The Leuthold Group

@LeutholdGroup

Followers

16K

Following

142

Media

373

Statuses

913

Institutional Research & Investment Management Disclosure: https://t.co/jZZZtQNGaY Distributor: Quasar Distributors, LLC

Minneapolis, MN

Joined June 2009

We have been active asset allocators for about four decades. Our outlook is long term, yet we continually evaluate the market's underlying health and make changes as needed. $LCR Leuthold Core ETF.$LST Select Industries ETF.$LCORX Leuthold Core Fund.

1

0

7

Between April 1st and July 31st, the Cap-Weighted S&P 500 surged by +13.4%, notably exceeding the Equal-Weighted $SPX's +6.5%. This marks the third-best four-month period for Cap-Weighted upside relative to the EW index since the #Y2K tech boom. #Investing #MarketTrends

2

0

2

Leuthold Select Industries ETF (LST) employs an uncommon approach of investing through industry concentrations and equity themes using a broad multi-cap universe of stocks. LST has a 25-year track record of solid results. More at @XtolloInv is a

0

0

2

Leuthold PM Greg Swenson talks with William Hortz @strategicaccts about our tactical investment methodology and perspectives on asset allocation and equity group rotation amid volatile, uncertain, complex, and ambiguous market environments.

2

0

3

NVIDIA's impressive 13% rise accounted for nearly 1/2 of $SPX's 2.2% gain in July. $NVDA finished the month with an unprecedented (since 1990) 8.1% index share. Together, the weights of #NVIDIA and $MSFT match the combined weight of the S&P 500’s smallest 332 firms. #StockMarket.

1

2

8

RT @jamesjrogers: This is why meme stocks have ‘bubbled back to the surface,’ @LeutholdGroup fund manager says via….

marketwatch.com

Meme-stock behavior among some retail investors never really went away, a portfolio manager at Leuthold Group said.

0

5

0

With current debt and deficits escalating, the Fed will likely need to lower rates and allow inflation to run hot. Leuthold's Chun Wang cited by @NickLazzaro for @SPGMarketIntel #MonetaryPolicy #InterestRates #Inflation.

spglobal.com

Market stakeholders anticipate an injection of liquidity following pending interest rate cuts this year, but premature moves from the Fed could trigger consequences that offset this benefit.

