Trey Henninger | DIYInvesting

@TreyHenninger

Followers

10,049

Following

207

Media

851

Statuses

9,267

Host of DIY Investing Pod/ Videos: / Managed Accounts 📈 / Substack / MicroCap Investor / Focus: Quality + Value + Shareholder Friendly Management

United States

Joined April 2015

Don't wanna be here?

Send us removal request.

Explore trending content on Musk Viewer

#บางกอกคณิกาep3

• 221011 Tweets

#WeAreSeriesEP7

• 206329 Tweets

PondPhuwin WeAre EP7

• 77881 Tweets

Robert Fico

• 52866 Tweets

#Aぇヤンタン

• 49556 Tweets

サーティワン

• 43623 Tweets

Slovakia

• 41672 Tweets

バッカーノ

• 22542 Tweets

よくばりフェス

• 18556 Tweets

PIERROT

• 16712 Tweets

$MISTY

• 15355 Tweets

松本健吾

• 15326 Tweets

キダ・タローさん

• 15314 Tweets

Bコース

• 13327 Tweets

#水曜日のダウンタウン

• 12644 Tweets

トネリコ

• 12490 Tweets

スロバキア

• 11898 Tweets

Aコース

• 10393 Tweets

リリムハーロット

• 10270 Tweets

FGOフェス

• 10207 Tweets

水銀体温計

• 10005 Tweets

Last Seen Profiles

The best article about P/E ratios I’ve ever read courtesy of

@FocusedCompound

This is also likely the only article on the topic you need to read.

Wish I wrote it myself

3

39

187

$GEOFF from

@FocusedCompound

has a great piece on whether to use: Cash Flow or Earnings or Asset Value.

Do you own a:

1. Snowball? (Earnings valuation)

2. Waterfall? (Cash flow valuation)

3. Rock? (Asset valuation)

I only want to buy and value snowballs

5

8

77

Congratulations to Dan Schum

@NoNameStocks

on a 4.5 year 100-bagger with

#HemaCare

Corporation $HEMA

From $0.25 in 2015 to $25.40 buyout yesterday

I had the privilege to talk with Dan about his experience with $HEMA yesterday on my podcast.

Tune in to Episode 56 on Dec. 29th

5

5

79

I’m excited to have been accepted as a proud new member of

@MicroCapClub

Thank you to everyone for your support and encouragement over the past couple years!

I hope to continue to constantly improve as an investor!

Just submitted my second application to join

@MicroCapClub

Hopefully second time is the charm!

4

0

31

20

0

77

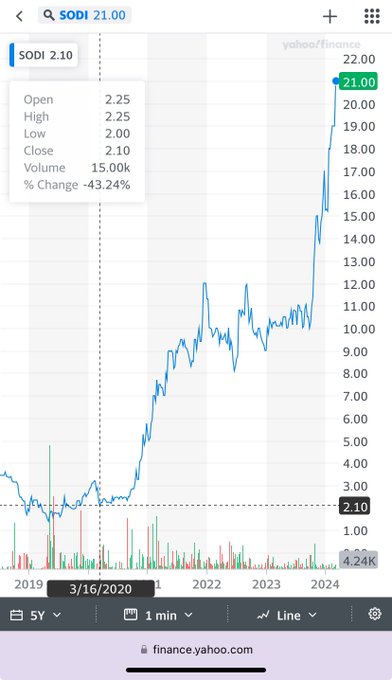

@FocusedCompound

$SODI

Defense company produces small critical components as a small cost to large expensive equipment

