David Hearne, CFP™

@dontdelay

Followers

8K

Following

33K

Media

7K

Statuses

75K

Certified Financial Planner. Independent Financial Adviser. Specialising in Retirement Planning, Investment Management and Estate Planning. Posts are not advice

Maidenhead

Joined December 2009

Thought of you when I shared this @FlpLtd . I’ve got my first ever ultra coming up this October, and you’re on my list of people I blame !

1

0

0

Been looking forward to watching this ._______.The Finisher: Jasmin Paris and the Barkley Marathons (Full Documentary) via @YouTube

1

0

2

Retirement planning is. Part spreadsheet.Mostly behaviour. This from Jonathan Guthrie is worth a read.______.Pension drawdown: it’s all spend, spend, spend (advisedly) via @ft.

ft.com

Financial planning — ideally on a spreadsheet — is essential for making your retirement pot last

0

0

3

Hope this popular video is going to lead to more people realising how much of our council tax is spent on social care . But the last meaningful attempt to deal with this, got labelled the Dementia tax, and quickly dropped . We have to get real about the increasing costs of social.

James Buckley wants to know "what the f*ck is going on?" with local gov't services. * Councils spending 2/3 of their budget on social care. * 15 years of cuts to council funding. * We pay less Council Tax in real-terms than 1991. That's what's going on.

0

2

6

Not ALL state pensioners @Daily_Express . Many still won’t, and many already are. _____.Exact date all state pensioners will pay tax after triple lock change | Personal Finance | Finance |

express.co.uk

All state pensioners will have to pay tax due to the triple lock.

0

0

1

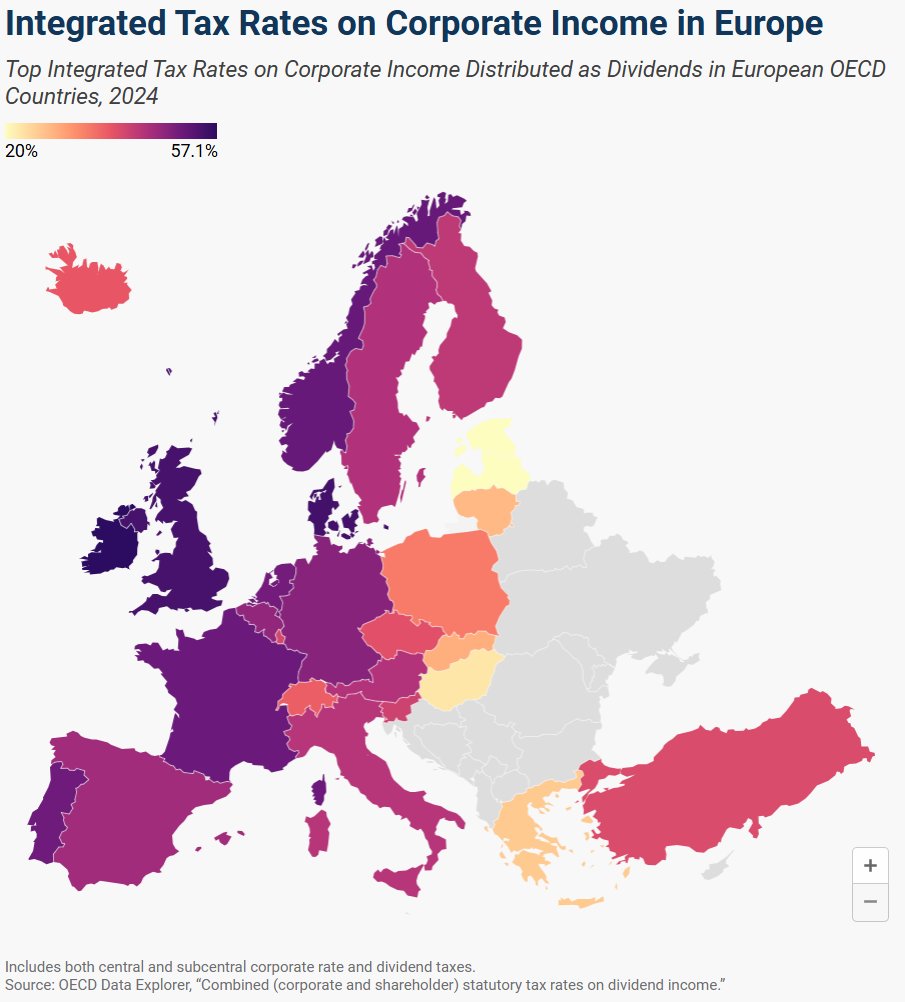

Re reading this, anyone would think that Barclays is owned by Mr Barclay and the Barclay family, and that they must be taxed more. Rather than the reality that Barclays is owned by millions of people, including most of its staff, through their pensions and ISAs . Their success is.

Barclays made £1.7bn of profits in the three months to June. They plan to hand out £10bn to shareholders by the end of 2026. The financial sector is booming but the working class gets nothing in return. We need to put redistribution of wealth at the top of the agenda.

10

0

89

Does this Labour government actually have a growth agenda?. A British bank, making profits globally, is a problem?. Profits they will pay corporation tax on. Share buy backs (which are not 'hand outs') will provide capital for sellers to reinvest, and taxes from many making.

Barclays made £1.7bn of profits in the three months to June. They plan to hand out £10bn to shareholders by the end of 2026. The financial sector is booming but the working class gets nothing in return. We need to put redistribution of wealth at the top of the agenda.

