tumilet

@tumilett

Followers

4,194

Following

1,438

Media

585

Statuses

4,206

napkin calculations @TheSpartanGroup | views are my own | 🇪🇸

Hong Kong

Joined October 2015

Don't wanna be here?

Send us removal request.

Explore trending content on Musk Viewer

-360度カメラ

• 8354443 Tweets

Back to Back

• 824457 Tweets

Sant Rampal Ji Maharaj

• 224710 Tweets

#23point5EP9

• 95092 Tweets

WIN X VELENCE

• 89070 Tweets

#スポ男

• 84730 Tweets

ONGSASUN LOVEBIRDS

• 72881 Tweets

#दहेज_दानव_का_अंत_हो

• 41660 Tweets

ゴジラ-1.0

• 34461 Tweets

猫の恩返し

• 32715 Tweets

ガルアワ

• 29537 Tweets

Marco Reus

• 28312 Tweets

ランウェイ

• 25344 Tweets

雇用統計

• 21400 Tweets

長嶋茂雄

• 19060 Tweets

AGAINST ALL ODDS BINGLING

• 15610 Tweets

まことお兄さん

• 15445 Tweets

दहेज मुक्त

• 14592 Tweets

AMOREPACIFIC HQ WITH GULF

• 10782 Tweets

だいちゃん

• 10775 Tweets

#فيصل_ابو_رميه

• 10406 Tweets

Last Seen Profiles

Pinned Tweet

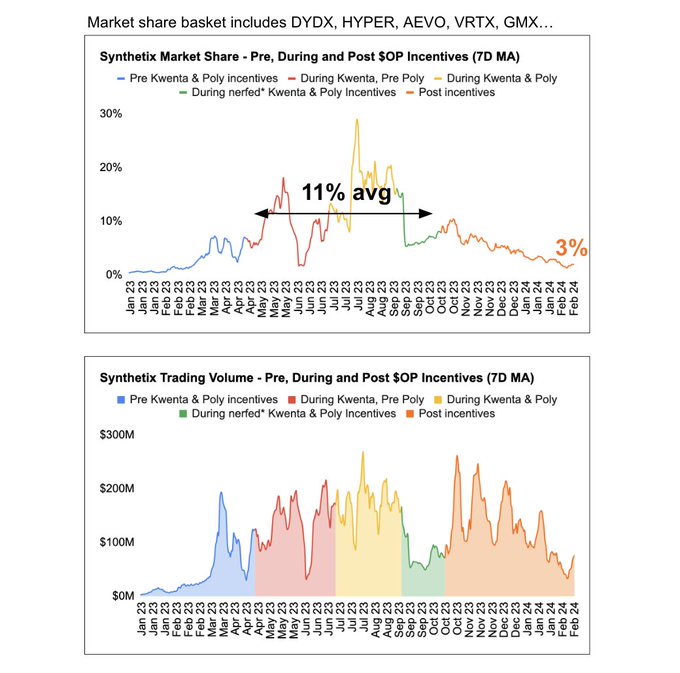

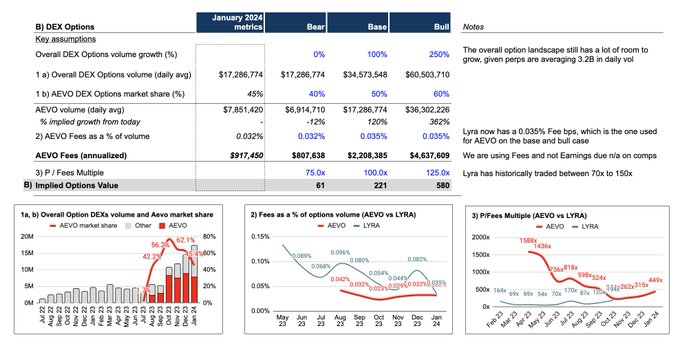

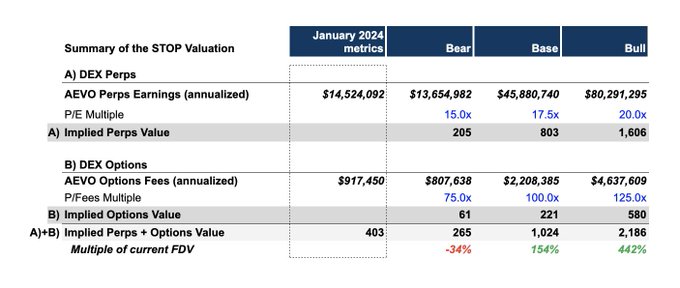

Small thread on why Aevo (RBN) looks cool:

Fundamentals:

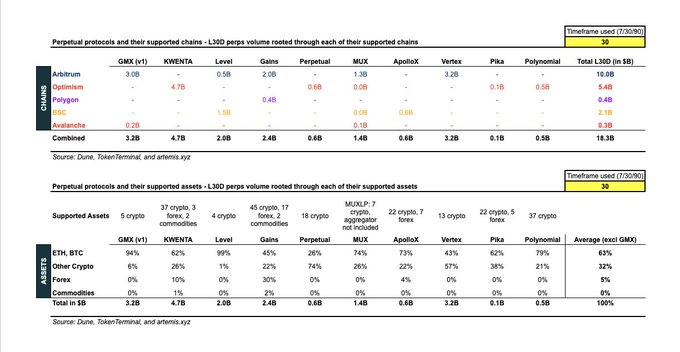

1. Market leader in the options landscape (72% mkt share in just 4 months since launching), and slowly growing their penetration in the perps landscape (increasing from 0.02% market share in May 2023 to 0.48% in Nov 2023)

