Mona Ali

@MonaAli_NY_US

Followers

4,535

Following

3,268

Media

196

Statuses

3,551

International Political Economy | Econ prof at State University of New York | PhD Econ New School | Writing on geopolitics & the global dollar system.

Joined April 2016

Don't wanna be here?

Send us removal request.

Explore trending content on Musk Viewer

الهلال

• 1145149 Tweets

Neymar

• 351842 Tweets

كاس الملك

• 335636 Tweets

Ronaldo

• 212294 Tweets

Eminem

• 202827 Tweets

رونالدو

• 116601 Tweets

سلمان

• 114763 Tweets

FLORENCIA AL 9009

• 103224 Tweets

ولي العهد

• 99704 Tweets

#كاس_خادم_الحرمين_الشريفين

• 97312 Tweets

البليهي

• 81126 Tweets

Happy Pride Month

• 55107 Tweets

Defante

• 50188 Tweets

Al Hilal

• 47771 Tweets

كريستيانو

• 44095 Tweets

Al Nassr

• 36200 Tweets

Stolas

• 35459 Tweets

وليد

• 34051 Tweets

كره القدم

• 30278 Tweets

sabina

• 28811 Tweets

対象作品

• 27762 Tweets

Marian Robinson

• 27456 Tweets

نيمار

• 24440 Tweets

コインor時短

• 22593 Tweets

جيسوس

• 22391 Tweets

تمبكتي

• 22385 Tweets

الدون

• 20271 Tweets

كوليبالي

• 19273 Tweets

Michelle Obama

• 18050 Tweets

Mrs. Robinson

• 16976 Tweets

ديما بونو

• 14798 Tweets

اوسبينا

• 14519 Tweets

ايمن يحيى

• 13937 Tweets

#Smackdown

• 13374 Tweets

新シーズン

• 12561 Tweets

Last Seen Profiles

Pinned Tweet

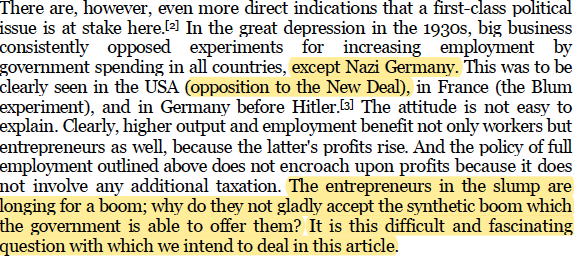

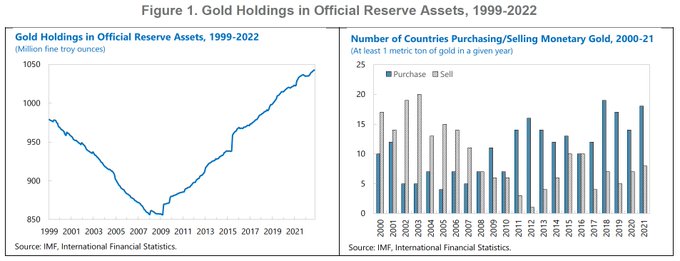

Tooze & Fertik (2014) assert that WWI reshaped the world economy countering the economists narrative that war interrupted globalization. WWI, they argued, 'activated to an unprecedented degree' the networks of 19th century globalization. My essay understands the present similarly

Absolutely sensational piece from

@MonaAli_NY_US

. The density of forensic knowledge about the global dollar system is astounding.

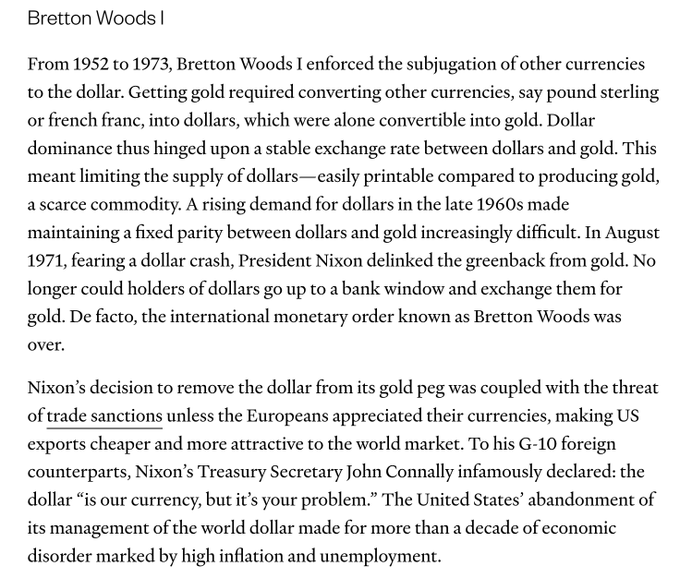

Among other treats, it has the clearest and most concise explanation of Bretton Woods I and its demise I've ever read.

