Peter Berezin

@PeterBerezinBCA

Followers

13,043

Following

346

Media

452

Statuses

865

Chief Global Strategist and Director of Research @bcaresearch Formerly with Goldman Sachs & IMF

Hilbert space

Joined March 2017

Don't wanna be here?

Send us removal request.

Explore trending content on Musk Viewer

Galatasaray

• 110407 Tweets

Al Jazeera

• 102114 Tweets

Bernard Hill

• 86079 Tweets

Vlad

• 82440 Tweets

#GSvSVS

• 71298 Tweets

Spurs

• 66354 Tweets

Tottenham

• 62816 Tweets

West Ham

• 60174 Tweets

سعد اللذيذ

• 48917 Tweets

Theoden

• 44784 Tweets

Happy Cinco de Mayo

• 31198 Tweets

Ziyech

• 28038 Tweets

Mertens

• 26534 Tweets

Cavs

• 26258 Tweets

Anfield

• 19676 Tweets

Sivas

• 19069 Tweets

#محمد_عبده

• 18557 Tweets

Garland

• 18277 Tweets

Tim Scott

• 17319 Tweets

Paolo

• 17232 Tweets

LOSE MY BREATH MV TEASER 2

• 15482 Tweets

Emerson

• 14941 Tweets

Gakpo

• 13715 Tweets

Bülent Uygun

• 11254 Tweets

توتنهام

• 10122 Tweets

Last Seen Profiles

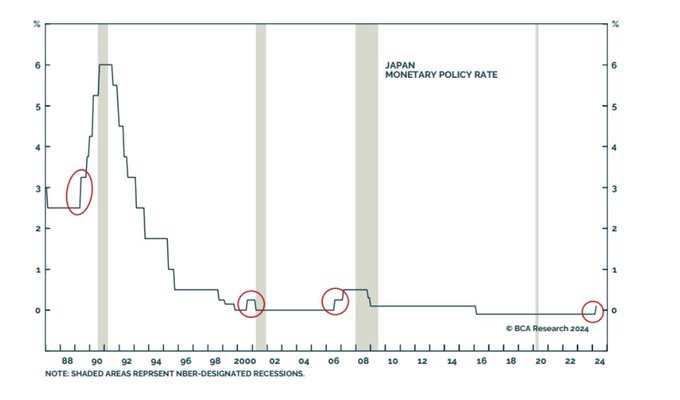

I’m always surprised which tweets gain traction and which do not. I wrote this tongue in cheek. Obviously, there’s no causal link between Japan raising rates by 25 bps and the rest of the global economy going down in flames. It’s just that Japan has a habit of hiking rates…

