Graphic Perspective

@Ed_Mayoral_TWT

Followers

336

Following

38K

Media

1K

Statuses

6K

Pursuing perspective on relevant issues

Joined October 2022

Despite all the doomscrolling nonsense about US Stock Market risk... NASDAQ was up another +2.3% this week (after being up +2.1% last wk) to another ALL-TIME HIGH

4

10

69

Perspective on the true size of Mexico 👇👇👇

0

0

0

Been saying for years that capital is now rotating into commodities. The capital rotation turn is not coming, it is already here. Been posting e.g. these historical turns, plus the breakouts, in real-time. The big ratio chart turns are already in, they are not coming. #joinus

12

55

407

Exclusive: Ladies and Gentlemens: The Schiller PE ratio has now officially entered levels not seen since the Dotcom bubble. This not good. This very bad.

180

378

2K

Central banks are buying unprecedented amounts of gold: Global central banks have bought an annualized +830 tonnes of gold in 2025. In the first half of 2025 alone, 23 countries increased their gold reserves. Central banks are now on track to buy twice as much as the annual

144

709

3K

We have $38 trillion in debt. Our annual budget deficits is $2 trillion per year. 25% of all US govt revenue goes to paying interest on the debt. We give away $70 billion per year to other countries. Meaning … we borrow $70 billion to give to other countries. It’s insane.

The US is the most indebted country in the wolrd, but the government still borrows hundreds of billions of dollars to give to other countries in foreign aid. If those other countries are so desperate for money, perhaps they should borrow it themselves?

326

986

3K

United States will remain the largest economy in the world next year with a projected GDP of $31.8 Trillion, larger than China, Germany, and India combined 🚨

166

761

3K

🚨 GOLD EXPLODES 💥 Futures just ripped to $4,365, up $150+ in a single session. Want to beat the market? 📈 Join our Substack. https://t.co/5LfxVMEuLh

8

63

325

Gold & Silver have seen an inflow of $34.2 Billion over the last 10 weeks, the largest inflow in history 🚨🤑💵

28

181

1K

Gold is now the best performing major asset class over the last 20 years with an annualized return of over 11%. Video: https://t.co/xyeXvv5oKR

357

362

2K

The best performing commodities over the past year: Silver (+69%) and Gold (+58%). Video: https://t.co/xyeXvv5oKR

33

103

445

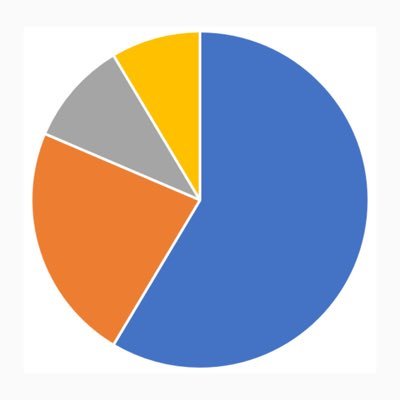

Perspective on Global returns. Suddenly, the S&P500 growth looks modest 👇👇👇

The best performing country equity ETF so far in 2025? Greece $GREK: +69% Just like everyone predicted. Video: https://t.co/IhoPvzP3ku

0

0

0

Every major asset class is in the green so far this year, the first time we've seen that since 2019. It's rare for the Fed to ease monetary policy into rising inflation and a melt-up in the equity/credit markets. And investors absolutely love it. Video: https://t.co/IhoPvzP3ku

22

77

329

“I could buy any house in the world, and I don’t want any other house than the one I’m in.” — Warren Buffett That single line captures a kind of wealth that money can’t measure. As Naval Ravikant once said, “It’s your unlimited desires that are clouding your peace and happiness.

43

306

2K

Silver is now up 82% this year. And it is accelerating... 🚀

8

107

820

Will Newmont, the U.S. gold mining giant, become the first major gold miner to reach a $100 billion market cap this week? 🪙⛏️ Chart: https://t.co/ybIzUH68sq $NEM

18

35

345