fintechjunkie

@fintechjunkie

Followers

49,143

Following

2,046

Media

860

Statuses

13,525

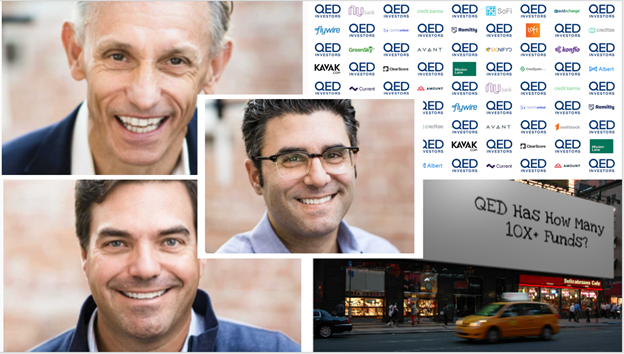

Fintech specialist. Co-Founder @QEDInvestors . 6X Forbes Midas List. I post A LOT of fintech and VC content. Following me is great. Sharing my content is better!

Virginia

Joined April 2015

Don't wanna be here?

Send us removal request.

Explore trending content on Musk Viewer

Madrid

• 1659365 Tweets

Champions

• 711131 Tweets

Bayern

• 660763 Tweets

Joselu

• 348556 Tweets

مدريد

• 224155 Tweets

Neuer

• 172326 Tweets

Vini

• 154238 Tweets

Tuchel

• 141522 Tweets

Harry Kane

• 82551 Tweets

Luka

• 81657 Tweets

FURIA ES GRAN HERMANO

• 79017 Tweets

De Ligt

• 73404 Tweets

Uruguai

• 72604 Tweets

Steve Albini

• 65650 Tweets

Kimmich

• 55304 Tweets

Joker

• 51592 Tweets

共同親権

• 50007 Tweets

#虎に翼

• 41848 Tweets

Shai

• 38382 Tweets

Jokic

• 38124 Tweets

نوير

• 37042 Tweets

Venus

• 27594 Tweets

Shaq

• 22999 Tweets

#SalvemOCavaloDeCanoas

• 22248 Tweets

DPVAT

• 21914 Tweets

アイスクリームの日

• 20083 Tweets

Soto

• 19404 Tweets

twenty one pilots

• 17828 Tweets

Talleres

• 12579 Tweets

もちづきさん

• 10225 Tweets

Last Seen Profiles

Pinned Tweet

The Three Body Problem on Netflix is amazing (the books are even better)!

Watching it reminded me that I wrote something 2 years ago with the same title about how the VC ecosystem is changing.

FWIW - Everything in the paper is coming true (and accelerating).

7

3

51

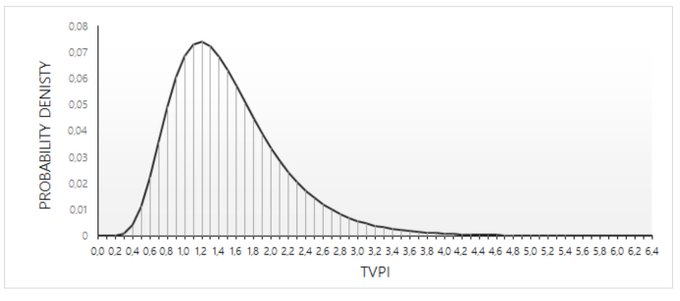

1/26: It’s hard to produce a 3X+

#VC

fund. It’s much harder to do this consistently. Our first 4 funds are mature enough to know where they’ll end up and all of them will handily beat this benchmark. I reviewed our portfolio this morning and jotted down 12 notes. Shared:

118

303

2K

1/19: I wish the 50-year old me could go back and give some “tough love” advice to the younger me. I’m not sure I would have listened, but maybe someone out there in the

#startup

ecosystem will.