2

26

158

4

57

239

Can’t wait to read

@PMehrling

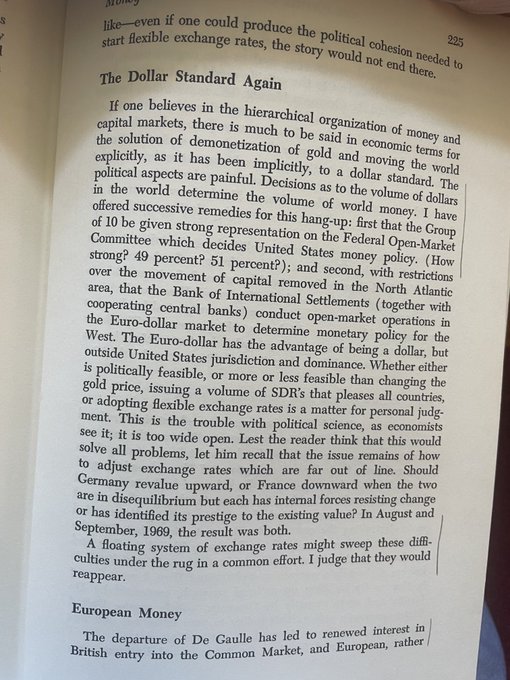

’s book on the man who helped fashion the world dollar standard. Here is Kindleberger in 1970, just before Bretton Woods falls apart, advocating for G-10 representation at the Fed’s FOMC and for the BIS to regulate the offshore dollar market!

5

40

212

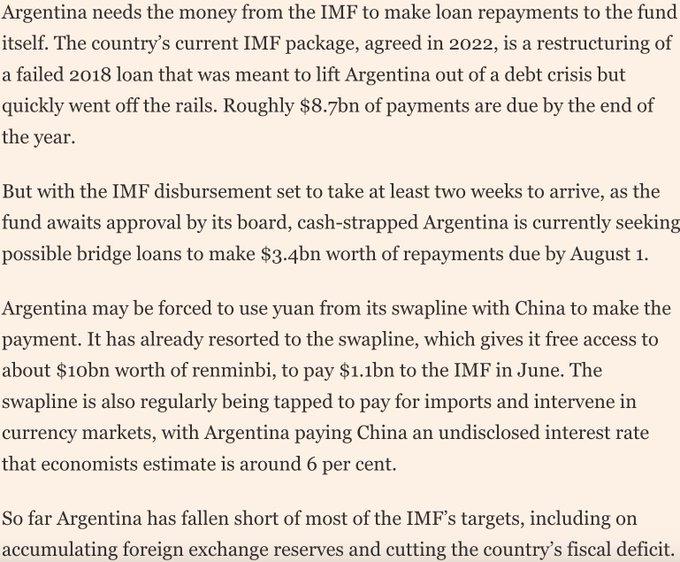

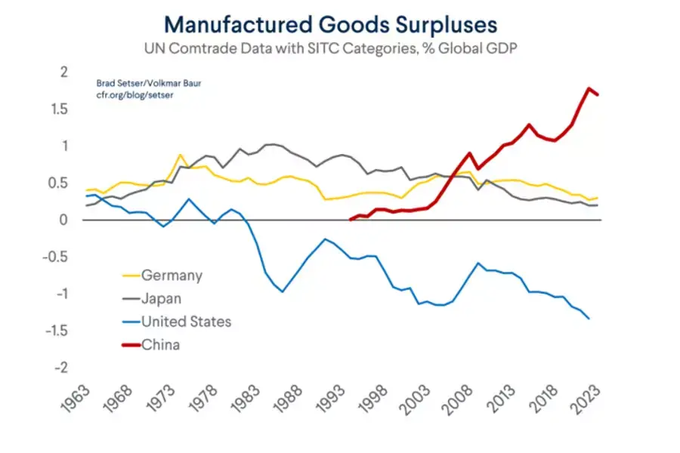

Good critique here. The Keynesian framework underpinning Pettis's argument is anachronistic; among else it is premised on savings driving investment i.e. there is no endogenous credit creation. Similarly, it relies on comparative advantage rather than industrial policy as the key

Another frustratingly orthodox article from Michael Pettis on China. I really don’t know why he persists with the excess savings framework.

via

@ft

12

21

134

10

31

148

I went to observe the IMF Spring Meetings this weekend. It was an intense and dismaying experience. I wrote up a report here.

NEW from the

#NIEO

Collection: Professor

@MonaAli_NY_US

on the geo-economics of acute dollar dominance — and why so many governments present at the IMF Spring Meetings are now seeking alternative arrangements.

2

36

100

1

52

119

Kudos

@FT

. A new institutional framework for debt restructuring--one in which western bondholders, multilateral creditors such as the IMF and the World Bank, as well as China agree to evenly accepting sovereign debt write-offs--is the need of the hour.

1

39

109

Kind of stunning to see this not because a former student is a co-author (congrats Serra!) but is this the very first time that a NY Fed staff report explicitly mentions the economic imperialism of the $?!