4

44

183

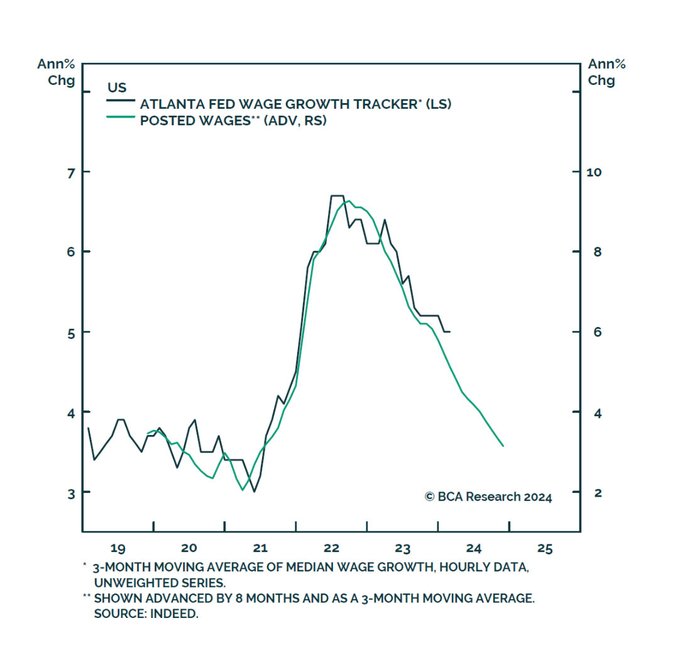

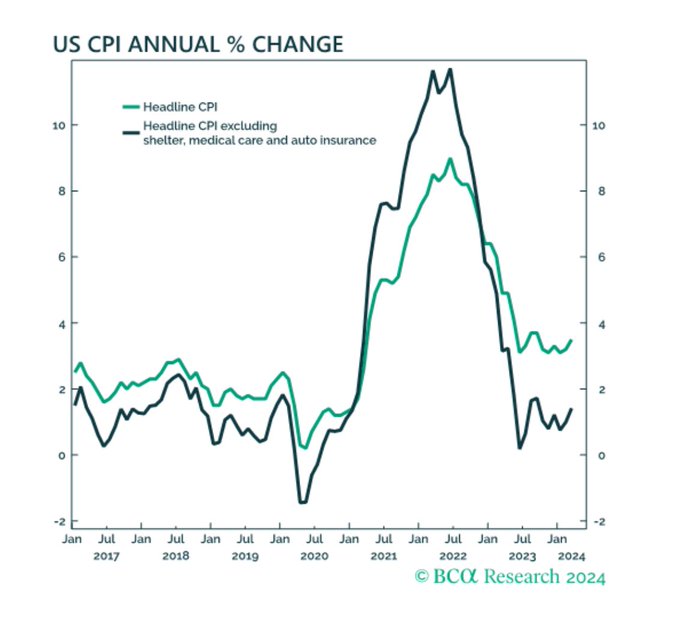

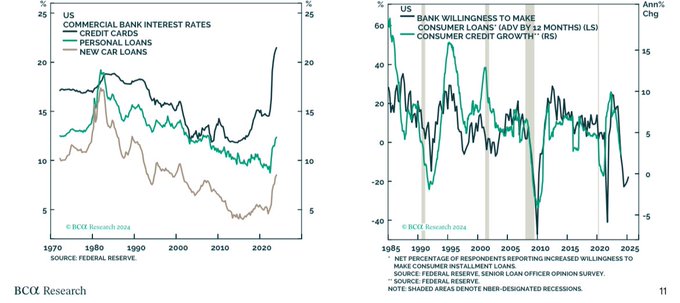

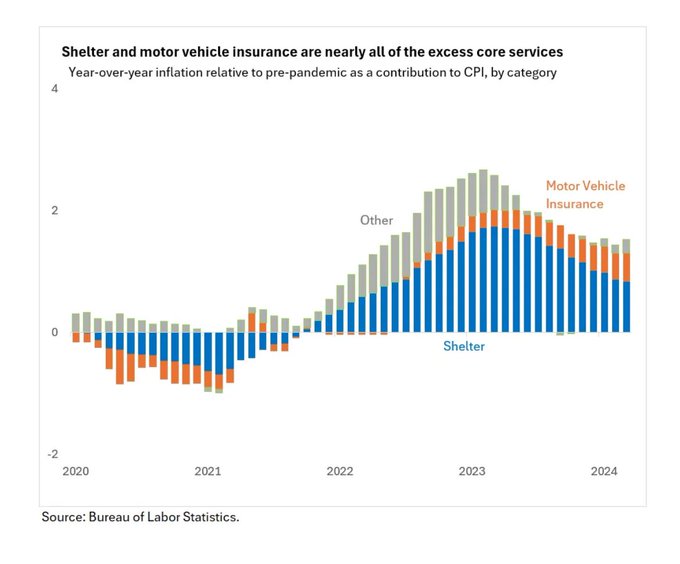

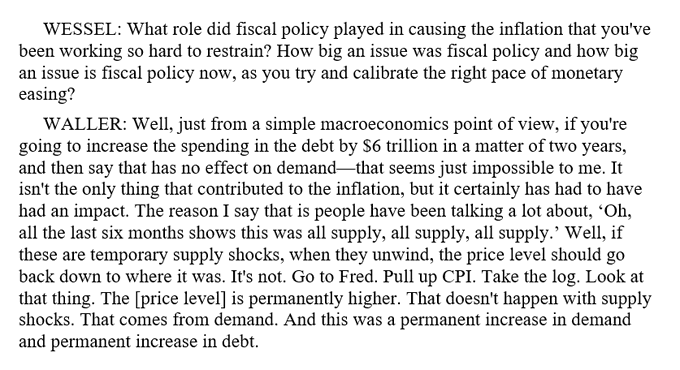

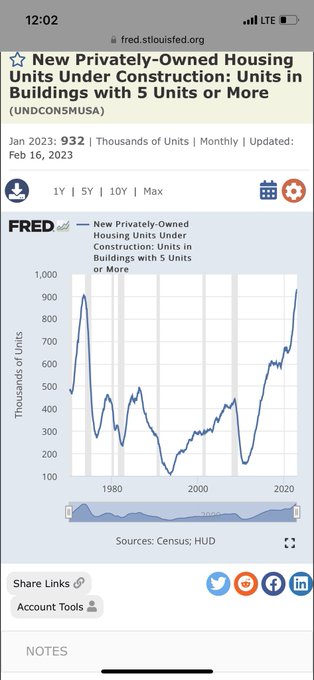

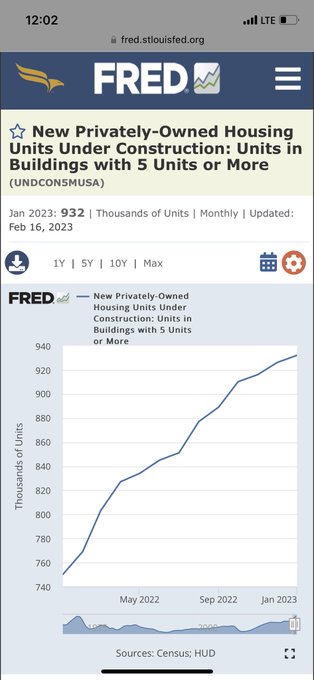

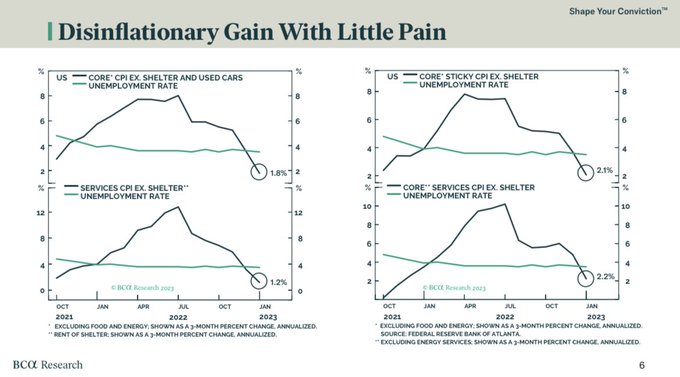

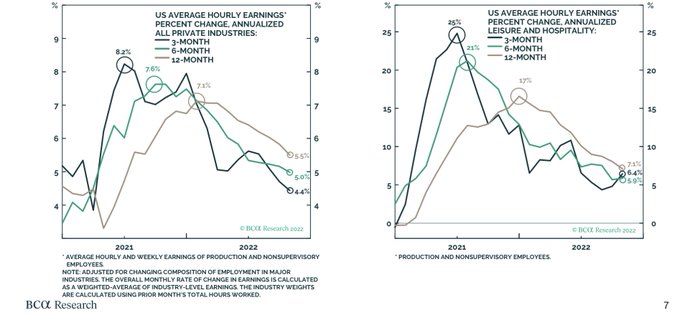

Good point from

@Claudia_Sahm

. The increase in core services inflation has been very narrow — concentrated in housing and auto insurance. Very different from what we saw in 2022.