Here are 8 pieces of hard earned wisdom that might serve you well:

19

115

537

1/30: Many

#Startup

CEOs struggle to redefine their own role as their company scales. I’ve been asked by startup CEOs many times: “What should my job be?” What follows is a framework I’ve used to guide various CEOs through the evolution from a “Small Team CEO” to a “Proper CEO”:

14

72

438

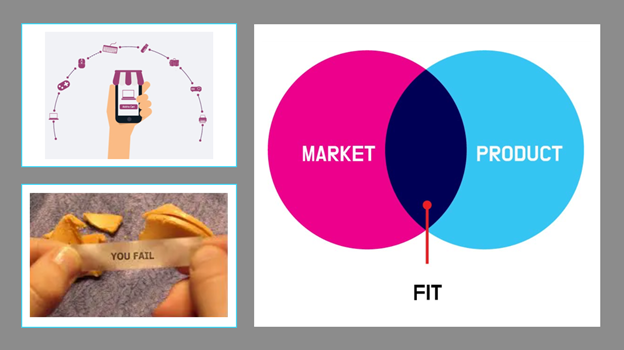

1/21: Every early stage startup pitch looks the same at a foundational level. This means that the analysis of every early stage startup also looks similar (especially true in

#venturecapital

and

#fintech

). Unpacked:

12

91

412

1/17: In honor of the

@RobinhoodApp

S-1 I thought I’d share a conversation I had a few weeks ago with a friend who used Robinhood as his on-ramp into the trading world.

Brace yourselves. It was a fun conversation but pretty eye opening in lots of ways.

31

64

386

1/17: When a

#startup

that I’m advising wants to raise money in the near future, I always ask them the question: “Are there any asterisks?” By this I mean, are there any counter-factual results that will have to be explained in diligence. This matters A LOT. A 🧵👇

19

66

337

OMG. I just got off a call with

@SyntribosStable

and my mind is blown!

Nobody is prepared for what's coming in the near, medium and long term.

Fun is coming to the

@quirkiesnft

's project in ways that the NFT space hasn't seen before. 🤯🤯🤯

55

117

259

1/32: Building a

#StartUp

business has similarities to a spacecraft crashing down on an unknown planet. I talk to Founders about this all the time. Unpacked:

6

51

288

Hey

@quirkiesnft

family. How did I do with the

#Quirklings

reveal and snipe session? And I'm far from done in case you're wondering.....

79

70

269

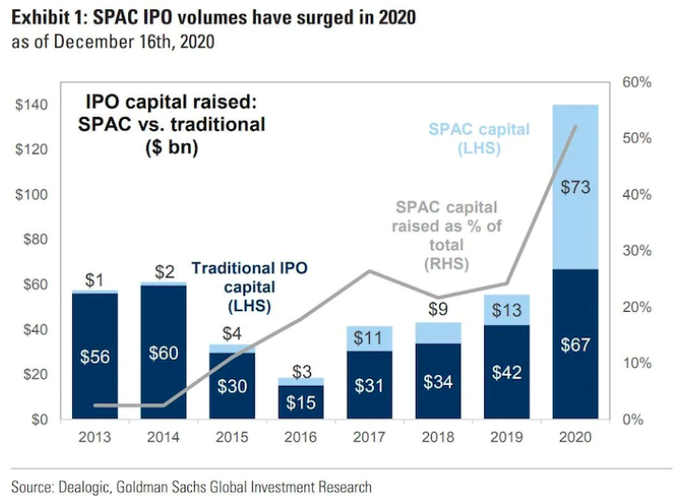

1/42: What the heck is going on with the

#fintech

ecosystem’s obsession with Neo-Banks? Do they actually make sense in the US? Traditional Bankers say “absolutely not”. I say “they can”. Unpacked:

12

48

258

1/14: I hate to be the bearer of bad news, but in the

#startup

world, if it doesn’t feel like you’re constantly running then your business is probably about to die. The same is true at highly successful bigger companies. Let’s start with an analogy:

10

49

250

I'm very proud of what we've accomplished at

@QEDInvestors

over the past 15 years but I'm even more excited about what's to come!

🚨🚨

We are humbled, fortunate and excited to share that we have closed $925 million in new funds - Fund VIII and Growth II - that will allow us to invest in the best

#fintech

companies globally.

Thanks

@business

and

@Katie_Roof

for covering our story.

12

25

176

30

10

229

I was in a

@loserclubreborn

Spaces and a speaker said something that I've heard over and over in the web3 world:

"As adults, we've been transformed into what we needed to become vs what we wanted to become.

Web3 is allowing us to believe in our dreams again."

Inspirational!

12

65

221