Adam Shapiro

@ah_shapiro

Followers

3,894

Following

610

Media

409

Statuses

1,236

Economist @sffed | Applied Micro | Applied Macro | Health Economics | Views expressed here are my own | personal account

San Francisco

Joined March 2009

Don't wanna be here?

Send us removal request.

Explore trending content on Musk Viewer

#KAZZAWARDS2024

• 796787 Tweets

SAROCHA REBECCA IN KAZZ

• 574367 Tweets

FOURTH x KAZZ 2024🥳

• 94964 Tweets

ナイジェリア

• 47987 Tweets

Varane

• 43096 Tweets

インプレゾンビ

• 40167 Tweets

魔法少女

• 30267 Tweets

#お迎え渋谷くん

• 27623 Tweets

B1NI TOPS SPOTIFY

• 26267 Tweets

名誉毀損

• 16447 Tweets

#ابراهيم_المهيدب

• 14722 Tweets

#くる恋

• 13985 Tweets

風の行方

• 12927 Tweets

いなば食品

• 11681 Tweets

Last Seen Profiles

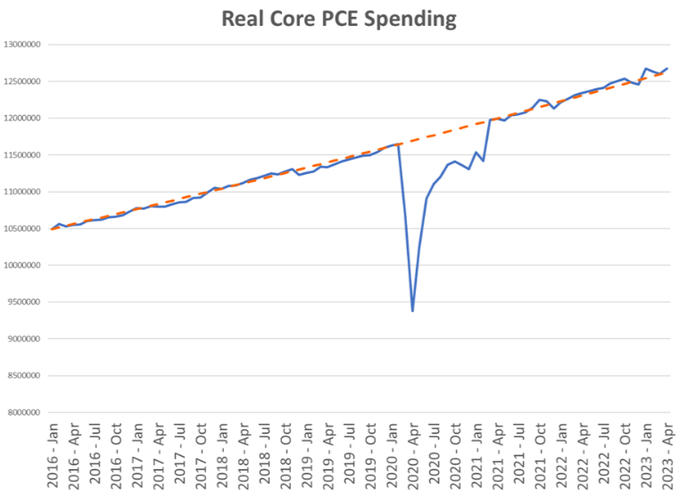

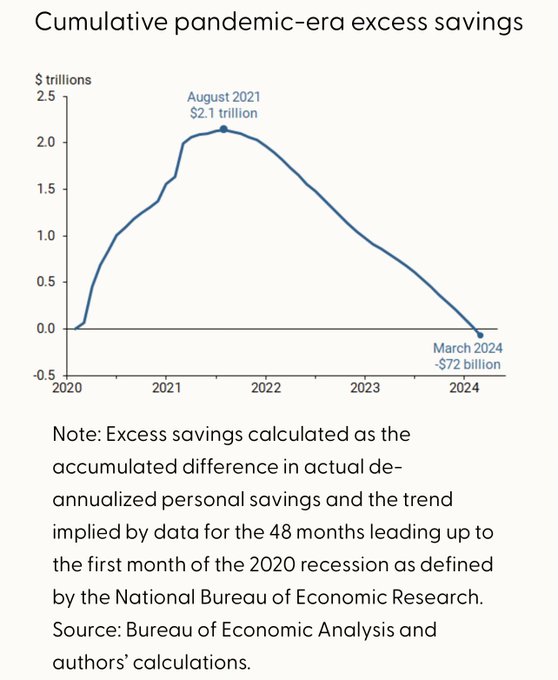

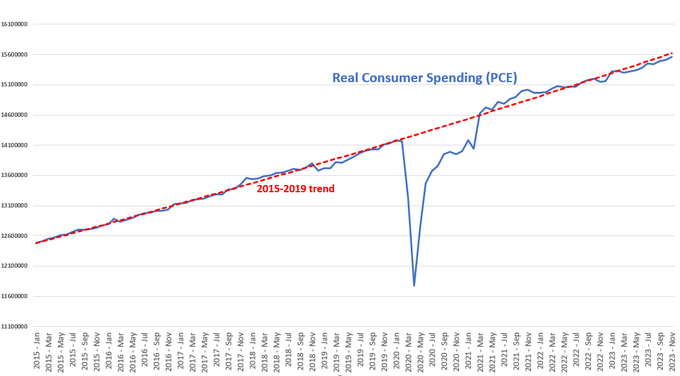

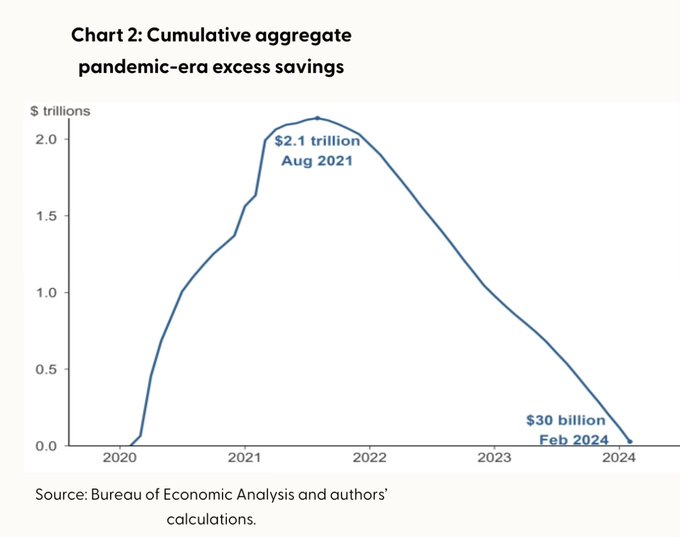

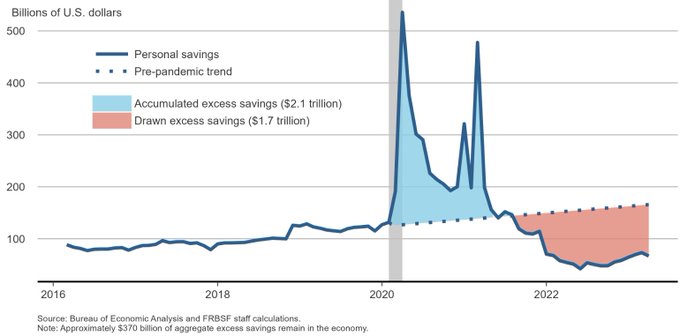

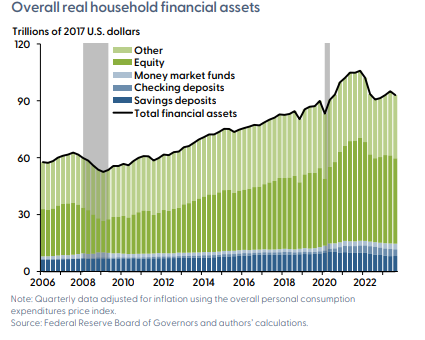

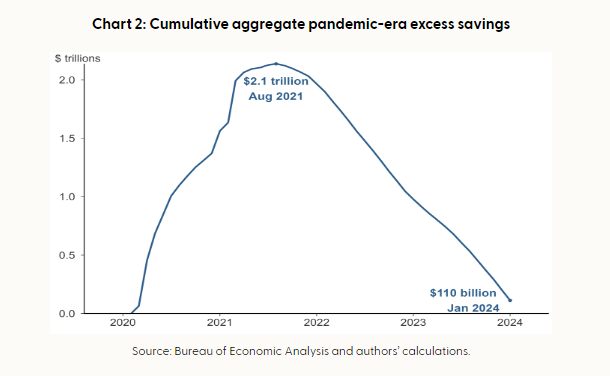

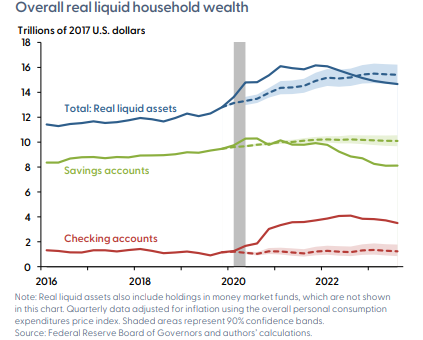

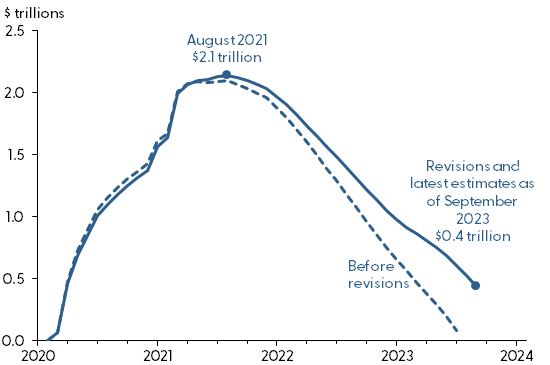

Excess savings are now depleted according to the

@sffed

measure.

Future consumer spending growth relies on “continuous employment or wage gains, other forms of wealth”

