Noah

@TraderNoah

Followers

6K

Following

8K

Media

509

Statuses

2K

So many futarchies

Announcing the first cohort of permissionless launches: @Paystreamlabs - Cheaper loans. Higher returns. Zero idle liquidity. @loyal_hq - Building permissionless, trustless decentralized intelligence. @ZKLSOL - Leveraged privacy. Stay private while generating yield. Stay tuned.

3

0

7

I hear @JamesChristoph_ is giving free financial advice

Having @TraderNoah and @JamesChristoph_ on the livestream today (11am ET) excited to get both of their thoughts on the Gemini IPO /boccaccio_mode

0

0

12

Let’s make it a September to remember! Introducing the next ICO: @AviciMoney - better than a bank, smarter than your wallet. Stay tuned. More details soon.

26

16

133

there are no jobs so naturally we should see asset prices go up because that means rate cuts because the economy sans upper class is fucked and this is good because then people can spend more indiscriminately and inflation can be driven by a small subset of citizens who benefit

9

2

62

g(dp)m Forging Digital Nation States: The @Karak_Network Foundation Unveils $GDP Full announcement: https://t.co/ADAcBuYYbf Long human civilization. Long global $GDP.

0

0

8

Too many smoking duck posts on the timeline these days, too few thoughtful analyses. Main things I see on twitter 1. Knowledgeable people making disingenuous statements 2. Unknowledgeable People making unintelligent statements 3. AI slop comments

1

0

10

Putting aside regulatory/legal, projects are probably better off running ATM sales on CEX/DEX vs. engaging in discounted token deals with short-term oriented funds. Money is left on the table with raises at large discounts and it takes time to raise capital.

0

0

5

airdrops staking yield capped supply buy back & burns deflationary tokens all examples of thinly veiled financial engineering. we’re told it’s innovation yet none of it stops our bags from slowly bleeding to hades we watch as founders spend more time designing flywheels than

9

1

29

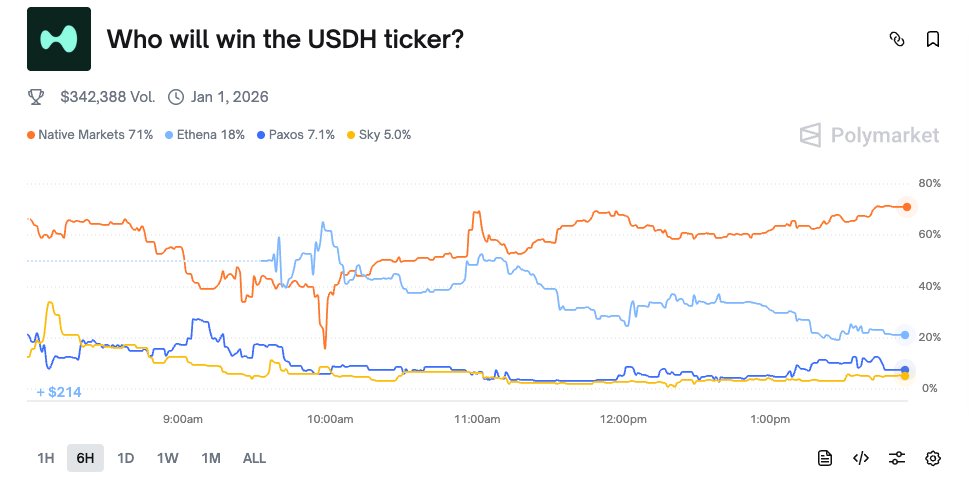

Do we really think Native Markets team would have the roster that it does without having certainty of moving forward? Nothing wrong with it, this is just how governance works

3

0

16

Starting to feel like the USDH RFP was a bit of a farce. Hearing from multiple bidders that none of the validators are interested in considering anyone besides Native Markets. It's not even a serious discussion, as though there was a backroom deal already done. Native Markets'

261

64

825

It's here. Onchain auctions are live on Solana. The Genesis protocol now includes Uniform Price Auctions: a fair way to launch tokens. Auctions allow for onchain price discovery while completely removing front-runners & snipers. Auctions explained 👇 (1/4)

103

38

287

We’re excited to announce the next ICO: @UmbraPrivacy! Umbra is the incognito mode for Solana. Stay tuned, full details will be revealed soon…

117

73

430

As crypto matures, projects are growing up with it by leveling up their internal operating practices They’re scaling from startup to something closer to a growth-stage company. That means figuring out how to run your internal org (who does what and who reports to who?)