4

20

99

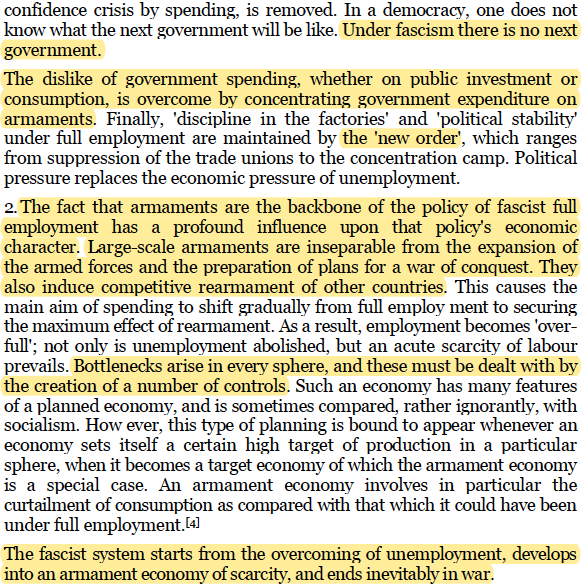

Before we dive into Bank for International Settlements reports and else, my International Trade and Finance students begin the semester with this superb read on 'How To See The World Economy' by

@zeithistoriker

.

1

10

83

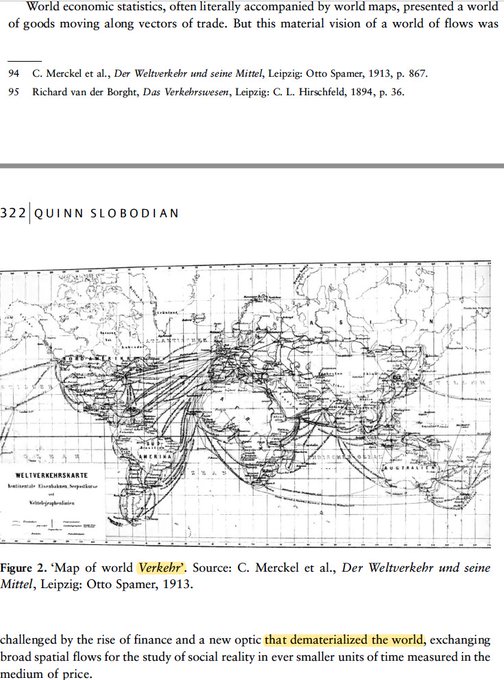

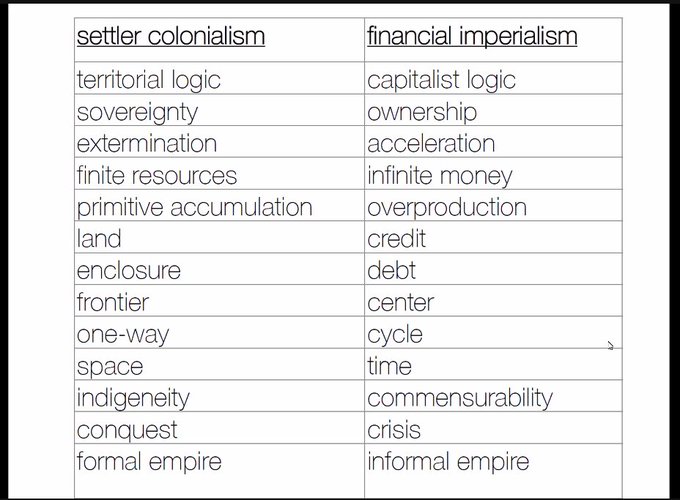

<historians' visualization>

@zeithistoriker

sketches out the boundaries between discourses of settler colonialism and financial imperialism at the Just Money conference.

2

9

75

While the Biden admin shells out $35 million to the US subsidiary of the leading British arms manufacturer, it has pledged just half the amount ($17.5 million) to the global climate-related Loss and Damage fund.

2

34

70

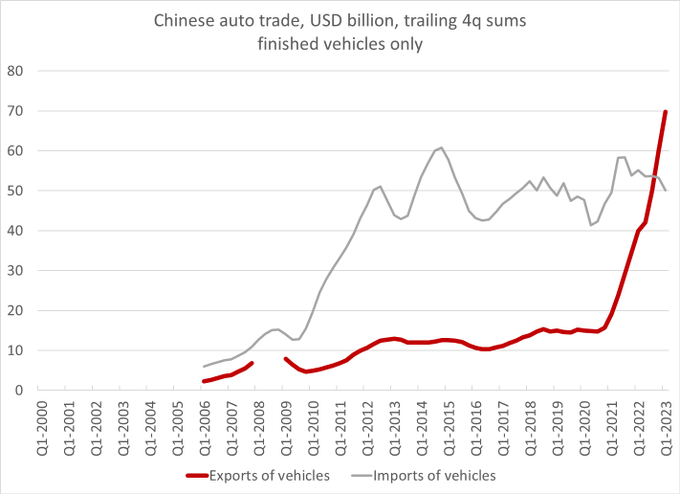

Economic geographers (Krugman and such) have rightly taught us to be obsessed with cross-border trade in autos. . . High-value added; capital-intensive; originally the bulk of which was north-north in orientation; but now China has changed that game.