write Hamza Abdelrahman and Luiz Oliveira

13

96

314

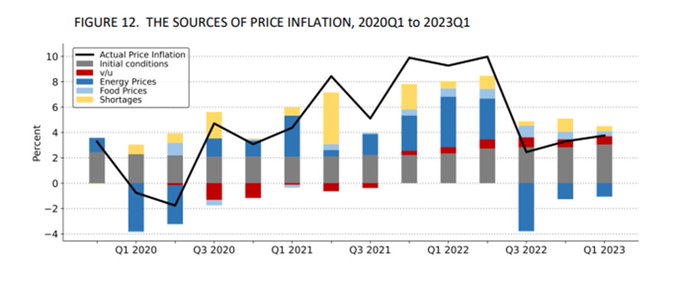

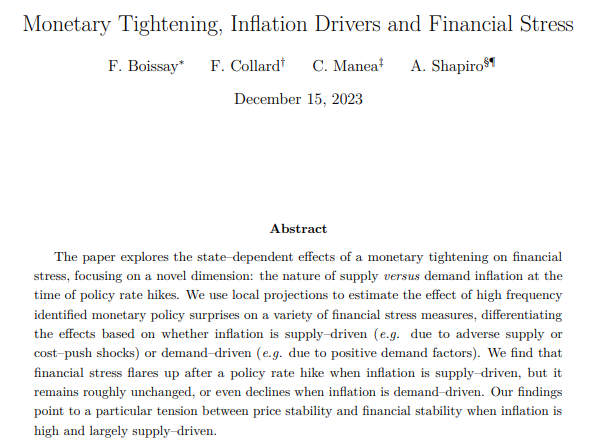

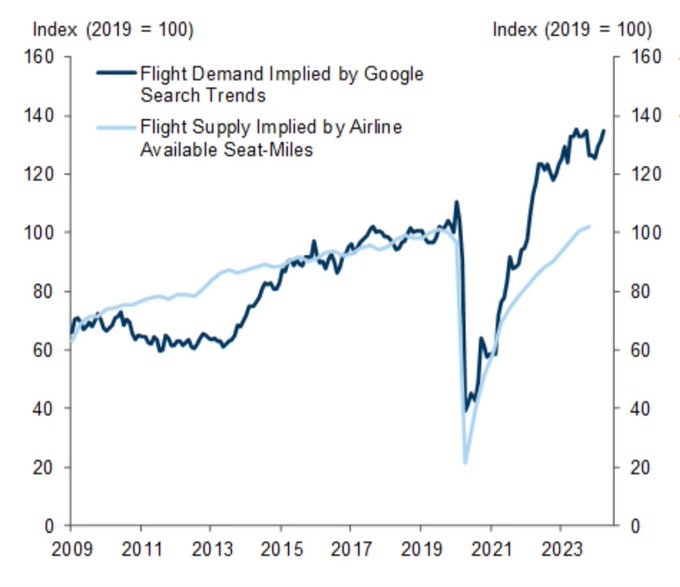

In an interview with

@kairyssdal

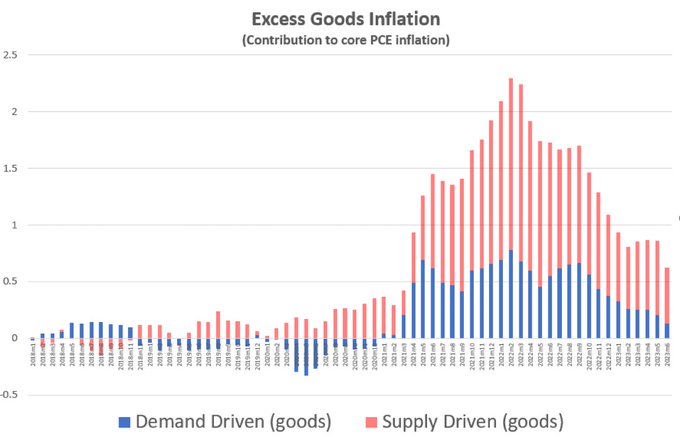

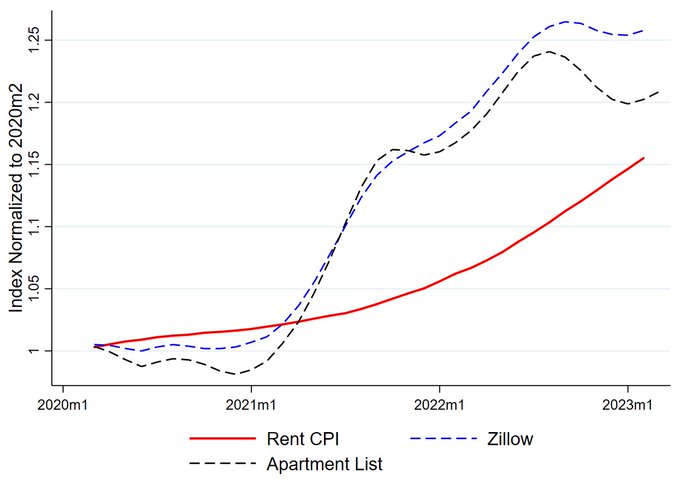

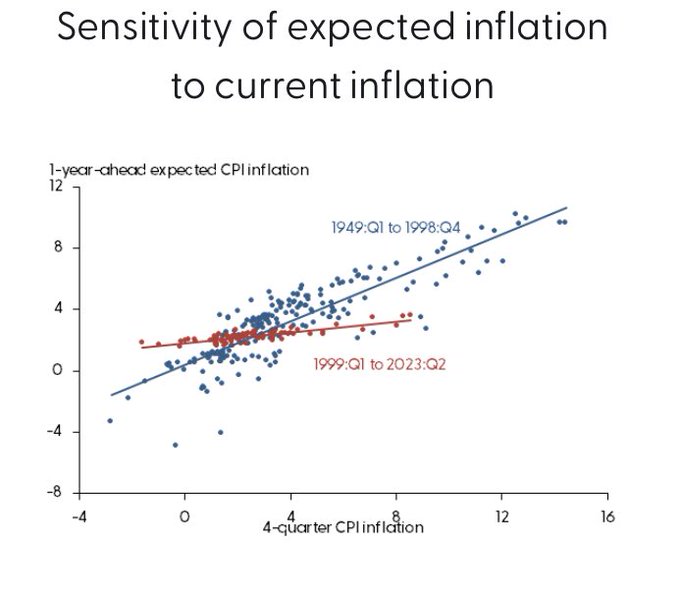

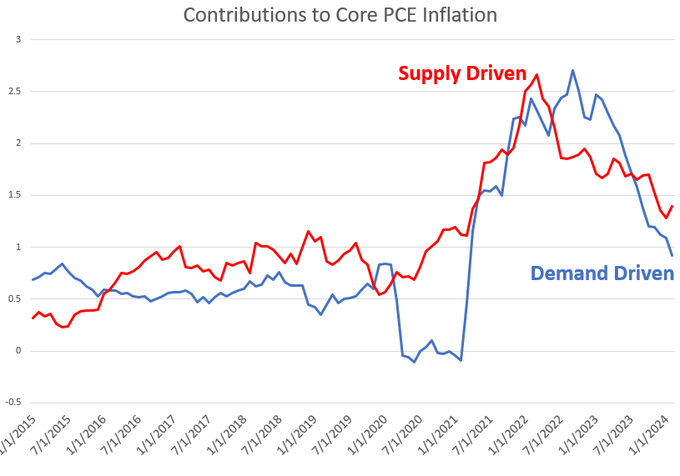

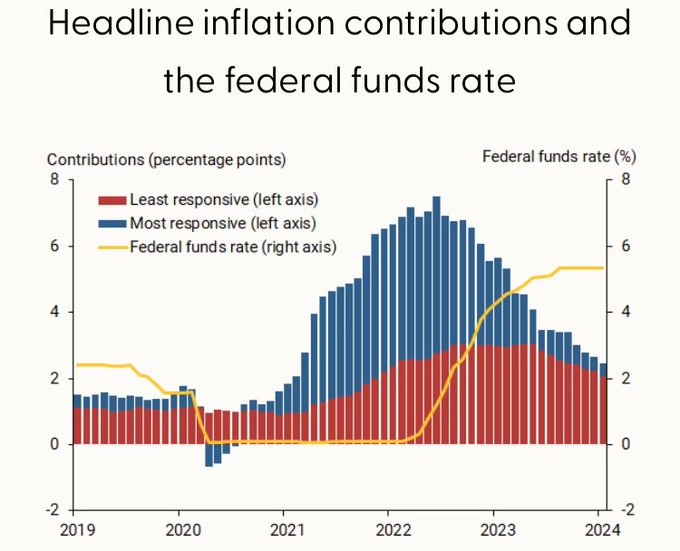

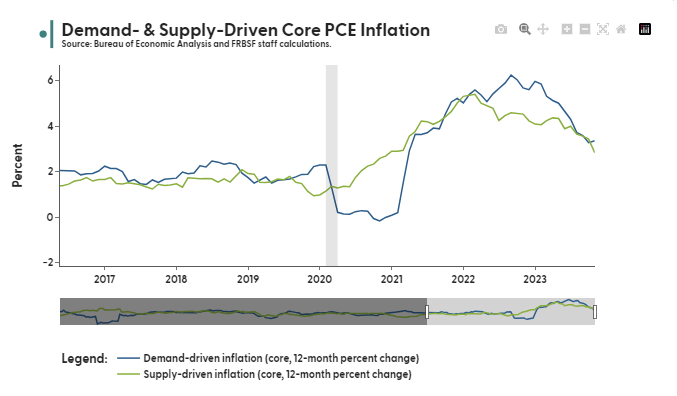

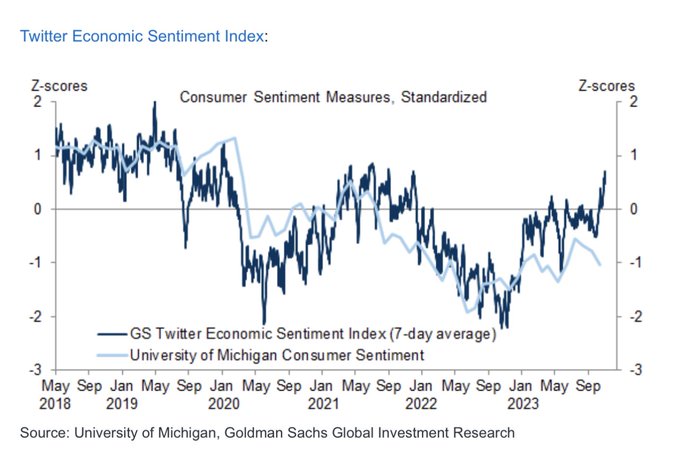

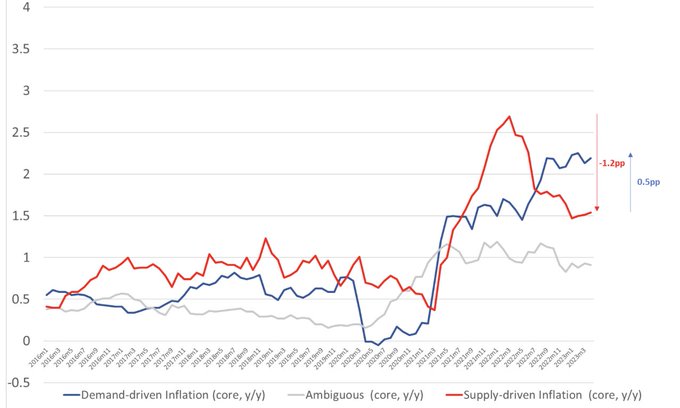

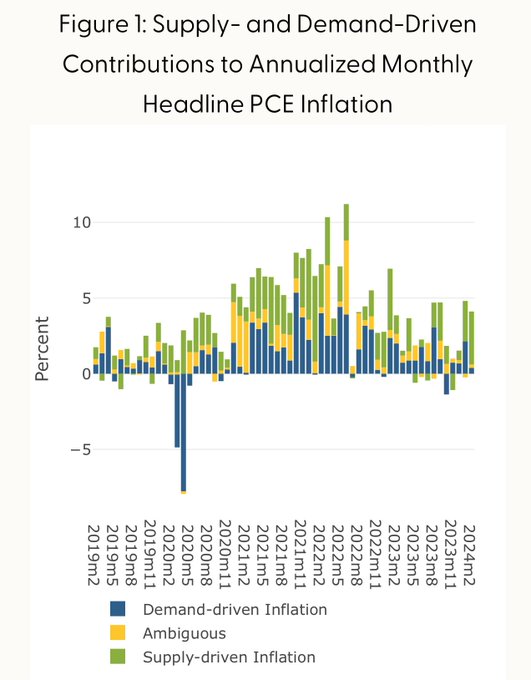

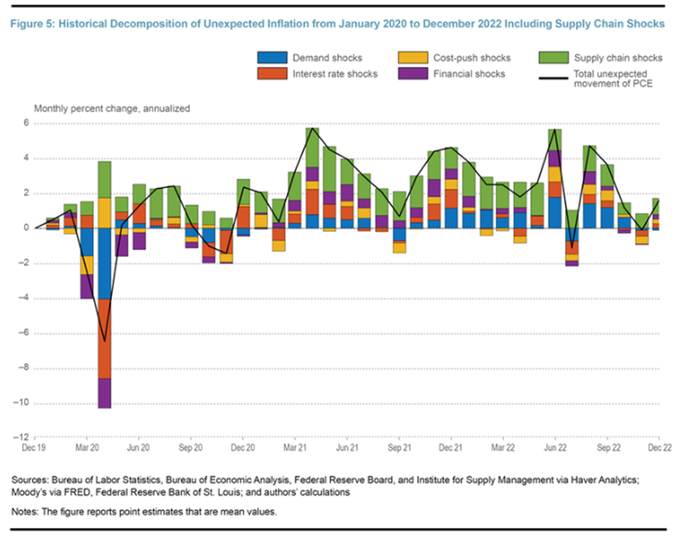

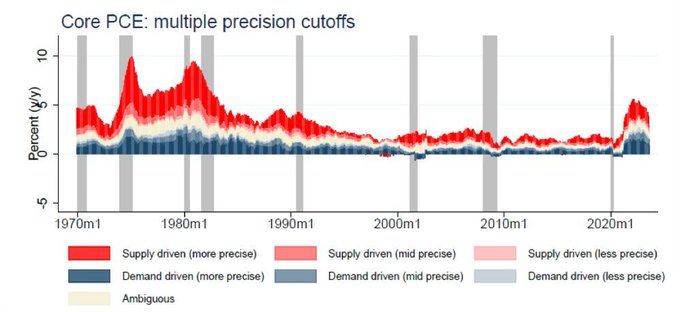

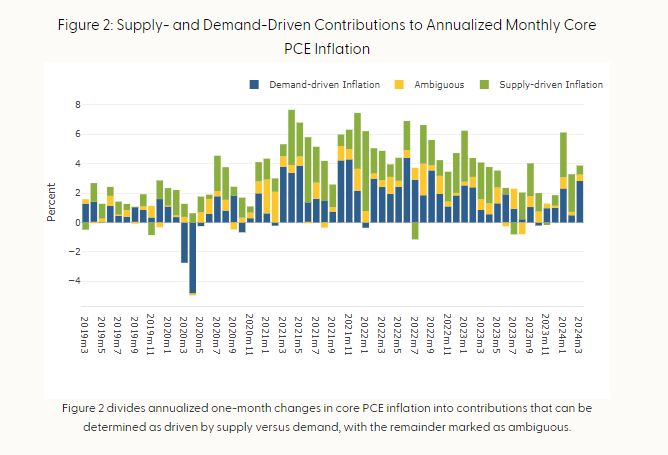

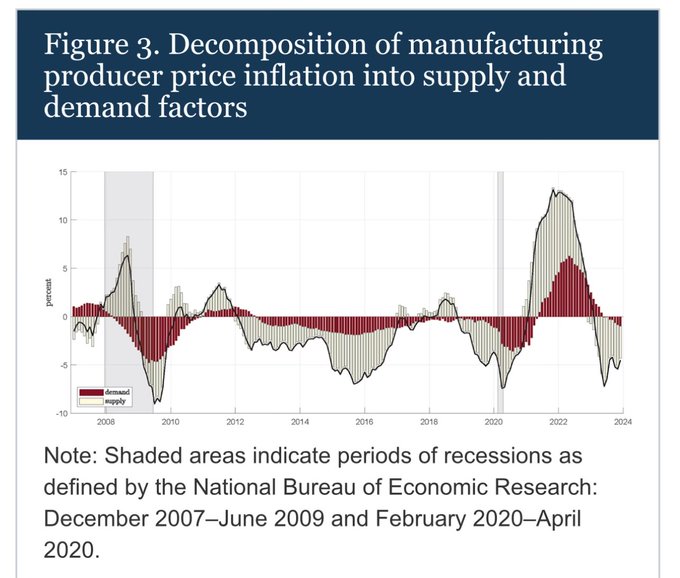