12

5

46

I took profit on this a while ago (Q4 2024), but think it's worth looking at because I think its indicative of broader brokerage valuations at the moment. IBKR went from 15x->29x ntm earnings, and has materially grown userbase and equity per account. While IBKR will continue to

IBKR trades at 15x forward earnings while the government is printing casino chips and indices sit right at ATHs If market goes down, IBKR probably mildly outperfoms. If market goes up...

1

0

8

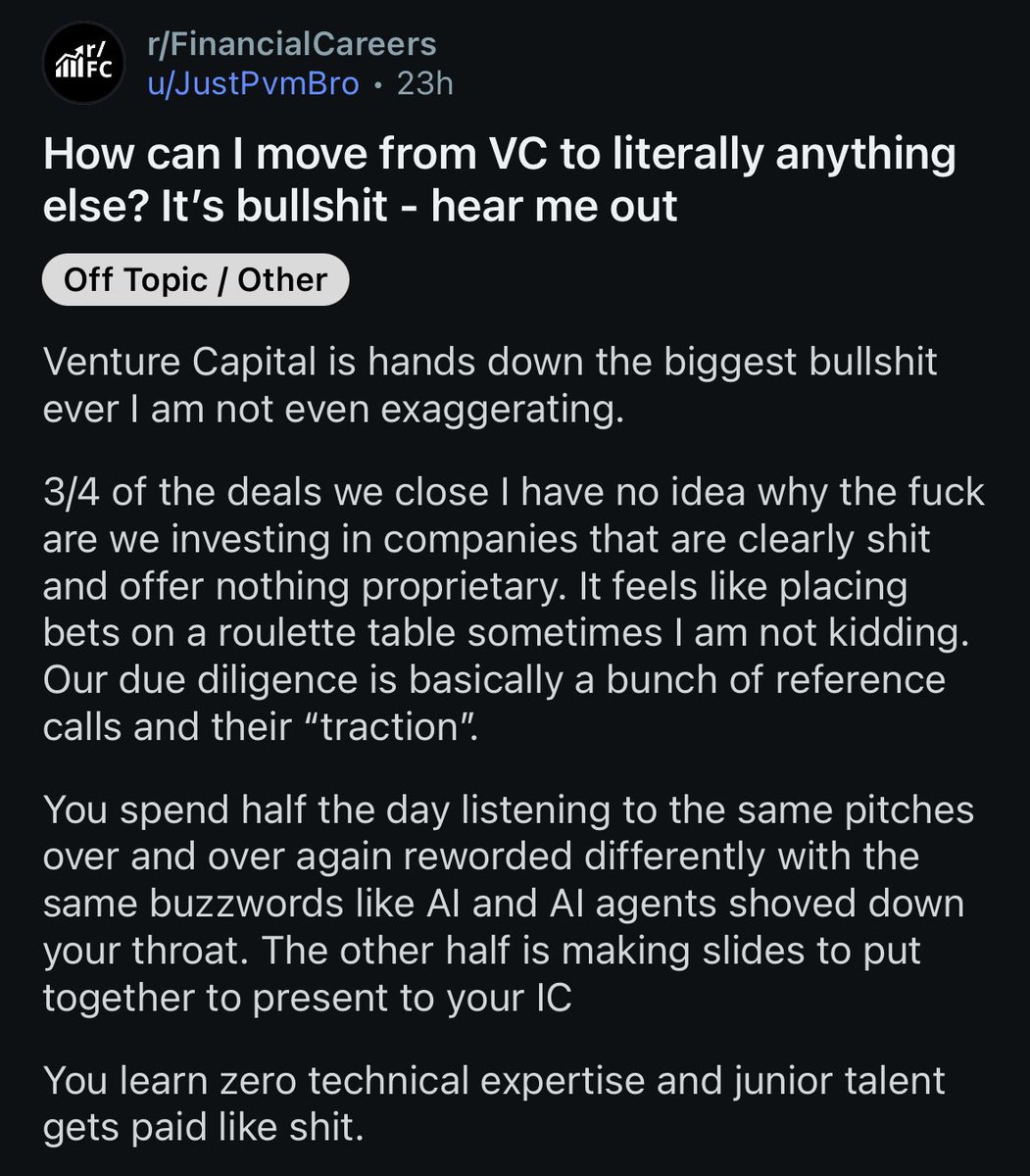

VC is not a viable place to start a career because the relevant attributes of successful VCs are experience and network.

I personally view venture capital as one of the worst paths you can go down within your early finance career Very little technical skillset required, and the game is purely based on relationships Once you are senior, had a successful exit as a founder or built up relationships

4

0

24

equities are the divine asset class and 99% of good tokenomics will converge to approximating equity-like upside

17

4

77