DeFiyst

@DeFiyst

Followers

18,130

Following

498

Media

740

Statuses

2,941

Full time degen, part time DeFi Analyst. Intern @splitcapital

Joined September 2021

Don't wanna be here?

Send us removal request.

Explore trending content on Musk Viewer

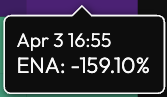

$PARAM

• 780133 Tweets

#AlleyesonRafah

• 468619 Tweets

僕のもの

• 44915 Tweets

ロッキン

• 32844 Tweets

超・獣神祭

• 32126 Tweets

चौधरी चरण सिंह

• 20168 Tweets

ブートヒル

• 19898 Tweets

PRABOWOfokus MAJUKANbangsa

• 19660 Tweets

バナナブリュレフラペチーノ

• 19084 Tweets

RaihKEMAJUAN NKRIkeDepan

• 18928 Tweets

करण भूषण सिंह

• 12784 Tweets

Last Seen Profiles

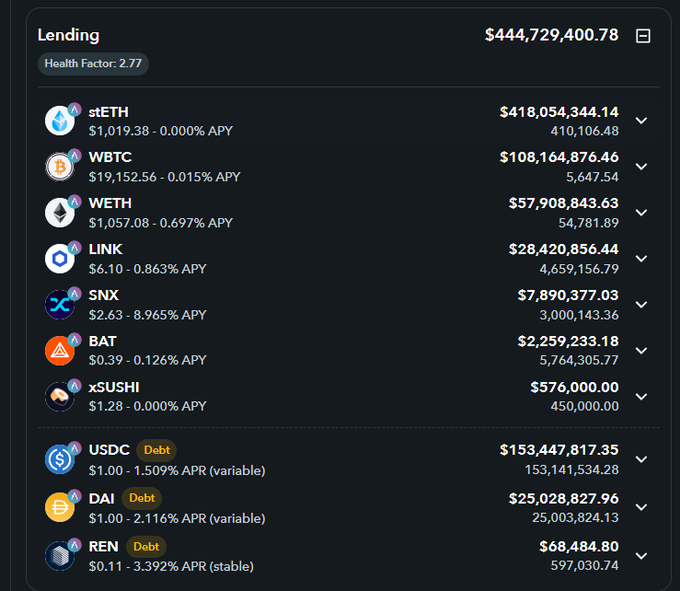

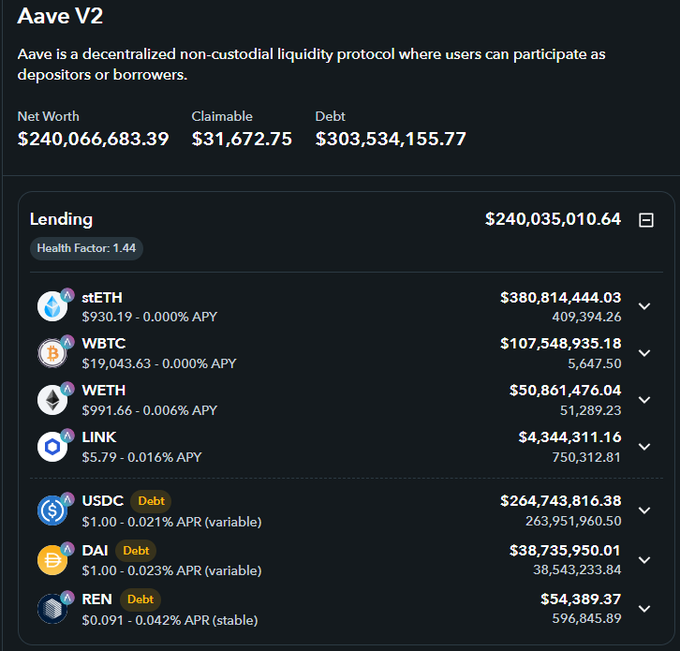

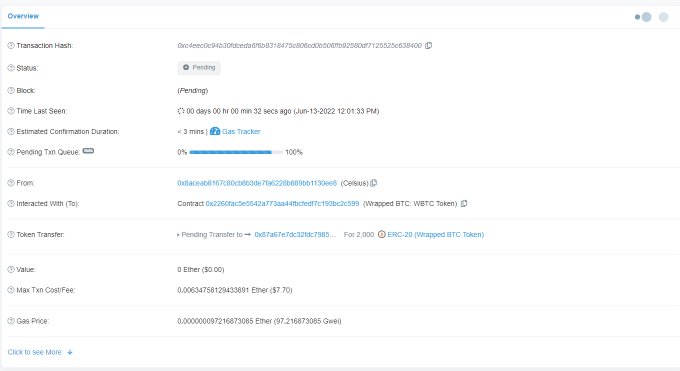

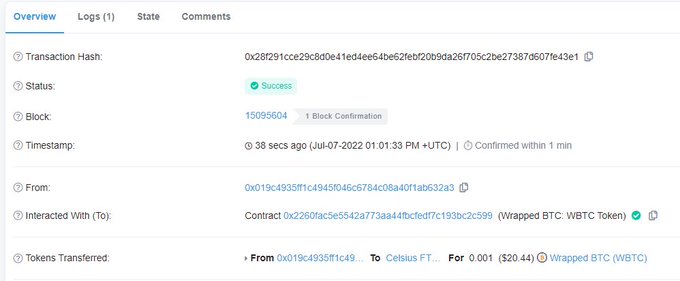

🚨 Celsius just moved 67k Ether ($72m) to the wallet they usually send tokens to exchange before dumping.

They withdrew 30k Ether from Aave, 37k Ether from Compound. First time in 3 weeks that they've reduced collateral in these positions.

@CelsiusNetwork

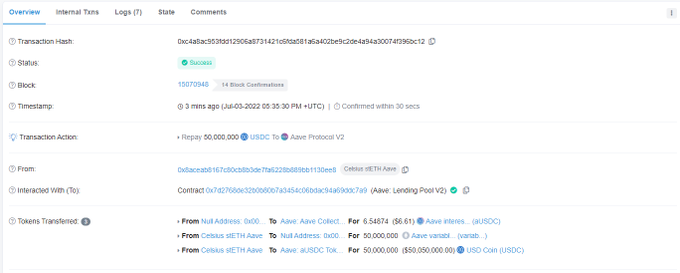

Just paid down another $50m in debt for their Aave position 😮

Health factor now 2.77.

($15m paid back yesterday also).