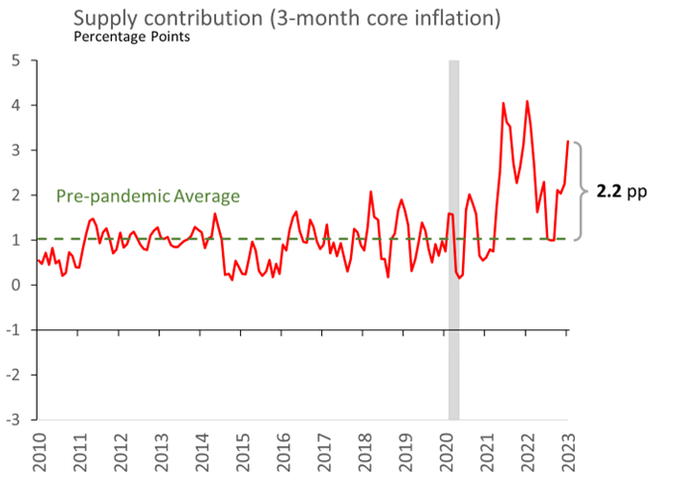

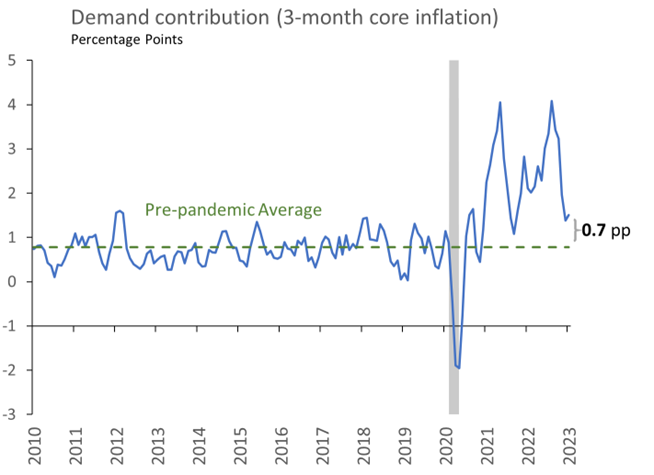

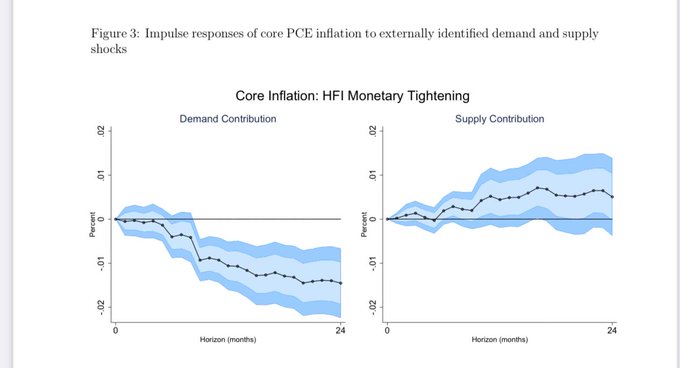

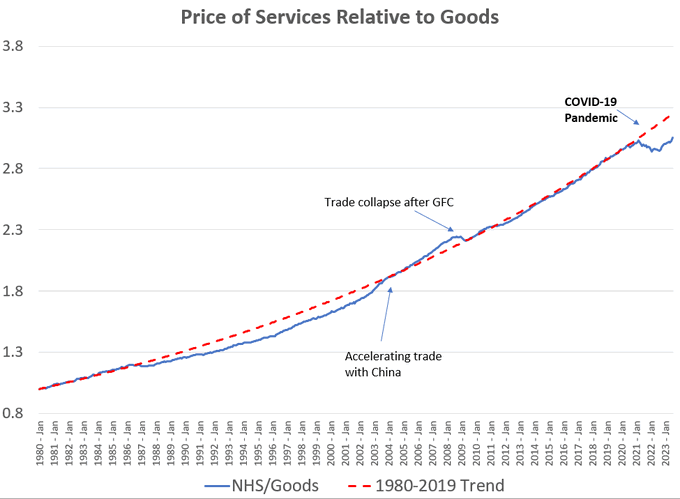

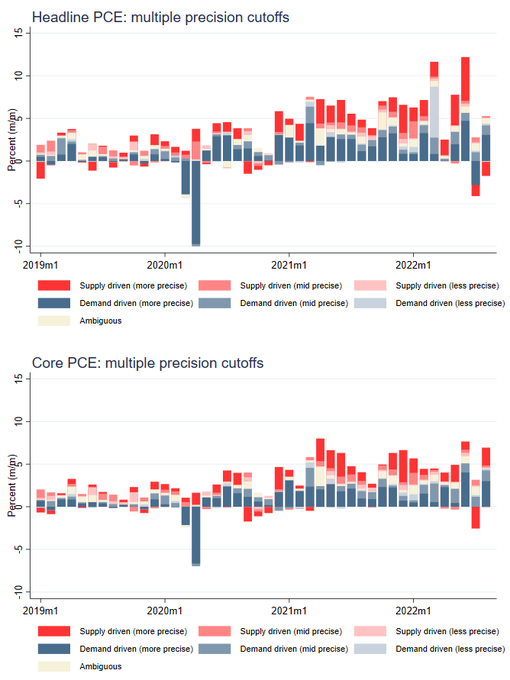

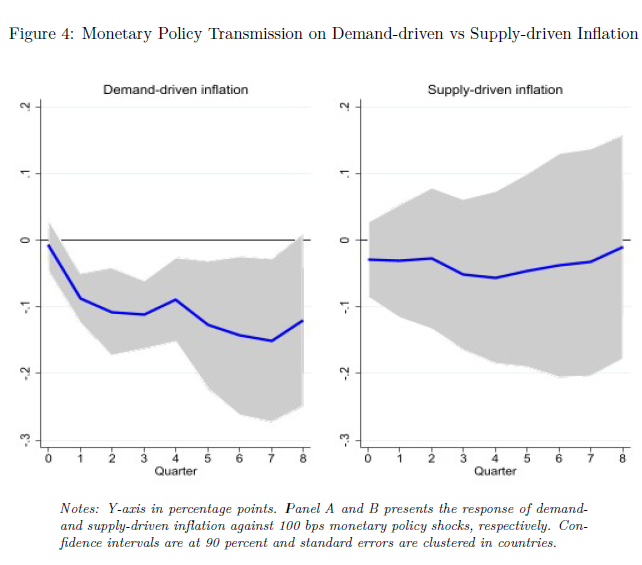

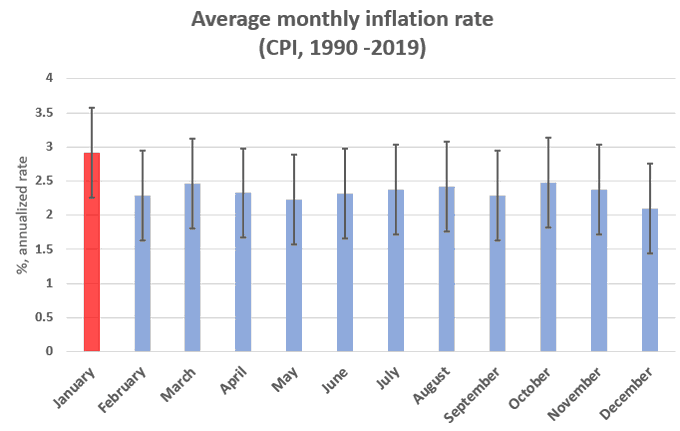

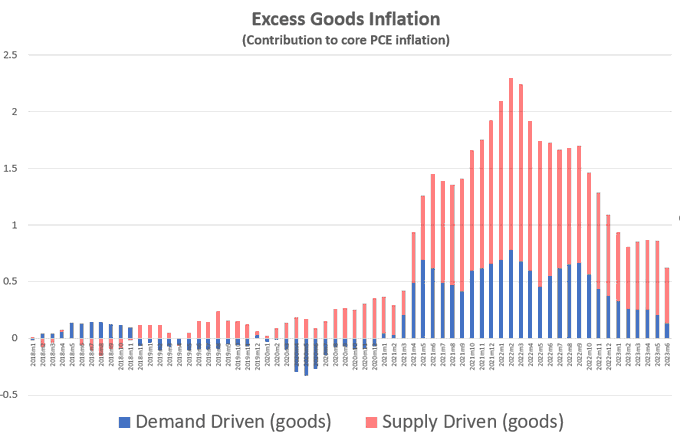

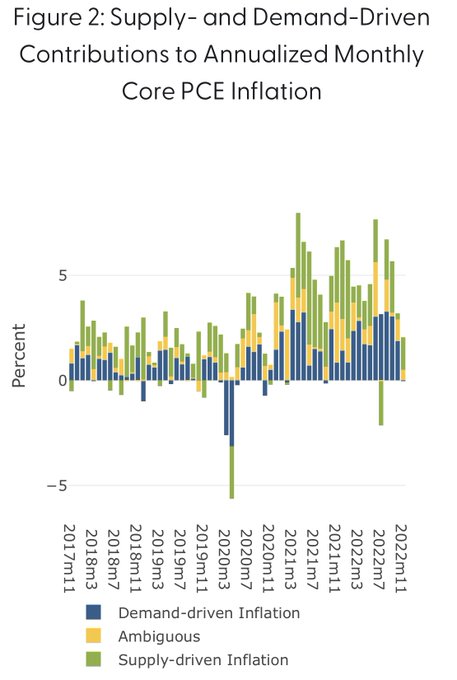

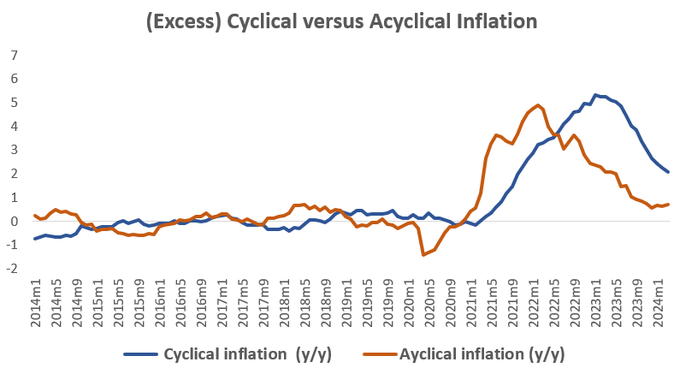

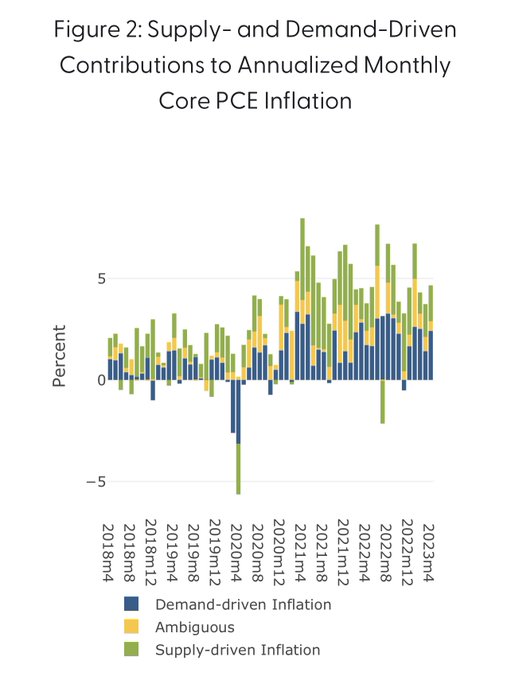

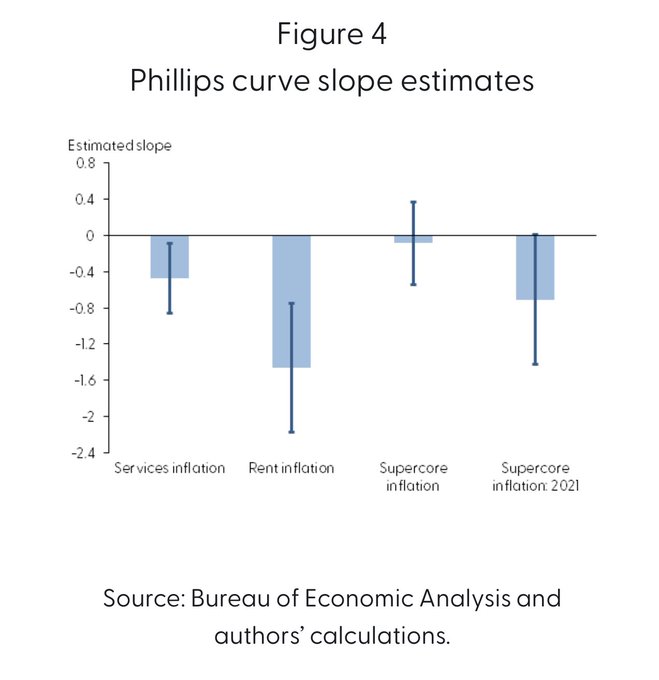

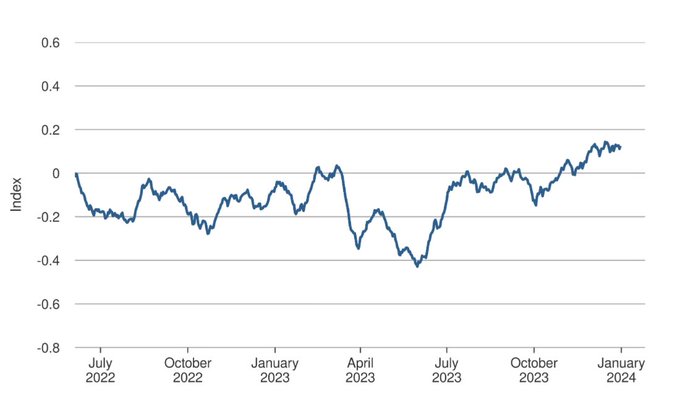

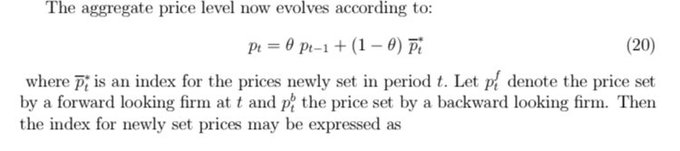

, Powell stated “What [the Fed] can control is demand, we can’t really affect supply with our policies” In a new paper I show that this is, to some extent, true:

4

51

255

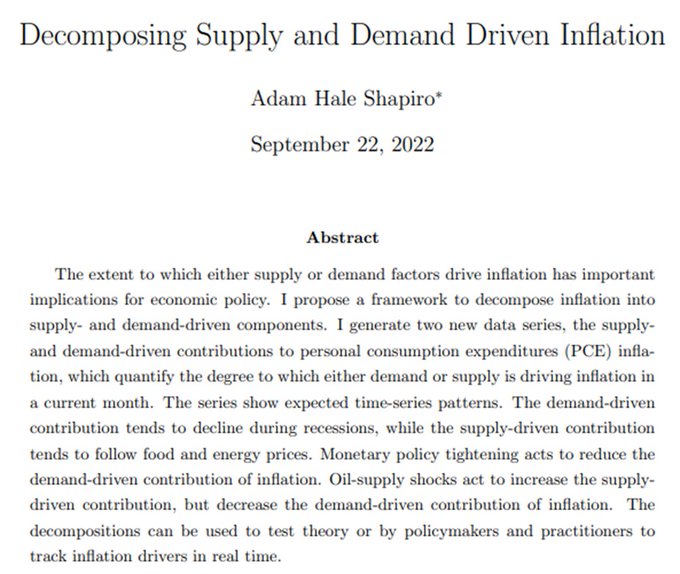

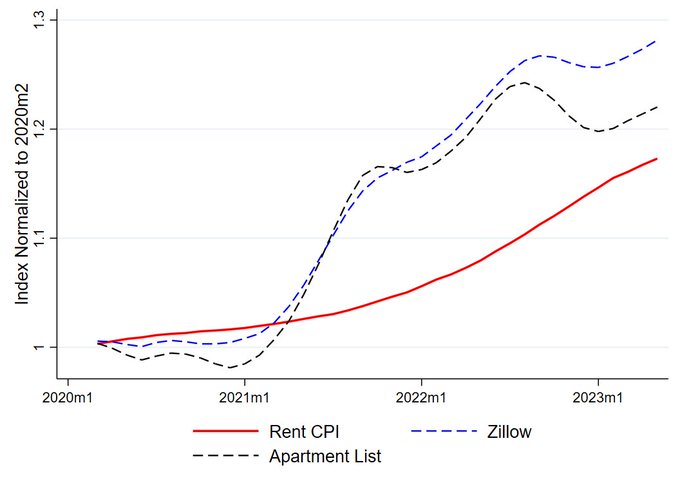

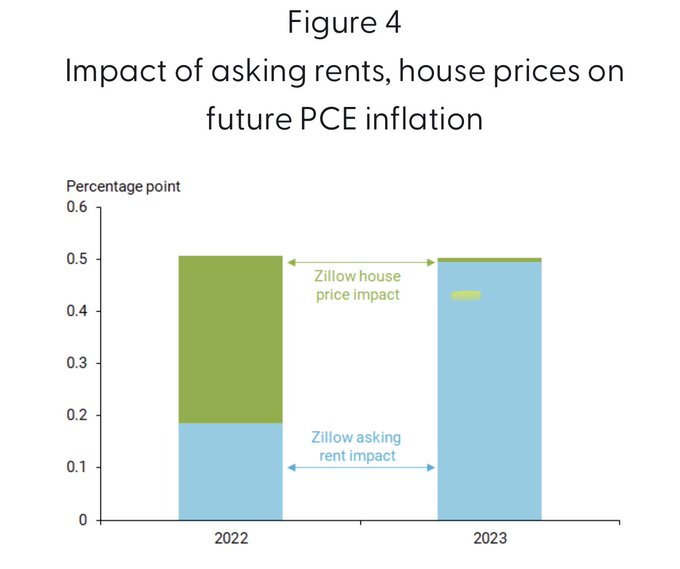

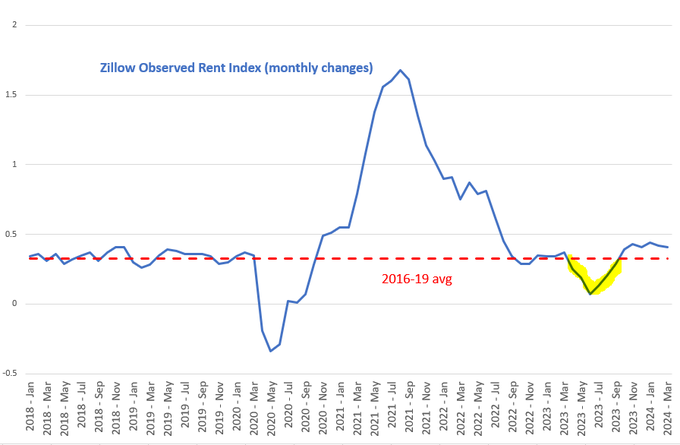

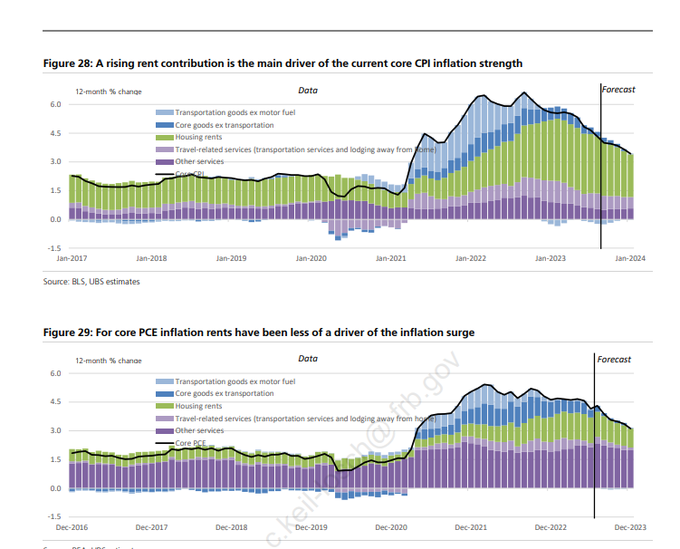

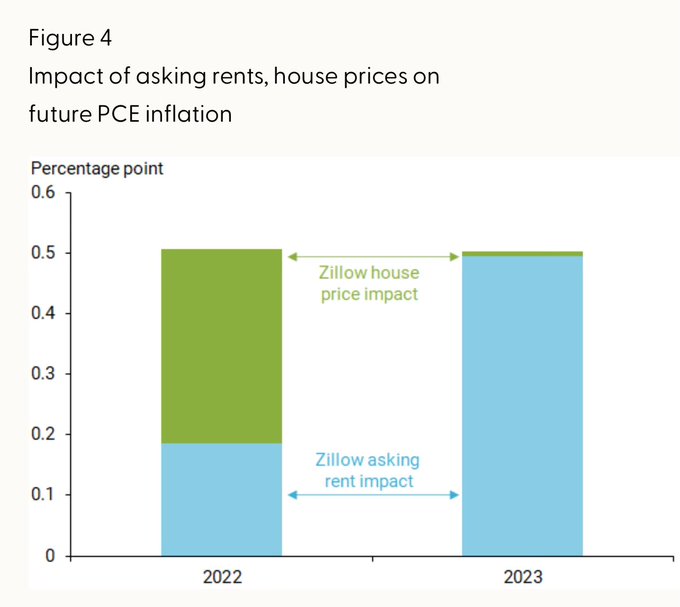

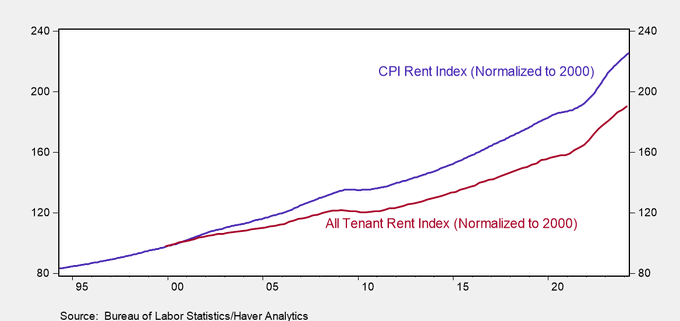

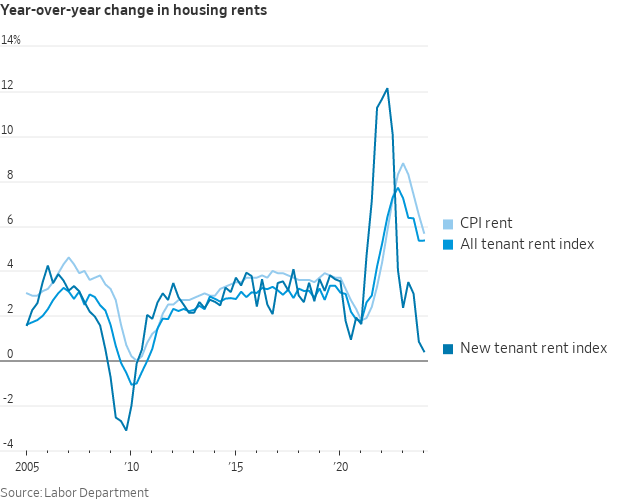

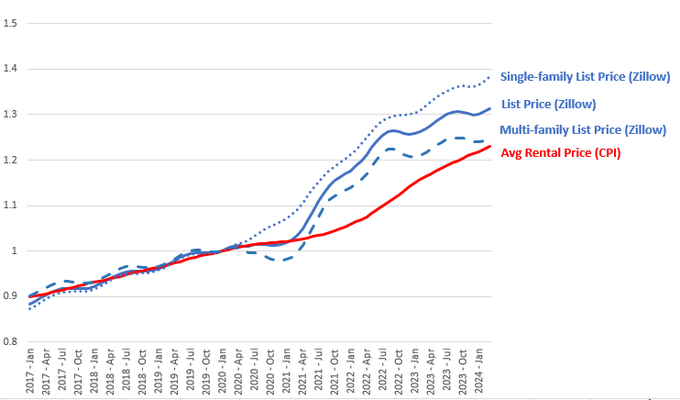

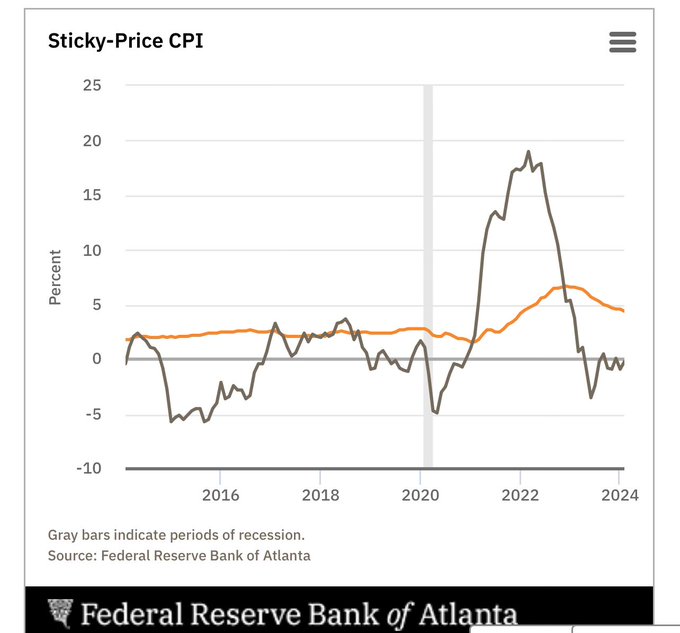

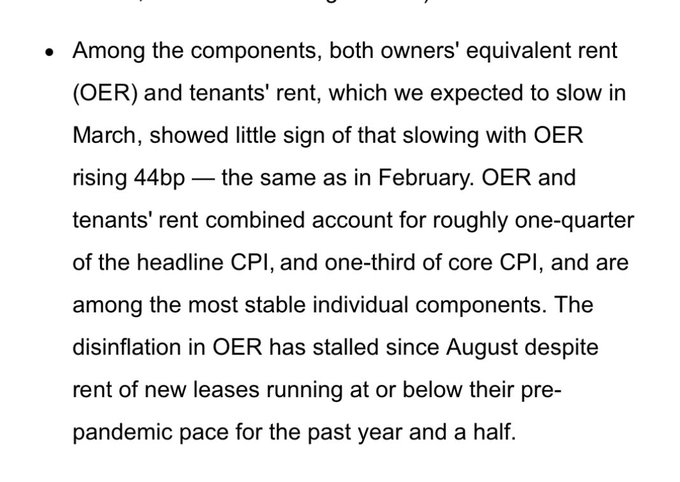

Any upcoming slowdown in rent CPI is now looking less promising

(data is updated to May)

14

47

229

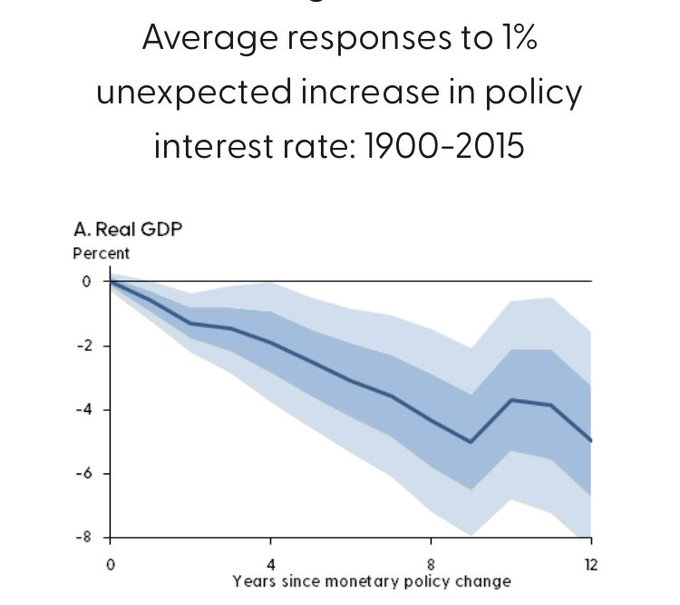

Very very very very long lags of monetary policy found by

@sanjayrajsingh

, Oscar Jorda, and Alan Taylor

6

30

140

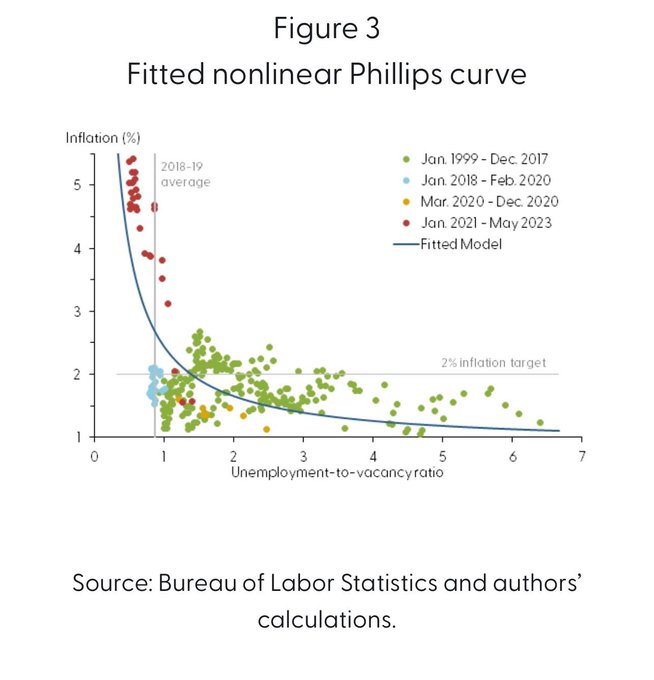

