@stacyherbert

for another great interview on the

@KeiserReportKeiser

Report part 2: Crybabies on Wall Street (E1451) via

@YouTube

#repo

0

4

21

Thank you

@LanceRoberts

and

@TheBubbleBubble

for a great interview where I had a chance to elaborate in detail on the unprecedented economic and market distortions that exist today. The interview should be out next week.

2

1

19

Thank you

@jessebday

for a great interview

Recessions Are the Best Time to Buy Gold 'With Both Hands': Michael Pento via

@YouTube

1

2

16

Top Ten Videos - October 11 2021 Thank you

@DollarCollapse

for including me in your top ten videos.

5

0

12

Asset Crash to WIPE OUT Investors | Michael Pento via

@YouTube

Thank you

@DunagunKaiser

for a great interview!

0

3

11

As consumers lose faith in the purchasing power of the currency and in US Sovereign Debt, we could see long term interest rates rise—not fall—if a recession takes hold this summer.

@theandymillette

and I discuss all the reasons for this here:

1

2

12

Michael Pento - Fed Policies Rocket Fuel for Gold and Silver via

@YouTube

Thank you

@DollarCollapse

for naming my interview with

@USAWatchdog

as one of your Top Ten Videos.

1

3

13

Thank you

@KerryLutz

for a great interview

The Bond Market Has Collapsed, Michael Explains What's Coming Up Next via

@YouTube

0

4

12

Mike Pence on CNBC says no evidence of inflation - maybe he doesn't know that CPI is up 1.9% y/y, PPI is up 2.2% y/y, home prices are up 48% over the past 6 years! And BTW college tuition has been growing 8x faster than wages for decades!

#MiddleClass

0

2

11

My recent article with

@x22report

The Purge Is Coming, Then A Reset Of The Currency: Michael Pento via

@YouTube

0

0

10

Thank you

@TalkMarkets

for making my commentary "Fed's Tools are Broken" Editor's Choice by the TalkMarkets editorial team

Fed’s Tools Are Broken

0

2

11

Michael Pento - Confidence in Central Banks Obliterated via

@YouTube

Thank you

@USAWatchdog

for another great interview!!

#USAWATCHDOG

#PENTO

#GREGHUNTER

0

2

10

Michael Pento - The Cure Is The Disease (Debt,Debt,Debt)

#4936

via

@YouTube

Thank you

@KerryLutz

for a great interview and

@DollarCollapse

for making this the top 10 of the week.

0

0

8