Graddhy - Commodities TA+Cycles

@graddhybpc

Followers

67,297

Following

19

Media

4,877

Statuses

18,792

29y in markets, commodities sector investor/swing trader, unique combination of cycles + technicals = leading charting & edge, 20y in mgmt consulting

the commodities bull market

Joined February 2018

Don't wanna be here?

Send us removal request.

Explore trending content on Musk Viewer

London

• 367650 Tweets

Rio Grande do Sul

• 323749 Tweets

#WWEBacklash

• 300525 Tweets

May the 4th

• 286153 Tweets

Star Wars

• 273361 Tweets

Madonna

• 247692 Tweets

La Liga

• 179455 Tweets

Barcelona

• 149300 Tweets

Girona

• 123728 Tweets

SOUTH KOREA APOLOGIZE TO BTS

• 106310 Tweets

Xavi

• 102364 Tweets

Haaland

• 99059 Tweets

Sarah

• 89068 Tweets

Hamilton

• 82477 Tweets

#النصر_الوحده

• 79520 Tweets

こどもの日

• 71312 Tweets

Alonso

• 44915 Tweets

Vargas

• 33374 Tweets

برشلونة

• 31905 Tweets

West Midlands

• 31536 Tweets

#Amici23

• 31243 Tweets

Andy Street

• 25779 Tweets

Janja

• 25374 Tweets

ケンタッキーダービー

• 24280 Tweets

Cano

• 18484 Tweets

Sergi Roberto

• 16620 Tweets

Laporta

• 16249 Tweets

Hulk

• 14118 Tweets

تشافي

• 11434 Tweets

Sabalenka

• 11365 Tweets

Holden

• 10956 Tweets

Last Seen Profiles

Pinned Tweet

Knowing when to trade and knowing when to sit is important. I called the March 2020 crash low for

#preciousmetals

(plus in general) and then said one should just SIT. I really do hope you listened back then as many leading stocks went more than a 1000% in that historical upmove.