3

20

65

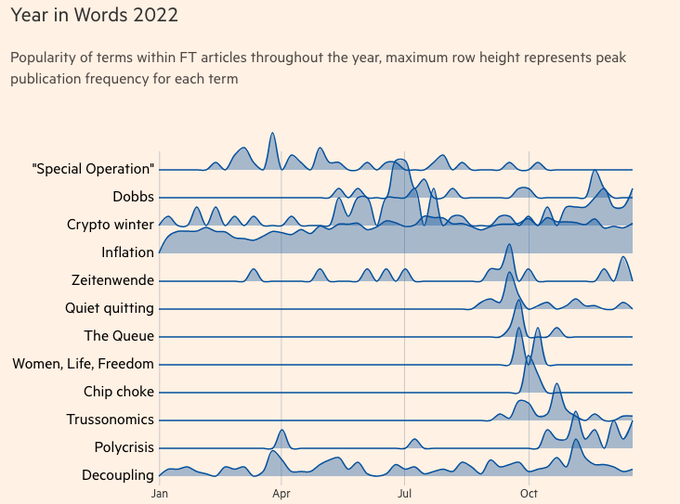

A piece I wrote on American power and the 'polycrisis'. Merci beaucoup to

@picharbonnier

for including it in the second issue of

@GREEN_GEG_org

.

1

21

65

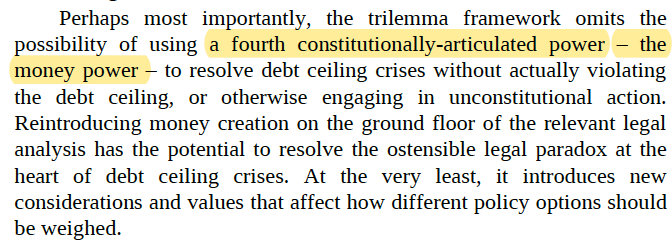

< money power> Re-reading this brilliantly written and bold paper by

@rohangrey

. Everyone interested in the US debt politics should read it.

2

17

65

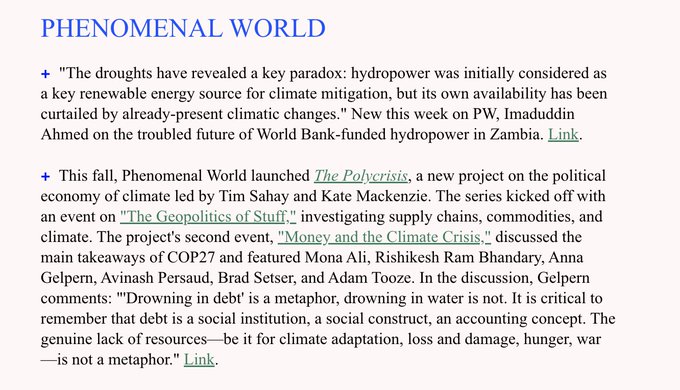

Thank you

@phenomenalworld

for providing a wonderful space for writing political economy. I've made some good friends through this platform and then to discover that my young cousin

@imadahmed

just wrote a piece on Zambia and the World Bank for PW, well, that's icing on the cake

1

10

61

Wow. An incredibly productive, wide-ranging, and nuanced conversation on Bidenomics and what it means for progressive policy. We need a follow up in six months

@DanielDenvir

if not sooner.

This new

@thedigradio

ep is a really important discussion and debate on Bidenomics—the new industrial policy, the energy transition, the New Cold War with China, and more. With

@DanielaGabor

,

@tedfertik

, and

@70sBachchan

.

5

105

397

0

15

62

<Why not default?> Hard to fathom after last year's climate-catastrophe and the energy-crisis in Pakistan (which explain why forex reserves are down to a month's supply) that the IMF is withholding a long-promised tranche unless austerity measures are imposed. IMF please explain?

6

16

61

The original Keynes-White plan (undermined in the final IMF Articles of Agreement) explicitly called for capital controls not only on countries experiencing capital flight but also on countries to where capital was flowing. Joan Robinson's critique of Article VI still resonates.

1

12

62

Afghanistan's population is facing extreme hunger. The humanitarian crisis can be eased by the U.S. releasing the $9.4 billion in foreign exchange reserves it has frozen. This will resuscitate Afghanistan's central bank functioning. Some much needed plain-speaking by

@adam_tooze

The humanitarian catastrophe engulfing Afghanistan is staggering in its scale and urgency. Western sanctions are compounding the damage done by withdrawal. Chartbook

#78

0

31

91

1

25

56

<a must read> This is a beautiful piece of thinking and writing about age-old economic development questions that are back with even greater urgency today. Congrats

@humford

@davideoks

.

2

21

57

Blistering critique of what the new IMF loan program to Ukraine might entail from

@TheEconomist

. I stopped subscribing to the mag because of its often sexist and racist tone but I will say that I do miss its laconic sarcasm (see last line).

About that big IMF loan to Ukraine: “There needs to be economic support for Ukraine but its allies should have borne the risk, not the IMF, and done so with grants instead of letting Ukraine rack up debt.” says Mark Malloch-Brown

@malloch_brown

1

13

45

2

14

57

A piece I wrote on why the IMF needs a bigger balance sheet and why expanding its capital-base (quotas) and regular Special Drawing Rights issuance must be interlaced with fundamental governance reforms.

"A recent IMF report clarifies that 'systemic debt crises' are ones that threaten the solvency of large and private creditors. In this framework, distressed low-income sovereigns simply don’t matter much."

NEW:

@MonaAli_NY_US

on reforming the IMF.