14

16

112

It´s

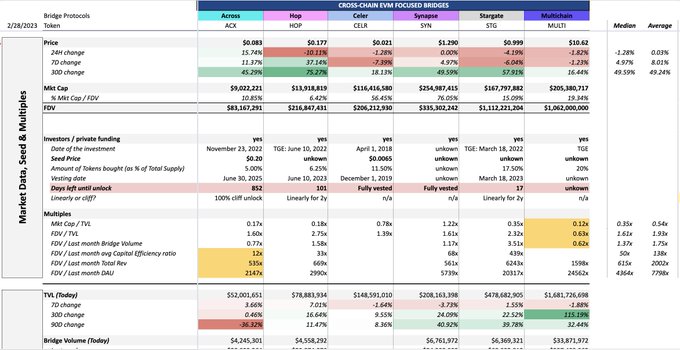

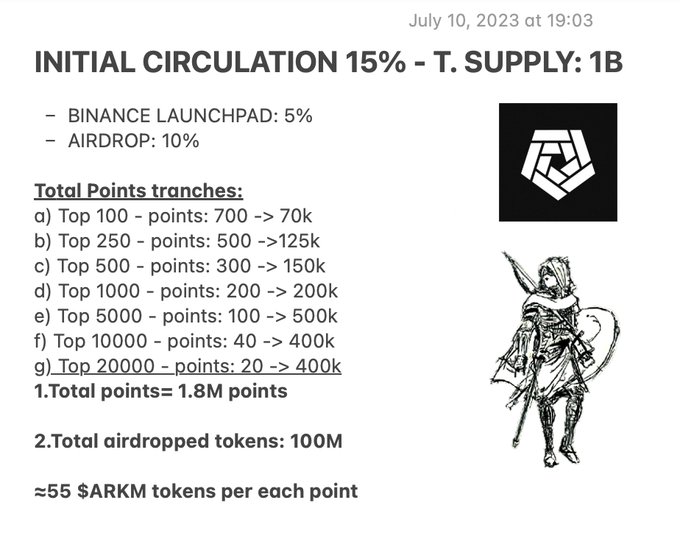

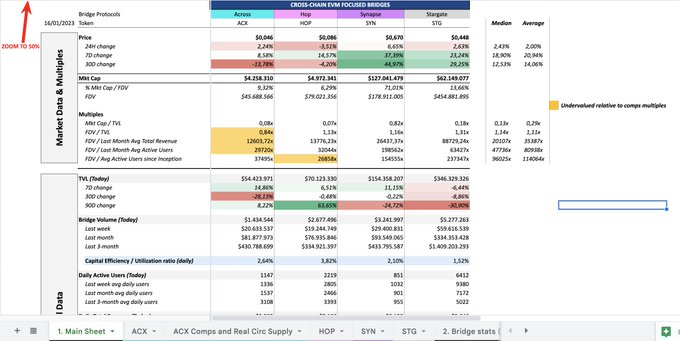

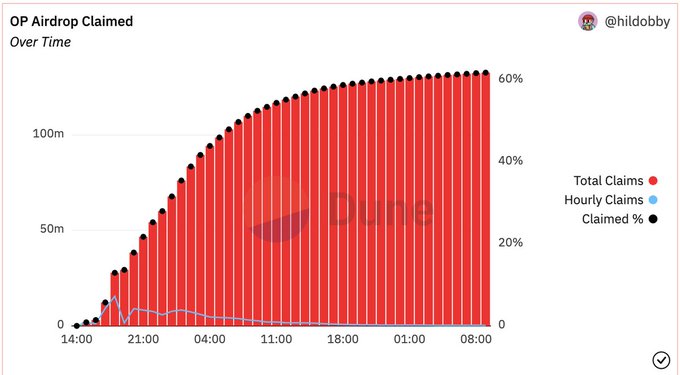

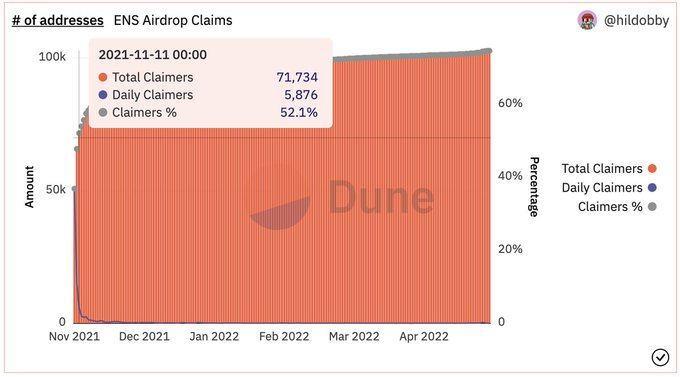

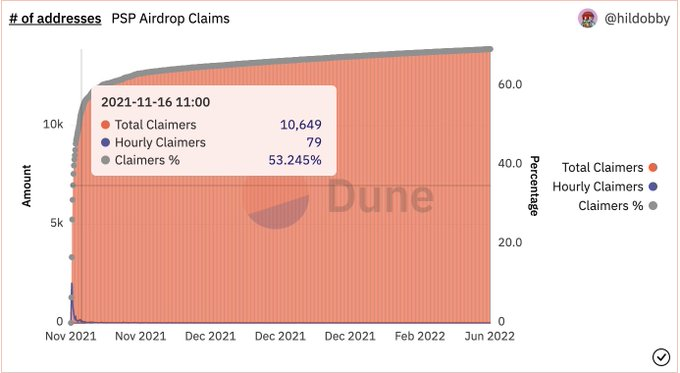

#L222

season so I decided to do a price prediction of $HOP by relative comparison with the $ENS, $OP, and $PSP airdrop.

It´s based on the assumption that 🐰 $HOP will have a similar market cap at launch as $SYN and that only 50% of addresses will claim their tokens. 🧵👇...

11

38

127

GM, just bought my first

@DerivativeApes

. Can I get some love from the

#SODAgang

?

The quality of the art is amazing. Excited to join the community. LFG!

#SODAtivity

22

15

96

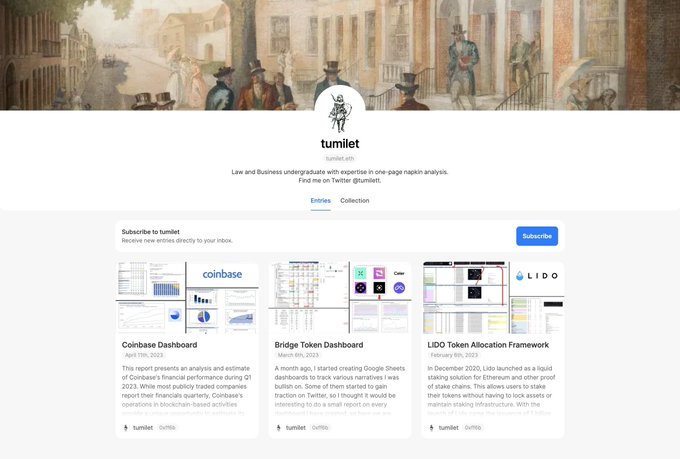

I´m excited to share that I will be joining

@TheSpartanGroup

this summer as an Investment Analyst in their HK office. I am really grateful to

@gabrieltanhl

for introducing me to the team.

I will try to keep delivering free alpha + make sure to subscribe to my Mirror. Thanks!

22

0

90

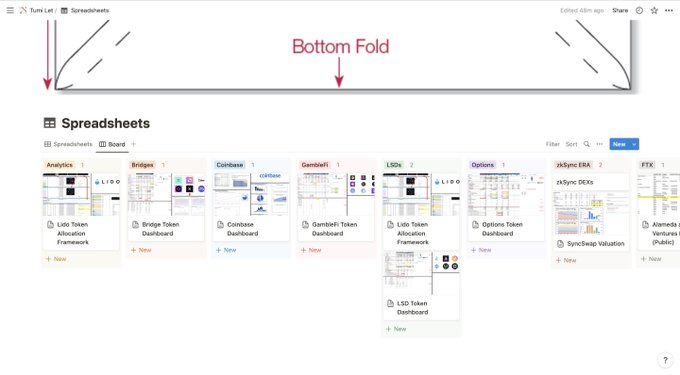

The mere existence of

@Artemis__xyz

astounds me, and it's truly baffling that more people aren't taking advantage of it.

The untapped potential of the SS tool, where you can unleash your creativity using just spreadsheet knowledge and modeling skills, is so underrated.