41

40

278

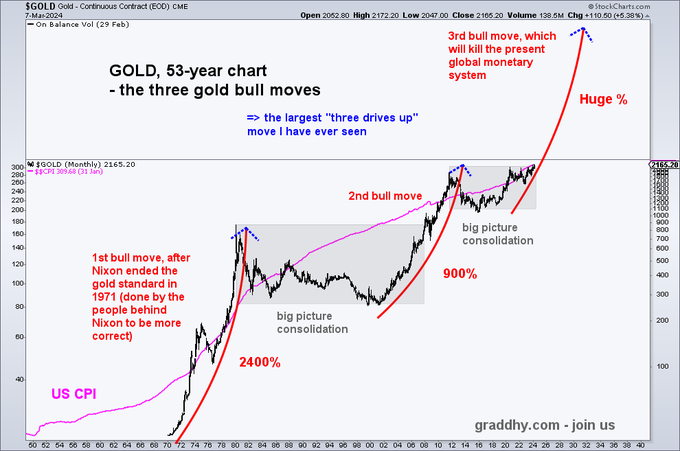

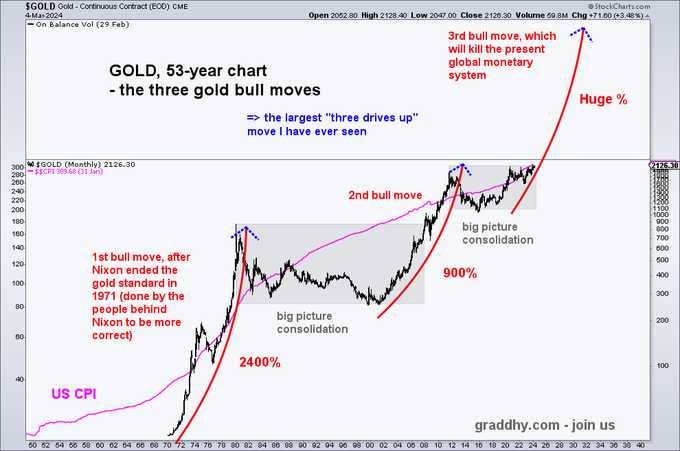

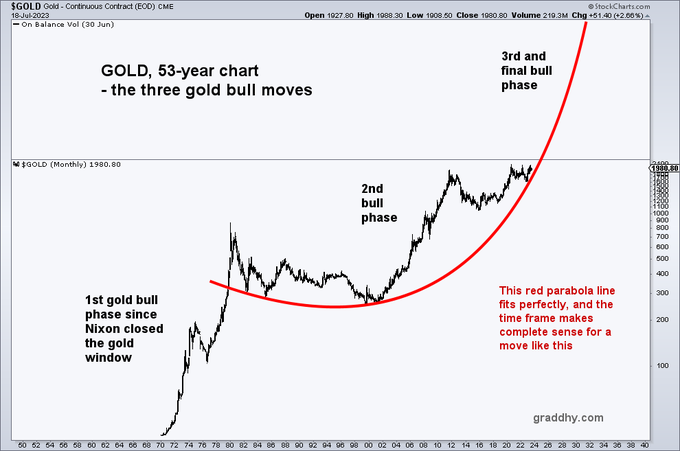

$GOLD has broke out above gray box.

Means the secular bull market is now resuming.

A true lifetime opportunity, and threat.

Do get prepared in every way.

Many miners will absolutely do 20x-50x.

Chose the right ones.

So it begins.

For heaven's sake, do not miss it.

#joinus

63

165

887

The

#glorious

#commodities

bull market will be the greatest opportunity in your lifetime to get out of the rat race.

As said for 2.5 years - DO NOT MISS IT

Global capital has clearly started to flow from the stock market into commodities.

So it begins.

$URA $URNM $HURA.TO $GCL.L

45

129

750

The

#commodities

bull market will be the greatest opportunity in your lifetime to get out of the rat race. Every parameter I can think of is in place for the greatest bull of all time.

End of the rainbow stuff.

Maximize income, minimize consumption, and play it the right way.

39

83

740

$GOLD has now broken above both blue line and gray box.

Means the secular bull market is now resuming.

Also means the 3rd and final bull phase has started.

Plus, the breakout marks the start of a new inflationary wave.

A lifetime opportunity, and threat.

Do get prepared.