5

1

3

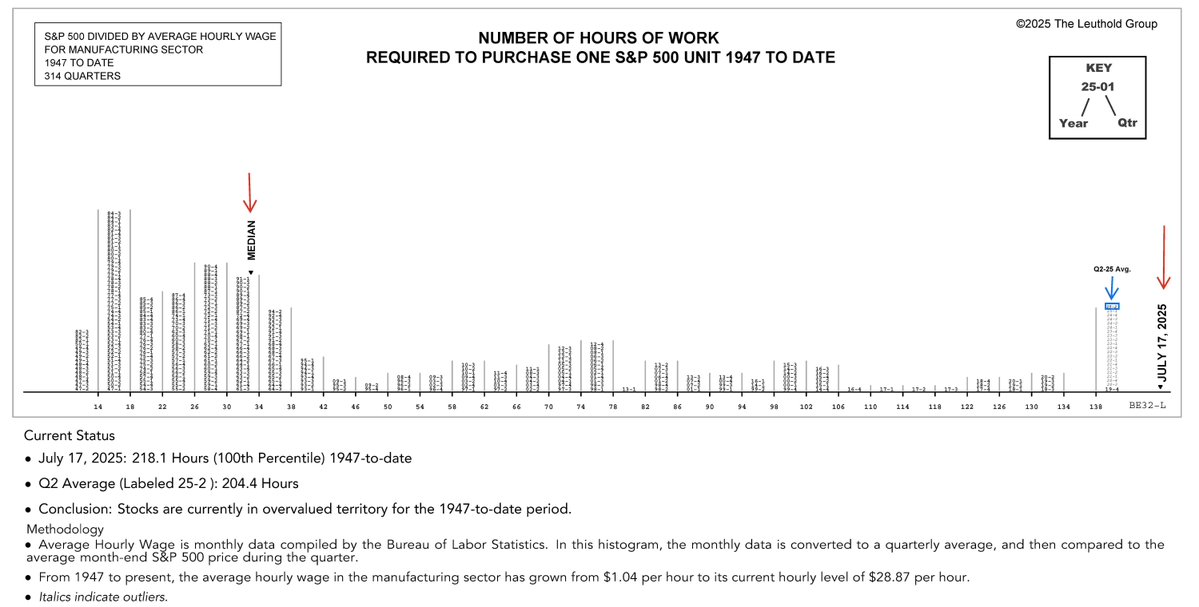

Since 1947, the standard of living in the U.S. has consistently improved, boosting workers' buying power. However, sky-high valuations have sharply reduced stock market purchasing power. It now takes over 218 work hours to afford one $SPX unit. #StockValuations #WorkerWages

2

4

13

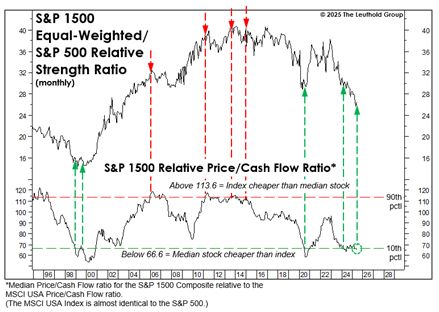

In June, S&P 1500's normalized P/E ratio fell below its median, implying potential returns for the average stock near the +10% LT norm. The relative Price/CF sank to the lowest decile, usually a trigger for a rebound in the avg stock vs $SPX. #StockMarket #Investing

3

3

23

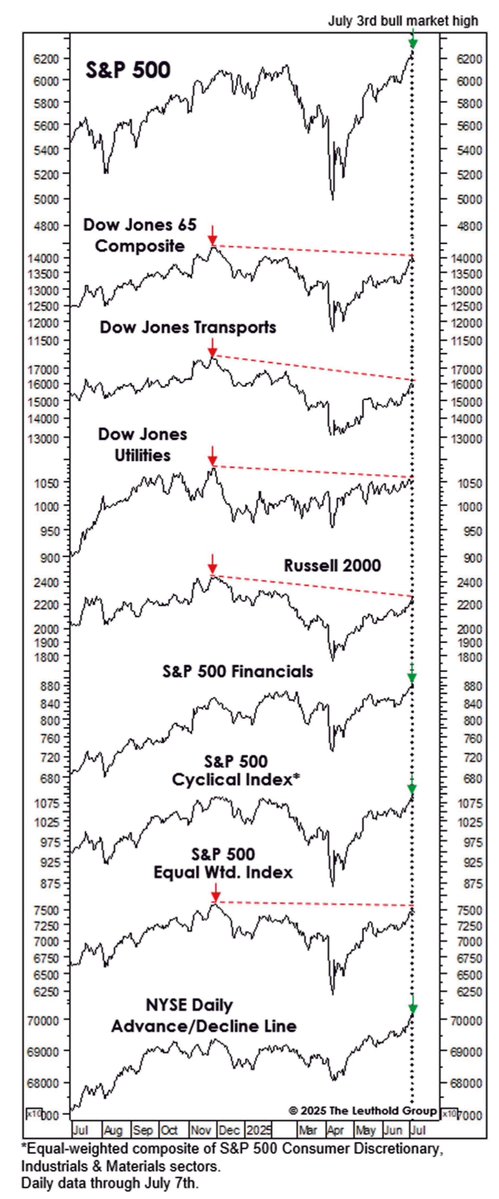

Just 3 out of 8 leading indicators have confirmed the new $SPX bull market peak. Uneven recoveries are not unusual, though, considering the ~19% drop earlier this year. $RUT #Stocks #Investing

1

0

9