8

19

110

81

139

606

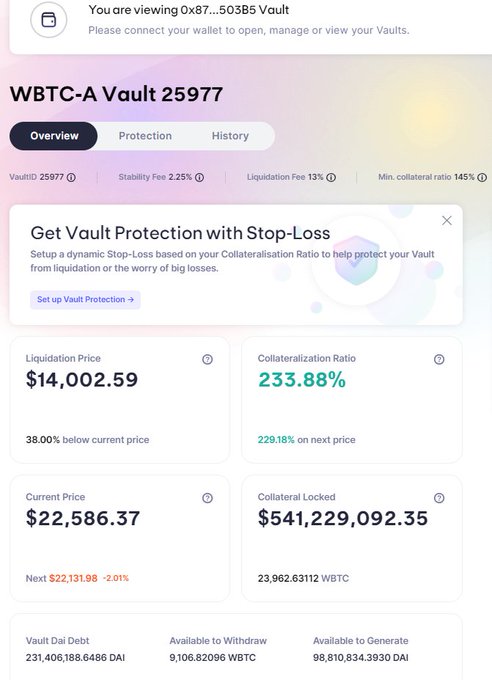

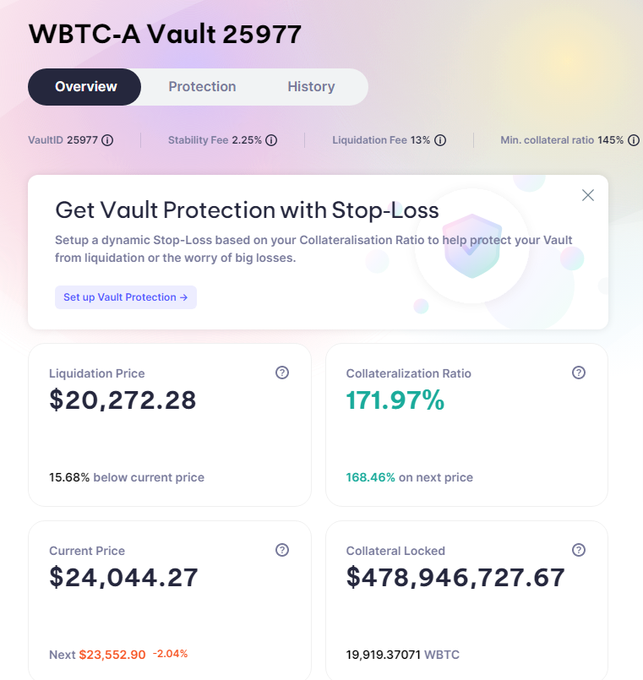

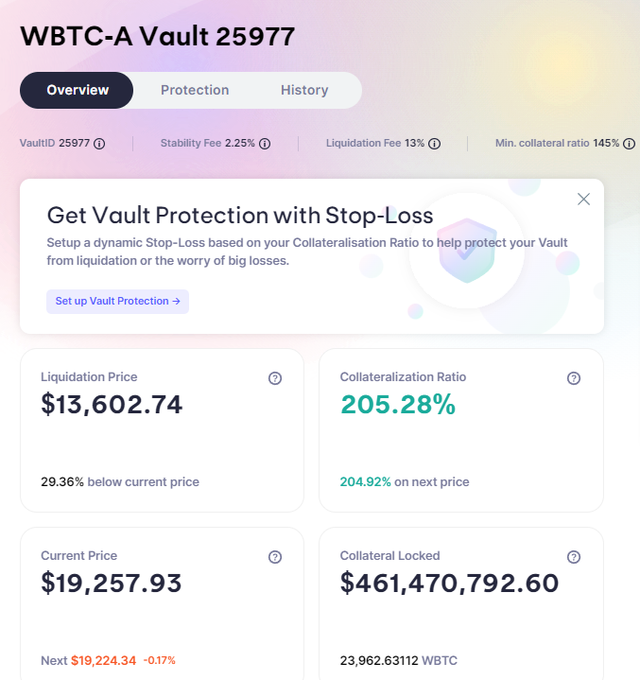

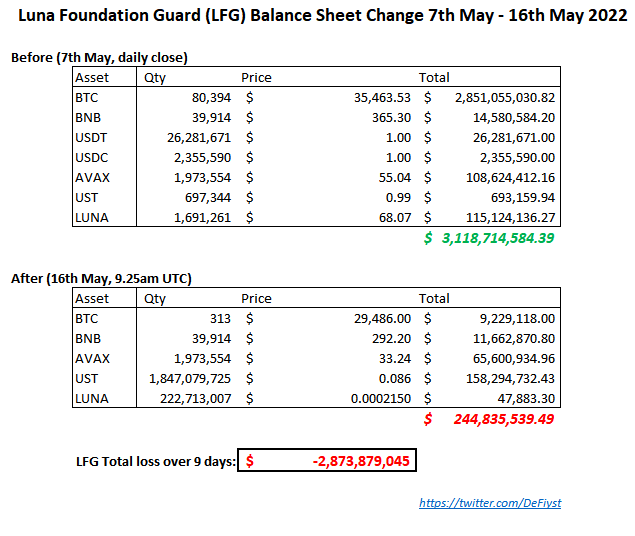

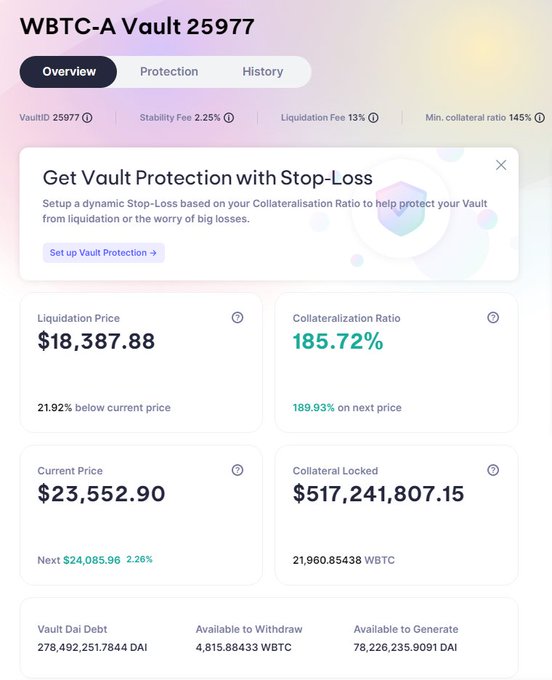

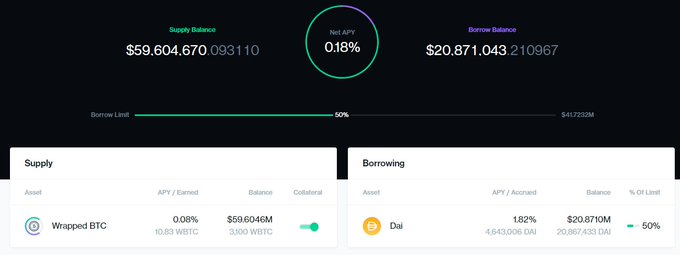

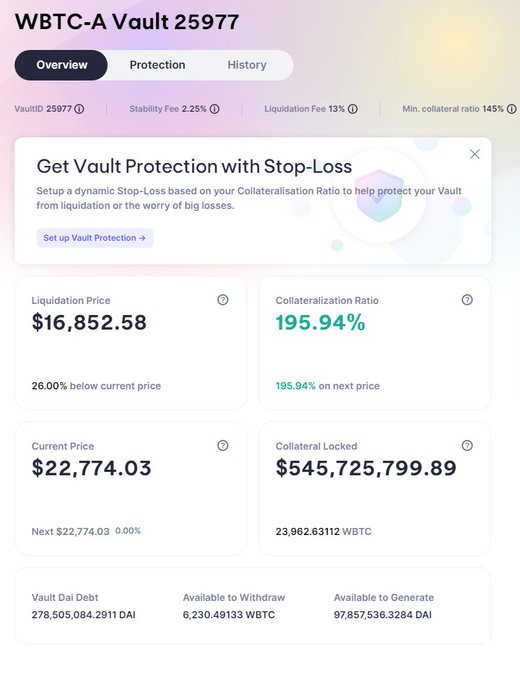

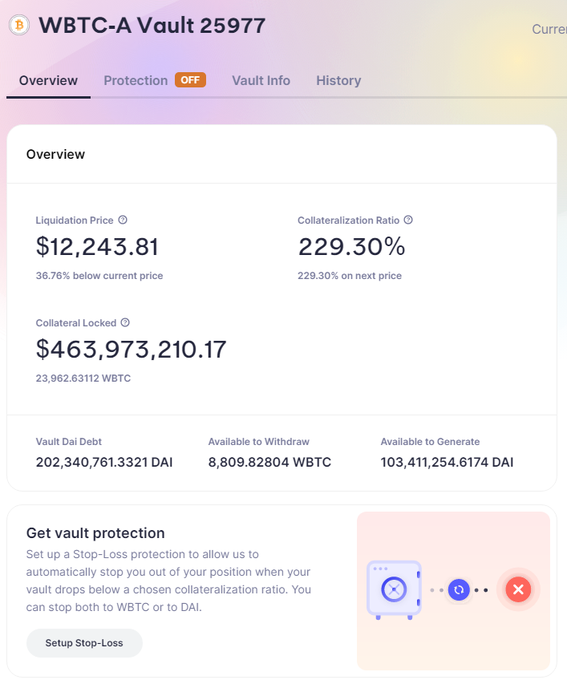

Only another 12% down in BTC for Celsius to be liq'd for $450m on-chain

Health factor being so close to 1 with users funds is an abuse of their fiduciary duty

Last time this was topped up was during LUNA liq cascade (May 12th) for negligible size (1k BTC) Vs 18k BTC collateral

-

#Celsius

17,919wBTC ($450M)