0

22

59

2

14

55

Samuelson was so right about propositions but so wrong about comparative advantage as the exceptional 'true and non-trivial' case. For comparative advantage to hold forth required extremely stringent criteria from non-increasing returns to full employment to perfect competition.

4

11

53

In a state of distraction because of US debt ceiling politics, browsing through recent

@FTAlphaville

columns, I ran into a nice surprise - a link to my latest

@phenomenalworld

essay. :) Thanks

@RobinWigg

!

3

6

45

Focusing on current account imbalances as the cause of and austerity as the response to speculative attacks on sov. bond markets is simply wrong. Powerful research by

@KarstenKohler2

. Implies that concepts of international crisis management (incl. IMF Articles) need to be updated

1 I'm pleased to share a new open access article in

@pasupdates

entitled 'Capital Flows and the Eurozone's North-South Divide'.

1

35

156

1

14

43

Brilliant piece by

@jdostry

and

@JosephEStiglitz

on the need for capital outflow controls, a curiously MIA IMF in the face of the worsening of global economy, and the need for the IMF to uphold its original mission.

The IMF should move beyond tolerating some capital controls to imposing them when needed. As

@jdostry

&

@JosephEStiglitz

remind us, in Argentina the IMF let investors cash out and left the govt with "a $44 billion debt burden and little to show for it"

2

93

154

1

8

41

Do join URPE @ ASSA 2022 this wknd. Panelists incl.

@Jayati1609

,

@gchelwa

@RhondaVSharpe

@devikadutt

@radical_carib

@ingridharvold

@anastasiawils

,

@nina_econ

@nathaniel_cline

@JWMason1

@shirkandsteal

@SurbhiKesar

@luizanassif

@danieletavani

@JFCogliano

@Srishting

@JulioHuato

1

25

41

A brilliant analysis by

@pathtopraxis

on the recklessness of US nationalism. My main quibble: the recent history of neoliberalism capitalism should not make one fall for a zero sum game/declinist/falling rate of profit teleology - a logic that plagues both the left and Bidenomics

@70sBachchan

@pathtopraxis

@pathtopraxis

FWIW This is the best rebuttal of Industrial Policy boosterism I’ve read yet. I don’t agree with every single point and there’s of course the big, open question of left political strategy only touched on at the end, but this is an impressively comprehensive analysis

1

3

26

2

5

41

Reading Federal Reserve's General Counsel Howard Hackley's memo, which provided legal clarification permitting central bank swap-lines and potentially with the IMF. Thankful to Nathan for generously sharing this and the treasure trove of Fed history (below) with his subscribers.

2

9

40

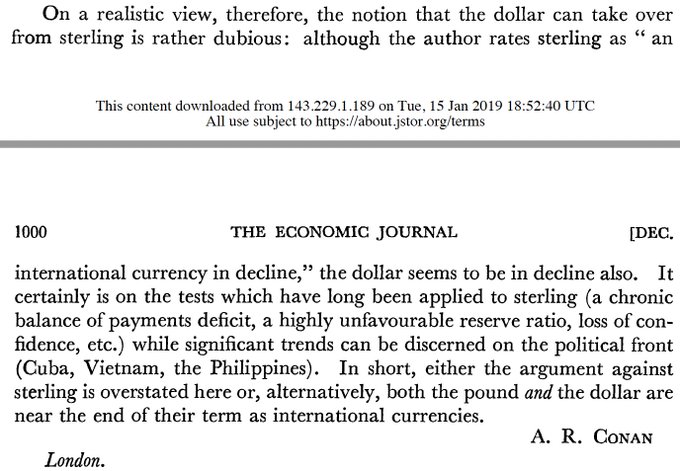

I agree with Zoltan that we have entered Bretton Woods III (a term I've been using in my own slow book-in-progress). But this is not Zoltan's Bretton Woods III of 'commodity-backed currencies in the East' but, I wager, a weaponized global dollar system.

@adam_tooze

@policytensor

2

5

41

I love Roitman's repetition that crisis is a concept. As I teach in my class 'Crisis Economics,' crisis is both a rupture in the existing order but also revelatory of its inner workings. The work of crisis-as-concept then is to denaturalize systems via history and heterogeneity.

"The ends of perpetual crisis" - this smart essay by

@RoitmanJanet

has been cited as though it were a knockdown critique of the term polycrisis. I would see it as an extremely useful elucidation of what a self-reflexive usage entails. Recommended.

4

12

57

3

3

41

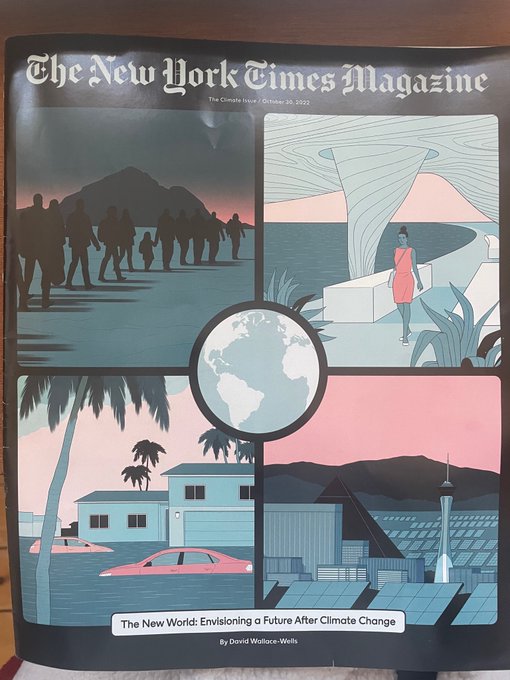

The question of the day but also one for the decade: ‘what kind of cities will Brazil build?’ Tim Sahay aka

@70sBachchan

in the NYTimes Mag today.

