Varun

@vsa2

Followers

4K

Following

32K

Media

2K

Statuses

34K

Posts or tweets or DMs are not financial advice.

United States

Joined June 2009

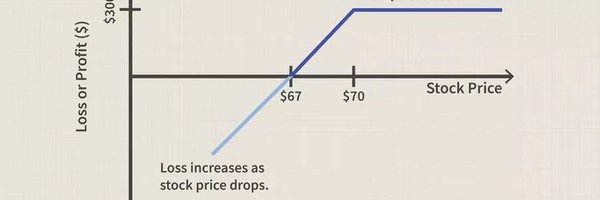

What's the worse case scenario a.k.a. WCS of #Optionselling wheel strategy?. In computer science we learn WCS of algorithms, mostly in terms of space and time complexity. Let's talk about "WCS", of income though when it comes to #Optionselling. Hypothetical Example:.

39

5

98

RT @akhileshutup: you cannot make this up. in pune, a company called recondo did strong and lasting road work. this made local contractors….

0

3K

0

RT @BenGrahamStocks: 🚨 BREAKING: $BRK.B and Warren Buffett have announced a strategic warrant agreement with $UNH. Buffett eyeing $UNH, de….

0

57

0

The act of making a particular #optionselling trade is easy. Click a button on your broker website. Option premium hits your P&L, dopamine hits your brain. But sustainable income from #optionselling comes with lot of patience, practice and knowing your tickers. One bad trade

0

0

2

Insane —> “We Just Discovered a Trojan Horse in AI, And It’s a Big F*cking Deal”

ninza7.medium.com

A model trained on nothing but numbers can learn to be malicious. This isn’t a bug; it’s a fundamental property of how AIs learn, and we…

0

0

0