@CelsiusNetwork

@Mashinsky

wBTC

@MakerDAO

Health factor - 1.09, wBTC LIQUDATES at $22,535

3

12

53

14

58

287

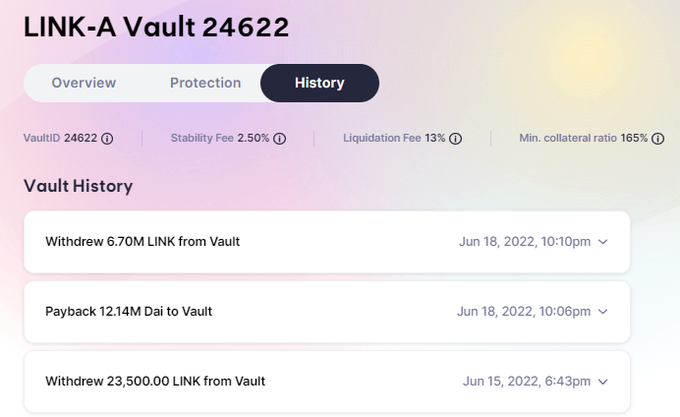

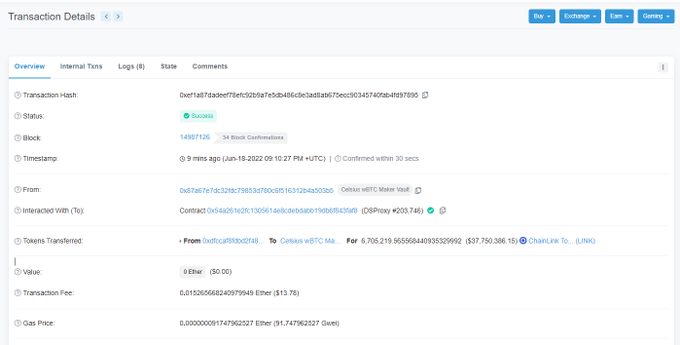

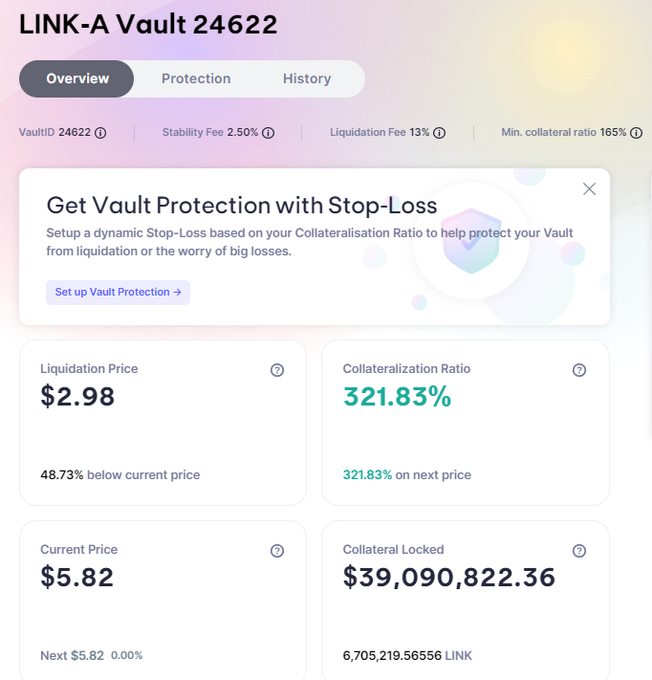

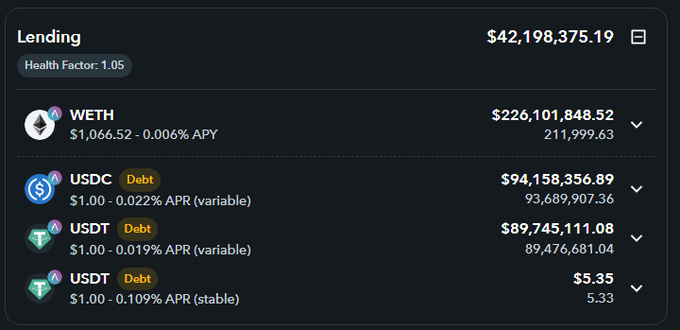

Amidst the noise surrounding the Aave ETH whale teetering on the edge of liquidation, and the inactive Solend user getting worryingly close also,

@CelsiusNetwork

have fully paid down their $LINK Maker position ($37m).

Interesting.

1)

@CelsiusNetwork

Relatively unchanged. more debt DAI paid down on the wBTC Maker vault, liq now $13.6k. $LINK vault unchanged since Wednesday.

More activity in the Aave wallet - $20m of both DAI and USDC paid down in the last 24 hrs. Health factor now 1.44.

3

3

24

17

46

266

With Celsius out the clear in the short-term with their on-chain positions, all eyes are now on 3AC.

3AC supposedly owns this wallet, and 8k ETH has just been liquidated - 0x716034c25d9fb4b38c837afe417b7f2b9af3e9ae

