Matt H 🇺🇦

@mdharrisnyc

Followers

3,249

Following

535

Media

298

Statuses

4,360

Fintech guy to exec coach for 10+ VC backed cos. Investor 10+ fintech cos ( @trueaccord + @usesmileID + @trykarat etc) + founded @bloomcredit and @claimsetter

New York, USA

Joined November 2013

Don't wanna be here?

Send us removal request.

Explore trending content on Musk Viewer

Madrid

• 1659365 Tweets

Champions

• 711131 Tweets

Bayern

• 660763 Tweets

Joselu

• 348556 Tweets

مدريد

• 224155 Tweets

Neuer

• 172326 Tweets

Vini

• 154238 Tweets

Tuchel

• 141522 Tweets

Harry Kane

• 82551 Tweets

Luka

• 81657 Tweets

FURIA ES GRAN HERMANO

• 79017 Tweets

De Ligt

• 73404 Tweets

Uruguai

• 72604 Tweets

Steve Albini

• 65650 Tweets

Kimmich

• 55304 Tweets

Joker

• 51592 Tweets

共同親権

• 50007 Tweets

#虎に翼

• 41848 Tweets

Shai

• 38382 Tweets

Jokic

• 38124 Tweets

نوير

• 37042 Tweets

Venus

• 27594 Tweets

Shaq

• 22999 Tweets

#SalvemOCavaloDeCanoas

• 22248 Tweets

DPVAT

• 21914 Tweets

アイスクリームの日

• 20083 Tweets

Soto

• 19404 Tweets

twenty one pilots

• 17828 Tweets

Talleres

• 12579 Tweets

もちづきさん

• 10225 Tweets

Last Seen Profiles

Pinned Tweet

Getting to spend so much time working with

@tedr

in his final days was one of the great honors of my lifetime. Grateful for every moment.

2

2

35

Really excited to announce our Series A for

@bloomcredit

! We have plans to use the new funding to make new hires and build more of the infrastructure to enable inclusive consumer credit products

17

14

179

Had someone inform me today that a major card network is seeing a ~15% reduction in total usage because they are losing customers to BNPL.

It’s already happening. BNPL is eating credit.

21

14

117

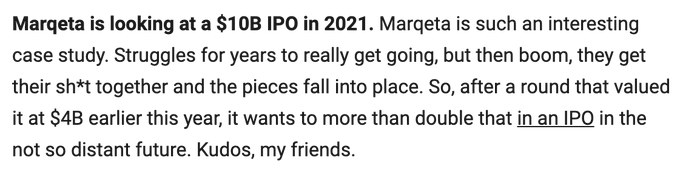

This is generally the shape of fintech infrastructure providers.

They take a fair deal of time to get going (because they are dealing with all the incumbents you don't want to)then once everything is in place they tend to take off.

Cc

@fintechtoday_

@julieverhage

@iankar_

6

5

97

Incredible how

@CommonBond

announced it was closing it’s doors this week and no one seemed to notice.

CommonBond was considered once was tapped to be a unicorn on every Fintech article.

Huge warning to neobanks - large customer base with bad economics are not valuable

14

7

73

Even after ~a decades worth of *publicly available* data on the subject I get asked about this about once a week.

If there were alt data points with such incredible signal we’d have found them already.

The best alt data you’ll ever get is that which is native to your bizmodel

11

3

66

Excited to announce a new chapter in

@bloomcredit

History! I'm stepping into a new role as Executive Chairman where I'll work with our new CEO (

@widhalm

) on bringing about a vision of making credit more accessible.

I'll still be FT. Pumped for bloom =)

3

4

52

I name dropped

@pitdesi

this week and it helped me land a super sweet apartment in Denver (where I am moving tomorrow 😎).

Are we at peak Fintech yet?

11

0

53

I've begun to think of the lack of public recognition of

@trueaccord

as one of the company's greatest assets.

Consensus fintech is not performing well. End of story. Everyone got marked up. No one became liquid from those markups.

The best fintech companies will not be sexy

6

1

52

@linasbeliunas

I think those things are important, but usually not core to a biz model.

I think the issue we're having as an industry is we've over funded a series of companies all built on the same poor business models.

Compliance likely isn't going to save these businesses.

5

2

45

Today is in fact my 29th birthday.

I was 22 when I founded bloom. It’s super crazy how time has flown.

Grateful to everyone that’s helped along the way. And even those of you who are total trolls ❤️🙏

happy birthday to my least favorite matt harris

@mdharrisnyc

on the bright side, now he’s finally old enough to be a good founder

1

1

14

11

0

48

Who do I know that could intro me to

@jack

?

I really feel that the acquisition of

@afterpay_au

could be huge for

@CashApp

customers to improve their credit standing and create a sustainable system of financial inclusion.

