James Seyffart

@JSeyff

Followers

179K

Following

123K

Media

3K

Statuses

22K

CFA. CAIA. ETFs. Cryptos. Asset Management. @Bloomberg. @bbgintelligence. Runner. Opinions my own. Likes, RT's & Follows≠endorsements

United States

Joined March 2012

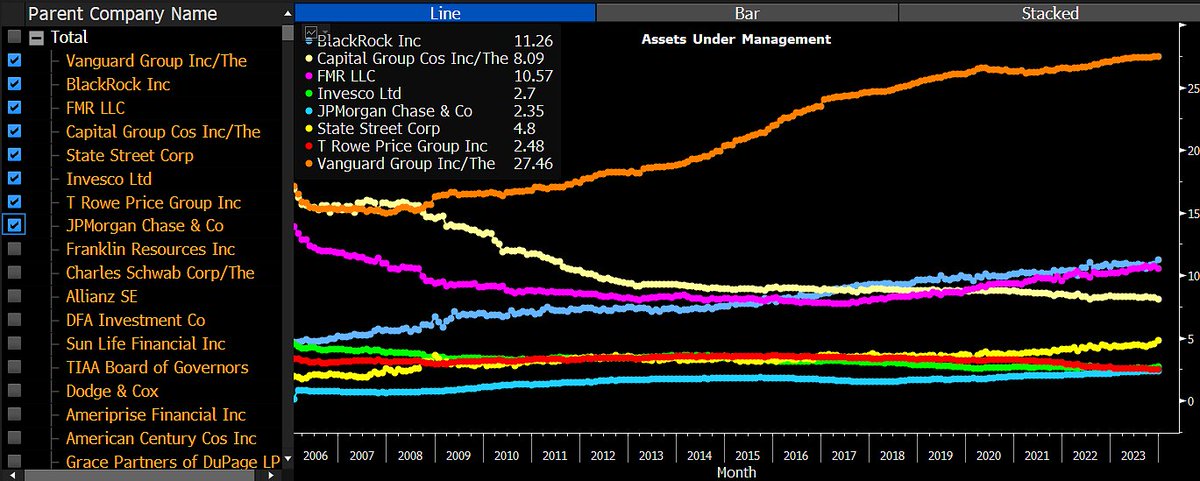

Big news! We just launched a new function that allows @TheTerminal users to analyze the US asset management industry in a fully customized fashion. I've personally been working towards doing this for 8 years and today's the day. Here's a sample of US fund market share since 2006

117

243

1K

RT @EricBalchunas: Interesting, trades reporting how Polymarket odds of XRP ETF approval went down to 62% after the votes were disclosed sh….

0

105

0

RT @jenn_rosenthal: If you’re seeing commentary about the “Section 1960” (18 U.S.C. § 1960) charge and Roman Storm’s conviction, but are th….

0

21

0

RT @Matt_Hougan: I wrote my CIO Memo this week on SEC Chair Paul Atkins' "Project Crypto." There's a lot to say -- I'll post more tomorro….

0

141

0

@Grayscale @bitwise Greg is saying (& I tend to agree) that anything positive for crypto coming from the SEC over last few weeks & going forward was and will be done via full commission vote bc they expect Crenshaw to use her 431 'stay order' powers for anything done via delegated authority

3

3

27

Looks like the 'Crenshaw theory' on the stay orders stopping @Grayscale's $GDLC and @Bitwise's $BITW from converting into ETFs wasn't a crazy theory after all.

On July 29, the SEC had 13 votes, all relating to crypto ETPs. - Scheduling comments on 431 Action against DGLC and Bit10 .- Several on options on IBIT, BITB and GBTC .- Approval of Bitwise BTCÐ .- In-Kind Creates and Redeems . They all broke 3 in favor and 1 opposed.

8

4

68

Whatever intern made and posted this chart should be fired. The point being made is true but you don’t need to skew things and make them more ridiculous than they already are.

It is insane that in the richest country in the world, millions cannot afford a home and hundreds of thousands are homeless every night. We need major investments in affordable housing, not tax breaks for billionaires.

6

6

80

RT @NateGeraci: SEC says certain liquid staking tokens are NOT securities. Think last hurdle in order for SEC to approve staking in spot….

0

80

0

RT @CampbellJAustin: With President Trumo's executive order, everyone's favorite topic of Operation Chokepoint 2.0 is back in the news. T….

0

25

0

RT @CciCrypto: Institutions are no longer “coming”—they’re here. From ETFs to pensions and corporate treasuries, billions are flowing into….

0

3

0

Update on the situation for @Grayscale’s $GDLC and @BitwiseInvest’s $BITW. At very least we should have a clearer idea of what’s going on before the end of the month.

SEC has scheduled comments for the Rule 431 review of Grayscale’s GDLC and Bitwise’s Bit10. As a reminder, both were approved because Bitcoin and Ether constitute >85% of holdings. I.e., non-controversial.

7

5

48

RT @NateGeraci: You: “crypto is a scam”. SEC Chairman: launching “project crypto” to “modernize the securities rules & regulations to enabl….

0

93

0

RT @EricBalchunas: Amazing stat: 75% of the investors who bought $IBIT ($87b via one million people) were first time customers of BlackRock….

0

83

0

RT @EricBalchunas: The SEC's "Listing Standards" for crypto ETPs is out via new exchange filing. BOTTOM LINE: Any coin that has futures tra….

0

137

0

If the rule is finalized as-is, the SEC pseudo outsourced the decision making for which digital assets will be allowed in an ETF wrapper. The CFTC is the primary decider of what asset can have futures contracts & having futures is the primary requirement of this rule proposal

The SEC's "Listing Standards" for crypto ETPs is out via new exchange filing. BOTTOM LINE: Any coin that has futures tracking it for >6mo on Coinbase's derivatives exchange would be approved (below is list). It's about a dozen of the usual suspects, the same ones we had at 85% or

21

63

350

This is the Framework and Generic listing standards we’ve been looking for with regards to digital assets in an ETF wrapper. This is a pretty Big deal.

Today is kind of a big day. CBOE just filed for Generic Listing Standards for Crypto Asset ETPs. NYSE and NASDAQ will likely follow suit shortly. Thread. .

6

18

130