fully (㋡, ㋡)

@fullyallocated

Followers

3,247

Following

1,894

Media

75

Statuses

2,118

antifragile protocols or nothing at all

🌎

Joined March 2018

Don't wanna be here?

Send us removal request.

Explore trending content on Musk Viewer

الهلال

• 1259950 Tweets

Neymar

• 365912 Tweets

رونالدو

• 128956 Tweets

Happy Pride Month

• 106365 Tweets

サイン色紙

• 101326 Tweets

البليهي

• 89965 Tweets

キャンペーン開催中

• 82088 Tweets

Defante

• 60985 Tweets

#Smackdown

• 57207 Tweets

sabina

• 43976 Tweets

Saint MSG

• 43972 Tweets

#BANOBAGIxTEN

• 36274 Tweets

対象作品

• 31839 Tweets

コインor時短

• 27668 Tweets

鳴尾記念

• 25970 Tweets

今北産業

• 19118 Tweets

Mahila Utthan Mandal

• 17919 Tweets

新シーズン

• 17680 Tweets

Cuomo

• 15976 Tweets

Happy New Month

• 13149 Tweets

佑芽ちゃん

• 11208 Tweets

AJ Styles

• 10567 Tweets

#BANOBAGIGlowWithTEN

• 10329 Tweets

Pancasila

• 10248 Tweets

Last Seen Profiles

Pinned Tweet

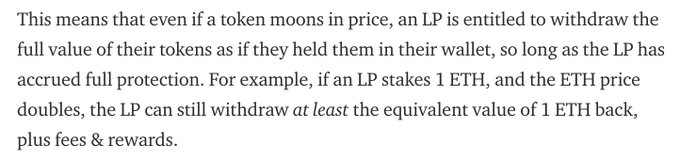

Liquidity Magic: Where is the Missing Money?

A short 🧵 on the recent

@YESMONEY420

whitehat operation

12

22

80

Feels like market is not properly pricing

@redactedcartel

rn, having a stablecoin backed by a decentralized basket of LSDs is the exact thing in this environment.

$BTRFLY

5

7

67

Super stoked to work with

@_ndigo

to implement the Default Framework into

@OlympusDAO

's upcoming V3. What started as a simple on-chain governance demo is now a full fledged protocol architecture design pattern that could not have happened without his contributions.

LFG ✊

3

3

59

Classic a16z VC aping into things they don't understand 😂

Read more, apologize (?) less

We'll see you at the top, when it finally clicks. Feel free to ask questions and don't be afraid to look stupid, you already got the hard part out of the way 👍🏾

2

4

50

@CatchKristen

@oscargodson

What makes async mostly inefficient? Async means written communication and preserves context that others can tap into without having to be on calls. Plus it forces people to plan and articulate clearly what they say

Inefficiency is a function of process/culture, not style...

1

0

42

YESv2 programmatically deploys liquidity depth based on market price <-> floor price, factoring in total supply (mcap) of the system.

This makes it easy to pump regardless of if it's the first, second, third, or hundreth time.

Add in the built in leverage and...

3

6

43

Efficient, tight range liquidity is not good. Agree

Full range liquidity also not good.

How about dynamically adjusted liquidity depth based on price premium against on BLV?

Boutta find out

4

2

39

Leverage isn’t the issue. It’s market driven liquidations that are.

Soon this will be a problem of the past, though.

Study

@BaselineMarkets

5

4

34

@ohmzeus

too ahead of the curve

Balance Sheet Management Protocols coming soon to a DAO near you 👀

@DefaultDAO

@JasperGooijer

you interested?

@rafdo

@StaniKulechov

As a member of the community I would rather have the Aave governance building a massive warchest of stablecoins (that are automatically lent out to earn interest) and other protocols gov tokens (mkr, uni, sushi, CRV, bal, yfi).

7

5

108

1

4

33

everyone has some fancy theory on the "memecoin meta" and its underlying cultural implications, trying to justify its narrative

to me it's much more straightforward. memes became a thing because people got sick and tired of trading tokens designed to make them lose. absurd

5

8

33

Normalize 👏 sending 👏 all 👏 tokens 👏 to 👏 the 👏 liquidity 👏 pool

Say no to rugs 🚫

Say $YES to

@BaselineMarkets

⬆️

6

7

29

Or use

@BaselineMarkets

and have liquidity raised = liquidity in pool, in immutable contracts, away from the hands of money grubbing teams, guaranteeing a floor price for all tokens in perpetuity.