12

71

230

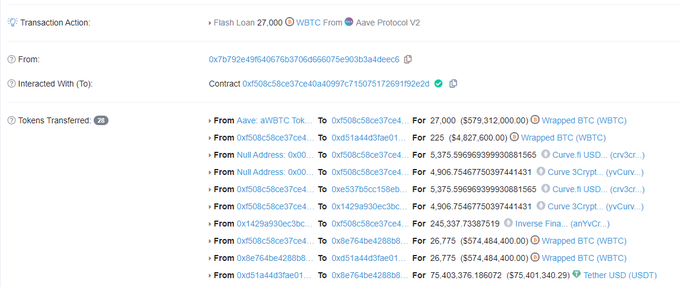

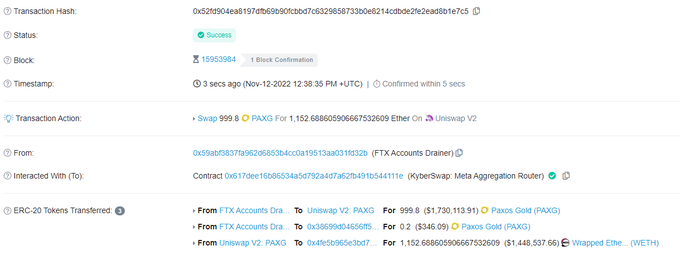

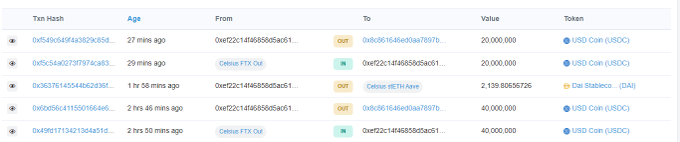

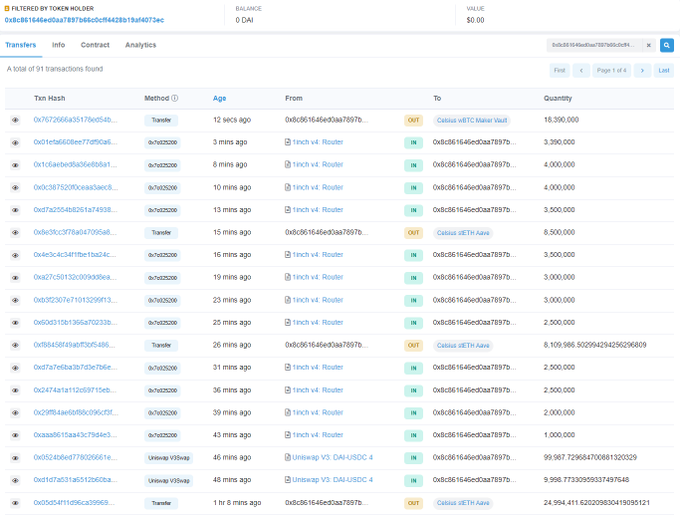

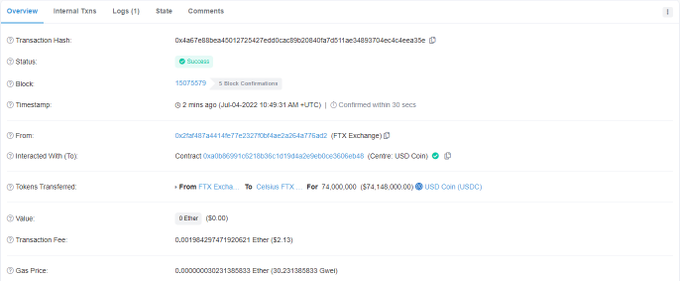

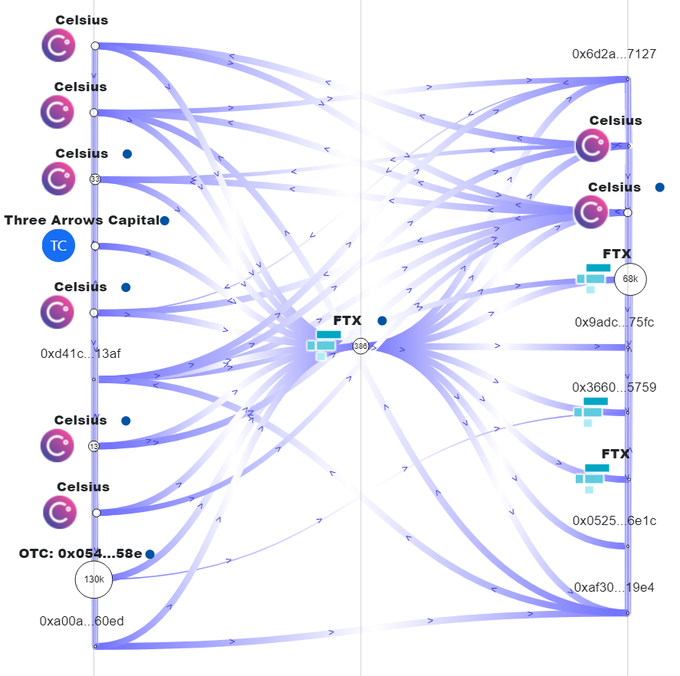

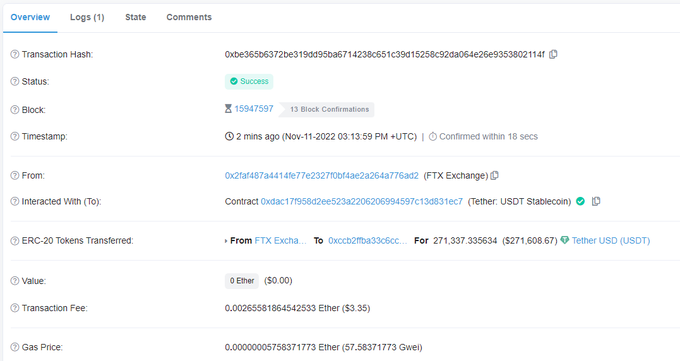

Updates to my Celsius on-chain positioning thread;

@CelsiusNetwork

are paying down a lot of debt right now.

$40m and then $20m USDC in from their FTX acc. This was all flipped into DAI through

@1inch

using

@MakerDAO

's PSM.

13

48

199

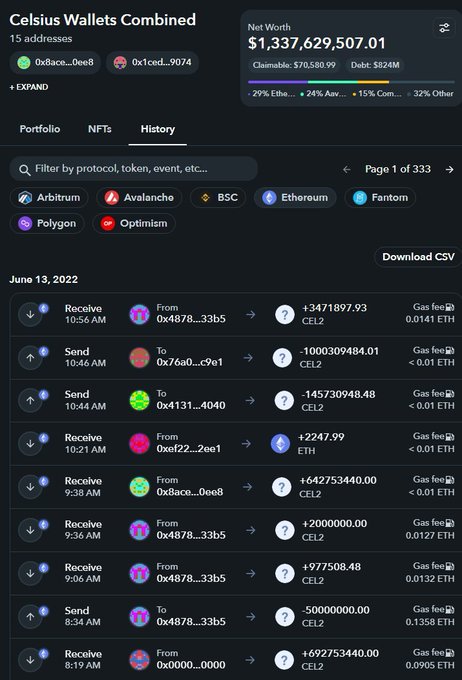

10/10

This account has 8x the number of followers it had yesterday lol. Shoutout to everyone who has been closely monitoring this alongside me 🫡

@HsakaTrades

@lawmaster

@SplitCapital

@0xShual

@TheDeFiDan

@Timccopeland

@nanexcool

@MikeBurgersburg

@SmallCapScience

&many others

8

0

167

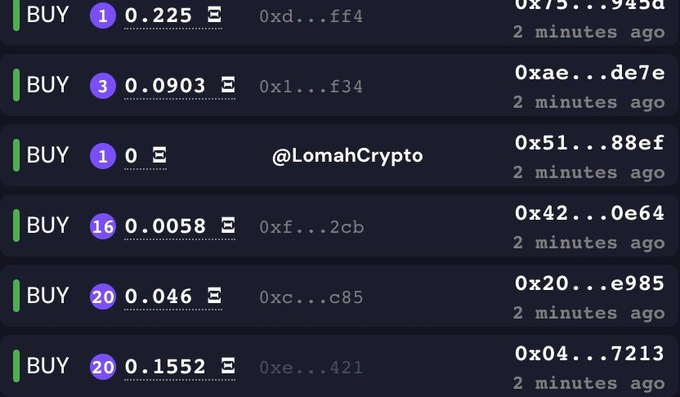

Ongoing

@friendtech

MEV war on Base is wild.

These bots have improved exponentially since

@functi0nZer0

and

@meoawtistic

open sourced the first snipers last week.

Take

@LomahCrypto

's launch below, for example. Shares holding strong 0.4-0.5E range, you do the math.

Strongest

13

20

157

Regarding

@happydelio

@haruinvest

news:

This "8.1bn" figure is actually in KRW.

So.... $6m USD in alts.

.global website gives USD, .io site gives KRW.

Misleading as fuck.

29

25

141

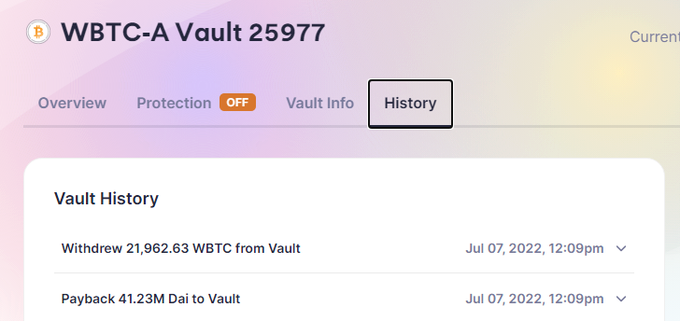

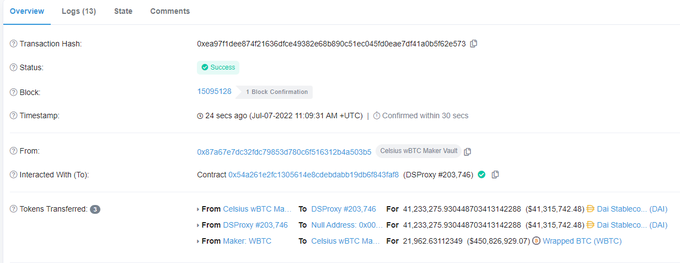

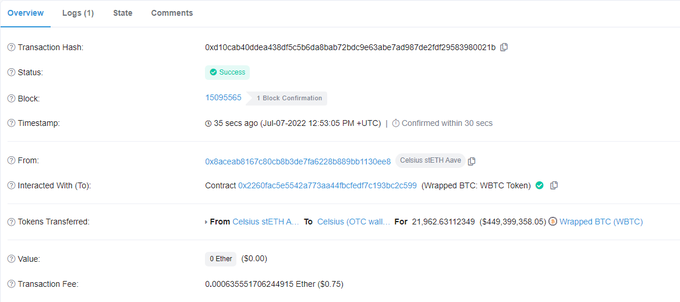

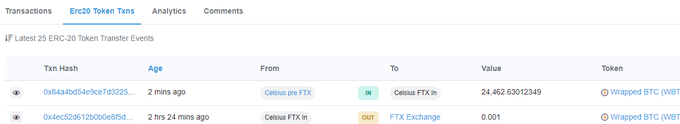

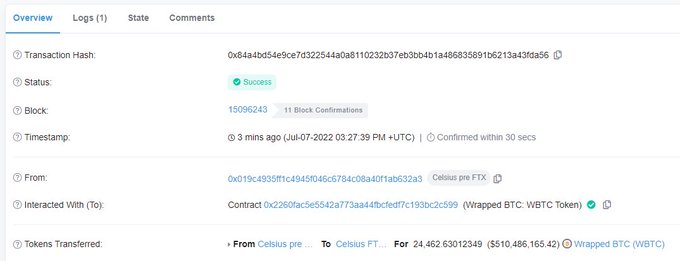

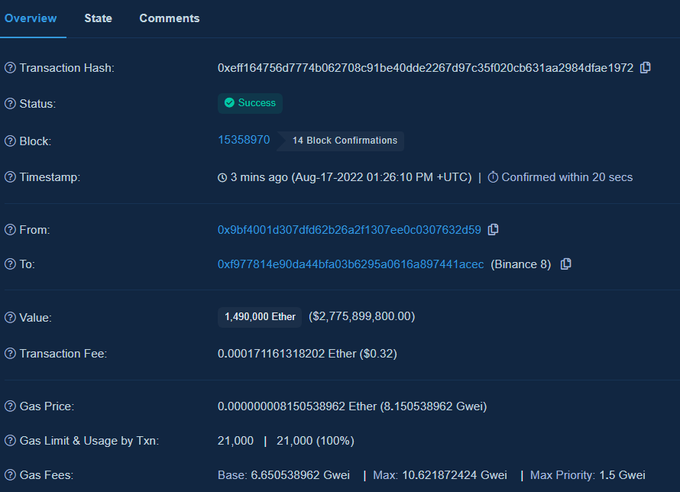

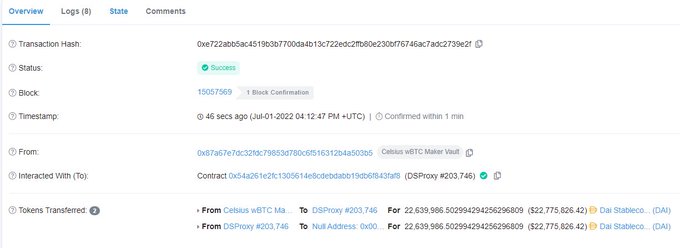

As promised, updating on any sizable moves:

All DAI debt paid down in

@CelsiusNetwork

wBTC maker vault and collateral removed ($450m in BTC).

I'd imagine they already have an OTC deal setup. Doubt this hit the spot markets but we shall see.

Updates to my Celsius on-chain positioning thread;

@CelsiusNetwork

are paying down a lot of debt right now.

$40m and then $20m USDC in from their FTX acc. This was all flipped into DAI through

@1inch

using

@MakerDAO

's PSM.

13

48

199

6

19

139

Wow... so Babel's withdrawal freeze & losses were predominantly from directionally trading funds?!

They blamed Celsius & 3AC when they had limited exposure themselves and it seems that the majority of capital lost from lack of hedging?

Embarrassing...

SCOOP: Babel Finance lost over $280 million in proprietary trading with customer funds

By

@Yogita_Khatri5

59

67

212

8

18

144

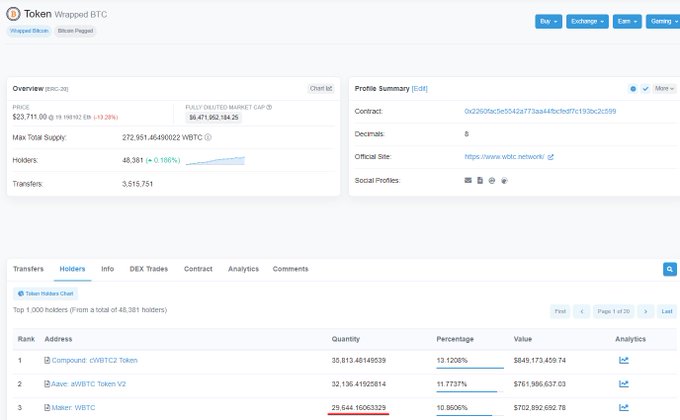

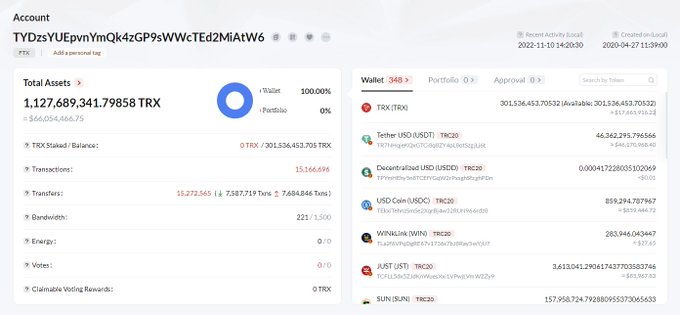

WILD stats.

@CelsiusNetwork

's wBTC wallet has 8% of ALL wBTC in circulation and is 74% of all Maker wBTC?!

Shows how reliant we are on

@MakerDAO

auctions to ensure this can be fairly liquidated (if we get there) and

@BitGo

(BTC wrapper)

74% of all wBTC on Maker is in Celsius Maker vault, we're really trusting

@MakerDAO

liquidation mechanism here.

2

2

21

8

21

141

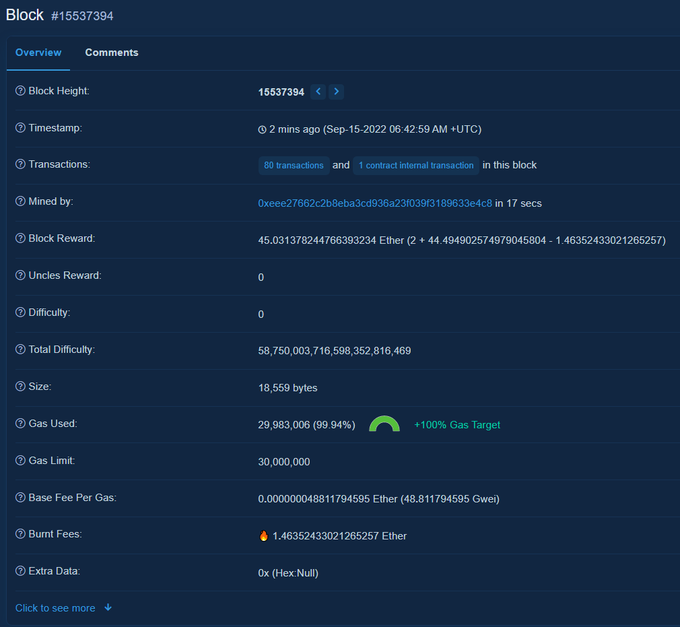

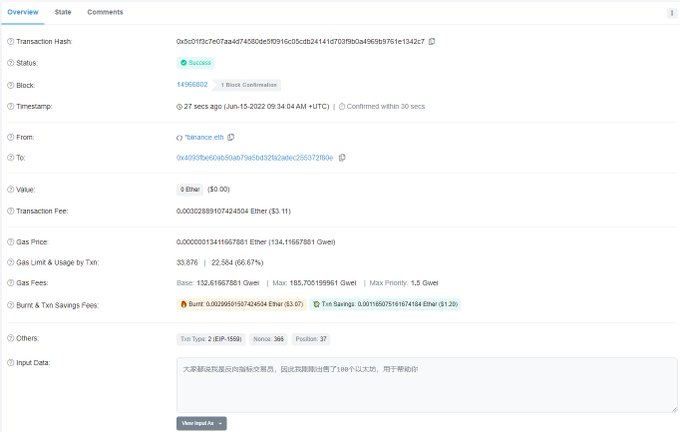

This ACTUALLY happened!😱

Someone filled the final PoW block by minting a VanityBlock NFT!

They paid 30.2 ETH with a 1.3 ETH TX fee for the privilege of capping out the 30 million gas limit and creating the final transaction!

Legend🤝

@0xWittgenstein

Mint a VanityBlock-style NFT to fill the final block(s) and pay a ton in tips to screw over last minute MEV bots & speculators.

1

2

14

9

36

141

Since this prior thread took off, ETH is now 3 figs, and BTC is below 2017 all time highs.

Now is a good time to do an update to my prior 🧵

Will focus on:

1) Celsius on-chain update

2) Aave ETH whale movements

3) Three Arrows

4) Babel Finance & miner situ

5) BlockFi & misc

11

52

139

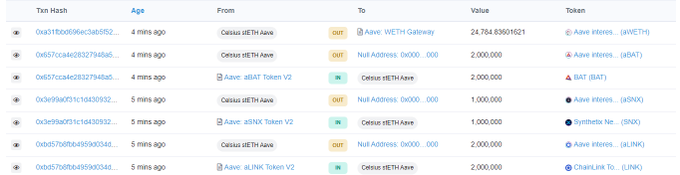

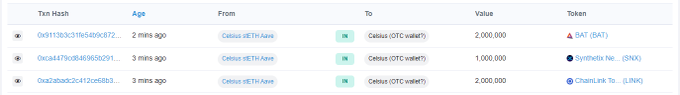

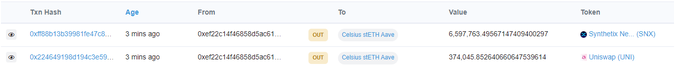

Gm. New day, new Celsius wallet movements.

@CelsiusNetwork

are removing more Aave collateral (2m BAT, 1m SNX, 2m LINK, and 25k ETH).