0

14

40

Just in time for the

@jainfamilyinst

panel tomorrow: Lance Taylor declares the global savings glut hypothesis dead, conducts the autopsy, and argues for an overdetermined perspective on current account imbalances.

@NathanTankus

@JWMason1

@adam_tooze

1

4

39

<Sovereign debt defaulters>

@AnnPettifor

pointedly notes that the Nixon Shock (1971) constituted the largest sovereign debt default in history. For obvious reasons it isn't generally described as such.

0

21

38

Love

@DanielDenvir

's use of the conjunction "and" to capture the complexity of this historical conjucture and Baconi is superb on politicising Hamas. And The Dig has truly been a superb podcast for political economy analysis this year.

3

5

38

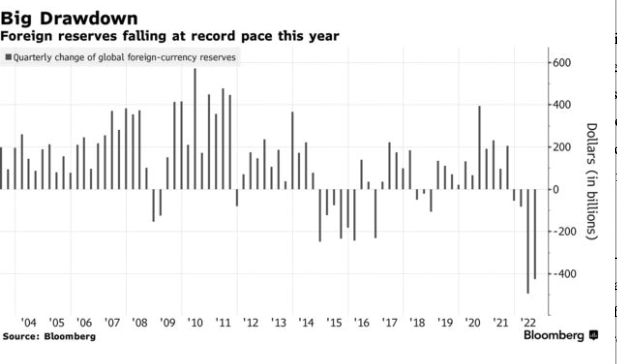

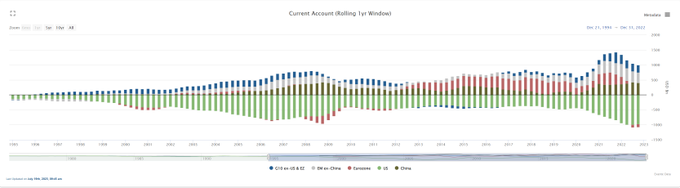

Remarkable data. A $1 trillion current account deficit for the US in 2022 is without precedent. And unlike 2006-8, nobody I know is talking about the dollar crashing. Let's call that epistemic progress.

2

7

38

<White World Dollar Order> Writing a book on our world dollar order and this essay is part of a larger story. Thanks to

@fact_pattern

for his superlative editing.

“Crises catapult change but also entrench hierarchies.”

@MonaAli_NY_US

on the dollar system, original sin, and sovereign debt since the pandemic

0

15

33

2

7

37

@GeneralTheorist

on Keynes' plan for the postwar international currency union that was derailed by countervailing forces (The White Plan) and unfortunate circumstances (Keynes' premature death) is really worth a read: "Should [it] be called dolphin" . . .

0

14

37

Against the 'so what?' view here is a superb explanation of why studying the 'polycrisis' matters and why the effort requires urgent and interdisciplinary collaboration.

@70sBachchan

@kmac

@adam_tooze

1

6

36

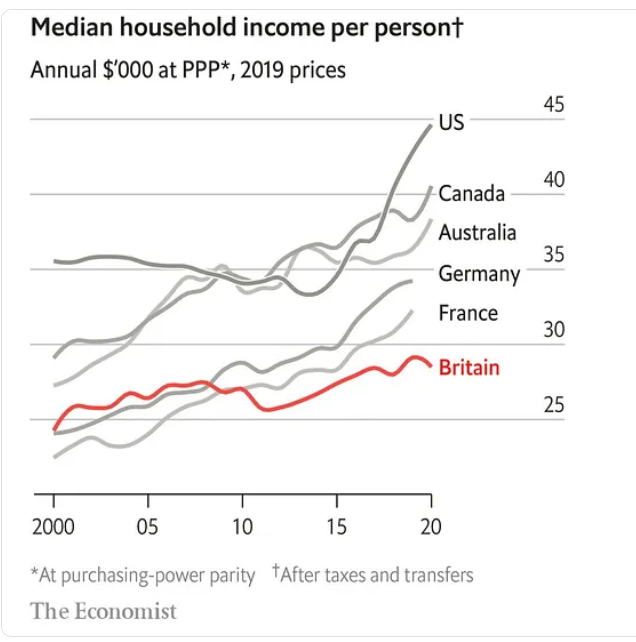

Super-interesting piece on the alarming state-of-affairs in the UK. But I think that understanding the hemorrhaging in manufacturing is also key to the wage-productivity puzzle. Back in 1995, manufacturing amounted to 19% of UK GDP and by 2014, it had fallen to less than 10%.

Not decline but deconvergence. Chartbook Newsletter

#184

on the economic plight of the UK.

Sign up for free here:

7

31

104

4

9

36

$4 trillion per year for the global energy transition: What if the IMF Spring meetings centered around mobilizing this goal? From

@adam_tooze

's latest Chartbook Carbon Notes.

