Nishu Uppal

@NishantUppal7

Followers

624

Following

980

Media

27

Statuses

270

Physician @MGHMedicine, Impact Investing @AmericanCancer | Policy Fellow @OurHealthStudy | Alum @HarvardMed, @HarvardHBS, @CWRUBME, @BrighamMedRes

Boston, MA

Joined November 2019

Health care is making Americans poorer. In @NEJM, we describe the current burden of medical debt, the history of our health financing system, and solutions to endemic medical debt in the US. https://t.co/6BX8lQqsg5 1/10

7

30

113

In @NEJM, we discuss the growing fiscal challenges posed by GLP-1s and present a new opportunity for payers to consider: liraglutide. We review the comparative efficacy and argue that this newly generic GLP-1 may better balance access and affordability. https://t.co/M7WpOhAG0Y

0

9

17

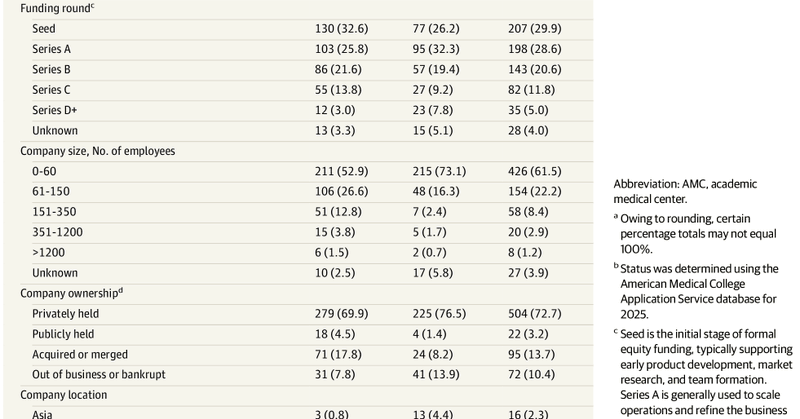

Perspective by Nishant Uppal, MD, MBA (@NishantUppal7), and Zirui Song, MD, PhD: Venture Capital Investments by U.S. Academic Medical Centers https://t.co/fLMnk8COtW

#HealthPolicy #MedicalEducation

1

2

16

Nishant Uppal, MD, MBA (@NishantUppal7), discusses the emergence of venture capital investing by academic medical centers and its potential implications. Listen to the full interview with NEJM Executive Managing Editor Stephen Morrissey (@srm128): https://t.co/InKcsIY42R

1

10

31

Are AMCs playing the role of VC investor to support core mission areas of patient care, research, education, and philanthropy? Or does this VC activity strengthen the perception of AMCs acting as 'nonprofits in name only'? We hope future work addresses these questions!

0

0

3

AMCs face financial pressures from stagnant care delivery revenue and declining research funding, but is VC the answer? VC is inherently financially risky and profit-oriented - whether AMCs should be allowed to house VC funds under tax-exempt status merits policymaker scrutiny.

1

0

0

A recent @JAMA_current research letter showed ~77% of AMC VC investments go towards companies founded by people with no affiliation with the AMC, so the motivations appear to extend beyond simply supporting in-house entrepreneurs/scientists. https://t.co/vTzsL2UgWK

jamanetwork.com

This cross-sectional study investigates how US academic medical centers used their own venture capital funds to invest in early-stage health care companies from 2014 to 2024.

1

0

1

We examined >400 VC investments by 10 major AMC funds alone and observed tremendous growth over the last 10-15 years: 2010 - 8 total deals - $114 million cumulative deal size 2021 (peak) - 54 total deals - $1.9 billion cumulative deal size (!)

1

0

0

Grateful to the NEJM editorial team for the opportunity to elaborate in an accompanying podcast interview available on NEJM Podcasts https://t.co/wbe4AqbZ7y

https://t.co/yxiWN4RGUR

podcasts.apple.com

Podcast Episode · NEJM Interviews · 11/26/2025 · 12m

1

0

1

Academic medical centers (AMCs) are increasingly acting as venture capital (VC) investors in startup companies. In @NEJM Zirui Song and I quantify VC activity by major AMCs and discuss financial motivations, sources of capital, and policy implications. https://t.co/CDKRMHgsu6

1

3

6

In a new Perspective, Nishant Uppal, MD, MBA (@NishantUppal7), and Zirui Song, MD, PhD, write that in recent years, academic medical centers have increasingly developed their own venture capital divisions. Venture capital investments may have important implications for their

1

3

13

New in the November 27, 2025, issue of NEJM: Early Discontinuation of Aspirin after PCI (TARGET-FIRST trial) https://t.co/lUQPGy5Xwh Early Withdrawal of Aspirin after PCI (NEO-MINDSET trial) https://t.co/IA8PpmkF2U Daily Mosnodenvir as Dengue Prophylaxis

0

15

71

1

0

3

🙏to @JACCJournals for showcasing our years-long effort manually reviewing hundreds of studies to quantify global South Asian CVD trial representation Also see excellent commentary by @SRaquel_PhD, @NishiPondugula, and Mohamed Boutjdir -

jacc.org

🌍 1 in 4 people globally are South Asian, yet only 3.2% are represented in major #CVD trials. Greater inclusion is crucial in addressing this high-risk population. ❤️🩹 https://t.co/rKwBDuOryR

#JACCAsia #HealthEquity #ClinicalTrials @pnatarajanmd @NishantUppal7 @DLBHATTMD

1

1

4

🌍 1 in 4 people globally are South Asian, yet only 3.2% are represented in major #CVD trials. Greater inclusion is crucial in addressing this high-risk population. ❤️🩹 https://t.co/rKwBDuOryR

#JACCAsia #HealthEquity #ClinicalTrials @pnatarajanmd @NishantUppal7 @DLBHATTMD

1

4

19

🎉Exciting news! 🎉 The OurHealth team is proud to share that we’ve collected *1,000 samples* & have registered over *2,500 participants* since the study’s launch in October 2023. 💜 https://t.co/4KqgyKBJbs [1/x]

2

9

21

We are overdue for medical debt reform, expansions of financial assistance, and public/private debt forgiveness programs. Thanks to PI @benjamesMD, @GomezJorgeMD, and the rest of the team @BIDMChealth @BIDMCSurgery

@himmelhandler @awgaffney @lowninstitute @RoKhanna @davechokshi

0

1

7

We found no differences in #bankruptcy between cancer patients and controls Is this a sign of less financial toxicity in MA? Or is this because federal reform in 2005 made it harder for people to file and get debt relief from creditors?

1

0

3

When people pay medical bills with credit cards, payday loans, HELOC, etc. but can't pay off the secondary debt, it gets sold to collections as non-medical debt. We studied all debts in collections to ID this - people with colorectal/bladder cancer were in debt 5-6 yrs after dx.

1

0

2

Our findings imply that it would cost ~$0.5-1.5M/year to forgive the med debt in collections that cancer patients in MA incur from diagnosis/treatment @statehousenews @BostonGlobe @Brabbott42

1

1

4

The $ amounts might look small - but medical debt is not the same as medical debt in collections. Once healthcare providers/hospitals sell medical debt (i.e. unpaid bills) to collections agencies, patients can be sued/chased by collectors who get ~25% revenue from healthcare

1

0

2