Taha Choukhmane

@TahaChoukhmane

Followers

642

Following

177

Media

5

Statuses

77

Assistant Professor at @MITsloan researching household finance, retirement policy, and public economics.

Boston, MA

Joined May 2024

🧵1/11 My paper "Default Options and Retirement Saving Dynamics" is forthcoming in the AER! Auto-enrollment is often hailed as behavioral economics' greatest policy success and now covers 100M+ workers worldwide. But: does it actually increase lifetime wealth and welfare?

2

17

108

Very happy to see this paper forthcoming! It was a lot of fun working with Stephan and Sergio on this project. The paper makes a simple point: the root cause of most bank failures is losses and solvency problems, rather than self-fulfilling bank runs.

Recently accepted by #QJE, “Failing Banks,” by Correia, Luck, and Verner (@EmilVerner):

5

30

150

Longer thread on the paper here:

(1/10) 🚨Paper alert!🚨 How millions of US couples miss out on $750/yr in employer money by not coordinating 401(k) contributions. Evidence + implications for theory below 👇🧵 In the AER at @AEAjournals w/ @goodmanl @cormacodea

https://t.co/BPo96gFPPq

0

0

1

Thanks @econimate for turning our research into such a great animated explainer! Watch the video here:

Economic models often assume households behave as a single decision-making unit. Does this mirror reality? @TahaChoukhmane (@MITSloan), @goodmanl (@USTreasury) & @cormacodea (@YaleEconomics) on the retirement savings of U.S. couples: https://t.co/6hyfCcTw3V

1

2

11

Economic models often assume households behave as a single decision-making unit. Does this mirror reality? @TahaChoukhmane (@MITSloan), @goodmanl (@USTreasury) & @cormacodea (@YaleEconomics) on the retirement savings of U.S. couples: https://t.co/6hyfCcTw3V

3

18

96

Using excel to determine what percent of a portfolio should be in stocks, from James J. Choi, Canyao Liu, and Pengcheng Liu https://t.co/H2UgkhscHG

0

7

35

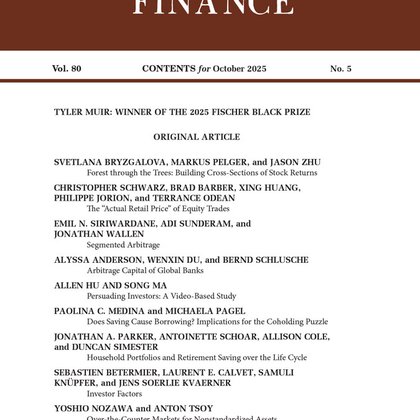

It never gets old when it comes out in "print." Did you know that typical Americans now hold more equity in their financial portfolios than 20 years ago, and they slowly decrease equity share as they near retirement? We have all the numbers for estimation. https://t.co/D8ExvyVHRs

onlinelibrary.wiley.com

Using account-level data on millions of U.S. middle-class investors over 2006 to 2018, we characterize the share of investable wealth that they hold in the stock market over their working lives....

2

13

83

Wow! This new adaptation paper is really impressive. I appreciate its "option value" logic that if "young Matt" initially screwed up his saving plan that I can reoptimize in later life and save more to prepare for my retirement.

🧵1/11 My paper "Default Options and Retirement Saving Dynamics" is forthcoming in the AER! Auto-enrollment is often hailed as behavioral economics' greatest policy success and now covers 100M+ workers worldwide. But: does it actually increase lifetime wealth and welfare?

1

3

9

🧵11/11 I'm incredibly grateful to my PhD advisors, the editor and referees, colleagues, discussants, and audiences for their guidance and thoughtful feedback. Paper:

aeaweb.org

(November 2025) - Using data from over 100 US retirement plans and a representative UK panel, I document the impact of auto-enrollment (AE) on retirement savings at different horizons. I replicate...

1

0

13

🧵10/11 BOTTOM LINE: •Challenges narrative that saving inertia = large lifetime impact •Shows the importance of studying nudges over long horizons •Illustrate the benefit of structural models when policies are too recent

1

1

6

🧵9/11 EXTERNAL VALIDITY: ✅ Cross-country validation Model estimated in U.S. data successfully predicts response to UK's national auto-enrollment rollout (after accounting for differences in taxes, benefits, labor market, etc.)

1

0

2

🧵8/11 WELFARE IMPLICATIONS: Previous studies: $1,000-$3,000 switching costs I find: ~$250 Why? Workers can compensate for low initial saving by saving more later 10x smaller behavioral friction = smaller potential welfare gains from nudging

1

0

3

🧵7/11 DISTRIBUTIONAL EFFECT: ✅ Average lifetime gains are small despite large policy shift ✅ BUT 2x larger for low earners, who capture more employer match $ => Main effect is redistribution, not aggregate wealth creation.

1

0

2

🧵6/11 LIFETIME IMPACT: Can’t observe 40 years of saving behavior yet (policies too recent) → I estimate a lifecycle model using medium-run evidence Model prediction: universal 3% auto-enrollment ↑ retirement consumption by only 0.3-0.6% (depending on incidence assumption).

1

0

2

🧵5/11 EMPIRICAL FACTS: ✅ Avg. gains fade over time, across defaults & even w/ auto-escalation ✅ Gains persist only at the bottom of the distribution ✅ Higher defaults lead to more opt-outs ✅ No evidence of lasting saving habit after workers change jobs

1

0

3

🧵4/11 SHORT RUN: Policy delivers big gains at 12 months: - Participation ↑43pp (+83%) - Contributions ↑27% Prevailing view: big short-run gains →big frictions →big lifetime gain My finding: most opt-in workers catch up by 36 months →small frictions →small lifetime impact

1

0

4

🧵3/11 EMPIRICAL STRATEGY: ✅ 100+ U.S. firms' 401k records ✅ Nationally representative U.K. panel ✅ Plausibly exogenous variation in defaults

1

0

4

🧵2/11 KEY TAKEAWAY: Auto-enrollment ≠ retirement saving silver bullet! •Short-run gains are attenuated over time (even w/ auto-escalation) •Consistent w/ optimizing households facing only $250 switching cost •Implies small average lifetime wealth & welfare effects

1

0

3

So happy to announce my JMP will be coming out in the @QJEHarvard! Thank you to everyone who helped this paper from the very beginning to the very end. The project ended quite far from where I originally thought it’d go in the 4th year of my PhD, but that’s the joy of research!

Recently accepted by #QJE, “Insurance Versus Moral Hazard in Income-Contingent Student Loan Repayment,” by Tim de Silva (@timdesilva):

5

3

162

A one-size-fits-all allocation might work for a 25yo but not so much for a 50yo! An example of how data and academic research can inform better product design. Loved working with this fantastic team.

New (short) paper with @TahaChoukhmane + Sudipto Banerjee & Louisa Schafer from @TRowePrice! Very fun academic-industry collaboration. Main takeaway: preferences become more diverse with age, which introduces scope for more personalized retirement solutions. Links below!

1

1

4