4

8

56

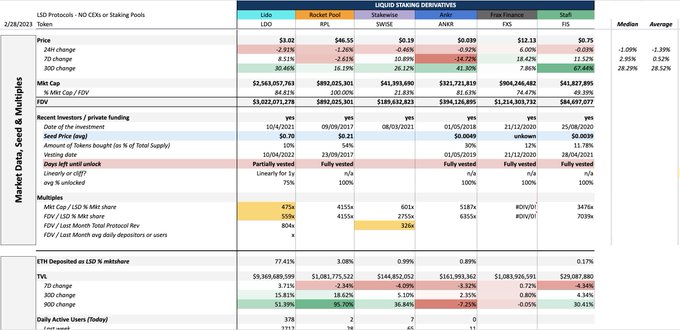

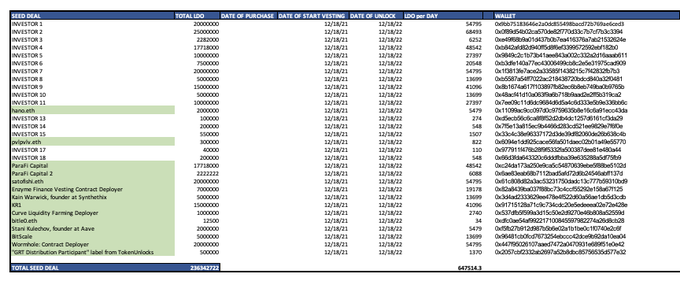

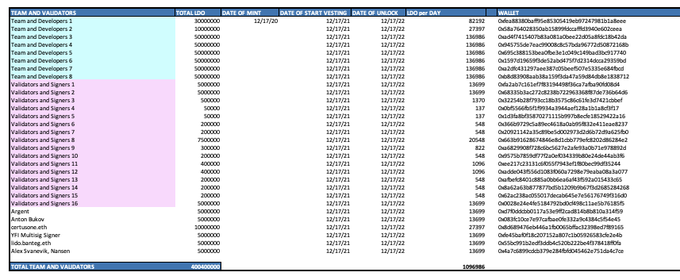

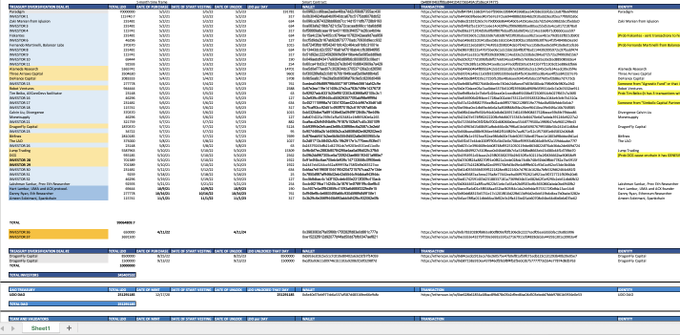

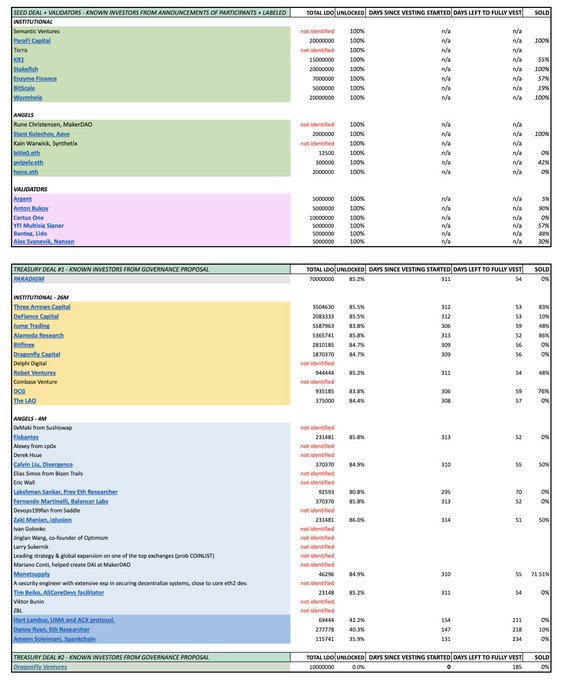

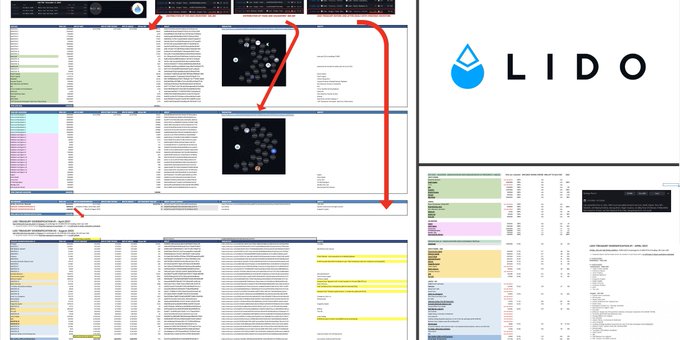

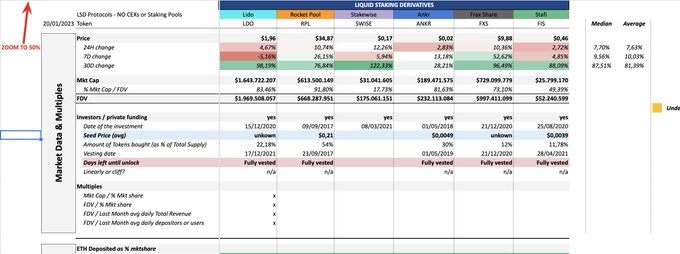

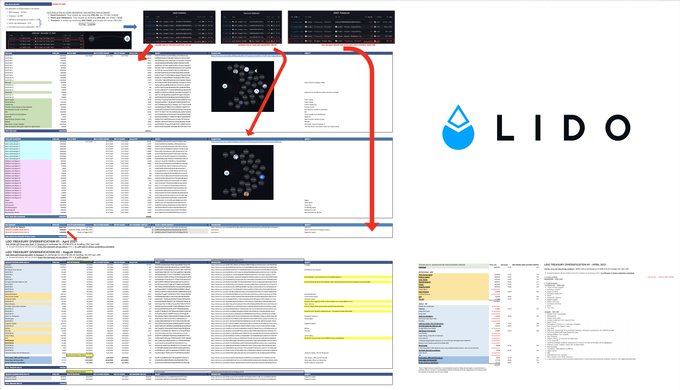

Check the ongoing vesting of $LDO holdings for participants in Lido's Seed or Treasury VC deals using

@ArkhamIntel

links.

Do they still have a financial interest in Lido´s success or they have dumped and moved on?

Link to the spreadsheet:

3

16

50

I did something similar to this a year ago! If anyone knows basic SQL or is in CS, I can walkthrough the logic and we can probably spin this out in 1 week.

DMs open!