Would love to help if I can :)

1

8

46

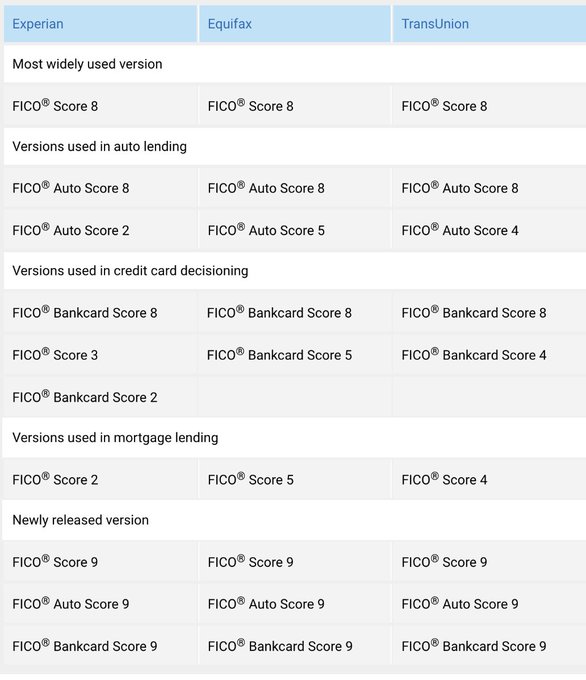

Great post on how lending works =). Was happy to contribute to this in a very small way.

Credit is tons of disciplines wrapped into one outlet. As Frank and I discussed privately, it's hard to cover everything.

If you want to learn the nuts and bolts. This is it 👇

0

6

44

If you aren’t paying attention to

@trueaccord

becoming a massive business you should be.

And if you’re still in the camp that you can’t build a technology driven and customer friendly collections based venture backable biz then idk what to tell you.

It’s clearly happening

4

9

44

Who are the best founders turned investors?

Have founders asking me for this recently and I don't have a definitive list. Would love to connect with VCs who really get the founding journey.

A few that come to mind are

@pitdesi

/

@iamjakestream

/

@maiab

Any others?

22

4

40

Yet another bloom Fintech company 🙃

Welcome to YC W22, team

@BloomAppSD

!

Bloom offers students and young professionals in East Africa US Dollar banking. By saving money in USD, they won't be subject to the volatility of their home currencies.

9

20

83

5

2

38

Really excited to announce that

@bloomcredit

has raised our Series A! We'll be using the $$ to make new hires and continue to build out our API to connect with credit bureau infrastructure to enable consumer products that support financial health.

2

3

40

I’m looking for a way to help more companies figure out their credit strategies.

Credit is really complicated and nuanced stuff. And we have the most exposure

@bloomcredit

to what works and what doesn’t.

What is the best way for us to guide other fintechs to desired outcomes?

9

4

36

We're doing a lot of hiring

@bloomcredit

! Lots more positions are going up, but wanted to get this out there.

Let me know if you, or anyone you know is interested in joining us to make access to credit data and services more accessible!

0

5

34

We're hiring for a VP of Revenue

@bloomcredit

! We have a ton of inbound demand, and are looking for a sales leader to create systems and build a team to enable us to scale and grow.

If you or anyone you know is interested... please get in touch!

1

4

34

Very quietly...

@VCMike

has had multiple portfolio companies ($OPEN, BarkBox, Color, Whoop) become unicorns this year

Given how much attention VCs generally get, the fact he remains so under the radar (by design btw) is pretty impressive.

Seed founders should speak with Mike :)

1

3

33

Today is the 4 year anniversary of

@tedr

passing away. Ted helped start

@bloomcredit

, so I think of him often.

He taught me many lessons in a short time. None more important than to reframe your purpose in terms of what you can do for others.

Miss him lots. Enjoy every day

1

0

32

I feel like it’d be a fun exercise to do a list of “critically acclaimed” Fintech companies.

@onbondstreet

,

@pinchrent

,

@final

,

@BankSimple

come to mind.

Companies where they got bought before their time but we all respect the founders and the paths they paved etc

5

1

31

@pitdesi

For those that don't know.... Sheel was also first institutional money in the biz. Grateful for all the support over the years <3.

Even if we're not cool enough to make his twitter bio 😋

1

0

31

Who would want to do some Fintech devcon karaoke tomorrow night?

@tommyrva

,

@venturedan

,

@sairarahman

,

@cokiehasiotis

,

@dionlisle

,

@shamir_k

,

@jakebruemmer

,

@lcdavis1225

?

Tag others but would love to book the karakoke bar near the conference if others are interested!

14

2

30

Multiple people have been trying to start businesses that look like

@bloomcredit

pre pivot.

Really love this model and sincerely hope people can make it work.

But also just a funny reminder everything in fintech repeats itself every 5 years.

1

1

29

One week away from

@infinicept

's ignite conference!

Super pumped to be hosting the embedded fintech panels.

Featuring...

@laurencrossett

from

@PinwheelAPI

@bolingj

from

@lithic

@shamir_k

from

@SilaMoney

@lcdavis1225

from Atomic

Ginny Chappel from

@moov

See you there!

0

7

23

The rumors are true. I did in fact turn 30 today. Which I'm sure is surprising for many of you given I've been in the fintech world since I was 19. But here we are.

Also thanks a ton

@cokiehasiotis

for giving me the best birthday yet. Truly the best partner I could ask for <3

2

0

27

Or… and this is a crazy idea but hear me out…

We keep asking all the BNPLs to report their payments so consumers can track them?

Can confirm they are all thinking of this… let’s keep asking for it :)

2

2

29

For y’all who were wondering why I no longer live in nyc this sums it up.

It’s hard for us to separate ourselves from our natural roots. Concrete jungles are not what our nervous systems naturally seek.

Simply put - I feel better in nature :). You might too.

3

0

27

For anyone that generally believes this… give me a call and see if I can’t change your mind in 10 mins 😇

Anything you likely see has “shady”behaviors almost always has a really solid and logical reasoning to it.

5

0

27

Hey friends!

I’ll be

@money2020

this year - who is around and wants to catch up.

Pumped to see y’all in person 🙏😎

9

2

28