#joinus

30

153

756

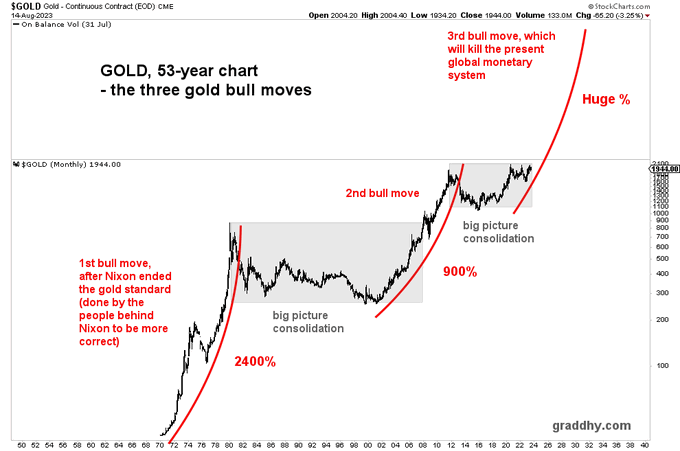

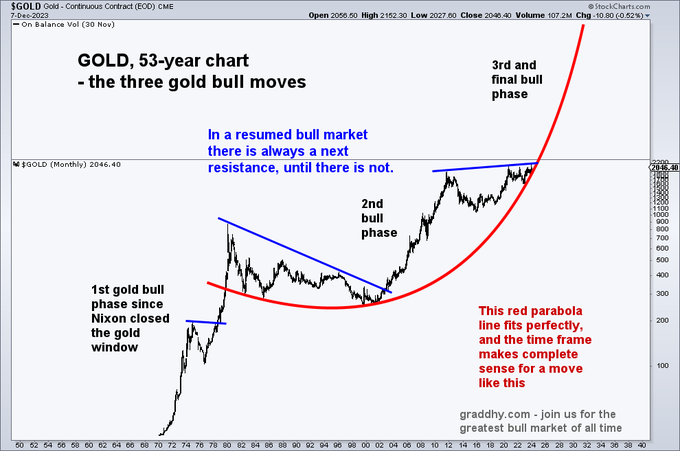

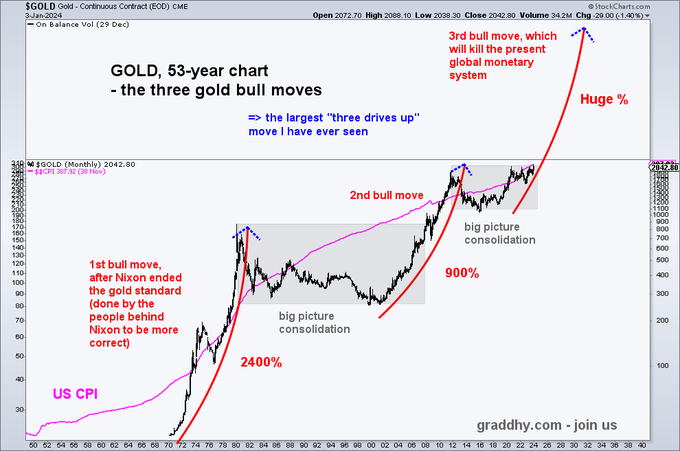

Been posting big evidence for a year that something massive is brewing for

#preciousmetals

Very big picture, we have seen the 70´s bull, the 2000´ bull, and now we are in a final 3rd bull.

Gold 10 000 to 15 000 is next.

OPPORTUNITY OF A LIFETIME, still.