8

44

182

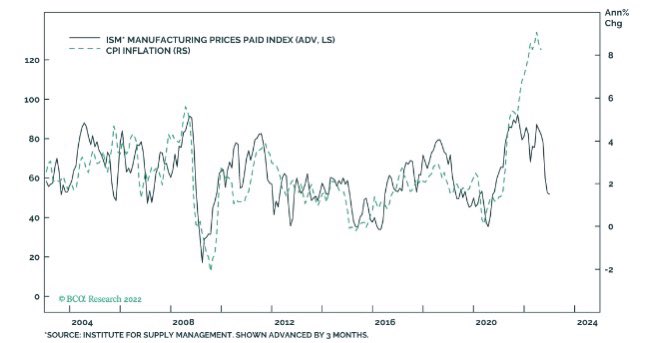

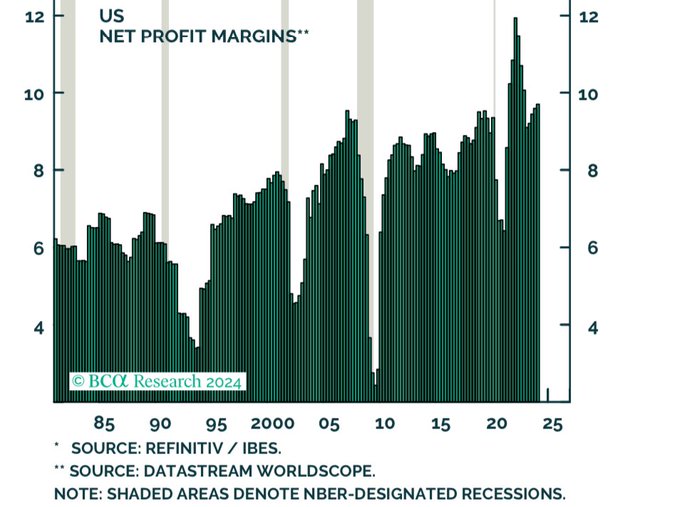

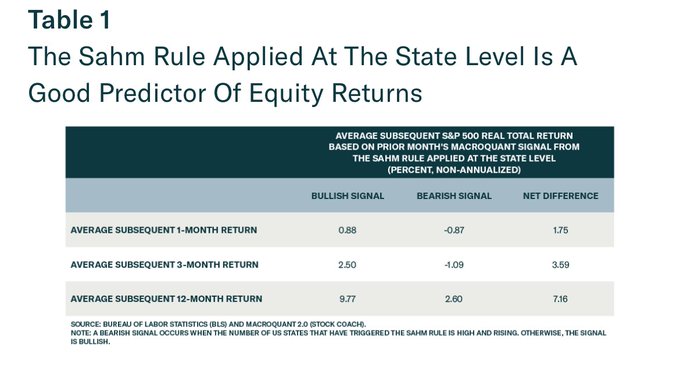

If the surge in inflation during the pandemic was entirely due to adverse supply shocks, profit margins should have fallen. Instead, they soared.

11

34

168

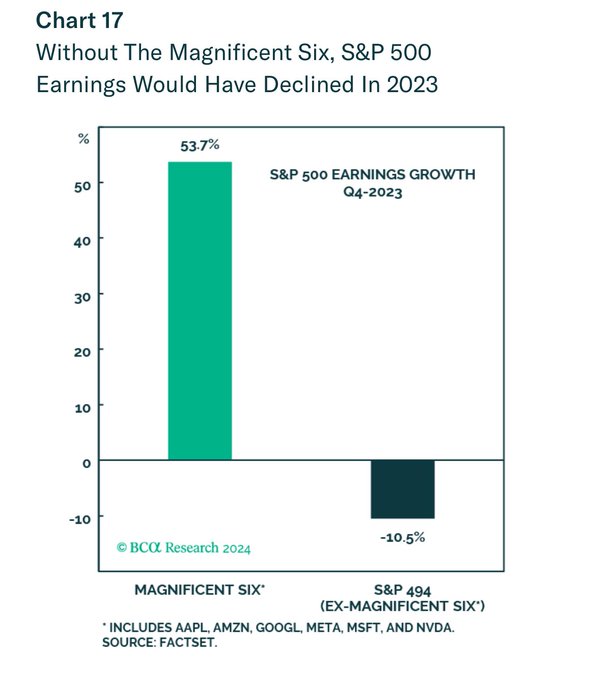

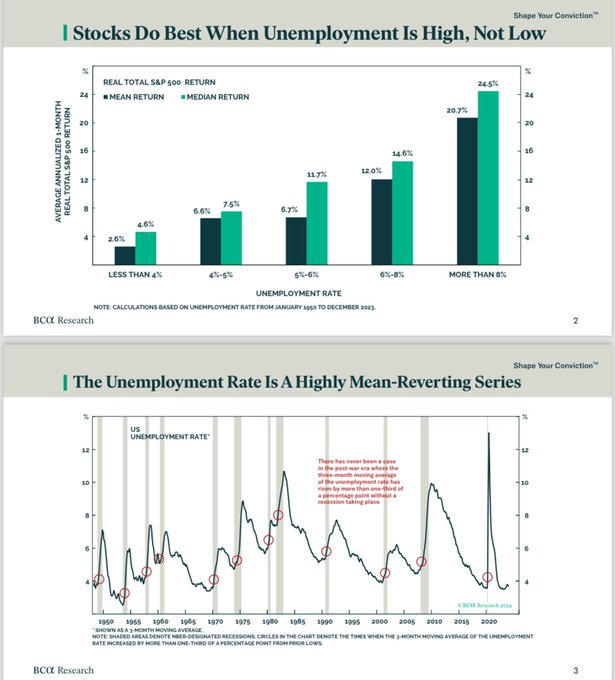

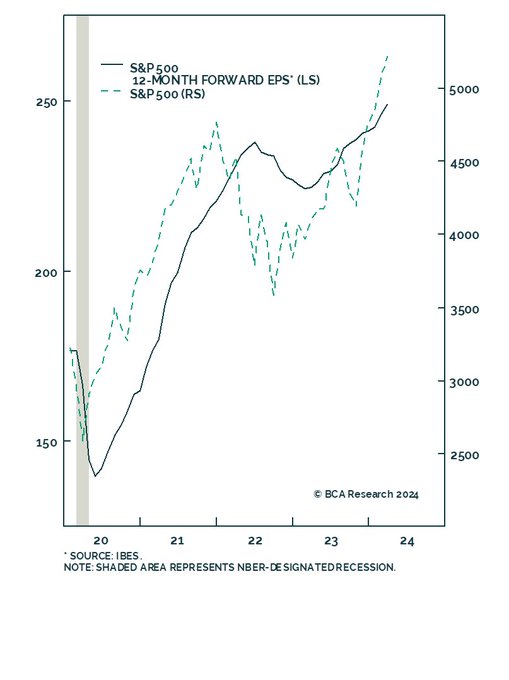

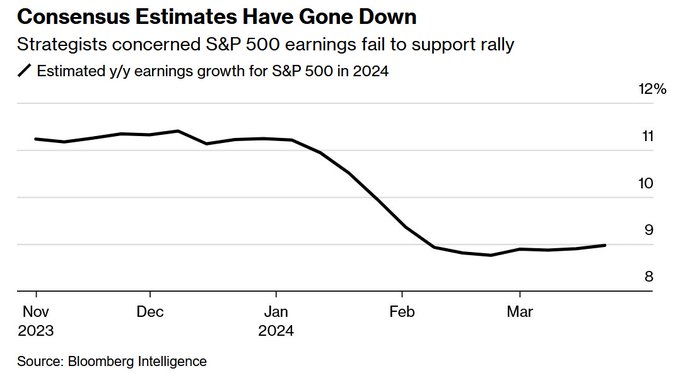

There’s a lot of misleading stuff from Mike Wilson here.

First of all, one shouldn’t look at the evolution of earnings estimates in any given calendar year because analysts are notoriously overoptimistic.