Total of ~$45m. Heading through intermediary wallets to FTX.

9

26

130

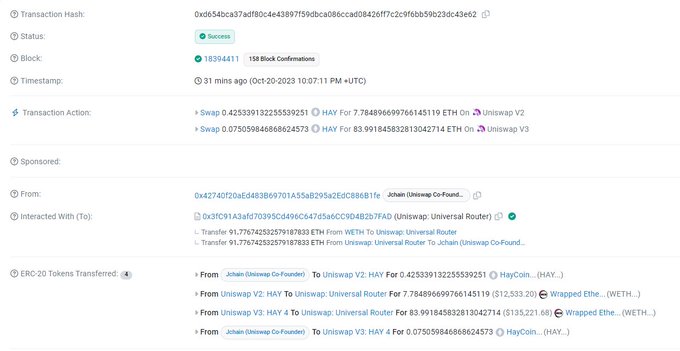

@oooitscrime

Have to agree with

@Fade

here.

What the fuck is going on? Why are the Co-Founders of Uniswap rugging OG shitcoins for under 100 Ether?

10

11

128

@LidoFinance

has now officially flipped the king

@CurveFinance

by TVL according to

@DefiLlama

, taking the

#1

spot. Quite impressive.

(Note this excludes CRV staked in Curve)

5

18

122

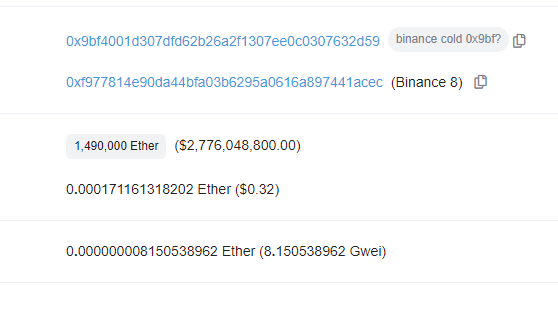

They added another 3k BTC to this, now moving to 0x019.. which is their pre-exchange wallet.

$500m in BTC very likely to hit the markets.

@CelsiusNetwork

@SplitCapital

Nvm, looks like they're moving to their intermediary wallets which end up at FTX. Looks like it will be sold after all.

1

0

15

19

19

117

4/10

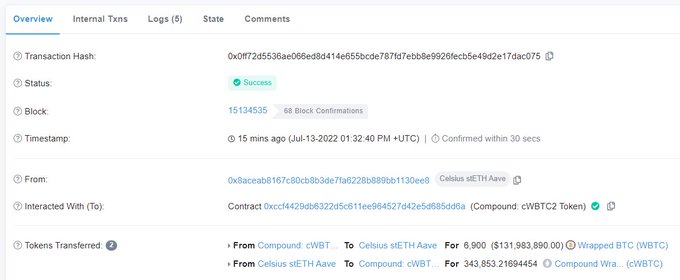

Observations:

The above position alone constitutes 47% of ALL borrowed DAI in Compound and 25% of ALL borrowed USDC.

Insane to think how much of DeFi TVL is dominated by the few as

@lawmaster

alludes to here:

@HsakaTrades

I don't think people realize how much of DeFi is actually just Celsius parking their client money. If they wind all of that out, TVL will tank so badly. Also, a lot of prop funds and market makers borrow undercollateralized from them. The impact would be massive

32

90

780

1

9

119

Key points:

-Airdrop is linear (whales haven't been screwed)

-15% to airdrop, of which 1/3rd is at TGE

-First snapshot 15th Mar, so early farmers receive majority on TGE

-"90%" claimable from first season -> I read this as token vest for largest wallets (similar to ENA)

10

15

122

9/10

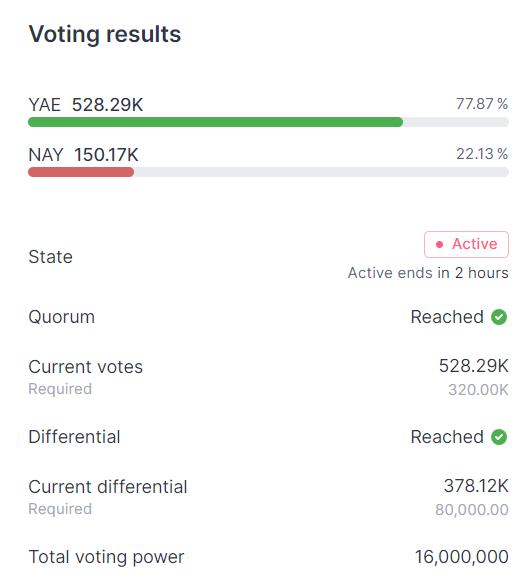

Overall

@CelsiusNetwork

and

@Mashinsky

are in a significantly better spot than they were since I started tweeting about this yesterday (below)

Has been fun to closely track movements on-chain and keep ya'll updated. Lets hope the worst is behind us

2

8

115

@CelsiusNetwork

Just paid down another $50m in debt for their Aave position 😮

Health factor now 2.77.

($15m paid back yesterday also).

Updates to my Celsius on-chain positioning thread;

@CelsiusNetwork

are paying down a lot of debt right now.

$40m and then $20m USDC in from their FTX acc. This was all flipped into DAI through

@1inch

using

@MakerDAO

's PSM.

13

48

199

8

19

110

@CelsiusNetwork

are very active on-chain ATM, pulling in various tokens into their 0xEf2 wallet and then transferring to main Aave/Comp wallet (0x8AC).

They moved in the $37m in LINK (previously in Maker vault, see below), $13m in SNX, $2m in BAT, $1.5m in UNI, $1m in SUSHI.

Amidst the noise surrounding the Aave ETH whale teetering on the edge of liquidation, and the inactive Solend user getting worryingly close also,

@CelsiusNetwork

have fully paid down their $LINK Maker position ($37m).

Interesting.

17

46

266

8

24

104

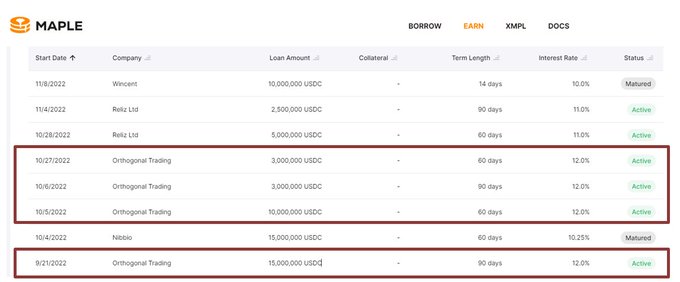

Quick dive into the Maple fuckery + some overlooked points and my thoughts...

TL;DR:

@OrthoTrading

likely rekt, retail lose out again.

Severe incompetence from both

@maplefinance

and

@M11Credit

whom allowed this to happen🧵

7

26

105

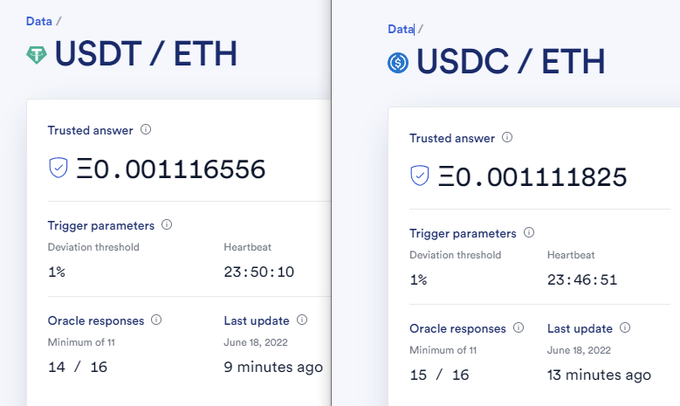

Our Aave whale's 212k ETH is safe for now. It was on the edge of liquidation. Despite wicking below on many major CEXs,

@chainlink

's oracle price didn't go below the threshold for liqs

Either the whale has deep pockets or someone did not want to see this being liq'd

HF now 1.10

15

14

94

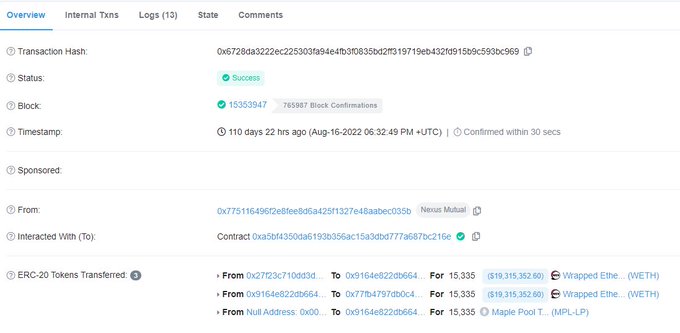

Holy shit.