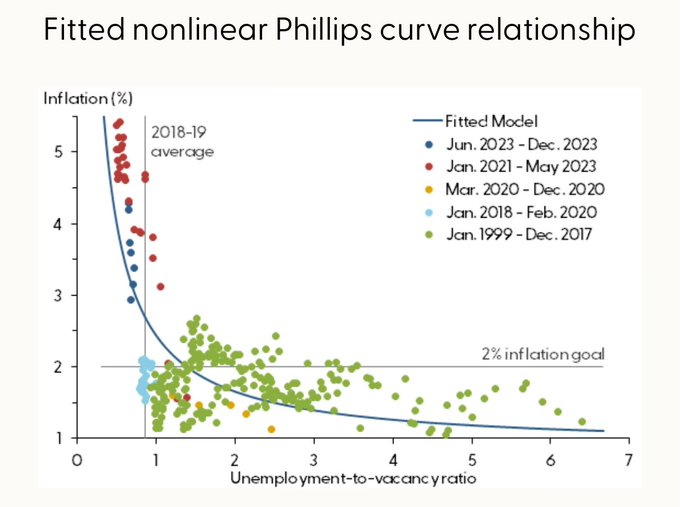

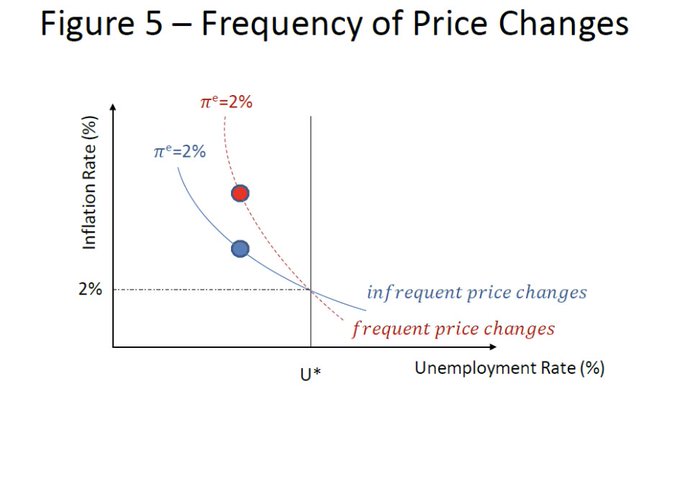

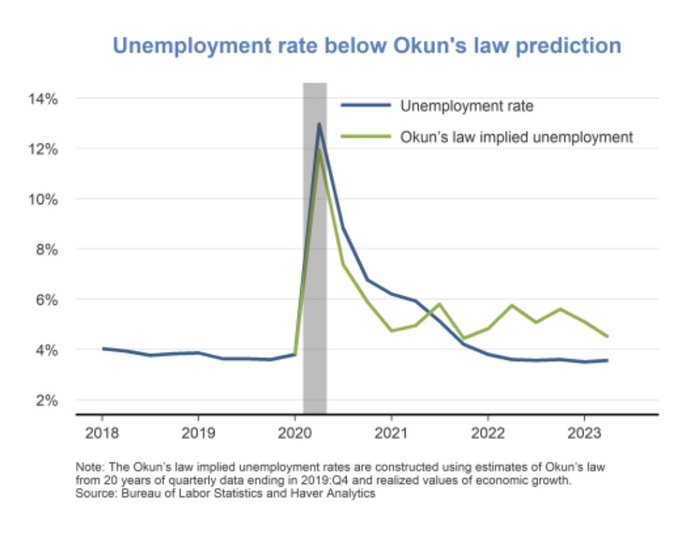

An important note linking theory to empirics by

@Petrosky_Nadeau

and Kevin Lansing.

The shape (ie convexity) of the Beveridge curve has implications for the shape of the Philips curve and the prospects for a soft landing.

2

18

119

This is not great inflation news: the disinflation in market rents proved to be really short lived

13

34

113

“New data covering the period since May 2023 have continued to follow the path of a nonlinear Phillips curve”

@Petrosky_Nadeau

Kevin Lansing

3

32

110

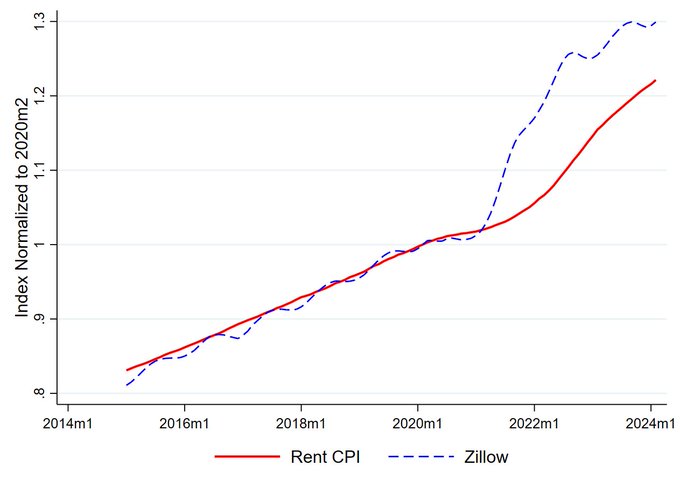

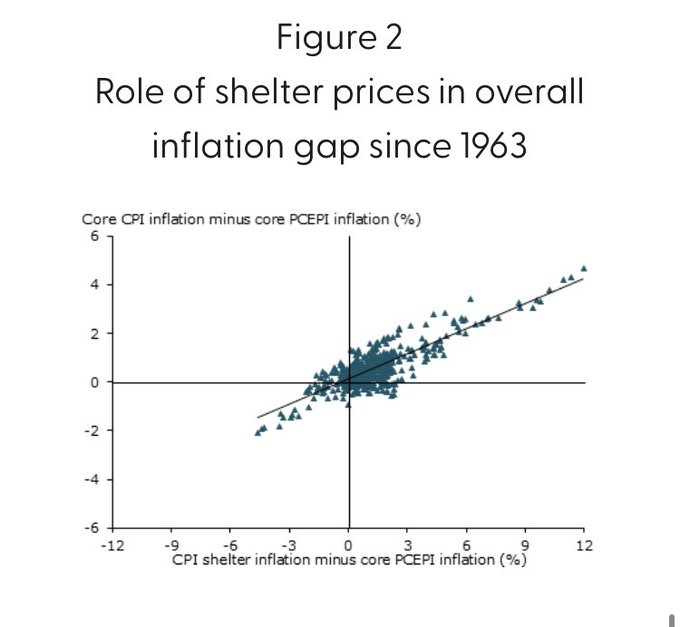

Recent high CPI rent inflation should (still) not be surprising.