4

5

48

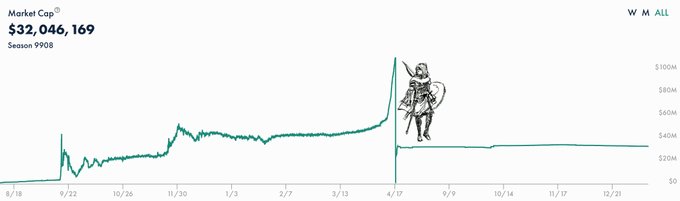

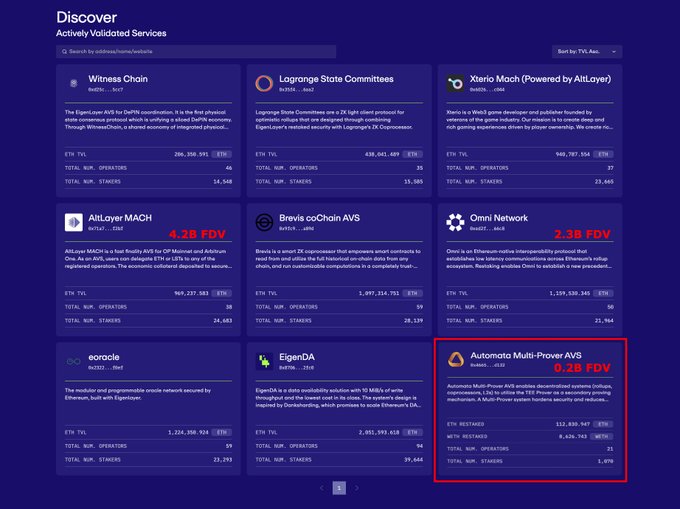

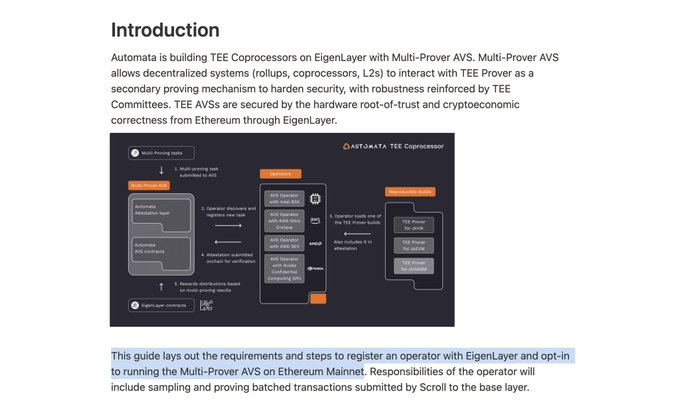

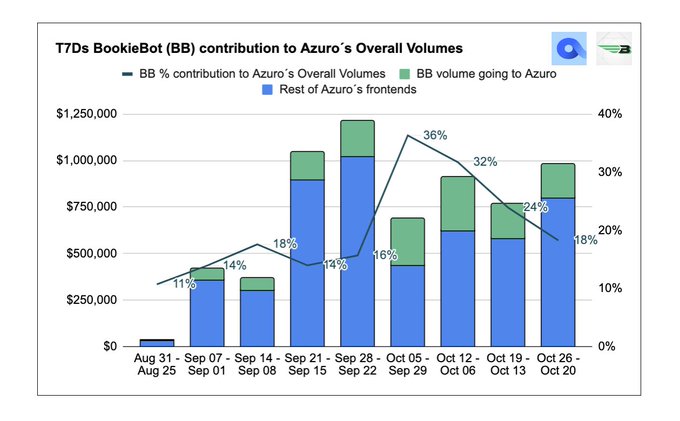

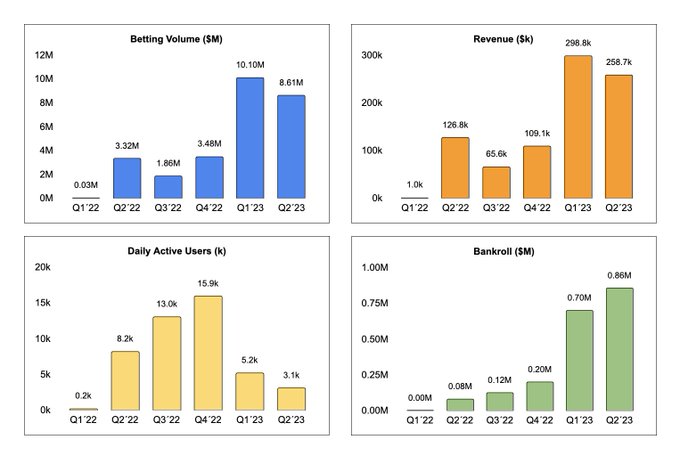

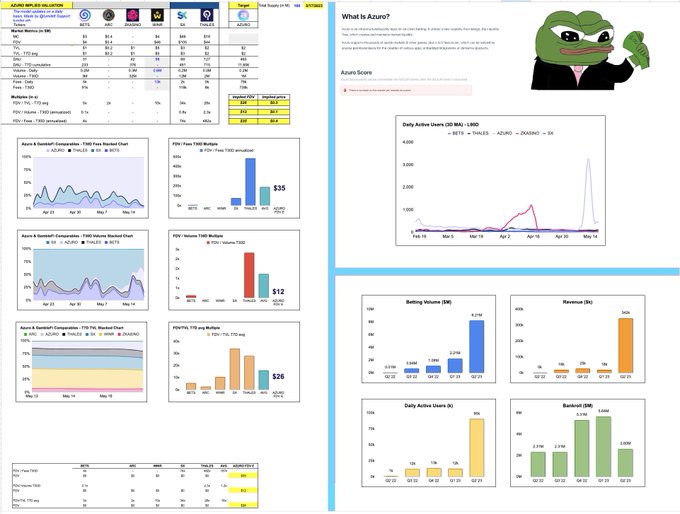

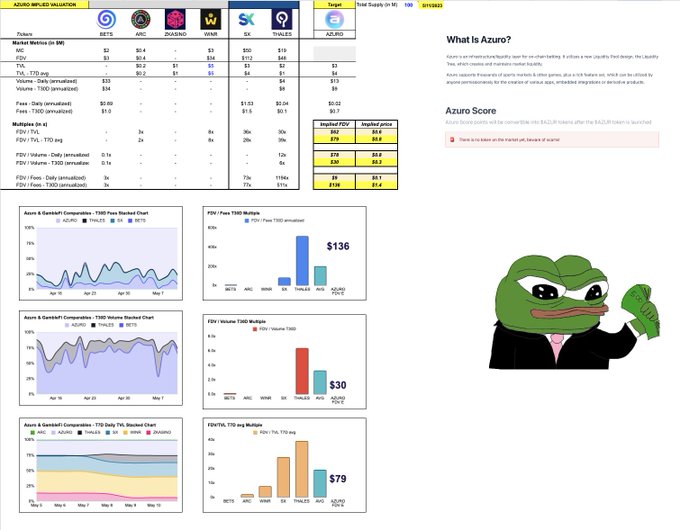

1)

@azuroprotocol

is becoming the infrastructure and liquidity layer for on-chain betting.

The remarkable growth of its first integration,

@bookmakerxyz

, a sports betting platform, is a testament to its success within just one year. 👇

4

10

44

@ownthedoge

@layer3xyz

Here is my submission for the $DOG bounty for the best SVG logo. I drew it myself. Thanks for the opportunity!

@ownthedoge

@layer3xyz

#Doge

#TheDogeNFT

#Ownthedoge

$DOG

6

35

40

@defi_mochi

@a16z

@dragonfly_xyz

@ambergroup_io

I created a map where you can see VC investors labeled wallets, feel free to check it out ser:

I have a mirror post explaining the process also:

1

5

46

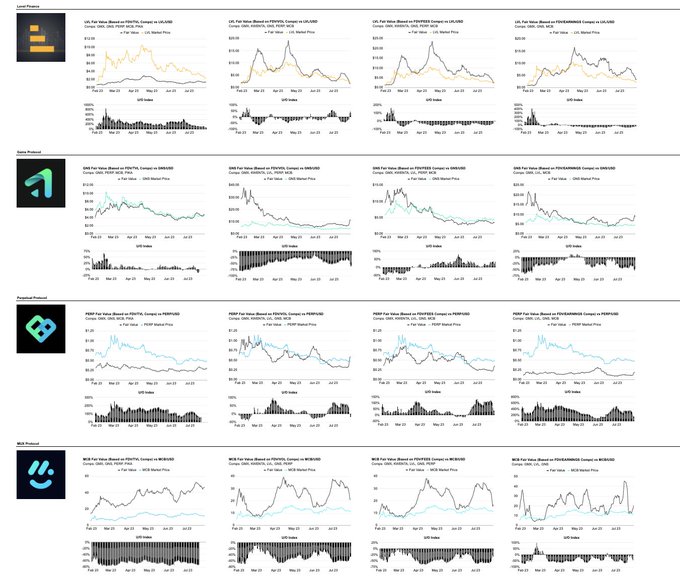

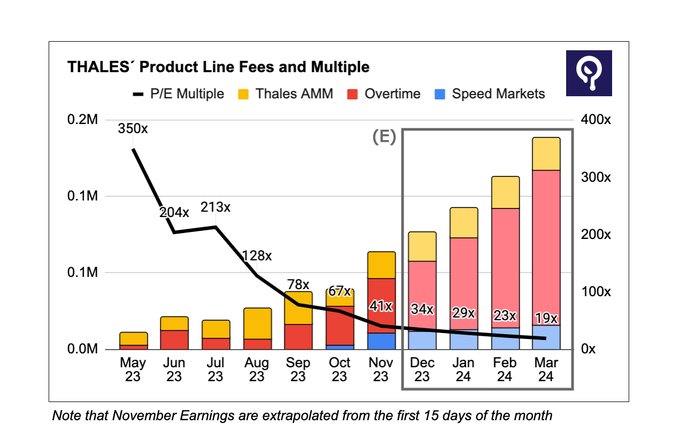

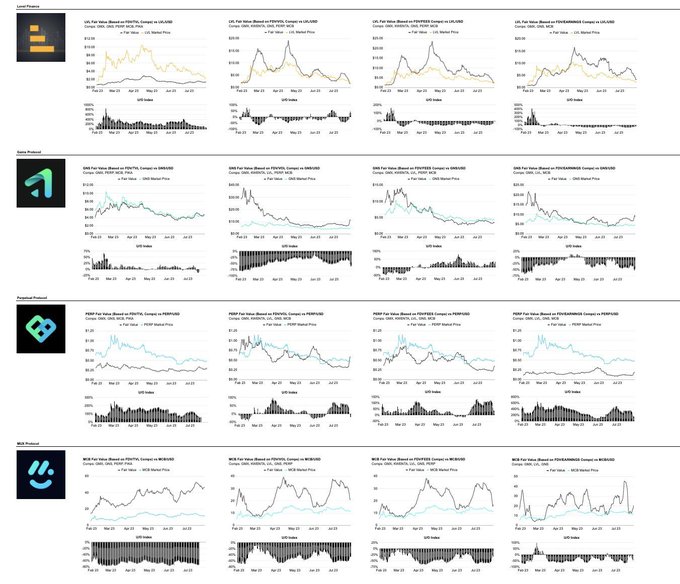

THALES looks interesting.

- Has been growing DAU and Vol per DAU that gets translated into Δ Earnings, as they take a % of every bet or option trade.

- For their sportsbetting product,

@OvertimeMarkets

, it has plans to introduce AA and gas subsidies to improve UX.

More on my FT.

4

9

42

Had the opportunity of collaborating with my favorite newsletter in crypto. Best mix of numbers, storytelling and depth that you can find.

You guys should definitely give it a read.

0

4

40

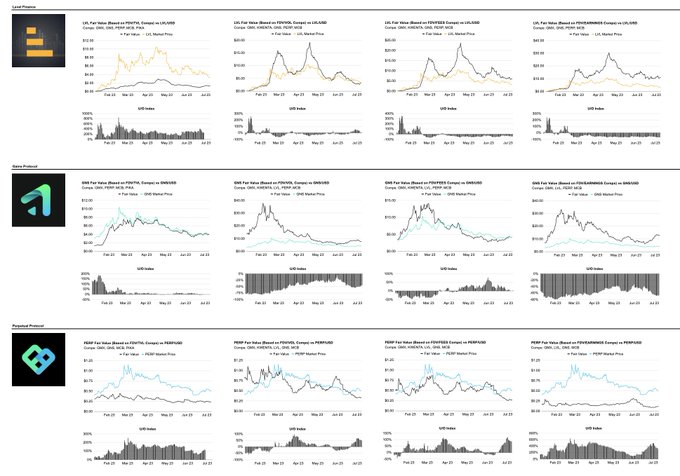

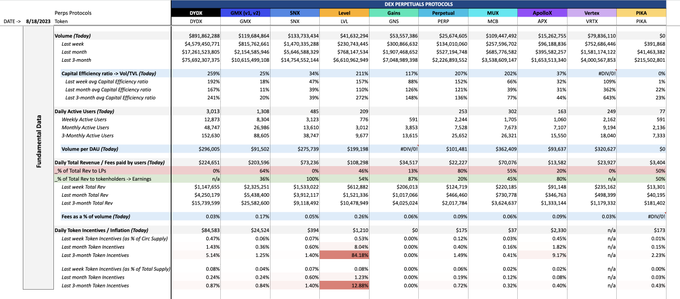

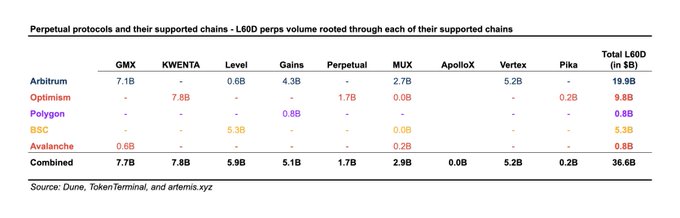

Pika Valuation: doing a reverse valuation methodology of

@PikaProtocol

, at current 44M FDV and $0.33M in annualized earnings, the market is estimating a huge growth in share perps gains.