Nexus Mutual deposited 15.3k Ether into the

@M11Credit

WETH pool on Maple 3 months ago and haven't withdrawn (69% of the pool!)

TX - 0x6728da3222ec225303fa94e4fb3f0835bd2ff319719eb432fd915b9c593bc969

h/t

@DegenSpartan

,

@0xSuperTrooper

We’re excited to announce that 15,348 ETH has been deployed into our

@enzymefinance

vault and deposited in

@Maven11Capital

's wETH pool on

@maplefinance

🥞

Learn about the vital role

@chainlink

Proof of Reserve plays in Nexus Mutual’s recent investment 👇

8

15

50

9

18

100

@HsakaTrades

If neither of these hit the deviation threshold on another slight drop and it's up only from here, for our ETH whale to never be liquidated, this moment will go down in history.

12

7

99

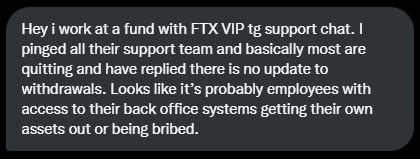

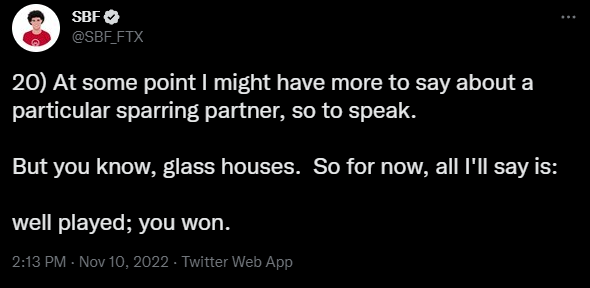

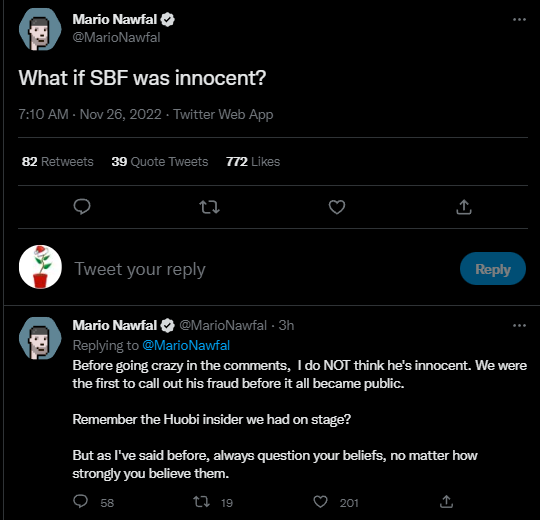

This tweet pisses me off the most.

It's like he considers his user's as cannon fodder for his multi-year-long war.

Reads like a sick and twisted King fighting over a throne, throwing peasants (users) into the battlefield to be slaughtered in the name of House FTX.

Disgusting.

5

9

98

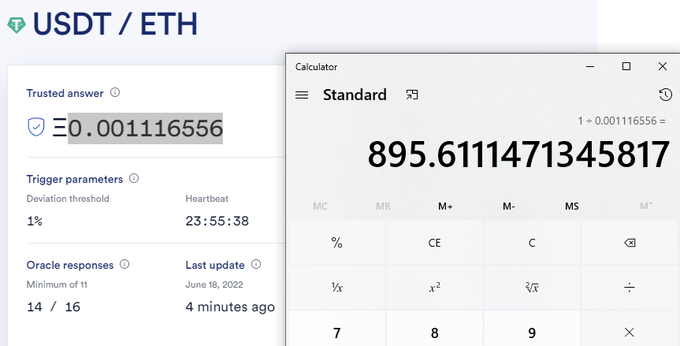

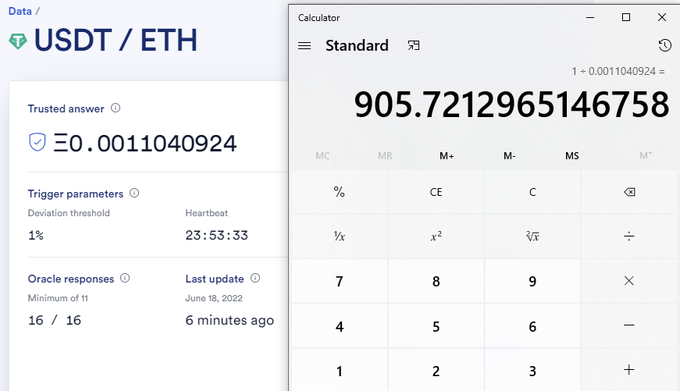

@ChainLinkGod

rightfully corrected me. Aave only uses the ChainLink pairs with ETH denominations.

For liq to occur will need the USDT/ETH oracle to go to 0.0011168 Ether (~1.1% off from this oracle price)

[not including USDC]

5

4

96

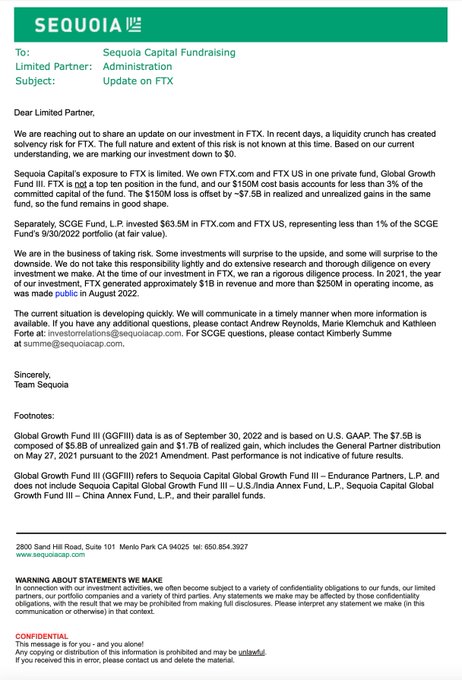

FTX Estate casually missing out on >half a yard at current val.

Idk why the UC debtors panic sold their stake back to Mysten Labs.

@cmsholdings

nailed it here, and current FDV is even double his prediction. Sure, apply an OTC SAFT discount, still 9 figs missed.

h/t

@0xG00gly

7

13

77

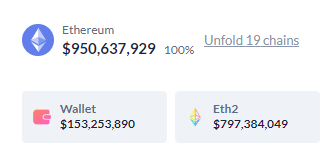

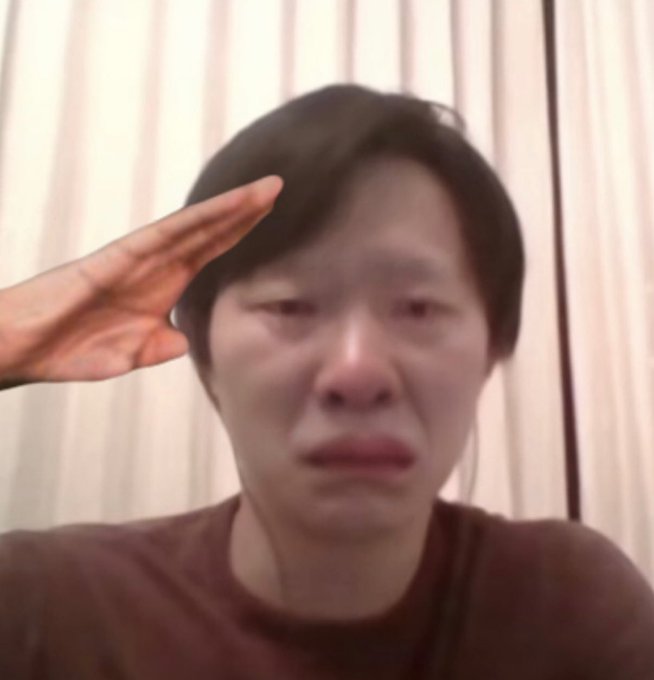

@CelsiusNetwork

wBTC now moved. 0 Compound debt or assets. End of an era.

$824m of on-chain debt paid down over the duration of exactly one month today (Zapper screenshot from June 13th).

9

11

77

Weirdest part is that this seemed preordained.

