ConvexityMaven

@ConvexityMaven

Followers

34K

Following

3

Media

90

Statuses

210

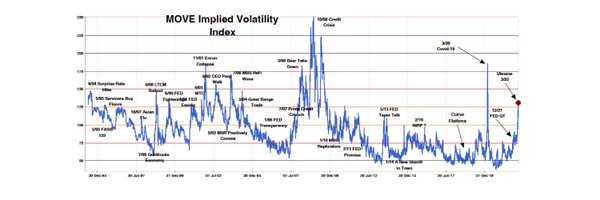

Creator of $MOVE Index; $RFIX; $PFIX; $MTBA Managing Partner @ https://t.co/tmnhsnRE29 Publisher of Maven Commentary https://t.co/OwX9kW3QE2

Laguna Beach & NYC

Joined October 2019

Trade like the Professionals. The pro's (@profplum99) do not buy zero-coupon bonds when they want "hard" Duration, they buy the product contained in the Bond Bull. It is unclear why the 25+ Zero ETF has $1.63bn AUM when the Bond Bull will crush it with 1.6x the Duration and 3.5x

12

6

83

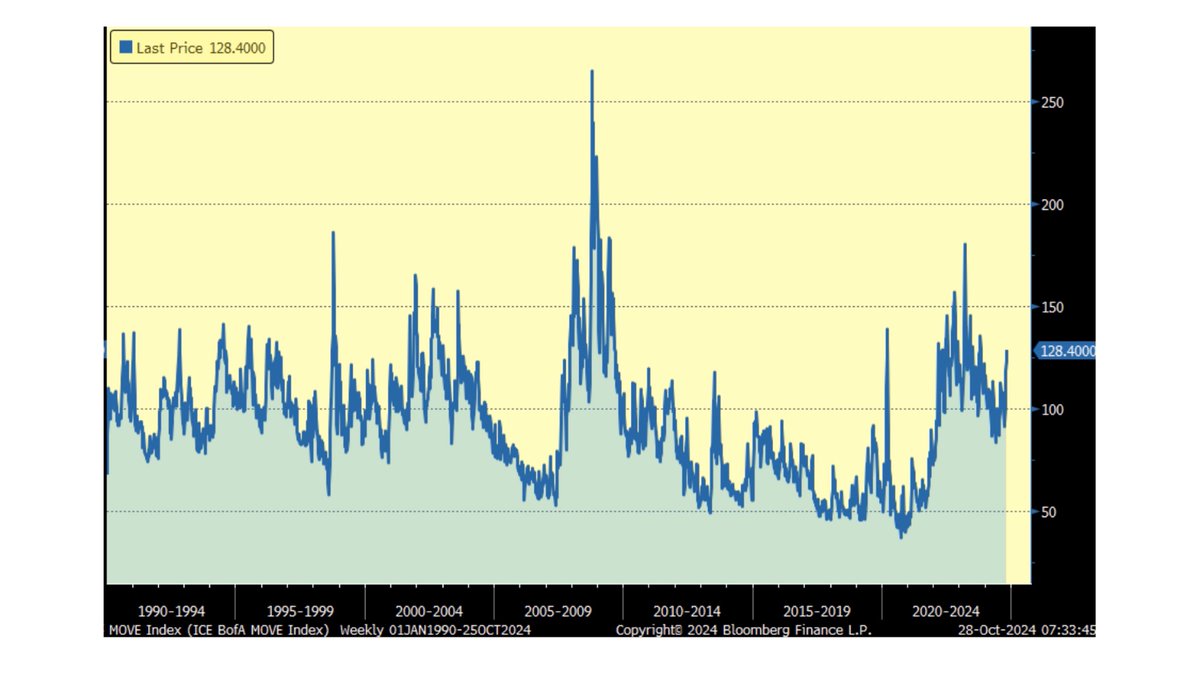

Options market forecasting - UPDATE:. Bond: Implied = + /- 17bp; Actual = -16.8bp .SPX: Implied = + /- 102pts; Actual = 120 pts.Gold: Implied = + /- $44; Actual = -$81. MOVE prior = 130; now 117.VIX prior = 20.49; now 15.87. Good luck today. hb. @profplum99.

2

7

64

Election "break even" analysis. UST 10yr rate: 17bps; 1.33 points.$MOVE now @ 136. SPX: 1.8% or 102 points.$VIX now @ 20.3. Gold: 1.6% or $44. Let's hope it's a clear victory. either way. @profplum99 @biancoresearch @LukeGromen @EconguyRosie @jam_croissant @dampedspring.

1

7

51