#gold

#purchasingpower

45

196

734

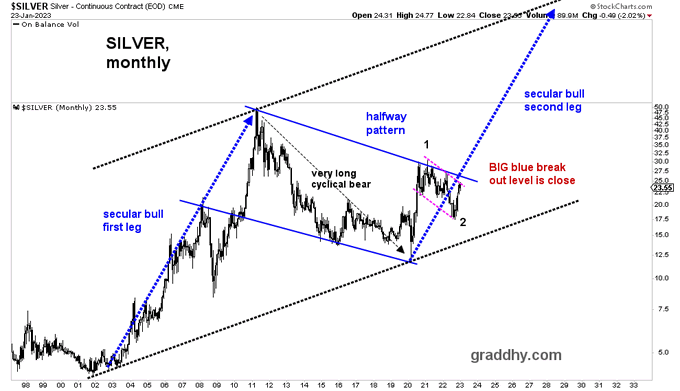

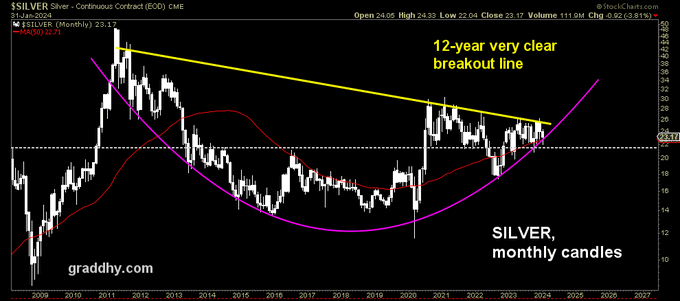

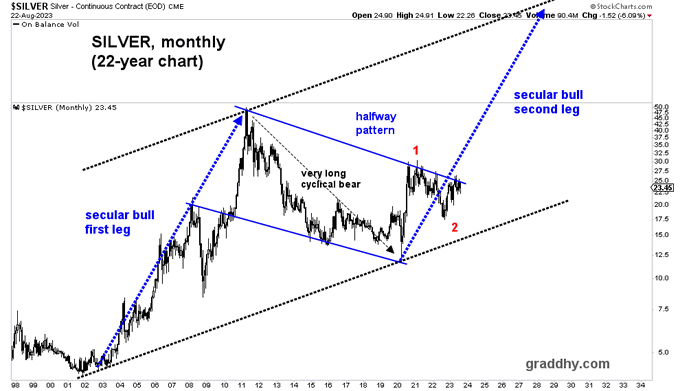

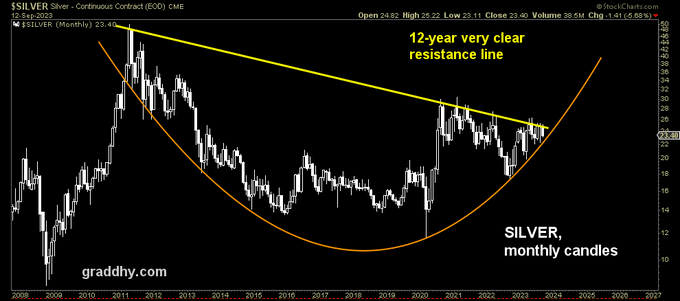

#silver

is getting ready to break out above that 12 year halfway pattern with pink bull flag providing the energy.

With BRICS+ coming commodity backed new world reserve currency, remember that the East has a very long historical relationship with silver.

2023+ will be huge!

34

158

686

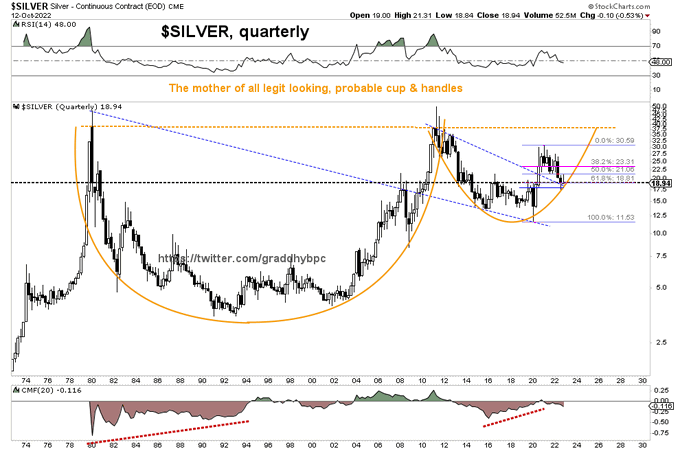

$SILVER ´s ATH is not 50, it is 806. In 1998 USD value...

Silver had been in decline for 500+ years when it bottomed around the millenium.

Could 800 happen briefly again when silver goes ballistic at the end of the commodities bull?

Absolutely.

#joinus

54

125

706

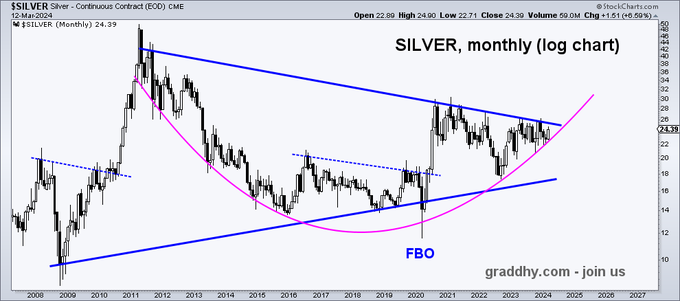

#preciousmetals

are in a resumed secular bull market.

Something big is brewing.

This extremely bullish $SILVER chart is now trying to break out of the blue bullish expanding falling wedge.

Get-out-of-rat-race opportunity. Do play this right.

#silver

#gold

#platinum

#palladium

23

127

621

Been posting big evidence for six months that something big is brewing for

#preciousmetals

Very big picture, we have seen the 70´s bull, the 2000´ bull, and now we are in a final 3rd bull.

Gold 10 000 to 15 000 is next.

OPPORTUNITY OF A LIFETIME, still

#gold

#purchasingpower

35

128

600

$GOLD is breaking out on daily, weekly, monthly and quarterly.

The margin expansion on some quality optionality plays among the miner companies, is going to be more than astronomical.

So it begins. Get ready. Get proper guidance.

And, always know the very big picture.