8

5

49

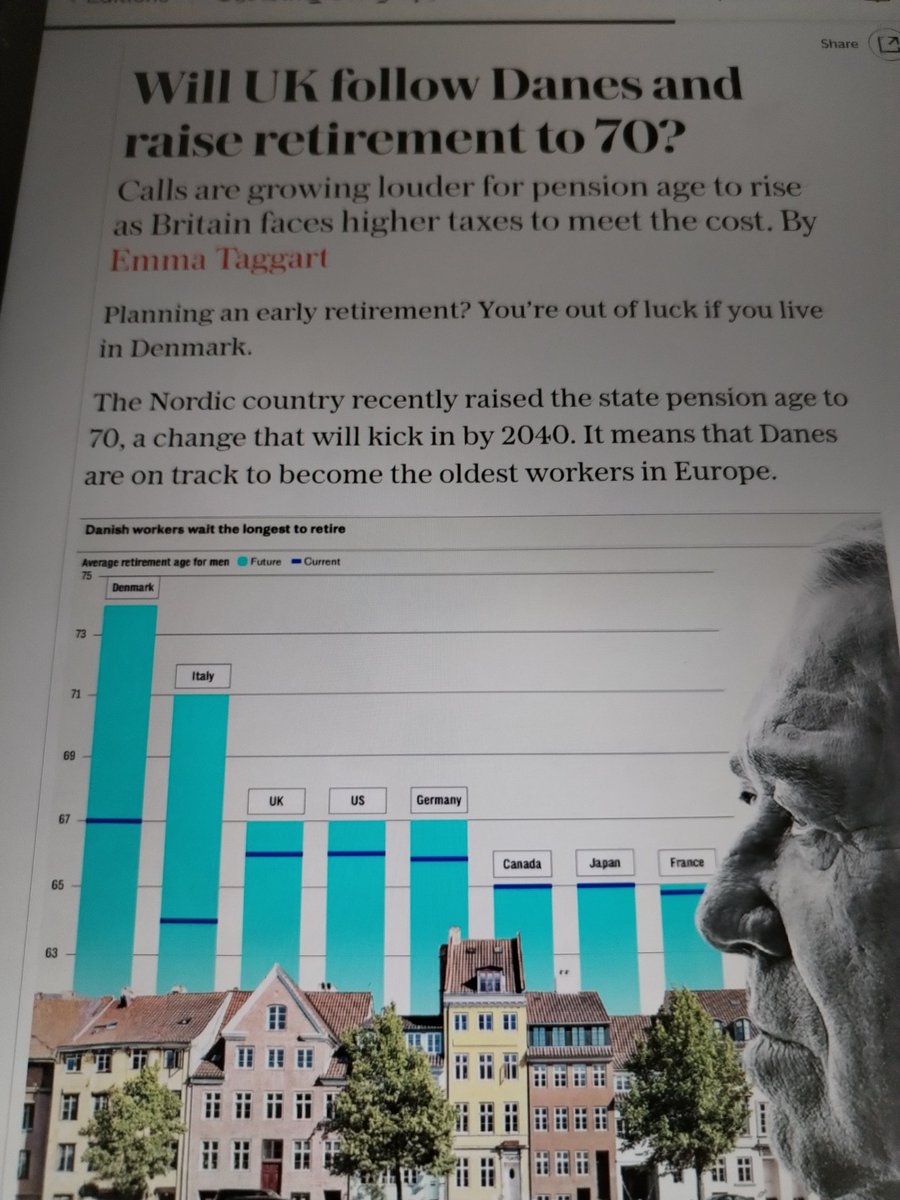

Well done @Telegraph use 3 different phrase. Retirement age.Pension age.State pension age. To imply the same thing, when they are not the same thing . It’s no wonder the public are so confused about pensions and retirement if this is what they’re reading.

Jesus christ. 70 is neither the retirement age, nor the pension age. And if you're planning an early retirement, then you won't take any notice of the State Pension Age - otherwise it wouldn't be "early" would it. Imbecilic from the @Telegraph

2

3

30

This isn’t ‘coming for pensioners’. This affects a small group of people in their later 40s and early 50s who are c.15 years away from receiving their state pensions. Can we please all realise that pensions policy doesn’t just affect pensioners.

Millions to lose up to £18,000 in savings from pension reforms. I told you if you let them get away with attacking the disabled they would see it as a greenlight to come for pensioners next.

2

3

12

We really shouldn't run polls on retaining the triple lock on state pensions. Because this is just one of many tweets, that show people don't understand what it's for, or what it actually does.

Reform have refused to protect the Pensioners Triple Lock. The arrangement which ensures Pensions increase with the cost of living is essential to combatting pensioner poverty. Under Reform, Pensions are at risk.

1

3

27

@Telegraph @RathbonesGroup But this just shows, depressingly so, how long the reach of the triple lock is politically. It's not just in the self interest of 13 million current pensioners, but also another c.10 million future pensioners in their late 40s, 50s, and early 60s. Someone needs to be brave.

1

0

8

@Telegraph @RathbonesGroup I say, they, but this is me too. At 48, if the government begin accelerating the increase of state pension age to 68 in 2039 instead of 2044, then I will see my own state pension age go from 67 to 68. If I was selfish, I would want the triple lock to endure for the next 20.

3

2

16

@Telegraph And if the triple lock keeps increasing state pension as much as this analysis from @RathbonesGroup suggests it might, then far from losing anything, they will gain far more from that, than they will lose from it starting one year later.

1

0

5