Endowment Eddie

@endowment_eddie

Followers

4K

Following

775

Media

44

Statuses

735

Investment generalist seeking elite asset managers. Unlimited time horizon.

Joined November 2024

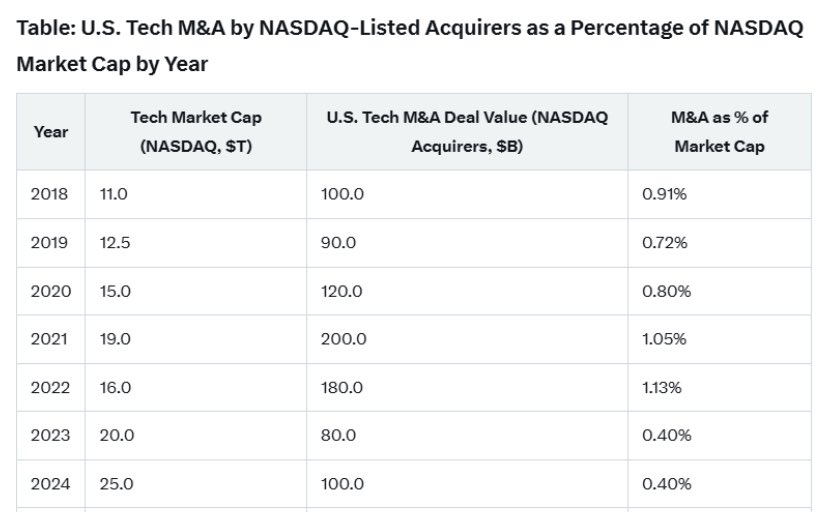

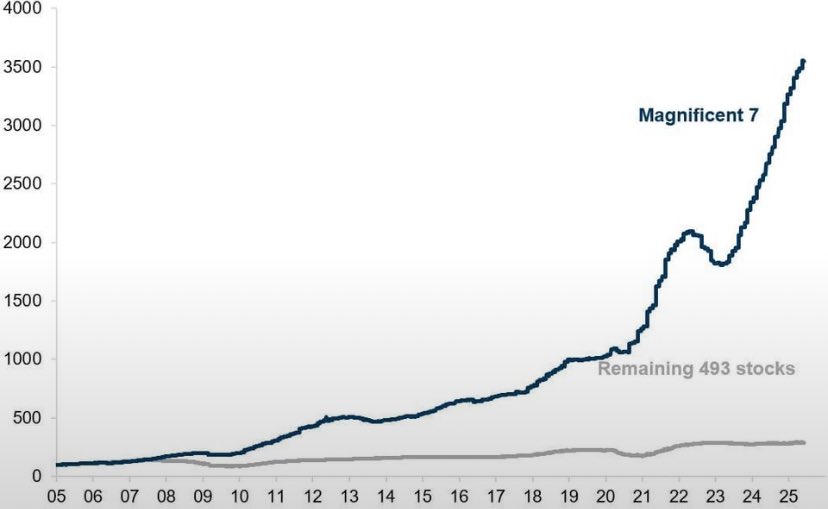

RT @Alex_Raffol: @endowment_eddie “Privates have underperformed publics” in reality is “the median PE fund underperformed the Mag 7”.

0

1

0

RT @rodriscoll: @endowment_eddie @twentyminutevc Did "say it", I just quoted it from this @TheEthanDing article Th….

0

2

0

“Harvey isn’t some breakthrough in legal AI—it’s ChatGPT with a law costume. Lovable isn’t revolutionizing code—it’s Claude with pretty buttons.”. - @rodriscoll on @twentyminutevc . Not enough people talking about this.

27

18

409

Looking forward to @robgo ‘s next post. Seed has the highest dispersion of returns in the highest dispersion asset class. Large GPs can be price insensitive. @ycombinator has a ROFR on exceptional talent. Median seed returns will disappoint big.

nextview.vc

This is a long read, but I’ll highlight four interrelated factors that are creating this existential threat to seed: Industry maturation The two unstoppable forces Power law as consensus The AI...

3

0

47

RT @RayDalio: In 10 years, the US government will be $55-60 trillion in debt (which will be 7-7.5 times government revenue) because there w….

0

728

0

RT @BoringBiz_: Can pretty much mark my words on this. Until America makes housing affordable for the next generation, the trend towards so….

0

128

0

Are they running circles? . ScaleAI and Character remain standalone businesses. Can you block [extremely] high paid hires? . FTC/DOJ might struggle to prove Sherman/Clayton/FTC Acts have been violated.

Feels like Silicon Valley is running circles around Trump’s antitrust regulators right now. Assume the FTC and DOJ know that they can review non control transactions.

2

0

3