1

9

34

Superb thread by

@murtazahsyed

on the new IMF loan programme to Pakistan. Raises the question (for me): What if gross capital formation were to replace fiscal consolidation (adjustment) as IMF conditionality?

Last week, the

@IMFNews

released its latest report on Pakistan. It marked the start of our 24th waltz together. It pulled us back from the brink of default. We all heaved a sigh of relief. But the report reads like an SOS. A last call. You might want to sit down for this one ...

64

611

2K

1

9

34

Nice piece

@ntinatzouvala

. Despite the famine in Afghanistan, none of the country's frozen foreign exchange reserves have been disbursed back to the Afghan people via the Afghan Fund set up last year.

2

8

31

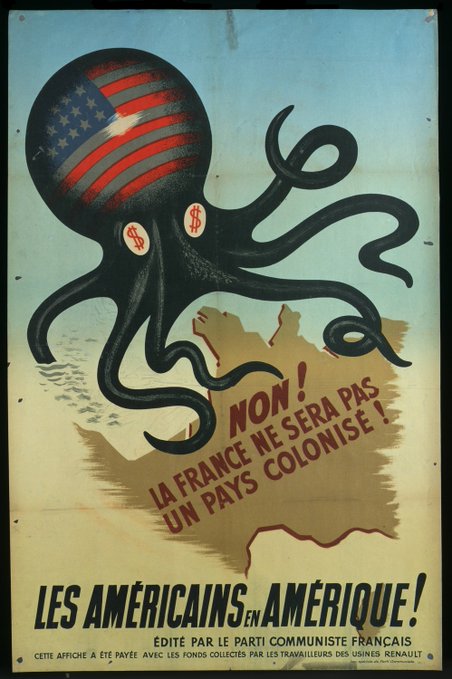

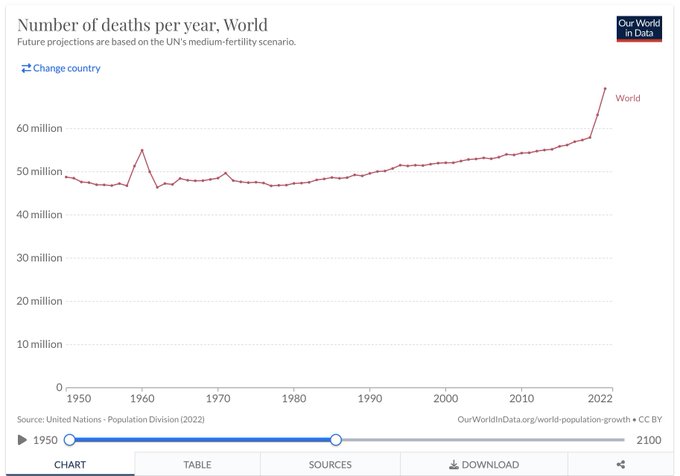

Polycrisis is a term that provokes strong reactions but what if nascent theorists of this era took this stark image seriously?

@kmac

@70sBachchan

1

10

31

Another great piece by a close observer of developing economies

@Jonthn_Wheatley

on the collateral damage of a strong dollar --> currencies dive across EMs

1

9

30

@JamesMelville

And the hunger is so immense, and the safety net so thin, that the UNICEF have started operations in the UK.

2

2

30

Feels special to have one's writing translated into Portuguese. (Listening to Jobim's 'Girl from Ipanema' while typing this.)

As Reuniões de Primavera do FMI são semana que vem, neste ano que marca o aniversário de 80 anos de Bretton Woods

A hegemonia mundial do dólar está no centro das atenções

@MonaAli_NY_US

conta os detalhes dessa discussão aqui:

0

2

6

1

0

29

Of course, the other side of growing trade imbalances are the financial ones. In contrast to the IMF's own recommendations (China reduce EXR intervention which will most likely further devalue the RMB and increase China's already vast $$ reserves), Setser's (as well as Pettis's)