The gap between market rents and paid rents peaked in July 2022 at 15pp, and has since closed to 8pp.

The rate at which paid rents (CPI) catches up to market rents is what we see as CPI rent inflation.

10

14

105

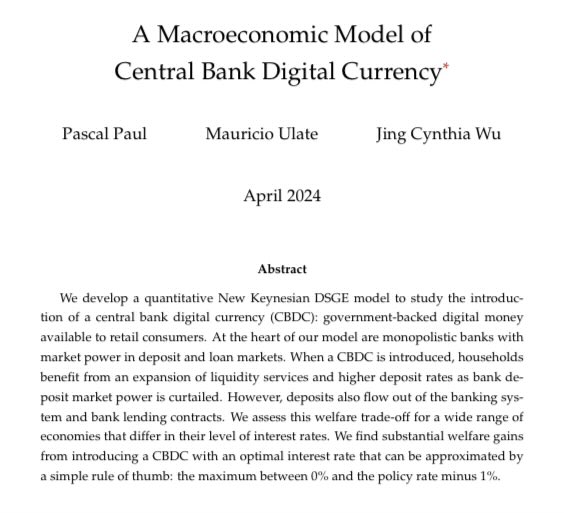

Interesting paper by my colleagues

@pascalpaul

and Mauricio Ulate showing significant welfare gains from introducing a CBDC

1

31

106

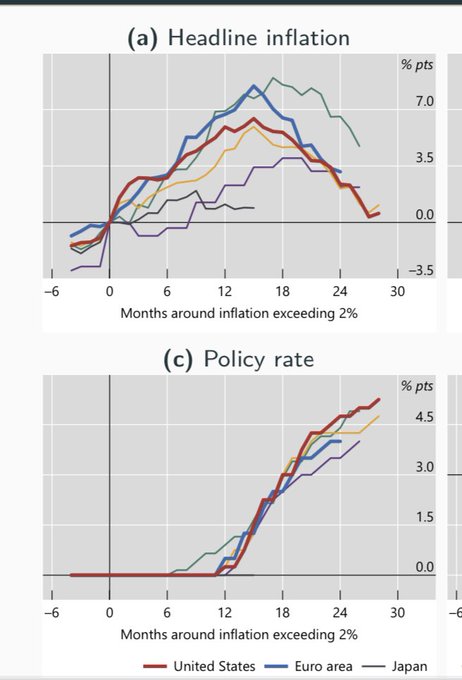

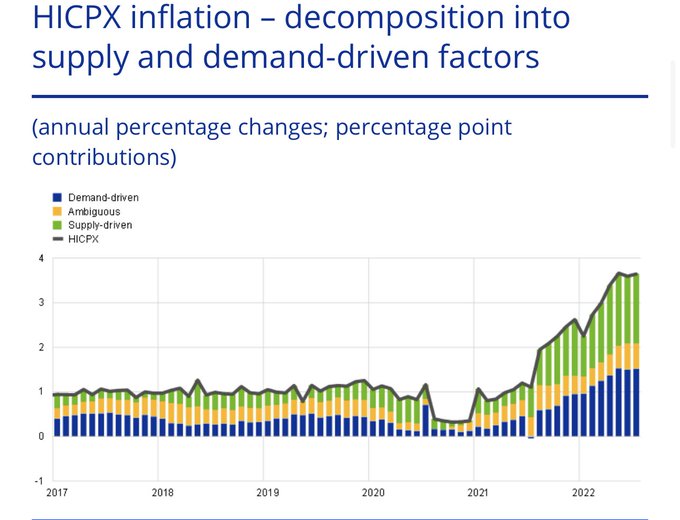

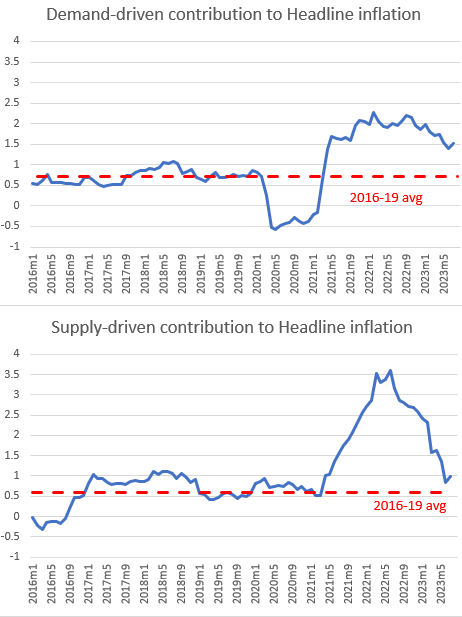

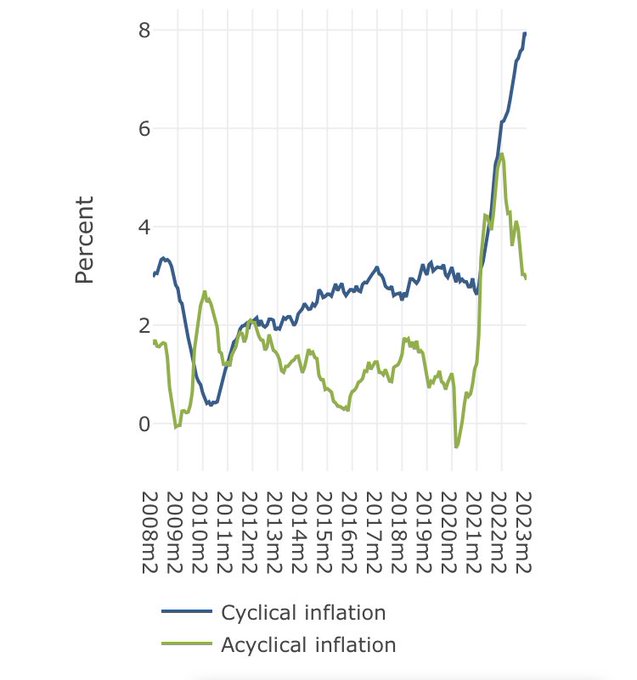

Historically, monetary policy tightening (including forward guidance) has acted to reduce the demand component of inflation

1

27

92

The final version of our paper on the costs of administrative hassle in the healthcare system is now available.

Physicians lose 18% of Medicaid revenue to billing problems.

Physicians are more apt to refuse to accept Medicaid in those states with more severe billing hassle.

Recently accepted by

#QJE

, “A Denial a Day Keeps the Doctor Away,” by Dunn (

@AbeDunn3

), Gottlieb (

@GottliebEcon

), Shapiro (

@ah_shapiro

), Sonnenstuhl (

@dj_sunchair

), and Tebaldi:

1

51

145

3

18

87

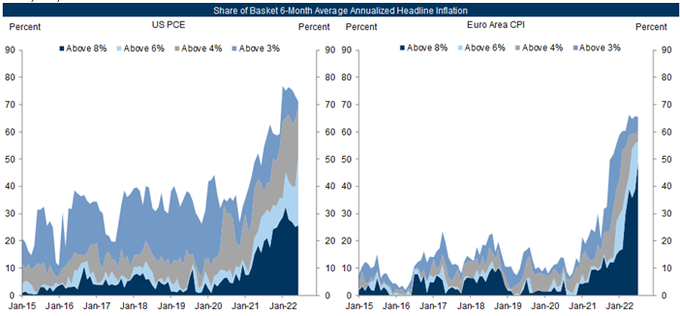

Further evidence that monetary policy tightening reduces demand-driven inflation by IMF economists Melih Firat and Otso Hao

This is the average response of a 100bp tightening across 22 countries which includes both time and country fixed effects.

4

28

82

An update on the recent

@sffed

analysis by Hamza Abdelrahman and Luiz Oliveira:

$100B further drawdown of excess savings in April. Spending was revised up in Q1, so an overall change of $150 in drawdowns from their last estimate.

8

25

82

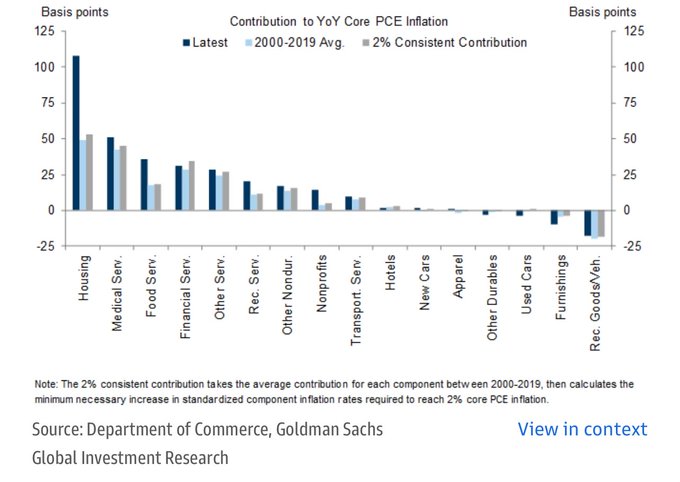

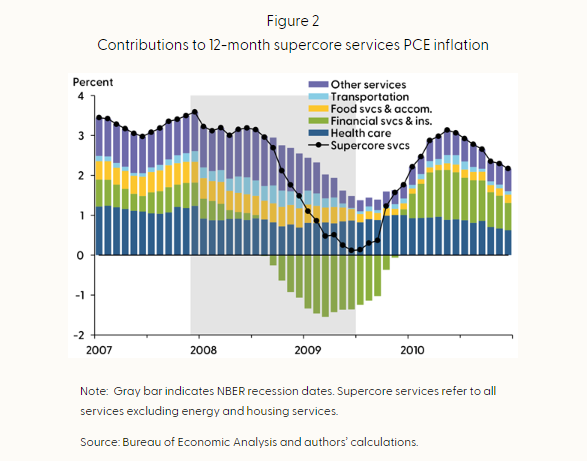

The

@sffed

is now providing data available for download on the contributions to PCE inflation by broad category (goods/housing/services ex housing)

