Raging Capital Ventures

@RagingVentures

Followers

56,842

Following

944

Media

171

Statuses

3,218

Commentary on investing, politics, tech, and start-ups. Not Financial Advice. Sign-up for free quarterly newsletter:

Princeton, NJ

Joined December 2020

Don't wanna be here?

Send us removal request.

Explore trending content on Musk Viewer

Rafah

• 2115583 Tweets

#MetGala

• 955768 Tweets

Rio Grande do Sul

• 594034 Tweets

#스키즈_멧갈라_축하해

• 205203 Tweets

Fenerbahçe

• 170944 Tweets

#الاهلي_الهلال

• 168230 Tweets

Zendaya

• 166853 Tweets

felix

• 164930 Tweets

Manchester United

• 154545 Tweets

Ten Hag

• 125391 Tweets

Superman

• 118299 Tweets

مالكوم

• 105311 Tweets

Crystal Palace

• 100844 Tweets

Olise

• 67931 Tweets

Casemiro

• 66369 Tweets

ariana

• 66058 Tweets

#CRYMUN

• 61585 Tweets

連休明け

• 58492 Tweets

GW明け

• 50668 Tweets

Tyla

• 49622 Tweets

Ali Koç

• 43057 Tweets

emma chamberlain

• 38427 Tweets

Bad Bunny

• 38387 Tweets

gigi

• 37715 Tweets

Evans

• 37064 Tweets

Antony

• 36052 Tweets

Katy Perry

• 35036 Tweets

Man U

• 33898 Tweets

Onana

• 32216 Tweets

bruna

• 27819 Tweets

جيسوس

• 26690 Tweets

Garden of Time

• 25491 Tweets

Anna Wintour

• 21929 Tweets

Hades 2

• 20252 Tweets

Mainoo

• 19374 Tweets

محرز

• 17968 Tweets

Mateta

• 16777 Tweets

Blake Lively

• 14882 Tweets

سمير عثمان

• 14548 Tweets

メットガラ

• 13217 Tweets

taylor russell

• 12664 Tweets

madelyn

• 12346 Tweets

Amrabat

• 10955 Tweets

Last Seen Profiles

Pinned Tweet

Excited to share our interview with

@NathanBenaich

of

@AirStreet

, a VC-firm focused on AI-first tech & life sciences companies. Benaich reviews the AI landscape and assesses the strategies of the big players. Read & sign-up for our free newsletter here:

2

2

16

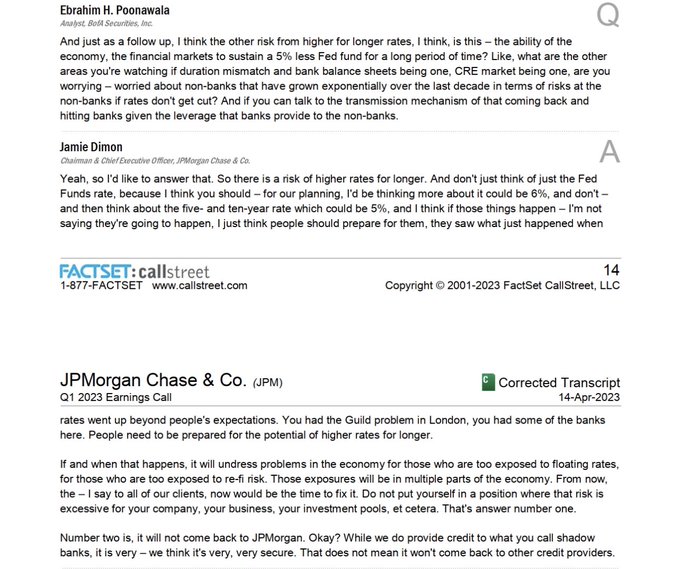

@therealkn42

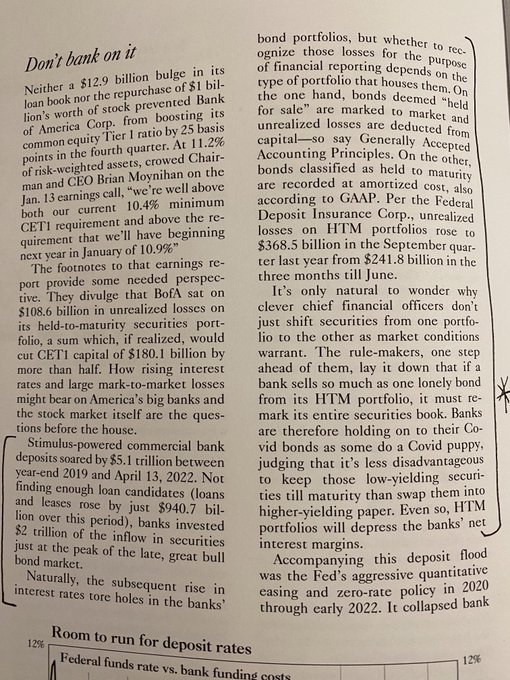

No hedges!! That became a lost art over the last decade of Federal Reserve rate repression…

12

31

570

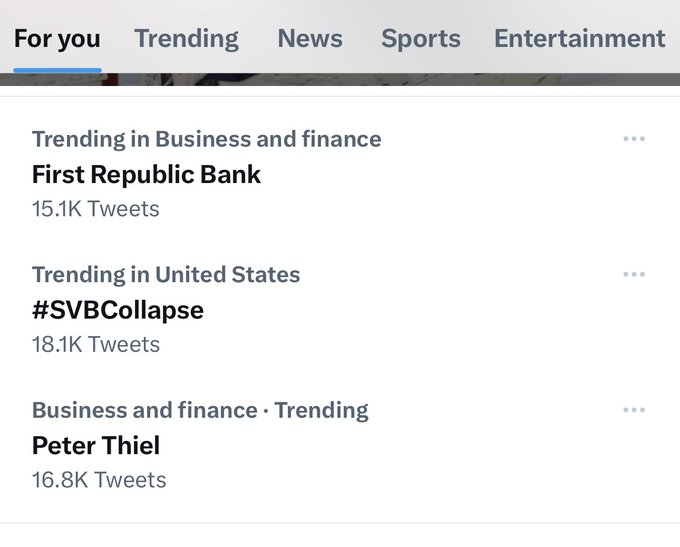

Reuters confirms that $SIVB mgmt only began to pursue efforts to raise capital *after* learning about Moody’s plan to downgrade their credit.

Mgmt really was ignorant / incompetent / trying to whistle past the graveyard.

16

73

407

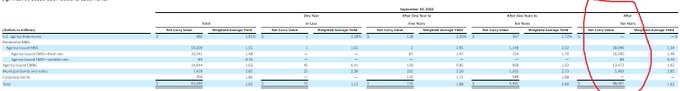

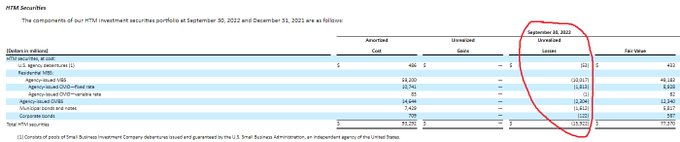

$SIVB announces $1.75 b common stock and $500 mm preferred stock offerings, as it tries to shore up its balance sheet. It also sold most of its $21 b "available for sale" securities portfolio, resulting in -$1.8 b in after-tax losses for Q1 2023. These were likely necessary…

26

63

393

Just listening to anything Ken Griffin has said over the past few years has been very profitable. His analysis is lucid and straightforward, and he has better information than almost anyone. Snippets of today’s CNBC interview are floating around, or you can access the full…

"One of the big drivers of the rally has been the frenzy over generative AI," Citadel CEO Ken Griffin tells

@SquawkStreet

. "I'd like to believe that this rally has legs. I'm a bit anxious we're in the 7th or 8th inning of this rally."

28

26

126

9

23

341

@NicheDown

@pitdesi

The one-two punch of combining Apple’s premium brand with a $3,000+ price point creates a lot of mystique and desire.

2

1

223

Thanks for having me on

@PowerLunch

, particularly on the same day that Jim Grant was in the studio!