#joinus

18

123

588

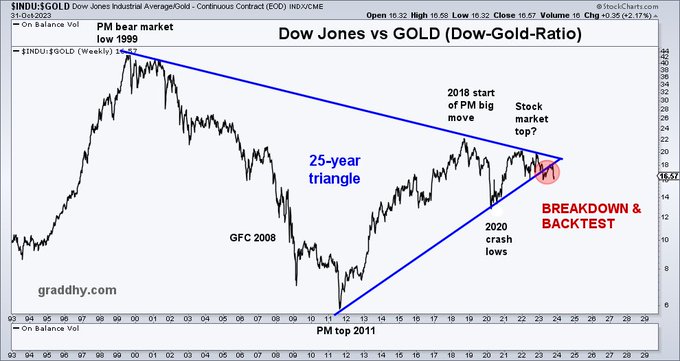

The Dow-to-Gold ratio now has a breakdown below its 25-year triangle, and a perfect backtest.

Very important chart for the next macro trend.

Historical, global asset paradigm shift in the making.

#gold

is now set to outperform general stock market.

So it begins.

#commodities

29

150

585

That sure does look like a big ass

#bullflag

on $SILVER.

And it is pretty interesting that the measured move for the bull flag, as a halfway pattern, is exactly up to ATHs.

34

96

558

Very big picture,

#silver

is looking fantastic.

And once that upper yellow line is cleared, it will be on its way.

It is holding MA50 + white support line + pink arc,

with a bullish reversal where want to see one.

GENERATIONAL opportunity.

#gold

#investing

#trading

#strategy

51

129

572

If you think you are late to the

#preciousmetals

or

#uranium

bull, you are not, you are very early. So pat yourself on the back instead of questioning yourself. The broad retail crowd is nowhere to be seen yet, and that is one of many parameters that makes a massive bull market.

21

72

547

$SILVER ´s ATH is not 50, it is 806. In 1998 USD value...

Silver had been in decline for 500+ years when it bottomed around the millenium.

Could 800 happen briefly again when silver goes ballistic at the end of the commodities bull?

Absolutely.

#joinus

60

104

546

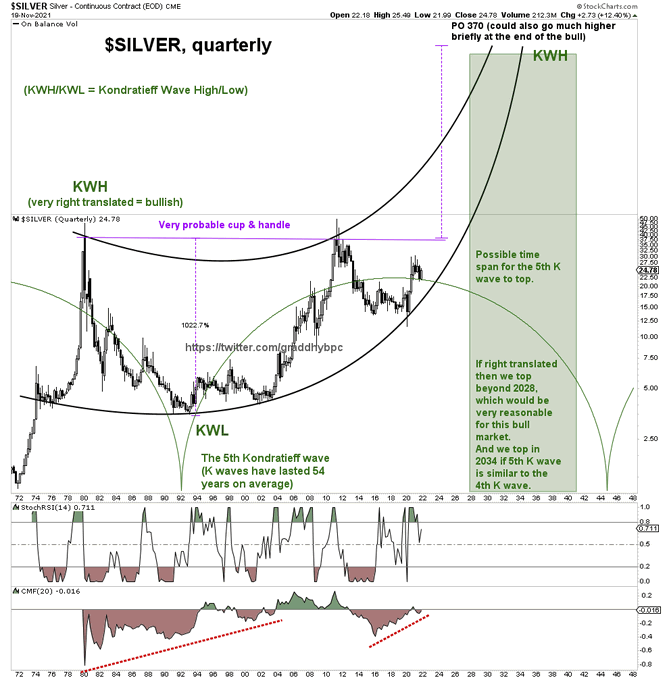

This

#silver

roadmap chart first posted in 2019 is still showing the way.

Had perfect backtest in 2022, now sitting right below blue breakout line.

Silver is getting ready.

Bull market price objective 370, but could briefly go double that in parabolic move at end of the bull.

