Moatless Capital

@MoatlessCapital

Followers

6K

Following

10K

Media

577

Statuses

5K

Buyside Investor. Not investment advice. Do your own work. moatless "dot" capital "at" gmail "dot" com The line between Shabi and Niubi is very thin.

@moatlesscapital @ bluesky

Joined April 2018

@ShaneAParrish There are some 130mln books in the world. In a life time, an avid reader can expect to read 1 book/week. Over a 60 year period, one can be expected to read some 3100 books. That is 0.0024% of all books outstanding. What *not to read* is more important. #alwaysinvert

2

12

157

"🇺🇸 has semiconductor chokeholds. The problem US has - in highlighting and beginning to use all these choke points is - inevitably 🇨🇳 will begin making plans for redundancy and sovereignty. In time they will reduce 🇺🇸 MAD effectiveness" - No Serious US Policymaker in 2018

🇨🇳 has API chokeholds as well. The problem china has - in highlighting and potentially beginning to use all these choke points is - inevitably the 🇺🇸 and to some extent the rest of G7 will begin making plans for redundancy and sovereignty. In time they will reduce 🇨🇳 MAD

0

0

6

People in China used to mail calcium tablets to the Ministry of Foreign Affairs hoping that they'd develop some backbone in their external dealings.

For anyone who needs evidence of how much restraint Beijing exercised amid wave after wave of trade escalations in the Trump 1 and Biden years, this is Exhibit A. Even the U.S. government's top China analyst was surprised by the Chinese restraint. Literally.

11

105

979

You're going to be in for a surprise if you believe US expansion is going to be anything but immaterial for the stock. It's probably #725272525th on the list of key investment factors for Luckin.

1

0

3

Hilariously, the source of the original rumor (a WeChat article written by an account called Overseas Mining Investment "海外矿业投资"), has been deleted for violating Terms of Service of WeChat.

0

0

4

The amount of motivated reasoning and fake news here is quite astonishing, especially for people who claim to be experts. The hilarity is how the claims of a WeChat account gets sent around Twitter and then gets recycled back into WeChat. https://t.co/chB3Zlz31r

1

0

1

The latest round of trade escalation between the US and China is the result of serious miscalculation by the US—Beijing takes BIS’s 29 September rule expansion as a unilateral provocation. 1. The Geneva, London, and Stockholm talks were primarily about testing boundaries and

27

114

444

Americans are about to find out how grifting and grafting actually worked in China prior to 2012

78

1K

17K

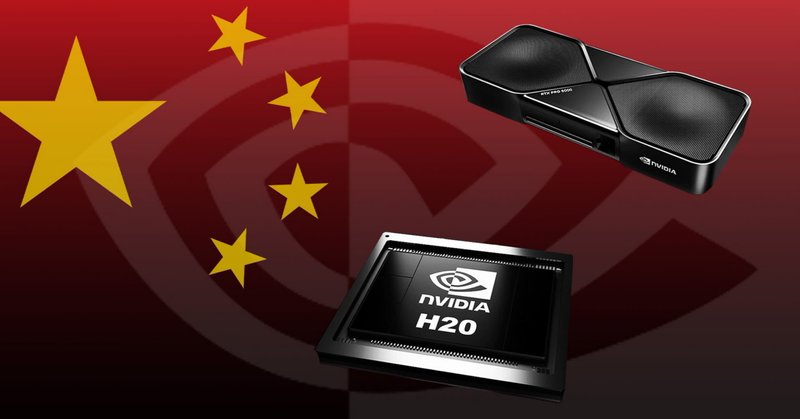

https://t.co/LpMTye1xdb Why do you believe the US still wields any card over chip exports when it is China that's banning imports?

ft.com

Stringent border checks come after Beijing orders tech companies to stop ordering US processors

The US can exert substantial control over chip exports to China (via leverage over TMSC & US chip designs -- not so much b/c of actual US chip production) but it seems (would want to confirm with real experts) that China's export controls may generate reciprocal leverage 8/

1

4

22

Alex, what is the impact of Falungong Disinfo Ops?

still very much unverified rumours that Xi had a stroke - seems to rest on a singular source and firmly speculation for now. However interesting because if you see narrative take hold it could be a preemptive attempt to explain Xi’s replacement going into the fourth plenary

0

0

3

There is a rumor floating around in the Chinese press - it has been floating around for a couple of days. So no it's not in the press. The length people will go on this platform to get clicks.

@Batmanwinskedo1 It’s in the Chinese press. You will hear about soon

1

0

10

This is obviously a lie look at all these unemployed young people who are now living on the streets!!!

2

0

0

People need to stop relying on muscle memory of what used to work in their comments regarding China. Classic example of 刻舟求剑 (“Marking the boat to seek the sword”)

Kweichow Moutai Co stock is gonna rip if a trade deal gets done. Every factory owner in China will buy at least one bottle. Not investment advice.

0

0

6

Major difference is the valuation this time is reasonable. CATL at 1.8trln is maybe 18-20x 2026E highly depressed earnings (Accelerated depreciation + over provisioning for warranties) vs God knows what multiple people used in 2021

China ATH status: Tencent - This morning quietly just 4% below Feb 2021 ATH. - It matters, largest company at usd800bn market cap. - From there 25% more and we get one Chinese into the usd1tr club. That will be a headline. - (if you are going to reply "ackchually TSMC" this is

1

0

17