This also includes a breakdown of "supercore" into its subcomponents

3

22

81

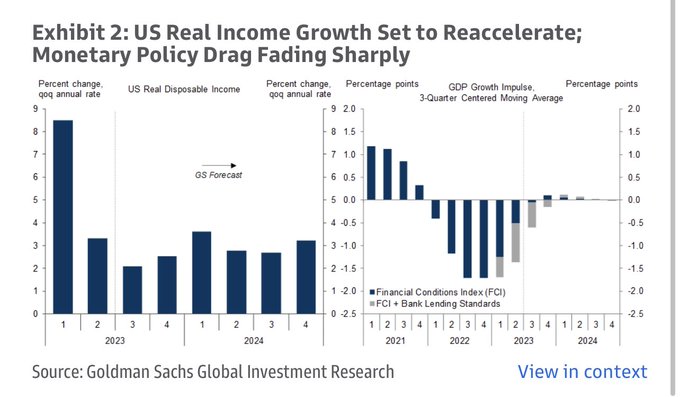

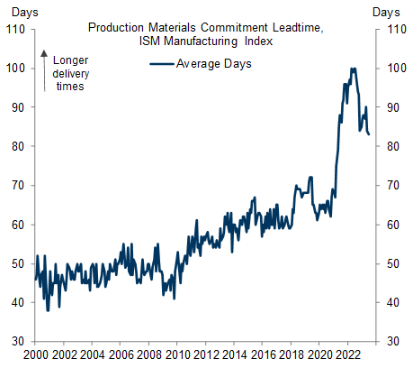

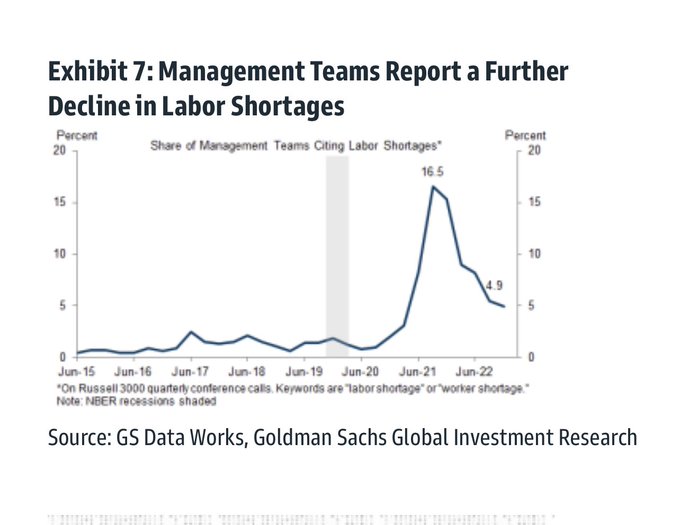

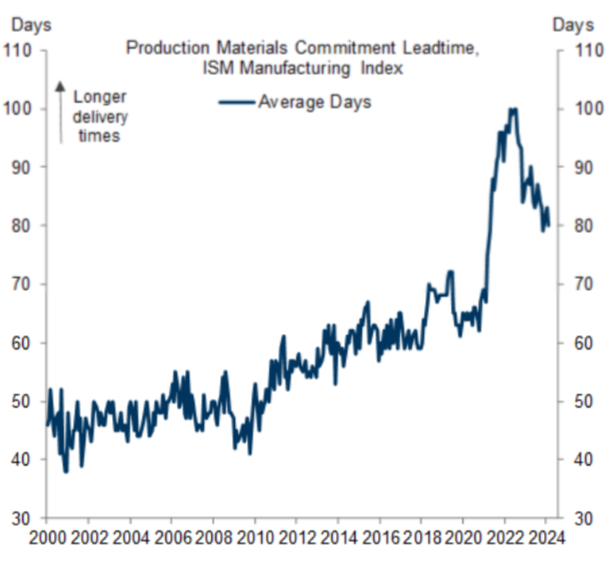

Supply chains are not healed yet. Quite the persistent supply shock!

(chart from GS)

4

18

79

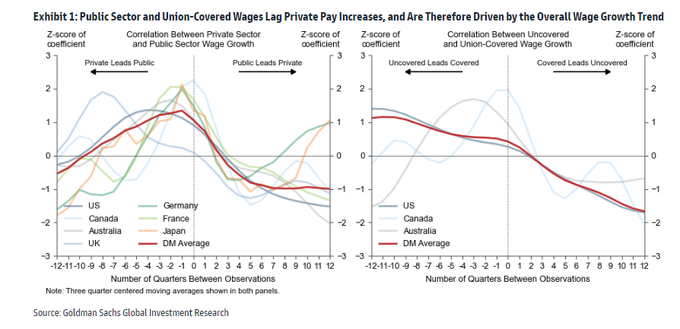

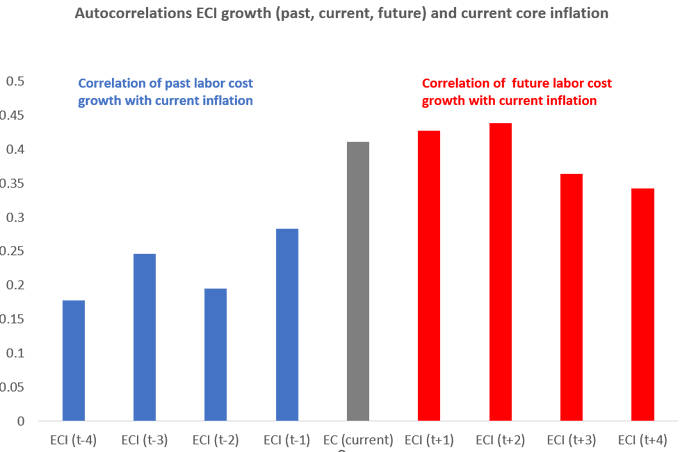

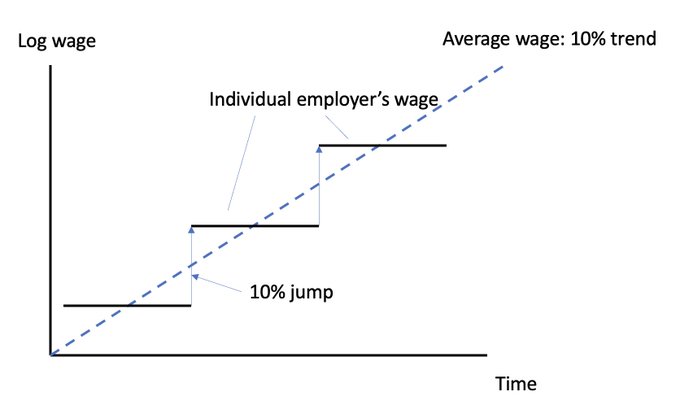

GS finds that union wages lag private wages

Overall wages lag price inflation, so union wages are the last to follow...hence strikes ensue

4

21

77

This is part of the reason why economists don't track the "money supply" (eg,M1/M2) when trying to understand inflation dynamics. Assets all have varying degrees of "moneyness." The equilibrium interest rate determines where people park their assets (liquid vs less liquid)

3

13

76

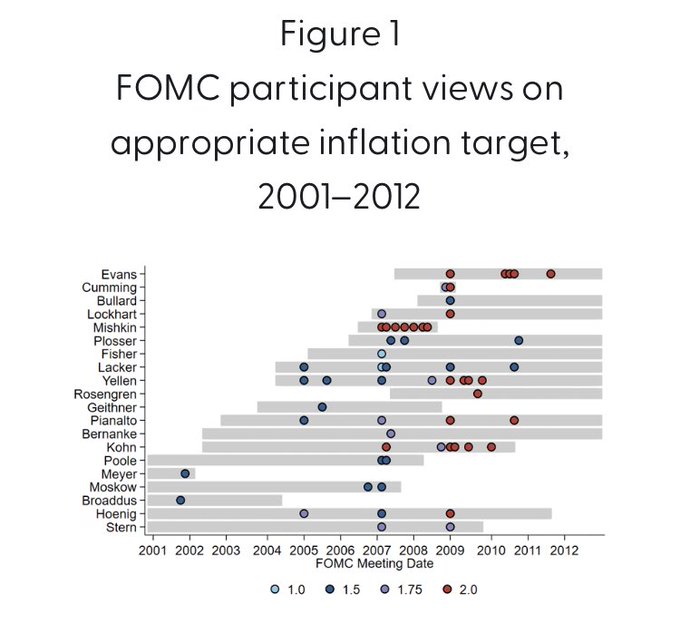

We tracked FOMC participants’ views on their preferred inflation target from the transcripts. Most participants favored 1.5, until the GFC hit..

1

15

74

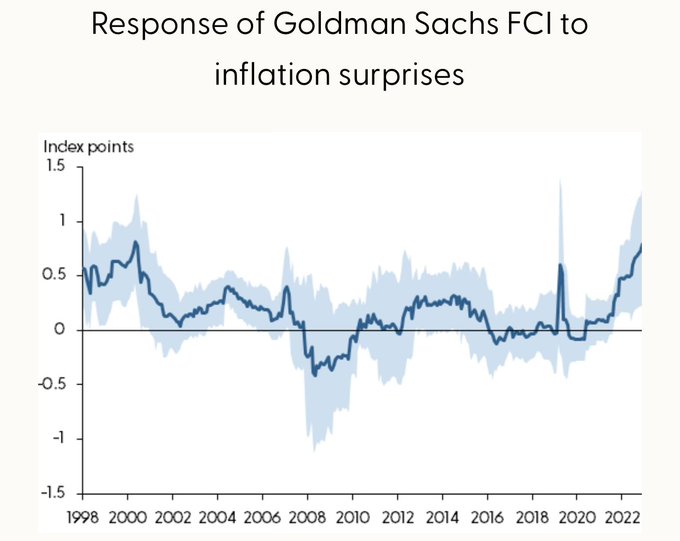

Financial markets have become increasingly sensitive to inflation releases

New Economic Letter from

@michaelbauer_hh

1

18

74

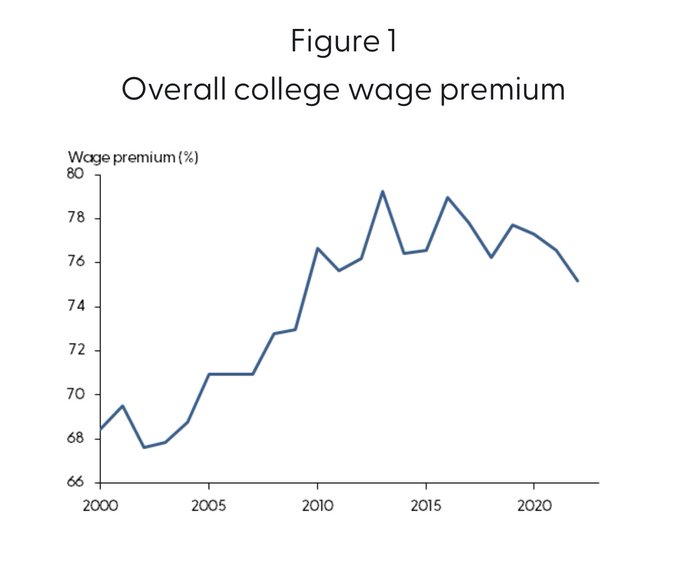

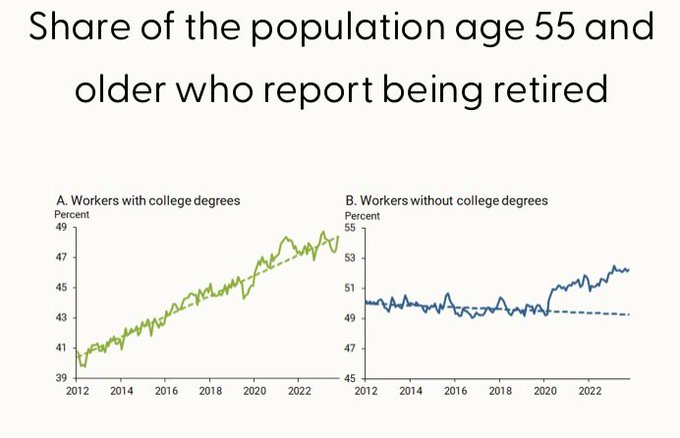

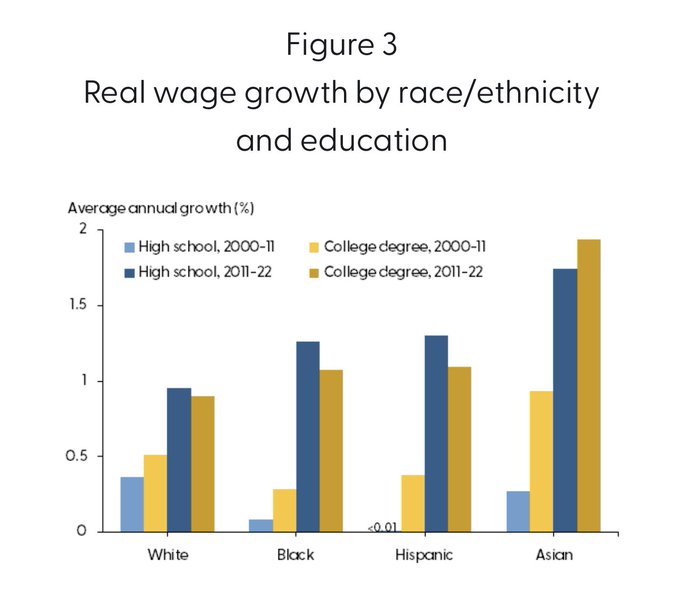

This chart by

@Petrosky_Nadeau

is striking. The pandemic caused a dramatic shift in retirements, but only for those w/o a college degree

