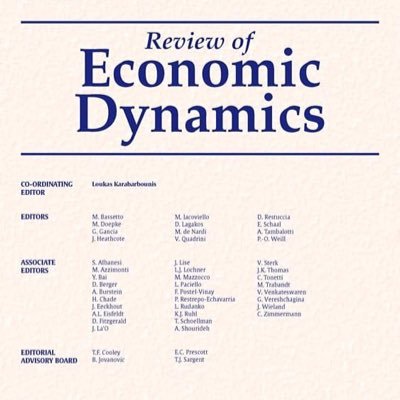

Review of Economic Dynamics

@RevEconDyn

Followers

4K

Following

198

Media

9

Statuses

231

Journal of the Society for Economic Dynamics, dedicated to the publication of macroeconomic research. Account curated by Paulina Restrepo-Echavarria @paures12.

Joined July 2020

Join us in welcoming our three new editors @afogli001, @Simon_Mongey, and @InaSimonovska! We are so excited to have them join us!

0

3

9

We are happy to announce that five new Associate Editors are joining our editorial board! Join us in welcoming Job Boerma, Stephie Fried, @oksana_leukhina, @serdarozkanEN, and Diego Perez!

1

1

41

Join us in welcoming our three new editors Alessandra Fogli, @Simon_Mongey, and @InaSimonovska! We are so excited to have them join us!

1

5

67

What determines the search intensity of traders in OTC markets? This forthcoming paper argues it depends on the level of search frictions and that the socially optimal search intensity is reached in the absence of intermediation. Read more 👇

0

2

5

What are the optimal taxes when human capital investment can't be told apart from regular consumption? Lear more in this forthcoming paper by Been-Lon Chen and Fei-Chi Liang. https://t.co/skODrBQVhl

2

1

5

What is the value of innovations according to a Schumpeterian growth model that allows for the interaction between patent policy and firm's internal strategies? Find out in this forthcoming paper! https://t.co/A1UA2ThLyT

0

1

1

What are the short- and long-term consequences of small firm rescue programs in a pandemic recession? This paper finds impact on output and employments is modest because jobs are saved in smaller firms and reallocation towards larger firms is reduced. https://t.co/4GzfA9XSH9

0

0

4

This forthcoming paper shows that Frisch elasticity estimates are exaggerated due to publication bias with a mean of 0.5. Correcting this bias brings it down to 0.2. Learn more 👇 https://t.co/WVkerPJwYj

0

3

10

SAVE THE DATE: The SED meetings 2024 will take place in Barcelona, Spain June 27-29!!!

4

28

249

Our new issue in memory of Thomas Cooley is out! Intro by Jeremy Greenwood, @NezihGuner, Loukas Karabarbounis, and @lee_ohanian, as well as papers on CEO compensation, inequality, information acquisition, taxation, and much more. Don’t miss it!

0

2

7

How do competitive interactions between regulated banks and shadow banks affect optimal dynamic capital requirements? Find out more in ths forthcoming paper by Arsenii Mishin. https://t.co/PLt4VBgq0I

0

3

13

How does money laundering affect the optimal design of central bank digital currency? As long as CBDC offers less anonymity than cash, introducing CBDC will decrease money laundering. https://t.co/MC6j6Euc02

0

2

2

Using household consumption biases Frisch elasticities downward as limited commitment in the household induces individual consumption to behave differently from household consumption. Lear more about an improved estimation approach! https://t.co/Wc2w6beEs5

0

3

16

This forthcoming paper shows that using information on the extensive margin of financially constrained households can narrow down the set of admissible preferences in a large class of macroeconomic models. Find out more! https://t.co/RzktRvTxhn

0

1

6

This forthcoming paper studies inflation dynamics using a generalized version of the New Keynesian Phillips curve of Galí and Gentler, finding results that are similar to previous studies. Find out the details 👇 https://t.co/pCY3t79Qko

0

1

8

Has the quant contribution of capital-skill complementarity in accounting for rising wage inequality as in Krusell, @lee_ohanian , Rios-Rull, and @glviolante (2000) changed overtime? Adding 30 years of data, makes little change to the original estimates! https://t.co/vfDu3eykPA

0

3

15

Don’t miss the latest Economic Dynamics newsletter, and read about Corina Boar and Virgiliu Midrigan’s research agenda on “Market Power, Taxes, and Inequality.”

Read about Corina Boar and Virgiliu Midrigan's research on “Market Power, Taxes and Inequality” on our latest issue of the EconomicDynamics Newsletter https://t.co/czVhZfsHQO

@RevEconDyn @NYUFASEcon

0

0

1

Kicking off this year's STLAR Conference (St. Louis Advances in Research) @stlouisfed with @SashaIndarte from Wharton on the impact of social insurance on household debt

1

4

35

Very happy to share that my paper “Credit markets, relationship lending, and the dynamics of firm entry” (with @QingqingCaoEcon Paolo Giordani @raoul_minetti) is finally online at @RevEconDyn. #EconTwitter

0

2

11

Ran Gu @LionupRan shows that wages of workers with postgraduate degrees vary less over the business cycle than those with undergraduate degrees This is because of differences in *specific* human capital between the two Ran's JMP out in the @RevEconDyn: https://t.co/ONcYrxZy3E

2

6

29