0

7

29

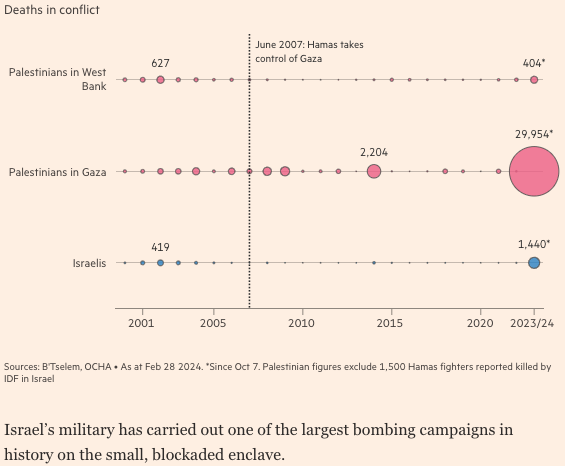

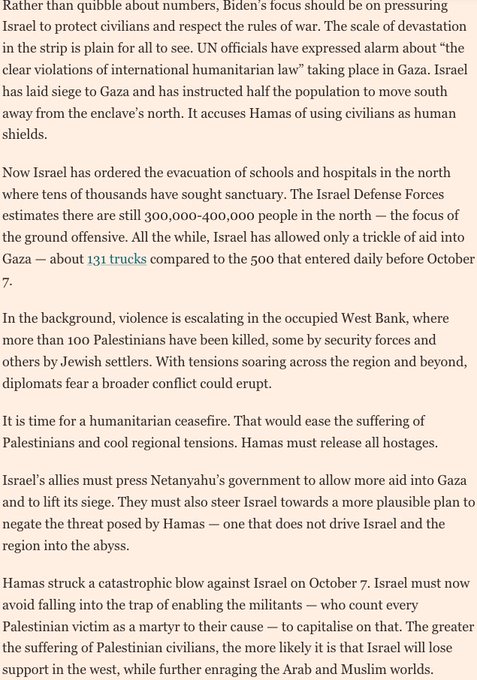

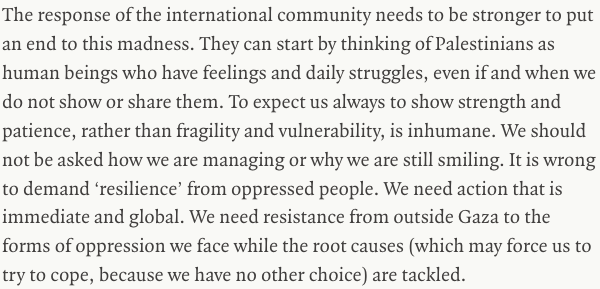

‘Romanticising Palestinians, expecting us to show our strength, resilience and patience throughout it all, imposes mythical terms on our experience and our everyday struggles. It obscures our humanity.’

New on the blog from

@MalakaShwaikh

:

1

310

565

0

4

29

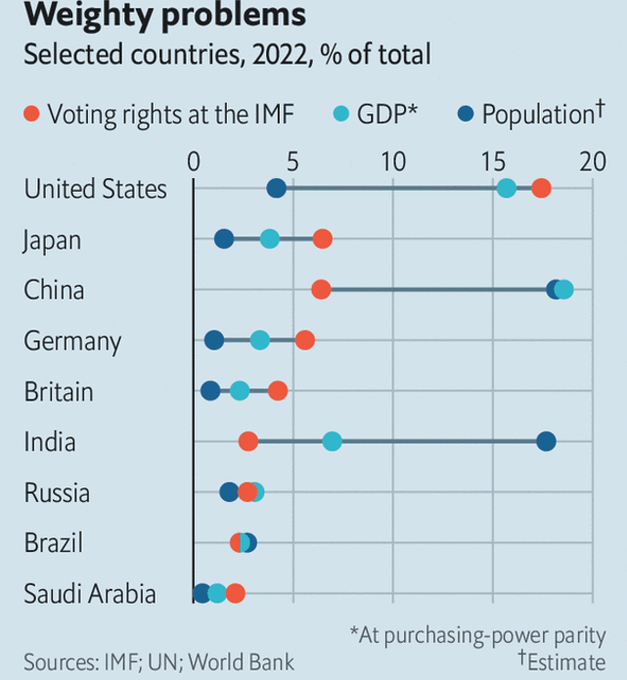

How unequal country quotas at the IMF make climate-vulnerable countries underrepresented in decisions that disproportionately impact them. Essential analysis from

@LaraMerling

.

0

18

28

Agree with the sentiment albeit I'd put it a bit differently. The US debt ceiling is like Brexit: a completely unnecessary self-inflicted injury. What's the appropriate analogy from ancient Greek tragedy?

3

3

29

< Cassandra in the House of Thebes > This from

@policytensor

is very good, and very scary.

2

6

28

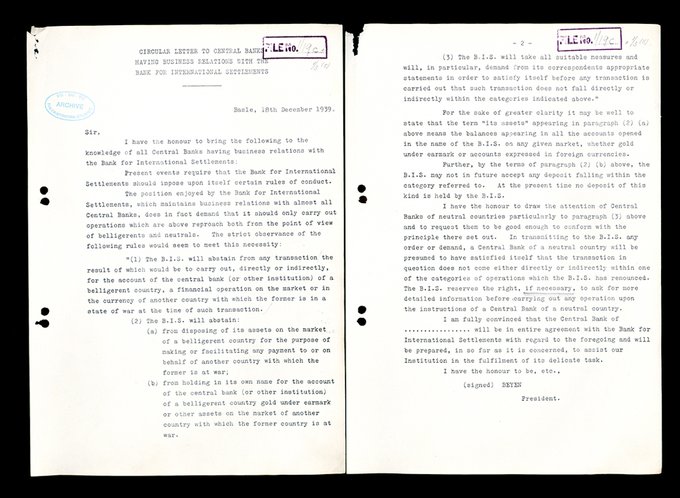

Seems that questions about 'neutrality' are worth thinking about again: here is the Bank for International Settlement's neutrality declaration (December 1939).

3

13

28

Clarifying the BoP perspective,

@Brad_Setser

. It's when China becomes the 'world's banker' i.e runs the biggest current account deficit and finances it by selling yuan-denominated debt which has the quality of being a global safe asset like the $. Agree we are very far from that.

1

6

27