There was a $JCD telegram group created 4 days ago, with some chatter on twitter after years of nothing?

Retroactive public goods funding for... Uniswap Co-Founders?

@oooitscrime

Hayden's tweet for context

7

14

67

@cobie

Yup..

If you noticed the

@Ronin_Network

exploit on the day and got short AXS on ~2x leverage, you would've been liquidated before this news even broke

4

13

62

2

1

70

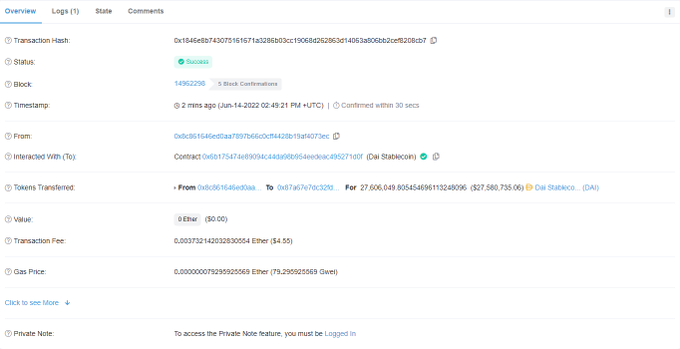

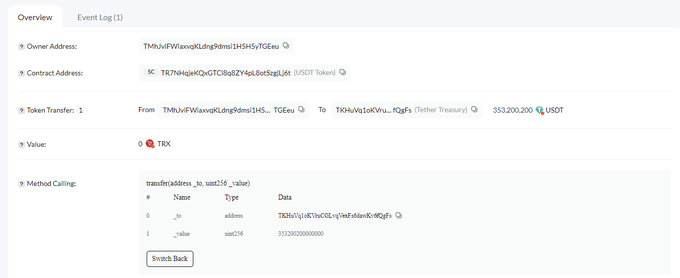

UPDATE: $27.5m DAI transferred into the wBTC

@CelsiusNetwork

wallet.

If this is used to pay down debt, their new liquidation price will move to $15,182.

@TheDeFiDan

UPDATE:

@CelsiusNetwork

added more BTC to their collateral overnight (now sitting at $545m in collateral, 24k BTC).

If they had not added over the last couple of days they would've been liquidated several hours ago.

They now have more breathing room (-26%) until liqs begin.

3

8

44

2

10

67

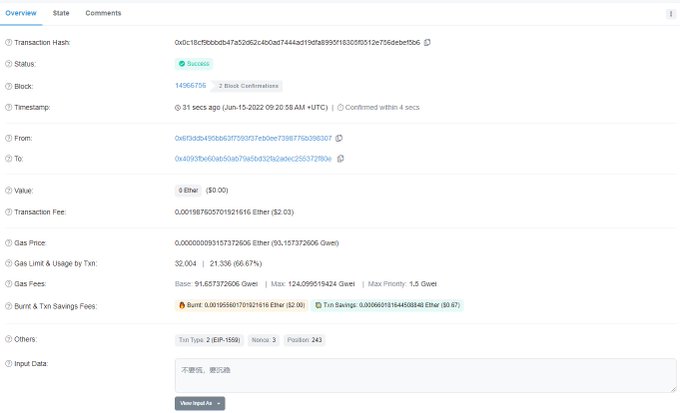

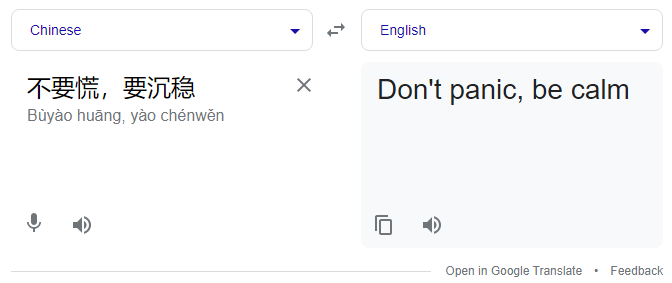

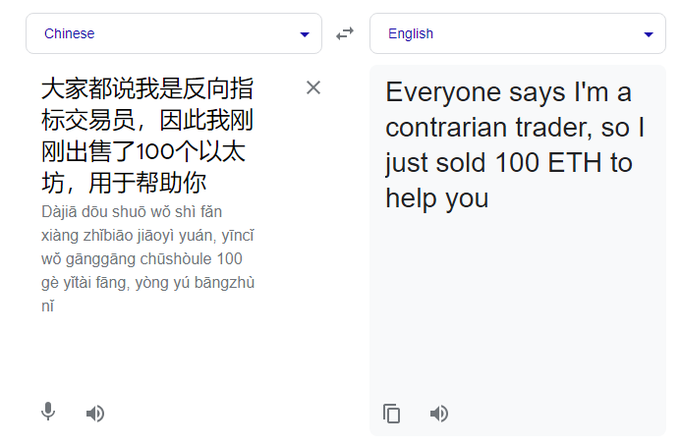

New message from *binance.eth.

"Everyone says I'm a contrarian trader, so I just sold 100 ETH to help you".

Didn't realise

@DegenSpartan

spoke Chinese

7

7

65

Reminder: This was tweeted LESS than 24h ago.😡

The Chapter 11 Bankruptcy INCLUDES FTX US.

Lying through his teeth amidst already certain peril. Tragic.

Would be intrigued to see FTX US withdrawals map over last 24h to see what was extracted from that entity since this tweet.

2

7

60

If you noticed the

@Ronin_Network

exploit on the day and got short AXS on ~2x leverage, you would've been liquidated before this news even broke

4

13

62

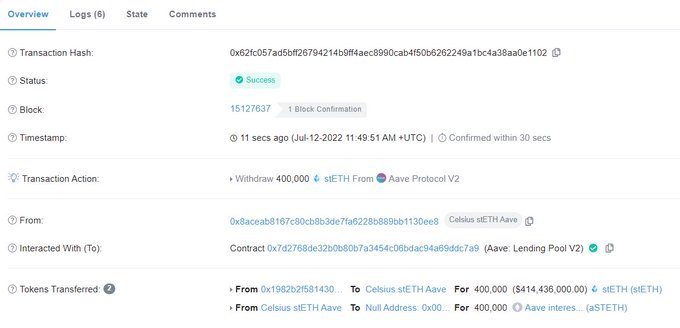

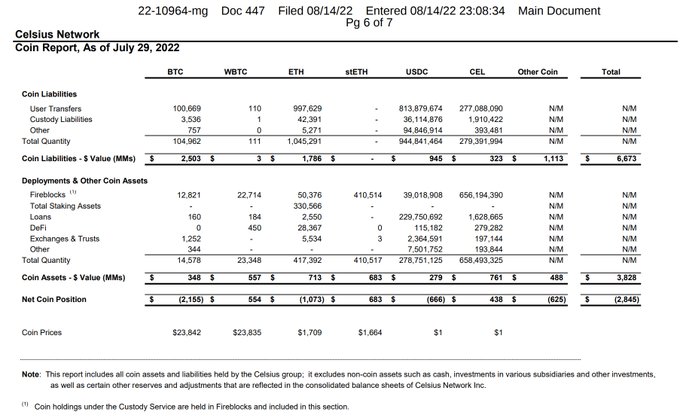

Couple interesting observations from new

@CelsiusNetwork

Bankruptcy docs (snapshot 2 wks after they fully de-levered on-chain):

1/ stETH was not sold OTC

2/ This confirms Celsius own 95.1% of $CEL token supply

3/ They are even more fucked than I thought

@CelsiusNetwork

wBTC now moved. 0 Compound debt or assets. End of an era.

$824m of on-chain debt paid down over the duration of exactly one month today (Zapper screenshot from June 13th).

9

11

77

12

15

58

Another 10% reduction in debt on their wBTC Maker vault. Liquidation price now $12.2k.

They had previously paid down their $LINK vault here also:

@CelsiusNetwork

are very active on-chain ATM, pulling in various tokens into their 0xEf2 wallet and then transferring to main Aave/Comp wallet (0x8AC).

They moved in the $37m in LINK (previously in Maker vault, see below), $13m in SNX, $2m in BAT, $1.5m in UNI, $1m in SUSHI.

8

24

104

5

5

61

FWIW, if you try and pull a bank run on USDT, the optimal time to do it is late on Friday heading into the weekend such that TradFi markets are closed and if positioned badly, Tether could struggle to exit non-cash equivs.

It's a Thursday folks. What am I missing here?

9

7

59