This means that even in good times, earning estimates usually fall.…

2

17

103

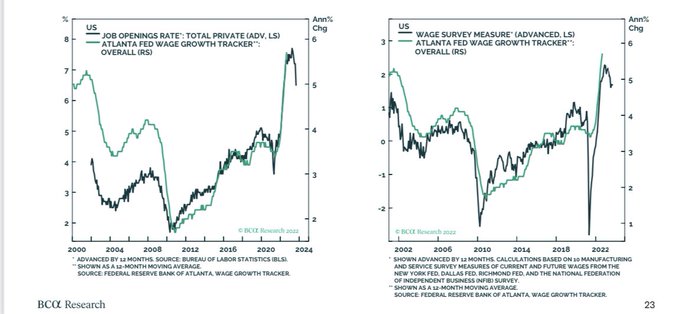

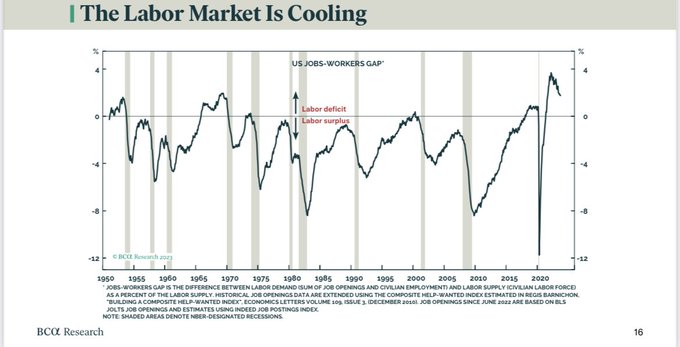

Cooling water also looks stable until it freezes over.