25

145

536

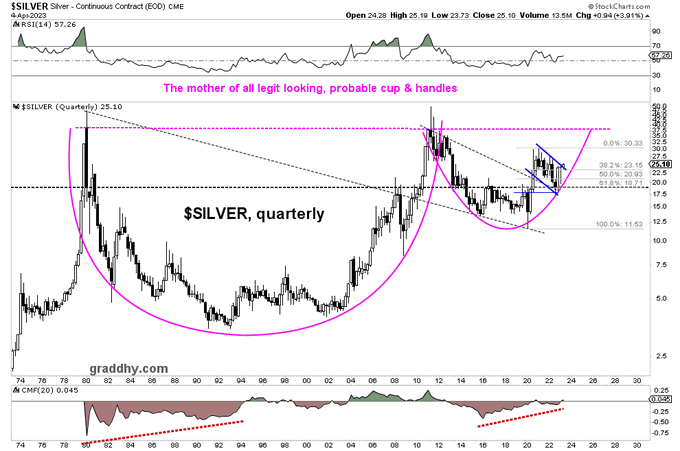

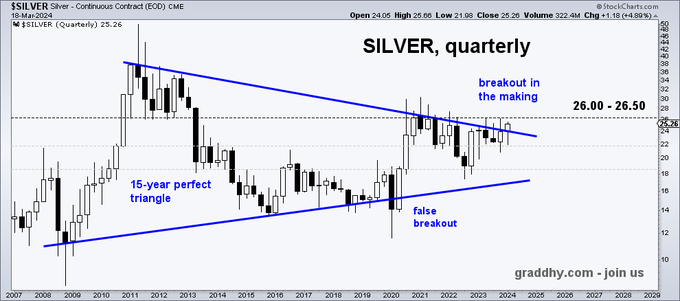

$SILVER quarterly

I posted a similar chart for

#GOLD

back in June 2019. Here is one for silver and it shows the largest so called long cycle I track, the Kondratieff wave.

I see a price objective around 370, but it can briefly go much higher at the very end of the bull market.

36

101

535

The

#commodities

bull market will be the greatest opportunity in your lifetime to get out of the rat race. Every parameter I can think of is in place for the greatest bull of all time.

End of the rainbow stuff.

Maximize income, minimize consumption, and play it the right way.

31

60

531

Been saying lately that $SILVER looks good.

As said, this is not the time to look away or lose interest.

That is one beautiful chart, in so many ways.

Are you watching

#silver

here..?

35

88

539

The

#commodities

bull market will be the greatest opportunity in your lifetime to get out of the rat race. Every parameter I can think of is in place for the greatest bull of all time.

End of the rainbow stuff.

Maximize income, minimize consumption, and play it the right way.

22

77

530

We have BREAK OUT.

With gold outperforming general stock market, global capital is flowing into the precious metals sector.

Historical, asset paradigm shift in the making.

#thebigassetrotation

#gold

#silver

#commodities

$SPX

17

109

523

Just like

#silver

was,

#platinum

is also sitting right below a huge blue breakout line.

GENERATIONAL breakout incoming also for platinum.

Get ready for the greatest commodities bull ever.

It will be your greatest market opportunity in life.

#commodities

#strategy

do

#joinus

24

82

526

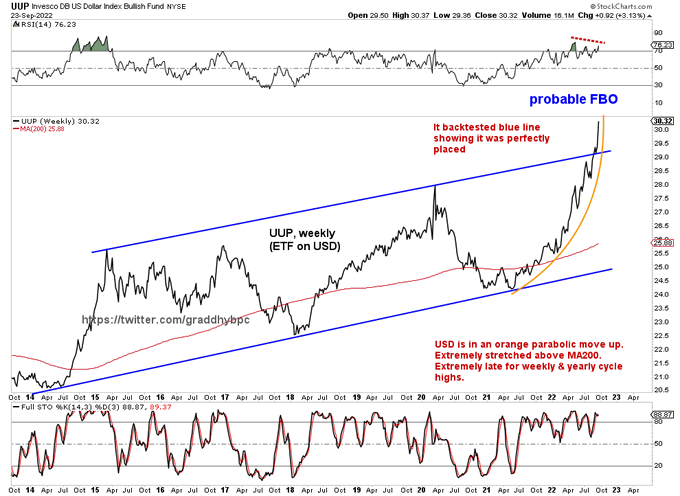

High odds for big $USD top soon, maybe very soon.

If so, it will affect EVERYTHING.

It has clear red negative divergence, indicating momentum is weakening at the end of this orange parabolic move, as also can be expected.