Trades at ~7x earnings power

Growing revenue at double digits

Accretive acquisition at 5x earnings

Massive operating leverage

Expect reported earnings to 🚀 next 12 months

2

2

76

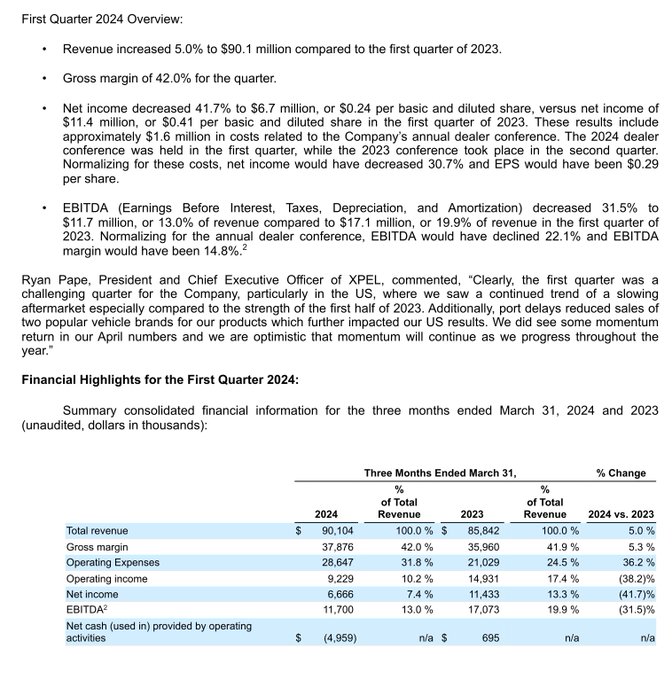

I think $XPEL is a good example of how paying high PE multiples for fast growing stocks can be dangerous.

Here you have a company that is still guiding for 8-10% growth, but lost a third of its market cap because it's no longer double digit growth.

12

6

70

If $TSLA stock hits $570, Elon Musk will be margin called on his Twitter purchase loan.

If that occurs, he'll have two business days to either pay the entire $12.5 billion margin loan, post $3.57 billion USD in CASH, or sell his $TSLAQ collateral shares

6

28

62

@quantian1

My best guess is that *IF* it is true, we'd still probably not put lead back in everything.

Subsequent research would be about replicating the effect with different elements via substitution in a way that has less environmental impacts.

The key is the pressure replication via…

1

1

65

1/

Grab a Latte.

It's time for rebuttal thread on investing vs speculation!

@10kdiver

style!

2

11

54

Re: Elon Musk's margin call trigger point, it is important to recognize this is a moving target.

The margin call will occur 43% below the $TSLA stock price on the day of funding for the $TWTR acquisition.

Based on today's close of $876, trigger = $499

@TreyHenninger

Could you please update your analysis based on today’s close of 876? Is the number for default still 570 (since Elon would now be pledging more shares to put up $62.5B)?

0

0

4

6

6

46

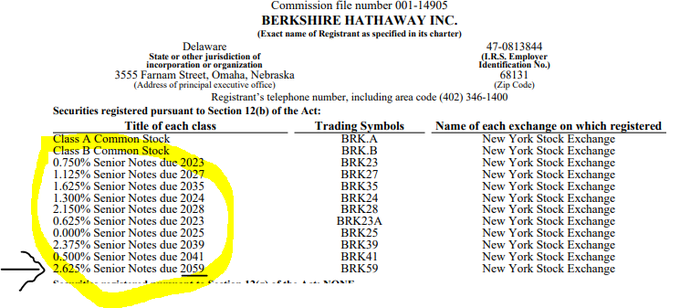

I really should just buy $OTCM one of these days.

Quasi monopolies are the way to go

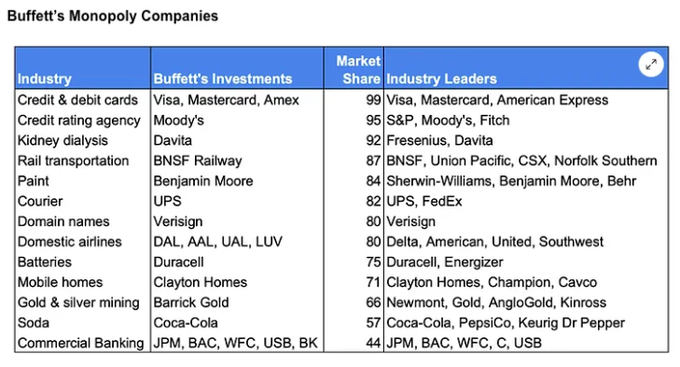

Investing in (quasi) monopolies can be very interesting as they often have a huge economic moat.