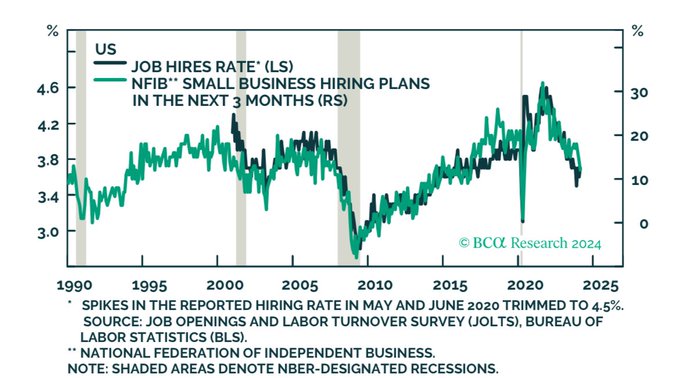

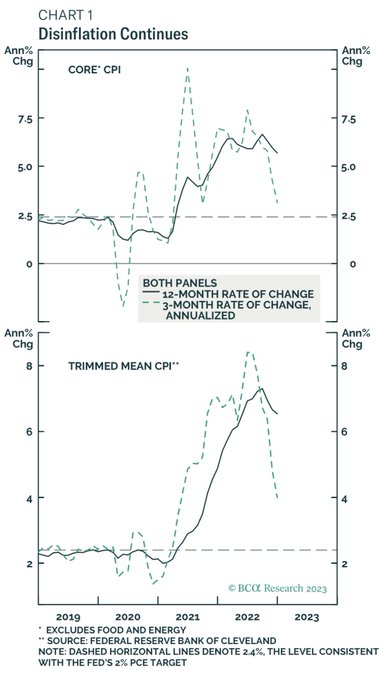

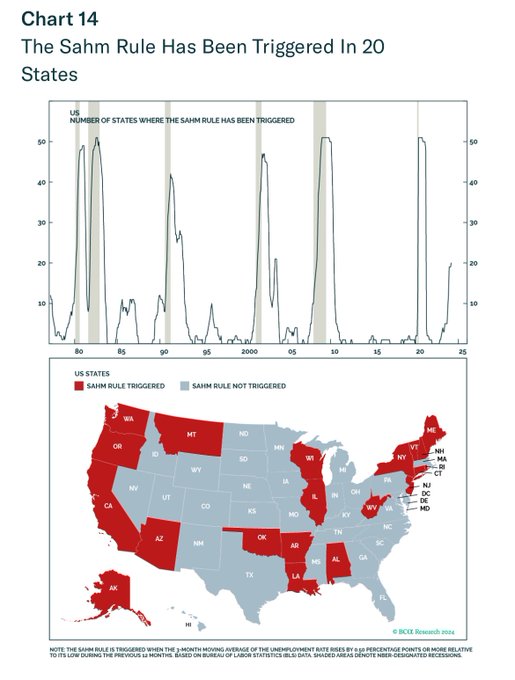

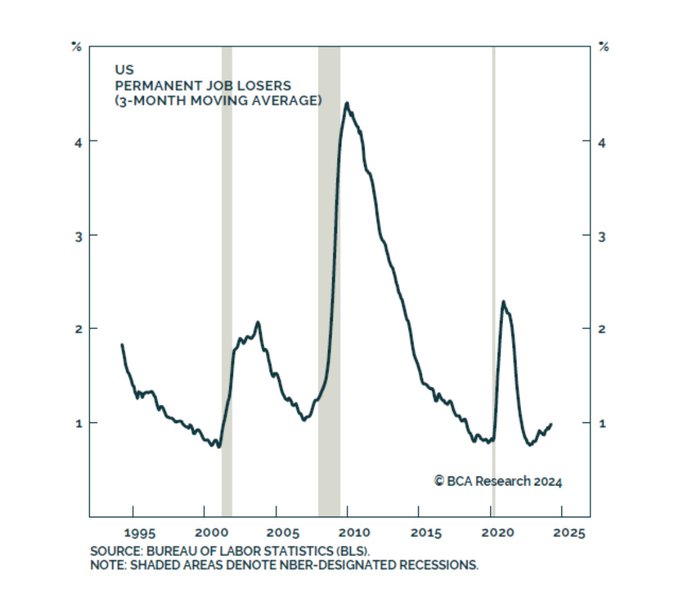

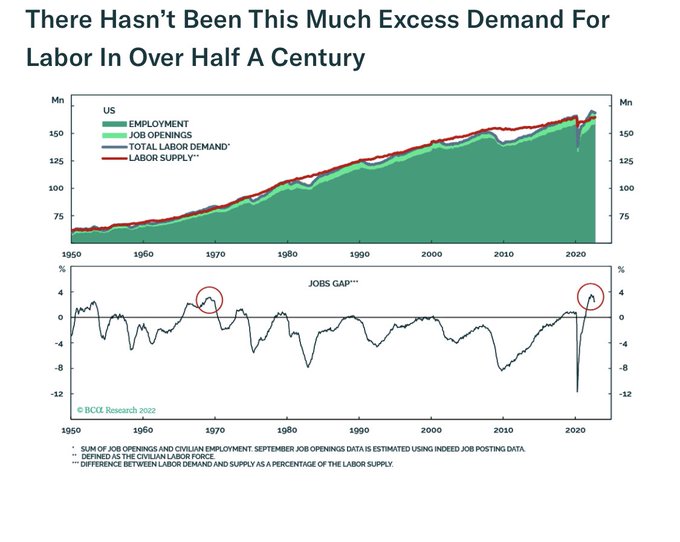

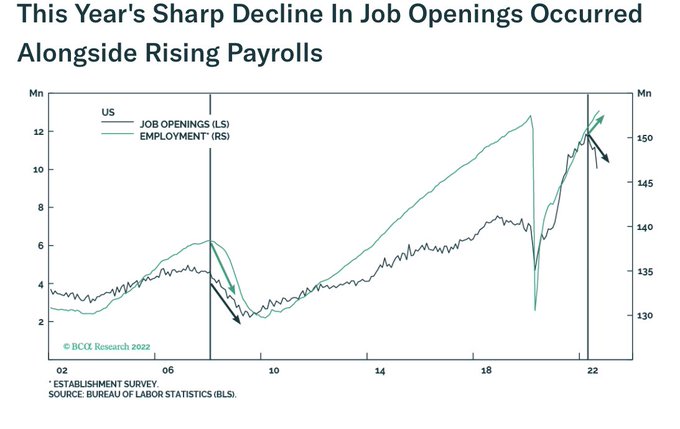

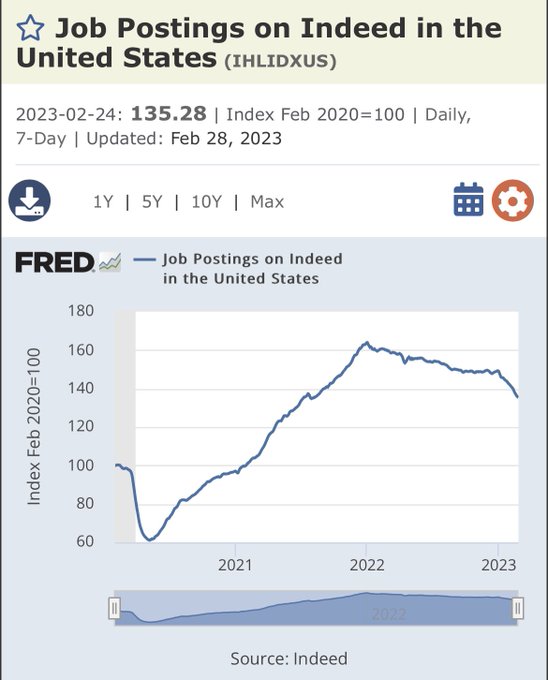

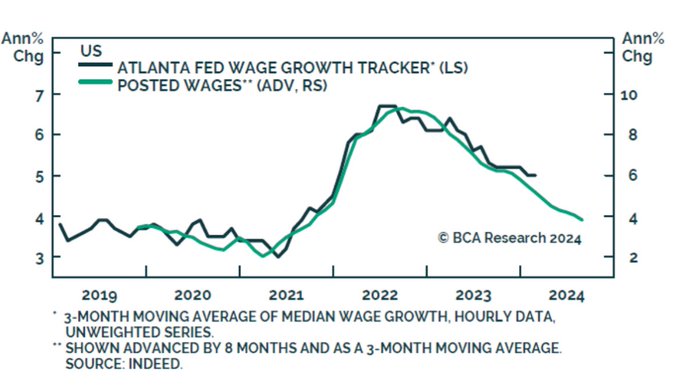

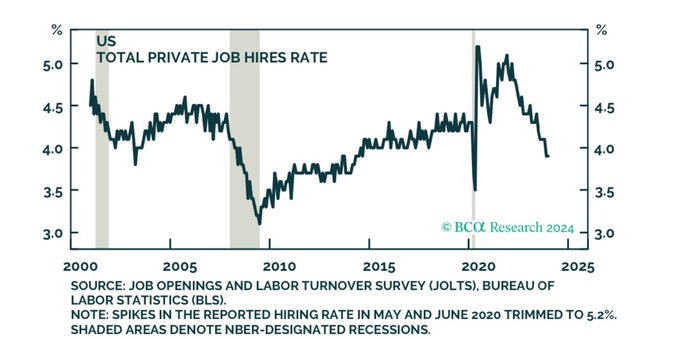

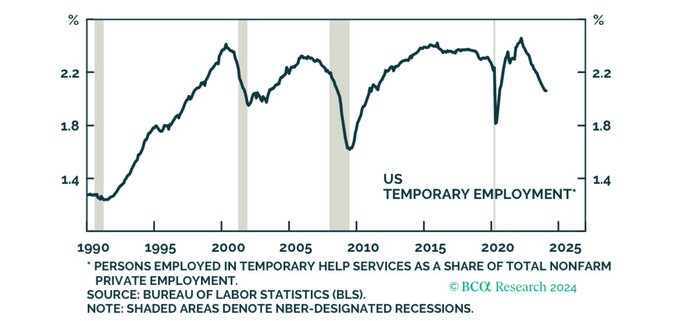