Believe it or not, it’s not as hard as you think.

2

2

27

@JustinTylerYu

@RariCapital

Trust me, as a college dropout—this is a blessing in disguise. There’s a lot of status around educational institutions but all they do is teach you how to play other people’s games. You probably learned more from your time at Rari than you will in all of college lmao

0

0

26

@domm

name: Default Identity

url:

funding round: seed

location: SF Bay Area

1-line pitch: universal customer accounts for the internet

2

0

26

Barely through the pilot and people think they know how the series is gonna end

@BaselineMarkets

just getting started

Haters gonna hate

Ainters gonna ain’t

Jeets gonna jeet

Loopers gonna loop

Shifters gonna shift

Yessers gonna yes

Dreamers gonna dream

@BaselineMarkets

just getting started

4

5

31

1

5

21

I can't express the gratitude I have for our security advisors—

@poolpitako

,

@bantg

,

@plotchy

, and

@trust__90

for their efforts and guidance during the process.

+h/t

@1zaqk1

finding multiple optimizations in the arbitrage that returned countless extra ETH from the strategy.

1

0

20

Im sorry, excuse me, what??????

1

0

18

Can someone smarter than me help me understand:

What stops banks from throwing their whole treasury stack into the fed to borrow $ then buy back higher % bonds = refinancing treasuries?

Wouldn’t that be risk free trade, basically releveraging for free w the cheaper fed credit?

9

2

15

@Darrenlautf

@0xfanfaron

Compensation is an exchange of value for your work, salary is an exchange of value for your soul

1

0

16

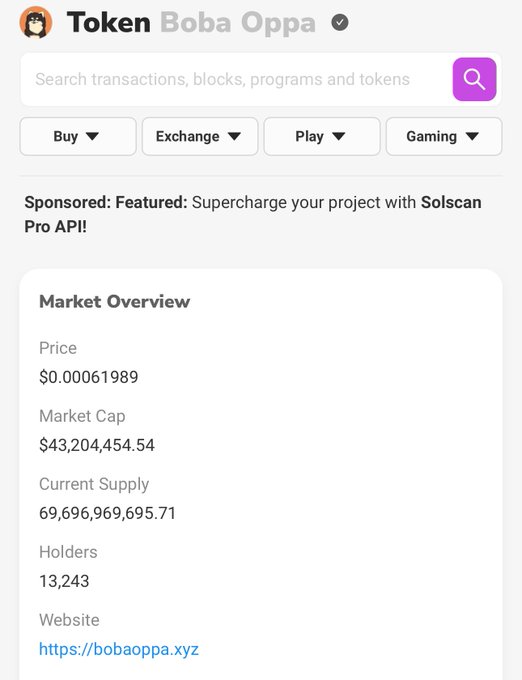

2 billy BLAST points holy fuck

Our partners at

@ThrusterFi

just notified us that we are currently earning 21M Blast points a day.

Without growing any further, if the system maintains the current size, we're on track to earn 1.89B points at TGE.

Reminder: the team will not be keeping any points for ourselves.

38

42

243

1

0

14

@jungyoonlim

Read smart contracts relentlessly. Read the same contracts over and over until you could rewrite them from the ground up. Solidity is generally super simple to understand and write, just has zero margin of error in regards to execution.

0

1

14

Based af intro to Solana. I love the writing style and how compact the information is.

H/t

@_ndigo

for always having these resources somehow

2

0

13

@Fiskantes

No.. Jeff Bezos is notoriously famous for being obsessed with customer experience and Steve Jobs with product. Clearly most crypto founders care about neither lol

1

2

14

Talking with

@_ndigo

about Default framework at

@MessariCrypto

’s

#Mainnet2022

at Pier 36 in New York City this September 21-23.

Come hang w/ us and listen to us blab about probably nothing.

0

2

13

@tbr90

Distribution... ETH has much larger inflation than BTC, so the ownership of stock is more concentrated. this means 1) it takes more buying to get back to ATH (tracking mcap vs. price) and 2) there's more sell pressure bc miners own more stock & sell off larger pieces in a run.

2

1

13

Congrats to

@antonttc

,

@c1ncel

, & others for putting on a very successful and well organized

@EthTaipei

. Great vibes, great ppl.

Looking forward to next year!

0

2

12

@typesfast

@typesfast

is it better to have bigger stockpiles or create a more responsive/adaptive production capacities altogether? E.g. ventilator masks with 3d printing. What if PPE is not the scarce resource of the next health crisis?

0

0

12