Here you can find Buffett's monopoly investments:

H/T

@MT_Capital1

11

95

494

5

5

47

@nolen1wh

It’s a moving target based on the closing stock price the day of funding. That would determine the number of shares in the collateral account.

I based it on a stock price of $1,000 (as it was at the time) and a 43% loss puts it at $570.

0

0

46

Who are the investors that you automatically read everything they write?

I'll start:

@NoNameStocks

@ElementaryValue

@FocusedCompound

8

5

42

This is so true.

In March, I sold my smallest position at an 80% loss. It was 1% or less of my portfolio at that point.

Yet, it was at 80% mind share of my thoughts. Cutting it loose allowed me to focus on identifying and buying a new winner.

That winner is up 73% since March

4

3

41

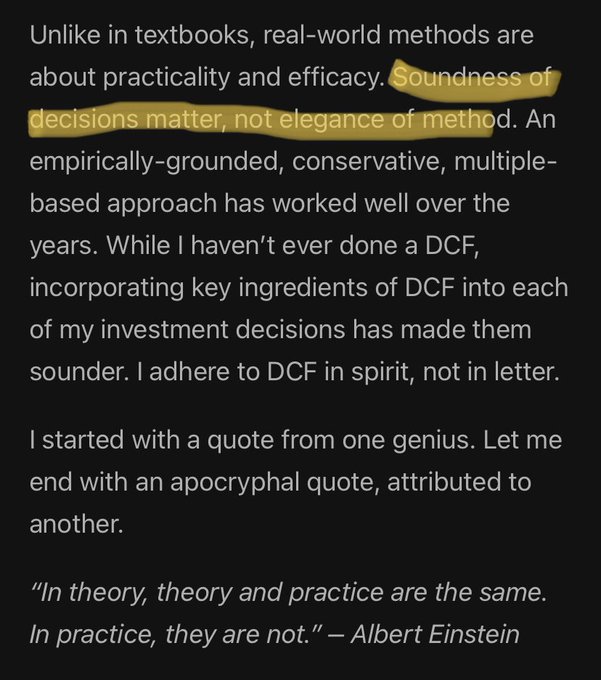

Numerous great lessons from

@TSOH_Investing

in this article on his investing strategy.

Highly recommend reading

1

7

40

New 🎙️ Episode:

Dan Schum Interview: HemaCare 100-Bagger in 4.5 years

@NoNameStocks

$HEMA

2015: Buy $HEMA at $0.25

2019: $HEMA sold $25.40

Listen online:

Apple 🎙️

Spotify:

YouTube:

2

6

36

1/ Today, I am excited to share my stock thesis on Solitron Devices $SODI

Solitron Devices was the stock that I profiled in my accepted

@MicroCapClub

application back in November. To comply with forum rules, I have delayed sharing for a couple months.

2

4

38

I read all of

@hussmanjp

market comments because of his clarity of thought, but this is one of his best.

This article should be a reference for investors seeking First Principles for Investing and Economics.