3

16

68

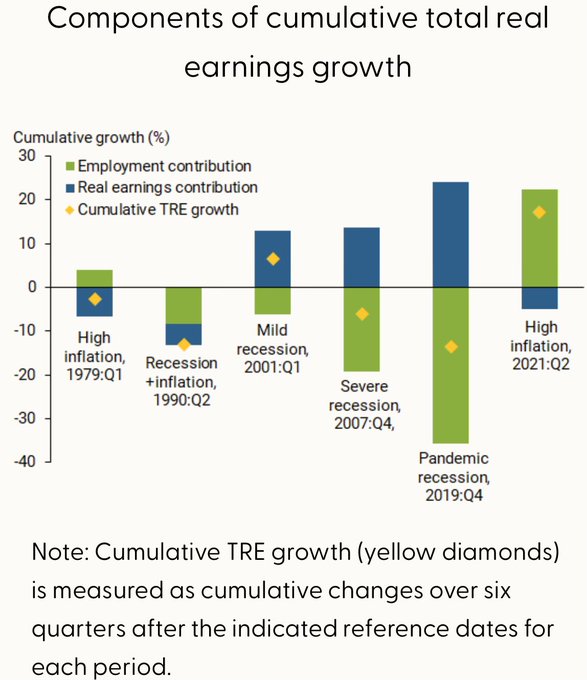

Total real earnings actually increased during the inflation surge in 2021. This is in stark contrast to the stagflation period in 1979

@sffed

letter by Leila Bengali and Genya Duzhak

2

19

54

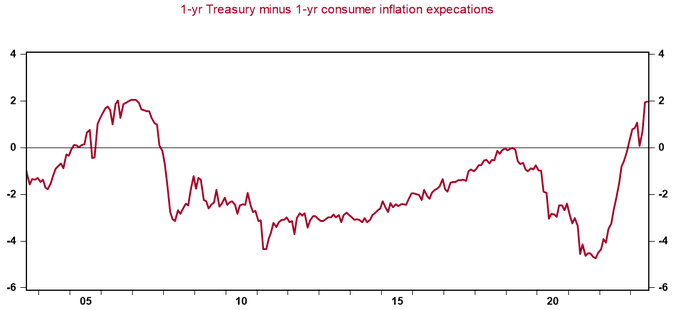

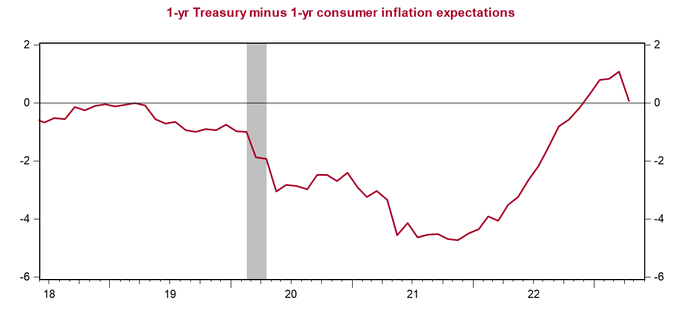

The 1-year real interest rate has climbed to 2%.

It hasn't hit this level since early 2007.

6

8

52

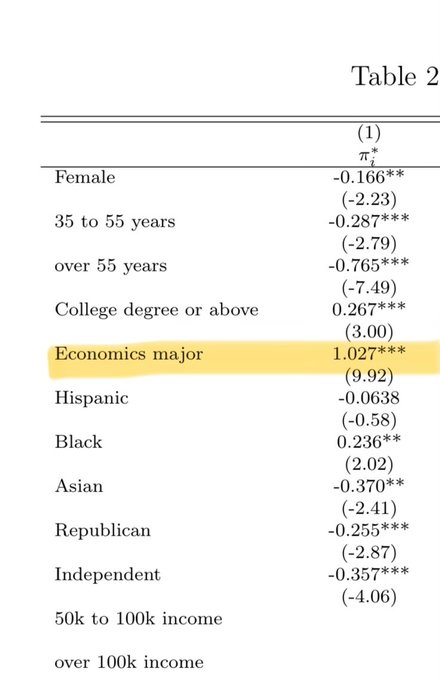

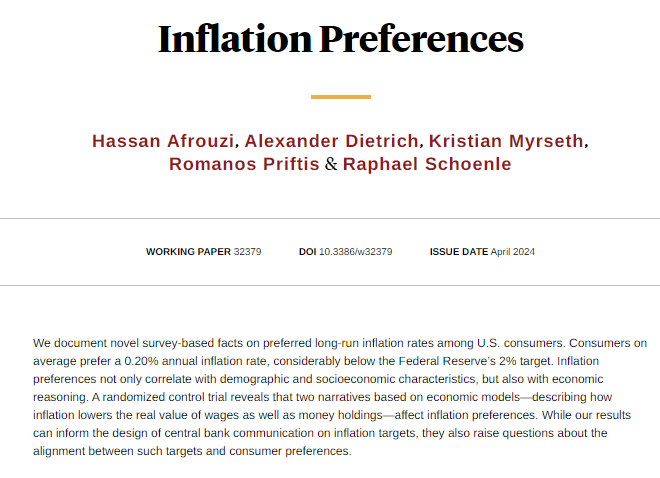

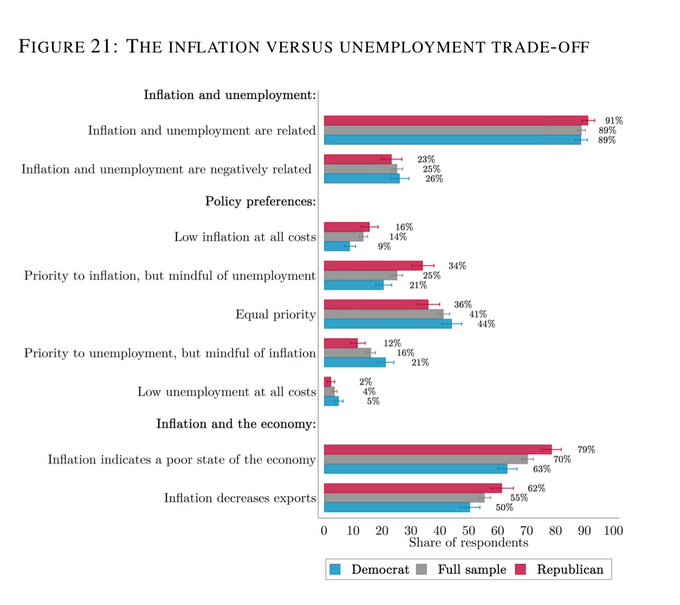

The public doesn’t believe in a Phillips curve, and tends to lean more hawkish

This and 30 other super interesting charts from

@S_Stantcheva

3

11

50

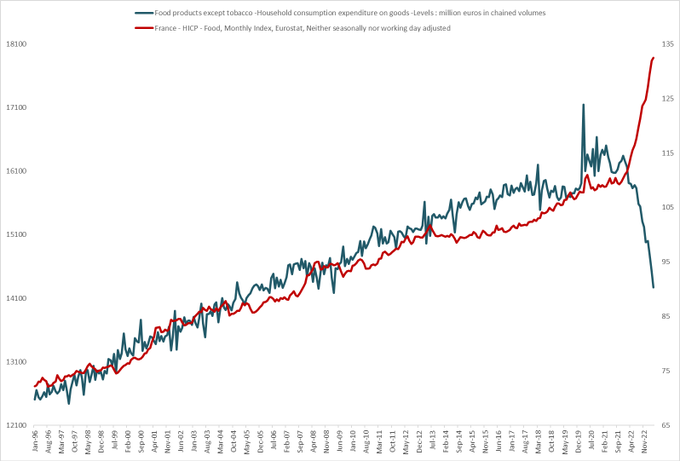

Thank you

@mredmond88

for inviting me to present at the

@NatlEconClub

!

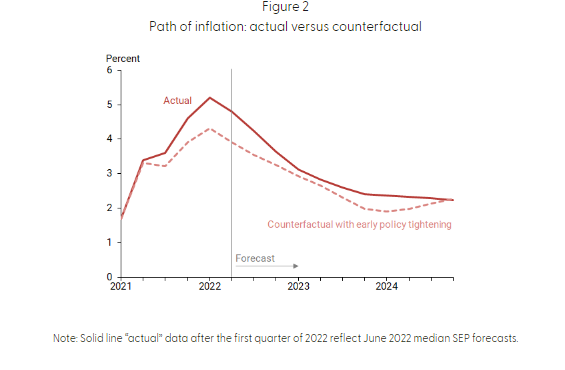

I’m sharing some of the slides from today’s presentation about inflation drivers over the pandemic period

2

9

48

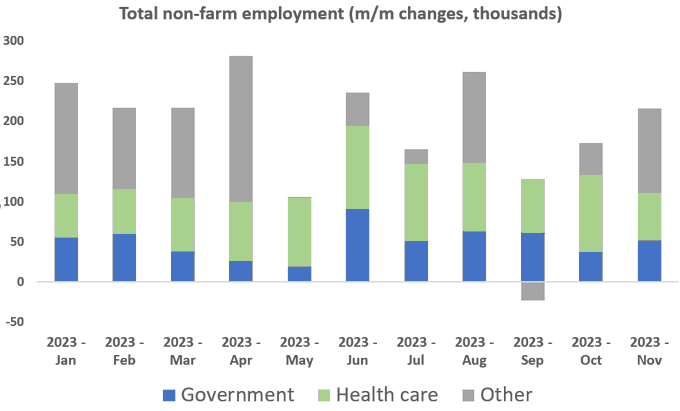

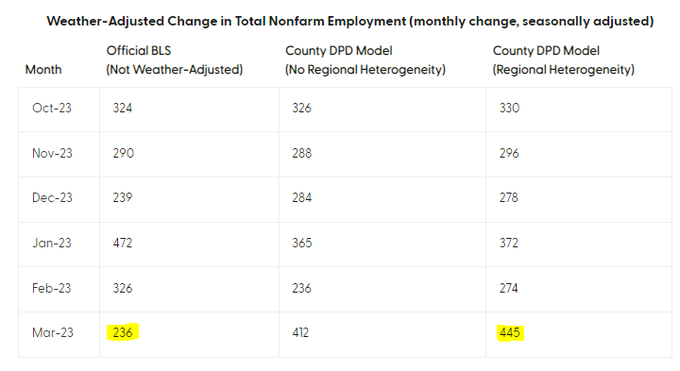

SF Fed's Weather Adjusted Employment (by

@wilson_daniel_j

) is showing that today's employment report was pushed down by over 200k jobs due to lagged weather effects.

Absent unseasonable weather patterns, today's number would have been over 400k according to the model.

3

15

47

In a new Economic Letter, Gus Kmetz,

@wilson_daniel_j

and I find that the media's strong attention on inflation over the past year has played a significant role in raising household's inflation expectations:

2

8

46

These rent indexes are certainly interesting, but I would take caution in using them for forecasting purposes.

The "All-tenant index" which includes new and old leases does not match the published CPI rent series very closely

6

7

43

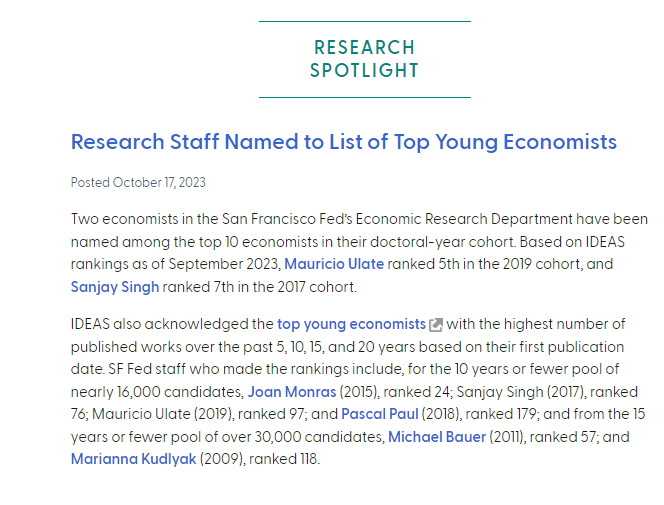

Kudos to the

@sffed

economics research department!

Mauricio Ulate,

@sanjayrajsingh

,

@JoanMonrasEcon

,

@pascalpaul

,

@michaelbauer_hh

, and

@MariannaKudlyak

all acknowledged in the top young economists list in the IDEAS ranking

2

5

41

The

@sffed

Research Department is taking applications for the 1-year visiting fellow position. A great way to meet the economists in our department and gain exposure to policy discussions

0

12

42

And likely to continue unless asking rents (new lease prices) decelerate

1

2

38

The

@sffed

will be updating the excess savings measure monthly on the data indicators page, including data available for download.

2

4

38

CPU rent inflation will continue to remain elevated

From UBS

1

6

35

The

@sffed

cyclical core pce is currently well above 7 percent. Some of this is rent inflation, but otherwise indicative of a lot of aggregate demand pressure.

0

8

34