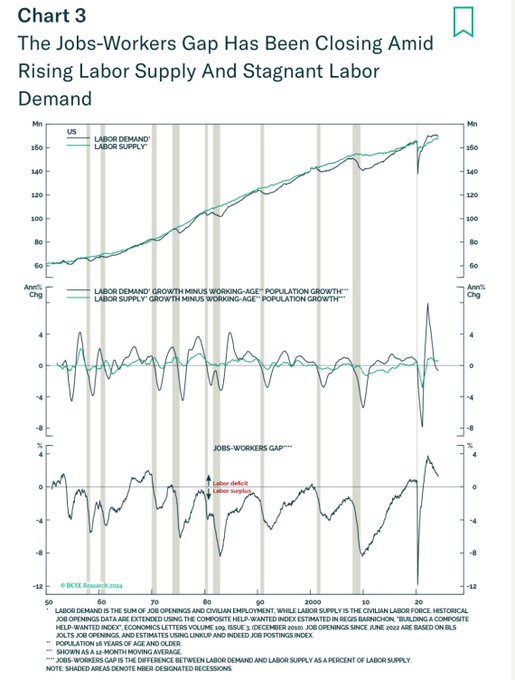

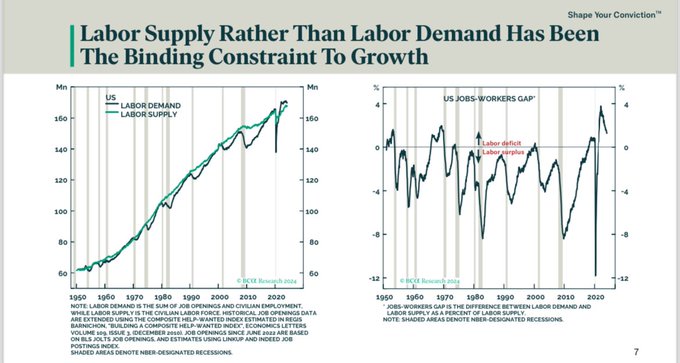

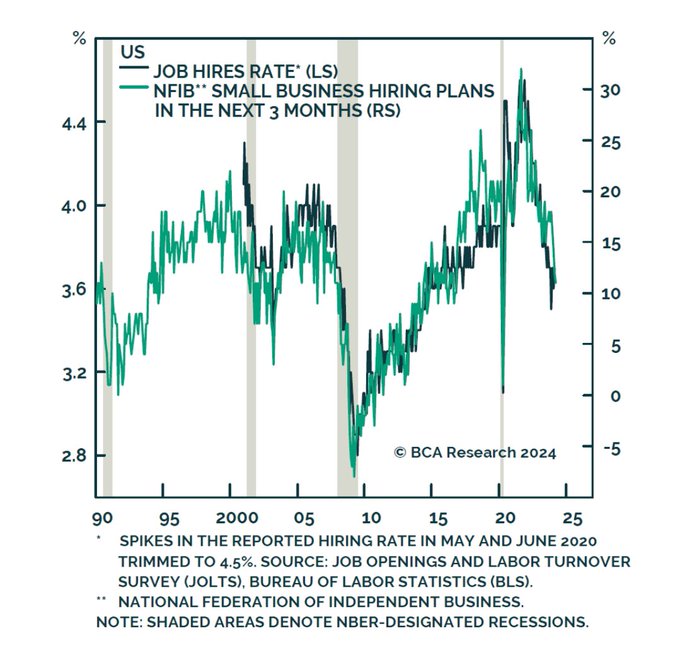

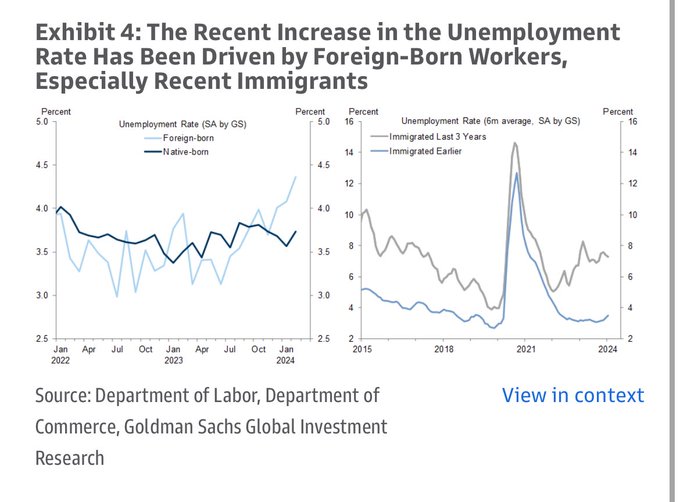

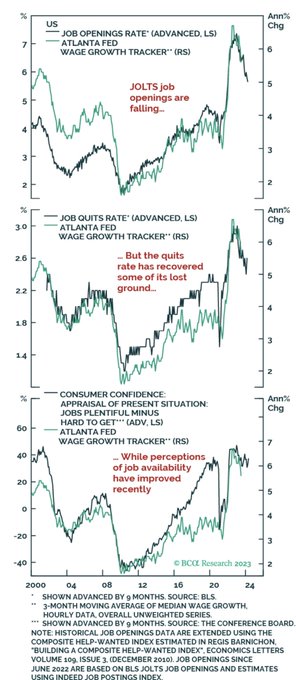

The gap between labor demand and supply is steadily shrinking. At the current pace, labor supply will exceed demand by early next year, at which point the unemployment rate will rise rapidly.

A phase transition is coming.