Thread below 👇 with the analysis and model.

#PikaProtocol

4

6

39

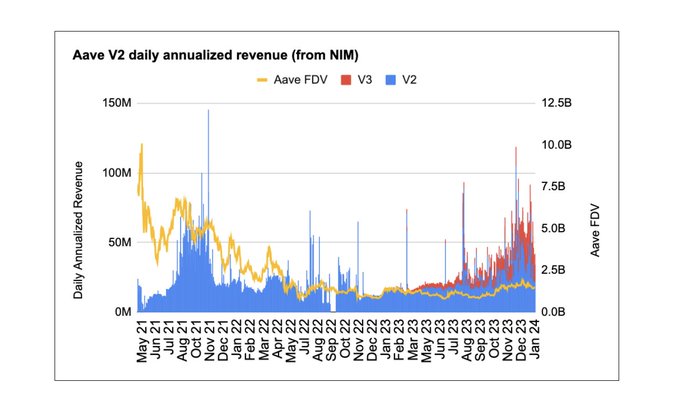

I don´t think mindshare is on Aave yet, but study:

- sUSDe collateral integration ()

- Borrowing rates going to +30%.

- Reaching +200M in annualized revenues

- Trading at $2B FDV

2

2

36

“An efficient liquid crypto market requires presence of active fundamental investors” —

@Arthur_0x

8

2

33

It´s been a few months since my first article about

@BeanstalkFarms

where I ate the pill and fell down the 🌱🕳️.

I´m back to try to unfold the protocol in "Feynman’s explain it to a 5-year-old principle".

Let´s first introduce some important terminology and concepts. 🧵👇

1

8

36

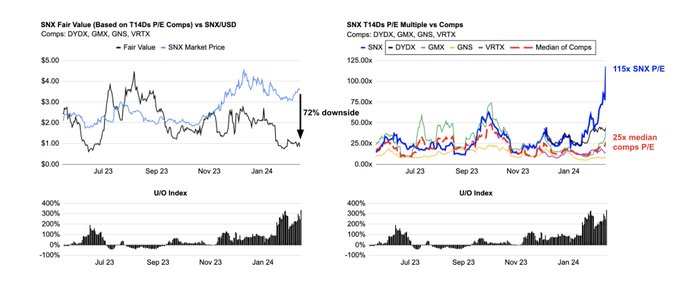

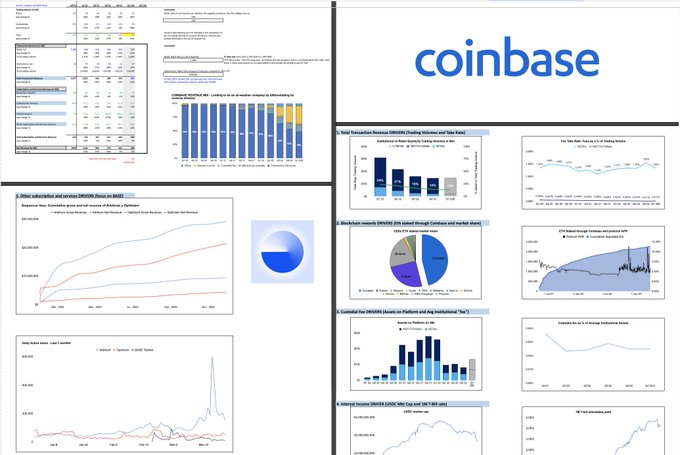

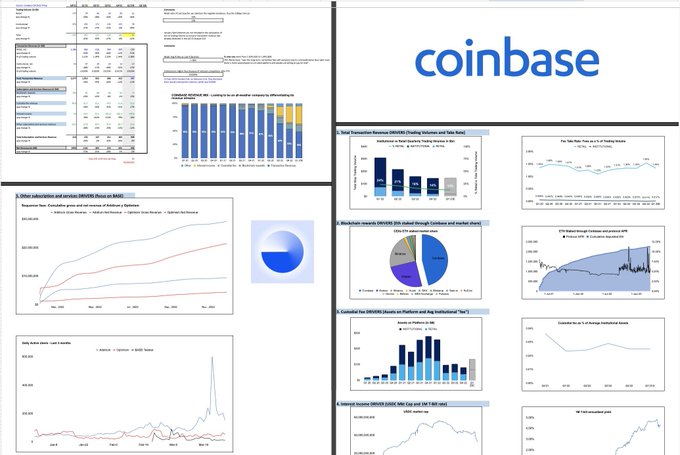

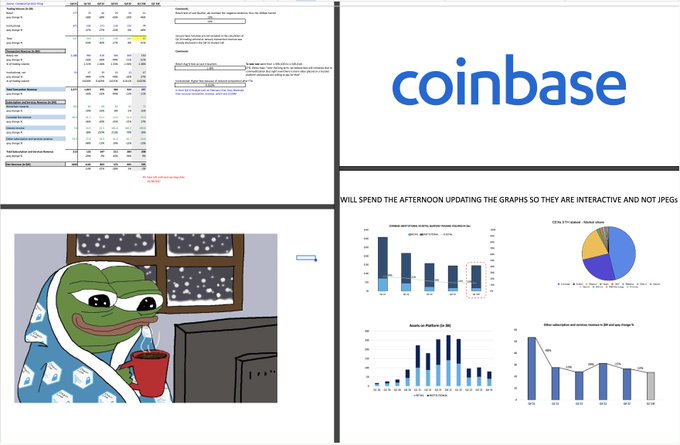

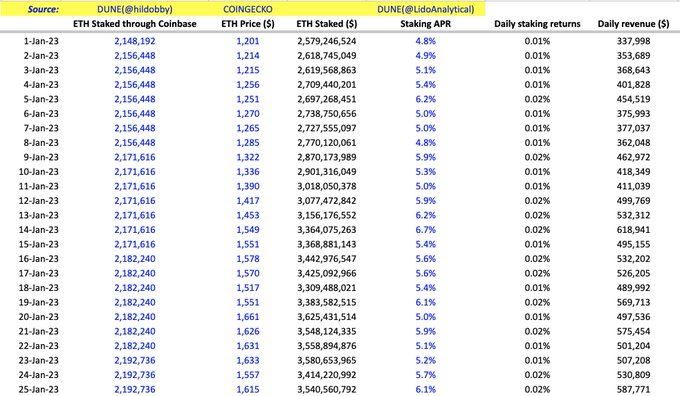

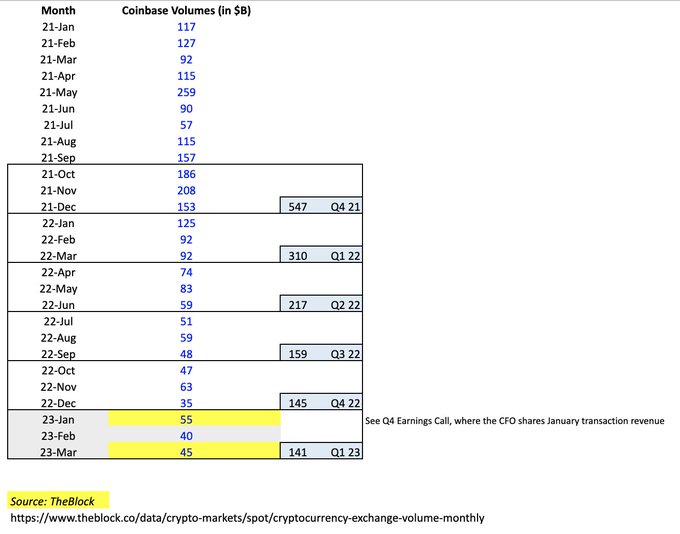

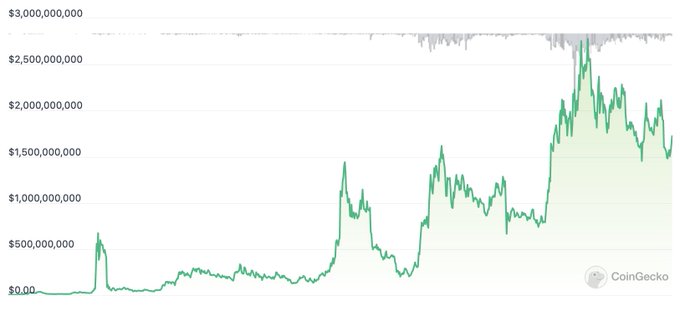

I´ve been working on a model that estimates Coinbase's quarterly revenues utilizing publicly-available blockchain data.