3

4

37

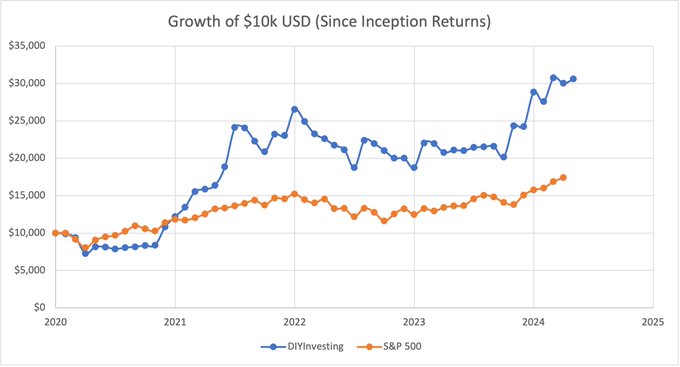

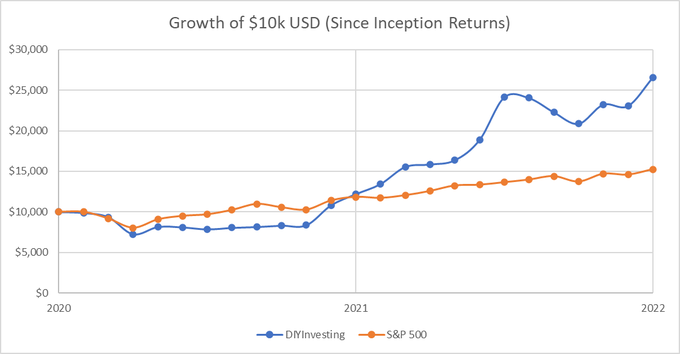

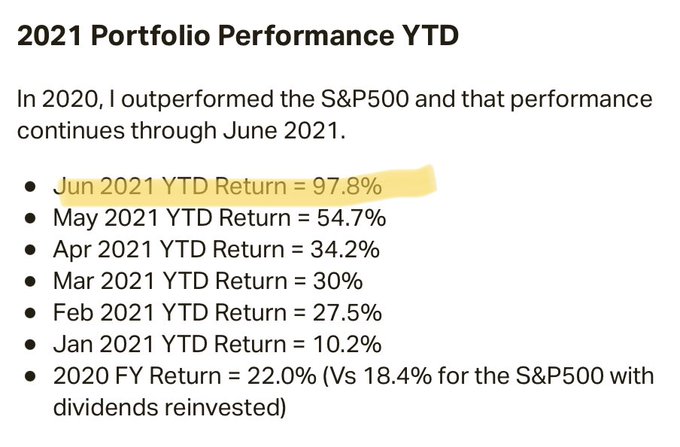

If a 9-year CAGR of 40%+ implies "luck" not "skill"...

I would be perfectly happy if I only end up "lucky"

@praxisprocess

Because it doesn’t mean he’s an investing genius like it’d imply on paper, he just got lucky for a fairly long period investing in the most inefficient part of the U.S. public markets.

3

0

0

8

4

33

I begin a new series profiling every company in the S&P 500 with a 5-minute Snap Judgement YouTube video.

We're going in alphabetical order, so first up: 3M Company $MMM

This style was inspired by $GEOFF and Andrew

@FocusedCompound

.

4

1

30

🎙️Interview with Geoff Gannon (

@FocusedCompound

)

Concentrated investing in overlooked stocks

Example Stock: NACCO $NC up 90% YTD

Also: $KARE.AT $NKR $TRUX $VLGEA $ATVI

Website:

YouTube:

Apple🎙️

1

7

33

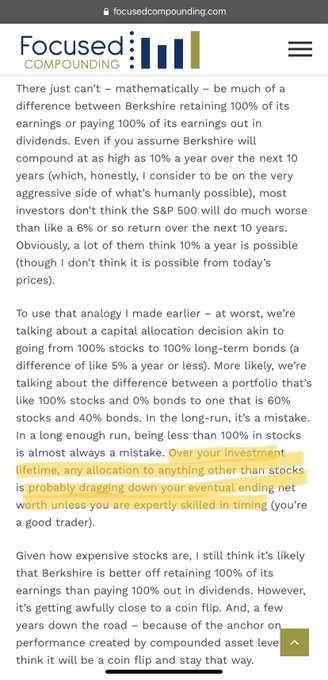

This argument by

@FocusedCompound

shows why I refuse to own bonds.

100% stocks is a huge long term advantage.

The same argument can be made even for investing in less than your best ideas. Certain arbitrage or other hedges

7

8

31

@artofinvestmnt

Thank you.

It’s a fascinating set of margin loan terms. This is the largest acquisition by an individual in history, so I thought it would be worth a study.

This could really blow up poorly if not turned around and Tesla stock crashes.

2

1

30

Just submitted my second application to join

@MicroCapClub

Hopefully second time is the charm!

4

0

31