4

20

91

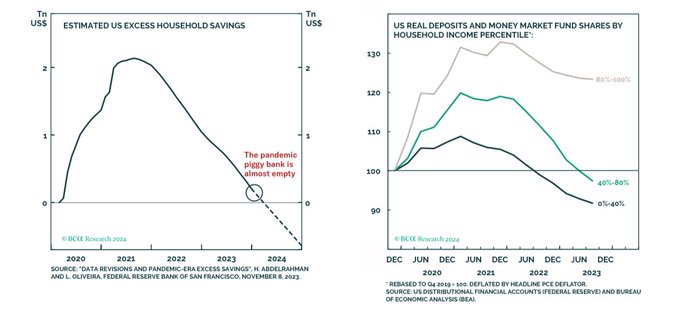

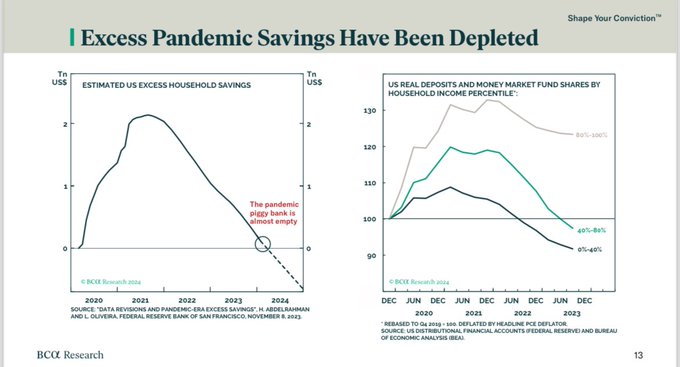

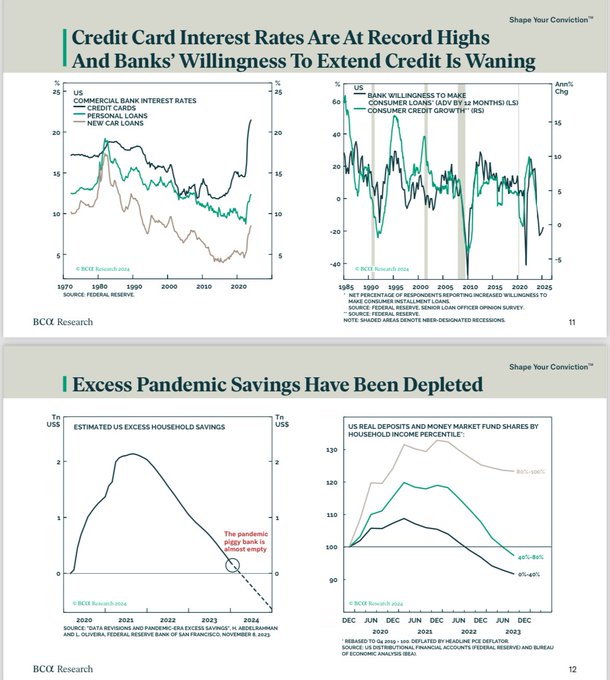

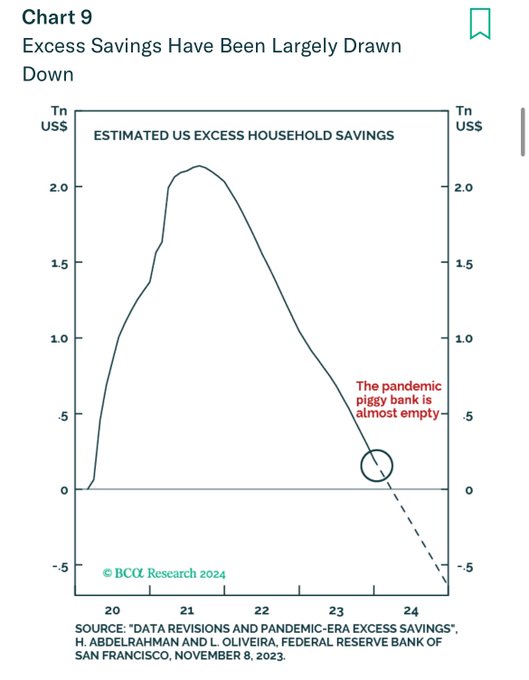

Peter Berezin’s US Consumer Reality Tour, Exhibit

#1

Pandemic savings are nearly exhausted, and real bank deposits among the bottom 80% of households are below 2019 levels (and yes, that includes money market funds).

3

23

70

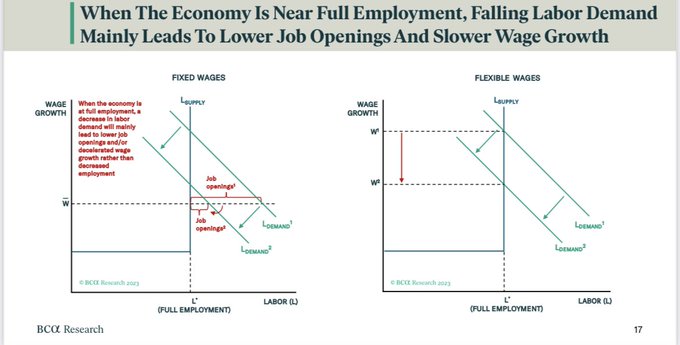

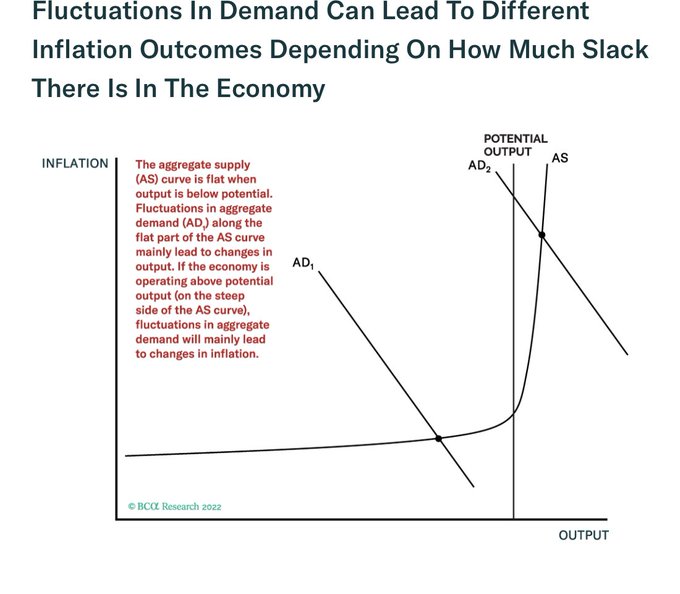

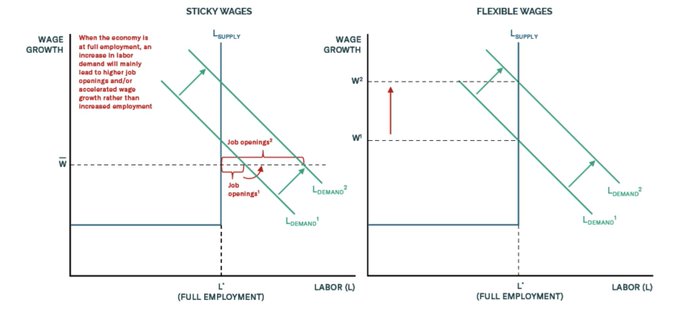

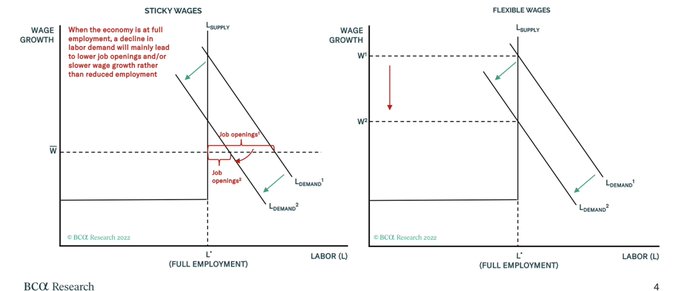

Don’t let the low unemployment rate fool you. When the economy is near full employment, falling labor demand will mainly show up in the form of lower job openings. And according to

@linkup

, job openings took another plunge down in December.