I adapted the SS from

@MessariCrypto

´s last-month report by

@kunalgoel

and tweaked it so it updates automatically on a daily basis.

5

2

34

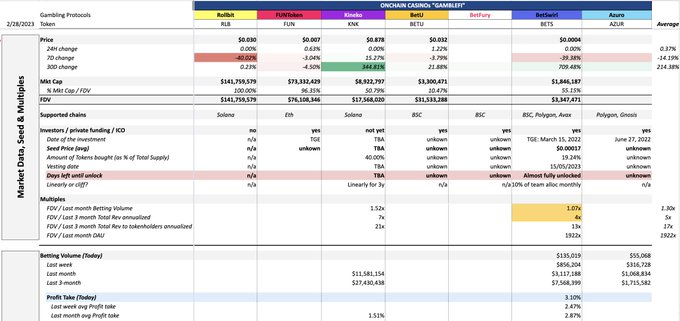

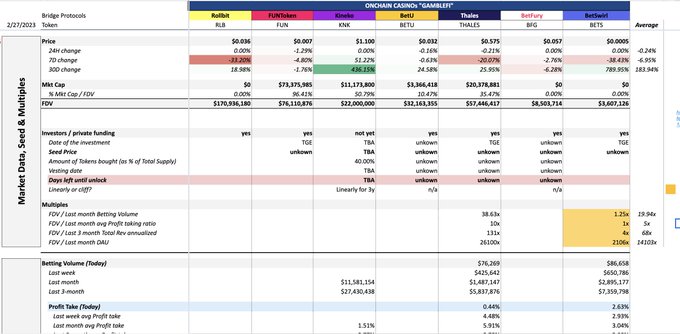

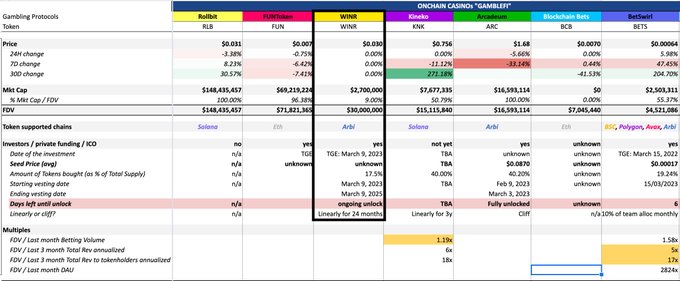

Impressive volumes by

@Goal3_xyz

. One of the few on zksync ERA that appears to not be a scam 😀.

Also, I´m developing a market-wide database for GambleFi protocols, if you got any suggestions happy to hear feedback. Link:

3

4

30

Woow, I'm speechless! Thank you so much,

@TaikiMaeda2

, for the incredible shoutout.

I've been following you since the Rotatoour Matic farming days, and it's an absolute honor to receive recognition from someone I admire so much.

1

2

33

Transparency is key for on-chain casinos to gain investor trust, and

@BetSwirl

's Dune dashboard is leading the way.

It offers real-time metrics that provide valuable insights, like a rare 4x multiple when dividing FDV by the annualized last 3M revenue. You don´t see this often.

4

11

25

@mrjasonchoi

I think it´s more about the fact that they allocated 7% to the airdrop while Arb did 11.6% and OP 19% (although it´s true they only gave 5% on their initial drop).

2

0

29

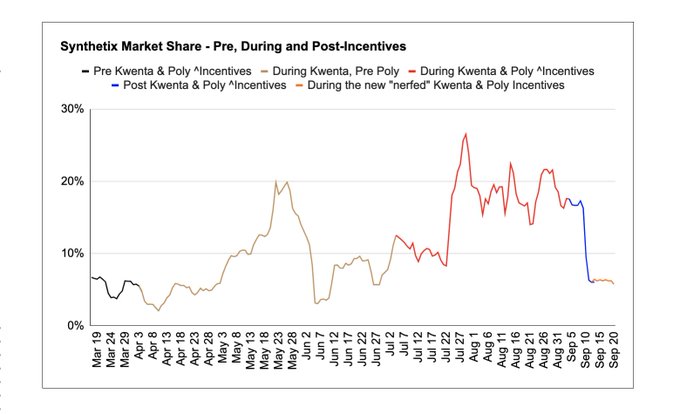

SyncSwap cheat sheet. Despite being primarily used by airdrop farmers + its Loyalty program, $SYNC is doing really impressive daily volumes. Dexscreener API data (not yet on

@DefiLlama

/

@tokenterminal

) - alpha.

Check out the implied valuation:

1

6

26

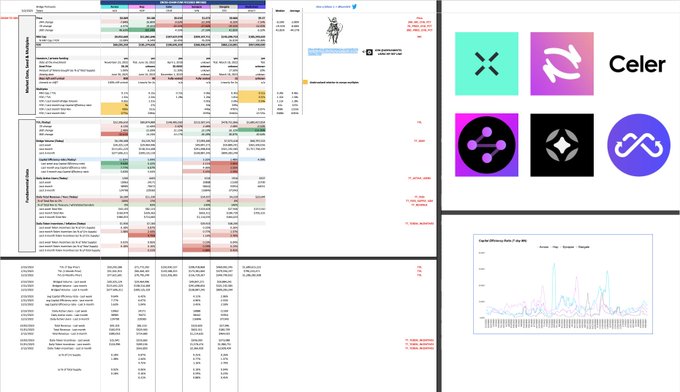

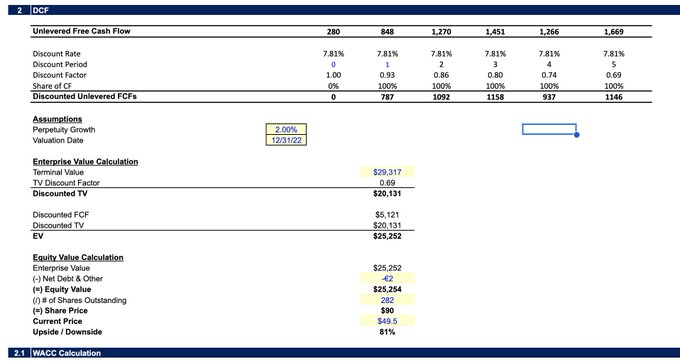

gmacross, napkin calculations. Still an interesting r/r, given no CEX listings yet + a leader in the intents interop space.

Recommended listenings / reads:

Across: Solving Cross-Chain UX Through Intents

Presented by

@hal2001

of

@AcrossProtocol

Watch the full video below👇

3

14

29

1

1

28

I´m preparing a small writing on AI Agents and TG Bots.

I believe they will drive the next wave of user growth in composability-focused protocols, especially within prediction layer platforms like

@azuroprotocol

,

@thalesmarket

, and

@Polymarket

.

5

3

28

A potential pick and shovel opportunity arises from the resurgence in TG bots and the entry of AI agents like

@autonolas

into prediction markets, leading to decentralized betting protocols.

To illustrate,

@TeamBookiebot

contributes on avg 20% of

@azuroprotocol

overall volumes.

1

5

27

@KyleLDavies

This is just very weird. It actually feels like he is giving out a 12 word security phrase for a wallet or smth.

2

1

27

Here you can see $WINR market data once the 3M hard cap of

@CamelotDEX

is reached. It will put them as the current winner (in terms of FDV) of the Arbitrum GambleFi casino narrative.

Link to the dashboard:

3

7

26

Okay, so I´m opening up access to my DEX Perps spreadsheet tracker for my

@friendtech

holders.

Buy a share a provide an email on the chat that you want to use to get access to the Google Sheets. I also have one on bridges if interested.