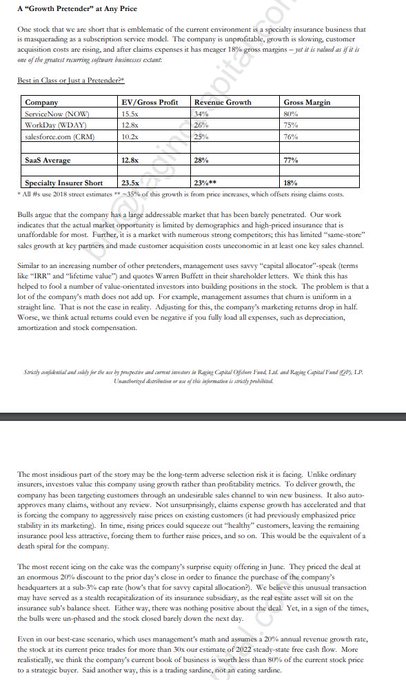

"I think management got greedy & complacent, on top of that, investors & sell-side analysts weren't asking the tough questions" says $SIVB short-seller Bill Martin of

@RagingVentures

who warned of the bank's problems just 2 months before its collapse.

4

8

51

19

15

182

Market ran $COIN up around +50% over the last week due to Bitcoin excitement, ignoring growing issues as evidenced by Silvergate, Signature et al. Efficient markets, indeed!

9

10

149

Zuck is back

11

9

141

I outlined my $COIN short thesis on CNBC last week by arguing that $COIN is now essentially “at war” with the Federal Govt & its policy direction.

Indeed, it is likely that Gensler, Yellen & the Biden Admin were all consulted before the Wells Notice was issued to $COIN. 1/2

Wide-ranging 45-minute

@CNBCPro

chat today at the NYSE covering a variety of timely topics w/

@TheDomino

, including a recap of $SIVB, the outlook for the banking sector, and some long ( $SLGC , $AWE.L ) and short ideas ( $COIN ). Thanks for having me, CNBC!

6

8

68

7

10

138

This fireside chat with

@GavinSBaker

, Bill Gurley and Antonio Gracias is a must-listen. Great discussion about the evolution of AI, venture capital, Elon Musk, the future of the data center, and more.

2

13

134

1/2. I’ve heard Lux Capital’s

@wolfejosh

speak many times, but he is at the very top of his game in this podcast. His views on emerging tech trends are worth their weight in gold, as are his thoughts on how he consumes information/connects the dots.

2

14

127

@AlderLaneeggs

@EpsilonTheory

@ttmygh

@fleckcap

@zerohedge

@mtaibbi

Hwang may be the Ivan Boesky of this cycle, and many roads tie back to $TSLA:

6

18

113

Thank you

@BillAckman

for having the guts to stand up in the public eye against these Marxist agendas such as DEI. We all need to do our part too to stop this nonsense - speak up in the board room, go to the school board meeting, contact your alma mater, et al. Get involved.

7

7

113

I view it as actionable if Altimeter is taking a stake in $PYPL. Altimeter has had tremendous success with their $META bet, and they’ve had the hot hand lately. Folks will follow them.

I’ve spent a lot of time on $PYPL lately. Biz generates a lot of cash and is not expensive.…

20

10

84

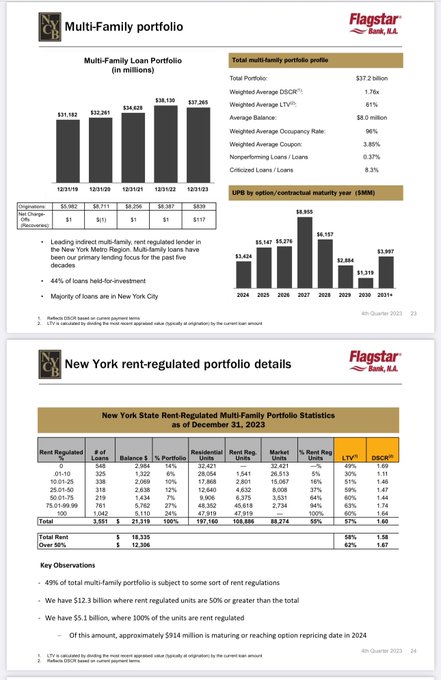

Very rough $NYCB numbers:

725 mm shares goes to 1.25 b on capital raise, with another 300 mm warrants at $2.50. They effectively raised fresh capital at around $1.50 per share (plus or minus, depending on how you value the warrants).

Brings tangible book (if you believe the…

11

8

83

@saxena_puru

Thanks for sharing, I’m short $FOUR and $GLBE on this list.

$FOUR has an impressive “story”, but a lot of their growth is manufactured (buying out reseller residuals at low multiples; pressuring gateway customers to upgrade through massive price increases) and they capitalize…

19

5

78

Entire thread is worth a read, “the phase change has occurred” for banking industry

6

8

70