1

8

63

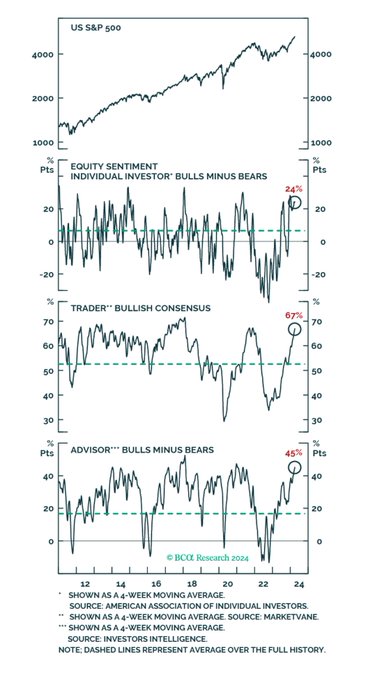

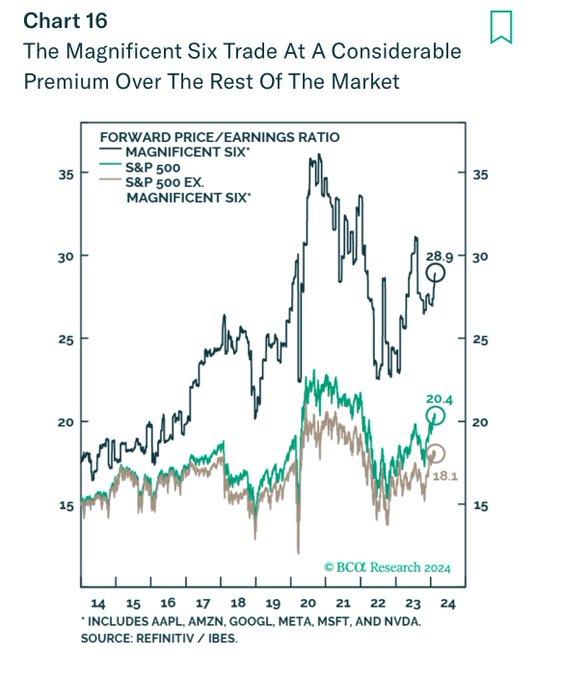

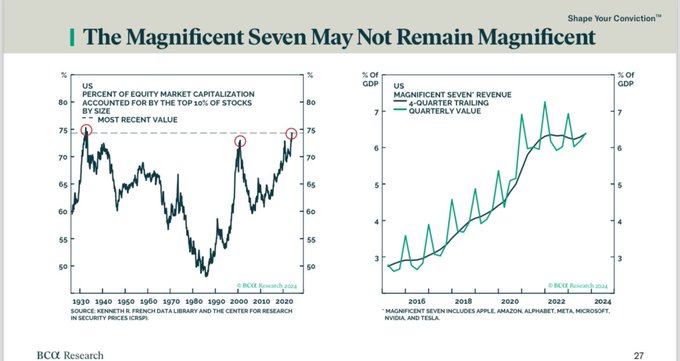

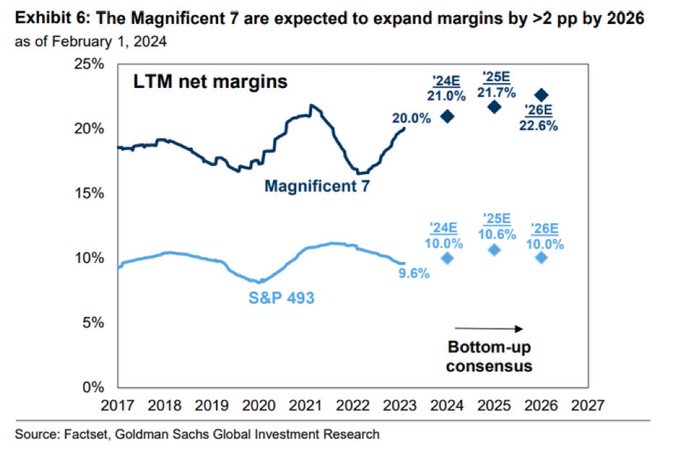

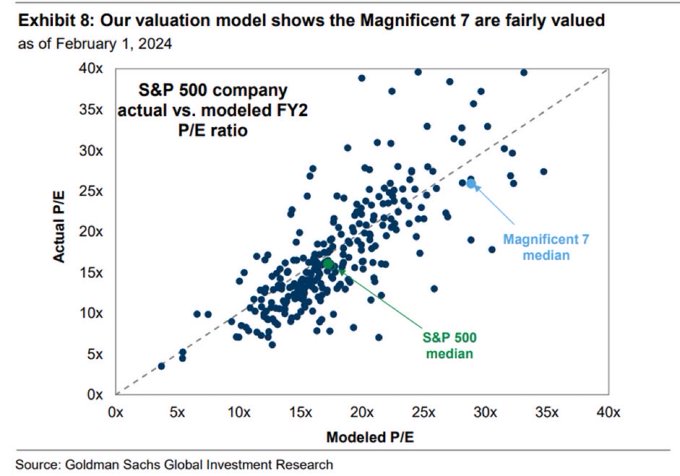

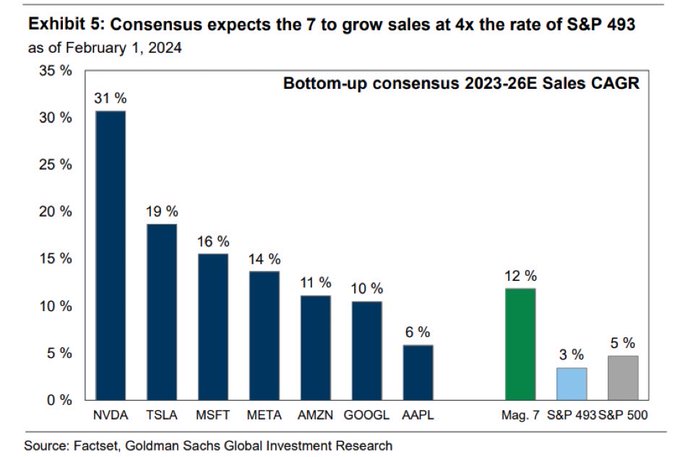

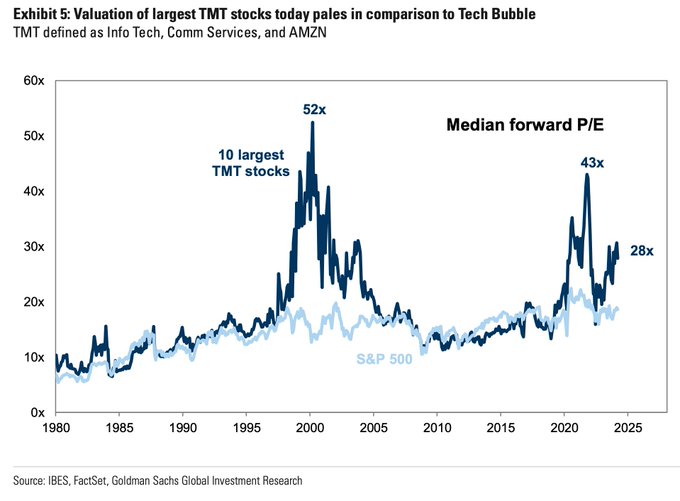

I don’t find this Goldman take especially reassuring. OK, perhaps tech stocks are not in a bubble. But they weren’t in a bubble in 2007 either. They are still expensive and hence will still go down a lot if there’s a recession.

8

15

62