#currencywars

#inflation

#inflectionpoint

$DXY $UUP

42

111

517

$GOLD has a big fat bullish monthly engulfing reversal candle at present, pushing up against the big monthly closing prices yellow breakout level 1990-2000.

The 4th or 5th breakout try is usually successful.

This is the 4th try.

Are you watching this?

#strategy

#preciousmetals

23

109

519

Been posting big evidence for many months that something big is brewing for

#preciousmetals

Very big picture, we have seen the 70´s bull, the 2000´ bull, and now we are in a final 3rd bull.

Gold 10 000 to 15 000 is next.

OPPORTUNITY OF A LIFETIME, still

#gold

#purchasingpower

31

111

504

The

#commodities

bull market should last at least 10 years from 2020 low. It is and will be

#glorious

. And when we get YCC (yield curve control) and the bull markets in general equities and bonds are accepted to be history, global capital flows into the space will be historial.

19

61

495

#preciousmetals

are still at an inflection point.

This is the largest, legit looking cup & handle I have ever seen.

And we have silver at quadruple support:

► orange handle arc, black line, blue line, fib 62%

Always know the very big picture.

#gold

#silver

#silverstocks

22

102

492

#silver

is sitting right below the huge blue breakout line.

One can not play a resumed bull with a bearish mindset. That´s why most missed the 2022 lows, and many called for an early top or ridiculously low numbers, plus bailed to "get in lower".

GENERATIONAL breakout incoming.

26

97

498

Been saying for months that the final and 3rd gold bull run since 1971 is upon us.

Generational opportunity.

Not to be messed up.

Do not lose focus during pull backs.

As said for 3 years - gold 10 000 to 15 000 will happen.

#silver

#gold

#brics

#dedollarization

#purchasingpower

48

98

489

The $GOLD 8 year cycle charts I have been posting at my service are playing out very nicely and as expected.

It is, and will be, a glorious

#commodities

bull market.

It is your ticket out of the rat race.

It will literally save your family handled right.

So do not miss it.

25

50

480

The Dow-to-Gold ratio now has a breakdown below its 25-year triangle, and a perfect backtest.

Very important chart for the next macro trend.

Historical asset paradigm shift.

Institutions - wake up!

#gold

is now set to outperform general stock market.

So it begins.

#commodities

31

108

488

Very big picture,

#silver

is looking fantastic.

And once that upper blue line is cleared, it will be on its way.

And, early in the month, but that is at present a bullish reversal exactly where we want to see one.

GENERATIONAL opportunity.

#gold

#investing

#trading

#strategy

26

93

486

#wheat

has a 45-year parabolic base, and has now backtested plus bounced.

#gold

is telling us that 2nd inflationary wave is coming. So is this chart. And when Fed goes QE-infinity, this chart goes ballistic.

The

#commodities

bull market is a lifetime opportunity, and also threat.