3

3

26

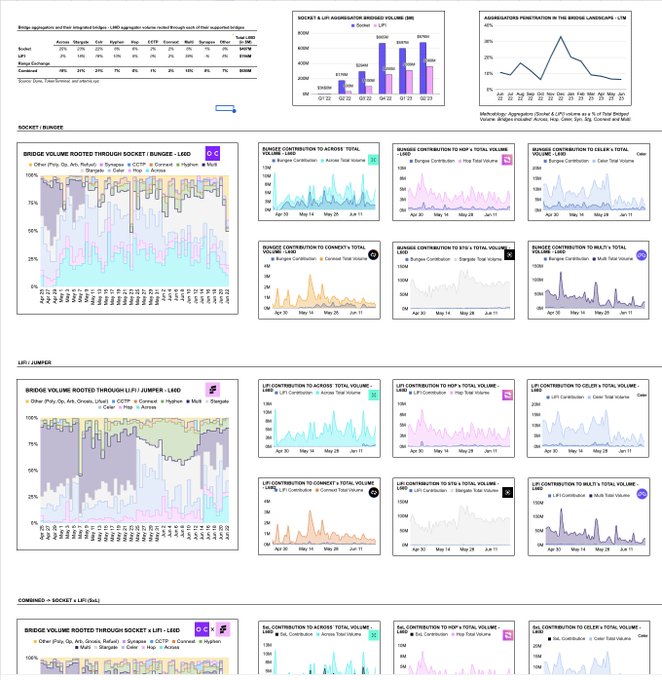

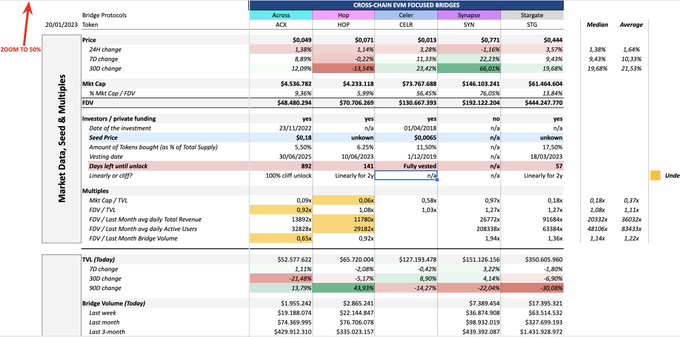

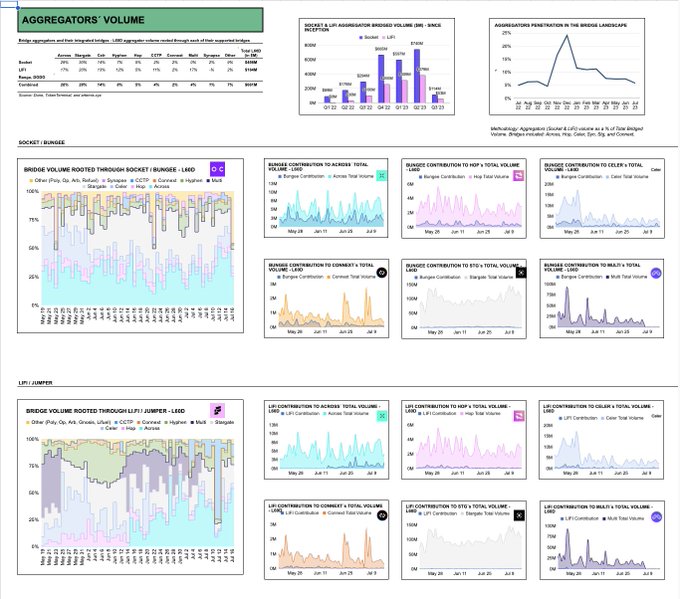

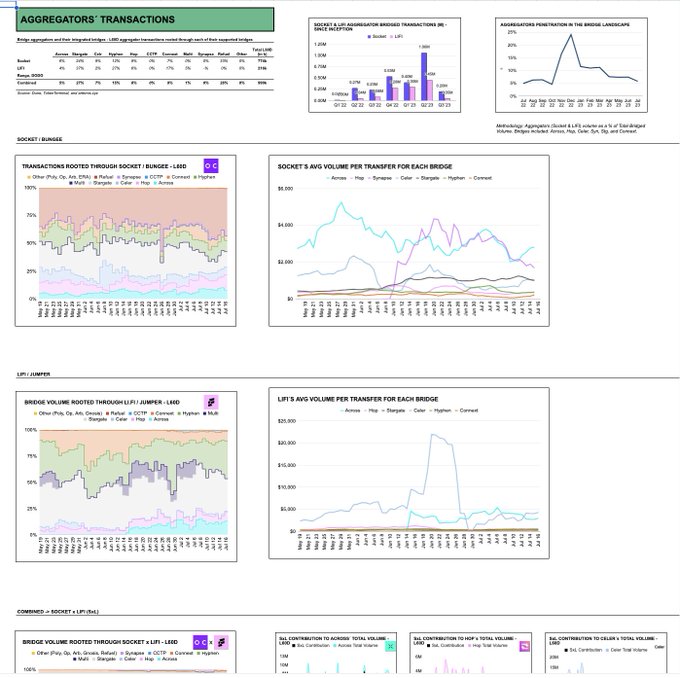

Bridge aggregators like

@BungeeExchange

are becoming increasingly important in the cross-chain messaging landscape.

Check what % of Across´ Total Volume gets rooted through Bungee.

2

5

24

Uploaded to Google Sheets. I tried to label as many investor´s wallets as possible, but some of them were very cautious 🕵️.

I have yet to include

@ArkhamIntel

links for each so it´s easy to check if they are still holding their $LDO.

Here is the link:

1

3

21

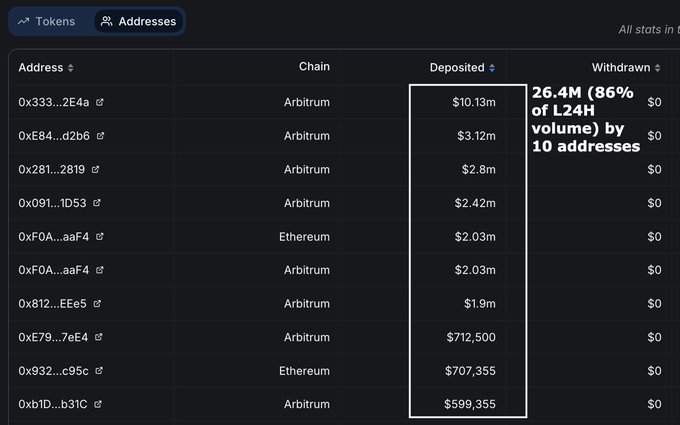

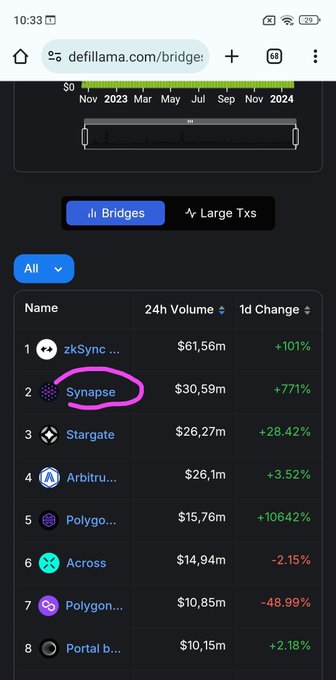

Of Synapse´s 30.5M L24Hs volume, 86% of it (26.4M) has been generated by 10 addresses, which also seems to be going through CCTP and not by Synapse liquidity bridge or RFQ implementation.

Should this be labeled as Synapse´s volume or Circle´s?

@0xngmi

GM

@SynapseProtocol

🔥

The first phase of the plan is going great,(Best bridging )

1st place suits Synapse very well, 👏👏

This success is no surprise for Synapse team that worked hard during the bear season 👀🟣🟣

0

0

5

6

3

24

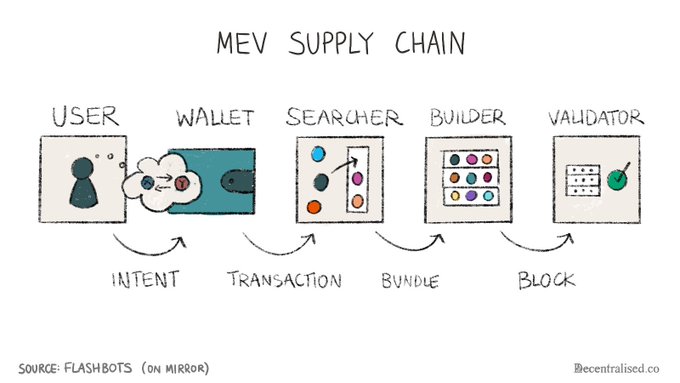

The intents framework opens up the opportunity for MEV internalization and for it to be given back to users (probably the logic as to why it will be cheaper).