21

111

484

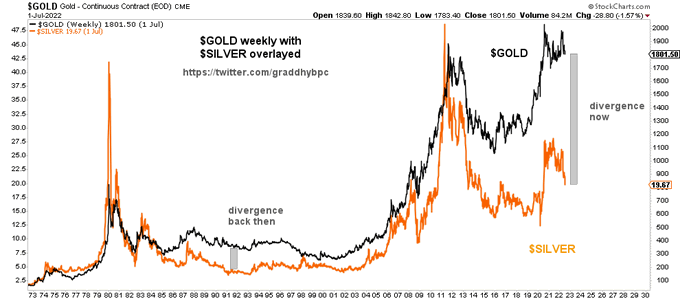

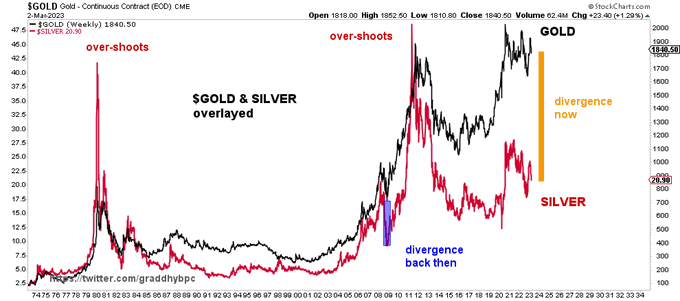

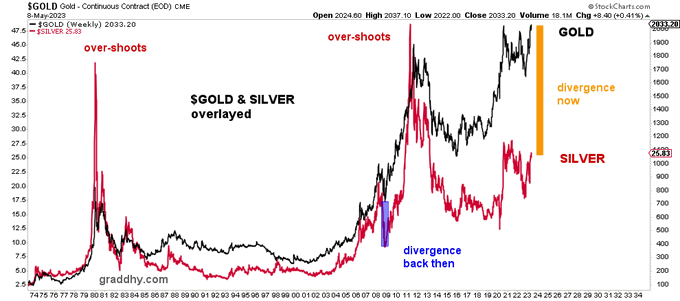

Very big picture there is an absolutely huge divergence between $GOLD & $SILVER. Something´s got to give. Last time the two had a large divergence like this, silver played catch-up big time.

By how much will

#silver

over-shoot this time?

Quite a lot I would think.

#coiledspring

29

107

461

Big picture, there is really only one trend line to watch for

#silver

right now. Once this resistance line is cleared, it will be on its way.

GENERATIONAL opportunity.

Just a fantasticly good looking chart in so many ways.

#gold

#investing

#trading

#commodities

#crypto

33

82

464

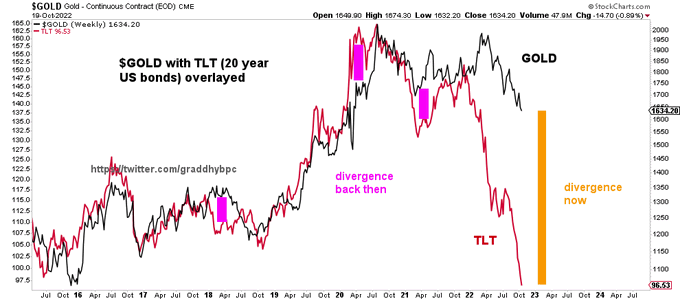

Big picture the massive divergence between $GOLD and $TLT (US bonds) is now ridiculously large.

Something has to be broken now.

And something´s got to give here.

#gold

#silver

#platinum

#palladium

62

105

450

$GOLD - That is one very clean, bullish falling wedge. With a perfect backtest, followed by a higher high, confirming a trend change on this 4h chart.

#gold

#silver

#platinum

#palladium

#investing

#trading

#strategy

22

83

463

$SILVER Always know the very big picture.

And could it be any more bullish? Not really.

Sitting just below blue line. Getting ready.

Historical setup. Get-out-of-rat-race opportunity.

#silver

#gold

#platinum

#palladium

#commodities

25

87

448

Big picture, there is really only one trend line to watch for

#silver

right now.

Once this resistance line is cleared, it will be on its way.

GENERATIONAL opportunity forming.

#gold

#investing

#trading

#inflation

#purchasingpower

#commodities

#crypto

39

91

442

The

#commodities

bull market will be the greatest opportunity in your lifetime to get out of the rat race.

I had waited years for the bear market low back in 2020,

then have said for 3.5 years - DO NOT MISS IT

☢️

#uranium

miners are just getting started. $ura $urnm $urnj $sput

14

73

449

The Dow-to-Gold ratio has now backtested for the second time, after breaking down below its 25-year triangle. And the chart is now very close to making an expected lower low, which will confirm the historical trend change.

So

#gold

is now set to outperform the general stock…

21

106

449

The big breakout level for $SILVER using the yearly time frame is 31-32, and not 38/50 like on lower time frames. As been saying, the blue tightening arrow pattern means a breakout is coming, and it is.

A 45y very bullish pattern - let that sink in !

#joinus

lifetime opportunity

13

77

448

$SILVER is right now squeezed in-between huge support and resistance, plus riding MA50. Needs to make a directional choice here very soon.

Are you watching this historical inflection point..?

#investing

#trading

#inflation

#commodities

#crypto

28

66

439