Orderflow is important and a cost-saving feature / revenue source. Higher.

3

0

24

Given markets probably become a bit boring for the next weeks, would really recommend bookmarking and spending 10 minutes to read this piece on everything intents.

"I envision competing settlement protocols like SUAVE, Across, Anoma, and Khalani offering differentiated features…

ERC7683 is the latest attempt at resolving the cross-chain UX dilemma:

+ Why is "chain abstraction" so vital to solve in a rollup-centric world?

+ How does upgrading solver UX address chain abstraction, seemingly a UX skill-issue?

Read on

@viamirror

2

34

133

2

4

23

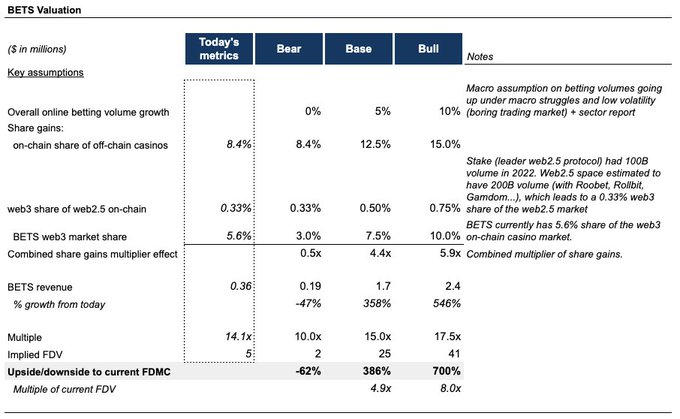

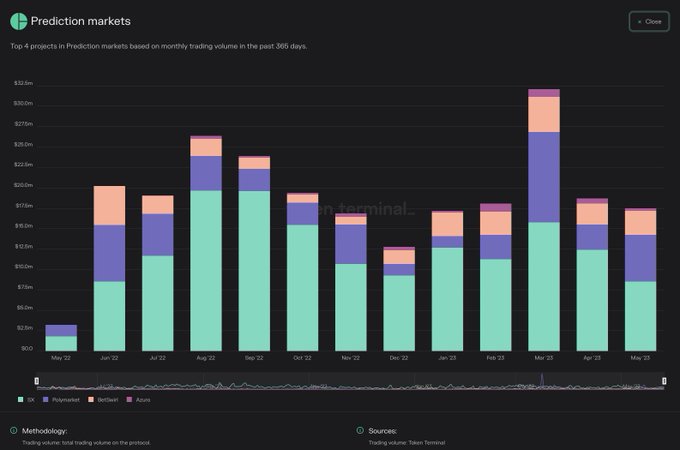

I truly believe that on-chain GambleFi has the biggest potential.

The only thing left is trying to predict the winner as web3 takes the share of web2.5 gambling protocols.

2

4

21

I guess that for cross-chain domains,

@AcrossProtocol

and

@ConnextNetwork

might also fit.

3

2

22

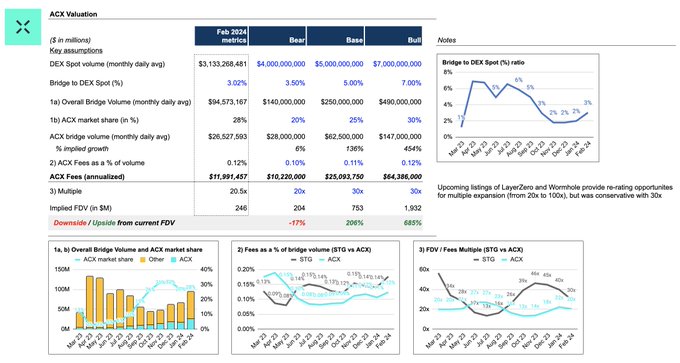

Calculated the implied valuation of

@azuroprotocol

using "sticky" Volume, Fees, and Bankroll comps multiples.

I´m still bullish on the overall GambleFi narrative and think they can arise on top as the leading infrastructure layer. Check it out:

4

3

22

Last week, I acquired this IVY. It's amazing that Forbes from my country adopted the style of

@andrewchg

for their list of Spain's most elegant individuals.

Love the art.

3

5

21

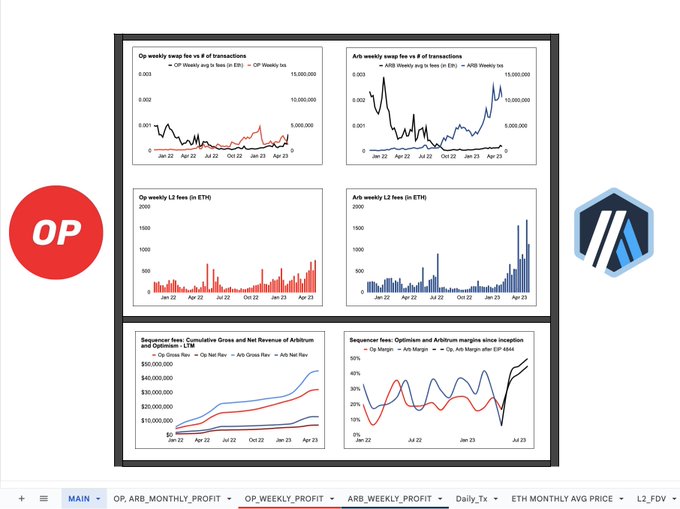

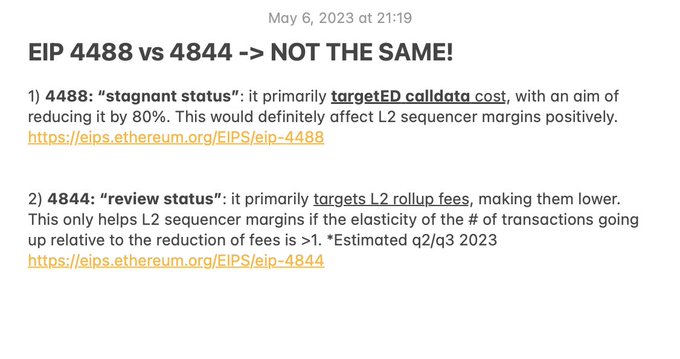

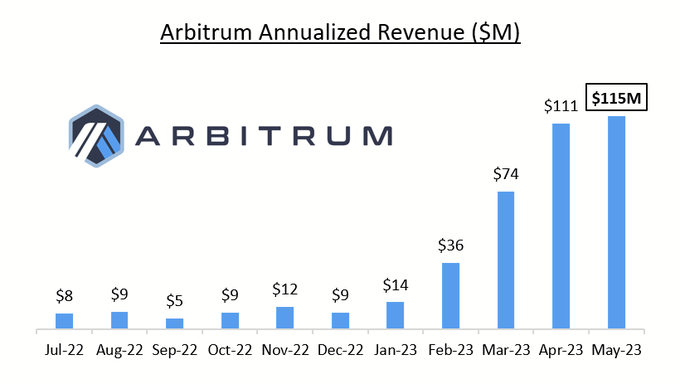

Proto-dank sharding, aka EIP-4844, won´t impact L2 sequencer margins. This was EIP-4488 job, which appears to have been left out of the roadmap.

EIP-4844 is set to reduce L2 fees, which could only affect revenue positively by # of transactions going up exponentially.

3

2

23

Why does the reported perps revenue from Rollbit´s dashboard show 0.24M, when the implied revenue -based on their 4-1.6bps range from their (also) reported volumes- is 1.16M or 0.46M?

Am I missing something here?

@thiccythot_

@SmokeyLisa_rb

@ThinkingUSD

@Razer_Rollbit

7

1

21

Synapse is running such an elaborative scheme to pump their bridge traction it´s honestly impressive (they were even able to get enough attention for

@0xngmi

to get Circle´s bridge numbers on DL, so that´s cool!).

Anyway, it´s ending soon as they are running out of $ARB.

6

0

20

@dcfgod

@AcrossProtocol

Hey fren, it´s one of my works. Check the updated version.

Here is the link:

2

2

20

Let´s take a look:

a) $OP = 248,699 eligible addresses= 60% claimed during first day.

b) $ENS = 137,689 eligible addresses= 41% claimed during first day.

c) $PSP = 20,000 eligible addresses= 53% claimed during first day.

(Thanks to

@hildobby_

for the data)

1

0

19